Fill Out Your Deposit Slip Bank America Form

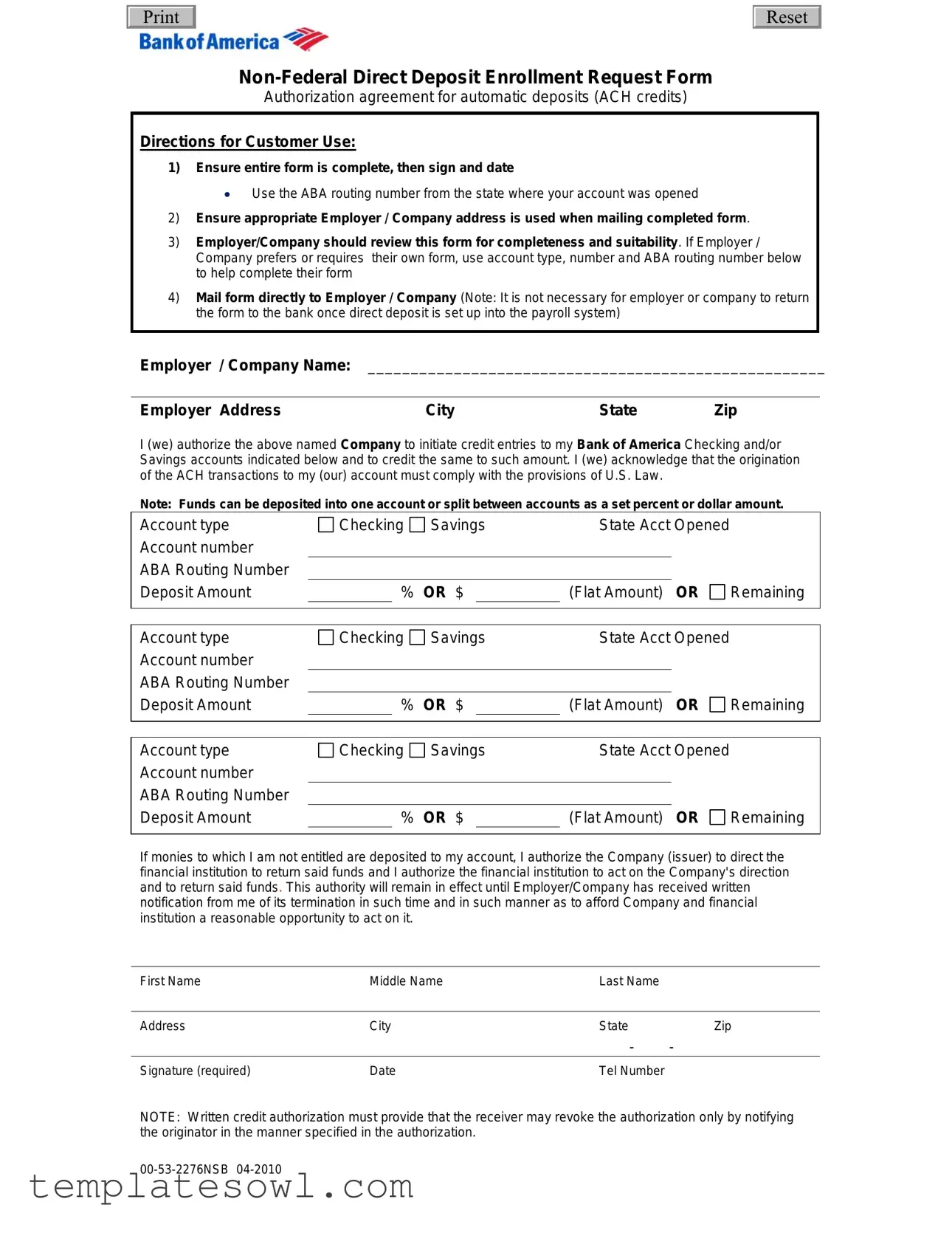

The Bank of America Deposit Slip form is essential for individuals enrolling in Direct Deposit for their payroll or other automatic deposits. This form authorizes your employer or company to deposit funds directly into your designated Bank of America accounts. It is crucial to complete the form accurately, including details such as your account type, account number, and the ABA routing number associated with your account's state of origin. A key feature is the ability to specify how your funds are distributed—whether deposited into one account or split between multiple accounts. You'll also need to provide your employer's address to ensure they have the correct information for processing. Additionally, it is necessary for the employer to review the form for completeness before any submissions. Once the form is submitted, employers are not required to return it to the bank, simplifying the process for both parties involved. Keeping this form updated is vital, as your authorization will remain in effect until you provide written notice of its termination to your employer. Make sure to sign and date the form to validate your request and initiate your direct deposit process smoothly.

Deposit Slip Bank America Example

Reset

Authorization agreement for automatic deposits (ACH credits)

Directions for Customer Use:

1)Ensure entire form is complete, then sign and date

Use the ABA routing number from the state where your account was opened

2)Ensure appropriate Employer / Company address is used when mailing completed form.

3)Employer/Company should review this form for completeness and suitability. If Employer / Company prefers or requires their own form, use account type, number and ABA routing number below to help complete their form

4)Mail form directly to Employer / Company (Note: It is not necessary for employer or company to return the form to the bank once direct deposit is set up into the payroll system)

Employer |

/ Company Name: |

_____________________________________________________ |

|||

|

|

|

|

|

|

Employer |

Address |

City |

State |

Zip |

|

I (we) authorize the above named Company to initiate credit entries to my Bank of America Checking and/or Savings accounts indicated below and to credit the same to such amount. I (we) acknowledge that the origination of the ACH transactions to my (our) account must comply with the provisions of U.S. Law.

Note: Funds can be deposited into one account or split between accounts as a set percent or dollar amount.

Account type |

Checking |

Savings |

State Acct Opened |

|

|||

Account number |

|

|

|

|

|

|

|

ABA Routing Number |

|

|

|

|

|

|

|

Deposit Amount |

|

% OR $ |

|

(Flat Amount) OR |

Remaining |

||

|

|

|

|

|

|||

|

|

|

|

|

|||

Account type |

Checking |

Savings |

State Acct Opened |

|

|||

Account number |

|

|

|

|

|

|

|

ABA Routing Number |

|

|

|

|

|

|

|

Deposit Amount |

|

% OR $ |

|

(Flat Amount) OR |

Remaining |

||

|

|

|

|

|

|||

|

|

|

|

|

|||

Account type |

Checking |

Savings |

State Acct Opened |

|

|||

Account number |

|

|

|

|

|

|

|

ABA Routing Number |

|

|

|

|

|

|

|

Deposit Amount |

|

% OR $ |

(Flat Amount) OR |

Remaining |

|||

|

|

|

|

|

|

|

|

If monies to which I am not entitled are deposited to my account, I authorize the Company (issuer) to direct the financial institution to return said funds and I authorize the financial institution to act on the Company's direction and to return said funds. This authority will remain in effect until Employer/Company has received written notification from me of its termination in such time and in such manner as to afford Company and financial institution a reasonable opportunity to act on it.

First Name |

Middle Name |

Last Name |

|

|

|

|

|

Address |

City |

State |

Zip |

|

|

- |

- |

Signature (required) |

Date |

Tel Number |

|

NOTE: Written credit authorization must provide that the receiver may revoke the authorization only by notifying the originator in the manner specified in the authorization.

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This form is used for initiating direct deposit into a Bank of America checking or savings account. |

| Employer's Role | Employees must mail the completed form to their employer or company, which reviews it for completeness before processing. |

| ABA Routing Number | The form requires the ABA routing number from the state where the account was opened. |

| Funds Allocation | Deposited funds can either go entirely into one account or be split among multiple accounts in set amounts or percentages. |

| Authorization | By signing the form, the individual authorizes the employer to initiate credit entries to their Bank of America accounts. |

| Regulatory Compliance | All ACH transactions must comply with applicable U.S. laws regulating electronic funds transfers. |

| Revocation of Authorization | Written authorization can only be revoked by notifying the employer in the specified manner, ensuring proper procedures are followed. |

| Retention of Authority | The authorization remains valid until the employer receives a written termination notice from the individual. |

Guidelines on Utilizing Deposit Slip Bank America

Once the Deposit Slip Bank America form is completed, it is essential to ensure it is submitted to the employer or company that requested it. Take care to follow the outlined steps precisely to avoid any delays in processing your direct deposit.

- Fill in the Employer/Company Name and address fields accurately.

- Provide your first name, middle name, and last name in the designated areas.

- Enter your address, city, state, and zip code.

- Indicate the account type (Checking or Savings) for the first account.

- Fill in the account number and ABA routing number for the first account.

- Specify the deposit amount, allowing for a percentage, flat amount, or remaining balance.

- Repeat the previous three steps for a second and third account if necessary.

- Sign and date the form at the bottom where indicated.

- Include your telephone number for further contact if needed.

- Review the completed form for any errors before submission.

- Mail the form directly to your employer or company.

What You Should Know About This Form

What is the Deposit Slip Bank America form used for?

The Deposit Slip Bank America form is primarily used to initiate automatic deposits into your Bank of America accounts. This can include direct deposits from employers or other sources. The form allows customers to authorize an employer or company to credit their checking and/or savings accounts with each payroll cycle or at other scheduled intervals.

How do I fill out the Deposit Slip Bank America form?

To complete the form, ensure you fill in all required fields accurately. Start by providing your personal information, including your name and address. Next, include the employer or company information along with the specific bank account details, such as the account type, number, ABA routing number, and the deposit amount or percentages. Finally, you must sign and date the form before submission.

Where do I send the completed Deposit Slip Bank America form?

After filling out the form, mail it directly to your employer or company. It is essential that the employer/company reviews the form before processing it for direct deposit. Remember, once the direct deposit is set up in the payroll system, there is no need for your employer or company to return the form to the bank.

Can I split my deposits between multiple accounts?

Yes, the form allows you to divide your deposit among multiple accounts. You can specify the amount or percentage of your paycheck that you wish to deposit into each account. Whether it’s a flat dollar amount or a percentage, ensure that the breakdown is clearly indicated on the form.

What should I do if I no longer want my direct deposit?

If you wish to revoke your authorization for direct deposit, you must notify your employer or company in writing. It is important to do this in a timely manner so that your employer and the financial institution have enough time to act on your termination request.

What happens if money is mistakenly deposited into my account?

If funds that you are not entitled to are deposited into your account, you give your employer or issuer the authority to direct the bank to return those funds. The bank will act on the instruction from your employer or company regarding the return of these funds.

Is my authorization valid indefinitely?

No, your authorization for direct deposits remains valid until you provide written notification to your employer or company to cancel it. Make sure your notice is clear and gives your employer enough time to process the termination as specified in the authorization.

Common mistakes

When filling out the Deposit Slip Bank America form, people often make mistakes that can delay their direct deposit setup. One common error is failing to complete the entire form. Every section is crucial to ensure that funds are deposited accurately. Leaving any part blank can lead to confusion or even rejected applications.

Another frequent issue occurs when individuals use the wrong ABA routing number. It is essential to use the routing number from the state where the bank account was opened. Using an incorrect number can result in misdirected deposits, causing unnecessary frustration.

Some people neglect to review the form for completeness before submitting it. It’s vital for the employer or company to verify that all information is correct and suitable. The employer may have their own form, and if so, ensure that the relevant account type, number, and routing number are correctly filled out on their version.

In addition, mailing the completed form to the wrong address can lead to delays. Always ensure that the appropriate employer or company address is used when sending the form. Double-checking this detail can save a lot of time and hassle.

Another mistake is not including a clear authorization for the employer to initiate credit entries. This section outlines the agreement between the employee and employer regarding direct deposits. If it's missing or not properly filled out, it can result in delayed payments.

Some users may overlook the importance of specifying how funds should be allocated between accounts. Yes, funds can be split between multiple accounts, but it’s crucial to clearly indicate the percentage or flat amount designated for each account. This eliminates any ambiguity for the bank.

Failing to provide a complete mailing address for yourself is also an oversight that can affect processing. The form requires your full name, address, city, state, and ZIP code to connect the deposit to the right person. Without accurate information, there may be complications in processing the deposit.

Another common error is skipping the signature section. A signature is required to authorize transactions. Without it, the bank cannot proceed with direct deposit arrangements, leading to delays in receiving funds.

Lastly, not providing a telephone number can hinder communication. If the bank or employer needs to reach out for clarification, having your contact information readily available is essential. It's a simple addition that can make a significant difference in the efficiency of the processing.

Documents used along the form

When dealing with banking transactions and deposits, several documents naturally accompany the Deposit Slip Bank of America form. Each document serves a distinct purpose and is essential for ensuring that deposits and transactions are processed smoothly. Below is a list of commonly used forms and documents that you might find helpful.

- Direct Deposit Enrollment Form: This form allows employees to authorize their employer to deposit their paychecks directly into their bank account. It collects details such as the employee’s account number and bank routing number.

- ACH Authorization Form: This document authorizes an organization to make automatic withdrawals from an account. It’s often used for recurring payments like utilities or subscriptions.

- Deposit Agreement: A formal agreement that outlines the terms and conditions related to account deposits. It offers necessary information about fees and processing times.

- Account Verification Form: Used to confirm bank account details, this form is often requested by organizations to ensure that the account numbers they have on file are accurate.

- Withdrawal Slip: This form is used when individuals want to take money out of their accounts. It typically requires the account holder’s signature and details about the amount being withdrawn.

- Wire Transfer Request Form: When money needs to be sent between banks, this form provides the necessary details for a wire transfer, including account numbers and routing information.

- Bank Statement Request Form: If you need your recent bank statements for personal or business records, this form allows you to formally request that information from your bank.

- Stop Payment Request Form: If you need to cancel a pending payment (like a check), this document can initiate a stop payment with your bank to prevent the transaction from being processed.

- Change of Address Form: This form is for customers who want to update the mailing address associated with their bank account, ensuring that all correspondence is correctly routed.

Each of these documents plays a critical role in managing banking transactions, especially concerning direct deposits. Familiarizing yourself with these forms can help streamline your financial processes, making banking more efficient. Always ensure that your forms are filled out clearly and accurately to avoid any delays or issues with your banking transactions.

Similar forms

- Direct Deposit Authorization Form: Similar to the Deposit Slip Bank America form, this document also allows individuals to authorize their employer or another entity to deposit funds directly into their bank account. It typically requires personal information, banking details, and a signature.

- ACH Credit Authorization Form: This form is used to grant permission for future Automated Clearing House (ACH) credits to be directed into a specified bank account. Like the Deposit Slip, it outlines the designated accounts and deposit amounts.

- Payroll Deduction Authorization Form: This document enables employees to authorize their employer to deduct specific amounts from their paychecks for various purposes, such as retirement savings or insurance. It shares an authorization structure similar to the Deposit Slip.

- Wire Transfer Authorization Form: When using this form, individuals provide instructions for their bank to transfer money to another bank. Both documents request specific banking details to complete the transaction.

- Bank Account Application: This application is completed by a person seeking to open a bank account, requiring similar personal and banking details. Both documents necessitate a thorough review and authorization for financial transactions.

- Automatic Payment Authorization Form: This form permits companies or service providers to automatically withdraw payments from a customer's account. It parallels the Deposit Slip's purpose by enabling automatic fund transfers under agreed conditions.

- Electronic Funds Transfer (EFT) Authorization Form: This document allows individuals to permit electronic transfers between their bank accounts and other institutions. Like the Deposit Slip, it details transaction amounts and account specifics for proper processing.

Dos and Don'ts

When filling out the Bank of America Deposit Slip, consider the following guidelines. These tips will help ensure that your form is completed accurately and efficiently.

- Do ensure that the entire form is complete before submitting.

- Do sign and date the form to validate your authorization.

- Do use the correct ABA routing number from the state where your account was opened.

- Do verify that the employer or company address is accurate for proper mailing.

- Do check with your employer or company to ensure they have reviewed the form.

- Don’t send the form back to the bank; instead, mail it directly to your employer or company.

- Don’t forget to provide clear instructions for splitting deposits, if preferred.

- Don’t overlook any required personal information, such as Name and Address.

- Don’t ignore the importance of keeping a copy of the completed form for your records.

- Don’t assume that your authorization remains valid indefinitely; notify your employer if you wish to revoke it.

Misconceptions

- All fields on the form are optional. Many people believe they can skip sections, but it's crucial to complete every part to avoid delays.

- You can use any routing number. In reality, you must use the ABA routing number from the state where your account was originally opened.

- Employers must return the form to the bank. This isn't necessary once direct deposit is set up; the employer only needs to process it internally.

- Direct deposits can only go into one account. You have the option to split funds across multiple accounts or specify flat amounts.

- Once submitted, the authorization is permanent. You can revoke this authorization by notifying your employer in writing.

- The employer is responsible for accuracy. While they review the form, it's ultimately your responsibility to ensure all information is correct.

- Little information is needed for account specification. You need to provide details like account type, number, and routing number accurately.

- The bank is liable for errors made by employers. If funds are incorrectly deposited, the issue lies with the employer and their processes, not the bank's.

Key takeaways

Understanding how to properly fill out and use the Deposit Slip Bank of America form is crucial for ensuring efficient and accurate direct deposits. Here are some key takeaways to guide you:

- Complete the Entire Form: Make sure every section of the form is filled out completely. This includes your personal details and the specific deposit instructions.

- Use Correct Routing Numbers: Always use the ABA routing number from the state where your account was originally opened.

- Employer/Company Review: It’s essential that your employer or company reviews the form for completeness and suitability before submission.

- Mailing Instructions: After you fill it out, send the completed form directly to your employer or company. The bank does not need to receive a copy once the direct deposit is set up.

- Account Options: You have the choice to deposit funds into one account, or split the deposit percentage or flat amount across multiple accounts.

- Authorization: Signing the form grants your employer the authority to initiate ACH credit entries to your specified Bank of America accounts.

- Revocation Process: If you need to revoke authorization, you must provide written notification to your employer in a timely manner.

- Returned Funds Protocol: If incorrect funds are deposited into your account, you allow the employer to direct the financial institution to return those funds.

- Signature Requirement: Your signature and the date are required on the form to validate the authorization.

By keeping these key points in mind, you can ensure that your direct deposit requests are processed smoothly and accurately.

Browse Other Templates

Sellers Permit Florida - Submitting the DR-700030 is part of obtaining necessary tax compliance permits.

Resume How to - Ensure that personal information is kept private and confidential.