Fill Out Your Deposit Refund Form

When renting a property, understanding the financial aspects of your agreement is crucial, especially regarding security deposits. The Deposit Refund form serves as a formal record of the deductions made from a tenant's security deposit, as outlined in the lease agreement. It includes essential details like the names of the tenant and landlord, the rental property address, and the date the agreement was signed. You'll find an itemized list that clearly states the various deductions taken from the deposit amount, ensuring transparency in the process. The form also highlights any applicable interest on the security deposit and specifies whether the total deposit held exceeded one month's rent. After all deductions are calculated, the form summarizes the amount due to either the tenant or the landlord, along with instructions for payment. This comprehensive document protects both parties by providing a clear paper trail of transactions and obligations. Proper use of this form can help prevent disputes and facilitate a smooth conclusion to the rental relationship.

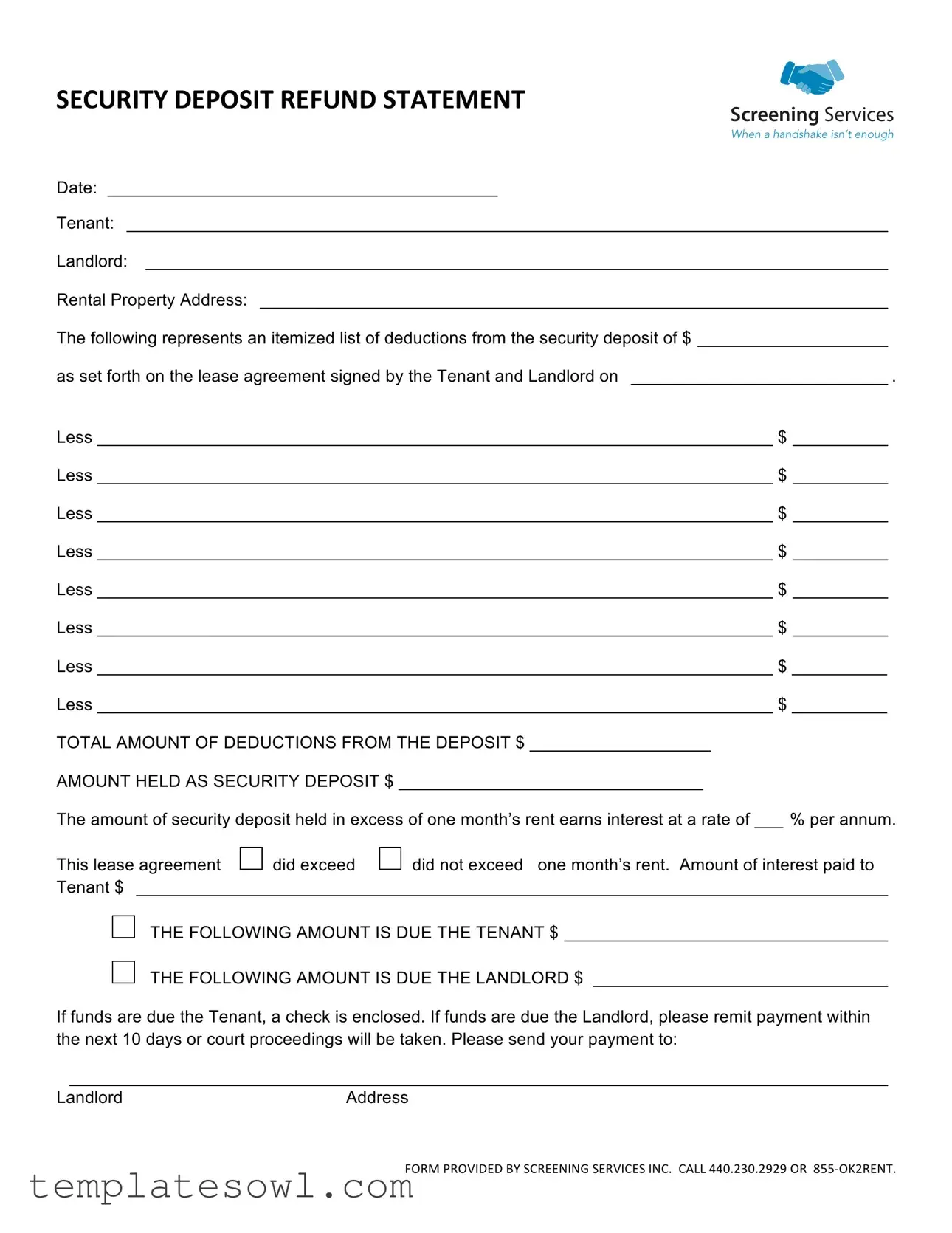

Deposit Refund Example

SECURITY DEPOSIT REFUND STATEMENT

SCREENING SERVICES

When a handshake isn’t enough

Date: _________________________________________

Tenant: ________________________________________________________________________________

Landlord: ______________________________________________________________________________

Rental Property Address: __________________________________________________________________

The following represents an itemized list of deductions from the security deposit of $ ____________________

as set forth on the lease agreement signed by the Tenant and Landlord on ___________________________ .

Less _______________________________________________________________________ $ __________

Less _______________________________________________________________________ $ __________

Less _______________________________________________________________________ $ __________

Less _______________________________________________________________________ $ __________

Less _______________________________________________________________________ $ __________

Less _______________________________________________________________________ $ __________

Less _______________________________________________________________________ $ __________

Less _______________________________________________________________________ $ __________

TOTAL AMOUNT OF DEDUCTIONS FROM THE DEPOSIT $ ___________________

AMOUNT HELD AS SECURITY DEPOSIT $ ________________________________

The amount of security deposit held in excess of one month’s rent earns interest at a rate of ___ % per annum.

This lease agreement |

did exceed |

did not exceed one month’s rent. Amount of interest paid to |

Tenant $ _______________________________________________________________________________

THE FOLLOWING AMOUNT IS DUE THE TENANT $ __________________________________

THE FOLLOWING AMOUNT IS DUE THE LANDLORD $ _______________________________

If funds are due the Tenant, a check is enclosed. If funds are due the Landlord, please remit payment within the next 10 days or court proceedings will be taken. Please send your payment to:

______________________________________________________________________________________

Landlord |

Address |

|

FORM PROVIDED BY SCREENING SERVICES INC. CALL 440.230.2929 OR 855‐OK2RENT. |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Deposit Refund form is used to outline the deductions taken from a tenant's security deposit, ensuring transparency for both tenants and landlords. |

| Itemized Deductions | Landlords must provide an itemized list of deductions from the security deposit. This list should include specific details and total amounts deducted. |

| Interest on Deposits | If the security deposit held exceeds one month’s rent, it earns interest at a specified rate. The interest must be clearly stated on the form. |

| Payment Obligations | Any amounts owed to the tenant will be issued via check, whereas amounts due to the landlord must be paid within 10 days. Failure to pay could lead to court proceedings. |

| Governing Law | The regulations governing the security deposit refund process can vary by state. It’s essential to reference the applicable state laws to ensure compliance. |

Guidelines on Utilizing Deposit Refund

Once you have gathered the necessary information, you are ready to complete the Deposit Refund form. Make sure to fill in all required fields accurately to avoid delays in processing.

- Date: Enter the current date in the designated area.

- Tenant: Fill in the full name of the tenant.

- Landlord: Complete the name of the landlord.

- Rental Property Address: Write the full address of the rental property.

- Security Deposit Amount: Indicate the total amount of the security deposit.

- Lease Agreement Date: Provide the date the lease was signed.

- Deductions: List each deduction with a brief description and the dollar amount next to it. Repeat for all applicable deductions.

- Total Amount of Deductions: Calculate and enter the total deductions from the deposit.

- Amount Held as Security Deposit: Enter the remaining balance of the security deposit.

- Interest Rate: Indicate the interest rate applied to the security deposit.

- Interest Status: Mark whether the lease agreement exceeded one month’s rent or not.

- Amount of Interest Paid to Tenant: Fill in the amount of interest due, if applicable.

- Amount Due to Tenant: State the amount payable to the tenant.

- Amount Due to Landlord: State the amount payable to the landlord.

- Payment Instructions: Include the landlord’s payment address if funds are owed.

After completing the form, double-check all entries for accuracy. This will ensure efficient handling of the refund process. Once verified, you may sign and date the form, then proceed to submit it as instructed within the document.

What You Should Know About This Form

What is the purpose of the Deposit Refund form?

The Deposit Refund form serves to document the return of a security deposit to a tenant after the end of a rental agreement. It provides a clear record of the amount originally held as a security deposit, details any deductions that are taken from this deposit, and specifies the final amount that is either due to the tenant or the landlord. This structured approach helps foster transparency and ensures both parties have a mutual understanding of the financial obligations involved.

How are deductions from the security deposit determined?

Deductions from the security deposit are usually based on the terms specified in the lease agreement between the tenant and landlord. Common reasons for deductions may include unpaid rent, damages to the property beyond normal wear and tear, or outstanding utility bills. The form requires an itemized list of these deductions, allowing for a comprehensive overview of charges against the deposit. It is vital for the landlord to provide documentation and justification for any amounts deducted to ensure the process is fair and legally compliant.

What should a tenant do if they disagree with the deductions listed?

If a tenant disagrees with the deductions presented in the Deposit Refund form, they should first review the lease agreement to understand the terms regarding the security deposit. It is also advisable for the tenant to gather any evidence, such as photographs or correspondence, that might support their case. Open communication with the landlord can help resolve disputes; however, if disagreements persist, legal counsel may be sought or mediation services may be considered to reach an amicable solution.

What happens if payments are due to the landlord?

If the Deposit Refund form indicates that payment is due to the landlord, they are responsible for remitting that payment within ten days as stipulated. Failure to adhere to this timeline may lead to legal action, according to the terms outlined in the form. The landlord must send the payment to the address specified on the form to avoid any misunderstandings or further complications.

Does any portion of the security deposit earn interest?

Yes, if the amount of the security deposit held exceeds one month’s rent, that excess balance earns interest at a specified annual rate. The refund form includes a section to report the amount of interest accrued during the rental period. This detail ensures that tenants are fully informed about any additional funds that may be due to them as part of their security deposit refund.

Common mistakes

Filling out a Deposit Refund form can seem straightforward, but many individuals make common mistakes that could delay the process or result in disputes. One of the most frequent errors is failing to clearly specify the rental property address. When the address is incomplete or incorrect, it can create confusion and difficulty in properly processing the claim. Ensure that all parts of the address, including apartment numbers if applicable, are clearly written.

Another mistake people often make involves inaccurate calculations of deductions. When tenants or landlords list amounts without double-checking their arithmetic, they could either overestimate or underestimate what is owed. It is essential to carefully verify each deduction amount and the total to avoid discrepancies that could lead to disagreements or delays.

Additionally, some individuals neglect to provide a clear itemized list of deductions. The form requires specific details regarding any deductions from the security deposit. Failing to outline these items can lead to misunderstandings. Precise, detailed entries help both parties understand the basis for each charge and reduce the likelihood of disputes.

An often-overlooked aspect is the inclusion of relevant dates. Many people forget to fill in the date the form is completed or the date when the lease agreement was signed. These dates can be crucial in addressing disputes regarding the timeliness of the notice or the return of funds. It is advisable to always include pertinent dates to maintain a clear timeline.

Another frequent issue is not correctly stating whether the lease agreement exceeded one month’s rent. This detail impacts how interest on the security deposit is calculated and addressed. Be careful to confirm this information, as misrepresentation can lead to complications in the refund process.

Lastly, many mistakes occur when individuals fail to sign the form. A signature is often required to validate the document. Without it, the form may be considered incomplete, leading to delays or even rejection of the claim. Always double-check to ensure all necessary signatures are present before submitting the form.

Documents used along the form

When navigating a rental situation, various documents often accompany the Deposit Refund form to ensure clear communication between tenants and landlords. Understanding these forms is beneficial for both parties, providing transparency and accountability.

- Lease Agreement: This document outlines the terms and conditions of the rental, including rent amount, lease duration, and responsibilities of both tenant and landlord.

- Move-in Checklist: A checklist that documents the condition of the rental unit at the time of move-in, noting any existing damage or necessary repairs, which can impact the security deposit return.

- Notice to Vacate: A formal written notice by the tenant that informs the landlord of the intention to move out, typically requiring a certain notice period as specified in the lease.

- Security Deposit Receipt: A receipt provided by the landlord to the tenant when the security deposit is paid, confirming the amount and the conditions under which it may be withheld.

- Walk-through Inspection Report: A report completed during a final walk-through prior to move-out, which notes the condition of the property and any potential deductions from the deposit.

- Repair Invoices: Invoices for any repairs made to the rental unit that may be deducted from the security deposit, establishing a clear record of charges.

- Claim for Damages Form: A form used by landlords to document specific damages beyond normal wear and tear, justifying the deductions taken from the security deposit.

- Accounting Statement: A breakdown of the final financial transactions related to the security deposit, detailing deductions and the final amount refunded or owed.

Overall, each of these documents plays a vital role in the deposit refund process. They create a framework that protects both parties and ensures compliance with rental laws and agreements.

Similar forms

- Lease Agreement: This document outlines the terms of rental between the landlord and tenant. Much like the Deposit Refund form, it details financial obligations and conditions regarding the security deposit and potential deductions.

- Move-In/Move-Out Inspection Checklist: Similar to the Deposit Refund form, this checklist is an itemized list that assesses the condition of the property upon key handover. Both documents serve to define the state of the property and may lead to deductions from the security deposit based on damage or wear.

- Security Deposit Receipt: This receipt is issued when the tenant pays the security deposit, confirming the amount collected. Like the Deposit Refund form, it details the financial aspects of the rental agreement and establishes initial agreements regarding the deposit's return.

- Account Statement: This document displays transactions related to the security deposit, including deductions for repairs or unpaid rent. Similar to the Deposit Refund form, it itemizes these charges and clarifies the remaining balance owed to the tenant or the landlord.

- Notice of Intent to Evict: This notice informs the tenant of potential eviction due to non-payment or violation of lease terms. While focused on eviction, it often references the security deposit and any deductions related to damage, linking it back to duties outlined in the Deposit Refund form.

Dos and Don'ts

When filling out the Deposit Refund form, it's essential to follow certain practices to ensure accuracy and efficiency. Here are five recommendations:

- Do fill in all required fields completely and accurately to avoid delays.

- Do double-check the calculation of deductions to ensure they are correct and justified.

- Do provide clear documentation for any deductions listed, including receipts or invoices.

- Do keep a copy of the completed form for your records, as it may be needed for future reference.

- Do submit the form promptly to adhere to any timelines specified in the lease agreement.

Conversely, there are also important things to avoid:

- Don't leave any fields blank; incomplete forms may lead to rejection.

- Don't include deductions that are not specified in the lease agreement, as this can lead to disputes.

- Don't submit the form without reviewing it for errors or inconsistencies.

- Don't forget to sign and date the form to verify your agreement with its contents.

- Don't disregard any required follow-up actions or communications regarding the refund process.

Misconceptions

Understanding the nuances of the Deposit Refund Form can help tenants and landlords navigate the often confusing process of security deposit returns. Despite its importance, a number of misconceptions surround this form. Here are six common misunderstandings:

- All security deposits must be refunded in full. Many tenants believe that they are entitled to the entire security deposit back. However, landlords can deduct legitimate expenses for damages or unpaid rent as outlined in the lease agreement.

- There is a standard timeline for refunds. It's a common myth that all landlords must return deposits within a specific timeframe. In reality, state laws often dictate the timeline for return, and these deadlines can vary significantly.

- Interest on the security deposit is automatic. Tenants may assume they automatically receive interest on their security deposits. While some states require landlords to pay interest, it depends on local laws and whether the deposit exceeds a certain amount.

- Landlords can deduct any amount from the deposit. This misconception suggests that landlords can deduct anything they choose. In truth, deductions must be reasonable and documented, aligning with what is permitted in the lease agreement.

- Signatures are not necessary for the deposit refund process. Some individuals think that obtaining signatures on the Deposit Refund Form isn't essential. However, both parties' signatures can provide clear evidence of agreement regarding deductions and the remaining balance.

- Only landlords can fill out the form. While landlords typically initiate the process by itemizing deductions, tenants are encouraged to review, contest, and make comments on the form. Open communication is key to resolving any disputes regarding the deductions.

By debunking these misconceptions, both tenants and landlords can approach the refund process with greater clarity and confidence.

Key takeaways

When completing and using the Deposit Refund form, consider the following key takeaways:

- The form is designed to clearly document any deductions from the security deposit, ensuring transparency between the Tenant and Landlord.

- Always fill in the date and relevant names (Tenant and Landlord) at the top of the form to establish the context of the refund.

- Complete the itemized list of deductions accurately. Each deduction should be accompanied by a clear description and the corresponding dollar amount.

- Calculate the total amount of deductions carefully. This will determine how much of the security deposit will be refunded.

- Consult the lease agreement to confirm whether the security deposit exceeded one month’s rent, as this affects interest calculations.

- The form should also specify the amount due to both the Tenant and the Landlord, ensuring all parties are informed of the financial outcomes.

- If a refund is due to the Tenant, include a check with the form. If the Landlord owes money, clearly state the payment deadline to avoid confusion.

Following these tips can help streamline the refund process and prevent potential disputes.

Browse Other Templates

Note Card Template Word - Familiarity with the adjustments can make creating and printing index cards more efficient.

Types of Court Petitions - This subpoena is an essential tool for legal advocacy and compliance.