Fill Out Your Dhs 3531 Form

The DHS 3531 form plays a critical role in the application process for Medical Assistance for Long-Term Care Services (MA-LTC) under the Minnesota Health Care Programs. This application is designed specifically for individuals seeking health care coverage for various long-term care options, including residency in nursing homes or intermediate care facilities, as well as services that enable individuals to remain in their homes or communities through home and community-based services (HCBS) waivers. These waivers cater to diverse needs, with specific programs available for brain injury care, community access for disability inclusion, developmental disabilities, the elderly, and more. Before financial assistance can be provided for long-term care services, applicants must undergo a Long-Term Care Consultation (LTCC) assessment, which is critical in determining the required level of care. Timely action is essential; therefore, it is advisable to contact your county agency to schedule this assessment as soon as possible. Notably, this form does not cover other health care services, nor does it provide assistance for financial aid programs such as cash or food benefits. It is crucial that applicants fill out the form completely and attach all necessary documentation, ensuring that their application reaches the appropriate county or tribal agency without delay. If you have questions about the process or need guidance, don't hesitate to reach out to local resources or helplines provided by county and tribal agencies.

Dhs 3531 Example

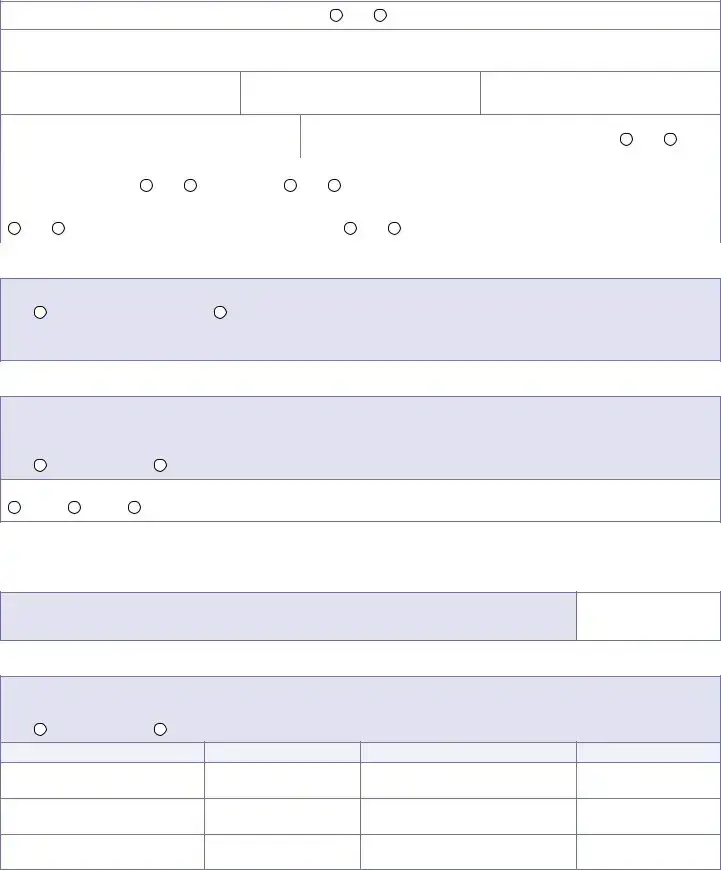

MINNESOTA HEALTH CARE PROGRAMS (MHCP)

Application for Medical Assistance for

■What is this application for?

Use this application to apply for health care coverage for:

■

■Services to help you stay in your home or other settings in the community through these home and

•Brain Injury (BI)

•Community Access for Disability Inclusion (CADI)

•Community Alternative Care (CAC)

•Developmental Disabilities (DD)

•Elderly Waiver (EW)

IMPORTANT: You must have an LTC consultation (LTCC) assessment before our program can pay for LTC in a facility or for additional services to help you stay in your home. The LTCC assessment will help you decide what type of care or additional services you need to stay in your home. Call your county agency as soon as possible to schedule an LTCC assessment. Payment for LTC services can only begin starting the date of the LTCC assessment.

Do not use this application to apply for these things:

■Health care coverage other than LTC described above

■Cash or food and nutrition programs

■Health care coverage for family members other than the person applying for LTC

Call your county or tribal agency for the correct application for your situation. The phone numbers for county agencies are listed in Attachment C.

■What do I need to do with this form?

1.Read the Notice of Privacy Practices and Notice of Rights and Responsibilities in Attachment A. Tear them off and keep them.

2.Answer all questions on the application. If you need more space, write the number of the question and the answer on a separate piece of paper. Include it with the application.

3.Sign and date the application.

4.Attach proofs.

5.Mail or take the application to your county or tribal agency. The addresses for county agencies are listed in Attachment C.

Send in your application right away even if you do not have all proofs. We will contact you if we need more information.

■Questions?

If you have questions or need help, call your county or tribal agency. The phone numbers for county agencies are listed in Attachment C. If you are 60 years old or older, you can also call the Senior LinkAge Line® at

ADA1

For accessible formats of this publication or assistance with additional equal access to human services, write to DHS.info@state.mn.us, call

Clear Form

MINNESOTA HEALTH CARE PROGRAMS (MHCP)

Application for Medical Assistance for

DATE RECEIVED

|

Office Use Only |

CASE NUMBER |

WORKER NUMBER |

■Answer all questions the best you can.

■Return the form right away.

■We will contact you if we need more information.

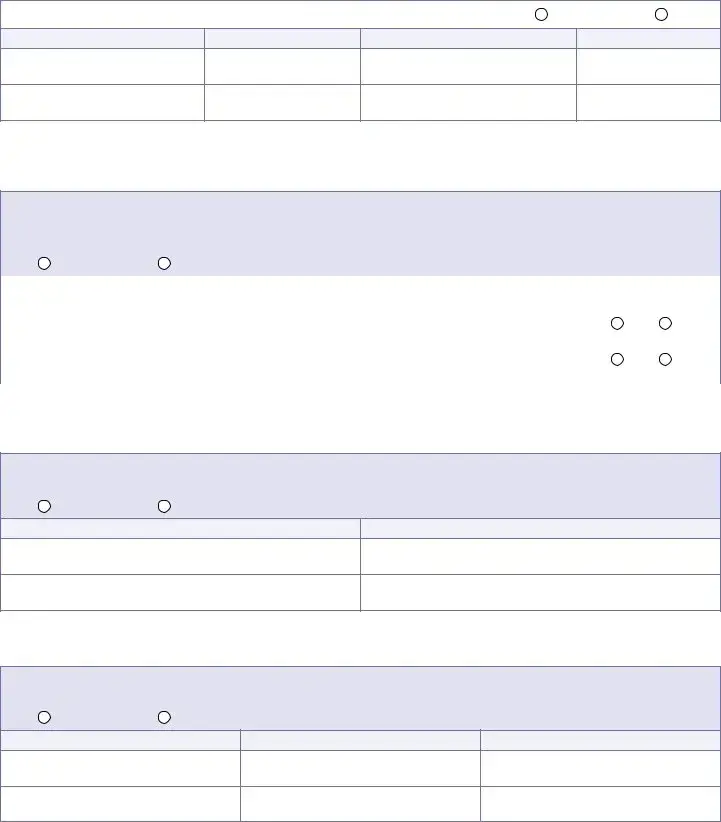

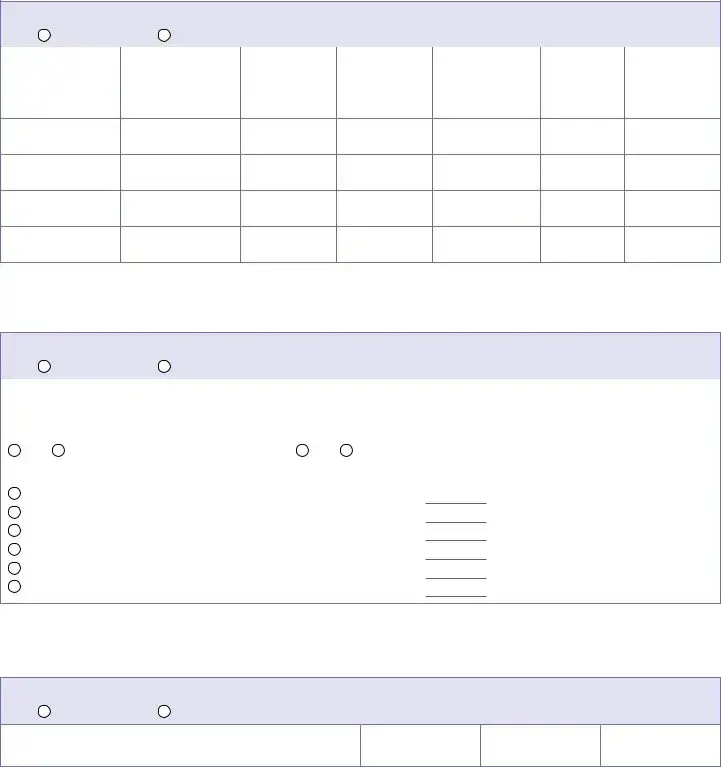

1.Information for the person living in or planning to live in a

FIRST NAME

MI

LAST NAME

DATE OF BIRTH

GENDER |

|

MARITAL STATUS |

|

|

|

|

|

|

Male |

Female |

Legally separated |

Divorced |

Never married |

Married |

Widowed |

||

Do you have a Social Security number (SSN)? |

Yes |

No |

|

|

|

|

||

IF YES, WHAT IS YOUR SSN?

IF NO, HAVE YOU APPLIED FOR AN SSN?

Yes

Yes  No

No

IF YOU HAVE NOT APPLIED, WHY NOT? (Choose a reason code from the list on Attachment B)

Do you have a guardian or conservator? |

Yes – fill in the following |

No |

|

|

|

NAME OF GUARDIAN OR CONSERVATOR

CITY

|

PHONE NUMBER |

|

|

STATE |

ZIP CODE |

|

|

Are you a veteran or the spouse of a veteran? |

Are you blind, or do you have a physical or mental health condition that limits your ability |

||||||||||||||||||||

Yes |

No |

|

|

|

|

to work or perform daily activities? |

Yes |

No |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Are you pregnant? |

|

IF YES, HOW MANY BABIES ARE EXPECTED? |

DUE DATE (MM/DD/YYYY) |

|

Have you had a |

||||||||||||||||

Yes |

No |

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

Don't know |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

What language do you speak most of the time? |

|

|

|

|

|

|

|

|

|

|

|

Do you need an interpreter? |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RACE (check all that apply) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

White |

|

|

Black or African American |

|

|

American Indian or Alaska Native |

Asian Indian |

|||||||||||

OPTIONAL |

|

|

Chinese |

|

|

Filipino |

|

|

|

|

Japanese |

|

|

|

|

|

|

Korean |

|||

|

|

Vietnamese |

|

|

Other Asian |

|

|

|

|

Native Hawaiian |

|

|

|

|

|

Guamanian or Chamorro |

|||||

INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Samoan |

|

|

Other Pacific Islander |

|

|

Other: |

|

|

|

|

|

|

|

|

|

||||

→ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HISPANIC OR LATINO ETHNICITY (check all that apply) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Mexican |

Mexican American |

Chicano or Chicana |

Puerto Rican |

|

Cuban |

Other: |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 1 of 11

2. Are there other family members living with you? |

Yes – fill in below |

No |

|

|

|

Name (First, MI, Last)

Date of birth

(MM/DD/YYYY)

Relationship to you

3.If you or anyone in your family is an American Indian or Alaska Native, some income and assets might not count toward your eligibility and you might not be required to pay premiums or copays. Do you want to apply for these exceptions?

Yes – you need to complete and include Appendix A

Yes – you need to complete and include Appendix A  No

No

4. Address and phone number

STREET ADDRESS WHERE YOU ARE CURRENTLY LIVING |

|

CITY |

|

|

STATE |

ZIP CODE |

COUNTY |

||||

|

|

|

|

|

|

|

|

|

|

|

|

MAILING ADDRESS (if different) |

|

|

CITY |

|

|

STATE |

ZIP CODE |

COUNTY |

|||

|

|

|

|

|

|

|

|

||||

PHONE NUMBER |

Do you plan to make Minnesota your home? |

Do you currently have medical benefits from another state? |

WHICH STATE? |

||||||||

|

Yes |

No |

|

|

Yes – fill in the following |

No |

|

|

|||

|

|

|

|

|

|

|

|

|

|||

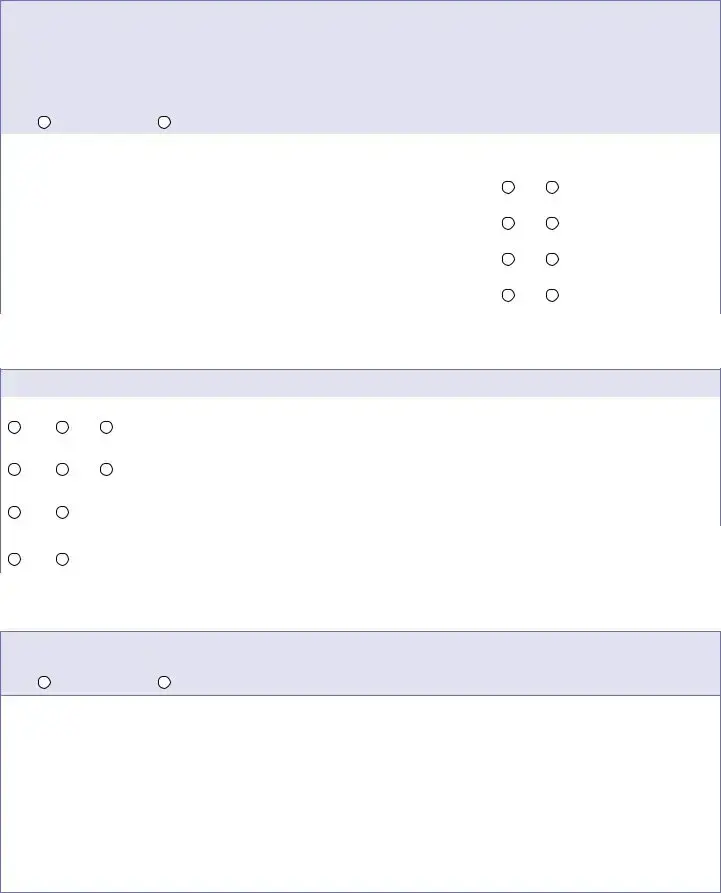

Are you currently in a |

Yes – fill in the following |

No |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

DATE MOVED INTO THIS FACILITY (MM/DD/YYYY)

STREET ADDRESS BEFORE MOVING TO THIS FACILITY

CITY

STATE

ZIP CODE

COUNTY

If you have a home, do you plan to return there? |

Yes |

No |

|

|

|

OPTIONAL

INFORMATION

→

What is your living situation? (choose one)

I live in a hospital, nursing home, treatment facility or detox center.

I live in a hospital, nursing home, treatment facility or detox center.

I have my own housing (rent, pay a mortgage or share housing costs with a roommate).

I have my own housing (rent, pay a mortgage or share housing costs with a roommate).

l live with family or friends because of economic hardship.

l live with family or friends because of economic hardship.

I live in an emergency shelter.

I live in an emergency shelter.

I live in a service provider’s housing (foster home or group home).

I live in a service provider’s housing (foster home or group home).

Unknown

Unknown

I live in a jail, prison or juvenile detention facility.

I live in a jail, prison or juvenile detention facility.

I live in a hotel or motel.

I live in a hotel or motel.

I decline to answer.

I decline to answer.

I live in a place not meant for housing (anywhere outside, a vehicle, an abandoned building, a bus or train station, or an airport). In which county do you live?

I live in a place not meant for housing (anywhere outside, a vehicle, an abandoned building, a bus or train station, or an airport). In which county do you live?

Page 2 of 11 |

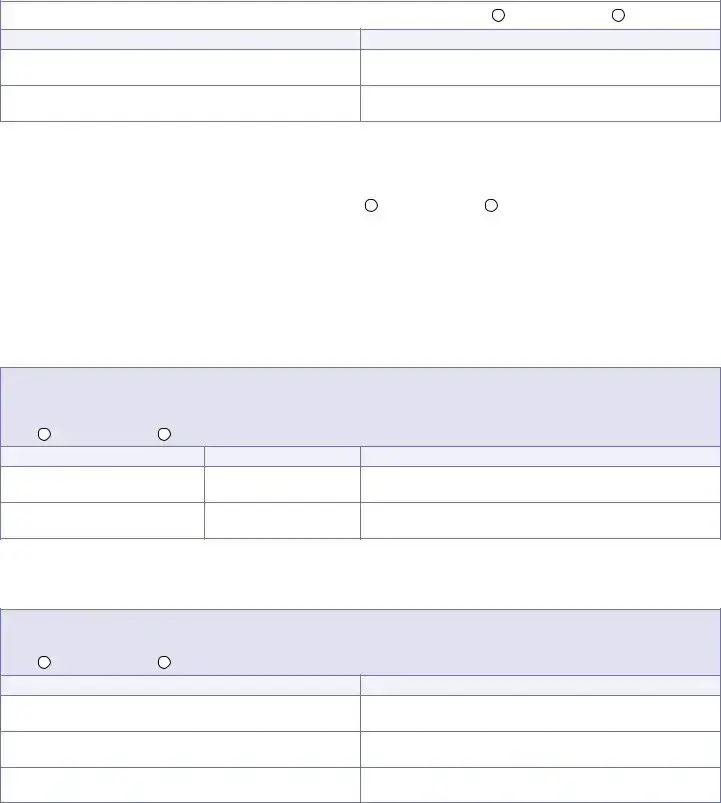

5. Are you a U.S. citizen or U.S. national? |

Yes |

No – fill in below |

|

|

|

What is your current immigration status? (Choose a status code from the list on Attachment B, or write in your status below if it is not on the list.)

a. IMMIGRATION DOCUMENT TYPE

b. ALIEN ID NUMBER

c. CARD NUMBER

d. Did you enter the United States before August 22, 1996?

Yes

Yes  No

No

e. Have you lived in the United States for five years or more in a qualified status?

(See Attachment B to determine whether you have a qualified status.) |

Yes |

No |

f. DATE OF ENTRY (MM/DD/YYYY) |

g. Do you have a sponsor? |

h. Are you, or is your spouse or parent, a veteran or |

||||

|

|

Yes |

No |

Yes |

No |

|

|

|

|

|

|||

i. Do you want help paying for a medical emergency? |

|

j. Are you getting services from the Center for Victims of Torture? |

||||

Yes |

No |

|

|

Yes |

No |

|

|

|

|

|

|

|

|

6. Do you want someone to act on your behalf as an authorized representative?

Yes – complete Appendix B |

No |

(You can give a trusted person permission to talk about this application with us, see your information and act for you on matters related to this application, including getting information about your application and signing your application on your behalf.)

7. Do you want help from MA to pay for medical bills from the past three months?

(The start date for MA can go back up to three months from your application date if you have medical bills from that time and meet the MA requirements.)

|

Yes – fill in below |

No |

How many months? |

|

|

One |

Two |

Three |

You must provide proof of your medical expenses, income and assets in each of the months for which you are requesting coverage.

Refer to the types of proof listed after each of the following questions for examples of acceptable proof for the income and assets you had.

8.How much cash do you or your spouse have on hand, in a safety deposit box, at home and at the facility where you live?

$

9.Do you or your spouse have savings or checking accounts, money market accounts or certificates of deposit?

Yes – fill in below |

No |

Owner name(s)

Type of account

Bank name and address

Account number

You must provide proof of these assets. Proof may be recent account statements or a written statement from your bank showing the current balance or value of accounts.

Page 3 of 11 |

10. Do you or your spouse have stocks, bonds or retirement accounts? |

Yes – fill in below |

No |

|

|

|

Owner name(s)

Type of investment

Company or bank name and address

Account number

You must provide proof of these assets. Proof may be copies of bonds, stock ownership, retirement accounts, or documents showing current loan balance owed against the asset.

11.Do you or your spouse own or

Yes – fill in below |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you or your spouse |

|

Owner name(s) |

|

Type of property |

Property address |

live here all year? |

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

You must provide proof of these assets. Proof may be real property tax statements, warranty deeds, quit claim deeds, life estate or other real property agreements or documents showing the amounts owed against the property.

12.Do you or your spouse own or

Yes – fill in below |

No |

Owner name(s)

Type of asset

You must provide proof of these assets. Proof may be copies of the contract for deed, mortgage, loan contract, or promissory note.

13. Do you or your spouse have any vehicles in your name? Include cars, trucks, vans, motorcycles, motor

homes, campers, boats, snowmobiles,

Yes – fill in below |

No |

Owner name(s)

Type of vehicle

Year, make, model

You must provide proof of these assets. Proof may be copies of your vehicle title.

Page 4 of 11 |

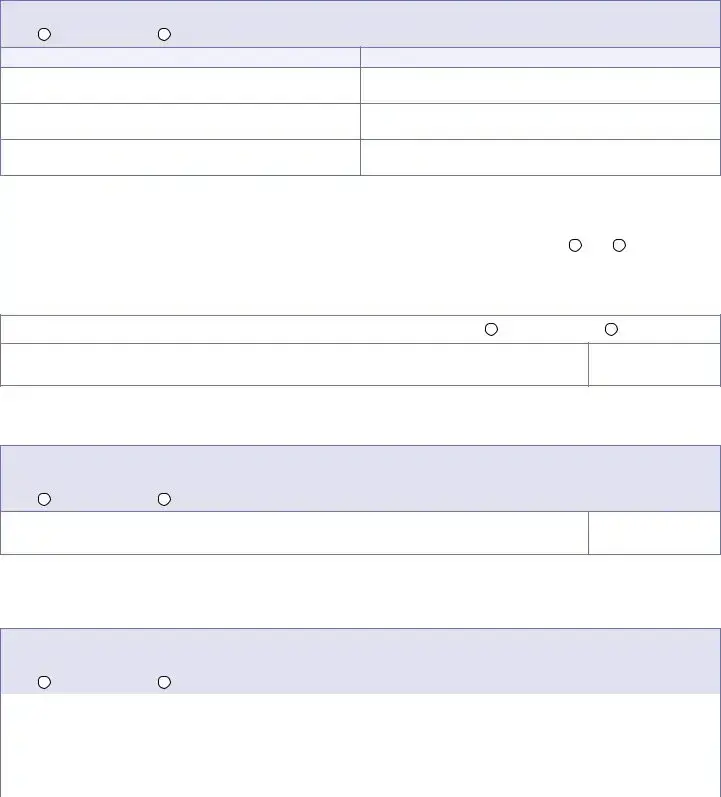

14. Do you or your spouse have an interest in a trust or annuity? |

Yes – fill in below |

No |

|

|

|

Owner name(s)

Type

You must provide proof of these assets. Proof may be copies of the annuity contract, other documents showing the value of the annuity or copies of the entire trust document.

15. Do you or your spouse have life insurance? |

Yes – fill in below |

No |

|

|

|

|

|

Owner name(s) |

Policy number |

Insurance company name and address |

|

|

|

|

|

|

|

|

|

You must provide proof of these assets. Proof may be a copy of your life insurance policy.

16. Do you or your spouse have a prepaid burial account or burial trust? Include revocable and irrevocable accounts,

Yes – fill in below |

No |

Owner name(s)

Type of burial asset

Company or bank name and address

You must provide proof of these assets. Proof may be copies of the life insurance policy, burial contracts or other documents showing the current value of the assets.

17.Do you or your spouse have assets currently used for

Yes – fill in below |

No |

Owner name(s)

Type of asset

You must provide proof of these assets. Proof may be current tax documents, business ledgers, or account statements.

Page 5 of 11 |

18. Do you or your spouse own or

Yes – fill in below |

No |

Owner name(s)

Type of asset

You must provide proof of these assets.

19. Do you or your spouse live in a continuing care retirement community? |

Yes |

No |

|

|

|

You must provide proof of these assets. Proof may be a copy of the continuing care retirement contract.

20. Did you or your spouse create a trust in the last 60 months? |

Yes – fill in below |

No |

|

|

|

NAME(S) OF WHO CREATED THE TRUST

DATE CREATED (MM/DD/YYYY)

You must provide proof of these assets. Proof may be copies of the entire trust document.

21.Did you or your spouse buy an annuity, life estate in another person's home, a promissory note, loan or mortgage in the last 60 months?

Yes – fill in below |

No |

|

|

WHAT WAS BOUGHT? |

|

|

|

DATE BOUGHT (MM/DD/YYYY)

You must provide proof of these purchases. Proof may be copies of the annuity contract, promissory note, mortgage or loan contract, or life estate, as well as documentation of amounts owed against the property.

22.Did you or your spouse not accept items or income you could have taken, such as an inheritance or a pension, in the last 60 months?

Yes – fill in below |

No |

|

|

|

|

|

|

|

Item(s) you did not take |

Value of the item or income |

Date happened |

|

(MM/DD/YYYY) |

||

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

You must provide proof of this income. Proof may be award letters, copies of checks, tax forms or court orders or other documents.

Page 6 of 11 |

23. Did you or your spouse sell, trade or give away items or income in the last 60 months?

Yes – fill in below |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sold, traded or |

|

Date |

Amount you |

Owner name(s) |

|

Item or income |

Value |

given away? |

To whom? |

were paid |

|

|

(MM/DD/YYYY) |

||||||

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

$

$

$

$

$

$

$

$

You must provide proof of sale of these items. Proof may be accounts showing income given away in the last 60 months or receipts from sale or trade of assets documenting the amount each asset was sold or traded for.

24. Are you working, or do you expect to work in the next month? Include temporary and seasonal work.

|

Yes – fill in below |

No |

|

|

|

|

|

|

|

|

|

EMPLOYER NAME |

|

|

|

START DATE (MM/DD/YYYY) |

|

|

|

|

|

||

Is this job seasonal? |

|

Has this job ended? |

IF YES, END DATE (MM/DD/YYYY) |

||

Yes |

No |

|

Yes |

No |

|

|

|

|

|

|

|

Wages and tips before taxes (Choose one and fill in the dollar amount and your hours per week.)

Hourly |

$ |

|

per hour |

Hours per week: |

Weekly |

$ |

|

|

Hours per week: |

Every two weeks |

$ |

|

|

Hours per week: |

Twice a month |

$ |

|

|

Hours per week: |

Monthly |

$ |

|

|

Hours per week: |

Yearly |

$ |

|

|

Hours per week: |

You must provide proof of this income. Proof may be paystubs or a written statement of earnings from your employer if you do not have paystubs.

25. Are you

Yes – fill in below |

No |

TYPE OF WORK

MONTHLY INCOME

$

MONTHLY EXPENSES

$

START DATE (MM/DD/YYYY)

You must provide proof of this income. Proof may be most recent income tax returns and all related schedules or business records if taxes are not filed.

Page 7 of 11 |

26. Did you get money this month or do you expect to get money next month from sources other than work?

Include: ■ Social Security |

■ Spousal support |

■ Unemployment |

■ Interest |

|||||

■ Supplemental Security Income (SSI) |

■ Workers' compensation |

■ Veterans' benefits |

■ Dividends |

|||||

■ Retirement or pension payments |

■ Public assistance payments |

■ Rental income |

■ Trusts |

|||||

■ Payments from a contract for deed |

■ Annuities |

■ Any other payments |

||||||

Yes – fill in below |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of income |

|

Amount |

How often received? |

|

|

Has this income ended? |

||

|

|

$ |

|

|

|

Yes |

No |

IF YES, END DATE (MM/DD/YYYY) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

Yes |

No |

IF YES, END DATE (MM/DD/YYYY) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

Yes |

No |

IF YES, END DATE (MM/DD/YYYY) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

Yes |

No |

IF YES, END DATE (MM/DD/YYYY) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

You must provide proof of this income. Proof may be award letters, copies of checks, tax forms, court orders, or other documents.

27. Expenses

If you are blind or have a disability, do you have work expenses? |

IF YES, TYPE OF EXPENSE(S) |

|

MONTHLY AMOUNT |

|||

Yes |

No |

Not applicable |

|

|

|

$ |

|

|

|

|

|

||

If you have a legal guardian or conservator, do you pay a fee? |

IF YES, FEE PAID |

|

|

|||

Yes |

No |

Not applicable |

$ |

|

|

|

|

|

|

|

|||

Do you have |

|

IF YES, AMOUNT PER MONTH |

||||

Yes |

No |

|

|

|

$ |

|

|

|

|

||||

|

|

|

|

|

|

|

Do you have |

|

IF YES, AMOUNT PER MONTH |

||||

Yes |

No |

|

|

|

$ |

|

|

|

|

|

|

|

|

You must provide proof of these expenses. Proof may be court orders or paystubs.

28.Do you have medical expenses? Include health insurance premiums, pharmacy

Yes – fill in below |

No |

LIST EACH MEDICAL EXPENSE

You must provide proof of these expenses. Proof may be receipts of pharmacy

Page 8 of 11 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The DHS-3531 form is used to apply for health care coverage specifically for long-term care services, including nursing home care and home-based services. |

| Eligibility Requirement | Applicants must have a Long-Term Care Consultation (LTCC) assessment completed before receiving financial assistance for long-term care services. |

| Prohibited Applications | The form cannot be used to apply for general health care coverage, cash assistance, food programs, or for family members other than the applicant. |

| Submission Process | Applicants need to answer all questions, attach necessary proof, and submit the form to their county or tribal agency to begin the application process. |

| Age Considerations | Individuals aged 60 or older can call the Senior LinkAge Line for assistance, while those with disabilities have access to the Disability Linkage Line. |

| Contact Information | County agency phone numbers for assistance are provided in an attachment, ensuring applicants can easily reach out for help. |

| Governing Laws | This form is governed by Minnesota's laws related to health care programs, specifically under the Minnesota Health Care Programs (MHCP). |

Guidelines on Utilizing Dhs 3531

After completing the DHS 3531 form, the next step involves submitting your application, along with any required documentation. It's important to do this as quickly as possible, even if you're missing some information. The agency will reach out for anything they need to finalize your application.

- Read the Notice of Privacy Practices and Notice of Rights and Responsibilities in Attachment A. Tear off the sections and keep them for your records.

- Fill out all the questions on the application. If you need more space, add your answers on a separate sheet of paper, referencing the question numbers.

- Sign and date the application to validate it.

- Gather and attach any necessary proof of information requested in the form.

- Mail or deliver the completed application to your county or tribal agency. You can find the addresses in Attachment C.

Submit your application right away. If any proofs are missing, don’t worry. The agency will contact you if they need additional information.

What You Should Know About This Form

What is the DHS-3531 form used for?

The DHS-3531 form is an application for medical assistance specifically aimed at providing health care coverage for long-term care services. This includes care in nursing homes, intermediate care facilities, and some hospital settings. It can also apply to home and community-based services through various waiver programs, such as the Brain Injury waiver and the Elderly Waiver. Before the program can begin payment for long-term care in a facility or additional home assistance, an LTC consultation assessment is necessary. This assessment helps determine the appropriate level of care needed and starts the payment process from the date of assessment.

How should I complete and submit the DHS-3531 form?

To complete the DHS-3531 form, start by carefully reading the accompanying Notice of Privacy Practices and Notice of Rights and Responsibilities. Make sure to answer all questions on the application. If you need more space, feel free to write your responses on a separate paper and include it with the application. Once completed, sign and date the form, and attach any necessary documents as proof of eligibility. After that, mail or deliver your application to your county or tribal agency, whose contact details are in Attachment C. It's advisable to send in the application even if you do not have all your supporting documents, as the agency will reach out to you if additional information is required.

What types of coverage are not applicable with the DHS-3531 form?

The DHS-3531 form is focused exclusively on medical assistance for long-term care services. It should not be used to apply for other health care coverage, cash assistance, food programs, or health care coverage for family members. If you need assistance outside the scope of long-term care, it is important to contact your county or tribal agency to find the correct application that fits your situation.

Who can I contact for assistance with the DHS-3531 form?

If you have questions about completing the DHS-3531 form or need additional help, you can contact your county or tribal agency directly. The phone numbers for these agencies are provided in Attachment C of the application. Additionally, if you are 60 years or older, the Senior LinkAge Line® is available at 800-333-2433. Individuals with disabilities can reach out to the Disability Linkage Line® at 866-333-2466. These resources are designed to provide the support you need to successfully apply for medical assistance.

Common mistakes

When filling out the DHS 3531 form, many applicants make common mistakes that can lead to delays or complications in their application process. First, failing to read all instructions thoroughly often results in incomplete or incorrect applications. Each section of the form has specific requirements, and missing even one detail can delay approval for medical assistance. It’s crucial to understand what additional documentation is necessary and ensure all answers are provided accurately.

Secondly, not providing all required proofs can be a significant oversight. Applicants often assume submitting the application without supporting documents is acceptable, thinking they can provide them later. However, this can complicate the process. It’s important to collect and attach all necessary documents, such as proof of income, assets, and identity. Incomplete submissions can lead to processing delays while the agency seeks the missing information.

Another common error is neglecting to sign and date the application. An unsigned form can lead to it being deemed invalid. This oversight may seem small, but it’s critical. Take a moment to review the entire application before submission to ensure all sections, including signatures, are completed properly.

Lastly, applicants sometimes provide inconsistent information or fail to disclose all relevant details. This may include previous medical assistance received or other assets that could affect eligibility. Inconsistencies can raise red flags during the review process and may lead to a denial or need for clarification. Always double-check facts and numbers to ensure that the information provided is consistent across all parts of the application.

Documents used along the form

The DHS-3531 form is essential for individuals seeking medical assistance for long-term care services in Minnesota. To effectively complete the application and ensure eligibility, several other documents may need to accompany it. Below are some common forms you may encounter along with brief descriptions of their purposes.

- LTCC Assessment Form: This form documents the Long-Term Care Consultation assessment you must complete before applying for services. It evaluates your needs and determines the type of care you might require.

- Proof of Income Documentation: This includes pay stubs, benefit statements, or tax returns that provide evidence of your income. It is necessary to demonstrate your financial eligibility for assistance.

- Proof of Assets Documentation: This includes bank statements, property deeds, or investment account summaries. It helps verify your total assets, which is a key factor in determining your eligibility.

- Appendix A (American Indian Income Exemptions): If applicable, this appendix outlines income exceptions for American Indian or Alaska Native applicants. It must be filled out if you want to apply for these exemptions.

Collecting and submitting these documents alongside the DHS-3531 form can help ensure a smoother application process. Always reach out to your county or tribal agency if you have questions or need further assistance.

Similar forms

- Medicaid Application Form: Similar to the DHS-3531, this form is utilized to apply for medical assistance for long-term care services and must detail financial information, residency status, and medical history.

- Medicare Application: Like the DHS-3531, the Medicare application requires personal information, including Social Security numbers and income details, to determine eligibility for federal health care coverage.

- Social Security Administration Disability Application: This application shares similarities with the DHS-3531 in that it requires information about current living situations and health statuses to evaluate eligibility for disability benefits.

- Food Support Application: While primarily for food assistance, the food support application, much like the DHS-3531, collects detailed household and financial information to determine eligibility for assistance programs.

- Child Care Assistance Application: Both the child care assistance and DHS-3531 forms require applicant details and household information to assess eligibility for support services, focusing on economic needs.

- Home and Community-Based Services Application: This application mimics the DHS-3531 in its purpose of applying for community support services, emphasizing the need for documentation of care requirements and financial assets.

Dos and Don'ts

When filling out the DHS 3531 form, it's important to approach the task thoughtfully. Here are ten things to do and avoid as you complete the application.

- Do make sure to read the entire form carefully. Understanding all sections prevents mistakes.

- Do answer every question. If you need extra space, attach a separate sheet with the question number and answer.

- Do keep the Notice of Privacy Practices and Notice of Rights. These documents are important for your information.

- Do sign and date the application. Your signature is necessary for processing.

- Do submit your application as soon as possible. Even if all documents aren't available, submit it now.

- Do reach out for help if needed. You can call your county or tribal agency for assistance.

- Don't forget to attach necessary proof. Ensure all required documents are included before sending.

- Don't leave any questions unanswered. Incomplete applications can lead to delays.

- Don't submit the form without checking for errors. Always proofread for mistakes or missing information.

- Don't use this form for other types of assistance. This application is only for specific health care coverage.

By following this list, you can help ensure that your application process goes smoothly and efficiently.

Misconceptions

- Form DHS 3531 is only for nursing home applicants. Many people think this form solely applies to those seeking nursing home care. In reality, it can also help individuals who need community-based services to stay at home.

- You can use this form for any health care coverage. Some mistakenly believe this application is a catch-all for health benefits. It's specifically for applying to Medical Assistance for Long-Term Care Services, not other health care programs.

- Submitting the application is enough to start receiving services. The truth is that you must complete a Long-Term Care Consultation (LTCC) assessment first. This assessment determines your eligibility and the type of care needed.

- It's fine to delay submitting the form if information is missing. People often wait until they have all required documents before submitting the application. However, it's best to send it as soon as possible, even if you’re still gathering information.

- You must include all proofs with the initial application. While it’s important to provide supporting documents, you can still submit your application right away, and the office will contact you if they need more information.

- The form can be submitted anywhere. Some believe that any office or agency will process this application. It's crucial to return it to the specific county or tribal agency where you reside.

- This application is for individuals only. Many think the form is exclusively for individuals applying for themselves. In fact, it can include care options for someone applying on behalf of a family member or dependent.

- Eligibility is not influenced by family income. Some assume their financial situation doesn’t affect their application. Eligibility can be affected by both the applicant's and any household members’ incomes.

- You can't reapply if your situation changes. It's a common myth that once you submit the application, you cannot reapply or update your information. If your circumstances change, it’s advisable to inform your agency immediately.

- The process is quick and straightforward. While many anticipate a fast turnaround, the application and assessment processes can take some time. It’s important to be patient and follow up as needed.

Key takeaways

- Purpose of the Form: The DHS 3531 form is specifically for applying for medical assistance related to long-term care (LTC) services.

- Consultation Required: Before any payment for LTC services can begin, applicants must complete a long-term care consultation (LTCC) assessment.

- Timeliness is Key: Submit the application promptly, even if all required documentation is not available. The agency will follow up if more information is needed.

- Do Not Use for Other Benefits: This application is not applicable for cash, food assistance, or healthcare coverage for family members.

- Proof of Eligibility: Attach necessary proof documents with the application to demonstrate eligibility for LTC services.

- Contact Information: Questions related to the application can be directed to county or tribal agencies, whose contact information is provided in the instructions.

- Interpreter Services: If needed, indicate that you require an interpreter to facilitate the application process.

- Section on Assets: Disclose cash and bank accounts as part of the application process to determine eligibility. Provide proof of these assets.

- Additional Assistance: Applicants aged 60 or older may contact the Senior LinkAge Line® for more assistance.

- Authorized Representatives: Applicants can authorize someone to act on their behalf by completing Appendix B of the form.

Browse Other Templates

Da 3955 - Includes routing and control information for efficient tracking.

Arkansas State Tax Form - Any applicable personal, child care, and other tax credits can further reduce the overall tax liability.