Fill Out Your Delaware Ap1 Form

The Delaware AP1 form serves as a crucial document for businesses when reporting unclaimed or abandoned property to the state. This requirement ensures that businesses uphold their responsibilities in maintaining accurate records and returning property to rightful owners whenever possible. Designed specifically for banking organizations and life insurance companies, the AP1 form requires detailed information about the holder, including the federal employer identification number and contact details. It distinguishes between final and supplemental reports, each serving unique purposes in the reporting process, with strict deadlines that must be adhered to. The form also necessitates a recap of reported amounts, broken down into various asset categories such as cash, securities, and any relevant account balances. Additionally, businesses are prompted to include essential transactional documentation to verify ownership and facilitate seamless reporting. This verification process reflects the state's commitment to transparency and accountability, while also safeguarding the interests of property owners. Overall, the AP1 form embodies both a regulatory obligation and an opportunity for organizations to demonstrate diligence in managing unclaimed property.

Delaware Ap1 Example

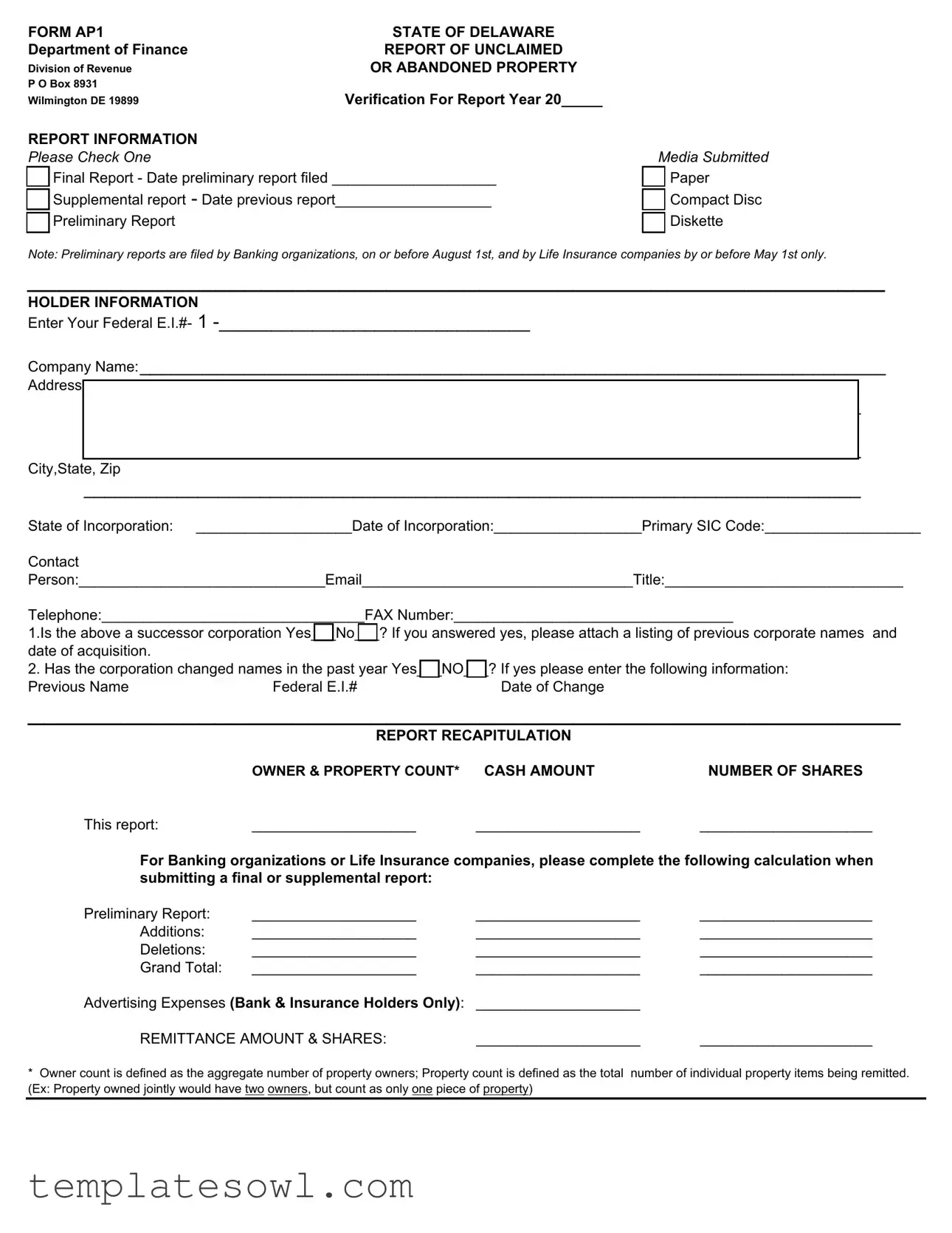

FORM AP1 |

STATE OF DELAWARE |

Department of Finance |

REPORT OF UNCLAIMED |

Division of Revenue |

OR ABANDONED PROPERTY |

P O Box 8931 |

|

Wilmington DE 19899 |

Verification For Report Year 20_____ |

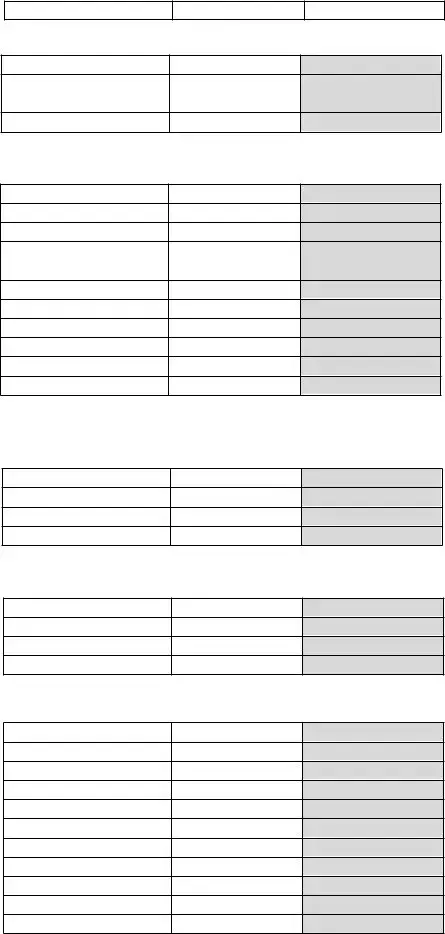

REPORT INFORMATION

Please Check One

[] Final Report - Date preliminary report filed ____________________

[] Supplemental report - Date previous report___________________

[] Preliminary Report

Media Submitted

[] Paper

[] Compact Disc

[] Diskette

Note: Preliminary reports are filed by Banking organizations, on or before August 1st, and by Life Insurance companies by or before May 1st only.

_______________________________________________________

HOLDER INFORMATION

Enter Your Federal E.I.#- 1

Company Name:________________________________________________________________________

Address:

___________________________________________________________________________

___________________________________________________________________________

City,State, Zip

___________________________________________________________________________

State of Incorporation: ___________________Date of Incorporation:__________________Primary SIC Code:___________________

Contact

Person:______________________________Email_________________________________Title:_____________________________

Telephone:________________________________FAX Number:__________________________________

1.Is the above a successor corporation Yes___No___? If you answered yes, please attach a listing of previous corporate names and date of acquisition.

2. Has the corporation changed names in the past year Yes___NO___? If yes please enter the following information:

Previous NameFederal E.I.#Date of Change

________________________________________________________

|

REPORT RECAPITULATION |

|

|

|

OWNER & PROPERTY COUNT* |

CASH AMOUNT |

NUMBER OF SHARES |

This report: |

____________________ |

____________________ |

_____________________ |

For Banking organizations or Life Insurance companies, please complete the following calculation when |

|||

submitting a final or supplemental report: |

|

|

|

Preliminary Report: |

____________________ |

____________________ |

_____________________ |

Additions: |

____________________ |

____________________ |

_____________________ |

Deletions: |

____________________ |

____________________ |

_____________________ |

Grand Total: |

____________________ |

____________________ |

_____________________ |

Advertising Expenses (Bank & Insurance Holders Only): ____________________ |

|

||

REMITTANCE AMOUNT & SHARES: |

____________________ |

_____________________ |

|

*Owner count is defined as the aggregate number of property owners; Property count is defined as the total number of individual property items being remitted. (Ex: Property owned jointly would have two owners, but count as only one piece of property)

FORM AP1 |

STATE OF DELAWARE |

Department of Finance |

REPORT OF UNCLAIMED |

Division of Revenue |

OR ABANDONED PROPERTY |

P O Box 8931 |

|

Wilmington DE 19899 |

Verification For Report Year 20_____ |

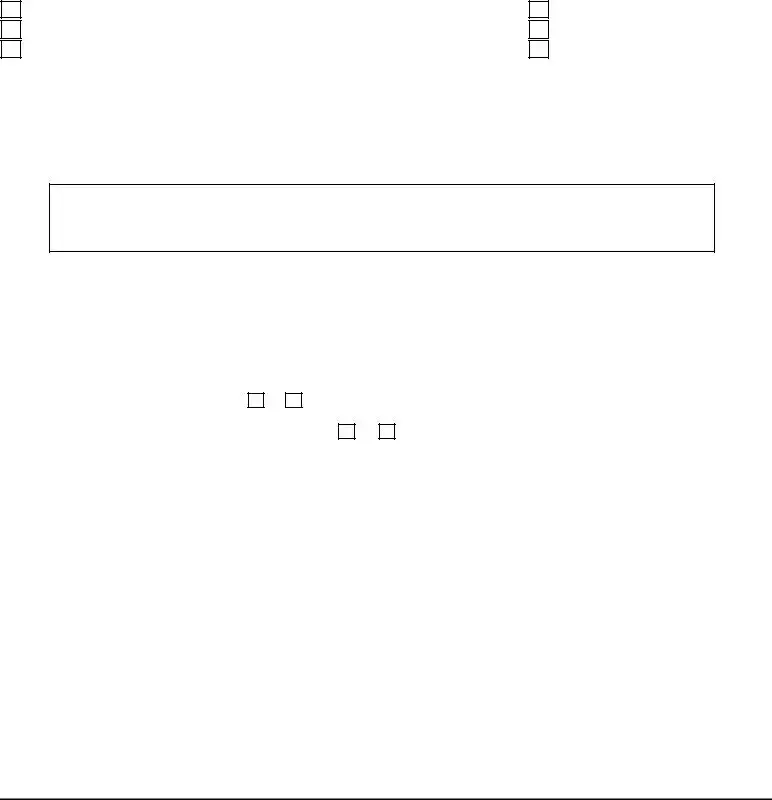

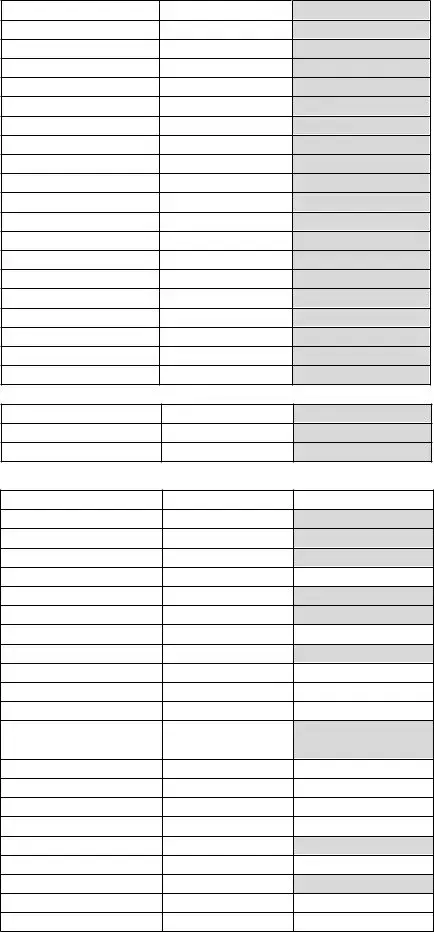

HOLDER DELIVERY OF SECURITIES:

Holders delivering securities must provide account statements and documentation related to the State of Delaware Escheatment. Have securities been transferred to the State account: ______Yes ______ No

Are account statements and transfer documentation included with this report: ______Yes ______ No

_____________________________________________________________________________________

VERIFICATION

State of_________________________:

County of________________________: ss

I, ________________________________________ being first duly sworn, on oath depose and state that I have caused to be prepared and have

examined this report as to property presumed abandoned under the Delaware Unclaimed Property Law for the year ending as stated; that I am duly authorized by the holder to execute this report; and I believe that said report is true, correct and complete as of said date, excepting for such property as has ceased to be abandoned.

Signature__________________________________ Title________________________________________

Subscribed and sworn to before me this____________day of__________, 20_________.

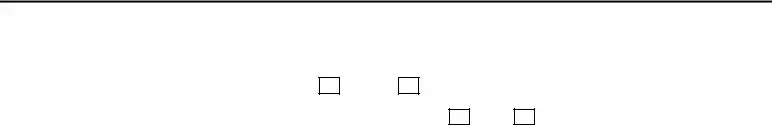

DOCUMENT NO:

# OWNERS / # PROP. |

$ REPORTED |

# SHARES |

ACCOUNT BALANCES

AC01 Checking Accounts

AC02 Savings Accounts

AC03 Matured CD or Savings Certs.

AC04 Christmas Club Accounts

AC05 Money on Deposit to Secure Funds

AC06 Security Deposits

AC07 Unidentified Deposits

AC08 Suspense Accounts

AC99 Aggregate

TOTAL

UNCASHED CHECKS

CK01 Cashiers Checks

CK02 Certified Checks

CK03 Registered Checks

CK04 Treasurers Checks

CK05 Drafts

CK06 Warrants

CK07 Money Orders

CK08 Travelers Checks

CK09 Foreign Exchange Checks

CK10 Expense Checks

CK11 Pension Checks

CK12 Credit Checks or Memos

CK13 Vendor Checks

CK14 Checks Written off to Income

CK15 Other Official Checks

CK16 CD Interest Checks

CK99 Aggregate

TOTAL

COURT DEPOSITS

CT01 Escrow Funds

CT02 Condemnation Awards

CT03 Missing Heirs’ Fund

CT04 Suspense Accounts

CT05 Other Court Deposits

CT99 Aggregate

TOTAL

EDUCATIONAL SAVINGS ACCOUNTS

CS01 Cash

CS02 Mutual Funds

CS03 Securities

TOTAL

# OWNERS / # PROP.

HEALTH SAVINGS PLAN

HS01 Health Savings Account

HS02 Health Savings Account

Investment

TOTAL

INSURANCE

IN01 Indiv. Policy Benefits or Claims

IN02 Group Policy Benefits or Claims

IN03 Proceeds Due Beneficiaries

IN04 Proceeds From Matured Policies,

Endowments or Annuities

IN05 Premium Refunds

IN06 Unidentified Remittances

IN07 Other Amounts Due Under Policy

IN08 Agent Credit Balances

IN99 Aggregate

TOTAL

IRA - TRADITIONAL, SEP, SARSEP, AND SIMPLE

IR01 Cash

IR02 Mutual Funds

IR03 Securities

TOTAL

IRA - ROTH

IR05 Cash

IR06 Mutual Funds

IR07 Securities

TOTAL

MINERAL PROCEEDS & INTERESTS

MI01 Net Revenue Interest

MI02 Royalties

MI03 Overriding Royalties

MI04 Production Payments

MI05 Working Interest

MI06 Bonuses

MI07 Delay Rentals

MI08

MI09 Minimum Royalties

MI99 Aggregate

TOTAL

$ REPORTED

# SHARES

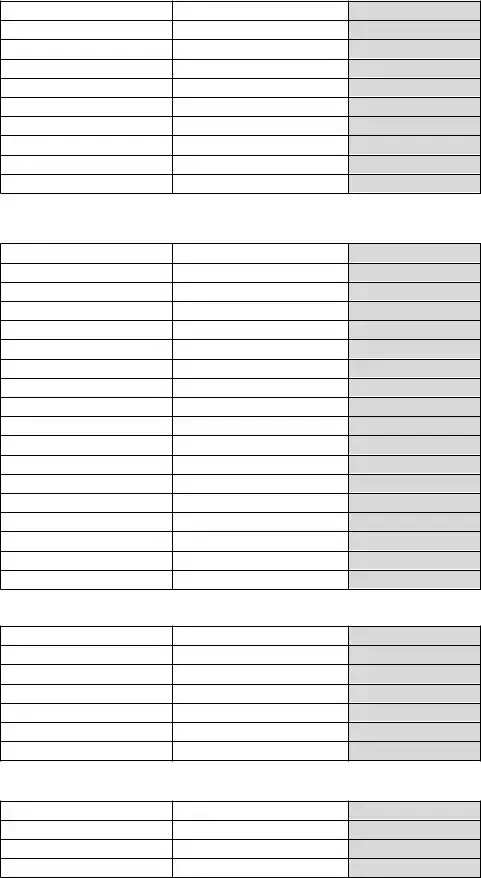

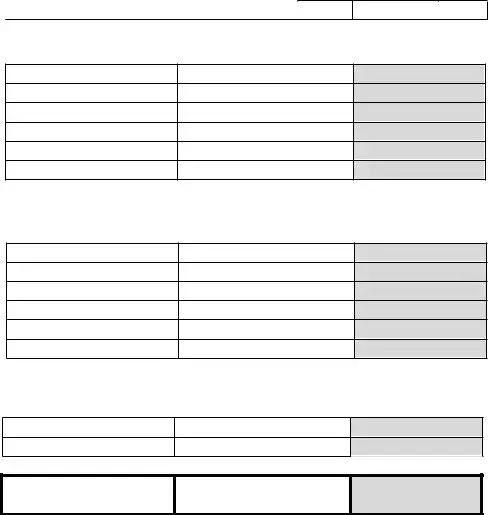

# OWNERS / #PROP. |

$ REPORTED |

# SHARES |

|

|

|

MISC. CHECKS & INTANGIBLE PERSONAL PROPERTY

MS01 Wages, Payroll, Salary

MS02 Commissions

MS03 Workers Compensation Benefits

MS04 Payment for Goods & Services

MS05 Customer Overpayments

MS06 Unidentified Remittances

MS07 Unrefunded Overcharges

MS08 Accounts Payable

MS09 Credit Balances

MS10 Discounts Due

MS11 Refunds Due

MS12 Unredeemed Gift Certificates

MS13 Unclaimed Loan Collateral

MS14 Pension & Profit Sharing Plans

MS15 Dissolution or Liquidation

MS16 Misc Outstanding Checks

MS17 Misc Intangible Property

MS18 Suspense Liabilities

MS99 Aggregate

TOTAL

SAFE DEPOSIT BOX (SAFEKEEPING)

SD01 SD Box Net Proceeds

SD02 Other Safekeeping

TOTAL

SECURITIES

SC01 Dividends

SC02 Interest (Bond Coupons)

SC03 Principal Payments

SC04 Equity Payments

SC05 Profits

SC06 Funds to Purchase Shares

SC07 Funds for Stocks & Bonds

SC08 Shares of Stock (Returned by P.O.)

SC09 Cash For Fractional Shares

SC10 Unexchanged Shares of Successor Corp

SC11 Other Certs. of Ownership

SC12 Underlying Shares

SC13

of unsurrendered Stock or bonds

SC14 Debentures

SC15 US Government Securities

SC16 Mutual Fund Shares

SC17 Warrants (Rights)

SC18 Matured Bond Principal

SC19 Dividend Reinvestment Plans

SC20 Credit Balances

SC99 Aggregate

TOTAL

|

|

|

# OWNERS / #PROP. |

$ REPORTED |

|

|

|

|

# SHARES

TRUST, INVESTMENT & ESCROW ACCOUNTS

TR01 Paying Agent Accounts

TR02 Undelivered or Uncashed Dividends

TR03 Funds Held In Fiduciary Capacity

TR04 Escrow Accounts

TR05 Trust Vouchers

TOTAL

UTILITIES

UT01 Utility Deposits

UT02 Membership Fees

UT03 Refunds or Rebates

UT04 Capital Credit Distributions

UT99 Aggregate

TOTAL

ALL OTHER PROPERTY NOT IDENTIFIED ABOVE

ZZZZ ALL OTHER PROPERTY

TOTAL

GRAND TOTAL *

* Please total all property categories and enter grand total on front of form

(REVISED 02/ 17/ 11)

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose of the Form | The Delaware Form AP1 is designed for reporting unclaimed or abandoned property to the state, as required by law. |

| Filing Deadline | Banking organizations must submit preliminary reports by August 1st, while life insurance companies have a deadline of May 1st. |

| Governing Law | The reporting of unclaimed property in Delaware is governed by the Delaware Unclaimed Property Law. |

| Holder Information | Holders must provide their Federal Employer Identification Number (EIN) and other relevant company details on the form. |

| Owner & Property Count | The report includes definitions for owner count and property count, which aid in calculating total numbers for the submission. |

| Verification Requirements | Submitters must verify the accuracy of the report by signing and swearing to its completeness under oath. |

| Delivery of Securities | If securities are being delivered, holders must ensure that account statements and relevant documentation are included with the report. |

Guidelines on Utilizing Delaware Ap1

Once you have gathered all required information and documents, you can begin to fill out the Delaware AP1 form. It's important to be thorough and accurate in this process as it ensures compliance with state regulations regarding unclaimed property. Below are detailed steps to guide you through completing the form.

- Start with the Report Information section: Indicate whether this is a final, supplemental, or preliminary report by checking the appropriate box. If applicable, fill in the dates for preliminary or previous reports.

- In the Holder Information section, provide your Federal Employer Identification Number (E.I.#) and the name of your company. Ensure that the company name aligns with official records.

- Enter the company’s address, including the city, state, and zip code. Don’t forget to mention the date and state of incorporation, as well as your primary SIC code.

- List a contact person and provide their email address, title, telephone, and fax number for further communication.

- Answer the two key questions regarding the status of your corporation: whether it's a successor corporation and if the name has changed in the past year. If applicable, provide details about previous names and dates of changes.

- Move on to the Report Recapitulation: Fill in the owner and property count, cash amount, and the number of shares being reported. This includes totals for banking organizations or life insurance companies.

- Complete the Advertising Expenses section if applicable and proceed to the Remittance Amount & Shares section to indicate the amounts and shares being submitted.

- If you have securities to deliver, affirm whether they have been transferred to the State account and ensure all documentation is included with this report.

- Fill out the Verification section, sign your name, and provide your title. This certifies that you are authorized to submit the report and that all information provided is accurate to the best of your knowledge.

- Finally, have your signature notarized. Provide the date for the notarization as well.

After completing the form, review all information carefully for accuracy before submission. Ensure every section is filled out, and you have attached any required documentation. Once finalized, you can send the completed form to the designated address provided on the form.

What You Should Know About This Form

What is the Delaware AP1 form and who needs to file it?

The Delaware AP1 form is a report used to declare unclaimed or abandoned property, which could include various types of financial assets such as bank accounts, insurance policies, or uncashed checks. Any organization that holds property that may be deemed unclaimed—such as banking institutions, insurance companies, and other businesses—must submit this report. The deadline varies; banking organizations must file by August 1st, and life insurance companies by May 1st each year.

How do I complete the Delaware AP1 form?

Completing the AP1 form requires detailed information about your organization and the unclaimed property. You’ll need your Federal Employer Identification Number (E.I. #), a list of the type of abandoned property, and the total cash amount or number of shares involved. Make sure to indicate if this report is final, supplemental, or preliminary, and provide the necessary calculations for additions and deletions. The thoroughness of your report is essential to ensure compliance with state laws.

What happens if I miss the filing deadline for the AP1 form?

Missing the filing deadline for the AP1 form can have serious implications. Your organization may face fines or penalties, and lingering issues could affect your ability to operate smoothly. It’s a good idea to keep a close eye on deadlines and allow enough time to gather all necessary documents. If you realize you’ve missed a deadline, consult a legal expert in unclaimed property to understand your options.

Is there assistance available for filing the Delaware AP1 form?

Yes, assistance is available for organizations navigating the complexities of filing the Delaware AP1 form. The state provides resources, including guides and FAQ documents, and there are professionals who specialize in unclaimed property compliance. Don’t hesitate to reach out for help, as addressing your questions and concerns proactively can help prevent errors in your filing.

Common mistakes

Filling out the Delaware AP1 form accurately is crucial to ensure compliance with unclaimed property regulations. Various mistakes can occur, which might lead to delays or complications in processing the report. One common issue is incomplete information in the Holder Information section. Missing details, such as the Federal Employer Identification number (EIN) or the name of the company, can hinder the audit process and result in rejection of the submission.

Another frequent error is the failure to specify the type of report being submitted. The choices must be clearly indicated as either a Final, Supplemental, or Preliminary report. Not marking this adequately can lead to misunderstandings about the submission's intent and requirements, thereby complicating the review process.

Errors in the Owner & Property Count section also occur often. It is essential to ensure that the numbers provided are consistent and accurate. Inaccurate counts of owners or properties may prompt additional inquiries from the Delaware Division of Revenue, resulting in unnecessary delays.

Individuals frequently neglect the Verification section, where a sworn statement confirming the accuracy of the information is required. Missing signatures or lacking the notarization can invalidate the entire report, requiring a resubmission and possibly incurring penalties.

Providing insufficient documentation for securities delivery can complicate matters as well. Holders must affirm that all relevant account statements and transfer documentation are included. Failing to confirm these inclusions could result in additional scrutiny from state auditors.

Another mistake relates to ignoring the submission deadlines specific to different types of entities. Banking organizations and life insurance companies have distinct filing timelines that must be adhered to. Misalignment with these deadlines can prevent timely compliance with state laws.

Using outdated forms or failing to check for revisions before submission is another common misstep. Regulatory forms can change; thus, using an obsolete version of the AP1 form can lead to rejections or compliance issues.

Many individuals also mistakenly overlook the requirement for detailed account listing and categorization. Items must be reported accurately, including cash amounts and shares. This meticulousness ensures transparency and facilitates a smoother review process.

Lastly, neglecting to keep copies of submitted forms and documents can result in a lack of proof in case of disputes or discrepancies. It is best practice to maintain thorough records of all submissions for reference in the future.

Documents used along the form

The Delaware AP1 form is used for reporting unclaimed or abandoned property to the state. In conjunction with this form, several other documents are commonly required to ensure proper compliance. Below is a list of documents that may be needed, along with brief descriptions.

- Annual Report: This document provides a yearly account of a business's activities, financial performance, and other relevant information. It is often required for corporations to maintain good standing in Delaware.

- Verification of Ownership: This document verifies the claim of ownership for any unclaimed property and may include supporting documentation, such as account statements or transaction records.

- Prior Corporate Names Listing: For corporations that have changed names, this document should list all previous names along with the dates of those changes.

- Final Report of Unclaimed Property: This submission should include the final figures for all unclaimed or abandoned property, clearly detailing any remittances made to the state.

- Transfer Documentation: For holders transferring securities to the state, this documentation is necessary to provide evidence of the transfer process, including account statements showing ownership.

- Corporate Authorization Resolution: This document is a formal statement authorized by board members allowing designated individuals to act on behalf of the corporation regarding unclaimed property matters.

- Owner Contact Information: This document collects contact details of property owners to notify them of the unclaimed property and provide proper claim instructions.

- Audit Reports: If applicable, these reports from an independent auditor may be required to affirm that the processes for identifying unclaimed property are accurate and compliant.

- Schedule of Properties: A detailed list of all unclaimed properties, including their descriptions, owners, and values, which is often necessary for state reporting requirements.

- Proof of Identity: For individuals claiming property, providing a form of identification such as a driver's license or passport may be necessary to prevent fraud.

It is essential to gather and prepare these documents carefully to facilitate the unclaimed property reporting process. Each form and document plays a role in ensuring compliance with Delaware laws and regulations. Proper management can lead to smoother interactions with state authorities and easier resolution of unclaimed property issues.

Similar forms

Form 1099 – Similar to the Delaware AP1 form, Form 1099 is used to report various types of income other than wages, salaries, and tips. Just as the AP1 form captures unclaimed or abandoned property data, the 1099 reflects income that is reported to the IRS for tax purposes.

Form W-2 – This document details wages paid to employees and the taxes withheld. Like the AP1 form, it requires annual verification and submission to ensure that the reported amounts are correct and up-to-date.

IRS Form 990 – Nonprofit organizations must file this form to provide the IRS with information about their activities, governance, and financials. Similar to the AP1, it requires accurate reporting and full accountability of financial dealings.

Form K-1 – This form is issued to partners in a partnership, detailing their income share. The K-1 shares information like the AP1 about ownership and amounts that require validation and accurate reporting.

FinCEN Form 114 (FBAR) – This report is used to disclose foreign bank accounts with balances exceeding certain thresholds. Just as the AP1 form focuses on unclaimed property, FBAR addresses compliance issues regarding foreign funds.

Form 945 – This form is used to report nonpayroll withholding. The process involves summarizing withheld amounts similarly to how the AP1 summarizes abandoned property for state authorities.

Form 1346 – This document is used to report additional information required for taxes, resembling the detailed accountabilities maintained in the AP1 for tracking property details.

State Unemployment Reports – Employers file these reports to document unemployment insurance contributions. Both documents provide oversight on funds collected and how they are allocated or claimed.

Court Affidavit of Lost Property – Similar to AP1, this legal document serves as proof that a property owner has lost their property. Both require acknowledgment and validation of ownership and circumstances surrounding property claims.

Dos and Don'ts

Filling out the Delaware Ap1 form may seem daunting, but following a few key guidelines can make the process smoother. Below is a list of important dos and don'ts to keep in mind.

- Do ensure that all entries are accurate and complete.

- Do check the appropriate box for the report type at the beginning of the form.

- Do submit any required attachments if your corporation is a successor.

- Do provide a valid Federal Employer Identification Number (E.I.#).

- Don’t leave any sections blank, especially critical contact information.

- Don’t forget to include documentation for securities transferred to the state account.

- Don’t delay in submitting the form by the due dates specific to different organizations.

- Don’t overlook the requirement to sign and date the verification section of the form.

By adhering to these guidelines, individuals and companies can help ensure their reports are processed efficiently. Clarity and attention to detail can significantly ease what might otherwise be a complex task.

Misconceptions

Understanding the Delaware AP1 form is crucial for any business that deals with unclaimed or abandoned property. However, there are several misconceptions about this form that can lead to confusion. Below is a list of nine common misconceptions along with clarifications for each.

- Misconception 1: The AP1 form is only for banks and insurance companies.

- Misconception 2: The filing deadline is the same for all types of entities.

- Misconception 3: The form must be mailed physically.

- Misconception 4: The AP1 form's purpose is solely to report financial accounts.

- Misconception 5: Once a report is filed, the property is automatically transferred to the state.

- Misconception 6: Detailed documentation is not necessary when submitting the AP1.

- Misconception 7: The AP1 form doesn't require an authorized signature.

- Misconception 8: After submitting the AP1 form, organizations never hear from the state again.

- Misconception 9: Any property over a certain age is automatically considered abandoned.

While banks and life insurance companies are required to file it, any organization holding unclaimed property must complete the AP1 form.

Different deadlines apply. For banking organizations, reports are due by August 1st, while life insurance companies must file by May 1st.

Organizations have the option to submit the AP1 form electronically. However, ensure that documentation accompanies your electronic submission.

It encompasses various types of unclaimed property, such as securities, insurance benefits, and even safe deposit box contents.

A verification process occurs after filing. Organizations must still ensure that claimed property is officially transferred to the state's account.

Holders must provide a detailed account statement and relevant documentation to support their claims of unclaimed property.

In fact, it must be signed by an authorized person who confirms that the information is true and complete.

States may follow up for additional information or clarification regarding the reported unclaimed property.

The definition of abandoned property varies. Organizations must evaluate each item individually based on specific criteria laid out in the law.

Gaining clarity on these misconceptions can help organizations navigate the complexities of unclaimed property reporting more effectively.

Key takeaways

Completing and submitting the Delaware AP1 form is an important process for organizations managing unclaimed or abandoned property. Here are key takeaways to keep in mind:

- The AP1 form is required for all reporting organizations to disclose unclaimed property to the Delaware Division of Revenue.

- Organizations must determine whether they are submitting a final, supplemental, or preliminary report.

- The deadline for preliminary reports varies; banking organizations must file by August 1, while life insurance companies must file by May 1.

- Report year information must be accurately filled out, entering the specific year in the designated field.

- Include the federal Employer Identification Number (E.I.#) of the reporting organization on the form.

- Verify if the organization is a successor corporation and provide necessary previous names if applicable.

- Account statements and any documentation regarding securities must accompany the form if securities are being transferred to the state account.

- Ensure to list the total number of individual property items being remitted, distinguishing between owner count and property count.

- The report requires a verification section where the holder must attest to the accuracy of the information provided.

- Submitting an incomplete or inaccurate form may lead to delays or administrative issues with compliance.

Browse Other Templates

It 203 - Line 13 represents the total of lines 10, 11, and 12 combined.

Routing Number Charles Schwab - The regular processing time for distributions may take approximately two weeks.

Real Estate Commission in Texas - Keep track of submission deadlines to avoid compliance issues with the Tennessee Real Estate Commission.