Fill Out Your Declaration Canada E311 Form

The Declaration Canada E311 form serves a critical role for travelers entering Canada. It is used to gather vital information from individuals entering the country, ensuring compliance with Canadian regulations. Each person traveling is responsible for submitting their own declaration, although up to four people residing at the same address can be included on a single card. This form requires travelers to report any currency and monetary instruments totaling CAN$10,000 or more that are within their possession. Failure to accurately declare goods can lead to penalties, including the potential for seizure or legal action. The data collected is authorized under the Customs Act and is essential for calculating duties and taxes on imported goods. The form distinguishes between visitors and residents, outlining distinct duty-free allowances based on the length of absence from Canada and specific items like alcohol and tobacco. Moreover, all information provided is kept under strict privacy regulations, allowing individuals to access or amend their personal details as permitted by law. In short, the E311 form is not just a bureaucratic hurdle; it is a necessary process that underscores the legal responsibilities of anyone crossing into Canada.

Declaration Canada E311 Example

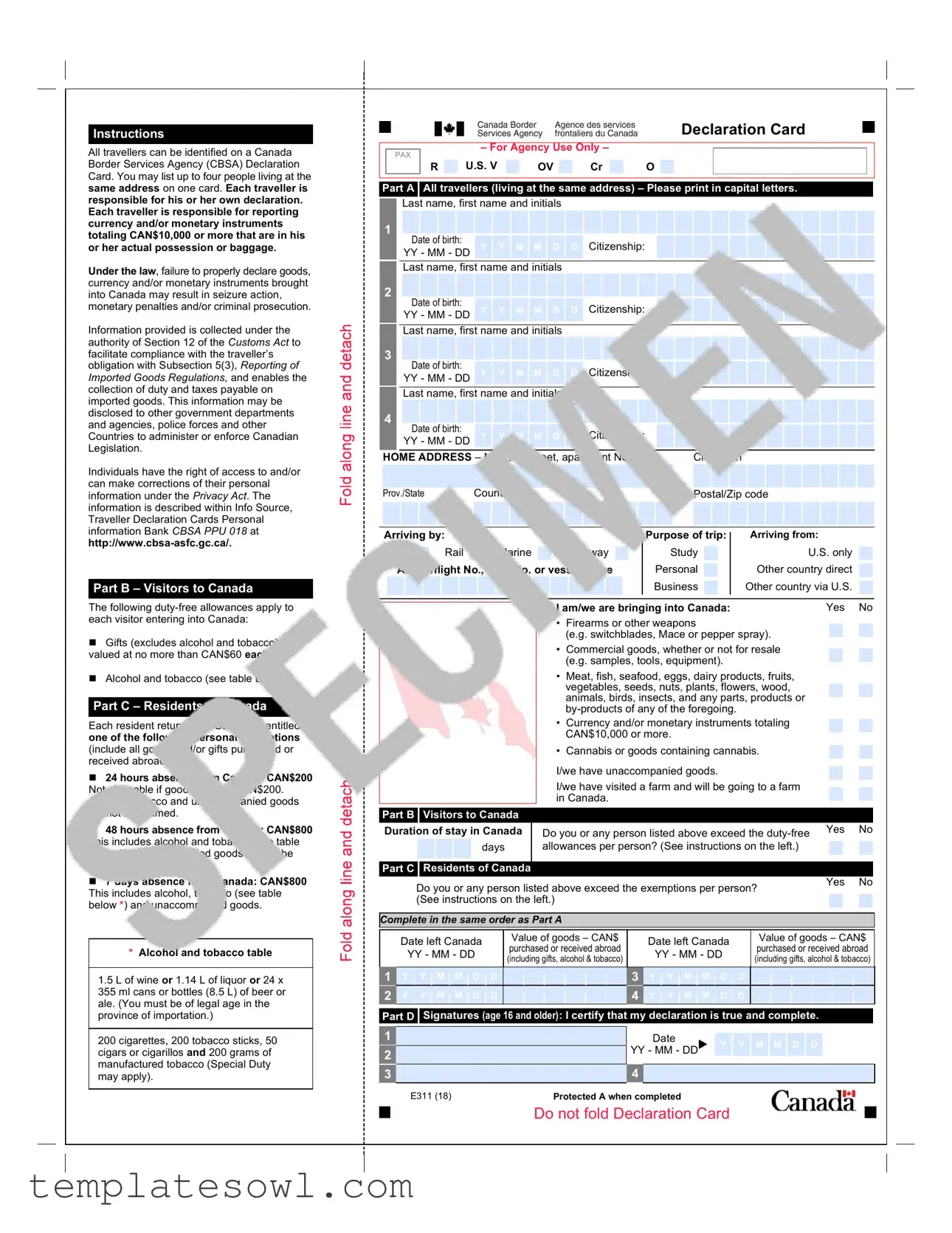

Instructions

All travellers can be identified on a Canada Border Services Agency (CBSA) Declaration Card. You may list up to four people living at the same address on one card. Each traveller is responsible for his or her own declaration. Each traveller is responsible for reporting currency and/or monetary instruments totaling CAN$10,000 or more that are in his or her actual possession or baggage.

Under the law, failure to properly declare goods, currency and/or monetary instruments brought into Canada may result in seizure action, monetary penalties and/or criminal prosecution.

Information provided is collected under the authority of Section 12 of the Customs Act to facilitate compliance with the traveller’s obligation with Subsection 5(3), Reporting of Imported Goods Regulations, and enables the collection of duty and taxes payable on imported goods. This information may be disclosed to other government departments and agencies, police forces and other Countries to administer or enforce Canadian Legislation.

Individuals have the right of access to and/or can make corrections of their personal information under the Privacy Act. The information is described within Info Source, Traveller Declaration Cards Personal information Bank CBSA PPU 018 at

Part B – Visitors to Canada

The following

Gifts (excludes alcohol and tobacco) valued at no more than CAN$60 each.

Alcohol and tobacco (see table below *).

Part C – Residents of Canada

Each resident returning to Canada is entitled to one of the following personal exemptions (include all goods and/or gifts purchased or received abroad):

24 hours absence from Canada: CAN$200 Not claimable if goods exceed CAN$200. Alcohol, tobacco and unaccompanied goods cannot be claimed.

48 hours absence from Canada: CAN$800 This includes alcohol and tobacco (see table below *). Unaccompanied goods cannot be claimed.

7 days absence from Canada: CAN$800 This includes alcohol, tobacco (see table below *) and unaccompanied goods.

* Alcohol and tobacco table

1.5L of wine or 1.14 L of liquor or 24 x 355 ml cans or bottles (8.5 L) of beer or ale. (You must be of legal age in the province of importation.)

200 cigarettes, 200 tobacco sticks, 50 cigars or cigarillos and 200 grams of manufactured tobacco (Special Duty may apply).

Declaration Card

– For Agency Use Only –

PAX

R |

U.S. V |

OV |

Cr |

O |

Part A

All travellers (living at the same address) – Please print in capital letters.

All travellers (living at the same address) – Please print in capital letters.

Last name, first name and initials

1

Date of birth: |

Y |

Y |

M |

M |

D |

D |

Citizenship: |

YY - MM - DD |

|||||||

|

|

||||||

Last name, first name and initials |

|

||||||

2 |

|

|

Date of birth: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Y |

Y |

M |

M |

|

D |

D |

Citizenship: |

|

|

|

|

|||||||

|

|

YY - MM - DD |

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Last name, first name and initials |

|

|

|

|

|

|

|

|

|

||||||||||

3 |

|

|

Date of birth: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Y |

Y |

M |

M |

|

D |

D |

Citizenship: |

|

|

|

|

|||||||

|

|

YY - MM - DD |

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last name, first name and initials |

|

|

|

|

|

|

|

|

|

||||||||||

4 |

|

|

Date of birth: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Y |

Y |

M |

M |

|

D |

D |

Citizenship: |

|

|

|

|

|||||||

|

|

YY - MM - DD |

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||

HOME ADDRESS – Number, street, apartment No. |

City/Town |

|

|||||||||||||||||||

Prov./State |

Country |

|

|

|

|

|

Postal/Zip code |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Arriving by: |

|

|

|

|

|

|

|

|

|

|

|

|

Purpose of trip: |

|

|

Arriving from: |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Air |

|

|

Rail |

|

Marine |

|

|

Highway |

|

|

|

Study |

|

|

U.S. only |

||||||

|

|

|

|

|

|

|

|

||||||||||||||

|

Airline/flight No., train No. or vessel name |

|

Personal |

|

|

Other country direct |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business |

|

|

Other country via U.S. |

|

|

|

|

|

|

|

I am/we are bringing into Canada: |

|

Yes |

No |

||||

|

|

|

|

|

|

|

• |

Firearms or other weapons |

|

|

|

|

||

|

|

|

|

|

|

|

|

(e.g. switchblades, Mace or pepper spray). |

|

|

|

|||

|

|

|

|

|

|

|

• |

Commercial goods, whether or not for resale |

|

|

|

|||

|

|

|

|

|

|

|

|

(e.g. samples, tools, equipment). |

|

|

|

|

||

|

|

|

|

|

|

|

• |

Meat, fish, seafood, eggs, dairy products, fruits, |

|

|

|

|||

|

|

|

|

|

|

|

|

vegetables, seeds, nuts, plants, flowers, wood, |

|

|

|

|||

|

|

|

|

|

|

|

|

animals, birds, insects, and any parts, products or |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

• |

Currency and/or monetary instruments totaling |

|

|

|

|||

|

|

|

|

|

|

|

|

CAN$10,000 or more. |

|

|

|

|

||

|

|

|

|

|

|

|

• |

Cannabis or goods containing cannabis. |

|

|

|

|||

|

|

|

|

|

|

|

I/we have unaccompanied goods. |

|

|

|

|

|||

|

|

|

|

|

|

|

I/we have visited a farm and will be going to a farm |

|

|

|

||||

|

|

|

|

|

|

|

in Canada. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part B |

|

Visitors to Canada |

|

|

|

|

|

|

|

|

|

|||

Duration of stay in Canada |

|

Do you or any person listed above exceed the |

No |

|||||||||||

|

|

|

days |

|

|

allowances per person? (See instructions on the left.) |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part C |

|

Residents of Canada |

|

|

|

|

|

|

|

|

|

|||

|

Do you or any person listed above exceed the exemptions per person? |

Yes |

No |

|

||||||||||

|

|

|

|

|||||||||||

|

(See instructions on the left.) |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||

Complete in the same order as Part A |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date left Canada |

Value of goods – CAN$ |

|

Date left Canada |

Value of goods – CAN$ |

|||||||||

|

purchased or received abroad |

|

purchased or received abroad |

|||||||||||

|

YY - MM - DD |

|

YY - MM - DD |

|||||||||||

|

(including gifts, alcohol & tobacco) |

|

(including gifts, alcohol & tobacco) |

|||||||||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Y Y M M D D |

|

|

|

|

|

3 |

Y Y M M D D |

|

|

|

|

||

2 |

Y Y M M D D |

|

|

|

|

|

4 |

Y Y M M D D |

|

|

|

|

||

Part D

Signatures (age 16 and older): I certify that my declaration is true and complete.

Signatures (age 16 and older): I certify that my declaration is true and complete.

1 |

|

|

|

Date |

|

|

|

|

|

|

|

Y |

Y |

M |

M |

D |

D |

|

|||||

2 |

|

|

YY - MM - DD |

|

|||||||

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

4 |

|

|

|

|

|

|

|

|

|

E311 (18) |

Protected A when completed |

|

|

|

|

|

|

|

||

Do not fold Declaration Card

Form Characteristics

| Fact Name | Description |

|---|---|

| Declaration Responsibility | Each traveller must independently declare their goods and report any currency or monetary instruments of CAN$10,000 or more in their possession. |

| Legal Consequences | Failure to declare goods or currency may lead to seizure, fines, or criminal prosecution as per the provisions of the Customs Act. |

| Information Collection | Information provided is gathered under Section 12 of the Customs Act and is necessary for compliance with reporting regulations. |

| Duty-Free Allowances | Visitors to Canada have various duty-free allowances based on their duration of stay, including personal exemptions for goods and gifts. |

Guidelines on Utilizing Declaration Canada E311

Filling out the Declaration Canada E311 form is a straightforward process, but it is important to ensure that all information is accurate and complete. This form is used when travelling to Canada, and it provides important details about the travellers and any goods they may be bringing into the country. Once the form is filled out, it should be presented to the Canada Border Services Agency (CBSA) upon arrival.

- Begin by writing the last name, first name, and initials of each traveller in the designated fields. You can list up to four individuals living at the same address.

- Next, enter each traveller's date of birth in the format of year (YY), month (MM), and day (DD).

- Indicate the citizenship for each person on the form.

- Fill in the home address including the number, street, apartment number (if applicable), city or town, province or state, country, and postal or zip code.

- Specify how you are arriving in Canada by selecting from the options: Air, Rail, Marine, or Highway. If arriving from the U.S. only, ensure to mention that here as well.

- Choose the purpose of your trip from the given options: Personal, Business, or Other.

- Identify your arrival country by selecting whether you are arriving from the U.S. or another country directly or via the U.S.

- Answer the questions about what you are bringing into Canada, checking “Yes” or “No” for firearms, commercial goods, certain food items, and whether you have currency totaling CAN$10,000 or more.

- State if you have unaccompanied goods or if you have visited a farm and will be going to a farm in Canada.

- If applicable, fill out Part B about your duration of stay in Canada. Indicate whether anyone listed exceeds the duty-free allowances per person.

- For residents returning to Canada, complete Part C by stating if anyone exceeds the exemptions per person.

- For each traveller aged 16 and older, provide a signature to certify that the declaration is true and complete. Dates for signatures should also be included.

What You Should Know About This Form

What is the Declaration Canada E311 form?

The Declaration Canada E311 form is a card provided by the Canada Border Services Agency (CBSA) that travelers use when entering Canada. It allows individuals to declare any goods they are bringing into the country and includes important information about duty-free allowances and exemptions. Each traveler must complete their own declaration, even if they are traveling together with family or friends.

Who needs to fill out the E311 form?

Every traveler entering Canada must complete a Declaration Card. This includes visitors from other countries as well as residents returning to Canada. If you are traveling with others who live at the same address, you can list up to four people on a single card, but each person is still responsible for declaring their own items.

What happens if I don’t declare my goods properly?

Failure to declare goods accurately can lead to serious consequences. You could face seizure of your items, monetary penalties, or even criminal prosecution. It's very important to be honest and thorough when filling out the form to avoid any issues with customs officials.

Are there duty-free allowances for items I bring into Canada?

Yes, there are specific duty-free allowances that travelers can take advantage of. For example, visitors can bring gifts valued up to CAN$60 each (excluding alcohol and tobacco). Residents returning to Canada have different exemptions based on their time away: after 24 hours, you can bring goods valued up to CAN$200; after 48 hours, up to CAN$800; and after 7 days, also up to CAN$800. Make sure you check the details for alcohol and tobacco limits as well.

What should I do if I have currency or monetary instruments?

If you are bringing CAN$10,000 or more in currency or monetary instruments, you must declare this on your E311 form. This requirement applies to cash, traveler's checks, and other negotiable instruments, and it is crucial to report this accurately to avoid penalties.

What personal information is collected on the E311 form?

The information you provide is collected to ensure compliance with Canadian laws governing imports and exports. This includes your name, citizenship, birth date, and details of the goods you’re bringing. Additionally, this information may be shared with other government departments for enforcement purposes. You have the right to access and correct your personal information under the Privacy Act.

Can I declare unaccompanied goods?

Yes, you can declare unaccompanied goods, but they must be noted on the E311 form. Unaccompanied goods refer to items that arrive separately from you, such as those shipped ahead of time. Ensure you declare these clearly to avoid complications at the border.

Is there a specific age requirement for signing the E311 form?

Any traveler aged 16 years or older must sign the declaration. If you are under 16, a parent or guardian can sign on your behalf. It's important for all adult travelers to certify that their declarations are true and complete, as this carries legal obligations.

How do I complete the form if I'm traveling with family?

If you are traveling with family, fill out the form together. You can list up to four individuals living at the same address on one card. It’s essential to ensure that each person accurately states their declaration while referencing the shared address. Even when traveling together, each person is responsible for their own items and any required declarations.

Common mistakes

Completing the Declaration Canada E311 form requires careful attention to detail. One common mistake is not listing all individuals on the form. Each traveller is responsible for their own declaration, but up to four people living at the same address can share one card. Neglecting to include all travellers can lead to complications.

Another frequent error is failing to report currency accurately. If the total amount of currency and monetary instruments exceeds CAN$10,000, it must be declared. Ignoring this obligation could result in serious repercussions, including seizure of funds or fines.

Many people also misinterpret the duty-free allowances. Visitors must understand the specific limits on gifts and the exemptions based on absence duration from Canada. For instance, declaring goods worth more than CAN$200 after a 24-hour absence from Canada is not permitted, which can be overlooked.

Individuals often forget to sign the form or include the date when signing. Each person aged 16 or older must certify their declaration. A missing signature can render the declaration invalid and delay customs processing.

Accurate reporting of the value of goods purchased abroad is crucial. Some individuals may underestimate the value of their items or leave out gifts, potentially leading to issues with customs. It is essential to maintain clarity and truthfulness regarding all possessions.

The dates of travel are sometimes incorrectly entered, particularly if the travellers have had multiple trips. The form should reflect the accurate dates of departure and re-entry to Canada to ensure proper assessment of exemptions and allowances.

Some individuals skip the section regarding unaccompanied goods, misunderstanding its relevance. This section must be completed if applicable, as failing to do so could raise suspicions during inspection and lead to additional scrutiny.

Moreover, neglecting to mention firearms or specific prohibited items can result in legal consequences. The form requires travellers to indicate any weapons or commercial goods being brought into Canada, which must be disclosed in full to avoid issues.

In addition, the section stating the purpose of the trip is crucial and is often filled out hastily. Providing clear and accurate information here helps customs officers assess the declaration accurately.

Finally, not reviewing the form for any errors before submission can lead to avoidable problems. A quick check ensures completeness and accuracy, which can facilitate a smoother experience at the border.

Documents used along the form

When traveling to Canada, it's important to have all necessary forms and documents ready. In addition to the Declaration Canada E311 form, there are other documents that often accompany it. Each of these plays a role in ensuring compliance with Canadian regulations and facilitating a smoother border crossing experience. Below are some commonly used documents.

- Passport: This serves as your primary identification document. It is essential for proving your identity and citizenship. Ensure that it is valid for the duration of your stay in Canada.

- Visa: Depending on your nationality, you may require a visa to enter Canada. This document grants you permission to enter and stay in the country for a specific period.

- Customs Declaration Receipts: If you are carrying goods that need to be declared, customs receipts may be required. These documents detail the items you are bringing into Canada and help in assessing any duties or taxes owed.

- Travel Insurance Policy: This document outlines the coverage you have in case of unexpected events during your trip, such as medical emergencies or trip cancellations. It is advisable to have travel insurance to protect against unforeseen circumstances.

- Return Flight Ticket: Proof of your return or onward travel can be requested at the border. This document shows that you intend to leave Canada at the end of your visit, which is a requirement for some travelers.

- Proof of Accommodation: Having a document that confirms where you will be staying during your time in Canada, such as a hotel reservation or an invitation from a friend or family member, can also be helpful.

By preparing these documents in advance, travelers can help ensure a more straightforward customs process upon arriving in Canada. Being well-prepared not only streamlines travel but also helps in complying with necessary regulations. Safe travels!

Similar forms

The Declaration Canada E311 form is similar to several other documents used for reporting and declaring items when entering a country. Below is a list of nine documents that share similarities with the E311 form:

- CBP Declaration Form 6059B: This form is used by travelers entering the United States to declare goods, currency, and items subject to customs duties, akin to the E311's role in Canada.

- Customs Declaration Form (Australia): This Australian form requires travelers to disclose items they are bringing into the country, matching the E311's function of reporting imports.

- Traveler's Customs Declaration (European Union): This document collects information on goods being brought into EU countries, similar to the compliance aspects of the E311 form.

- Import Declaration Form (New Zealand): Used to declare items when entering New Zealand, reflecting similar responsibilities to declare currency or goods as seen in the E311.

- Form B3 (Canada): This is a Canada Customs form used for accounting and declaring goods imported into Canada, sharing a reporting function with the E311.

- Customs Declaration for Air Passengers (UK): Travelers arriving in the UK must declare items they bring, mirroring the obligations outlined in the E311.

- Incoming Goods Declaration (Germany): This form is required for travelers to report imports, similar to the responsibilities of declaring in the E311 form.

- Customs Declaration Form (Singapore): This form allows travelers to declare goods, currency, and dutiable items, reflecting the same purpose as the E311.

- CBP Form 7501: This U.S. Customs form is used to declare imports and ensure compliance with customs regulations, paralleling the E311's import declaration role.

Dos and Don'ts

When filling out the Declaration Canada E311 form, consider the following guidelines:

- Do list all individuals living at the same address on one card, up to four people.

- Do declare any currency and/or monetary instruments totaling CAN$10,000 or more that you have in your possession.

- Do provide accurate information. Ensure that all names and details are spelled correctly.

- Do sign and date the declaration, certifying that it is true and complete.

- Don't underestimate your exemptions. Know the limits based on your time spent away from Canada.

- Don't fold the Declaration Card, as this may cause processing issues.

- Don't bring in any items that require special permits without declaring them.

- Don't forget to report any goods that may be subject to duties or restrictions.

Misconceptions

Misconception 1: All travelers can group their declarations together on one form regardless of their relationship.

This is incorrect. Each traveler must be listed on a single form only if they are living at the same address. Otherwise, separate forms are required.

Misconception 2: It is the responsibility of one person in a group to report everything for everyone.

Each traveler is personally responsible for their own declaration. This means every individual should ensure that their information is accurate and complete.

Misconception 3: You can bring any amount of currency into Canada without having to declare it.

In fact, if an individual is carrying currency or monetary instruments totaling CAN$10,000 or more, they must report it. Not disclosing this can lead to serious repercussions.

Misconception 4: The information provided on the Declaration Canada E311 form is private and never shared.

Contrarily, the information collected may be shared with other government departments, agencies, and even international entities to enforce Canadian laws.

Misconception 5: Duty-free allowances are the same for both visitors and residents.

This is not true. The duty-free allowances depend on one's residency status and duration of absence from Canada, with different limits applied for visitors and returning residents.

Misconception 6: You can bring in unlimited alcohol and tobacco as long as you declare it.

There are specific limits on the amount of alcohol and tobacco products that can be brought into Canada duty-free. Exceeding these limits can result in additional taxes or seizures.

Misconception 7: Children do not need to complete a declaration if they are traveling with adults.

Every traveler, regardless of age, must be included in a declaration. Children’s names and information should also be listed.

Misconception 8: The Declaration Canada E311 form is optional for all travelers.

This is untrue. Completing the declaration is a legal requirement for travelers entering Canada, designed to ensure compliance with customs regulations.

Misconception 9: If you make a mistake on the declaration, you cannot correct it.

You are allowed to correct any errors. Under the Privacy Act, individuals can access their personal information and make necessary amendments.

Key takeaways

Here are key takeaways for filling out and using the Declaration Canada E311 form:

- Responsibility for Declarations: Each traveller is responsible for their own declaration, even when listed on the same card.

- Reporting Currency: Anyone carrying currency or monetary instruments totaling CAN$10,000 or more must declare it.

- Consequences of Non-Compliance: Failing to declare goods or currency can lead to penalties, seizures, or criminal charges.

- Duty-Free Allowances: Visitors can bring gifts worth up to CAN$60 each without duty and have specific allowances for alcohol and tobacco.

- Personal Exemptions for Residents: Residents returning can claim exemptions based on their absence from Canada, up to CAN$800 depending on duration.

- Access to Personal Information: Individuals have the right to access and correct their personal information under the Privacy Act.

Browse Other Templates

Hazmat Bill of Lading Pdf - It includes a description of the hazardous articles being shipped.

Ohio Medicaid Forms - The skills training must align with the specific health needs of the consumer as indicated.

How Long Does Uncontested Divorce Take in Ny - This resource emphasizes the importance of thorough preparation before entering the court system.