Fill Out Your Deposit Metlife Check Form

The Deposit Metlife Check form is a crucial document for those looking to deposit checks issued by Metlife. This form simplifies the process of depositing checks directly into a bank account, ensuring that the transaction is both efficient and secure. It typically includes key sections where you can enter personal information such as your name, account number, and the relevant check details. Completing the form accurately is essential to avoid any delays in processing your deposit. In addition, there may be instructions on how to submit the form, whether electronically or via mail. The design of the form is straightforward, catering to users who may not be familiar with banking procedures, making it accessible to a broad audience. Ensuring that every part of the form is filled out correctly will facilitate a smoother banking experience. Understanding the importance of this document will help you navigate your financial transactions with more confidence.

Deposit Metlife Check Example

O

P

0

@99

( |

( |

● F |

z |

●:@

●:@

a

u

●F w

●F

a |

R@ |

●F

@

’

R

w

R

A

R

Ba

R

HRa

’

R

( |

|

D@ |

|

|

||

R |

R |

|

|

|||

|

|

|

B |

|

JF: |

|

|

|

|

||||

|

, |

|

|

|||

|

R |

|

R |

|

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

: |

|

|

|

|

|

|

R |

|

|

|

|

P@a |

|

|

w |

|

|

|

|

|

|

|

||

|

|

|

|

|

||

|

R |

|

|

R |

|

|

|

|

|

|

|

|

|

( |

|

D@ |

|

|

||

|

|

|

||||

R |

R |

|

|

|||

|

|

|

|

|

|

|

)@9

R

FR

RY |

RH |

R, |

R: |

RN |

R |

|

|

|

|

|

|

z

w

R

,

R

B

R

JF:

R

A

R

:

R

R, |

|

|

vw,- |

:@ 1R 3 |

●H

●F

●F

●F

v@

R

v@

R

|

|

v@ |

|

|

|

|

R |

|

|

, |

|

B |

|

JF: |

|

|

|||

|

|

|||

R |

|

R |

|

R |

|

|

|

|

|

|

Ha |

|

|

|

R, |

RB@ |

|

|

|

|

|

v@ |

|

|

|

|

|

|

|

|

|

|

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

v@a |

|

|

|

|

|

|

|||

|

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RRR, |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

● |

|

FR |

|

|

|

|

|

|

|

|

● |

|

FR |

|

|

|

|

|

|

|

|

|

@ |

|

|

|

|

|

|

|

|

|

● |

|

F |

|

|

|

|

|

|

|

|

|

@99 |

|

|

|

|

|

|

|

|

|

● |

|

F |

|

|

|

|

|

|

|

|

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

|

’ |

|

|

RD@ |

|

|

|

|

|

|

|

R( |

|

|

|

|

|||

|

|

|

R |

R |

|

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

Rw |

||

|

|

|

|

|

RP@a |

|

||||

|

|

|

R |

|

|

|

|

R |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hf |

|

|

|

|

|

|

|

|

|

|

’ |

|

|

RD@ |

|

|

|

|

|

|

|

R( |

|

|

|

|

|||

|

|

|

R |

R |

|

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RP@a |

|||

|

|

|

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

vw,- |

:@ 2R 3 |

: |

|

|

|

x |

3 |

z |

|

O |

hlgaalgpplfyyq |

wOB |

|

:NRv |

|

|

|

D |

|

|

|

|

|

|

|

|

z |

|

|

|

|

|

|

vw,- |

:@ 3R 3 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The Deposit Metlife Check form is used for depositing checks issued by Metlife. |

| Eligibility | Anyone who has received a check from Metlife can utilize this form for deposit. |

| Submission Method | This form can be submitted through online banking or physically at a bank branch. |

| State-Specific Forms | Some states may have additional requirements or specific forms. Always check local regulations. |

| Governing Laws | Regulations regarding check deposits are governed by state banking laws and the Uniform Commercial Code (UCC). |

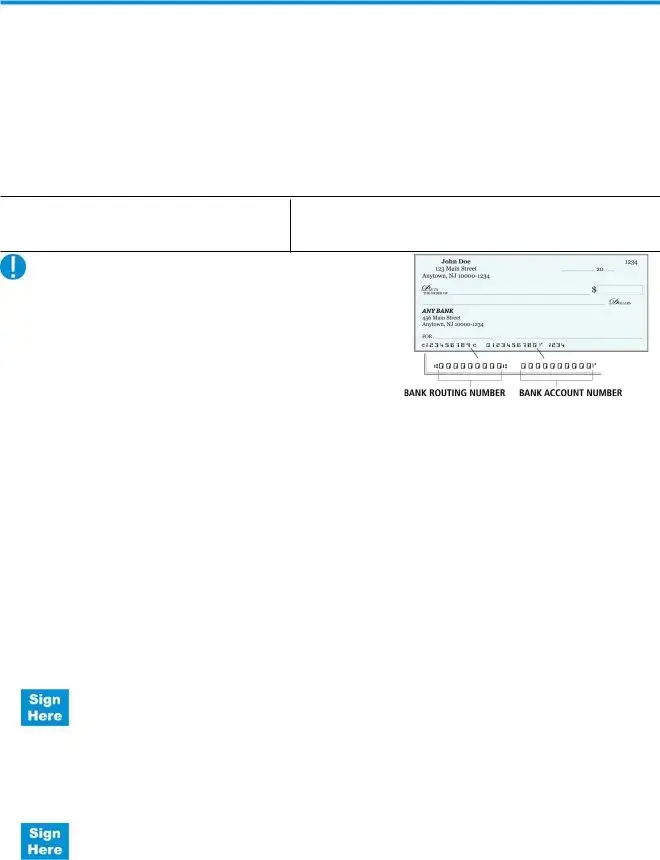

| Required Information | Basic information needed includes the account number, check details, and your signature. |

| Processing Time | Typically, deposits made using this form are processed within 1-3 business days. |

Guidelines on Utilizing Deposit Metlife Check

Completing the Deposit Metlife Check form is an important task that ensures your deposit is processed smoothly. After gathering your information, you can fill out the form accurately. Follow the steps below to ensure every necessary detail is included.

- Locate the Deposit Metlife Check form on your device or obtain a hard copy from your local office.

- Write your name in the designated field, ensuring it matches the name on your Metlife account.

- Provide your address, including street, city, state, and ZIP code, in the appropriate fields.

- Enter your Metlife account number carefully. Double-check for accuracy to avoid processing delays.

- Fill in the date of the check on the line provided.

- Indicate the amount of the check in both numeric form and written out in words. Precision is key.

- Review the information you have entered to ensure everything is correct and complete.

- Sign the form where indicated, as your signature is required for processing your deposit.

- Make a copy of the completed form for your records before submission.

- Submit the form as instructed—either electronically or by mailing it to the specified address.

What You Should Know About This Form

What is the Deposit Metlife Check form?

The Deposit Metlife Check form is a document that allows policyholders to deposit their Metlife insurance checks into their bank accounts. This form is designed to simplify the deposit process, ensuring that funds are transferred securely and efficiently. By filling out this form, individuals can authorize their bank to deposit the check on their behalf, making it easier to access their funds without having to visit a bank in person.

How do I fill out the Deposit Metlife Check form?

Filling out the Deposit Metlife Check form requires several basic steps. First, you should enter your personal information, including your full name and address. Next, provide details about your bank, such as the bank's name and account number. Be sure to double-check all the information for accuracy. You will also need to sign the form to authorize the deposit. Incomplete or incorrect forms may lead to delays, so it is essential to take your time and ensure that everything is filled out correctly.

Where do I submit the Deposit Metlife Check form?

Once the Deposit Metlife Check form has been completed and signed, you will need to submit it to your bank. It can typically be delivered in person at a bank branch or sent via mail or online banking channels, depending on your bank's policies. Be sure to retain a copy of the completed form for your records. Submitting the form through your bank can help streamline the deposit process, and they will handle the rest on your behalf.

What should I do if I encounter issues with my deposit?

If you experience any issues with your deposit after submitting the Deposit Metlife Check form, contacting your bank should be your first step. They can provide you with assistance and help troubleshoot the problem. Additionally, if there are concerns related to the Metlife check itself, contacting Metlife’s customer service is advisable. Keeping all documentation related to the deposit, including the filled-out form, can facilitate a quicker resolution.

Common mistakes

When it comes to filling out the Deposit Metlife Check form, many individuals unintentionally make mistakes that can lead to delays or complications. One common error is illegible handwriting. If the information on the form isn’t clear, bank or processing personnel may have difficulty reading it. This can result in checks being returned or deposits being stalled.

Another mistake often seen is incomplete information. Each section of the form must be filled out completely for it to be processed correctly. Missing details such as the check number or the amount can lead to confusion and may require you to submit the form again.

Failing to verify the signature is also a frequent pitfall. A signature that doesn’t match the one on file can cause issues. It's crucial to double-check that you are signing the form with the same signature that the bank or service provider recognizes.

Sometimes, individuals neglect to check the date on the form. An outdated or incorrectly entered date can lead to problems, particularly if you are trying to cash or deposit a check that is dated for a specific past time. Always ensure that your date is current and you’ve formatted it correctly.

Lastly, individuals often overlook following up after submitting their forms. It’s a good idea to confirm that the check was successfully deposited and there weren’t any issues. Not taking this step can lead to surprises later on that are easily avoidable with a little follow-up.

Documents used along the form

When dealing with the Deposit Metlife Check form, several other forms and documents may also be required for a smooth processing experience. Each of these documents serves a specific purpose, ensuring that all necessary information is gathered and verified. Below is a list of commonly used associated forms.

- Claim Form: This document is essential for reporting a loss or requesting benefits. It details the circumstances surrounding the claim and must be filled out accurately to ensure proper evaluation.

- Identity Verification Form: Used to confirm the identity of the individual submitting the deposit, this form may require personal information, such as a Social Security number, to prevent fraud.

- Direct Deposit Authorization Form: This form allows the funds to be deposited directly into a bank account, providing a faster and more secure method of receiving payment than by check.

- Tax Information Form: Often required to gather the necessary information for tax reporting purposes, it ensures compliance with tax regulations regarding income received from insurance payments.

- Beneficiary Designation Form: This document outlines who is entitled to benefits in the event of a claim, ensuring that funds are distributed according to the policyholder's wishes.

- Power of Attorney Document: In situations where someone else is handling the claim on behalf of the policyholder, this document grants them the legal authority to act in financial matters.

- Receipt of Payment Acknowledgment: This simple form confirms that the claimant has received the payment. It can serve as evidence for future reference.

- Policy Information Summary: This summary provides key details about the insurance policy associated with the Metlife Check, including coverage types, amounts, and policy numbers.

Each of these documents plays a vital role in ensuring that the deposit and related claims are processed efficiently and accurately. Understanding their purposes can help streamline the overall process and alleviate any concerns during the transaction.

Similar forms

Here are six documents similar to the Deposit Metlife Check form. Each serves a distinct purpose but carries common elements related to financial transactions.

- Deposit Slip: This is used to deposit cash or checks into a bank account. It includes the account holder's information and the amount of money being deposited, similar to how the Deposit Metlife Check form facilitates the deposit of a Metlife check.

- Withdrawal Slip: This document allows account holders to withdraw funds from their bank accounts. Like the Deposit Metlife Check form, it needs to be filled out with relevant account details and the amount being withdrawn.

- Bank Account Statement: This statement provides a summary of account activity over a specified period. While it is not a transactional form, it serves to confirm the deposits (including checks) made, which can be similar in purpose to the verification done with the Deposit Metlife Check form.

- Electronic Transfer Request Form: This form is used to authorize the transfer of funds between accounts electronically. It requires similar information to the Deposit Metlife Check form, such as account numbers and authorization signatures.

- Check Requisition Form: This internal document allows an individual to request a check from the company or organization. It involves collecting details like the payee's name and amount, akin to how details are collected in the Deposit Metlife Check form.

- Wire Transfer Authorization Form: This is used to authorize a wire transfer of funds between banks. It contains essential details such as the sender's account information and recipient's bank details, similar to the information needed for depositing a check via the Deposit Metlife Check form.

Dos and Don'ts

When filling out the Deposit Metlife Check form, follow these guidelines to ensure your submission is correct and processed without delays.

- Do write clearly and legibly to avoid misinterpretation.

- Do double-check the amount you have entered before submitting.

- Do sign the back of the check in the designated area.

- Do include your account number if the form requires it.

- Don't use correction fluid or tape on the form or check.

- Don't leave any fields blank unless specified.

- Don't forget to keep a copy of the check and form for your records.

- Don't submit the form if it is damaged or illegible.

By following these dos and don'ts, you can help ensure a smooth process when depositing your Metlife check.

Misconceptions

The Deposit Metlife Check form is often misunderstood. Here are six common misconceptions about this form:

- It is only for personal checks. Many people believe the form is exclusively for personal checks. In reality, the Deposit Metlife Check form can also be used for insurance payout checks and other qualifying documents.

- Filling it out is complicated. Some individuals think the form is complex and difficult to complete. However, the form is straightforward, with clearly labeled sections to guide you through the process.

- It must be mailed to complete the deposit. There is a misconception that mailing the form is the only way to deposit a check. In many cases, online or mobile deposit options are available, allowing for a quicker processing time.

- Signature requirements are the same for all deposits. People often believe that signature requirements do not vary. In fact, different types of checks may have different signature requirements as outlined on the form.

- The form can be used for any bank. Some assume the Deposit Metlife Check form is valid at all financial institutions. It's important to confirm with your bank whether they accept this specific form for deposits.

- Once submitted, funds are immediately available. Many think that submitting this form guarantees instant access to funds. In reality, processing times can vary, and it may take several days for the deposit to clear and for money to be accessible.

Key takeaways

When handling the Deposit Metlife Check form, a few important aspects come into play. Understanding these can simplify the process and foster better outcomes.

- Complete All Required Fields: Ensure that every section of the form is filled out accurately. Incomplete forms can lead to delays in processing.

- Double-Check Personal Information: Verify that your name and contact details match those on file with Metlife. Mismatches could result in issues with the deposit.

- Provide Accurate Check Details: Include the check number, amount, and any reference details. This information is crucial for proper tracking and processing.

- Submit in a Timely Manner: Be mindful of deadlines for check deposits. Timely submissions can prevent complications and ensure prompt processing.

- Keep Copies: Make copies of the completed form and the check for your records. This documentation can be invaluable in case of disputes.

- Follow Up: After submission, track the status of your deposit. If you have not received confirmation within a reasonable timeframe, contact Metlife for assistance.

- Use Secure Transmission Methods: Opt for secure channels when submitting your form, whether electronically or via mail, to protect your financial information.

By adhering to these key takeaways, individuals can navigate the process of filing the Deposit Metlife Check form more effectively. This proactive approach promotes efficiency and minimizes potential pitfalls.

Browse Other Templates

Modor Forms - Driveaway operations include delivery for sale and transporting vehicles for others.

Order Birth Certificate Florida - Birth registration in Florida began in 1917, affecting availability.

Ohio State Tax Forms - The Ohio IT 1040EZ form is necessary for individuals seeking to report their income accurately.