Fill Out Your Dekalb County License Application Form

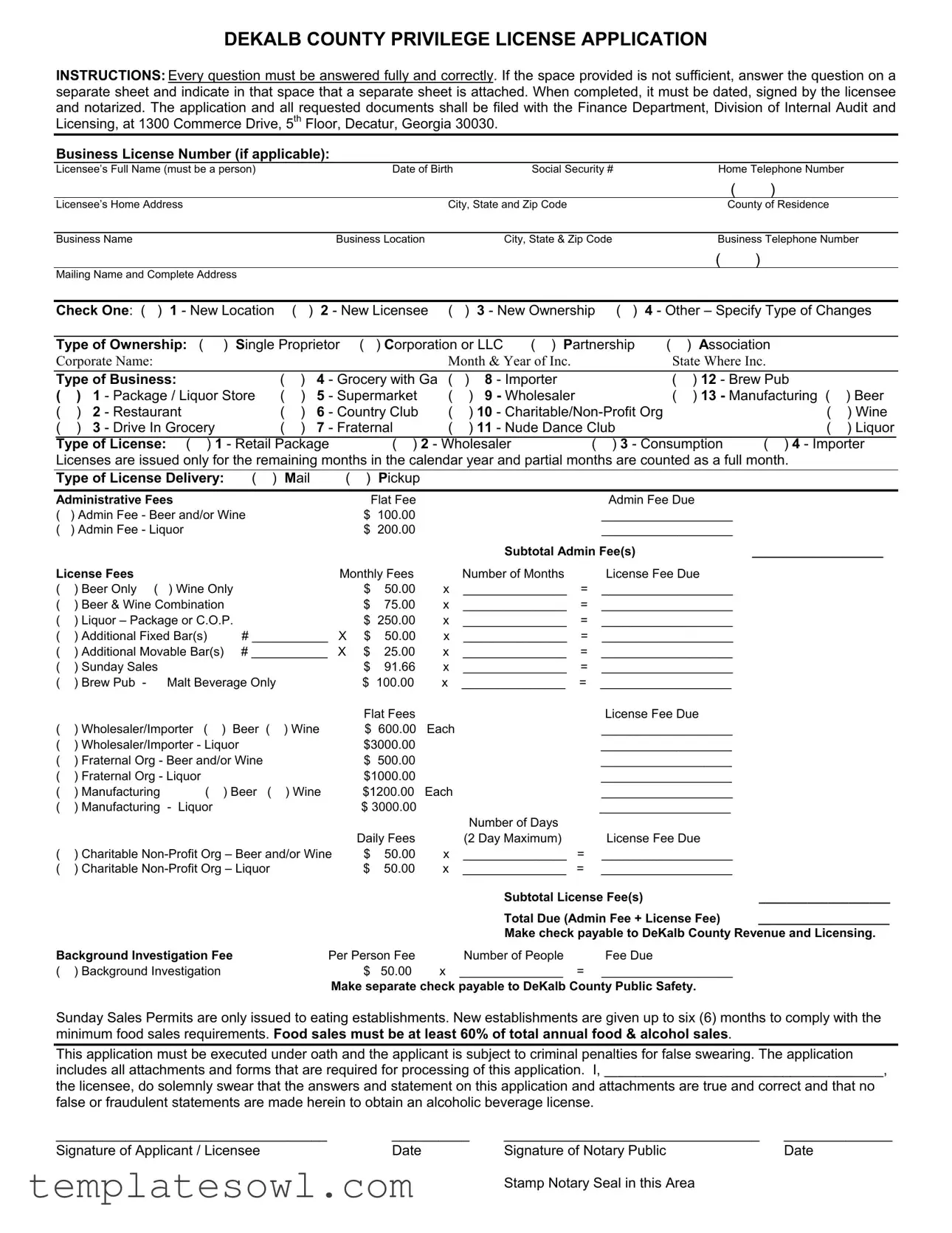

The DeKalb County License Application form is an essential document for anyone looking to conduct business involving alcoholic beverages in the region. This comprehensive form includes detailed instructions that guide applicants through the licensing process, ensuring that each section is completed accurately. Importantly, applicants must provide their full name, date of birth, Social Security number, and contact information, along with details about their business, including its name and physical location. It's crucial to select the appropriate options for the type of license being sought, with categories such as retail, wholesaler, and consumption licenses available. Additionally, applicants need to specify the type of business and ownership structure, whether it's a single proprietorship, corporation, or partnership. To complete the application, both the licensee's signature and notarization are required, affirming that all information provided is true and correct. Moreover, fees associated with the application process must be calculated and submitted to ensure proper processing. These fees vary based on the type of alcohol being sold and the nature of the establishment. This form not only serves as a gateway to legal permission for selling alcoholic beverages but also sets the stage for accountability through background checks and adherence to local regulations. Understanding the intricate details of the DeKalb County License Application form is therefore paramount for prospective licensees who wish to operate within compliance and maintain the integrity of their business endeavors.

Dekalb County License Application Example

DEKALB COUNTY PRIVILEGE LICENSE APPLICATION

INSTRUCTIONS: Every question must be answered fully and correctly. If the space provided is not sufficient, answer the question on a separate sheet and indicate in that space that a separate sheet is attached. When completed, it must be dated, signed by the licensee and notarized. The application and all requested documents shall be filed with the Finance Department, Division of Internal Audit and Licensing, at 1300 Commerce Drive, 5th Floor, Decatur, Georgia 30030.

Business License Number (if applicable):

Licensee’s Full Name (must be a person)Date of BirthSocial Security #Home Telephone Number

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

Licensee’s Home Address |

|

|

|

|

City, State and Zip Code |

|

County of Residence |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Business Name |

|

|

|

Business Location |

|

|

|

|

City, State & Zip Code |

|

Business Telephone Number |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

Mailing Name and Complete Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

||||||||||

Check One: ( ) 1 - New Location |

( |

|

) 2 - New Licensee |

( |

) |

3 - New Ownership ( ) 4 - Other – Specify Type of Changes |

||||||||||

|

|

|

|

|

||||||||||||

Type of Ownership: ( ) Single Proprietor ( ) Corporation or LLC |

( ) Partnership |

( |

) Association |

|

||||||||||||

Corporate Name: |

|

|

|

|

Month & Year of Inc. |

State Where Inc. |

|

|||||||||

Type of Business: |

( |

) |

4 |

- Grocery with Ga |

( |

) |

8 |

- Importer |

( |

) 12 - Brew Pub |

|

|||||

( |

) |

1 |

- Package / Liquor Store |

( |

) |

5 |

- Supermarket |

( |

) |

9 |

- Wholesaler |

( |

) 13 - Manufacturing ( |

) Beer |

||

( |

) |

2 |

- Restaurant |

( |

) |

6 |

- Country Club |

( |

) |

10 |

- |

|

|

( |

) Wine |

|

( |

) |

3 |

- Drive In Grocery |

( |

) |

7 |

- Fraternal |

( |

) |

11 |

- Nude Dance Club |

|

|

( |

) Liquor |

|

|

Type of License: |

( |

) 1 - Retail Package |

|

|

( ) 2 - Wholesaler |

|

( ) 3 - Consumption |

( ) 4 - Importer |

|

|||||||

|

Licenses are issued only for the remaining months in the calendar year and partial months are counted as a full month. |

|

|||||||||||||||

|

Type of License Delivery: |

( |

) |

( |

) |

Pickup |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Administrative Fees |

|

|

|

|

|

|

Flat Fee |

|

|

|

Admin Fee Due |

|

|

|||

|

( ) Admin Fee - Beer and/or Wine |

|

|

|

$ 100.00 |

|

|

|

___________________ |

|

|

||||||

|

( |

) Admin Fee - Liquor |

|

|

|

|

|

|

$ 200.00 |

|

|

|

___________________ |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtotal Admin Fee(s) |

___________________ |

|

||

|

License Fees |

|

|

|

|

|

|

Monthly Fees |

|

Number of Months |

|

License Fee Due |

|

|

|||

|

( |

) Beer Only ( |

) Wine Only |

|

|

|

$ |

50.00 |

x |

_______________ |

= |

___________________ |

|

|

|||

|

( ) Beer & Wine Combination |

|

|

|

|

$ |

75.00 |

x |

_______________ |

= |

___________________ |

|

|

||||

|

( ) Liquor – Package or C.O.P. |

|

|

|

$ 250.00 |

x |

_______________ |

= |

___________________ |

|

|

||||||

|

( |

) Additional Fixed Bar(s) |

|

# ___________ |

X |

$ |

50.00 |

x |

_______________ |

= |

___________________ |

|

|

||||

|

( |

) Additional Movable Bar(s) |

# ___________ |

X |

$ |

25.00 |

x |

_______________ |

= |

___________________ |

|

|

|||||

|

( |

) Sunday Sales |

|

|

|

|

|

|

|

$ |

91.66 |

x |

_______________ |

= |

___________________ |

|

|

|

( |

) Brew Pub - |

Malt Beverage Only |

|

|

$ 100.00 |

x |

_______________ |

= |

___________________ |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

Flat Fees |

|

|

|

License Fee Due |

|

|

|

|

( |

) Wholesaler/Importer |

( |

) |

Beer |

( |

) Wine |

|

$ |

600.00 |

Each |

|

|

___________________ |

|

|

|

|

( |

) Wholesaler/Importer - Liquor |

|

|

|

$3000.00 |

|

|

|

___________________ |

|

|

|||||

|

( ) Fraternal Org - Beer and/or Wine |

|

|

|

$ 500.00 |

|

|

|

___________________ |

|

|

||||||

|

( |

) Fraternal Org - Liquor |

|

|

|

|

|

|

$1000.00 |

|

|

|

___________________ |

|

|

||

|

( |

) Manufacturing |

|

( |

) Beer |

( |

) Wine |

|

$1200.00 |

Each |

|

|

___________________ |

|

|

||

|

( |

) Manufacturing - Liquor |

|

|

|

|

|

$ 3000.00 |

|

|

|

___________________ |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of Days |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daily Fees |

|

(2 Day Maximum) |

|

License Fee Due |

|

|

|

|

( ) Charitable |

|

$ |

50.00 |

x |

_______________ |

= |

___________________ |

|

|

|||||||

|

( ) Charitable |

|

|

$ |

50.00 |

x |

_______________ |

= |

___________________ |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtotal License Fee(s) |

___________________ |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due (Admin Fee + License Fee) |

___________________ |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Make check payable to DeKalb County Revenue and Licensing. |

|

|||

|

Background Investigation Fee |

|

Per Person Fee |

|

Number of People |

|

Fee Due |

|

|

||||||||

|

( |

) Background Investigation |

|

|

|

|

|

$ |

50.00 |

x |

_______________ |

= |

___________________ |

|

|

||

Make separate check payable to DeKalb County Public Safety.

Sunday Sales Permits are only issued to eating establishments. New establishments are given up to six (6) months to comply with the minimum food sales requirements. Food sales must be at least 60% of total annual food & alcohol sales.

This application must be executed under oath and the applicant is subject to criminal penalties for false swearing. The application includes all attachments and forms that are required for processing of this application. I, ____________________________________,

the licensee, do solemnly swear that the answers and statement on this application and attachments are true and correct and that no false or fraudulent statements are made herein to obtain an alcoholic beverage license.

___________________________________ |

__________ |

_________________________________ |

______________ |

Signature of Applicant / Licensee |

Date |

Signature of Notary Public |

Date |

|

|

Stamp Notary Seal in this Area |

|

Application – Page 2

1.Will you have entertainment? ________ If yes, describe in detail ____________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

2.Does the licensee, partner, corporation or owner have any ownership interest in any other licensed alcoholic beverage business in the State of Georgia? If yes, give name of that person, name of business and complete address of business. ________________

________________________________________________________________________________________________________

3.List the full name, address and other pertinent information for each person having any ownership interest in this business, corporate officers or partners:

Name: |

Social Security #: |

Date Of Birth: |

Home Address: |

City: |

State: |

|

|

|

Zip Code: |

Dollar Investment in Business: |

Percent of Interest: |

|

|

|

Name: |

Social Security #: |

Date Of Birth: |

Home Address: |

City: |

State: |

Zip Code: |

Dollar Investment in Business: |

Percent of Interest: |

Name: |

Social Security #: |

Date Of Birth: |

Home Address: |

City: |

State: |

|

|

|

Zip Code: |

Dollar Investment in Business: |

Percent of Interest: |

|

|

|

Name: |

Social Security #: |

Date Of Birth: |

Home Address: |

City: |

State: |

|

|

|

Zip Code: |

Dollar Investment in Business: |

Percent of Interest: |

|

|

|

4.List name and address of the owners of the building and land and the name and address of the lessor or

NameStreet Address City – State – Zip Amount of Rent Due Owner Building __________________________________________________________________________________________

Owner of Land __________________________________________________________________________________________

Lessor ___________________________________________________________________________________________

5.How much money is being invested in the business? Total amount of money paid _________________________

6.How much of the money being invested is borrowed and from whom? Show total amount borrowed ______________________

Name of Bank, Business or Person Street AddressCity-State-Zip Code

________________________________________________________________________________________________________

________________________________________________________________________________________________________

7.Name and home address of the manager of this business:

________________________________________________________________________________________________________

8.Have you attached a copy of the floor plans of this business showing inside layout of the store, including entrance(s) and exit(s). Nightclubs and restaurants needs to show kitchen, bathrooms, dining areas, entertainment area and any offices. Yes _________

9.If this is a corporation, Limited Liability Company or a partnership, please attach copies of the state Certificate of Incorporation along with copies of your corporate, LLC or partnership papers showing the officers.

10.Have you attached two (2) registered agent forms with pictures of the agent? ______________

11.Have you received a copy of the DeKalb County Alcoholic Beverage Ordinance? ___________ No application can be processed until you acknowledge receipt of the County Ordinance (rules and regulations).

____________________________________ |

________________________________________ |

_____________________ |

Print name of applicant / licensee |

Signature of applicant / licensee |

Date |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Application Requirement | Every question on the DeKalb County License Application form must be answered completely and accurately. |

| Document Submission | Completed applications and required documents should be submitted to the Finance Department, Division of Internal Audit and Licensing at 1300 Commerce Drive, Decatur, Georgia. |

| Notarization | The application must be signed, dated, and notarized for legitimacy. |

| Personal Information Needed | Applicants must provide personal details such as full name, date of birth, social security number, and home address. |

| License Types | Applicants choose from several license types including retail package, wholesaler, and consumption licenses. |

| Administrative Fees | Fees vary depending on the type of business and range from $100 for beer and wine to $3,000 for liquor wholesalers. |

| Sole Ownership | The form allows for types of ownership including sole proprietorship, corporation, LLC, and partnership. |

| Food Sales Requirement | New establishments must comply with a requirement that at least 60% of sales must come from food within the first six months. |

| Background Check Fee | A background investigation fee of $50 is required for each person involved in the business ownership. |

| Ordinance Acknowledgment | Applicants must acknowledge receipt of the DeKalb County Alcoholic Beverage Ordinance before application processing can begin. |

Guidelines on Utilizing Dekalb County License Application

Completing the Dekalb County License Application form requires attention to detail and ensuring every section is filled out accurately. Once the form is complete, it must be signed and notarized before being submitted to the appropriate department. Here's a straightforward guide to help you through the process.

- Start with the Business License Number, if you have one, and fill it in at the top of the form.

- Provide the Licensee’s Full Name. Remember, this must be a person's name, not a business name.

- Fill in the Date of Birth and Social Security Number of the licensee.

- Enter the Home Telephone Number of the licensee.

- Complete the Home Address section, including City, State, and ZIP Code.

- Indicate the County of Residence for the licensee.

- Input the Business Name and the Business Location, along with the corresponding City, State, and ZIP Code.

- Provide the Business Telephone Number.

- In the Mailing Name and Complete Address section, fill out if different from the business address.

- Choose the appropriate option under Check One for the type of application: New Location, New Licensee, New Ownership, or Other.

- Specify the Type of Ownership: Single Proprietor, Corporation or LLC, Partnership, or Association.

- If applicable, provide the Corporate Name along with the Month & Year of Incorporation and the State Where Incorporated.

- Select the Type of Business from the list provided, marking all that apply.

- Choose the type of Liquor License required by marking the appropriate box.

- Indicate the Type of License Delivery: Mail or Pickup.

- Complete the sections for Administrative Fees and License Fees, calculating and filling in amounts based on selections made. Ensure to perform accurate calculations for each applicable fee.

- State the Background Investigation Fee if applicable, providing the number of people this applies to.

- Review the application for completeness, ensuring all questions are answered fully, and additional sheets are attached where necessary.

- Sign and date the application where indicated, and have the signature notarized.

- Submit the completed application, along with all required attachments and fees, to the Finance Department at the designated address.

After submitting the completed application, the review process will begin. It is crucial to keep copies of everything submitted, including your receipts for any fees paid. Stay informed about the next steps and any further requirements as you await approval.

What You Should Know About This Form

1. What is the purpose of the Dekalb County License Application form?

The Dekalb County License Application form is necessary for individuals or businesses wishing to obtain a privilege license for selling alcoholic beverages. This form collects important information about the applicant, the business, and required fees to ensure compliance with local regulations. It also serves as a declaration under oath that all information provided is truthful.

2. Where should I submit the completed application?

Once you have completed the application, including the necessary signatures and notarization, submit it to the Finance Department, Division of Internal Audit and Licensing. The address for submission is 1300 Commerce Drive, 5th Floor, Decatur, Georgia 30030.

3. What information is required from the licensee on the application?

The application requires the licensee's full name, date of birth, social security number, home address, and contact details. Additionally, it asks for detailed information about the business, including its name, location, type of ownership, and the nature of the business operations. This information helps local authorities assess the application and ownership structure.

4. Are there fees associated with the application?

Yes, there are various administrative and license fees associated with the application. These fees differ based on the type of license being requested, such as for beer, wine, or liquor. For instance, the administrative fee for beer and/or wine is $100, while liquor has a $200 fee. Ensure to calculate the total amount due accurately.

5. What happens if I don't have enough space to answer a question on the form?

If the space provided on the application form is insufficient for a complete response, it is recommended to answer the question on a separate sheet. Make sure to note on the application that an additional sheet has been attached, so the reviewing officials are aware of the extended information.

6. Can I get a Sunday sales permit with this application?

A Sunday sales permit is available but is limited to eating establishments. New establishments can temporarily qualify for this permit; however, they must comply with food sales requirements within six months. Specifically, food sales must comprise at least 60% of the total annual sales of food and alcohol.

7. What is the significance of the background investigation fee?

The background investigation fee is intended to cover the cost of reviewing the personal backgrounds of individuals involved in the business. This $50 fee per person helps ensure that applicants do not have disqualifying criminal records that might hinder their ability to operate a licensed establishment.

8. Is notarization required for the application?

Yes, a notarization of the application is required. This step affirms that all statements made in the application are truthful. The notary public will confirm the identity of the licensee when they sign the application, providing additional legal assurance of accuracy.

9. What documents must I include with my application?

When submitting your application, include any required attachments, such as floor plans that depict the layout of the establishment and state certificates for corporations or LLCs if applicable. Additionally, two registered agent forms with pictures of the agents must be included as part of the submission package. Receipt of the DeKalb County Alcoholic Beverage Ordinance must also be acknowledged by the applicant.

Common mistakes

When filling out the DeKalb County License Application form, many applicants make common mistakes that can delay the process or lead to denials. One frequent error is failing to answer every question fully. The instructions clearly state that every question must be answered. If there isn’t enough space, applicants should attach a separate sheet and note it on the form. Skipping questions completely or providing incomplete answers can result in a rejection of the application.

Another mistake involves not providing accurate personal information. Applicants might overlook the importance of double-checking their information, such as the licensee’s full name, date of birth, and Social Security number. Even small typos or errors can create issues later on. It's essential to ensure that all personal details match official documents to avoid complications.

Some applicants fail to sign and date the form. The application must be signed by the licensee and notarized. Neglecting either of these steps means the application will not be considered valid. Don’t forget to ensure the notary’s stamp is in the designated area; otherwise, this could also lead to a delay.

Using incorrect payment methods can also create issues. The application specifies that payments should be made separately for administrative fees and background investigation fees. Some people may try to include everything in one check, which the processing office does not accept. Separate payments help keep everything organized and streamline the application process.

Lastly, failing to review additional requirements can be detrimental. Many applicants forget to include necessary documentation like floor plans, the Certificate of Incorporation, or agent forms. The application will not be processed until all attachments are received, particularly those that pertain to new establishments or corporations. Ensure all supporting materials are gathered before submitting the application to avoid unnecessary delays.

Documents used along the form

The Dekalb County License Application is often accompanied by several other important forms and documents. These additional documents help ensure compliance with local regulations and provide necessary information regarding the applicant and the intended business operation. Below is a list of commonly used forms associated with the Dekalb County License Application.

- Business Entity Registration: This document provides proof that the business has been duly registered with the state. It includes details about the business structure, such as whether it is a corporation, LLC, or partnership. Proper registration is a prerequisite for obtaining a business license.

- Certificate of Good Standing: A Certificate of Good Standing confirms that the business is active and compliant with state requirements. This document may be necessary to prove that there are no outstanding fees or legal issues related to the business.

- Floor Plans: For businesses that serve food or operate entertainment venues, detailed floor plans showing the layout of the building may be required. These plans should indicate entrances, exits, and specific areas such as dining and entertainment spaces, ensuring safety and compliance with health codes.

- Alcohol Beverage Ordinance Acknowledgment: Applicants usually need to submit a signed acknowledgment of receipt of the DeKalb County Alcoholic Beverage Ordinance. This document indicates that the applicant is aware of the rules and regulations governing the sale of alcoholic beverages.

Each of these forms plays a crucial role in the licensing process, ensuring that all necessary information is submitted for review. Properly completed documentation will facilitate a smoother application approval process.

Similar forms

The DeKalb County License Application form closely resembles several other documents that involve formal applications for various licenses and permits. Here’s a list of six documents that share key similarities:

- Business License Application: Like the DeKalb form, a typical business license application requires detailed information about the applicant, the nature of the business, and compliance with local regulations. Both forms necessitate notarization and may include fees based on the type or size of the business.

- Alcohol Beverage Control (ABC) License Application: This document is similar in that it must be completed accurately and usually requires a background check. Just as with the DeKalb County form, specific types of alcohol licenses may have different requirements and fees associated, tailored to the type of business applying.

- Health Permit Application: A health permit application requests extensive health-related information pertinent to the business, particularly for establishments serving food. Both applications cover compliance with laws and regulations, and often require proof of health inspections or certifications.

- Zoning Permit Application: This application is analogous in that it seeks to ensure the proposed business location complies with local zoning laws. Both documents may require detailed descriptions of the business and its operations, along with potential impacts on the surrounding area.

- Sales Tax Permit Application: Similar to the DeKalb County form, this document requires full disclosure of the business's ownership structure and intended operations. Both forms aim to establish compliance with state financial regulations to ensure proper taxation.

- Fire Department Permit Application: For businesses that will operate in a commercial space, this application ensures compliance with fire safety codes. Like the DeKalb License Application, it seeks essential details about the physical layout of the establishment and may include fees related to inspections.

Dos and Don'ts

When filling out the Dekalb County License Application form, consider these important do's and don'ts:

- Answer every question completely and accurately.

- Sign and date the application before submitting it.

- Attach any additional sheets if space is insufficient.

- Provide a valid mailing address for correspondence.

- Include copies of required documents when necessary.

- Do not leave any questions unanswered; this may delay processing.

- Avoid using abbreviations that could cause confusion.

- Do not submit incomplete applications; they will be returned.

- Refrain from providing false information; penalties apply.

- Do not forget to acknowledge receipt of the County Ordinance.

Misconceptions

When applying for a privilege license in Dekalb County, there are several misconceptions that can lead to confusion. Clarifying these misunderstandings is crucial for a smooth application process. Below are six common misconceptions:

- Misconception 1: Only businesses with a physical location need to apply.

- Misconception 2: The application can be submitted without notarization.

- Misconception 3: You can leave questions blank if you think they do not apply.

- Misconception 4: License fees are only calculated for full months.

- Misconception 5: You do not need to provide background information for partners or officers.

- Misconception 6: Once submitted, the application process is quick and straightforward.

This is not true. Even if you plan to run your business online or from home, a license is still required. All businesses operating in Dekalb County, regardless of their physical presence, must comply with licensing requirements.

Notarization is a mandatory step in the application process. The form must be dated, signed by the licensee, and notarized to ensure the authenticity of the claims made on the form.

Every question on the form must be answered fully and accurately. If you find that the provided space is insufficient, you should use a separate sheet and indicate that it is attached. Incomplete forms may result in delays or denials.

License fees are charged for the remaining months in the year, which includes partial months. Therefore, even if you are applying partway through a month, that time will be counted as a full month for fee purposes.

This is incorrect. You must provide complete background information for each person with ownership interest in the business, including partners and corporate officers. This ensures compliance with regulations and helps in the review process.

The application process can take time and requires thorough preparation. Anticipate potential delays if any part of the application is incomplete or if additional documentation is needed. It is advisable to start the process early and ensure all items are correctly submitted.

Key takeaways

Filling out the Dekalb County License Application form requires careful attention to detail. Every question must be answered fully and accurately. If there isn’t enough space provided for any inquiry, it’s essential to write the answer on a separate sheet and indicate that additional information is attached.

The completed application must be dated, signed, and notarized. It will need to be submitted to the Finance Department, specifically the Division of Internal Audit and Licensing. This office is located at 1300 Commerce Drive, 5th Floor, Decatur, Georgia 30030.

- Ensure that basic information such as the licensee's full name, date of birth, and business details are correctly filled out.

- Licenses are issued only for the remaining months of the calendar year. Therefore, it's important to calculate and include the appropriate fees, considering that partial months count as full months.

- Be aware of the administrative fees that apply based on the type of license. These vary depending on whether you’re seeking a beer and/or wine license, or a liquor license.

- Sunday Sales Permits are only applicable to eating establishments. Additionally, new establishments have a six-month compliance window to meet minimum food sales requirements.

Browse Other Templates

Rental Application Form,Lease Application Document,Tenant Application Sheet,Residential Rental Request,Lease Request Form,Tenant Information Application,Rental Information Sheet,Tenant Screening Application,Lease Eligibility Form,Property Rental Appl - Landlords may reject applications based on incomplete or misleading information provided in this document.

Taco Bell Company - Make a positive impact on your team and community through excellent service.