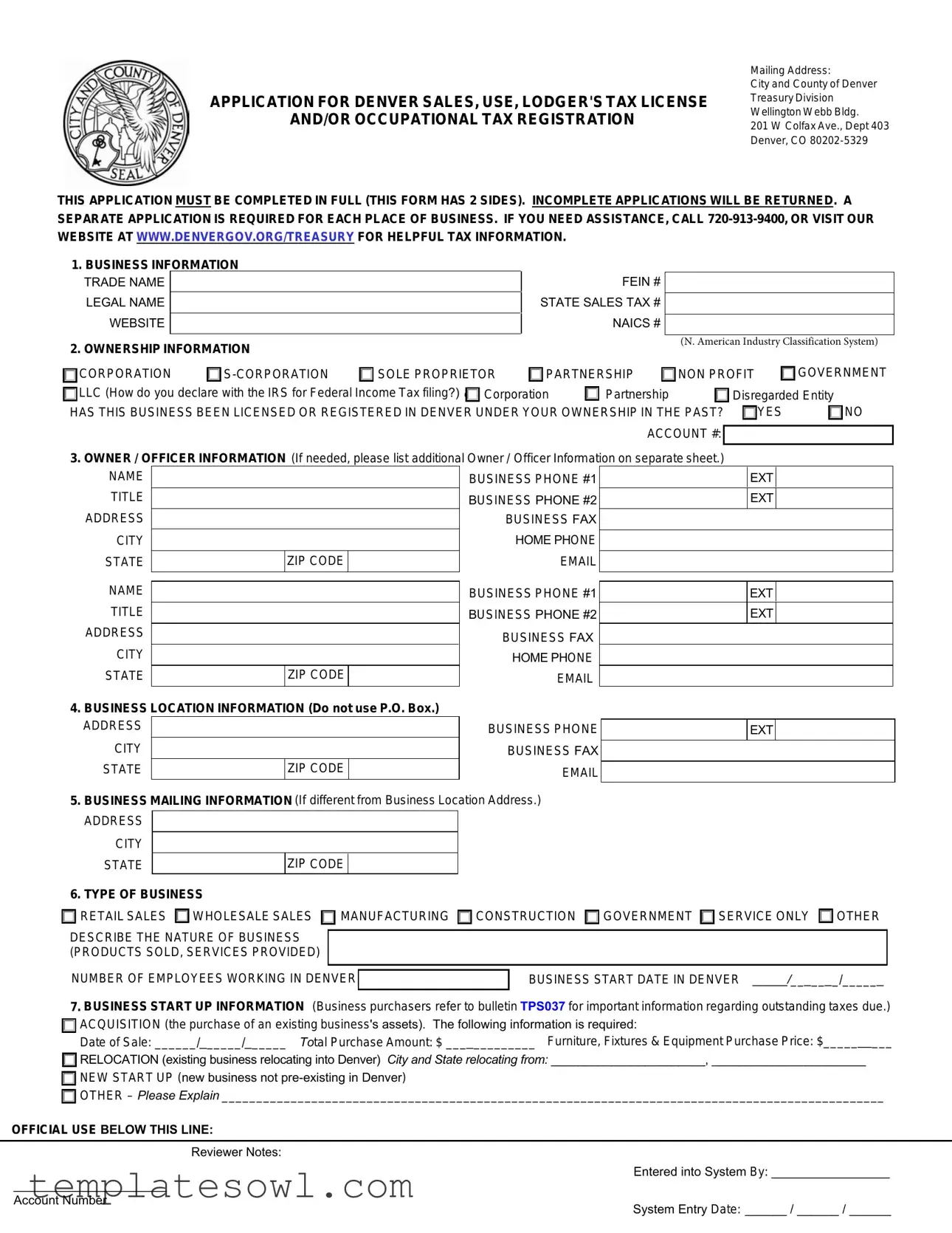

Fill Out Your Denver Sales Tax Application Form

The Denver Sales Tax Application form is a crucial document for businesses operating within the city. It serves as both an application for necessary licenses and a registration for various tax obligations that businesses must fulfill. Key sections of the form gather essential information such as the business’s name, ownership structure, and location. Whether you're a new venture or are relocating an existing business to Denver, completeness is essential; both sides of the form must be filled out. A separate application is required for each business address, and any omissions could lead to delays as applications deemed incomplete will be returned. The form also asks for specific tax type information, including options for sales tax, occupational tax, lodger's tax, and others applicable to your business model. Be mindful that the application includes an official use section, underscoring its significance in local tax administration. For any questions or assistance while filling out the form, the Denver Treasury Division provides resources and support, ensuring that you are well-equipped to meet your tax responsibilities. Remember, timely and accurate submission can save you from potential penalties, so it's imperative to familiarize yourself with every aspect of this important document.

Denver Sales Tax Application Example

APPLICATION FOR DENVER SALES, USE, LODGER'S TAX LICENSE

AND/OR OCCUPATIONAL TAX REGISTRATION

Mailing Address:

City and County of Denver

Treasury Division

Wellington Webb Bldg.

201 W Colfax Ave., Dept 403

Denver, CO

THIS APPLICATION MUST BE COMPLETED IN FULL (THIS FORM HAS 2 SIDES). INCOMPLETE APPLICATIONS WILL BE RETURNED. A SEPARATE APPLICATION IS REQUIRED FOR EACH PLACE OF BUSINESS. IF YOU NEED ASSISTANCE, CALL

1. BUSINESS INFORMATION |

FEIN # |

|

TRADE NAME |

|

|

LEGAL NAME |

|

STATE SALES TAX # |

WEBSITE |

|

NAICS # |

2. OWNERSHIP INFORMATION |

|

|

|

(N. American Industry Classification System) |

|||

|

|

|

|

|

|

||

CORPORATION |

SOLE PROPRIETOR |

PARTNERSHIP |

NON PROFIT |

GOVERNMENT |

|||

LLC (How do you declare with the IRS for Federal Income Tax filing?) Corporation |

Partnership |

|

Disregarded Entity |

||||

HAS THIS BUSINESS BEEN LICENSED OR REGISTERED IN DENVER UNDER YOUR OWNERSHIP IN THE PAST? |

YES |

NO |

|||||

ACCOUNT #:

3.OWNER / OFFICER INFORMATION (If needed, please list additional Owner / Officer Information on separate sheet.)

NAME |

|

|

|

BUSINESS PHONE #1 |

|

EXT |

|

|

TITLE |

|

|

|

BUSINESS PHONE #2 |

|

EXT |

|

|

ADDRESS |

|

|

|

BUSINESS FAX |

|

|

|

|

CITY |

|

|

|

HOME PHONE |

|

|

|

|

STATE |

|

ZIP CODE |

|

|

|

|

|

|

NAME |

|

TITLE |

|

ADDRESS |

|

CITY |

|

STATE |

ZIP CODE |

4.BUSINESS LOCATION INFORMATION (Do not use P.O. Box.)

ADDRESS

CITY |

|

STATE |

ZIP CODE |

BUSINESS PHONE #1 BUSINESS PHONE #2 BUSINESS FAX HOME PHONE EMAIL

BUSINESS PHONE BUSINESS FAX EMAIL

EXT

EXT

EXT

5. BUSINESS MAILING INFORMATION (If different from Business Location Address.)

ADDRESS CITY STATE

ZIP CODE

6. TYPE OF BUSINESS |

|

|

|

|

|

|

RETAIL SALES |

WHOLESALE SALES |

MANUFACTURING |

CONSTRUCTION |

GOVERNMENT |

SERVICE ONLY |

OTHER |

DESCRIBE THE NATURE OF BUSINESS |

|

|

|

|

|

|

(PRODUCTS SOLD, SERVICES PROVIDED) |

|

|

|

|

|

|

NUMBER OF EMPLOYEES WORKING IN DENVER |

BUSINESS START DATE IN DENVER _____/_______/______ |

|||||

7.BUSINESS START UP INFORMATION (Business purchasers refer to bulletin TPS037 for important information regarding outstanding taxes due.)  ACQUISITION (the purchase of an existing business's assets). The following information is required:

ACQUISITION (the purchase of an existing business's assets). The following information is required:

Date of Sale: ______/______/______ Total Purchase Amount: $ _____________ Furniture, Fixtures & Equipment Purchase Price: $__________

RELOCATION (existing business relocating into Denver) City and State relocating from: _______________________, _______________________

RELOCATION (existing business relocating into Denver) City and State relocating from: _______________________, _______________________

NEW START UP (new business not

NEW START UP (new business not

OTHER – Please Explain ________________________________________________________________________________________________

OTHER – Please Explain ________________________________________________________________________________________________

OFFICIAL USE BELOW THIS LINE:

|

Reviewer Notes: |

______________________ |

Entered into System By: _________________ |

|

|

Account Number |

System Entry Date: ______ / ______ / ______ |

|

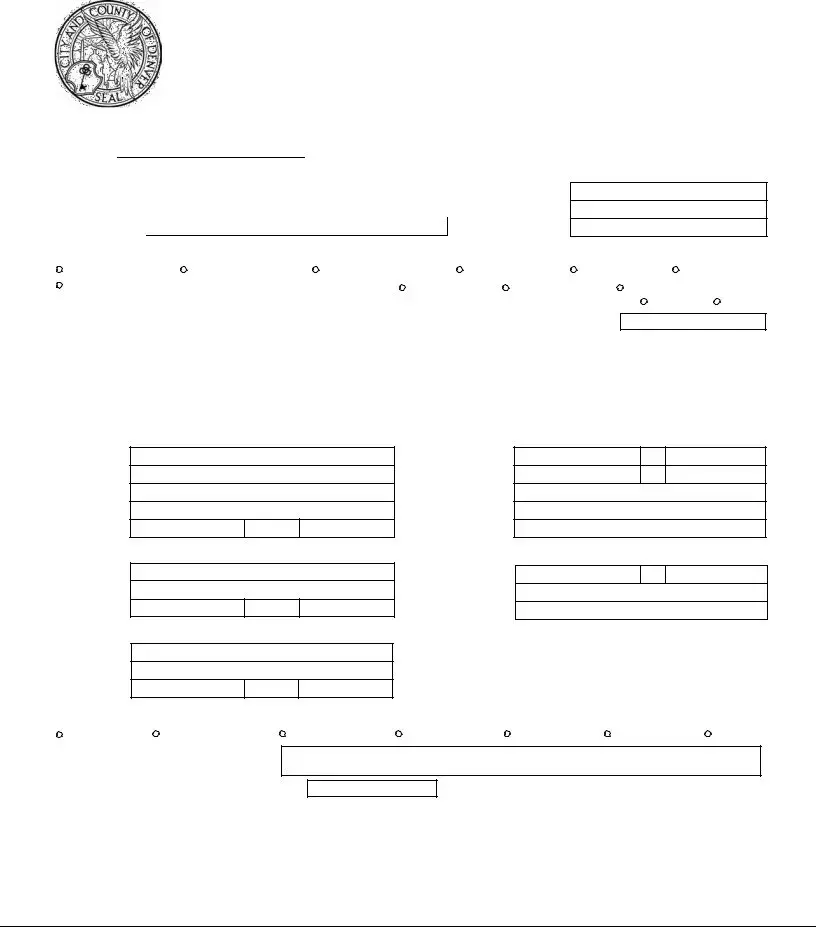

8.TAX TYPE INFORMATION

a)OCCUPATIONAL PRIVILEGE TAX ACCOUNT

THE CITY AND COUNTY OF DENVER IMPOSES AN OCCUPATIONAL PRIVILEGE TAX ON INDIVIDUALS WHO WORK WITHIN THE CITY LIMITS OF DENVER. THE EMPLOYEE NEED NOT LIVE IN DENVER AND THE BUSINESS NEED NOT BE BASED IN DENVER, THE PERSON NEED ONLY PERFORM SERVICES WITHIN THE CITY (REQUEST TPS003 FOR MORE INFORMATION).ANNUAL FILING IS ALLOWED ONLY FOR INDIVIDUALS, SOLE PROPRIETORS, AND PARTNERSHIPS WITHOUT ANY EMPLOYEES.UNQUALIFIED SELECTION OF THIS FILING FREQUENCY MAY RESULT IN THE ASSESSMENT OF LATE FILING PENALTIES AND INTEREST.

TAX WILL BE FILED BY: |

SELF |

FILING FREQUENCY: |

MONTHLY (MORE THAN 10 EMPLOYEES) |

|

3RD PARTY |

|

QUARTERLY (10 OR FEWER EMPLOYEES) |

b) CONSUMER USE TAX ACCOUNT (No License Fee.) |

|

ANNUALLY (SEE ABOVE) |

|

|

|

||

IF YOU BUY TANGIBLE PERSONAL PROPERTY FOR OWN USE AND THE VENDOR DOES NOT COLLECT DENVER SALES TAX ON THE INVOICE, THE TAX DUE TO DENVER MUST BE REPORTED AND PAID TO DENVER. THIS INCLUDES PERSONAL PROPERTY ACQUIRED WITH THE PURCHASE OF A BUSINESS (REQUEST TPS002 FOR MORE INFORMATION).

TAX WILL BE FILED BY: |

SELF |

FILING FREQUENCY: |

MONTHLY ($300 / MONTH OR MORE IS DUE) |

|

3RD PARTY |

|

QUARTERLY (LESS THAN $300 / MONTH IS DUE) |

c) SALES TAX LICENSE |

|

|

ANNUALLY (LESS THAN $15 / MONTH IS DUE) |

|

|

|

LICENSE IS REQUIRED IF YOU ARE A DENVER VENDOR. THE LICENSE AUTHORIZES YOU TO COLLECT AND REMIT SALES TAX YOU MAY OWE (REQUEST TPS001 FOR MORE INFORMATION). A TAX LICENSE IS NOT A LICENSE TO DO BUSINESS. ADDITIONAL BUSINESS LICENSES OR PERMITS MAY BE REQUIRED BY OTHER CITY DEPARTMENTS, EXCISE AND LICENSES DEPARTMENT

TAX WILL BE FILED BY: |

SELF |

FILING FREQUENCY: |

MONTHLY ($300 / MONTH OR MORE IS DUE) |

|

|

||

|

3RD PARTY |

|

QUARTERLY (LESS THAN $300 / MONTH IS DUE) |

d) RETAILER'S USE TAX LICENSE |

|

ANNUALLY (LESS THAN $15 / MONTH IS DUE) |

|

|

|

||

BUSINESSES LOCATED OUTSIDE OF DENVER MAY BE REQUIRED TO COLLECT RETAILER'S USE TAX (TAX ON DELIVERIES INTO DENVER AT THE SALES TAX RATE). IF REQUIRED TO COLLECT THE TAX, YOU MUST APPLY FOR A LICENSE.

TAX WILL BE FILED BY: |

SELF |

FILING FREQUENCY: |

MONTHLY ($300 / MONTH OR MORE IS DUE) |

|

3RD PARTY |

|

QUARTERLY (LESS THAN $300 / MONTH IS DUE) |

e) LODGER'S TAX LICENSE |

|

|

ANNUALLY (LESS THAN $15 / MONTH IS DUE) |

LICENSE IS REQUIRED, IF YOU FURNISH ROOMS OR ACCOMMODATIONS IN THE CITY OF DENVER FOR A PERIOD OF LESS THAN 30 CONSECUTIVE DAYS. A FEE IS REQUIRED, IF THE APPLICATION IS NOT COMBINED WITH A SALES TAX APPLICATION.

TAX WILL BE FILED BY: |

SELF |

FILING FREQUENCY: |

MONTHLY ($300 / MONTH OR MORE IS DUE) |

|

3RD PARTY |

|

QUARTERLY (LESS THAN $300 / MONTH IS DUE) |

f) TOURISM IMPROVEMENT DISTRICT TAX ACCOUNT (No License Fee) |

ANNUALLY (LESS THAN $15 / MONTH IS DUE) |

||

HOTELS WITH 50 OR MORE ROOMS ARE REQUIRED TO COLLECT THE TOURISM IMPROVEMENT DISTRICT TAX WHICH WILL BE FILED ON THE SAME RETURN AS LODGERS TAX. IF YOU ARE A HOTEL, PLEASE INDICATE HOW MANY ROOMS YOU HAVE.

50 OR MORE ROOMS NOTE: HOTELS WITH 50 OR MORE ROOMS ARE REQUIRED TO FILE ONLINE.

9. LICENSE FEE AND RENEWAL PERIOD

LICENSES WILL BE ISSUED FOR A

10. LICENSE FEE PRORATION SCHEDULE

TAX LICENSE TYPES |

|

MAKE CHECKS PAYABLE TO "MANAGER OF FINANCE" |

|||||

CIRCLE ONE ONLY |

Jan. 1. 2020 to |

July 1. 2020 to |

Jan. 1. 2021 to |

July 1. 2021 to |

|

(see mailing address on 1st page) |

|

June 30, 2020 |

Dec. 31, 2020 |

June 30, 2021 |

Dec. 31, 2021 |

|

LICENSE FEE REMITTED: |

||

|

|

||||||

SALES TAX |

$50.00 |

$37.50 |

$25.00 |

$12.50 |

|

|

|

SALES & LODGER'S TAX |

$50.00 |

$37.50 |

$25.00 |

$12.50 |

$ |

|

|

LODGER'S TAX |

$50.00 |

$37.50 |

$25.00 |

$12.50 |

|

|

|

|

|

|

|||||

RETAILER'S USE TAX |

$50.00 |

$37.50 |

$25.00 |

$12.50 |

|

|

|

11.CONTACTS (If different from Main Business Contact.)

TAX TYPE |

OCCUPATIONAL PRIVILEGE TAX |

CONSUMER USE TAX |

SALES / RETAILER'S USE TAX |

LODGER'S TAX |

||||||||

CONTACT PERSON |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TITLE |

|

|

|

|

|

|

|

|

|

|

|

|

BUSINESS PHONE |

|

EXT |

|

|

EXT |

|

|

EXT |

|

|

EXT |

|

BUSINESS FAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12.MAILING ADDRESSES (If different from Main Business Mailing Address.)

TAX TYPE |

OCCUPATIONAL PRIVILEGE TAX |

CONSUMER USE TAX |

SALES / RETAILER'S USE TAX |

LODGER'S TAX |

MAILING ADDRESS |

|

|

|

|

CITY |

|

|

|

|

STATE |

ZIP |

ZIP |

ZIP |

ZIP |

I HEREBY CERTIFY UNDER PENALTY OF PERJURY, THAT THE STATEMENTS MADE HEREIN ARE TO THE BEST OF MY KNOWLEDGE TRUE, CORRECT AND COMPLETE.

SIGNATURE OF APPLICANT |

|

TITLE |

|

DATE |

Form Characteristics

| Fact Name | Description |

|---|---|

| Mailing Address | The application must be sent to the City and County of Denver Treasury Division at 201 W Colfax Ave., Dept 403, Denver, CO 80202-5329. |

| Completeness Requirement | It is crucial to complete the application in full, as incomplete submissions will be returned for correction. |

| Per Application | A separate application is required for each location of business you intend to operate in Denver. |

| Governing Law | This form is governed by the Denver Revised Municipal Code, specifically sections pertaining to sales, use, and lodging taxes. |

Guidelines on Utilizing Denver Sales Tax Application

Completing the Denver Sales Tax Application is an important step in ensuring your business complies with local tax regulations. Once you have gathered all necessary information, follow these steps to fill out the form accurately. Remember, you must complete both sides of the application, and any incomplete entries will be returned.

- Business Information: Fill in the Federal Employer Identification Number (FEIN), trade name, legal name, state sales tax number, website, and NAICS number.

- Ownership Information: Indicate the type of ownership (e.g., corporation, sole proprietor, LLC) and whether the business has been licensed in Denver under your ownership before. If yes, provide the account number.

- Owner/Officer Information: List the primary owner or officer, including their name, title, business phone numbers, email, and address. Attach a separate sheet if you have more owners or officers to include.

- Business Location Information: Provide the physical address where the business is located (no P.O. Boxes allowed), along with contact numbers and email address.

- Mailing Information: If different from your business location, fill in the mailing address for receiving correspondence.

- Type of Business: Select your business type (e.g., retail, wholesale) and clarify the nature of your business. Report the number of employees working in Denver and the start date of your operations.

- Business Start-Up Information: Indicate if you are acquiring an existing business, relocating, or starting a new one. Fill in any relevant details such as the date of acquisition or previous location.

- Tax Type Information: Check the applicable tax accounts and filing frequencies based on your business operations: occupational privilege tax, consumer use tax, sales tax license, retailer's use tax, or lodger's tax license.

- License Fee and Renewal Period: Understand the renewal period and the license fee structure. Calculate the prorated fees based on your starting date.

- Contacts: If different from your main business contact, provide the relevant contact details for each tax type.

- Mailing Addresses: If applicable, include distinct mailing addresses for each tax type.

- Certification: Before submitting, sign and date the application, certifying that all provided information is true and correct.

Once you've completed all sections, review the application for accuracy and clarity. Then, send the application and any required fees to the provided mailing address for the City and County of Denver Treasury Division.

What You Should Know About This Form

What is the Denver Sales Tax Application form used for?

This application is necessary for individuals and businesses planning to operate within Denver. It serves as a license application for Denver sales tax, use tax, lodger’s tax, and occupational tax registration. Completing this form allows you to collect and remit the appropriate taxes to the City and County of Denver.

Who needs to complete this form?

Any business operating in or selling goods and services in Denver is required to fill out this application. This includes local vendors, those relocating into Denver, and even businesses outside the city that deliver into Denver. If you intend to operate as a retailer, service provider, or in any capacity that requires tax collection, this form is essential.

What information do I need to provide on the form?

The form requires detailed business information, including the legal name, trade name, type of business entity, and contact information. You must also specify the type of taxes for which you're applying, such as sales tax or lodger’s tax. Additionally, ownership information, business location, and employee details should be filled out completely.

How should I submit the Denver Sales Tax Application form?

You must mail your completed application to the City and County of Denver Treasury Division at the address provided on the form. Ensure that you have completed both sides of the application and included any necessary additional sheets. Incomplete applications will be returned, so double-check your entries before sending.

What is the filing frequency for the taxes included in the application?

Filing frequency can vary based on the tax type and the number of employees a business has. For instance, businesses with more than ten employees may need to file monthly for the Occupational Privilege Tax, while those with ten or fewer can opt for quarterly. Annual filing is possible for certain types of taxes under specific conditions. Make sure to indicate the filing frequency on your application as it will determine how often you need to report taxes.

Are there any fees associated with the application?

Yes, there are non-refundable license fees tied to your application. These fees support the administration of establishing and maintaining tax accounts. The costs will depend on the specific type of tax you are applying for. Be sure to check the prorated fees based on when your business begins operations.

Can I apply for multiple tax types on one application?

The form allows for the selection of various tax types but note that a separate application may be required for each place of business or different tax accounts. Read the instructions carefully to ensure that you complete all necessary parts of the form for each tax type you need.

What happens if my application is incomplete?

If you submit an incomplete application, it will be returned to you. To avoid delays, always make sure to fill out every section of the form. If you have questions while filling it out, the Denver Treasury Division provides assistance via phone or on their website.

How often do I need to renew my license?

Licenses are typically issued for a two-year period and must be renewed biennially. It is your responsibility to complete a renewal form by January 1 of even-numbered years if your business is still operational. Timely renewal helps ensure you remain compliant with Denver tax regulations.

Common mistakes

Completing the Denver Sales Tax Application form can be challenging, and many individuals may inadvertently make mistakes that could delay their application or lead to compliance issues. One common error is failing to fill out all required fields. The form clearly states that it must be completed in full, yet individuals sometimes overlook sections or leave them blank. Incomplete applications are returned, causing frustration and lost time.

Another frequent mistake involves not using the actual business address. Applicants might use a P.O. Box, which is specifically prohibited on the form. Organizations that do not provide their physical business address can face delays in processing their applications, as the city needs accurate location information to issue licenses.

Additionally, misidentifying the type of business can lead to complications. Each category, such as sole proprietorship, partnership, or corporation, has specific implications regarding taxation and licensing requirements. By selecting the wrong category, applicants may find themselves subjected to incorrect tax assessments or compliance issues down the road.

Providing the correct contact information, such as phone numbers and email addresses, is also crucial. Some applicants mistakenly enter outdated contact information or omit essential details. This can lead to difficulties in communication, potentially causing significant delays if further information or clarification is needed.

Another oversight occurs with the ownership information section. Some individuals neglect to indicate their legal name or trade name accurately. Confusion arises from variations in names, leading to discrepancies in official records and possible future legal complications.

When it comes to the frequency of tax filings, selecting the appropriate filing frequency is vital. Applicants sometimes misunderstand the descriptions and choose an unqualified filing frequency, which may result in late fees and additional penalties. It is crucial for individuals to assess their employee count accurately to select the ideal filing frequency.

Moreover, applicants may struggle with correctly documenting their business start date. It is important to use the proper format and ensure that the date reflects when the business began operations within Denver. A mistaken start date can affect tax liability and compliance requirements.

Finally, many applicants fail to check for any required attachments or additional information related to their specific business type. Whether it involves detailed explanations for special cases or documenting asset purchases, due diligence in reviewing the form can prevent delays. All applicants are encouraged to read the instructions carefully and to reach out for assistance if they encounter confusion during the application process.

Documents used along the form

When applying for a Denver Sales Tax license, several other forms and documents may also be required to ensure compliance with local laws. Each of these documents serves a specific purpose in the application process. Below is a list of commonly used forms along with a brief description of each.

- Occupational Privilege Tax Application: This document is needed if your business has employees working within Denver. It registers your business for the Occupational Privilege Tax, which is imposed on individuals who work in the city.

- Consumer Use Tax Application: This form is necessary for reporting any tangible personal property purchased for use within Denver when the vendor doesn't collect Denver Sales Tax. It ensures compliance with consumer use tax obligations.

- Retailer’s Use Tax Application: Businesses outside of Denver that sell goods in the city may require this form. It registers for collecting Retailer’s Use Tax on deliveries made into Denver.

- Sales Tax License Application: A crucial document for businesses intending to collect and remit sales tax on sales made within Denver. This form must be submitted to obtain the sales tax license.

- Lodger’s Tax License Application: Required for businesses providing accommodations in Denver for fewer than 30 consecutive days. This license allows you to collect and remit lodger's tax.

- Tourism Improvement District Tax Account: Hotels with 50 or more rooms need to use this form to report the corresponding taxes. It should be filed alongside the Lodger’s Tax return.

- Business License Application: This may be required for your specific type of business to legally operate in Denver. Different departments handle various business types, so it's wise to check what is needed.

- Proration Schedule Form: If your business starts partway through the license period, this form helps you determine the prorated license fees due based on the starting date.

- Renewal Application: Businesses must complete this form biennially to renew their sales tax license. It confirms ongoing compliance and updates any necessary information.

Submitting these forms along with the Denver Sales Tax Application will help ensure a smooth application process. Be sure to provide complete and accurate information to avoid any delays or complications.

Similar forms

-

Business License Application: This document requests essential information about the business, similar to the Denver Sales Tax Application. Both forms require details about ownership, including the business structure and contact information for owners.

-

Occupational Tax Permit: Like the Denver Sales Tax Application, this permit collects information on the nature of the business and its operational details. It emphasizes the need for an annual filing and tax obligations for engaging in business activities.

-

Retail Sales Tax Permit: This document is crucial for vendors who need to collect sales tax. It aligns with the Denver Sales Tax Application by requiring similar business information and tax filing details.

-

Consumer Use Tax Application: Both forms involve tax responsibility for businesses. This application focuses on reporting tax due for personal property bought without sales tax, echoing the requirements and obligations detailed in the Denver Sales Tax Application.

-

Food Service License Application: This document is specific to food businesses and shares similarities in the collection of ownership and operational details. Both applications ensure compliance with local regulations.

-

Lodging Tax License Application: This application is similar as it involves lodging businesses and mandates the collection of related tax. The information collected mirrors that of the Denver Sales Tax Application regarding ownership and business type.

-

Professional License Application: This type of application also collects vital information about the business and its owners. Similar to the Denver Sales Tax Application, it ensures that businesses meet local licensing requirements to operate.

Dos and Don'ts

When filling out the Denver Sales Tax Application form, it’s important to take care and ensure that all information is accurate and complete. Here are four essential dos and don’ts to keep in mind:

- Do complete all sections of the form: Make sure every part of the application is filled out thoroughly. Incomplete applications will be returned, which can delay your licensing process.

- Don’t use a P.O. Box for the business location: You must provide a physical address. Using a P.O. Box is not permitted.

- Do have all necessary documents ready: Gather any identification numbers and previous business licenses before you start filling out the form to ensure a smooth application process.

- Don’t forget to sign the application: Failing to include your signature may lead to automatic rejection of your application. Make sure to certify the information provided.

Taking the time to follow these simple guidelines can help streamline your application process and prevent unnecessary setbacks. Be diligent, and reach out for assistance if needed.

Misconceptions

- Misconception 1: The Denver Sales Tax Application is only for businesses based in Denver.

This form applies not only to businesses registered in Denver but also to those merely operating within the city's limits, even if headquartered elsewhere.

- Misconception 2: Only retail businesses need to apply.

This application is necessary for various types of businesses, including wholesalers, service providers, and manufacturers, among others.

- Misconception 3: Employers do not need to worry about registration if their employees live outside Denver.

Employees performing services within Denver city limits must contribute to the Occupational Privilege Tax regardless of their residence.

- Misconception 4: One application suffices for multiple business locations.

A separate application is required for each place of business, reflecting individual operations and licenses.

- Misconception 5: The application can be submitted even if incomplete.

Submitting an incomplete application is a common mistake. The form must be completed in full to avoid return and delays.

- Misconception 6: The sales tax license allows one to operate a business in Denver.

While important, the sales tax license does not serve as a business operating license. Additional permits may be necessary depending on the business type.

- Misconception 7: Filing frequency does not matter if you are compliant.

Filing frequency can lead to penalties. Failure to select the proper filing option can result in assessments and interest charges.

- Misconception 8: The license fee is refundable if the business closes.

License fees are not refundable. They cover administrative costs and must be paid regardless of business status.

- Misconception 9: Any tax type requires the same filing frequency.

Each tax type has specific filing requirements. Understanding these differences is crucial to remain compliant.

- Misconception 10: Only big businesses need to submit their sales tax regularly.

All businesses, no matter their size, must adhere to tax reporting guidelines. Compliance is essential for any entity conducting business activities in Denver.

Key takeaways

1. Complete All Sections: Make sure to fill out every part of the Denver Sales Tax Application form. An incomplete form will be returned, causing delays in processing.

2. Separate Applications Required: If you have multiple business locations, you must submit a separate application for each place of business. This is essential to ensure that each location is properly licensed.

3. Business Information Needed: You will need to provide important details about your business including the Federal Employer Identification Number (FEIN), trade name, and North American Industry Classification System (NAICS) number.

4. Tax Types to Consider: Depending on your business activities, you may need to apply for different types of tax licenses such as Sales Tax, Lodger's Tax, or Occupational Privilege Tax. Review your business structure to determine which categories apply.

5. Fee Structure: Be aware of the licensing fees associated with your application. These fees are non-refundable and support the administrative costs of maintaining tax accounts, so include the necessary payment with your application.

6. Renewal Process: Licenses are issued for a two-year period and must be renewed every even-numbered year. A renewal form will need to be completed to continue operating legally.

Browse Other Templates

Car Gift Tax California - All commodities must be identified with their respective HSN codes on the form.

Church Connect Card - Let us know your email address for our newsletters and updates.