Fill Out Your Direct Deposit Los Angeles Form

The Direct Deposit Los Angeles form is a vital resource for individuals receiving cash benefits from the Department of Public Social Services (DPSS). By opting for direct deposit, participants can ensure their funds are delivered securely and promptly to their designated bank accounts. This user-friendly form includes several key sections that need your careful attention. Payees must provide their personal information, including case number, account details, and contact information in the first section. This helps establish the direct deposit route correctly. The second section is designated for depository institutions, where a bank or credit union representative confirms the account details and agrees to receive the payments from the County of Los Angeles. It is crucial to fill out this form completely and accurately, as any discrepancies could delay the processing of benefits. Moreover, participants are reminded to notify DPSS of any changes or account closures to avoid disruptions in their cash benefits. By understanding the various components of the Direct Deposit Los Angeles form, recipients can navigate the process smoothly and enjoy the financial convenience that direct deposit offers.

Direct Deposit Los Angeles Example

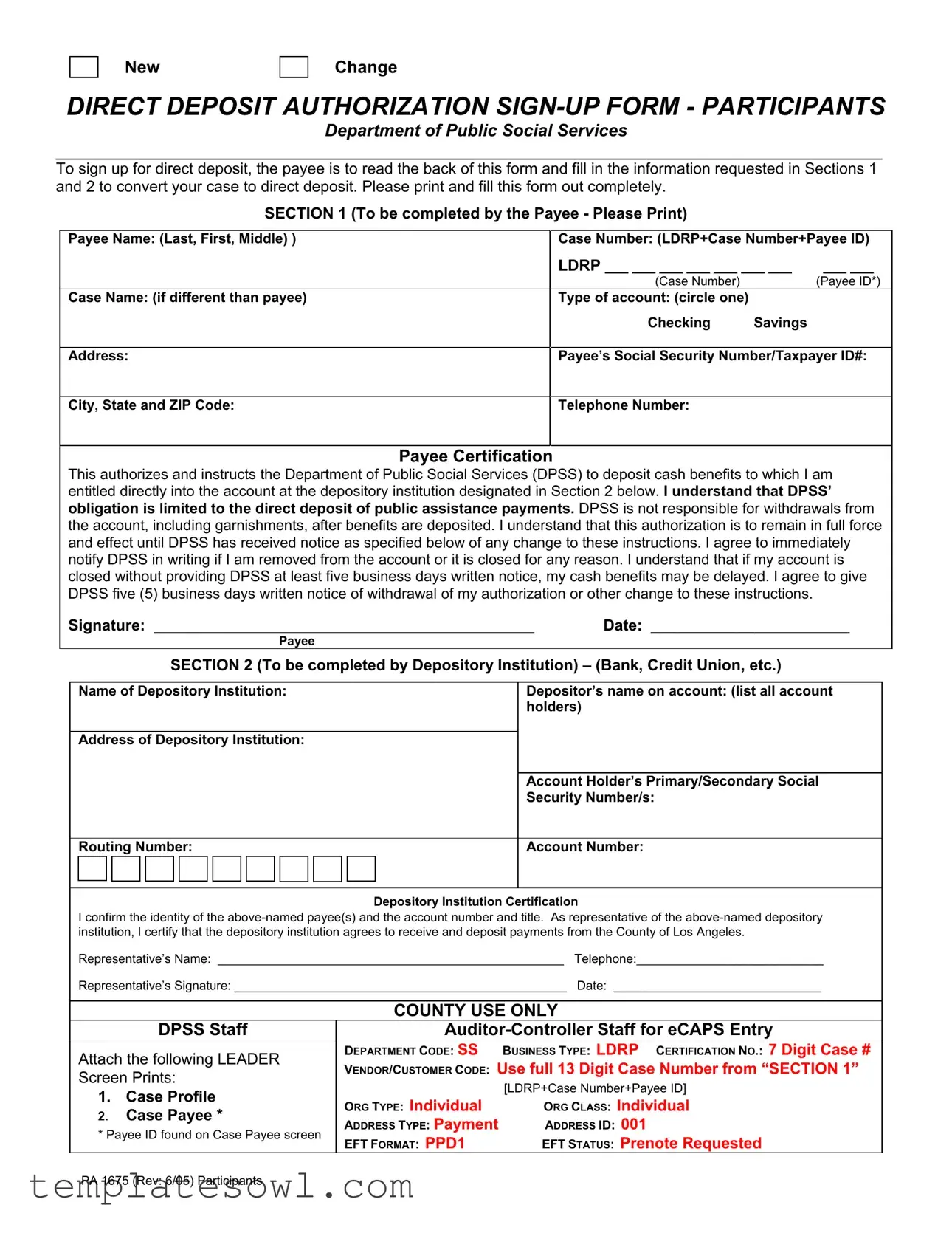

New

Change

DIRECT DEPOSIT AUTHORIZATION

Department of Public Social Services

To sign up for direct deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2 to convert your case to direct deposit. Please print and fill this form out completely.

SECTION 1 (To be completed by the Payee - Please Print)

Payee Name: (Last, First, Middle) ) |

Case Number: (LDRP+Case Number+Payee ID) |

||

|

LDRP ___ ___ ___ ___ ___ ___ ___ |

___ ___ |

|

|

(Case Number) |

|

(Payee ID*) |

Case Name: (if different than payee) |

Type of account: (circle one) |

|

|

|

Checking |

Savings |

|

|

|

||

Address: |

Payee’s Social Security Number/Taxpayer ID#: |

||

City, State and ZIP Code:

Telephone Number:

Payee Certification

This authorizes and instructs the Department of Public Social Services (DPSS) to deposit cash benefits to which I am entitled directly into the account at the depository institution designated in Section 2 below. I understand that DPSS’ obligation is limited to the direct deposit of public assistance payments. DPSS is not responsible for withdrawals from the account, including garnishments, after benefits are deposited. I understand that this authorization is to remain in full force and effect until DPSS has received notice as specified below of any change to these instructions. I agree to immediately notify DPSS in writing if I am removed from the account or it is closed for any reason. I understand that if my account is closed without providing DPSS at least five business days written notice, my cash benefits may be delayed. I agree to give DPSS five (5) business days written notice of withdrawal of my authorization or other change to these instructions.

Signature: ____________________________________________ |

Date: _______________________ |

Payee

SECTION 2 (To be completed by Depository Institution) – (Bank, Credit Union, etc.)

|

Name of Depository Institution: |

Depositor’s name on account: (list all account |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

holders) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of Depository Institution: |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account Holder’s Primary/Secondary Social |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Security Number/s: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Routing Number: |

Account Number: |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depository Institution Certification

I confirm the identity of the

Representative’s Name: __________________________________________________ |

Telephone:___________________________ |

||||

Representative’s Signature: ________________________________________________ |

Date: ______________________________ |

||||

|

|

|

|

||

|

|

COUNTY USE ONLY |

|

||

|

DPSS Staff |

||||

Attach the following LEADER |

DEPARTMENT CODE: SS |

BUSINESS TYPE: LDRP CERTIFICATION NO.: 7 Digit Case # |

|||

VENDOR/CUSTOMER CODE: Use full 13 Digit Case Number from “SECTION 1” |

|||||

Screen Prints: |

|||||

|

[LDRP+Case Number+Payee ID] |

||||

1. |

Case Profile |

|

|||

ORG TYPE: Individual |

ORG CLASS: Individual |

||||

2. |

Case Payee * |

||||

ADDRESS TYPE: Payment |

ADDRESS ID: 001 |

||||

* Payee ID found on Case Payee screen |

|||||

EFT FORMAT: PPD1 |

EFT STATUS: Prenote Requested |

||||

|

|

||||

PA 1675 (Rev: 6/05) Participants

PLEASE READ THIS CAREFULLY

The information provided on this form will remain confidential and be kept by the Department of the Auditor- Controller on behalf of Los Angeles County. Failure to provide the requested information may affect the processing of this form and may delay or prevent the receipt of benefits through the Direct Deposit Program.

Return this form with the computer screen printouts attached by your Eligibility Worker to the

Los Angeles County

P.O. Box 7000

Downey, CA

Instructions For Completing This Form

Print clearly and complete Section 1 of this form.

♦Write the payee name exactly as it appears on the printout.

♦Make sure the address on the printout provided by your Eligibility Worker is your current address. The County will reject applications if the address on the application does not match the printout.

♦Write your Case Number and Payee ID exactly as it appears on the printout.

If you want your cash benefits deposited into your checking account, attach a voided personal check to this form, and write, “VOID” on the front of the check OR ask your depository institution to complete Section 2. If you want your cash benefits to be deposited into your savings account, or into any credit union account, (checking or savings) a representative from your depository institution MUST complete Section 2.

If the address on your personal check is different from your current address, cross out your old address and print your new address on your personal check. The address printed or handwritten on your check must match your application and the printout provided by your Eligibility Worker.

Cancellation

Direct deposit will remain in effect until cancelled by either yourself or DPSS. To stop direct deposit, call your Eligibility Worker and request a PA

Changing Depository Institutions

To change depository institutions for direct deposit, you must complete a Cancellation for Direct Deposit Form and a new Direct Deposit

Los Angeles County

P.O. Box 7000

Downey, CA

It is recommended that you maintain accounts at both depository institutions until the new depository institution receives the first direct deposit.

PA 1675 (Rev: 6/05) Participants

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Direct Deposit Authorization Sign-Up Form allows individuals to have their public assistance benefits deposited directly into their bank accounts. |

| Governing Law | The form is governed under California Welfare and Institutions Code, particularly those sections relating to public assistance programs. |

| Sections Required | Payees must complete both Section 1 and Section 2 of the form. Section 1 is filled out by the payee and Section 2 is filled out by the depository institution. |

| Account Types | Payees may select either a checking or savings account for the direct deposit of benefits. |

| Notification Requirement | Payees must provide DPSS with five business days' written notice for any changes to their direct deposit authorization. |

| Confidentiality | Information on this form will remain confidential and will be securely stored by the Department of the Auditor-Controller. |

| Form Submission | The completed form must be returned to the Los Angeles County Auditor-Controller by mail or through an Eligibility Worker with necessary attachments. |

Guidelines on Utilizing Direct Deposit Los Angeles

Completing the Direct Deposit form for Los Angeles is a straightforward process. It’s essential to provide accurate information to ensure the timely deposit of your benefits. Follow the steps carefully to fill out the form correctly.

- Print your name: In Section 1, write your name (Last, First, Middle) as it appears on your printout.

- Enter your case number: Fill in the Case Number, which includes the LDRP code, your case number, and Payee ID exactly as provided.

- List the case name: If the case name is different from your payee name, include it in the designated area.

- Select the account type: Indicate whether the deposit will be made to a Checking or Savings account by circling the appropriate option.

- Provide your address: Write your full address, including city, state, and ZIP code, ensuring it matches the one on your eligibility printout.

- Enter your Social Security Number or Taxpayer ID: Fill in the required Social Security Number or Taxpayer ID.

- Include your telephone number: Write your contact telephone number for any necessary follow-ups.

- Read the certification section: Understand that this section is important for authorizing direct deposits.

- Sign and date: Finally, sign your name and provide the date below the certification section to confirm your agreement.

- Complete Section 2: Take the form to your bank, credit union, or other depository institution for them to fill out their section. This includes their name, your name on the account, the address of the institution, and account details.

- Attach supporting documents: If you are using a checking account, attach a voided check. Ensure the information matches the details on the form.

- Submit the form: Return the completed form, along with any required printouts, to your Eligibility Worker or directly to the Los Angeles County Auditor-Controller.

What You Should Know About This Form

What is the purpose of the Direct Deposit Los Angeles form?

The Direct Deposit Los Angeles form allows participants to authorize the Department of Public Social Services (DPSS) to deposit cash benefits directly into their bank accounts. Completing this form ensures that benefits are received efficiently, allowing for timely access to funds without the need for paper checks.

Who needs to fill out this form?

This form must be filled out by the payee who will receive the cash benefits. The payee is the individual authorized to receive funds through the public assistance program. It is important that the payee provides accurate and complete information in order to process the direct deposit request.

What information is required to complete the form?

The form requires several pieces of information. The payee must provide their name, case number, social security number or taxpayer ID, and address. Additionally, the payee must select the type of account (checking or savings) and provide the account number and routing number. Section 2 must be completed by the depository institution, which includes the bank or credit union name and account holder information.

What happens if I close my bank account?

If a payee closes their bank account without notifying DPSS, it may result in delays in receiving cash benefits. The payee is required to inform DPSS in writing at least five business days prior to any account closure. This helps ensure a smooth transition of benefits to a new account and avoids interruptions in payments.

What should I do if I want to change my direct deposit information?

To change your direct deposit information, you must fill out both a Cancellation for Direct Deposit Form and a new Direct Deposit Los Angeles form. Submit these forms along with any necessary documentation to your Eligibility Worker. It is advisable to keep accounts at both the old and new institutions until the new account starts receiving deposits to avoid potential payment issues.

Common mistakes

Filling out the Direct Deposit Los Angeles form can seem straightforward, but many make common mistakes that can delay processing. One frequent issue is related to the accuracy of personal details. Payees often write their name incorrectly or forget to include their middle name. It's crucial to ensure that the name matches exactly how it appears on official documents.

Another mistake involves the case number and payee ID. Individuals may not double-check the information on the printout provided by their Eligibility Worker. Any discrepancies can lead to rejection of the application. It is essential that this information is entered accurately to facilitate smooth processing.

The choice of account type can also lead to errors. Payees sometimes fail to circle either "Checking" or "Savings." If this section is left blank, the processing may stall as the authorities will not know where to deposit the funds. Clearly indicating your choice will help prevent any issues.

Addressing mismatched information is another common error. If someone’s address has changed and they don't accurately update it on the form, the County may reject the application. Printed details on checks must also match the information on the application. Failure to comply can delay deposits.

In Section 2, many individuals overlook the need for their depository institution's representative to sign. This certification confirms the identity of the payee and the accuracy of the account details. If the signature is missing, the form will require additional processing time.

Additionally, individuals sometimes submit the form without including any required attachments, such as a voided check for checking accounts or having a representative complete Section 2 for savings accounts. These attachments are essential for validating the account and facilitating deposit.

Finally, one major oversight relates to closure of bank accounts. People may close their bank accounts without notifying the Department of Public Social Services (DPSS) first. Not giving at least five business days' notice can lead to delays in receiving benefits. Coordination with DPSS is vital to avoid disruptions in cash benefits.

Documents used along the form

When signing up for direct deposit, individuals may need to provide several additional documents to ensure smooth processing. These documents help confirm identity, communicate changes, or provide important account information. Below are some key forms that are often used alongside the Direct Deposit Los Angeles form:

- Cancellation for Direct Deposit Form: This form is used to stop direct deposits into an account. It must be completed and submitted if an individual decides to cancel their direct deposit or wishes to change their bank account.

- Voided Check: A voided check is often required to verify the account number and routing information. The check should be marked "VOID" to prevent it from being used for transactions.

- Eligibility Verification Report: This document is sometimes needed to confirm the payee's eligibility for benefits. It provides vital information that may be necessary for record-keeping purposes.

- Direct Deposit Change Form: If an individual wants to switch their direct deposit to a new bank or account, this form is required. It allows the payee to request a change in their direct deposit information.

- Department Notification Form: When there are changes in circumstances, such as a change of address or removal from an account, this form is crucial for keeping the agency informed and avoiding delays in benefits.

Submitting the appropriate forms alongside the Direct Deposit Los Angeles form plays a vital role in ensuring that benefits are received without interruption. It is important to follow the instructions carefully and submit all required documents promptly.

Similar forms

The Direct Deposit Los Angeles form is essential for individuals receiving public assistance payments. It allows for the automatic deposit of benefits directly into a designated bank or credit union account. Several other forms share similarities with it, particularly in their purpose and structure. Below are five documents that resemble the Direct Deposit form:

- W-4 Form: This form is used by employees to indicate their tax situation to their employer. Just like the Direct Deposit form, it requires personal information and must be filled out accurately to ensure correct processing of benefits or withholdings.

- Direct Deposit Authorization Form: Often used across various organizations, this document allows individuals to authorize the deposit of funds into their bank accounts. Similar to the Direct Deposit Los Angeles form, it captures the payee’s account details and requires the payee’s signature.

- Benefits Change Report Form: This form is utilized to report changes in a beneficiary’s situation that may affect their benefits. Both the Benefits Change Report and the Direct Deposit form necessitate the clear communication of changes in personal information to ensure smooth processing of benefits.

- Payroll Authorization Form: Employees use this form to request direct deposit of their paychecks. Like the Direct Deposit Los Angeles form, it includes sections to verify the account information and the employee's consent to authorizations, ensuring proper management of funds.

- Medicaid Direct Deposit Form: This document is specifically used by recipients of Medicaid to facilitate the direct deposit of payments. Both forms require authorization and account verification to ensure that payments reach the correct accounts securely and efficiently.

Understanding these forms can help recipients navigate the requirements for managing their benefits effectively. Each requires accurate personal information, account details, and often an official signature to authorize the processing of funds.

Dos and Don'ts

When filling out the Direct Deposit Los Angeles form, there are essential steps to follow. The process can affect how quickly and accurately your benefits are deposited. Here is a list of things to do and avoid:

- Do print clearly in all sections to prevent any confusion.

- Do use your current address as indicated on your eligibility printout.

- Do ensure that your Case Number and Payee ID are correct, matching exactly what is on the printout.

- Do attach a voided personal check if you're depositing into a checking account.

- Do have a representative from your depository institution complete Section 2 if using savings or credit union accounts.

- Do report any changes or closures of your bank account promptly to avoid delays in your benefits.

- Don't submit the form until all sections are fully completed.

- Don't provide an old address on your personal check; this can lead to rejection of the application.

- Don't forget to keep both old and new accounts active until the first deposit goes through.

- Don't disregard the requirement to notify DPSS of any changes to your banking information.

Misconceptions

Understanding the Direct Deposit Los Angeles form is crucial for individuals hoping to receive their public assistance benefits without delays. Unfortunately, several misconceptions can lead to confusion. Below are four common misunderstandings:

- Misconception 1: The direct deposit is automatic.

- Misconception 2: One can change banking information without formal procedures.

- Misconception 3: All accounts are eligible for direct deposit.

- Misconception 4: Personal information isn’t sensitive.

Many believe that once they've filled out the form, direct deposit starts immediately. In reality, the setup takes time as it requires processing by the Department of Public Social Services (DPSS). It's essential to confirm with your eligibility worker when the direct deposit will begin.

Some people think they can easily switch their bank account information at any time. However, to change your depository institution, you must fill out both a Cancellation for Direct Deposit Form and a new Direct Deposit Sign-Up Form. Skipping these steps can lead to delays or lost benefits.

There's a belief that any bank or credit union account will do for direct deposit. This isn’t true. For instance, if you wish to use a savings account, a representative from the banking institution must complete a section on the form. Not adhering to this requirement can cause significant issues in receiving your funds.

Some individuals assume that the information provided in the form does not need to be treated securely. This is incorrect. The form contains sensitive details, including your social security number. Always ensure that your completed forms are returned securely to protect your private data.

Key takeaways

When filling out and utilizing the Direct Deposit Los Angeles form, it is important to keep the following points in mind:

- Complete the necessary sections: Payees should accurately fill out Sections 1 and 2 of the form. Incomplete information may delay processing.

- Match information with provided documentation: Ensure that the name, address, and case number entered on the form match those on the printout provided by your Eligibility Worker. Discrepancies may result in rejection of the application.

- Account type selection matters: Clearly indicate whether the funds should be deposited into a checking or savings account. The requirements differ depending on the account type.

- Notification of changes is necessary: If you close your account or change banking institutions, inform the Department of Public Social Services (DPSS) immediately. Written notice is required to avoid payment delays.

- Confidentiality is prioritized: The information on the form is kept confidential by the Department of the Auditor-Controller. However, failure to provide accurate information may hinder benefit processing.

Browse Other Templates

Ui-50a - Completing the form ensures continued compliance with state regulations.

State Residence Verification,Legal Domicile Certification,Military Residency Declaration,Tax Residency Affidavit,Service Member Residence Certification,Home of Record Confirmation,Income Tax Residency Form,Domicile Establishment Certificate,Military - Your intent to change residence must be clearly demonstrated.