Fill Out Your Dep 62 701 900 5 B Form

The DEP Form #62-701.900(5)(b), commonly referred to as the Solid Waste Facility Financial Guarantee Bond, is a critical instrument utilized within Florida’s solid waste management regulatory framework. This form ensures that owners or operators of solid waste facilities can fulfill their obligations related to closing, long-term care, or corrective actions for their sites as mandated by the Florida Solid Waste Management Act. By executing this bond, the principal—typically identified as a business entity—demonstrates its commitment to providing sufficient financial assurance for the requisite actions necessary for maintaining environmental integrity. The form requires specific information, including the legal name and address of the principal and the surety or sureties, as well as detailed descriptions of the facilities covered. Each facility is assigned a financial amount, or penal sum, that guarantees availability of funds for compliance purposes. Importantly, the bond not only outlines the responsibilities of the principal but also specifies the role of the surety in financially backing these obligations. Conditions under which the bond remains in effect, methods for cancellation by either the principal or the surety, and required adjustments to the bond amount periodically reflect the changing needs and financial realities of the facilities. This careful structuring underscores the importance of financial responsibility in the management of solid waste operations, ensuring that necessary funds are in place to address any future environmental impacts.

Dep 62 701 900 5 B Example

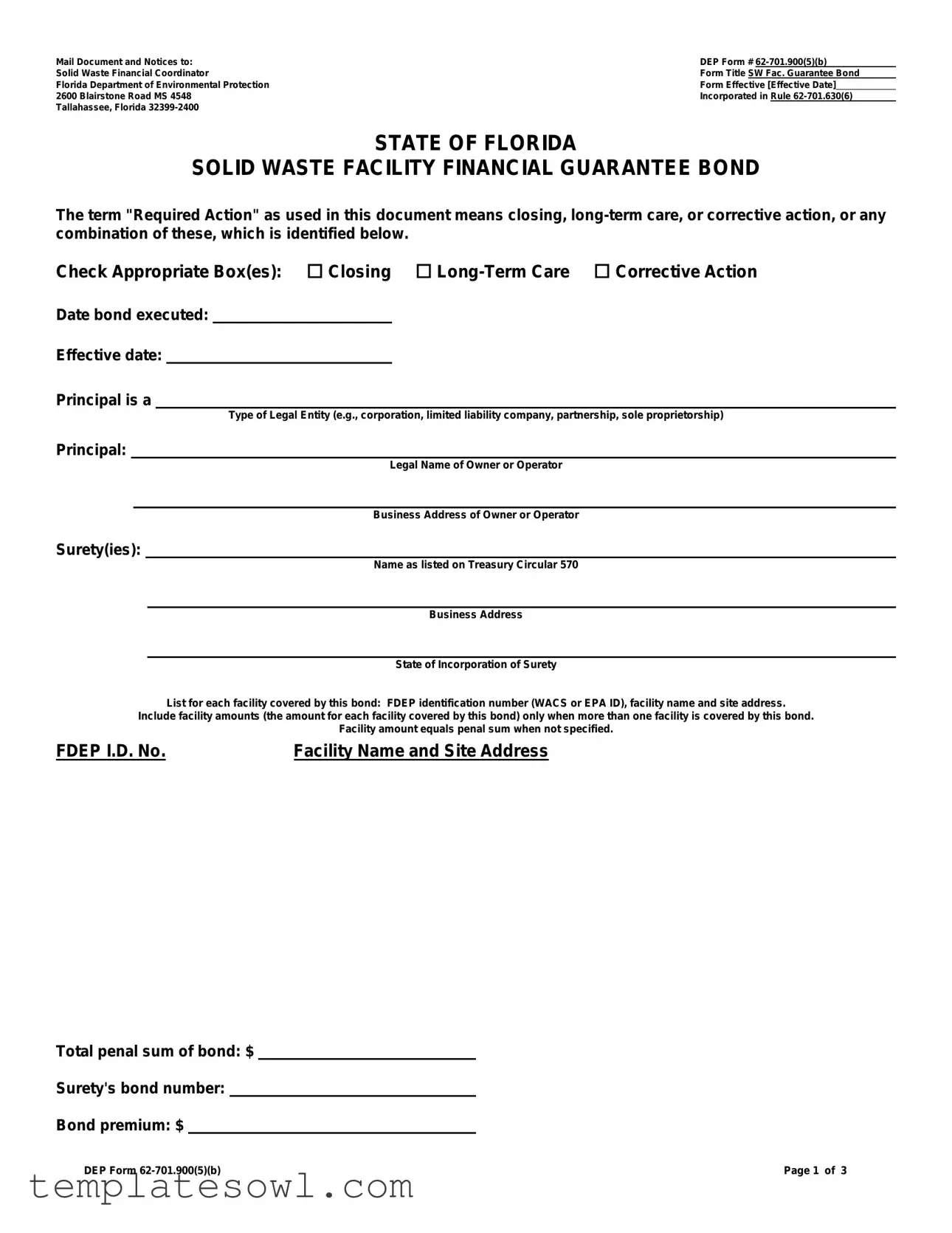

Mail Document and Notices to: |

DEP Form # |

||||

Solid Waste Financial Coordinator |

|

|

|

|

|

Form Title SW Fac. Guarantee Bond |

|||||

Florida Department of Environmental Protection |

|

|

|

|

|

Form Effective [Effective Date] |

|

||||

2600 Blairstone Road MS 4548 |

Incorporated in Rule |

||||

Tallahassee, Florida |

|

|

|

|

|

STATE OF FLORIDA

SOLID WASTE FACILITY FINANCIAL GUARANTEE BOND

The term "Required Action" as used in this document means closing,

Check Appropriate Box(es): Closing

Date bond executed:

Effective date:

Principal is a

Type of Legal Entity (e.g., corporation, limited liability company, partnership, sole proprietorship)

Principal:

Legal Name of Owner or Operator

Business Address of Owner or Operator

Surety(ies):

Name as listed on Treasury Circular 570

Business Address

State of Incorporation of Surety

List for each facility covered by this bond: FDEP identification number (WACS or EPA ID), facility name and site address.

Include facility amounts (the amount for each facility covered by this bond) only when more than one facility is covered by this bond.

Facility amount equals penal sum when not specified.

FDEP I.D. No. |

Facility Name and Site Address |

Total penal sum of bond: $

Surety's bond number:

Bond premium: $

DEP Form |

Page 1 of 3 |

Know All Persons By These Presents, That we, the Principal and Surety(ies) hereto are firmly bound to the Florida Department of Environmental Protection (hereinafter called FDEP), in the above penal sum for the payment of which we bind ourselves, our heirs, executors, administrators, successors, and assigns jointly and severally; provided that, where the Sureties are corporations acting as

WHEREAS, said Principal is required, under the Florida Solid Waste Management Act as amended, to have a permit in order to construct, operate or close each solid waste management facility identified above, and

WHEREAS, said Principal is required to provide financial assurance for the "Required Action," as a condition of the permit(s), and

WHEREAS, said principal shall establish a standby trust fund as is required when a surety bond is used to provide such financial assurance;

NOW, THEREFORE, the conditions of the obligation are such that if the Principal shall faithfully, before the beginning of Required Action(s) of each facility identified above, fund the standby trust fund in the amount identified above for the facility,

Or, if the Principal shall fund the standby trust fund in such amount within 15 days after an order to begin Required Action(s) is issued by the Secretary of the FDEP, or the Secretary's designee (the "designee"), or a U.S. district court or other court of competent jurisdiction,

Or, if the Principal shall provide alternate financial assurance and obtain the FDEP Secretary's, or designee's, written approval of such assurance, within 90 days after the date of notice of cancellation is received by both the Principal and the FDEP Secretary, or designee, from the Surety(ies), then this obligation shall be null and void, otherwise it is to remain in full force and effect.

The Surety(ies) shall become liable on this bond obligation only when the Principal has failed to fulfill the conditions described above. Upon notification by the FDEP Secretary, or designee, that the Principal has failed to perform as guaranteed by this bond, the Surety(ies) shall place funds in the amount guaranteed for the facility(ies) into the standby trust fund as directed by the FDEP Secretary, or designee.

The liability of the Surety(ies) shall not be discharged by any payment or succession of payments hereunder, unless and until such payment or payments shall amount in the aggregate to the penal sum of the bond, but in no event shall the obligation of the Surety(ies) hereunder exceed the amount of said penal sum.

The Surety(ies) may cancel the bond by sending notice of cancellation by certified mail to the Principal and to the Secretary of the FDEP, or designee; however, cancellation shall not occur during the 120 days beginning on the date of receipt of the notice of cancellation by both the Principal and the FDEP Secretary, or designee, as evidenced by the return receipts.

The Principal may terminate this bond by sending written notice to the Surety(ies); provided, however, that no such notice shall become effective until the Surety(ies) receive(s) written authorization for termination of the bond by the Secretary of the FDEP, or designee.

Principal and Surety(ies) hereby agree to adjust the penal sum of the bond yearly so that it guarantees new facility amount(s), provided that the penal sum does not increase by more than 20 percent in any one year, and no decrease in the penal sum takes place without the written permission of the FDEP Secretary, or designee.

DEP Form |

Page 2 of 3 |

IN WITNESS WHEREOF, the Principal and Surety(ies) have executed this Financial Guarantee Bond and have affixed their seals on the date set forth above.

The persons whose signatures appear below hereby certify that they are authorized to execute this surety bond on behalf of the Principal and Surety(ies), and that the wording of this surety bond is identical to the wording as adopted and incorporated by reference in Rule

PRINCIPAL

Signature of Authorized Representative of Principal

Type Name and Title

Telephone Number

Signature of Witness or NotaryDate

Printed Name of Witness or Notary Seal

CORPORATE SURETY(IES)

Provide the following for each surety

Surety Company

Liability Limit (for

(SEAL)

Signature of Authorized Representative of Surety (Attach Power of Attorney)

Type Name and Title

Address of Authorized Representative

Telephone Number

DEP Form |

Page 3 of 3 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | Solid Waste Facility Financial Guarantee Bond |

| Governing Law | Rule 62-701.630(6) of the Florida Administrative Code |

| Mailing Address | Florida Department of Environmental Protection, 2600 Blairstone Road MS 4548, Tallahassee, Florida 32399-2400 |

| Required Actions | Includes closing, long-term care, or corrective action for solid waste facilities. |

| Types of Principal | Legal entities such as corporations, limited liability companies, partnerships, or sole proprietorships. |

| Financial Assurance Requirement | The Principal must provide financial assurance for actions required under their permit. |

| Surety Bond Conditions | The Surety becomes liable if the Principal fails to fulfill obligations as specified. |

| Cancellation Notice | Sureties can cancel the bond with a certified mail notification, but not within 120 days. |

| Yearly Adjustments | The penal sum of the bond can be adjusted annually, but increases are limited to 20% per year. |

Guidelines on Utilizing Dep 62 701 900 5 B

Completing the DEP 62 701 900 5 B form is a vital step for entities looking to ensure compliance with Florida's environmental requirements concerning solid waste financial guarantees. Once you have gathered the necessary information, you can follow these detailed steps to accurately fill out the form.

- Begin by mailing documents and notices to the following address: Florida Department of Environmental Protection, 2600 Blairstone Road, MS 4548, Tallahassee, Florida 32399-2400.

- Indicate the effective date of the form in the designated field.

- Check the box that applies to the required action: Closing, Long-Term Care, or Corrective Action.

- Fill in the date the bond was executed.

- Provide the legal entity type of the principal (e.g., corporation, partnership).

- Enter the legal name of the owner or operator of the facility.

- List the business address of the owner or operator.

- Include the surety's name as it appears on Treasury Circular 570.

- Provide the business address of the surety.

- State the incorporation state of the surety.

- For each facility covered by the bond, list the following:

- FDEP identification number (WACS or EPA ID)

- Facility name

- Site address

- Facility amount (specify if more than one)

- Enter the total penal sum of the bond.

- Fill in the surety's bond number.

- Indicate the bond premium amount.

- Affix the signatures of the authorized representatives of the principal and each surety.

- Provide the printed names and titles of the signatories along with their contact information, including telephone numbers and email addresses.

- If applicable, attach a power of attorney for the surety.

- Obtain the signature of a witness or notary and include their printed name along with the official seal.

Once the form is completed, review all entries for accuracy to ensure compliance. Following this, submit the form as instructed, and ensure you retain copies for your records. This process supports not only regulatory compliance but also the responsible management of environmental obligations.

What You Should Know About This Form

What is the purpose of the DEP Form 62-701.900(5)(b)?

This form serves as a financial guarantee bond for solid waste facilities in Florida. It ensures that the facility has the necessary financial resources to cover costs related to closing, long-term care, or corrective actions. Essentially, it is a promise that resources will be available when needed to handle environmental responsibilities.

Who is required to complete this form?

What information must be included in this form?

Essential details such as the legal name and address of the facility owner or operator, the type of required action (closing, long-term care, or corrective action), and surety information must be provided. Additionally, the form should specify the total penal sum of the bond and the facility's identification number.

Can more than one facility be covered by a single bond?

Yes, the form allows for multiple facilities to be included. Each facility must be listed with its corresponding identification number, name, site address, and the facility amount. This structure aids in effectively managing financial assurance for several locations under one bond.

How is the penal sum of the bond determined?

The penal sum represents the total amount that the bond guarantees for potential required actions at the facility. If not specified for individual facilities, the facility amount will equal the full amount of the penal sum. Stakeholders should review this amount annually to ensure it meets any changing needs.

What happens if the Principal does not fulfill their financial obligations?

If the Principal fails to meet the obligations outlined in the bond, the surety may become liable to provide funds for the standby trust fund as directed by the Florida Department of Environmental Protection (FDEP). This ensures that resources are available to cover necessary actions to protect the environment.

Can the surety cancel the bond, and if so, how?

Yes, the surety has the right to cancel the bond. However, they must send a notice of cancellation via certified mail to both the Principal and the FDEP. A mandatory waiting period of 120 days following receipt of the cancellation notice is imposed, during which the bond remains in effect.

Is it possible to adjust the penal sum of the bond?

The penal sum can be adjusted yearly to reflect new amounts for facilities covered, although any increase cannot exceed 20 percent per year without prior written permission from the FDEP. Such adjustments ensure that the bond remains protective and appropriate for the operational realities of the facilities involved.

Common mistakes

When filling out the DEP Form # 62-701.900(5)(b), many people overlook important details, leading to mistakes that can delay the processing of their application. One common error is failing to check the appropriate boxes for the actions required, such as closing, long-term care, or corrective action. Ensure that these selections are made accurately as they define the responsibilities involved.

Another prevalent mistake is not providing the correct legal name of the principal or operator. An incorrect name can create complications and result in the rejection of the form. It’s crucial to cross-check this information with official documents to avoid potential issues.

Many individuals also mistakenly skip the section for the surety’s bond number. Failing to include this detail can lead to administrative delays and additional queries from the Florida Department of Environmental Protection (FDEP). It’s essential to have this information ready before submission.

Omitting the FDEP identification number for each facility that the bond covers is another frequent oversight. Each facility's identification number is vital for clarity and correctness of the bond. Ensure to double-check this part to prevent processing errors.

Another common issue includes failing to state the total penal sum of the bond. This amount must reflect the financial responsibility required for effective compliance. Errors in this figure could lead to significant misunderstandings with the FDEP.

Along with these mistakes, some applicants fail to include the signature of a witness or notary. Depending on the regulations, this signature might be necessary to authenticate the document. Ensure this is completed correctly as it underlines the form's legitimacy.

Additionally, individuals might forget to provide current contact information such as an email address or phone number. This information is crucial for the FDEP to reach out in case there are questions or further clarifications needed.

Too often, individuals neglect to include necessary attachments, such as the Power of Attorney for corporate sureties. This oversight can lead to the form being considered incomplete, making it vital to review what is required before submitting.

Finally, not keeping a copy of the submitted form can create problems down the line. It’s best to have a record of what was sent in case any follow-up or issues arise. Taking the time to avoid these common mistakes will help ensure a smoother application process.

Documents used along the form

When dealing with the Solid Waste Financial Guarantee Bond as represented by the Dep 62 701 900 5 B form, it's essential to recognize that several other documents often accompany it. Each of these forms plays a crucial role in ensuring compliance and financial assurance for solid waste facilities. Below is a brief overview of some commonly associated documents.

- Standby Trust Fund Agreement: This document outlines the establishment of a standby trust fund, ensuring that funds are available for required actions such as closing or long-term care of solid waste facilities. It details how funds will be allocated and stipulates conditions under which the trust may be accessed.

- Certificate of Insurance: This certificate serves to demonstrate that the facility holds insurance coverage sufficient to cover potential financial liabilities associated with its operations. It provides assurance that there are funds available for addressing unforeseen costs linked to solid waste management.

- Financial Assurance Mechanism Form: This form details the alternative financial assurance mechanisms that a facility might implement instead of a surety bond. It includes information about letters of credit, cash escrows, or other financial instruments meant to guarantee funds for necessary actions.

- Surety Bond Indemnity Agreement: In this agreement, the Principal typically agrees to indemnify the Surety against any losses incurred under the bond. It establishes the relationship between the parties and outlines the responsibilities in case of claims against the bond.

- Annual Financial Assurance Review: This document is generated during yearly assessments to evaluate the adequacy of the financial assurance provided. It ensures that the amounts are adjusted as necessary and remain in compliance with state regulations.

Each of these documents is integral to maintaining compliance with the Florida Solid Waste Management Act and ensuring that facilities are prepared for any financial obligations related to their operations. By understanding and properly managing these forms, facility operators can foster safer and more environmentally responsible waste management practices.

Similar forms

- Financial Assurance Mechanisms: Similar to the DEP Form 62-701.900(5)(b), other financial assurance documents, such as surety bonds, provide a guarantee that the principal will fulfill their obligations. They serve as a safety net for state agencies, ensuring that funds are available for closing or remediating solid waste facilities.

- Performance Bonds: Like the financial guarantee bond, performance bonds are a form of assurance that a contractor or operator will complete their obligations as specified in a contract. They protect against financial losses that may occur if the obligations are not met.

- Letters of Credit: Letters of credit are another financial assurance option that acts similarly to the bond by ensuring that funds will be made available to the state in case the principal fails to meet their commitments. They provide financial security by allowing the issuer to draw funds under certain conditions.

- Insurance Policies: Certain insurance policies can also fulfill the role of financial assurance, particularly in environmental contexts. They mitigate risk by ensuring that funds are available for remediation or closure activities in case of an incident, paralleling the obligation outlined in the DEP Form 62-701.900(5)(b).

Dos and Don'ts

When filling out the Dep 62 701 900 5 B form, here are four essential things to do and avoid:

- Do: Always use the legal name of the owner or operator as it appears in official documents.

- Do: Check all appropriate boxes for the required action, whether it’s closing, long-term care, or corrective action.

- Don't: Ignore the instructions on how to list each facility covered by the bond; include all relevant identification numbers and site addresses.

- Don't: Submit the form without ensuring that it has been signed by authorized representatives of both the principal and surety.

Misconceptions

- Misconception 1: The Dep 62 701 900 5 B form is only for new facilities.

- Misconception 2: Once submitted, the bond is set in stone.

- Misconception 3: Only the principal is responsible for the bond.

- Misconception 4: Cancellation of the bond is immediate.

- Misconception 5: The form does not require any additional documentation.

- Misconception 6: All surety companies can sign without restrictions.

This form applies to both existing and new solid waste facilities. It is a part of the permit process for any facility that needs to close or undertake long-term care or corrective action, regardless of whether it is newly established.

Actually, the penal sum of the bond can be adjusted yearly. This allows the principal to ensure that it remains aligned with any changes in facility amounts, helping to keep financial assurances current.

The sureties also share responsibility. They become liable only if the principal fails to meet the conditions outlined in the bond, so both parties are crucial for fulfilling obligations.

Cancellations do not happen right away. There is a 120-day period during which the bond remains active even after cancellation is requested, ensuring that obligations are met.

The form requires detailed information about each facility, including identification numbers and business addresses. Additional documentation may be needed to provide a comprehensive picture of the financial obligations.

Only surety companies listed on Treasury Circular 570 can act as sureties on this bond. This ensures that the surety is recognized and meets certain financial requirements.

Key takeaways

Accurate completion of the Dep 62 701 900 5 B form is critical as it establishes a financial guarantee for solid waste facility operations. The form details requirements for closing, long-term care, or corrective actions, ensuring compliance with environmental regulations.

Ensure that all sections regarding the Principal and Surety are filled out correctly. This includes providing the legal names, addresses, and relevant identification numbers. Missing or incorrect information can lead to delays or denial of the bond.

The financially guaranteed amount, referred to as the penal sum, must be accurately calculated and stated. If more than one facility is covered, include individual amounts for each facility. The total penal sum must reflect the highest obligation and cannot be less than specified.

After the bond has been executed, any changes to the penal sum or termination must follow established procedures. This includes notifying the Florida Department of Environmental Protection and clients in compliance with the specified timelines. Failure to do so may impact bond effectiveness.

Browse Other Templates

Wade College Dallas - Indicate whether you graduated from Wade College by selecting 'Yes' or 'No' on the form.

Subway Offers Today - Verify that you are the rightful owner of the Subway Card.

What Is a Verified Complaint in California - A lack of response on the part of the defendant can lead to a default judgment, making timely filing crucial.