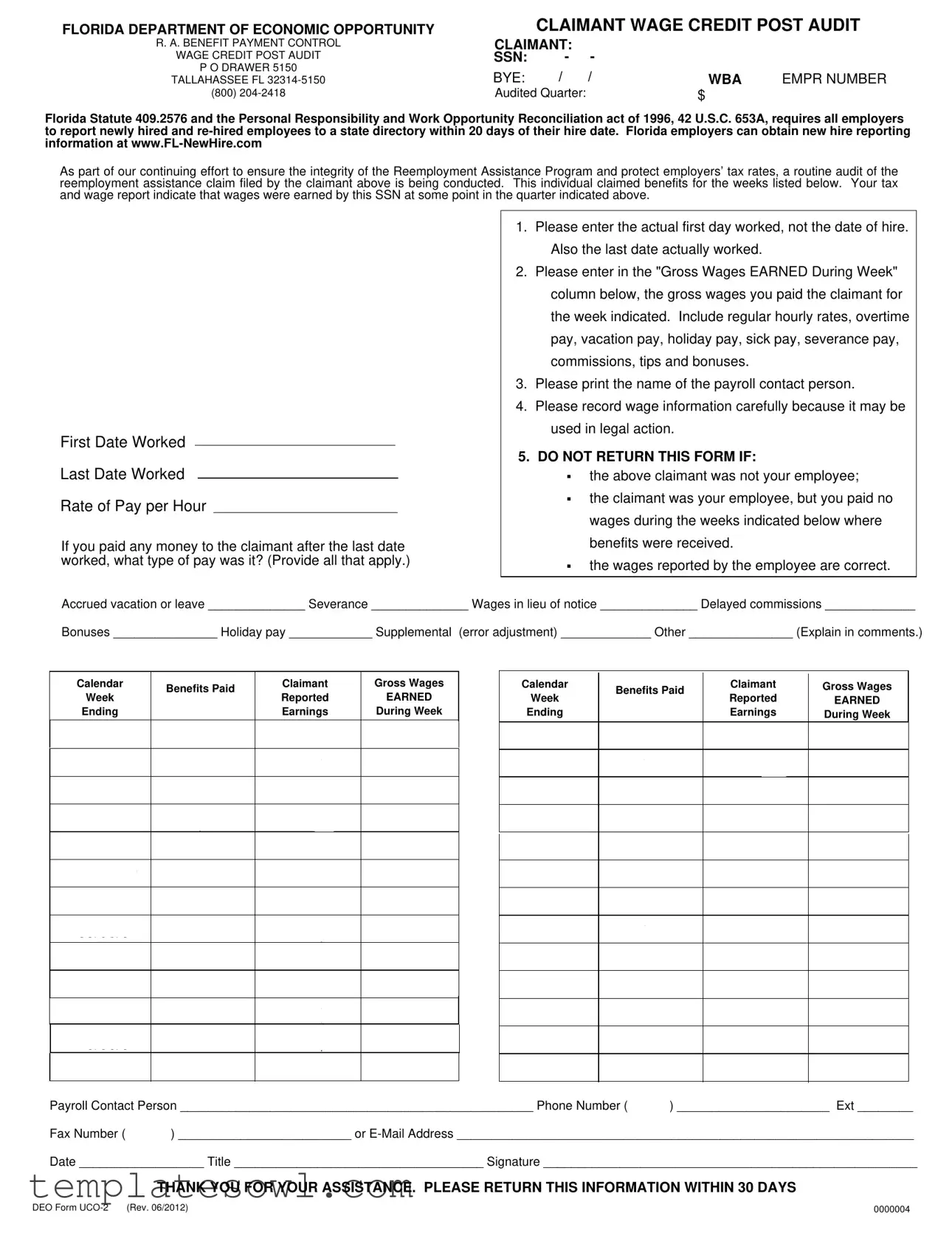

Fill Out Your Deo Uco 2 Form

The Deo Uco 2 form serves an essential role in the auditing process of unemployment claims within Florida's Reemployment Assistance Program. Designed for employers, this form aims to ensure that the benefits claimed by employees like Cynthia L. DeYoung align with the wages reported by those employers during specified periods. Prompt reporting of newly hired employees is mandated by Florida statute, emphasizing the state’s commitment to maintaining the integrity of its unemployment system. Within the form, detailed instructions guide employers on reporting critical wage information for each claimant, including instances of regular pay, overtime, and bonuses. Employers are required to carefully document both the first and last dates worked, as well as the gross wages paid during the claimed weeks. The comprehensive nature of this form not only facilitates accurate audits but also helps protect employers' tax rates by preventing fraudulent claims. Ultimately, the Deo Uco 2 form is a vital tool in the broader framework aimed at accountability and transparency in unemployment benefits distribution.

Deo Uco 2 Example

FLORIDA DEPARTMENT OF ECONOMIC OPPORTUNITY |

CLAIMANT WAGE CREDIT POST AUDIT |

||

R. A. BENEFIT PAYMENT CONTROL |

CLAIMANT: CYNTHIA |

L DE YOUNG |

|

WAGE CREDIT POST AUDIT |

SSN: 398 - 52 - 5407 |

|

|

P O DRAWER 5150 |

BYE: 07 / 07 / 2008 |

WBA |

EMPR NUMBER |

TALLAHASSEE FL |

|||

(800) |

Audited Quarter: 3/07 |

$ 275 |

0001450 |

Florida Statute 409.2576 and the Personal Responsibility and Work Opportunity Reconciliation act of 1996, 42 U.S.C. 653A, requires all employers to report newly hired and

As part of our continuing effort to ensure the integrity of the Reemployment Assistance Program and protect employers’ tax rates, a routine audit of the reemployment assistance claim filed by the claimant above is being conducted. This individual claimed benefits for the weeks listed below. Your tax and wage report indicate that wages were earned by this SSN at some point in the quarter indicated above.

AT & T CORP

ATTN TALX UCM SVCS INC UC EXPRESS PO BOX 283

SAINT LOUIS MO

First Date Worked

Last Date Worked

Rate of Pay per Hour

If you paid any money to the claimant after the last date worked, what type of pay was it? (Provide all that apply.)

1.Please enter the actual first day worked, not the date of hire. Also the last date actually worked.

2.Please enter in the "Gross Wages EARNED During Week" column below, the gross wages you paid the claimant for the week indicated. Include regular hourly rates, overtime pay, vacation pay, holiday pay, sick pay, severance pay, commissions, tips and bonuses.

3.Please print the name of the payroll contact person.

4.Please record wage information carefully because it may be used in legal action.

5.DO NOT RETURN THIS FORM IF:

. the above claimant was not your employee;

. the claimant was your employee, but you paid no wages during the weeks indicated below where benefits were received.

. the wages reported by the employee are correct.

Accrued vacation or leave ______________ Severance ______________ Wages in lieu of notice ______________ Delayed commissions _____________

Bonuses _______________ Holiday pay ____________ Supplemental (error adjustment) _____________ Other _______________ (Explain in comments.)

|

|

|

|

|

Calendar |

Benefits Paid |

Claimant |

Gross Wages |

||||||||||||||||

|

|

|

|

|

|

Week |

Reported |

EARNED |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

Ending |

|

|

|

|

|

|

|

Earnings |

During Week |

|||||||||

07/21/07 |

|

|

|

$275 |

|

|

$0 |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

$275 |

|

|

|

|

|

|

|

|

|

|

|

|

|

07/28/07 |

|

|

|

|

|

|

|

$0 |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

08/04/07 |

|

|

|

$275 |

|

|

|

|

|

$0 |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

08/11/07 |

|

|

|

$275 |

|

|

|

|

$0 |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

08/18/07 |

|

|

|

|

|

$275 |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

08/25/07 |

|

|

|

|

$275 |

|

|

|

|

$0 |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$275 |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

09/01/07 |

|

|

|

|

|

|

|

|

$0 |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

09/08/07 |

|

|

|

|

|

$275 |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

$0 |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

$275 |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

09/15/07 |

|

|

|

|

|

|

|

|

|

$0 |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

09/22/07 |

|

|

|

|

|

$275 |

|

|

|

|

$0 |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

09/29/07 |

|

|

|

|

|

|

|

|

$0 |

|

|

|

|

|||||||||||

|

|

|

|

|

$275 |

|

|

|

|

|

|

|||||||||||||

10/06/07 |

|

|

$275 |

|

|

$0 |

|

|

|

|

||||||||||||||

10/13/07 |

|

|

$275 |

|

|

$0 |

|

|

|

|

||||||||||||||

|

|

Calendar |

|

Benefits Paid |

|

Claimant |

|

Gross Wages |

||||||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

Week |

|

|

Reported |

|

EARNED |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

Ending |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings |

|

During Week |

|||||||||||

10/20/07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

$275 |

|

|

|

|

|

|

$0 |

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

10/27/07 |

|

|

|

|

|

$275 |

|

|

|

|

|

$0 |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11/03/07 |

|

|

|

|

|

|

|

$275 |

|

|

|

|

|

$0 |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

11/10/07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

$275 |

|

|

|

|

|

$0 |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$275 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

11/17/07 |

|

|

|

|

|

|

|

|

$0 |

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11/24/07 |

|

|

|

|

|

$275 |

|

|

|

|

|

$0 |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

12/01/07 |

|

|

|

|

|

$275 |

|

|

|

|

|

|

|

$0 |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12/08/07 |

|

|

|

|

$275 |

|

|

|

|

|

$0 |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payroll Contact Person ___________________________________________________ Phone Number ( |

) ______________________ Ext ________ |

|

Fax Number ( |

) _________________________ or |

|

Date __________________ Title ____________________________________ Signature ______________________________________________________

THANK YOU FOR YOUR ASSISTANCE. PLEASE RETURN THIS INFORMATION WITHIN 30 DAYS

DEO Form |

0000004 |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Governing Laws | The form is governed by Florida Statute 409.2576 and the Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (42 U.S.C. 653A). |

| Purpose | This form is used for auditing wage credits associated with a reemployment assistance claim. |

| Claimant Information | The form identifies the claimant by name, Social Security Number, and includes a contact section for the payroll contact person. |

| Audit Requirement | Employers must respond to the form within 30 days to assist with the audit process of claimed benefits. |

| Wage Reporting | Employers must provide detailed wage information, including regular pay, bonuses, and any other types of pay received by the claimant. |

| Non-Submission Conditions | Employers should not submit the form if the claimant was not employed or if no wages were paid during the indicated weeks. |

| Contact Information | The form includes space for the employer's payroll contact details, ensuring open communication regarding the claim. |

Guidelines on Utilizing Deo Uco 2

Submitting the Deo Uco 2 form is a critical part of the audit process concerning claimant wage credits. Completing this form accurately ensures that all necessary wage information is conveyed to the Florida Department of Economic Opportunity within the required time frame. Follow these steps carefully to fill out the form correctly.

- Provide the claimant's name and Social Security number in the designated fields.

- Enter the name of your company and the Employer Identification Number (EIN) if applicable.

- Indicate the audited quarter by writing the appropriate dates provided in the form.

- Fill in the "First Date Worked" and "Last Date Worked" fields with the actual dates of employment.

- List the rate of pay per hour in the specified section.

- Identify any additional payments made to the claimant after the last day worked, selecting all applicable types of payments.

- For each week indicated in the "Benefits Paid" section, enter the gross wages earned by the claimant during that week.

- Print the name of the payroll contact person and provide their phone number, fax number, and/or email address.

- Sign the form and include your title and the date of completion at the bottom.

- Review the form for accuracy and ensure all required information has been filled out.

After completing the form, submit it to the Florida Department of Economic Opportunity within 30 days of receipt. Timely submission is essential for compliance with state regulations.

What You Should Know About This Form

What is the purpose of the Deo Uco 2 form?

The Deo Uco 2 form is a crucial tool used by the Florida Department of Economic Opportunity. It conducts audits on reemployment assistance claims. It verifies the wages reported by claimants against the wages employers report. This ensures accuracy in benefit payments and protects the integrity of the reemployment assistance program.

Who is required to fill out this form?

This form must be completed by employers when they receive a request for information regarding an employee who has filed for reemployment assistance benefits. Specifically, it pertains to employees claimed and reported during the time period in question.

What information is required to complete the form?

When filling out the Deo Uco 2 form, employers need to provide several key pieces of information. This includes the first and last dates the employee worked, their hourly rate, payroll contact information, and a breakdown of wages paid during the specified weeks. Accurate details about types of pay like overtime, bonuses, and vacation pay must also be included.

What happens if I do not return the completed form?

If the completed Deo Uco 2 form is not returned within the specified 30-day period, it could lead to complications. The potential consequences include delays in the processing of the reemployment assistance claim or an inaccurate assumption about the wages reported. This could negatively affect benefits for both the claimant and the employer’s tax rates.

Are there penalties for providing false information on the form?

Yes, providing false information can lead to serious consequences. The information included in the form may be used in legal actions, and inaccuracies could result in penalties for the employer. It is essential to provide truthful and accurate details to ensure compliance with the law.

What should I do if the claimant was not my employee?

If the individual listed on the form was not your employee, you should not return the form. Instead, you should clearly indicate that they were never employed with your company. Providing accurate information is vital to maintaining the integrity of the reemployment assistance system.

How can I verify if the wages reported by the claimant are correct?

To verify the wages reported, you should cross-reference your payroll records for the relevant quarters. This will allow you to confirm whether the amounts claimed by the employee match what you have on file. Always double-check for accuracy before filling out the form.

What is the deadline for submitting the form?

Employers should return the completed Deo Uco 2 form within 30 days of receiving the request. Meeting this deadline is essential to ensure that the audit process moves forward without delays.

Whom do I contact if I have questions about completing the form?

If you have questions or need clarification while completing the Deo Uco 2 form, you can reach out to the Florida Department of Economic Opportunity. They provide assistance via phone or email as listed on the form, ensuring that you have the support you need.

Common mistakes

When completing the Deo Uco 2 form, accuracy is critical. One common mistake is failing to provide the actual first day worked instead of the date of hire. Providing the date of hire can lead to discrepancies that may complicate the audit process.

Another frequent error is not entering the gross wages earned during the specified week. This section must reflect all wages paid, including overtime, vacation pay, and bonuses. Omitting any type of pay can result in an incomplete report and potential issues with benefits eligibility.

Omitting the name of the payroll contact person is a mistake that can slow down communication with the Florida Department of Economic Opportunity. Include this information to ensure a smooth follow-up process if further clarification is needed.

Recording wage information carelessly can have serious consequences. This data may be referenced in legal actions, so attention to detail is essential. Double-check all entries before submitting the form to avoid future complications.

Failing to recognize when to return the form is another mistake. Do not submit the form if the claimant was not your employee or if you paid no wages during the weeks indicated. Knowing these guidelines will save time and resources.

Lastly, neglecting to provide explanations for any "Other" entries can lead to confusion. If any unique pay types were included, take the time to clearly explain them in the comments section to ensure clarity and avoid misunderstandings.

Being diligent in these areas helps maintain the integrity of the process and ensures compliance with state requirements.

Documents used along the form

The Deo Uco 2 form is a critical document used in the process of verifying employment and wage information for individuals claiming benefits in Florida. In addition to this form, several other documents may support or be required during the audit process. Below is a list of related forms and documents.

- New Hire Reporting Form: This document is submitted by employers to report newly hired or re-hired employees to the state directory. It ensures compliance with Florida law requiring reports within 20 days of hire.

- Payroll Records: These records provide detailed accounts of wages paid to employees over specific periods. They are essential for verifications and audits related to wage claims.

- Employee Time Sheets: Time sheets record the hours worked by employees. They may help determine the number of hours contributing to wage claims during the specified periods.

- Wage Statements: Also known as pay stubs, these documents show the actual earnings of an employee for a particular pay period, including bonuses and deductions.

- Termination Letter: If applicable, this letter outlines the reasons for an employee's termination. It can provide clarity in cases of contested benefit claims.

- Benefit Payment Control Documentation: This collection of documents tracks the payments made to claimants and can assist in audits related to claims and benefits administration.

- Employer’s Response to Claim: This form is used by employers to respond to a wage claim filed by an employee, detailing the circumstances around employment and wages paid.

- Claimant's Employment History: A summary of a claimant's work history with various employers, which may assist in verifying eligibility for benefits.

- Compliance and Audit Reports: Documentation from previous audits that assess adherence to state laws and regulations regarding wage reporting and benefit payments.

These forms and documents play a supportive role in the wage audit process, ensuring that claims are verified, accurate, and comply with legal requirements. Employers and claimants alike should be familiar with them to facilitate a smooth audit process.

Similar forms

The Deo Uco 2 form is similar to several other documents related to employment and wage reporting. Here’s a breakdown of those documents and how they compare:

- W-2 Form: Both documents require accurate reporting of earnings and wages. However, the W-2 is used for annual wage reporting to the IRS, while the Deo Uco 2 is focused on specific periods for benefit audits.

- 1099 Form: The 1099 form is used to report income paid to non-employees, like contractors. Similar to the Deo Uco 2, it ensures that all reported income is tracked for tax purposes.

- New Hire Report: Employers must submit new hire reports to state directories within a specified time frame, just as the Deo Uco 2 requires timely wage reporting for audits.

- Payroll Records: Both documents emphasize the need for accurate wage information, as payroll records detail individual employee earnings, which can be scrutinized during audits like those reflected in the Deo Uco 2.

- Unemployment Benefit Claim: This is filed by individuals claiming unemployment benefits. The Deo Uco 2 monitors these claims against reported earnings, ensuring the benefits are legitimate.

- Employment Verification Letter: This document verifies employment and wage details for various purposes. Like the Deo Uco 2, it must include precise employment dates and wage amounts.

- State Wage Report: Employers submit state wage reports to summarize earnings for tax purposes. The Deo Uco 2 aligns with this necessity, collecting similar earning details for audit reviews.

- Benefit Payment Control Form: This form is closely aligned with the Deo Uco 2 as it also aims to control and verify unemployment benefit payments against earned wages reported by employers.

- IRS Audits Documentation: Documents prepared for IRS audits require meticulous wage records and employment details, similar to what the Deo Uco 2 collects for state benefit audits.

Dos and Don'ts

When filling out the Deo Uco 2 form, there are several important guidelines to follow. Here are four things you should do and should not do:

- Do ensure accuracy: Double-check all entries to confirm they match your records.

- Do provide complete information: Fill in all required fields, including dates and wage details.

- Do submit on time: Return the completed form within 30 days of receipt.

- Do communicate with your payroll contact: Clearly print the name of the payroll contact person and provide their contact details.

- Don't submit if not applicable: If the claimant was not your employee, do not return the form.

- Don't overlook wage reporting: Do not skip any weeks where wages were paid when filling out the gross wages section.

- Don't ignore errors: If there are discrepancies, do not submit the form without addressing them.

- Don't forget your signature: Failing to sign the form may delay processing.

Misconceptions

Misconceptions about the Deo Uco 2 form can create confusion for both employers and employees. Understanding the truths behind these misconceptions can help clarify the process for reporting wage credits and benefits. Here’s a list of common misconceptions:

- 1. The Deo Uco 2 form is optional for employers. Many believe that completing this form is a choice. In reality, it is required when an audit is conducted on a claimant's benefits.

- 2. Employers do not need to provide wage information if the employee was not paid. Even if no wages were paid, employers must still submit the form indicating that no payments were made during the audit period.

- 3. The form only applies to employees who worked full-time. This is incorrect. The form must be filled out for all employees, whether they are full-time, part-time, or temporarily laid off.

- 4. All the wage data on the form is self-reported by the claimant. Employers are responsible for verifying and reporting employee wages; claimants cannot unilaterally determine their reported income.

- 5. Only hourly wages need to be reported. This misconception overlooks the need to report various types of earnings, including overtime, bonuses, and commissions.

- 6. The form must be returned immediately after completion. While timely submission is important, the form should be completed accurately, rather than rushed, to ensure compliance.

- 7. If there are errors in the employer's records, they can ignore the form. Ignoring the form will not resolve the issue. Employers must address any discrepancies and provide the most accurate information possible.

- 8. Claimants cannot appeal the results of the audit. In fact, claimants have the right to appeal audit findings if they believe there have been errors in reporting or interpretation.

- 9. The form is only for recent hires. The Deo Uco 2 form must be completed even for former employees if they are claiming benefits during the audit period.

- 10. The form has no impact on employer tax rates. The information provided in this form can affect the employer's tax rates, as it relates to the unemployment compensation system.

By dispelling these misconceptions, employers can navigate the process effectively and ensure that they are compliant with state regulations.

Key takeaways

When filling out and using the Deo Uco 2 form, consider the following key takeaways:

- The form is issued by the Florida Department of Economic Opportunity for wage credit post audits.

- Provide accurate information regarding the claimant, including their name and Social Security Number.

- It's essential to report the actual first day worked and the last day worked, not just the hire date.

- Report all gross wages earned during the indicated weeks, including regular pay, overtime, and any bonuses.

- Double-check the wages entered, as inaccuracies may lead to legal complications.

- Do not submit the form if the claimant was not your employee or if no wages were paid during the relevant weeks.

- Include the contact information for your payroll department for any follow-up queries.

- Respond within 30 days to avoid potential issues with the Reemployment Assistance Program.

- Keep a copy of the completed form for your records to ensure compliance.

- The form should be returned to the address provided, with all required information filled out completely.

Following these guidelines will assist in navigating the process smoothly.

Browse Other Templates

Dhs Income Guidelines - Applicants must sign Page 1 to initiate the application for assistance benefits.

Kaiser Life Care Planning - You can clarify your values regarding quality of life in a medical context with this form.

Winding Up Order - Initialing by the supervising senior indicates a commitment to the care of participating cadets.