Fill Out Your Dhs 1169 Form

Understanding the Dhs 1169 form is crucial for individuals navigating medical assistance in Hawaii, particularly for those who are patients in nursing facilities or similar medical institutions. This document plays a significant role in the state’s management of medical liens on home properties belonging to certain individuals receiving state-sponsored medical coverage. It requires the applicant or their authorized representative to provide detailed personal information, including their social security number and the name of the medical institution where they are residing. The form seeks to confirm the individual's ownership status of their home or any property they lived in prior to their admission. Questions on the form also explore the current living situation—addressing whether anyone has moved in or out of the home within the past twelve months. Importantly, the form reassures applicants that establishment of a lien does not equate to loss of ownership; rather, it serves as a security measure for the medical expenses covered by the state. Individuals can find that this lien may be lifted if they are discharged from the medical institution and resume residence in their home. The completion of the Dhs 1169 ensures that the state understands the applicant's situation thoroughly, which in turn, aids in fair and effective resource allocation.

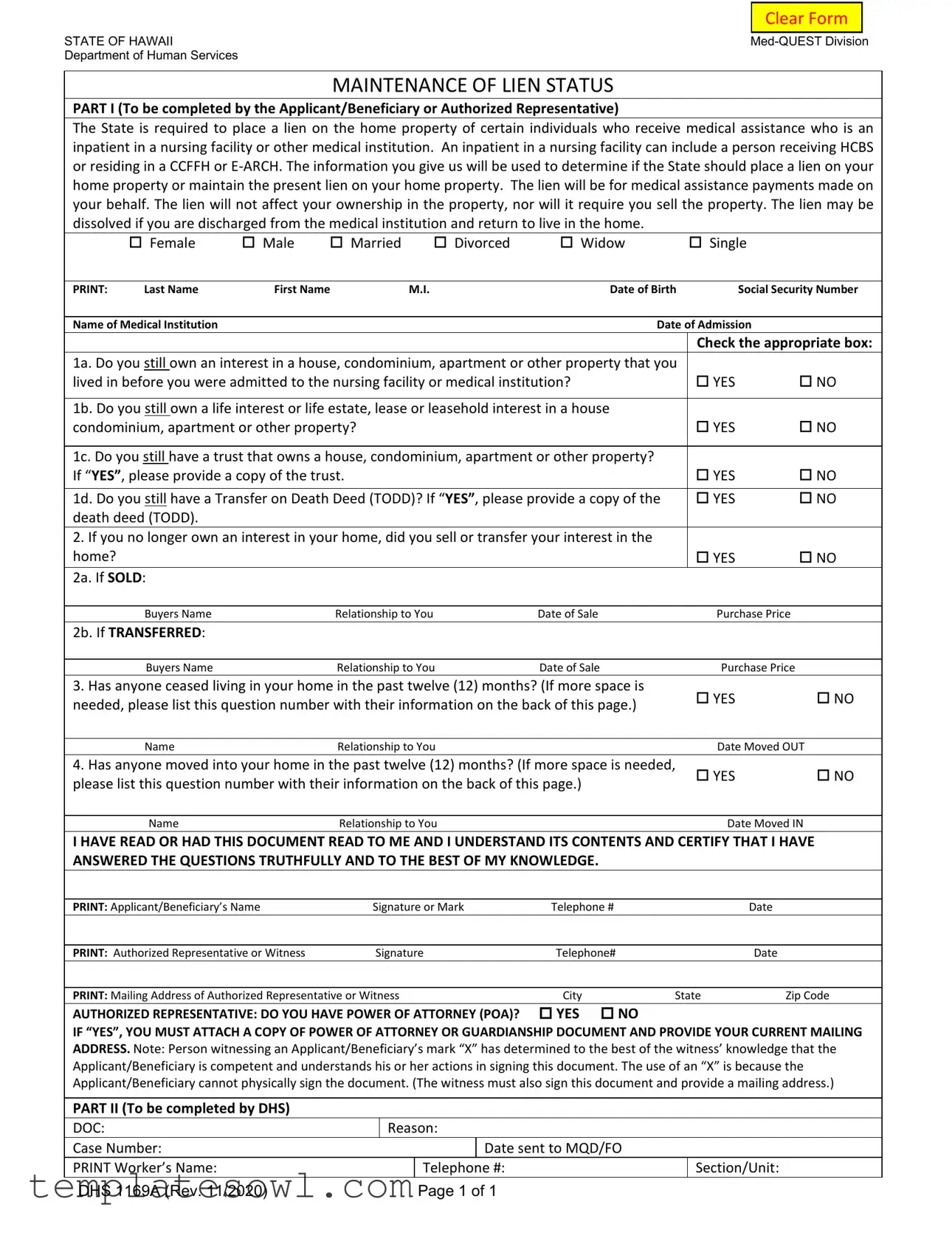

Dhs 1169 Example

|

Clear Form |

|

STATE OF HAWAII |

|

|

Department of Human Services |

|

|

MAINTENANCE OF LIEN STATUS

PART I (To be completed by the Applicant/Beneficiary or Authorized Representative)

The State is required to place a lien on the home property of certain individuals who receive medical assistance who is an inpatient in a nursing facility or other medical institution. An inpatient in a nursing facility can include a person receiving HCBS or residing in a CCFFH or

|

Female |

Male |

Married |

Divorced |

Widow |

Single |

|

|

|

|

|

|

|

|

|||

PRINT: |

Last Name |

First Name |

M.I. |

Date of Birth |

Social Security Number |

|||

|

|

|

|

|

|

|

||

Name of Medical Institution |

|

|

|

Date of Admission |

|

|||

|

|

|

|

|

|

Check the appropriate box: |

||

1a. Do you still own an interest in a house, condominium, apartment or other property that you |

|

|

||||||

lived in before you were admitted to the nursing facility or medical institution? |

YES |

NO |

||||||

|

|

|

||||||

1b. Do you still own a life interest or life estate, lease or leasehold interest in a house |

|

|

||||||

condominium, apartment or other property? |

|

|

YES |

NO |

||||

|

|

|

||||||

1c. Do you still have a trust that owns a house, condominium, apartment or other property? |

|

|

||||||

If “YES”, please provide a copy of the trust. |

|

|

YES |

NO |

||||

1d. Do you still have a Transfer on Death Deed (TODD)? If “YES”, please provide a copy of the |

YES |

NO |

||||||

death deed (TODD). |

|

|

|

|

|

|

||

2. If you no longer own an interest in your home, did you sell or transfer your interest in the |

|

|

||||||

home? |

|

|

|

|

|

YES |

NO |

|

2a. If SOLD: |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

Buyers Name |

|

Relationship to You |

Date of Sale |

Purchase Price |

|

||

2b. If TRANSFERRED: |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

Buyers Name |

|

Relationship to You |

Date of Sale |

Purchase Price |

|

||

3. Has anyone ceased living in your home in the past twelve (12) months? (If more space is |

YES |

NO |

||||||

needed, please list this question number with their information on the back of this page.) |

||||||||

|

|

|||||||

|

|

|

|

|

|

|||

|

Name |

|

Relationship to You |

|

Date Moved OUT |

|||

4. Has anyone moved into your home in the past twelve (12) months? (If more space is needed, |

YES |

NO |

||||||

please list this question number with their information on the back of this page.) |

|

|

||||||

|

|

|

|

|

|

|||

|

Name |

|

Relationship to You |

|

Date Moved IN |

|||

I HAVE READ OR HAD THIS DOCUMENT READ TO ME AND I UNDERSTAND ITS CONTENTS AND CERTIFY THAT I HAVE ANSWERED THE QUESTIONS TRUTHFULLY AND TO THE BEST OF MY KNOWLEDGE.

PRINT: Applicant/Beneficiary’s Name |

Signature or Mark |

Telephone # |

|

Date |

|

|

|

|

|

PRINT: Authorized Representative or Witness |

Signature |

Telephone# |

|

Date |

|

|

|

|

|

PRINT: Mailing Address of Authorized Representative or Witness |

City |

State |

Zip Code |

|

AUTHORIZED REPRESENTATIVE: DO YOU HAVE POWER OF ATTORNEY (POA)? |

YES NO |

|

|

|

IF “YES”, YOU MUST ATTACH A COPY OF POWER OF ATTORNEY OR GUARDIANSHIP DOCUMENT AND PROVIDE YOUR CURRENT MAILING ADDRESS. Note: Person witnessing an Applicant/Beneficiary’s mark “X” has determined to the best of the witness’ knowledge that the Applicant/Beneficiary is competent and understands his or her actions in signing this document. The use of an “X” is because the Applicant/Beneficiary cannot physically sign the document. (The witness must also sign this document and provide a mailing address.)

PART II (To be completed by DHS)

DOC: |

Reason: |

|

||

Case Number: |

|

|

Date sent to MQD/FO |

|

PRINT Worker’s Name: |

|

Telephone |

#: |

Section/Unit: |

DHS 1169A (Rev. 11/2020) |

|

Page 1 of 1 |

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | The DHS 1169 form is used to assess whether the State should place or maintain a lien on the home property of individuals receiving medical assistance while they are in a medical institution. |

| Target Audience | This form is intended for applicants or beneficiaries of medical assistance, as well as their authorized representatives. |

| Ownership | Completing the form does not affect your ownership of the property; you are not required to sell it due to the lien. |

| Possible Dissolution | The lien can be dissolved if the individual is discharged from the medical institution and returns to live in their home. |

| Confidentiality | The information provided will be kept confidential and used solely for determining lien status. |

| Documentation Requirement | If applicable, copies of trusts or Transfer on Death Deeds (TODD) must be attached to the form. |

| Completion Authority | The form can be completed by the applicant, a beneficiary, or an authorized representative of the individual. |

| Governing Law | This form is governed by the laws of the State of Hawaii, specifically under the Med-QUEST Division, Department of Human Services. |

Guidelines on Utilizing Dhs 1169

Completing the Dhs 1169 form is an important step in the process of maintaining the appropriate lien status on your property. After submitting this form, the necessary evaluations will take place concerning your situation and the impact on your property. Follow the steps below to ensure that you fill out the form correctly.

- Begin by indicating your gender and marital status by checking the appropriate boxes.

- Print your last name, first name, middle initial, date of birth, and Social Security Number.

- Provide the name of the medical institution where you are receiving care and your admission date.

- Answer question 1a by checking "YES" or "NO" regarding your ownership interest in a property you lived in prior to admission.

- Continue with questions 1b, 1c, and 1d, responding with "YES" or "NO," and provide copies of any relevant documents if applicable.

- If you no longer own interest in your home, answer question 2 about whether you sold or transferred it. Check "YES" or "NO." If you sold or transferred the property, fill in the buyer's name, relationship, date of sale, and purchase price where relevant.

- For question 3, indicate whether anyone ceased living in your home in the past 12 months by checking "YES" or "NO." If applicable, provide names, relationships, and dates on the back of the form.

- Answer question 4 regarding any new residents in your home in the past year, again checking "YES" or "NO" and providing the required details if necessary.

- Confirm that you have read and understood the document. Print your name, sign or mark, and provide your telephone number and the date.

- If applicable, have your authorized representative or witness print their name, sign, provide their telephone number, and mailing address.

- If you are using a Power of Attorney, check the "YES" or "NO" box and attach a copy of the relevant documents.

What You Should Know About This Form

What is the purpose of the DHS 1169 form?

The DHS 1169 form is used to determine whether the State should place or maintain a lien on your home property if you are receiving medical assistance and are an inpatient in a nursing facility or other medical institution. This form collects essential information about your property ownership and your living situation to assess lien status accurately.

Will a lien on my property affect my ownership rights?

No, placing a lien on your property does not affect your ownership rights. You will still hold ownership, and you will not be required to sell your property as a result of a lien being placed. However, it is important to understand the implications of the lien on future transactions and potential debts.

Can the lien be removed from my property?

Yes, the lien may be dissolved if you are discharged from a medical institution and return to live in your home. This means that if your situation changes, you should notify the authorities to explore the possibility of lifting the lien.

What information do I need to provide on the form?

You will need to provide personal details such as your name, date of birth, Social Security number, and information about your living situation. This includes questions regarding your ownership of property, any recent transactions involving your home, and details about anyone who has moved in or out of your residence in the past year.

What should I do if I have questions or need assistance with the form?

If you have questions regarding the form, seek assistance from a knowledgeable individual or legal professional who can guide you through the process. Ensuring that the form is completed accurately is crucial for your case, so do not hesitate to ask for help if needed.

Common mistakes

The Dhs 1169 form, essential for determining lien status related to property and medical assistance, is often completed incorrectly by applicants. One common mistake occurs in the initial sections where individuals forget to check their gender or marital status. This may seem trivial, but it can impede processing and create delays.

Another frequent error arises when answering questions regarding property ownership. Applicants often answer “no” to ownership-related questions without fully considering any interests they may have held prior to their medical admission. Failure to accurately assess property interests can lead to complications with the lien determination.

Completing personal information also presents challenges. Miswriting names, social security numbers, or dates of birth can lead to mismatches in governmental databases. Consequently, these inaccuracies may prevent timely access to benefits and create additional burdens on the applicant.

When it comes to the relationship questions, people frequently overlook providing adequate details about buyers or individuals who have moved in or out of their homes. It is essential to note accurate names and relationships, as this information plays a crucial role in the assessment of the lien.

Additionally, some applicants neglect to attach required documents, such as copies of trusts or Transfer on Death Deeds. This omission can significantly delay the processing of the application and may even lead to an outright rejection of the form.

The section regarding an Authorized Representative often leads to confusion. Individuals neglect to include a mailing address for the representative, which is necessary for subsequent communications. This lack of information can hinder the Department’s ability to process inquiries or updates on the application.

Some people do not ask for assistance when they struggle with the legal jargon used in the form. Without understanding what is required, applicants risk providing incomplete or misleading information. Seeking help can mitigate this risk significantly.

Finally, individuals sometimes fail to read the certification statement carefully. Signing without fully understanding the certification can lead to unintended consequences if the information provided was not accurate. Ensuring thorough comprehension before signing is crucial.

Documents used along the form

The DHS 1169 form is a significant document used in the State of Hawaii to establish or maintain a lien on a property owned by individuals receiving medical assistance. Along with this form, several other documents are commonly utilized to provide a comprehensive understanding of a person's financial and ownership situation concerning their property. Here are four important forms and documents that complement the DHS 1169 form.

- Power of Attorney (POA): This legal document allows one person to grant another the authority to act on their behalf in legal and financial matters. When submitting the DHS 1169 form, individuals are required to attach a copy of the POA if it exists, ensuring that their authorized representative has the legal right to manage their interests effectively.

- Trust Documents: If the applicant has a trust that owns property, the relevant trust documents must be provided along with the DHS 1169 form. These documents demonstrate the terms under which the property is held and specify the rights of the beneficiaries involved, which is crucial in determining lien status.

- Transfer on Death Deed (TODD): A TODD is a legal instrument that allows an individual to transfer their property upon death without going through probate. If the applicant has executed a TODD, a copy must accompany the application. This deed affects how the lien is placed on the property in the context of medical assistance.

- Property Deed: This document outlines the ownership of a property and is essential in confirming what assets are subject to the lien. It details the legal description of the property and the names of all owners involved, creating a clear picture of asset ownership for the authorities managing the lien process.

In summary, the proper completion and submission of the DHS 1169 form, alongside these accompanying documents, can significantly influence how the State of Hawaii manages medical assistance liens on an individual’s home property. Ensuring that each of these documents is prepared accurately can help facilitate a smoother process for all parties involved.

Similar forms

The DHS 1169 form, which is used by the State of Hawaii's Med-QUEST Division to determine the status of liens placed on home properties due to medical assistance, has characteristics similar to several other legal and administrative documents. Below is a list of these documents, detailing how they relate to the DHS 1169 form.

- Medicaid Lien Notice: This document serves to inform individuals about the lien placed on their property for Medicaid benefits. Like the DHS 1169, it outlines requirements and rights concerning property ownership while receiving benefits.

- Power of Attorney (POA): A POA grants someone the authority to make decisions on behalf of another individual. Much like the DHS 1169 requires information about authorized representatives, the Power of Attorney encompasses care and property management under similar conditions.

- Transfer on Death Deed (TODD): A TODD allows an individual to transfer property to beneficiaries upon death without going through probate. This document, similar to the DHS 1169, addresses ownership interests in property and estate planning while considering potential liens.

- Property Transfer Affidavit: This form is used to record the sale or transfer of real property. It mirrors the DHS 1169 in that it requires detailed information about property ownership and the circumstances of transfers.

- Homestead Affidavit: A Homestead Affidavit is filed to claim an exemption for property taxes. Like the DHS 1169, it addresses residency status and can impact property rights, especially for individuals receiving assistance.

- Estate Planning Documents: These documents outline how an individual's assets will be managed and distributed upon their death. They share commonality with the DHS 1169 when it comes to addressing property interests and liens that may arise during the individual's lifetime.

- Medicaid Eligibility Renewal Form: This form is required periodically to assess ongoing eligibility for Medicaid benefits. Its purpose parallels that of the DHS 1169, where both forms are focused on maintaining beneficiary compliance and understanding current property situations.

- Supplemental Security Income (SSI) Documentation: SSI documentation is necessary for individuals to receive benefits based on their income and resources. Like the DHS 1169, it assesses financial status and involves official reporting about owned property.

Each of these documents plays a vital role in ensuring that individuals are informed about their rights and responsibilities concerning property and medical assistance. Understanding their similarities to the DHS 1169 can help navigate processes related to property ownership and lien management effectively.

Dos and Don'ts

When completing the Dhs 1169 form, attention to detail is crucial. Here are some guidelines to help you navigate the process efficiently. Follow these do's and don'ts to ensure that your application is filled out correctly.

- Do read the form carefully before starting to fill it out.

- Do provide accurate information for each question, including your full legal name and Social Security number.

- Do check the appropriate boxes for gender and marital status accurately as this information is needed.

- Do include any necessary documentation, such as copies of trusts or Transfer on Death Deeds if applicable.

- Do ensure that you sign and date the form, and if applicable, have your authorized representative sign as well.

- Don't leave any questions unanswered unless they do not apply to your situation; always opt for “NO” if unsure.

- Don't rush through the process; mistakes can lead to delays or rejection of your application.

Misconceptions

Misconceptions about the DHS 1169 form can lead to confusion for those navigating medical assistance. Here are five common myths:

- The lien means you will lose your property. Many believe that the lien placed on their property equates to losing ownership. In reality, a lien does not affect your ownership rights. You can still live in and use your property as you wish.

- A lien requires you to sell your home. Some think that having a lien means they must sell their home to satisfy the state’s claim. That’s not true. As long as you remain eligible, you can keep your property without being forced to sell.

- The lien is permanent and cannot be removed. It’s a common thinking that once a lien is placed, it stays forever. However, if you are discharged from the medical institution and return home, the lien may be dissolved.

- The DHS 1169 form only applies to nursing home residents. Many assume this form is solely for individuals in nursing facilities. In truth, it applies to those receiving medical assistance in various settings, including home and community-based services.

- Filling out the form is optional. Some may think completing the DHS 1169 form is not necessary. However, it is crucial for assessing whether a lien should be placed or maintained on your property.

Key takeaways

Here are some key takeaways regarding the use of the DHS 1169 form:

- The form is required for individuals receiving medical assistance who are admitted to a nursing facility or medical institution.

- A lien may be placed on the home property of applicants, but this does not affect ownership rights.

- If discharged from the medical institution, the lien may be dissolved upon returning home.

- The form must be completed either by the applicant, beneficiary, or an authorized representative.

- Applicants must provide personal information such as name, date of birth, and the institution's name where they are receiving care.

- Several questions determine ownership of any property, including interests in trusts or life estates.

- Selling or transferring ownership must be documented with details of the transaction.

- The form requires disclosure of any changes in residency within the past twelve months, including people who have moved in or out.

- A statement at the end of the form certifies that the information provided is truthful and accurate.

- If an authorized representative is completing the form, a power of attorney document must be attached, if applicable.

Understanding these key points will help in the accurate completion and submission of the DHS 1169 form.

Browse Other Templates

Personal Representative Probate - The form serves to educate individuals about their administrative responsibilities.

Fl 335 - It captures the case number relevant to the family law proceeding.

Cold Chain Management - Users should know where to obtain ice or dry ice for transport.