Fill Out Your Direct Deposit For Job Form

The Direct Deposit for Job form is a crucial document for employees looking to streamline their payroll process. Whether you are setting up direct deposit for the first time or making changes to your existing account, this form serves as your pathway to efficient financial management. It is essential to note that processing can take up to two pay periods, during which employees will receive physical checks mailed to their registered addresses. The process begins by completing the required sections of the form, which includes personal identification information, selecting whether it is a new enrollment or an account change, and providing your bank's details. Additionally, you must read and sign an authorization statement, confirming your consent for direct deposits and any adjustments to correct overpayments. After filling out all necessary information, the completed form must be faxed to the Payroll Department to initiate the desired changes. Keeping track of any changes in your account or bank is vital, as delays or issues in communication may disrupt timely payments. This form not only facilitates direct deposits, but it also ensures that employees maintain control over their compensation by requiring explicit authorization for the management of their accounts.

Direct Deposit For Job Example

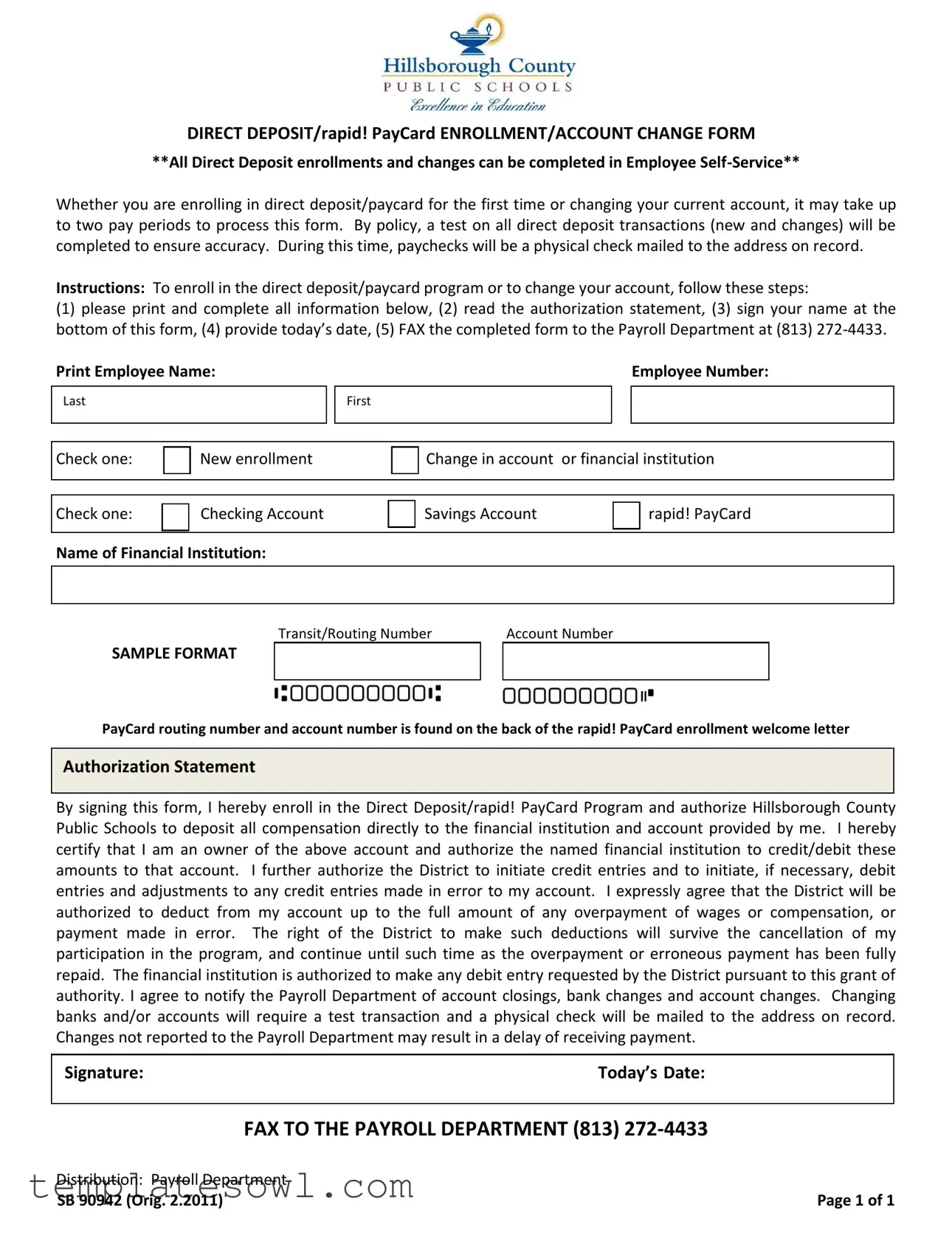

DIRECT DEPOSIT/rapid! PayCard ENROLLMENT/ACCOUNT CHANGE FORM

**All Direct Deposit enrollments and changes can be completed in Employee

Whether you are enrolling in direct deposit/paycard for the first time or changing your current account, it may take up to two pay periods to process this form. By policy, a test on all direct deposit transactions (new and changes) will be completed to ensure accuracy. During this time, paychecks will be a physical check mailed to the address on record.

Instructions: To enroll in the direct deposit/paycard program or to change your account, follow these steps:

(1)please print and complete all information below, (2) read the authorization statement, (3) sign your name at the bottom of this form, (4 provide today’s date, 5) FAX the completed form to the Payroll Department at (813)

Print Employee Name:

Last

Employee Number:

First

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check one: |

New enrollment |

|

Change in account or financial institution |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check one: |

|

Checking Account |

|

Savings Account |

rapid! PayCard |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Financial Institution: |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transit/Routing Number |

|

Account Number |

|

|

|

||||

SAMPLE FORMAT |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PayCard routing number and account number is found on the back of the rapid! PayCard enrollment welcome letter

Authorization Statement

By signing this form, I hereby enroll in the Direct Deposit/rapid! PayCard Program and authorize Hillsborough County Public Schools to deposit all compensation directly to the financial institution and account provided by me. I hereby certify that I am an owner of the above account and authorize the named financial institution to credit/debit these amounts to that account. I further authorize the District to initiate credit entries and to initiate, if necessary, debit entries and adjustments to any credit entries made in error to my account. I expressly agree that the District will be authorized to deduct from my account up to the full amount of any overpayment of wages or compensation, or payment made in error. The right of the District to make such deductions will survive the cancellation of my participation in the program, and continue until such time as the overpayment or erroneous payment has been fully repaid. The financial institution is authorized to make any debit entry requested by the District pursuant to this grant of authority. I agree to notify the Payroll Department of account closings, bank changes and account changes. Changing banks and/or accounts will require a test transaction and a physical check will be mailed to the address on record. Changes not reported to the Payroll Department may result in a delay of receiving payment.

Signature:Today’s Date:

FAX TO THE PAYROLL DEPARTMENT (813) |

|

Distribution: Payroll Department |

|

SB 90942 (Orig. 2.2011) |

Page 1 of 1 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Enrollment Process | Employees can enroll in direct deposit or change their current account through an easy step-by-step process outlined in the form. Completing the enrollment takes about two pay periods to process. |

| Temporary Payment Method | During the processing period of the direct deposit enrollment or change, employees will receive physical paychecks mailed to their address on record. |

| Authorization Statement | By signing the form, employees authorize their financial institution to credit and debit the account for wage deposits and corrections of any errors. |

| State-Specific Law | In compliance with the Florida Statutes Chapter 215, all processes related to direct deposit must ensure the accurate and timely payment of wages. |

| Notification Requirement | Employees must inform the Payroll Department of any changes to their banking information to avoid payment delays, as unreported changes could disrupt the deposit process. |

Guidelines on Utilizing Direct Deposit For Job

Once you have completed the Direct Deposit for Job form, it will be processed. Keep in mind that it might take up to two pay periods for you to see the changes reflected in your pay. During this processing time, you will receive physical checks by mail. Follow the steps below to fill out the form correctly.

- Please print and complete all information on the form.

- Read the authorization statement carefully.

- Sign your name at the bottom of the form.

- Provide today’s date in the designated area.

- Fax the completed form to the Payroll Department at (813) 272-4433.

What You Should Know About This Form

What is the Direct Deposit For Job form used for?

This form is utilized to enroll employees in the Direct Deposit or rapid! PayCard program, or to make changes to existing accounts. It facilitates the automatic deposit of compensation into the employee's chosen financial institution. This may include a checking account, savings account, or a rapid! PayCard. Completing this form ensures that payments are deposited directly, eliminating the need for physical checks.

How long does it take for the Direct Deposit changes to become effective?

Once the Direct Deposit For Job form is submitted, it may take up to two pay periods for the changes to be processed. During this processing time, employees will receive physical checks mailed to their registered address. New enrollments and changes undergo a testing process to confirm accuracy, which is a critical step to ensure proper transactions.

What steps are involved in completing the Direct Deposit For Job form?

To successfully complete the form, follow these steps: First, print and fill in all required information. Next, read the authorization statement thoroughly to understand the terms. After that, sign at the bottom of the form and include today’s date. Finally, fax the completed form to the Payroll Department at (813) 272-4433. It is essential to complete all steps accurately to prevent any delays in processing.

What happens if I change my bank account or financial institution?

If you decide to switch banks or accounts, you will need to submit a new Direct Deposit For Job form. A test transaction will be conducted by the payroll department upon making this change, meaning a physical check will again be mailed to your registered address during the transition period. It is vital to notify the Payroll Department promptly about any account changes to avoid potential payment delays.

Common mistakes

Many people encounter issues when filling out the Direct Deposit for Job form. A common mistake is failing to complete all the required fields. Each section must be filled out accurately to ensure the application can be processed without delays.

Another mistake involves improper signature placement. Individuals often forget to sign the form, which can lead to processing issues. Signing at the correct location indicates agreement with the stated terms and authorizes the financial institution to process the request.

An incorrect date can also cause problems. Some applicants overlook this step or forget to provide today's date, which is crucial for verifying the timing of the request. The date helps establish a timeline for the changes or enrollments being requested.

Another frequent error is mistakes in the account numbers or routing numbers. These numbers are vital for directing funds into the right bank account. It's essential to double-check all digits to avoid issues or misdirected payments.

People often select the wrong type of account, such as choosing a savings account when they intended to select a checking account. This simple mistake can lead to confusion and could delay the deposit process.

Some individuals neglect to review the authorization statement thoroughly. Not understanding the implications of this agreement can lead to misunderstandings regarding the authorization of bank transactions, including future deductions.

Applicants sometimes skip reading the instructions. Each instruction, such as how to submit the form by fax, contains important details that, if overlooked, may result in improper submission.

Failing to notify the Payroll Department of any account changes is another common issue. Anyone who changes banks or account numbers must communicate these changes to avoid payment disruptions.

Additionally, those using the rapid! PayCard must be aware that specific card information must be provided. Missing this information can lead to delays in access to funds.

Lastly, procrastination can be a common pitfall. Submitting the form at the last minute can result in processing delays, as it may take up to two pay periods for the direct deposit changes to take effect. Planning ahead is key.

Documents used along the form

The Direct Deposit for Job form is often accompanied by several important documents that aid in processing payroll and ensuring accuracy. Below is a list of these forms and a brief description of each.

- W-4 Form: This form is used by employees to indicate their tax situation to employers. It helps determine how much federal income tax should be withheld from paychecks.

- Employment Application: The application provides detailed information about an individual's work history, education, and skills. It is often required during the hiring process.

- I-9 Form: Required for employment eligibility verification, this form confirms that the employee is authorized to work in the United States.

- Direct Deposit Authorization Form: Similar to the Direct Deposit for Job form, it specifically authorizes employers to deposit funds directly into an employee’s bank account.

- Benefits Enrollment Form: This document allows employees to enroll in or modify their benefits, including health insurance and retirement plans.

- State Tax Withholding Form: Similar to the W-4, this form is used to determine how much state income tax should be withheld. It varies by state.

- Payroll Deduction Authorization Form: This form is used to authorize deductions from an employee's paycheck for various purposes, such as retirement contributions or union dues.

- Employee Handbook Acknowledgment Form: This document acknowledges that the employee has received and understood the company policies outlined in the employee handbook.

These forms play a vital role in ensuring proper payroll processing and maintaining clarity in employer-employee relationships. It's essential for employees to complete and submit these documents accurately to avoid delays and issues with their compensation.

Similar forms

W-4 Form: Like the Direct Deposit form, the W-4 form is essential for employees to manage their financial information with their employer. It determines how much tax should be withheld from your paycheck. Both involve personal financial details and require the employee's signature.

I-9 Form: This document verifies an employee's right to work in the U.S. Similar to the Direct Deposit form, it collects personal information and requires the employee to affirm the information provided is true, usually through a signature.

Change of Address Form: This form notifies an employer of an employee's new address and is pivotal for maintaining accurate records. It, too, focuses on the accuracy of personal information and may require additional verification for updates.

Health Insurance Enrollment Form: Employees use this document to enroll in or change their health insurance plan. It is akin to the Direct Deposit form in that it requires personal details and has an authorization statement for processing modifications.

Retirement Plan Enrollment Form: Similar to the Direct Deposit form, this document allows employees to opt into retirement savings plans. Both forms necessitate personal details and an employee’s consent to proceed with the enrollment.

Direct Deposit Change Form: This specific form is dedicated to altering existing direct deposit arrangements. Like the Direct Deposit form for the first time, it requests current banking information and the employee’s authorization.

Employee Self-Service Form: This form allows employees to manage various HR-related tasks online. Like the Direct Deposit form, it empowers employees to control their information and requires them to review and confirm their entries.

Time-off Request Form: This document is used to formally request time off from work. Similar to the Direct Deposit form, it stipulates the need for accurate personal information and may require managerial or HR approval.

Expense Reimbursement Form: Employees submit this form to receive reimbursement for business expenses. It shares similarities with the Direct Deposit form in that it involves financial transactions and requires detailed personal and account information.

Employment Verification Form: This document is utilized to confirm an employee's position and salary. It resembles the Direct Deposit form in its aim to ensure accuracy and authorization when dealing with personal employment data.

Dos and Don'ts

When filling out the Direct Deposit For Job form, it is crucial to be careful and attentive. Ensuring accuracy will help prevent delays in how you receive your pay. Here’s a list of what to do and what to avoid:

- Do read all instructions thoroughly before filling out the form.

- Do provide accurate and complete information regarding your financial institution.

- Do sign the authorization statement to validate your enrollment.

- Do submit the form promptly to avoid any delays in processing.

- Don't leave any required fields blank; every section must be completed.

- Don't forget to include your employee name and number on the form.

- Don't change your bank information without notifying the Payroll Department.

- Don't assume your direct deposit has been set up until you confirm it with Payroll.

Misconceptions

-

Direct deposit is immediate. Many believe that enrolling in direct deposit will result in instant access to funds. In reality, once you submit your enrollment or change form, it can take up to two pay periods for the process to complete. During this time, you will receive a physical check mailed to your address.

-

I can enroll or change my direct deposit information anytime. While you certainly can submit your request at any time, it's important to understand that changes generally require processing time. This means that any changes you make might not take effect until the following payday.

-

All my pay will go to my checking account. Some individuals think that enrolling in direct deposit means that their entire paycheck will automatically go into their checking account. However, you have the option to choose a savings account or use the rapid! PayCard instead.

-

The test transaction can be skipped. Some may think they can bypass the test transaction when changing accounts. This is not the case; a test transaction is mandatory to ensure that all details are accurate before regular deposits begin. Skipping this step could lead to payment issues.

-

One small mistake won’t matter. People often believe that minor errors on the form are inconsequential. Even a tiny mistake, such as an incorrect account number or routing number, can delay your direct deposit. Accuracy is crucial in ensuring timely payments.

Key takeaways

When filling out and using the Direct Deposit for Job form, consider the following key takeaways:

- Completing the form is essential for setting up direct deposit or changing account information. Ensure all sections are accurately filled out.

- It may take up to two pay periods for your enrollment or changes to be processed. During this time, expect to receive physical checks sent to your recorded address.

- A test transaction will be conducted for all direct deposit enrollments and changes. This step is crucial to confirm that your information is accurate.

- After filling out the form, remember to read the authorization statement carefully. It outlines your responsibilities and the agreement with your financial institution.

- Submitting the completed form promptly will help avoid delays. Fax the form to the Payroll Department at (813) 272-4433 to initiate the process.

- Notify the Payroll Department of any changes to your bank account or institution. Failure to do so may cause delays in your payment processing.

Browse Other Templates

Certificate of Foreign Limited Partnership Amendment,Amendment Application for Limited Partnership,Foreign Partnership Name Change Certificate,New York Limited Partnership Amendment Form,Limited Partnership Authority Modification Certificate,Certific - This document supports transparency in the partnership's business operations.

Virginia Medicaid Income Limits 2024 Calculator - Completing this form is a vital step to streamline Medicaid services for long-term care patients.

Kentucky Dmv Forms - The TC 96 15E form supports Kentucky's legislative initiative for promoting donation awareness.