Fill Out Your Dhs 4025 Form

The DHS 4025 form plays a crucial role in the process of applying for assistance with child care expenses in Michigan. This mandatory form is necessary for individuals seeking support through the Child Development and Care (CDC) program. Applicants may receive this form when they apply for child care assistance or when there’s a change in their CDC provider. Completing the DHS 4025 accurately and promptly is essential, as failure to do so can lead to denial of child care subsidy payments. Key sections of the form include provider information, child information, and both parent and provider agreements. The information must be filled out by both the provider and the applicant, ensuring clear communication and understanding of responsibilities. Parents agree to certain conditions, particularly if choosing unlicensed providers, while providers confirm their understanding of the CDC program’s rules. Submitting this form by the specified due date is paramount to avoiding interruptions in financial support for child care needs.

Dhs 4025 Example

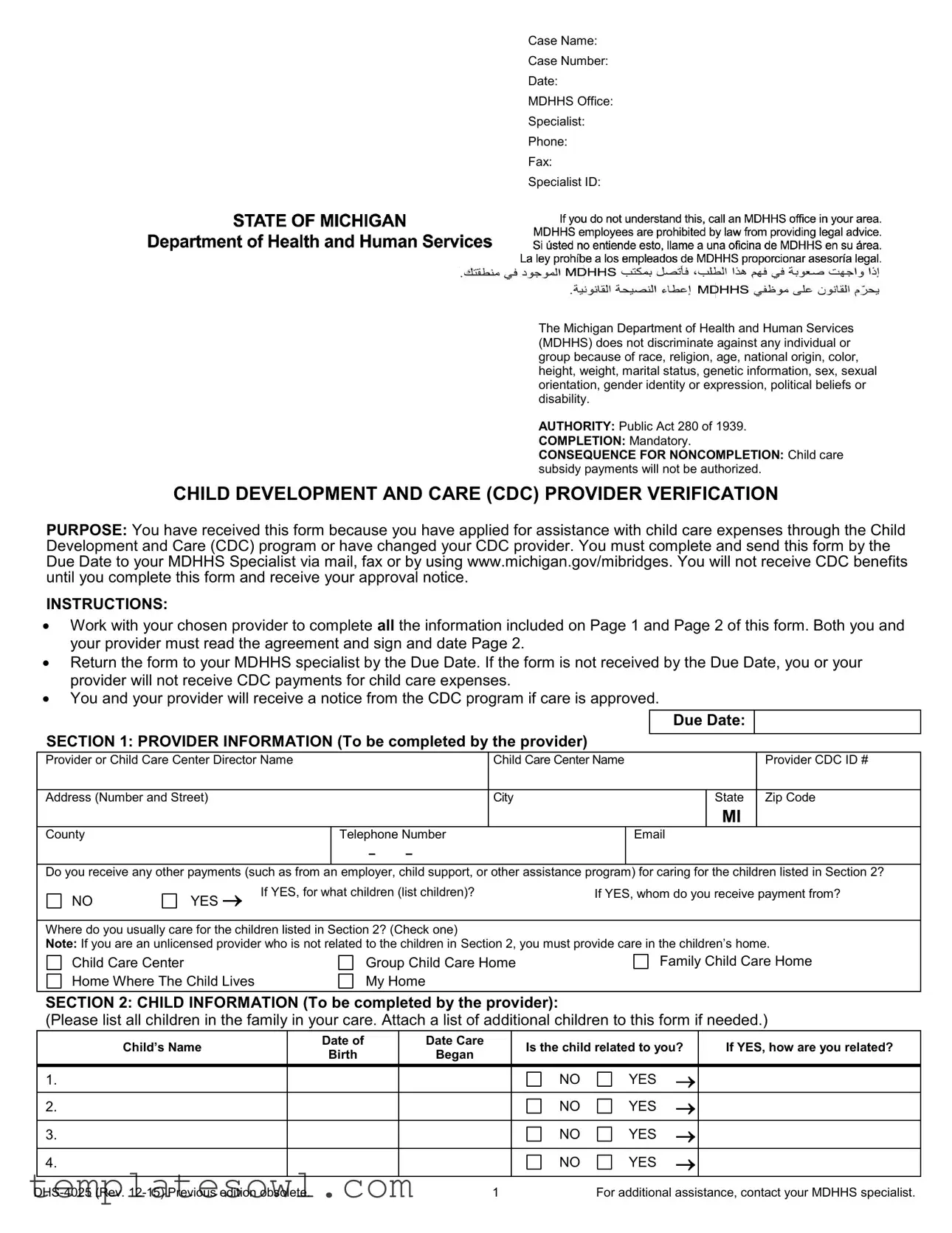

Case Name:

Case Number:

Date:

MDHHS Office:

Specialist:

Phone:

Fax:

Specialist ID:

The Michigan Department of Health and Human Services (MDHHS) does not discriminate against any individual or group because of race, religion, age, national origin, color, height, weight, marital status, genetic information, sex, sexual orientation, gender identity or expression, political beliefs or disability.

AUTHORITY: Public Act 280 of 1939.

COMPLETION: Mandatory.

CONSEQUENCE FOR NONCOMPLETION: Child care subsidy payments will not be authorized.

CHILD DEVELOPMENT AND CARE (CDC) PROVIDER VERIFICATION

PURPOSE: You have received this form because you have applied for assistance with child care expenses through the Child Development and Care (CDC) program or have changed your CDC provider. You must complete and send this form by the Due Date to your MDHHS Specialist via mail, fax or by using www.michigan.gov/mibridges. You will not receive CDC benefits until you complete this form and receive your approval notice.

INSTRUCTIONS:

Work with your chosen provider to complete all the information included on Page 1 and Page 2 of this form. Both you and your provider must read the agreement and sign and date Page 2.

Return the form to your MDHHS specialist by the Due Date. If the form is not received by the Due Date, you or your provider will not receive CDC payments for child care expenses.

You and your provider will receive a notice from the CDC program if care is approved.

|

|

|

|

Due Date: |

|

|

SECTION 1: PROVIDER INFORMATION (To be completed by the provider) |

|

|

|

|

||

|

|

|

|

|||

|

|

|

|

|

|

|

Provider or Child Care Center Director Name |

|

Child Care Center Name |

|

|

|

Provider CDC ID # |

|

|

|

|

|

|

|

Address (Number and Street) |

|

City |

|

|

State |

Zip Code |

|

|

|

|

|

MI |

|

County |

Telephone Number |

|||||

|

- - |

|

|

|

|

|

|

|

|

|

|

|

|

Do you receive any other payments (such as from an employer, child support, or other assistance program) for caring for the children listed in Section 2?

NO |

YES If YES, for what children (list children)? |

If YES, whom do you receive payment from? |

Where do you usually care for the children listed in Section 2? (Check one)

Note: If you are an unlicensed provider who is not related to the children in Section 2, you must provide care in the children’s home.

Child Care Center |

Group Child Care Home |

Family Child Care Home |

Home Where The Child Lives |

My Home |

|

SECTION 2: CHILD INFORMATION (To be completed by the provider):

(Please list all children in the family in your care. Attach a list of additional children to this form if needed.)

Child’s Name |

Date of |

|

Date Care |

Is the child related to you? |

If YES, how are you related? |

||

Birth |

|

Began |

|||||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

1. |

|

|

|

NO |

YES |

|

|

2. |

|

|

|

NO |

YES |

|

|

3. |

|

|

|

NO |

YES |

|

|

4. |

|

|

|

NO |

YES |

|

|

1 |

For additional assistance, contact your MDHHS specialist. |

Case Name

Case Number

Specialist

SECTION 3: PARENT/SUBSTITUTE PARENT AGREEMENT (To be completed by the parent) By signing, you agree to the following:

1.I understand that if I choose an unlicensed provider:

a.I am responsible for any child care expenses for the time my child is in care before my provider completes the Great Start to Quality Orientation training.

b.CDC payments will be issued to me and I am responsible for paying my provider.

c.I am responsible for reporting child care payments to the IRS and issuing my provider a Form

2.I certify that my child or children are or will be in care with this provider as of the “date care began” listed in Section 2.

3.I understand that my child care agreement is between myself and my provider.

4.I understand that the Department may request information from me in order to verify my provider’s billing information.

5.I understand and agree that if an overpayment is made to my provider for any reason, my provider must repay the extra payments. To help repay the money, the Department may reduce any future payments to my provider by up to 20%.

6.I understand that I may be prosecuted for perjury or fraud if I intentionally leave out or give any false information that causes me to receive CDC benefits that I am either not qualified for, or are greater than what I should receive.

7.I understand if I violate any of the program rules, I may be disqualified from the program for six (6) months, 12 months, or a lifetime.

Parent/Substitute Parent Signature |

Date |

SECTION 3: PROVIDER AGREEMENT (To be completed by the provider)

By signing, you agree to the following:

1.I understand if I am an unlicensed provider:

a.I must apply to be a CDC provider by completing the CDC Unlicensed Provider Application. The application can be found at www.michigan.gov/childcare

b.I will not receive CDC payment for any care I provide in the period before I complete the Great Start to Quality Orientation training. More information on the training can be found at www.GreatStarttoQuality.org.

c.CDC payments will be issued to the parent of the child or children in care. The parent is responsible for paying me, reporting my wages to the IRS, and issuing me a Form

d.I will use the CDC Daily Time and Attendance form found at http://www.michigan.gov/childcare.

2.I understand that I am not employed by the State of Michigan or the CDC Program, and that I will not receive unemployment insurance.

3.I will maintain time and attendance records for each child in my care. Each child’s parent/substitute parent must sign the records each day they are in my care. I will retain these records for four (4) years.

4.Parents of the children in care will have unlimited access to their children while in my care.

5.If an audit or investigation finds that I do not keep accurate time and attendance records, I may have to return CDC payments to the Department.

6.If I am overpaid for any reason, I must repay the Department, even if I am overpaid in error. If I am overpaid, the Department may hold up to 20% of any future payments.

7.I am responsible for what happens in the CDC

8.I will immediately contact the CDC Central Reconciliation Unit at

9.I will not bill for hours when the child is in school, to hold a spot for a child, or if the child is not expected to return to my care.

10.I understand that I may be prosecuted for perjury or fraud if I intentionally leave out or give false information that causes the parent/substitute parent to receive CDC benefits they are either not qualified for, or are greater than what they should receive.

11.I understand if I violate any of the program rules, I may be disqualified from the program for six (6) months, 12 months, or a lifetime.

Provider Signature |

Date |

For more information and requirements, see the CDC program handbook at

http://www.michigan.gov/childcare

2 |

For additional assistance, contact your MDHHS specialist. |

Form Characteristics

| Fact Name | Details |

|---|---|

| Case Information | The form requires important case details such as Case Name, Case Number, Date, and MDHHS Office. |

| Authority | This form is governed by Public Act 280 of 1939, which provides the required legal authority. |

| Mandatory Completion | Completion of the DHS 4025 form is mandatory; failure to do so will result in no child care subsidy payments. |

| Purpose | The form is used to verify child care providers for assistance under the Child Development and Care (CDC) program. |

| Submission Requirements | The completed form must be sent to your MDHHS Specialist by mail, fax, or electronically via www.michigan.gov/mibridges. |

| Compliance Consequences | Not adhering to the instructions or deadlines will lead to delays or disqualification from receiving CDC benefits. |

Guidelines on Utilizing Dhs 4025

Completing the Dhs 4025 form is essential for receiving assistance with child care expenses through the Child Development and Care (CDC) program. Ensure all necessary sections are filled precisely and accurately. Delays or omissions may lead to a denial of benefits. Follow these steps carefully to complete the form.

- Obtain the Dhs 4025 form, which can be found on the Michigan Department of Health and Human Services website or requested from your MDHHS specialist.

- Work with your chosen provider to fill out the information on Page 1 and Page 2. This includes details such as the provider's name, ID, and address.

- In Section 1, the provider must provide their name, child care center name, CDC ID, address, contact number, and email. Indicate whether the provider receives any other payments for the children noted in Section 2.

- List all children in the care of the provider in Section 2, including their names, birth dates, and the date care began. Specify if each child is related to the provider.

- In Section 3, both the parent and provider must read and agree to the terms outlined in their respective agreements. All applicable signatures and dates must be added.

- Review all entries for accuracy. Ensure that all required signatures are present.

- Return the completed form to your MDHHS specialist by the specified Due Date. Options for submission include mail, fax, or online submission through Michigan Bridges.

- After submission, expect a notice regarding the approval or denial of care through the CDC program. Approval must be confirmed before benefits are disbursed.

What You Should Know About This Form

1. What is the purpose of the Dhs 4025 form?

The Dhs 4025 form is used to verify child care providers in Michigan as part of the Child Development and Care (CDC) program. When families apply for assistance with child care expenses or change their child care provider, this form must be completed and submitted to the Michigan Department of Health and Human Services (MDHHS).

2. Who needs to complete the Dhs 4025 form?

Both the child care provider and the parent or substitute parent must complete sections of the Dhs 4025 form. The provider fills out information about themselves and the children in their care, while the parent confirms their agreement regarding the care arrangement and associated responsibilities.

3. What happens if I do not submit the Dhs 4025 form by the due date?

If the Dhs 4025 form is not submitted by the specified due date, you or your provider will not receive payments for child care expenses through CDC. It is essential to return the completed form to ensure benefits are authorized.

4. How do I submit the Dhs 4025 form once completed?

You can submit the completed Dhs 4025 form via mail, fax, or online through the Michigan Department of Health and Human Services’ MiBridges platform. Ensure it reaches your assigned MDHHS specialist by the due date for processing.

5. What documents or information are required to complete the Dhs 4025 form?

The form requires details such as the provider's name, address, CDC ID, and information about the children in care. Both the provider and parent need to read the agreement and provide their signatures to validate the information and agree to the terms.

6. What are the consequences of providing false information on the Dhs 4025 form?

Providing false or incomplete information can lead to severe consequences, including prosecution for perjury or fraud. It may also result in disqualification from the program for specified periods or the requirement to repay any overpayments made to the provider.

7. Where can I find additional resources or assistance regarding the Dhs 4025 form?

For more information and guidance, you can access the CDC program handbook at the Michigan government’s child care webpage. Additionally, you can contact your MDHHS specialist for one-on-one assistance.

Common mistakes

Filling out the Dhs 4025 form is crucial for parents applying for the Child Development and Care (CDC) program in Michigan. However, there are common mistakes that can delay or even jeopardize the approval of child care assistance. Understanding these errors can help ensure a smoother application process.

One significant mistake is failing to meet the due date. When you do not submit the completed form on or before this date, you risk not receiving any CDC payments for child care expenses. It’s essential to prioritize timely submission to avoid gaps in assistance.

Another error occurs when applicants omit necessary signatures. Both the parent and the provider must sign and date the form. Without these signatures, the application is incomplete and may be rejected. Always double-check that all required signatures are present.

Inaccurate information about the provider can also lead to complications. For example, if the CDC ID number is incorrect or the provider’s name does not match official records, it can cause delays. It’s important to ensure that all details are correct and verified before turning in the form.

Many people also forget to include all relevant children in Section 2. The form specifies that every child in the family under the provider's care must be listed. Omitting a child can not only lead to delays but also create issues with eligibility for certain benefits.

Additionally, failing to disclose other income sources can lead to significant problems. There is a section that asks whether the provider receives other payments. Neglecting to answer this question accurately can be seen as providing false information, which could lead to legal repercussions.

Sometimes, applicants misunderstand the requirement for unlicensed providers. They may begin care before the Great Start to Quality Orientation training is complete. As a result, they may face unexpected expenses. It’s vital for parents to understand that they are responsible for payments during this period, and not doing so can complicate their agreement.

Not keeping accurate time and attendance records is another mistake. Providers should maintain these records diligently for each child. An audit may require proof of care, and without proper documentation, providers can face penalties or have to repay funds.

Moreover, some applicants do not comprehend that any overpayment must be reported and repaid. A misunderstanding regarding financial responsibility can lead to further complications. Always be proactive about monitoring payments received and ensuring they align with the services rendered.

Finally, be aware of the serious consequences of providing false information. Intentionally leaving out or misrepresenting facts can result in criminal charges. The penalties for fraud can be severe and long-lasting, so it's essential to fill out the form honestly and entirely.

Documents used along the form

The DHS 4025 form is an important document utilized by individuals seeking assistance with child care expenses through the Michigan Department of Health and Human Services (MDHHS). Alongside this form, several other documents may be required to ensure a complete application process. Below are some common forms that accompany the DHS 4025 form, each serving a specific purpose within the Child Development and Care (CDC) program.

- CDC Unlicensed Provider Application: This form is necessary for unlicensed child care providers who wish to participate in the CDC program. It gathers relevant information about the provider and ensures compliance with the state’s eligibility requirements.

- CDC Daily Time and Attendance Form: Each provider must maintain accurate records of the time and attendance of children in their care. This form documents the hours that children are present, serving as vital evidence for billing purposes.

- Parental Consent Form: This document requires the parent or legal guardian's signature to verify that they consent to their child receiving care from the selected provider. It outlines parental responsibilities and rights regarding child care services.

- Provider Billing Documentation: This includes any invoices or receipts that the provider generates for their services. Keeping accurate billing records ensures transparency and helps in verifying that payments align with the services provided.

Ultimately, these documents work together with the DHS 4025 form to facilitate a smooth application process within the CDC program, ensuring that both providers and families are adequately supported in their child care needs.

Similar forms

I-9 Form: Both the DHS 4025 and the I-9 require information about individuals involved in a service provision. The I-9 validates employment eligibility, while the DHS 4025 verifies childcare services for subsidy employment.

W-2 Form: The W-2 form, like the DHS 4025, involves accurate financial reporting. The W-2 is used to report wages paid, while the DHS 4025 manages financial arrangements for childcare providers.

1099-MISC Form: Similar to the DHS 4025, the 1099-MISC is utilized for reporting payments made to service providers. Each document requires careful reporting of transactions between parents and providers.

Child Care Application: Just as the DHS 4025 facilitates childcare assistance applications, a Child Care Application helps parents secure formal assistance through programs designed for childcare financial support.

Provider Agreement Forms: Both documents necessitate a signed agreement between parties. The Provider Agreement Form outlines specific roles and responsibilities, much like the DHS 4025.

Medicaid Provider Enrollment: The DHS 4025 shares similarities with Medicaid enrollment forms, as both require providers to verify information to receive funding for services rendered.

Emergency Contact Form: Each document indicates the need for key information from involved parties. The Emergency Contact Form and the DHS 4025 both require reliable contacts for follow-up and safety procedures.

Child Care Subsidy Worksheet: Similar to the DHS 4025, this worksheet helps families calculate qualification for childcare financial assistance, reflecting the financial planning aspect involved in both documents.

Dependency Benefit Application: Both forms require detailed personal information and are essential for securing benefits. One addresses dependency support, while the other focuses specifically on childcare expense assistance.

Child Development Program Enrollment Form: This form shares a purpose with the DHS 4025 in enrolling children in programs that support and verify childcare services to receive funding.

Dos and Don'ts

When filling out the DHS 4025 form, it's essential to follow certain guidelines to ensure the process goes smoothly. Here are five crucial do's and don'ts:

- Do work with your chosen provider to complete all required information.

- Do sign and date Page 2 of the form with your provider.

- Do submit the form by the Due Date to avoid delays in child care subsidy payments.

- Do provide accurate information to prevent any issues with future payments.

- Do keep a copy of the completed form for your records.

- Don't forget to check for any missing information before mailing or faxing the form.

- Don't assume the form is complete without both signatures.

- Don't ignore the Due Date; make sure the form is sent on time.

- Don't submit the form without consulting your provider regarding any responses.

- Don't provide false information, as it may lead to serious legal consequences.

Misconceptions

Many people have misunderstandings about the DHS 4025 form, leading to confusion and even delays in receiving child care benefits. Here are five common misconceptions and clarifications to set the record straight:

- Misconception 1: The DHS 4025 form is optional for child care assistance.

- Misconception 2: Only providers need to complete the form.

- Misconception 3: Submitting the form late won't have serious consequences.

- Misconception 4: You can apply for benefits without any supporting documents.

- Misconception 5: I don’t need to track hours or attendance for my child.

This form is mandatory for those seeking assistance through the Child Development and Care (CDC) program. Completing and submitting the form by the Due Date is essential to receive your child care subsidy.

Both the provider and the parent must fill out sections of the form. It's important for both parties to sign and date the document to acknowledge their agreement regarding child care arrangements.

If the form is not submitted by the Due Date, neither the provider nor the parent will receive CDC payments. Timely submission is crucial for maintaining eligibility for assistance.

It is the responsibility of the provider to maintain accurate records of time and attendance. Parents should also keep track of their child's care to ensure compliance with the CDC program rules.

By understanding these points, parents and providers can work together more effectively. If ever in doubt about the DHS 4025 form, don't hesitate to reach out to your MDHHS specialist for guidance.

Key takeaways

Filling out the Dhs 4025 form correctly is crucial for accessing child care benefits through the Michigan Department of Health and Human Services (MDHHS). Here are some key takeaways for completing and utilizing this form effectively:

- Timeliness is Essential: The completed form must be sent to your MDHHS specialist by the specified due date. Failure to do so will result in delays or denial of child care subsidy payments.

- Collaboration with Providers: Parents and child care providers should work together to fill out all required sections. Both parties must understand their roles and responsibilities outlined on the form.

- Accurate Information is Key: Providing correct details about child care arrangements and expenses is necessary. Inaccurate information can lead to loss of benefits and possible legal consequences.

- Understand Your Agreements: By signing the form, parents and providers agree to adhere to specific conditions. Be sure to read and comprehend these provisions to avoid complications in the child care agreement.

Proper completion of the Dhs 4025 form not only helps in accessing financial assistance but also ensures a smooth process in securing quality child care services.

Browse Other Templates

Fw 001 - By utilizing the FW-001, you advocate for your financial needs within the legal system.

Tax Waiver Form Nj - This affidavit is used to release funds from New Jersey bank accounts.

Employee Travel Request Form - Check with your probation officer for any specific travel policies that may apply.