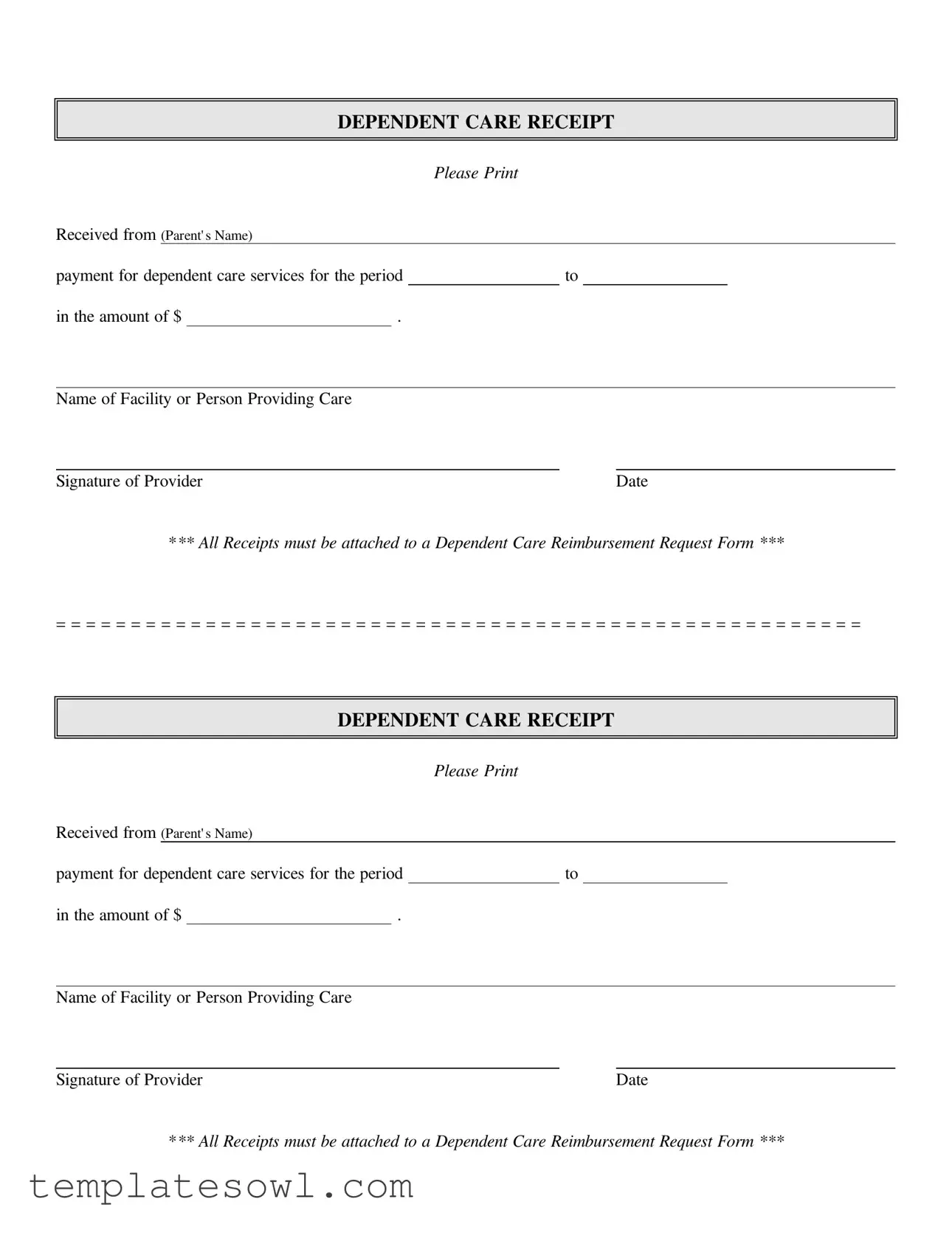

Fill Out Your Dependent Care Receipt Form

When managing dependent care expenses, utilizing the Dependent Care Receipt form becomes essential for parents. This form acts as a formal acknowledgment of payments made for dependent care services during a specified period. It requires the parent’s name, the amount paid, and the signature of the care provider, ensuring clarity and accountability for both parties. Additionally, it prompts users to attach all receipts to a Dependent Care Reimbursement Request Form for a smooth reimbursement process. Understanding these components is crucial for parents seeking financial reimbursement. The proper completion of this form not only helps in documenting the expense but also streamlines the submission process, ensuring that you receive the financial support you need to care for your dependents.

Dependent Care Receipt Example

|

|

|

|

DEPENDENT CARE RECEIPT |

|||||

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please Print |

|||

Received from (Parent' s Name) |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

||

payment for dependent care services for the period |

|

to |

|||||||

in the amount of $ |

|

|

. |

|

|

|

|

||

Name of Facility or Person Providing Care

Signature of Provider |

Date |

*** All Receipts must be attached to a Dependent Care Reimbursement Request Form ***

= = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = =

|

|

|

DEPENDENT CARE RECEIPT |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please Print |

|

|||

Received from (Parent' s Name) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

payment for dependent care services for the period |

|

to |

|

||||||

in the amount of $ |

|

|

. |

|

|

|

|

|

|

Name of Facility or Person Providing Care

Signature of Provider |

Date |

*** All Receipts must be attached to a Dependent Care Reimbursement Request Form ***

Form Characteristics

| Fact | Details |

|---|---|

| Purpose | The Dependent Care Receipt form is used to document expenses for dependent care services, allowing parents to request reimbursement. |

| Requirements | All receipts must be attached to a Dependent Care Reimbursement Request Form for processing. |

| Provider Signature | The form requires the signature of the provider offering the dependent care services. |

| Date of Service | Dates for the period of care must be noted on the form to clarify the duration of services provided. |

| Parent's Name | The receipt must list the parent’s name, ensuring proper identification of the requester. |

| State-Specific Forms | Different states may have unique requirements; check state regulations to ensure compliance with governing laws. |

| Payment Amount | The form must specify the amount paid for dependent care services, which is necessary for reimbursement calculations. |

| Document Retention | Parents should keep copies of all submitted receipts and forms for their records and any potential audits. |

Guidelines on Utilizing Dependent Care Receipt

After gathering your information, the next step is to accurately fill out the Dependent Care Receipt form. Proper completion ensures that all required details are included, helping to facilitate the reimbursement process.

- Start by printing the name of the parent or guardian in the designated space labeled "Received from (Parent's Name)."

- Indicate the period for which dependent care services were provided by writing the start and end dates in the "for the period to" section.

- Enter the total amount paid for dependent care services in the space next to "in the amount of $."

- List the name of the facility or individual who provided the care in the “Name of Facility or Person Providing Care” field.

- Ensure that the care provider signs the form where it says "Signature of Provider." This confirmation is crucial.

- Finally, add the date when the receipt is completed in the space labeled "Date."

Remember that all receipts must be attached to a Dependent Care Reimbursement Request Form before submission for reimbursement consideration.

What You Should Know About This Form

What is the purpose of the Dependent Care Receipt form?

The Dependent Care Receipt form serves as proof of payment for dependent care services. Parents or guardians fill out this form when they pay for childcare, allowing them to document their expenses for tax deductions or employer reimbursement programs. It outlines the details of the payment, including the name of the person or facility providing care, the amount paid, and the period for which care was provided. This form is essential for maintaining accurate records of dependent care expenses.

Who needs to sign the Dependent Care Receipt?

This form must be signed by the provider of the dependent care. Whether it's an individual caregiver or a daycare facility, the signature attests that the payment was received in full. Without this signature, the receipt may not be considered valid for reimbursement requests, which highlights the importance of ensuring that all necessary signatures are obtained before submission.

How do I submit the Dependent Care Receipt?

What happens if I lose my Dependent Care Receipt?

If you lose your Dependent Care Receipt, it is crucial to act promptly. Start by contacting the care provider to request a replacement receipt. Providers should have their records and may be able to issue a new document. If that is not possible, you might consider keeping detailed records of your payments and other related documents like bank statements as alternative proof. However, having a formal receipt is ideal for reimbursement purposes.

Common mistakes

Filling out the Dependent Care Receipt form can seem straightforward, but many people unknowingly make mistakes that can jeopardize their reimbursement claims. One common mistake is failing to include the correct parent’s name. If the name does not match the one on the reimbursement request or the associated account, it can lead to delays or denials.

Another frequent error arises from leaving the payment amount blank. This amount is crucial as it directly influences how much reimbursement the parent will receive. A receipt with no amount will almost certainly raise red flags with the reviewing authority.

Many individuals also overlook the specific care period on the form. Not detailing the exact dates for which care was provided can lead to confusion or questions during the reimbursement process. Accurate dates help ensure all services are accounted for and appropriate funds are allocated.

It's also essential to ensure that the signature of the provider is present. Many people assume the form speaks for itself, but without a provider’s signature, the receipt could be deemed invalid. This is a small but vital part of the documentation that shouldn’t be ignored.

Additionally, forgetting to attach the Dependent Care Reimbursement Request Form is another common error. All receipts must be submitted alongside the request. Failing to complete this step can result in the loss of the entire reimbursement request, forcing parents to start the process over.

Some recipients confuse personal care providers with official facilities. It's important to indicate whether the care was provided by a licensed facility or a personal caregiver, as different requirements may apply depending on the provider type. Mislabeling this can complicate claims.

People often make the mistake of not keeping copies of submitted documents. The importance of retaining copies cannot be overstated. Should there be any issues with claims processing, having a record of what was submitted can help resolve matters quickly.

Another common oversight is the date on the receipt. Some parents fill out the form too early or too late after care has been provided, which can cause discrepancies. Always ensure that the date accurately reflects when the service occurred.

In addition, some people include expenses that are not eligible for reimbursement. It’s vital to understand which services qualify under dependent care guidelines. Make sure to consult the requirements beforehand to avoid submitting ineligible expenses.

Finally, failing to double-check for manual errors is a significant mistake. Simple typos or incorrect information can lead to processing delays. Taking the time to review everything will help ensure that your submission is accurate and complete.

Documents used along the form

The Dependent Care Receipt form is essential for documenting payments made for dependent care services. However, several other forms and documents often accompany it to ensure a complete and accurate reimbursement process. Below is a list of related documents that can provide valuable context and support for your reimbursement request.

- Dependent Care Reimbursement Request Form: This form is submitted along with the receipts to officially request reimbursement for the dependent care expenses incurred. It outlines the details of the request and helps track payments.

- Tax Form 2441: Used when filing federal taxes, this form enables taxpayers to claim the Child and Dependent Care Expenses Credit. It summarizes the expenses that qualify for this credit, which can reduce taxable income.

- Provider's Agreement: This document outlines the terms of care between the parent and the care provider. It typically includes details such as hours of operation, fees, and cancellation policies, providing clarity and some protection to both parties.

- W-9 Form: Care providers who are classified as independent contractors must complete this form for tax purposes. The form provides the parent's tax preparer with the necessary information to report payments made to the provider for services rendered.

- Proof of Payment: This may include bank statements, canceled checks, or electronic payment confirmations showing that payment was made for the dependent care services. It helps establish a clear audit trail for reimbursement requests.

- Care Schedule: A document detailing the days and hours of care provided. When submitted with the receipt, it verifies the frequency and necessity of the services claimed for reimbursement.

- Child's Enrollment Verification: If applicable, this document indicates that the child is enrolled in a specific childcare facility or program. It may serve to confirm the legitimacy of the care provider's services.

- Letters for Special Circumstances: If there are unique situations such as last-minute care changes or extended needs, a letter explaining these circumstances can support the reimbursement request with additional context.

These documents, when assembled properly, create a comprehensive package that not only substantiates the claim for reimbursement but also enhances the clarity and professionalism of the request. Ensuring you have all relevant forms can streamline the process and prevent potential delays in receiving your reimbursement.

Similar forms

The Dependent Care Receipt form is an essential document for parents seeking reimbursement for caregiving expenses. It serves a specific purpose, but several other documents share similar characteristics. Here are five such documents:

- Child Care Provider Invoice: This document details charges for child care services provided, including the dates of service and total amount owed. Like the Dependent Care Receipt, it requires the provider's signature, ensuring authenticity.

- Medical Expense Receipt: Similar in structure, this receipt shows payments made for medical services. It includes the name of the service provider, details of the care received, and the amount paid, providing a clear record for reimbursement.

- Tuition Receipt: When parents pay for education-related services, they receive a tuition receipt. This document lists the school name, payment dates, and amounts, much like the Dependent Care Receipt, which is used to justify expense claims.

- Child Activity Fee Receipt: For fees associated with specific child programs or activities, this receipt includes the child's name, type of activity, cost, and service provider's information. It shares a common purpose with the Dependent Care Receipt in documenting out-of-pocket expenses.

- Personal Care Service Receipt: If a child requires personal care services, this receipt provides similar information as the Dependent Care Receipt. It indicates the service provided, the caregiver's name, and the payment amount, aiding in the reimbursement process.

Dos and Don'ts

Things to Do When Filling Out the Dependent Care Receipt Form:

- Print clearly in the designated spaces to ensure readability.

- Include the full name of the parent receiving the care.

- Specify the correct payment amount without errors.

- Obtain a signature from the provider of the care.

- Attach all required receipts to the Dependent Care Reimbursement Request Form.

Things to Avoid When Filling Out the Dependent Care Receipt Form:

- Do not leave any blank spaces unless the section does not apply.

- Avoid using incorrect or abbreviated names for the care provider.

- Do not forget to indicate the time period for the care services provided.

- Do not submit the form without verifying all information is accurate.

Misconceptions

When dealing with the Dependent Care Receipt form, misconceptions can lead to unnecessary confusion. Let's clear some of these up.

- Misconception 1: The form can be filled out without the provider's signature.

- Misconception 2: Any handwritten notes can substitute for the official receipt.

- Misconception 3: I can submit this form without any proof of payment.

- Misconception 4: You only need this form if you claim the childcare tax credit.

- Misconception 5: There’s no need to include dates on the receipt.

- Misconception 6: The name of the provider is optional on the form.

- Misconception 7: I can use a generic receipt template from the internet.

- Misconception 8: All forms are processed immediately.

This is false. The provider's signature is essential to validate the receipt. It confirms that care was provided and helps avoid disputes.

Handwritten notes may not suffice. A formal receipt helps ensure that the payment is recognized. Providers should give a detailed receipt that includes the necessary information.

While it's used for tax credits, its primary purpose is reimbursing expenses through your employer’s dependent care account. Many people use it for both.

This is misleading. Dates are essential for making clear when the services were provided. This helps in verifying the timeframe of care.

This is not correct. You must provide the name of the facility or individual providing care. This ensures accountability and helps trace back the services if necessary.

Using a generic receipt may not be advisable. The specifics of dependent care forms vary. It’s best to use the official template provided by your organization.

Not necessarily. Processing times can vary. It’s wise to submit your forms well in advance, allowing for any potential delays.

Key takeaways

Filling out the Dependent Care Receipt form can seem daunting, but understanding its key elements makes the process straightforward. Here are five essential takeaways:

- Always provide accurate details: Clearly print the parent's name, the service period, and the payment amount. This ensures proper processing.

- Identify the care provider: Include the name of the facility or individual providing the care. This information is vital for verification purposes.

- Require a signature: The care provider must sign the receipt. This signature serves as proof that the services were rendered and payment received.

- Don't forget the date: Make sure to enter the date on which the service was provided. This helps to track the timeframe of care.

- Attach to the reimbursement form: Always attach the completed receipt to a Dependent Care Reimbursement Request Form for reimbursement processing.

By paying attention to these details, you can ensure that your reimbursement requests are processed smoothly and efficiently.

Browse Other Templates

How to Respond to a Civil Lawsuit in California - Each individual claim should be backed by documentation where applicable.

George E Cole Legal Forms - All parties are responsible for complying with applicable laws and regulations.