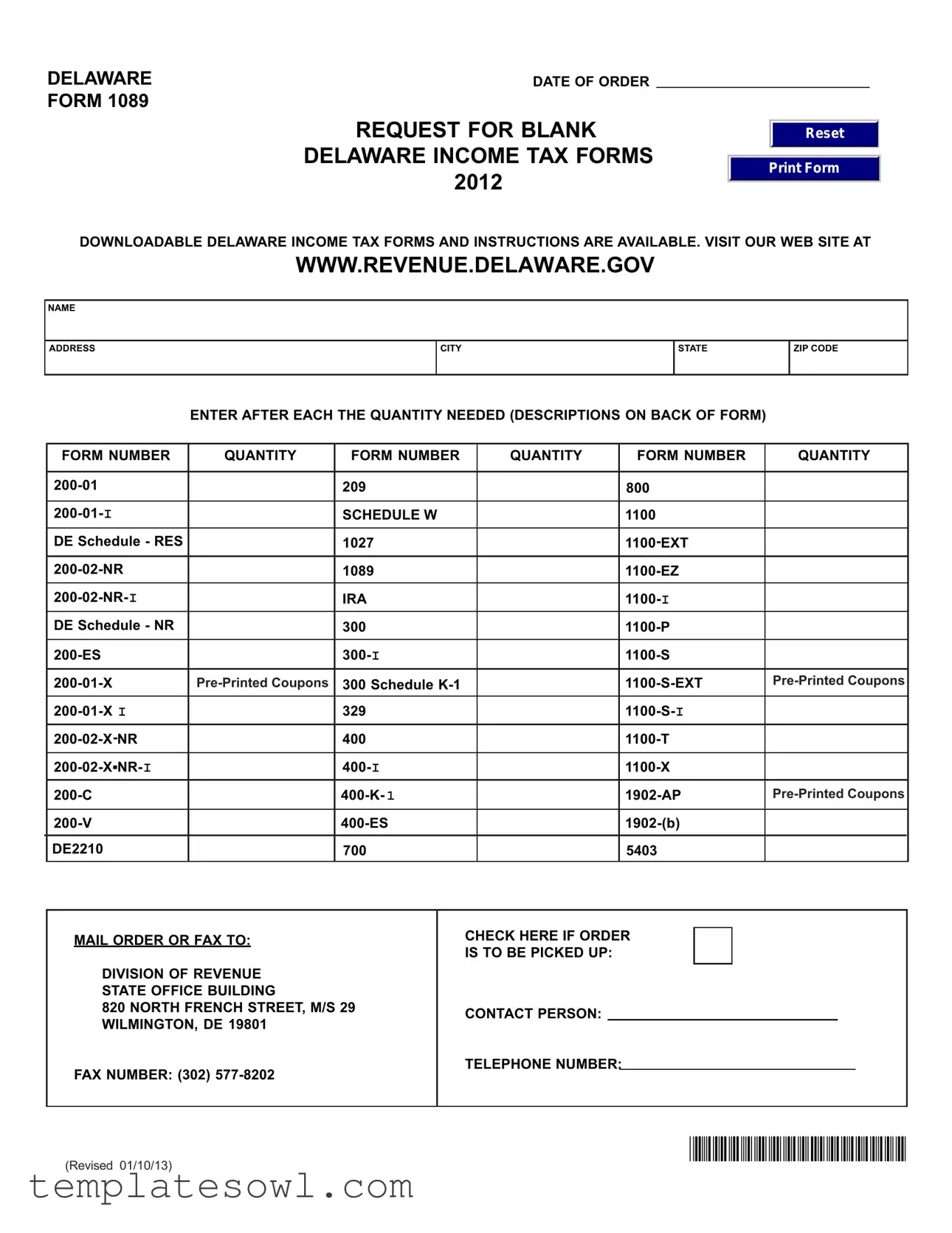

Fill Out Your Delaware 1089 Form

The Delaware 1089 form, known as the Request for Blank Delaware Income Tax Forms, is a crucial document for individuals and businesses looking to procure necessary tax forms for compliance with Delaware's income tax requirements. It allows taxpayers to request a variety of blank tax forms, including those for individual resident and non-resident income tax returns, as well as for corporations and partnerships. The form includes sections for users to specify the quantity of various forms, such as the Individual Resident Income Tax Return (200-01), the Individual Non-Resident Income Tax Return (200-02-NR), and various schedules essential for accurate tax reporting. Additional options for requesting other forms, like amending returns or claiming refunds for deceased taxpayers, are also provided. This convenience facilitates the annual tax preparation process, ensuring that all required documentation is readily available. Taxpayers can submit their requests via mail or fax, and the form includes clear instructions for proper completion, enhancing overall accessibility to vital tax resources.

Delaware 1089 Example

DELAWARE |

DATE OF ORDER |

FORM 1089 |

|

|

REQUEST FOR BLANK |

|

DELAWARE INCOME TAX FORMS |

|

2012 |

Reset

Print Form

DOWNLOADABLE DELAWARE INCOME TAX FORMS AND INSTRUCTIONS ARE AVAILABLE. VISIT OUR WEB SITE AT

WWW.REVENUE.DELAWARE.GOV

NAME

ADDRESS

CITY

STATE

ZIP CODE

ENTER AFTER EACH THE QUANTITY NEEDED (DESCRIPTIONS ON BACK OF FORM)

|

FORM NUMBER |

QUANTITY |

FORM NUMBER |

|

QUANTITY |

|

|

FORM NUMBER |

QUANTITY |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

209 |

|

|

|

|

800 |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE W |

|

|

|

1100 |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DE Schedule - RES |

|

1027 |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1089 |

|

|

|

|

|

|

|

|

||||||

|

|

IRA |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DE Schedule - NR |

|

300 |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

300 Schedule |

|

|

|

||||||||||||

|

|

329 |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

400 |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DE2210 |

|

700 |

|

|

|

|

5403 |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

MAIL ORDER OR FAX TO: |

|

|

CHECK HERE IF ORDER |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

IS TO BE PICKED UP: |

|

|

|

|

|

|

|

||||

|

DIVISION OF REVENUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STATE OFFICE BUILDING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

820 NORTH FRENCH STREET, M/S 29 |

|

CONTACT PERSON: |

|

|

|

|

|

|

|

||||||

|

WILMINGTON, DE 19801 |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

FAX NUMBER: (302) |

|

|

TELEPHONE NUMBER: |

|

( |

) |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Revised 01/10/13) |

*DF31112019999* |

|

FORM NUMBER |

DESCRIPTION |

INDIVIDUAL RESIDENT INCOME TAX RETURN |

|

INSTRUCTIONS FOR INDIVIDUAL RESIDENT INCOME TAX RETURN |

|

DE Schedule - RES |

DELAWARE RESIDENT SCHEDULES I, II, III |

INDIVIDUAL |

|

INSTRUCTIONS FOR INDIVIDUAL |

|

DE Schedule - NR |

DELAWARE |

ESTIMATED INCOME TAX RETURN BOOKLET (OCR BOOKLET, NOT DISTRIBUTED BLANK) |

|

AMENDED DELAWARE RESIDENT PERSONAL INCOME TAX RETURN |

|

INSTRUCTIONS FOR AMENDED DELAWARE RESIDENT PERSONAL INCOME TAX RETURN |

|

AMENDED DELAWARE |

|

INSTRUCTIONS FOR AMENDED DELAWARE |

|

COMPOSITE PERSONAL INCOME TAX RETURN WITH INSTRUCTIONS |

|

ELECTRONIC FILER PAYMENT VOUCHER FORM |

|

2210 |

UNDERPAYMENT OF ESTIMATED TAXES |

209 |

CLAIM FOR REFUND DUE ON BEHALF OF DECEASED TAXPAYER |

SCHEDULE W |

SCHEDULE OF DAYS WORKED OUTSIDE OF STATE |

1027 |

APPLICATION FOR AUTOMATIC EXTENSION OF TIME TO FILE DELAWARE INDIVIDUAL INCOME TAX |

1089 |

REQUEST FOR BLANK DELAWARE INCOME TAX RETURNS |

IRA |

DELAWARE SPECIAL TAX COMPUTATION FOR INDIVIDUAL RETIREMENT ACCOUNT DISTRIBUTION |

300 |

PARTNERSHIP RETURN |

INSTRUCTIONS FOR PARTNERSHIP RETURN |

|

300 Schedule |

PARTNERS SHARE OF INCOME |

329 |

LUMP SUM DISTRIBUTION FROM QUALIFIED RETIREMENT PLAN |

400 |

FIDUCIARY RETURN |

INSTRUCTIONS FOR FIDUCIARY RETURN |

|

400 Schedule |

BENEFICIARY’S INFORMATION |

FIDUCIARY ESTIMATE TAX RETURN BOOKLET |

|

700 |

BUSINESS TAX CREDITS FORM WITH INSTRUCTIONS |

800 |

BUSINESS INCOME OF |

1100 |

CORPORATION INCOME TAX RETURN |

CORPORATE INCOME TAX REQUEST FOR EXTENSION |

|

S CORPORATION INCOME TAX REQUEST FOR EXTENSION |

|

CORPORATION INCOME TAX RETURN (SHORT FORM) |

|

INSTRUCTIONS FOR CORPORATION INCOME TAX RETURN |

|

S CORPORATION ESTIMATED TAX RETURN BOOKLET (OCR BOOKLET, NOT DISTRIBUTED BLANK) |

|

SMALL BUSINESS CORPORATION INCOME TAX RETURN |

|

1100 |

INSTRUCTIONS FOR SMALL BUSINESS CORPORATION INCOME TAX RETURN |

CORPORATE TENTATIVE TAX RETURN BOOKLET (OCR BOOKLET, NOT DISTRIBUTED BLANK) |

|

AMENDED CORPORATION INCOME TAX RETURN |

|

APPLICATION FOR EXEMPTION FROM CORPORATION INCOME TAX |

|

DELAWARE INFORMATION RETURN HOLDING COMPANY/INVESTMENT COMPANY |

|

5403 |

DELAWARE REAL ESTATE TAX RETURN DECLARATION OF ESTIMATED TAXES |

(REVISED 01/10/13)

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Delaware 1089 form is used to request blank Delaware income tax returns. |

| Governing Laws | Regulations governing income tax forms in Delaware are outlined in Title 30 of the Delaware Code. |

| Submission Method | Individuals can submit the 1089 form by mail or fax to the Division of Revenue. |

| Contact Information | Submission should be directed to 820 North French Street, Wilmington, DE 19801. |

| Available Forms | The 1089 form provides access to various income tax forms such as resident and non-resident returns. |

| Print Option | A "Reset" option is included, allowing users to clear the form for new entries. |

| Website Resources | Additional Delaware income tax forms and instructions are available on the official website. |

| Revisions | The form was last revised on January 10, 2013, indicating up-to-date information. |

| Form Variations | The 1089 can be used to order several forms, including amended and special tax computation forms. |

Guidelines on Utilizing Delaware 1089

Once you've gathered the necessary information, filling out the Delaware 1089 form can be straightforward. By providing accurate details, you ensure that your request for blank Delaware income tax returns is processed efficiently. Follow these steps closely for a smooth experience.

- Begin by entering your full name in the designated space at the top of the form.

- Next, provide your address, including the street, city, state, and zip code.

- In the section below your name and address, list the quantity needed for each of the forms you require. You’ll find the form numbers and descriptions listed on the form for easy reference.

- For each form, enter the form number in the first column and the corresponding quantity in the second column. Be sure to check against the descriptions to ensure accuracy.

- If you want to pick up the forms in person, mark the checkbox indicating that you will pick them up.

- Include the name and telephone number of a contact person in case the Division of Revenue needs to reach you regarding your request.

- Finally, submit the form by either mailing it to the address provided or faxing it to the number listed at the bottom of the form.

Once submitted, the Division of Revenue will process your request. You can expect to receive the specified forms shortly, enabling you to move forward with your tax preparation for Delaware. Being prepared with accurate information will facilitate a smooth process.

What You Should Know About This Form

What is the Delaware 1089 form?

The Delaware 1089 form is a request for blank Delaware income tax returns. It is primarily used by individuals or entities that require copies of various Delaware income tax forms to complete their filing. This request helps ensure that individuals have the necessary forms to accurately report their income and tax liabilities to the state of Delaware.

Who should use the Delaware 1089 form?

This form is particularly useful for taxpayers who need additional copies of Delaware tax returns, such as individuals filing non-resident income tax returns or businesses needing corporate tax forms. It serves a broad audience, including individual residents, non-residents, and entities like corporations and partnerships.

How can I obtain the Delaware 1089 form?

The form can be downloaded from the Delaware Division of Revenue’s website. You can also contact the Division of Revenue directly to obtain the form if you prefer not to download it. Additionally, you can request copies in person or through fax by providing the necessary details.

What types of forms can I request with the Delaware 1089?

You can request various Delaware income tax forms using the 1089, including resident and non-resident income tax returns, estimated tax return booklets, and amended tax return forms. A specific quantity of each type of form can be indicated on the request to ensure you receive enough copies for your needs.

What is the address to mail the completed Delaware 1089 form?

Completed forms should be mailed to the Division of Revenue at the State Office Building, 820 North French Street, M/S 29, Wilmington, DE 19801. Make sure to include any required information to avoid delays in processing your request.

Is there a fax option available for submitting the Delaware 1089 form?

Yes, you can fax the completed Delaware 1089 form to (302) 577-8202. Ensure that your form is legible and all necessary details are filled out to facilitate a smooth request process.

Do I have to pay for the forms I request?

No, there is typically no fee for requesting blank Delaware income tax forms through the 1089. The Delaware Division of Revenue provides these forms to assist taxpayers in fulfilling their obligations without any charge.

What if I need help completing the forms I receive?

If you require assistance with completing the Delaware income tax forms, resources are available. You can refer to the instructions included with each form for guidance. Additionally, the Delaware Division of Revenue offers support through their contact center to help answer any questions you may have.

What is the deadline for requesting forms using the Delaware 1089?

While there isn't a specific deadline for requesting forms using the 1089, it is advisable to request them as early as possible. Doing so ensures you have adequate time to complete and submit your tax returns by the filing deadline set by the state.

Common mistakes

Many individuals encounter difficulties when filling out the Delaware 1089 form. One common mistake is failing to include the correct contact information. It's essential to provide accurate details, such as your name, address, city, state, and zip code. Omitting any part of this information could delay the processing of your request.

Another frequent error involves not specifying the quantity needed for each form. The form requires individuals to indicate how many of each tax form they wish to request. Leaving this section blank can lead to incomplete orders, which may require additional time and effort to resolve.

Some people also overlook the importance of reviewing the form before submission. Errors such as incorrect form numbers or miswritten details can result in returned applications or improper processing. Taking a moment to check the information listed can help avoid unnecessary complications.

Additionally, failure to provide a fax number or telephone number can hinder communication. In case the revenue division needs to reach you for clarification, not providing these details may prolong the application process. Being reachable can help expedite any necessary follow-ups.

Lastly, individuals sometimes neglect to indicate whether the order is to be picked up or mailed. This decision affects how the request is handled. If it's intended to be picked up, clearly marking that option can prevent confusion and ensure a smoother experience when obtaining the forms.

Documents used along the form

When filing taxes in Delaware, you might find that the Delaware 1089 form is just one piece of the puzzle. A variety of other forms and documents may accompany this request for blank income tax returns. Here's a brief overview of the key forms often used in conjunction with the Delaware 1089 form.

- 200-01: This is the Individual Resident Income Tax Return form, used by residents to report their income and compute their tax obligations.

- 200-02-NR: The Individual Non-Resident Income Tax Return, this form is designed for non-residents who have income sourced from Delaware.

- 200-01-X: This Amended Delaware Resident Personal Income Tax Return is for individuals who need to correct or update their previously filed returns.

- 200-02-X-NR: Similar to the amended resident form, this one is for non-residents seeking to amend their tax returns.

- 209: The Claim for Refund due on behalf of a deceased taxpayer is utilized to claim any tax refunds that might be owed to a decedent's estate.

- 400: The Fiduciary Return, used for estates and trusts, is essential for reporting income that belongs to beneficiaries.

- 400 Schedule K-1: This document reports a beneficiary’s share of income, deductions, and credits from a fiduciary return.

- 1100: The Corporation Income Tax Return is for businesses operating as corporations, ensuring compliance with tax regulations.

Understanding these forms and their purposes can significantly ease the tax-filing process. Whether you are a resident, non-resident, or handling a trust, being prepared with the correct documentation is essential for a smooth experience with Delaware's tax system.

Similar forms

The Delaware 1089 form is a request for blank Delaware income tax returns. It's used by individuals or entities needing to obtain income tax forms for filing purposes. Here are four documents that share similarities with the Delaware 1089 form:

- Delaware Individual Resident Income Tax Return (Form 200-01): This form is used for filing income taxes as a resident. Like the 1089, it is essential for individuals to report their income and calculate taxes owed.

- Delaware Individual Non-Resident Income Tax Return (Form 200-02-NR): Non-residents who earn income in Delaware must file this form. It functions similarly to the 1089 because it serves as a mechanism for reporting income and tax calculations, though it applies to non-residents.

- Delaware Application for Automatic Extension of Time to File (Form 1027): This form allows taxpayers to request additional time to file their income tax returns. While not a return itself, it relates to the 1089 by impacting when and how income tax forms are prepared and submitted.

- Delaware Amended Resident Personal Income Tax Return (Form 200-01-X): If errors are found on a previously submitted resident tax return, this form is used to make corrections. Its purpose aligns with the 1089 in that both facilitate proper tax reporting and compliance.

Dos and Don'ts

When filling out the Delaware 1089 form, it's crucial to follow specific guidelines to avoid mistakes. Here are some dos and don'ts to keep in mind:

- Do ensure that you enter your name and contact information accurately.

- Do double-check the quantities needed for each form to avoid running out.

- Do use the correct form number for the type of income tax return you are requesting.

- Do mail or fax your order to the correct address provided on the form.

- Don’t forget to check the box if you want to pick up the forms in person.

- Don’t leave any required fields blank, as incomplete forms can delay your request.

Each detail matters when handling your tax forms. By adhering to these guidelines, you can simplify the process and ensure that your request is processed smoothly.

Misconceptions

Misconceptions about the Delaware 1089 form are common among those navigating state tax requirements. Here are four prevalent misunderstandings:

- The 1089 form is a tax return. Many people believe that the Delaware 1089 form itself is a tax return. In reality, it is a request for blank Delaware income tax forms. The form allows individuals to obtain necessary tax forms required for filing their income tax returns.

- Only residents of Delaware need to use the 1089 form. Another common misconception is that this form is only applicable to Delaware residents. Non-residents with income sourced in Delaware may also need to file certain forms related to their tax responsibilities, and they can use the 1089 to request those forms.

- This form is only for individual taxpayers. Some individuals think that the 1089 form is solely intended for personal income tax. However, the request can also be utilized by businesses and fiduciaries to obtain necessary tax forms relevant to their specific tax situations.

- The 1089 form must be submitted annually. There is a belief that the 1089 form needs to be filled out and submitted each year. Actually, taxpayers only need to submit the 1089 form when they require additional blank forms for their tax filings. If no new forms are needed, the 1089 does not need to be submitted.

Understanding these misconceptions can help taxpayers make informed decisions regarding their tax obligations in Delaware.

Key takeaways

Here are some essential points to consider when filling out and using the Delaware 1089 form:

- Purpose of the Form: The Delaware 1089 form is a request for blank Delaware income tax returns.

- Who Should Use It: Individuals or entities needing to order income tax forms for filing purposes can use this form.

- Contact Information: Make sure to provide accurate contact details, including your name, address, and phone number.

- Quantities Needed: Clearly indicate the quantity of each form you require in the designated areas.

- Submission Methods: You can mail or fax the completed form to the Division of Revenue in Wilmington, DE.

- Collection Options: If you prefer to pick up the forms in person, check the appropriate box on the form.

- Available Forms: Familiarize yourself with the forms listed in the 1089 document to ensure you order the correct ones.

Browse Other Templates

Tesco Pet Insurance Uk - Complete the declaration section to confirm all information is truthful.

Sc Dmv Form - The form requires a declaration under penalties of perjury regarding residency status.

Firm Mailing Book - The form facilitates both business and personal mailing needs for accountable items.