Fill Out Your Deposit Slip Form

The Deposit Slip form plays a crucial role in the financial routine of clubs and organizations, facilitating the process of depositing funds into their accounts. Understanding how to properly fill out a deposit slip can ensure that your club’s financial interests are accurately represented and efficiently managed. Key elements of the form directly guide users through the submission process. First, it’s important to include the club number and name, establishing the identity of the organization making the deposit. The form also requires the name of the individual preparing the deposit, the date, and an income code that aligns with the reason for the deposit. Additionally, providing a convincing source and detailed description of the funds helps clarify the origin of the money being deposited. Each entry must be accompanied by the corresponding amount, along with a total at the bottom. To maintain organization, different types of deposited money—such as checks, coins, and currency—should be broken out on the slip. Finally, all checks must bear an endorsement on the reverse side, which includes stamping and writing the club number, solidifying the transaction. Understanding these steps can help clubs streamline their financial processes and maintain accurate records.

Deposit Slip Example

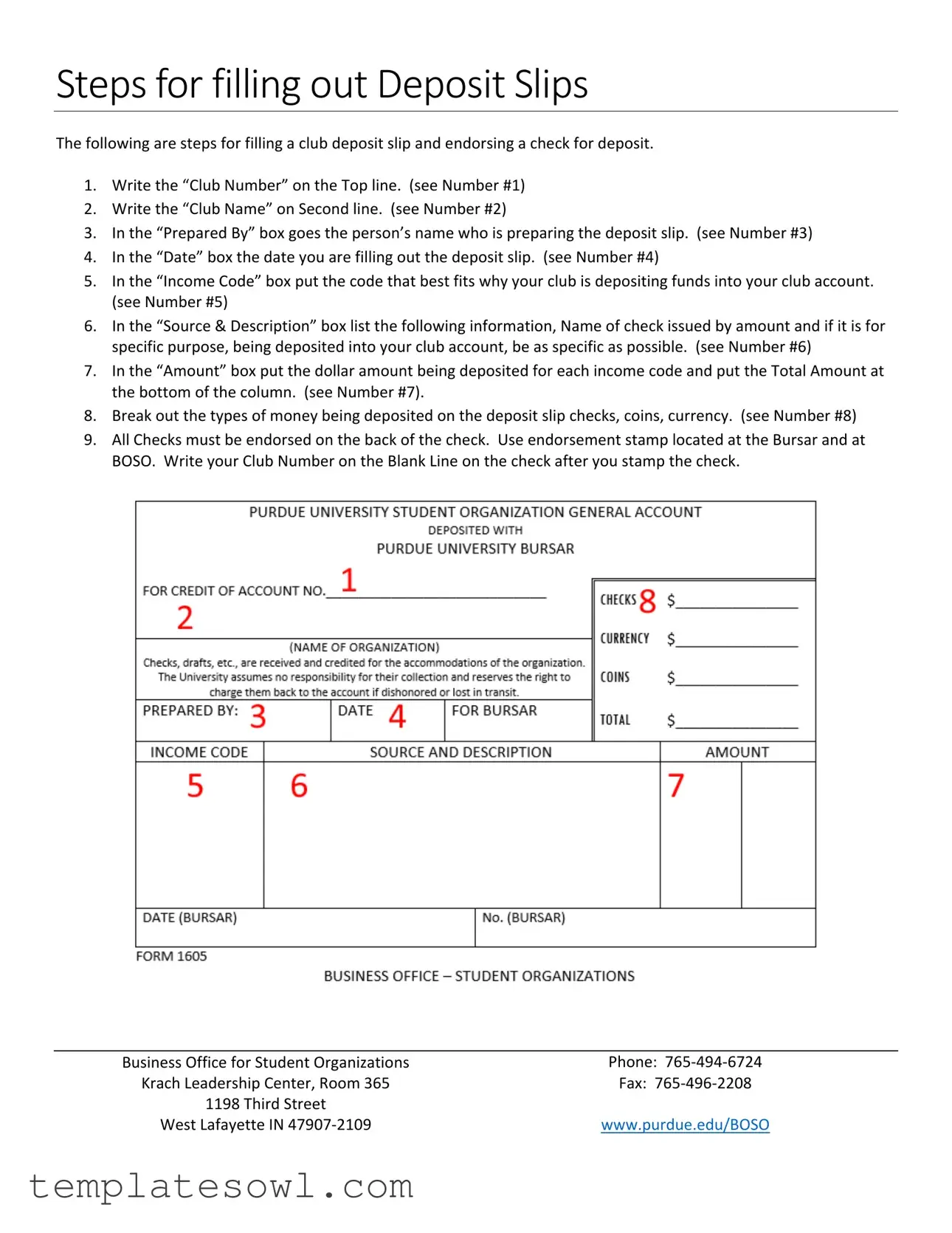

Steps for filling out Deposit Slips

The following are steps for filling a club deposit slip and endorsing a check for deposit.

1.Write the “Club Number” on the Top line. (see Number #1)

2.Write the “Club Name” on Second line. (see Number #2)

3.In the “Prepared By” box goes the person’s name who is preparing the deposit slip. (see Number #3)

4.In the “Date” box the date you are filling out the deposit slip. (see Number #4)

5.In the “Income Code” box put the code that best fits why your club is depositing funds into your club account. (see Number #5)

6.In the “Source & Description” box list the following information, Name of check issued by amount and if it is for specific purpose, being deposited into your club account, be as specific as possible. (see Number #6)

7.In the “Amount” box put the dollar amount being deposited for each income code and put the Total Amount at the bottom of the column. (see Number #7).

8.Break out the types of money being deposited on the deposit slip checks, coins, currency. (see Number #8)

9.All Checks must be endorsed on the back of the check. Use endorsement stamp located at the Bursar and at BOSO. Write your Club Number on the Blank Line on the check after you stamp the check.

Business Office for Student Organizations |

Phone: 765‐494‐6724 |

Krach Leadership Center, Room 365 |

Fax: 765‐496‐2208 |

1198 Third Street |

www.purdue.edu/BOSO |

West Lafayette IN 47907‐2109 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | A deposit slip is used to submit funds to a bank account, providing a record of the transaction. |

| Club Information | It is essential to write the Club Number and Club Name at the top of the deposit slip for proper identification. |

| Prepared By | The name of the individual preparing the deposit slip must be clearly stated in the designated box. |

| Date Requirement | The current date should be filled in to record when the deposit is made. |

| Income Code | Include an Income Code that best represents the reason for the deposit, ensuring accurate categorization. |

| Source & Description | It's important to provide detailed information about the source of the funds, including check names and amounts. |

| Amount Section | Each deposit amount should be clearly recorded, with a total amount indicated at the bottom of the column. |

| Types of Money | Clearly break down the types of funds being deposited, such as checks, coins, and currency. |

| Endorsement Requirement | All checks must be endorsed on the back; include the Club Number after stamping for tracking. |

| Contact Information | For assistance, you can reach the Business Office for Student Organizations at Purdue at 765-494-6724. |

Guidelines on Utilizing Deposit Slip

After completing the Deposit Slip form, it will be ready for submission to your financial institution. Ensure that all fields are filled accurately to avoid any delays in processing. Here are the steps to fill out the form:

- Write the “Club Number” on the top line.

- Write the “Club Name” on the second line.

- In the “Prepared By” box, enter the name of the person preparing the deposit slip.

- In the “Date” box, include the date you are filling out the deposit slip.

- In the “Income Code” box, put the code that best fits why your club is depositing funds into your club account.

- In the “Source & Description” box, list the name of the check issued, the amount, and specify the purpose if applicable.

- In the “Amount” box, write the dollar amount being deposited for each income code and total the amounts at the bottom of the column.

- Break out the types of money being deposited on the slip: checks, coins, and currency.

- All checks must be endorsed on the back using the endorsement stamp. After stamping, write your Club Number in the blank line on the check.

Make sure to double-check all entries for accuracy before submission.

What You Should Know About This Form

What is a Deposit Slip?

A Deposit Slip is a form used to record the details of money being deposited into a bank account. It outlines the source of the income and provides essential information necessary for accurate accounting and record-keeping.

How do I fill out a Deposit Slip?

To fill out a Deposit Slip, begin by writing your club number at the top. Next, include your club name on the second line. The "Prepared By" section should contain the name of the individual who is handling the deposit. Be sure to write the date in the designated box as well. In the "Income Code" box, enter the code that accurately describes why funds are being deposited. Then, in the "Source & Description" area, list details about the checks, specifically the names, amounts, and their purposes. Finally, be careful to include the amount being deposited next to each income code and calculate the total amount at the bottom of the column. It’s also important to categorize the types of money being deposited—checks, coins, and currency.

What should I include in the “Source & Description” box?

This box should contain detailed information regarding the checks being deposited. You should specify the name of each check issuer along with the amount and the purpose of each deposit. The more specific you can be, the easier it will be for anyone reviewing the slip to understand where the funds are coming from and why.

Is it necessary to endorse checks before depositing them?

Yes, it is essential to endorse every check before depositing. This guarantees that the funds can be processed and credited to your account without any issues. You can use the endorsement stamp located at the Bursar and at the Business Office for Student Organizations (BOSO) for this purpose.

Where should I write my Club Number on the check?

After stamping the back of the check with the endorsement stamp, you should write your Club Number on the blank line provided. This step helps to ensure that funds are accurately attributed to your specific club account.

What if I need help filling out the Deposit Slip?

If you encounter any issues or have questions while filling out your Deposit Slip, you can reach out for assistance at the Business Office for Student Organizations. Their phone number is 765-494-6724, and they are located at the Krach Leadership Center, Room 365.

Can I submit multiple deposits on one Deposit Slip?

It is generally advisable to submit only one deposit per Deposit Slip to maintain clarity in record-keeping. If you have multiple sources of income or checks to deposit, consider using separate slips for each source, as this will ultimately simplify the accounting process.

What should I do if I make a mistake on the Deposit Slip?

If you make an error while filling out the Deposit Slip, it is best to start over with a new form to avoid any confusion. Crossed-out information can lead to misinterpretations. Always double-check details before submitting the slip.

Common mistakes

Filling out a deposit slip can seem straightforward, yet many people make common mistakes that can lead to delays or issues with their deposits. One frequent error occurs when individuals neglect to write the Club Number on the top line. This information is critical for identifying the account and ensuring the funds are allocated correctly. Without it, the deposit may not be processed or could end up being misdirected.

Another mistake is related to the Income Code. People often fail to choose the appropriate code that describes the reason for the deposit. The right code helps in categorizing the income, which is essential for the club's accounting records. An incorrect or missing code can lead to confusion or audits, thereby complicating financial management.

Additionally, inaccuracies can happen in the Source & Description section. Many rush through this part and do not provide enough detail regarding the funds. It is important to list the name of the issued check along with its amount and purpose. Lack of specificity can cause problems later, particularly when the club needs to address questions about the source of the funds.

Lastly, some forget to properly endorse the checks. Endorsing a check on the back is a necessary step before submission. Individuals sometimes overlook using the endorsement stamp and forget to write their Club Number. This oversight can lead to complications and delays in processing the deposit. Always take a moment to double-check that both steps are completed correctly to avoid any unnecessary issues.

Documents used along the form

When completing a deposit slip form, you may find yourself needing additional documents for a smooth and organized process. These documents can help keep your records clear and ensure that your financial transactions are properly documented. Below is a list of forms and documents that are often used alongside the Deposit Slip form.

- Checks: Checks are written orders directing a bank to pay a specific amount from one account to another. They are often included with a deposit slip when funds are being added to an account.

- Check Endorsement Stamp: This stamp allows for quick endorsement of checks before they can be deposited. It provides the necessary signature or initials required for processing.

- Income Code List: This list outlines the specific codes used to categorize different types of income. It helps in identifying the purpose of deposits clearly.

- Source Documentation: This document can include invoices or receipts that explain the origin of funds being deposited. It serves as proof for accounting records.

- Record of Deposit Transactions: A ledger or document that tracks all deposits made over a specific period. This helps keep a comprehensive financial history for your account.

- Reimbursement Forms: If the deposit is a reimbursement, this form provides details on expenses incurred for which funds are being returned to the club.

- Financial Statements: These statements provide an overview of the club’s financial position, showing how deposits affect overall finances.

- Budget Proposals: If the deposit relates to a specific project or event, a budget proposal may accompany it to show how funds will be used.

- Club Meeting Minutes: The minutes from meetings that discuss financial decisions can serve as a record for why certain funds are being deposited.

By understanding these documents and their purposes, you can ensure that your deposits are accurately recorded and efficiently processed. Keeping everything organized will help build trust and transparency within your financial practices.

Similar forms

When filling out a Deposit Slip form, you may notice similarities with several other types of documents used in financial transactions and record-keeping. Here are seven documents that share a common purpose or structure with the Deposit Slip:

- Withdrawal Slip: Like a deposit slip, a withdrawal slip is used to indicate the amount of money being taken out of an account. Both documents require information such as account numbers and amounts to ensure accurate processing.

- Check: A check serves as a payment method and includes essential details about the amount, payee, date, and bank information. Similar to a deposit slip, a check must be properly filled out and signed for it to be valid.

- Money Order: A money order also functions as a payment method. It requires details about the sender and recipient, akin to the information needed on a deposit slip for tracking transactions.

- Invoice: An invoice lists goods or services provided along with their costs and payment terms. Although it’s typically issued by the seller, it helps in documenting funds owed, making it similar to the source and description section of a deposit slip.

- Receipt: A receipt acknowledges payment for goods or services. Both receipts and deposit slips serve as proof of financial transactions, highlighting the amounts involved and the parties engaged.

- Bank Statement: A bank statement summarizes all transactions over a period, including deposits. It shares common elements with deposit slips by detailing fund movements in and out of an account.

- Account Transfer Form: This form allows for the movement of funds between accounts. Like the deposit slip, it serves to record changes in account balances and requires careful documentation of amounts and account details.

Dos and Don'ts

When filling out a Deposit Slip form, careful attention to detail makes a significant difference. Below are some do's and don'ts to keep in mind:

- Write the correct Club Number on the top line to avoid confusion.

- Ensure the Preparation Date is accurate to maintain proper records.

- Be specific in the Source & Description box; clear details help track funds effectively.

- Double-check the total amount entered at the bottom of the column for accuracy.

- Don't leave the Prepared By box blank; this step is crucial for accountability.

- Avoid using vague descriptions in the Source & Description box; it may lead to misallocation of funds.

- Do not forget to endorse all checks; failure to do so can complicate the deposit process.

- Never mix different types of funds without indicating them clearly on the slip.

Misconceptions

Understanding how to properly fill out a deposit slip can help ensure that your transactions go smoothly. However, there are several misconceptions that can lead to confusion. Here are seven common misconceptions about the deposit slip form:

- All deposit slips are the same. Many believe that deposit slips come in a one-size-fits-all format. In reality, different institutions may have variations, and it’s essential to use the one specific to your organization.

- You don’t need to include the club number. Some people think the club number is optional. However, it is crucial to include the club number at the top of the slip for proper identification and processing.

- The "Prepared By" field can be left blank. This is another misconception. Always fill this out to indicate who is responsible for preparing the deposit slip, which helps maintain accountability.

- The date can be entered at any time. Some may believe that the date of the deposit does not matter. However, it's important to include the date you are filling out the slip; this provides a clear record for both you and the institution.

- Using an income code isn’t necessary. This is a common misunderstanding. It is essential to use the appropriate income code to classify why funds are being deposited. This helps streamline record-keeping for the organization.

- Listing the source and description is optional. Many think they can skip this section. In truth, providing a detailed source and description of the funds deposited helps clarify their purpose and maintains financial transparency.

- Endorsing checks is not required. Finally, some individuals believe that endorsement is unnecessary. However, all checks must be endorsed on the back before being submitted. This step is critical for the bank to process the check correctly.

By clarifying these misconceptions, you can ensure that your deposit is processed efficiently and accurately. Reviewing the deposit slip form and following these guidelines will help avoid errors and maintain clear financial records.

Key takeaways

Filling out a deposit slip accurately is essential for ensuring that funds are properly credited to a club's account. Below are key takeaways to keep in mind when completing the deposit slip form:

- Club Number: Start by writing the “Club Number” on the top line. This helps identify the account to which the funds are being deposited.

- Club Name: Clearly write the “Club Name” on the second line. Accurate identification aids in record-keeping.

- Prepared By: Enter the name of the individual preparing the deposit slip in the "Prepared By" box. This ensures accountability.

- Date: Fill in the “Date” box with the current date. This marks when the deposit is being made.

- Income Code: In the “Income Code” section, include the appropriate code that describes the reason for the deposit. This organizes financial information.

- Source & Description: Provide detailed information in the “Source & Description” box. Include the name of the check, amount, and purpose of the funds.

- Amount: Write the dollar amount being deposited for each income code. Don’t forget to calculate and note the total amount at the bottom of the column.

- Type of Money: Specify the types of money being deposited—checks, coins, or currency. This categorization aids in tracking deposits.

- Endorsement: Remember to endorse all checks on the back before submitting. Use the endorsement stamp provided and write the Club Number on the blank line after stamping.

By following these steps with attention to detail, clubs can ensure smooth deposits and maintain clear financial records.

Browse Other Templates

Llp Registration - Each submission requires a $30 filing fee and a separate $15 service fee for in-person submissions.

How Much to File for a Lost Title - Applications can be submitted by mail or in person at a Motor Vehicles office.