Fill Out Your Direct Deposit Paycard Authorization Form

The Direct Deposit Paycard Authorization form is a critical document that allows employees to streamline the process of receiving their wages. This form serves multiple purposes, including setting up new direct deposit accounts, changing existing deposit details, or canceling a previous authorization. Personal information, such as an employee's name, social security number, and date of birth, must be provided to ensure accurate processing. In addition, employees can specify their preferred method of pay stub delivery—whether through web access, mail, or office email. The form requires precise bank account information, including account type, routing numbers, and account numbers, for both primary and secondary accounts. Employees must also submit a voided check or bank verification for each account listed. Active participation is essential, as any changes to bank account details must be communicated to the designated payroll representative to prevent delays. Employees have the option to authorize payments via a paycard, along with an acknowledgment of understanding any associated fees. The consent granted on this form remains effective until a written notice of termination is received. Overall, the Direct Deposit Paycard Authorization form serves as a vital tool for managing payroll efficiency and ensuring timely wage deposits.

Direct Deposit Paycard Authorization Example

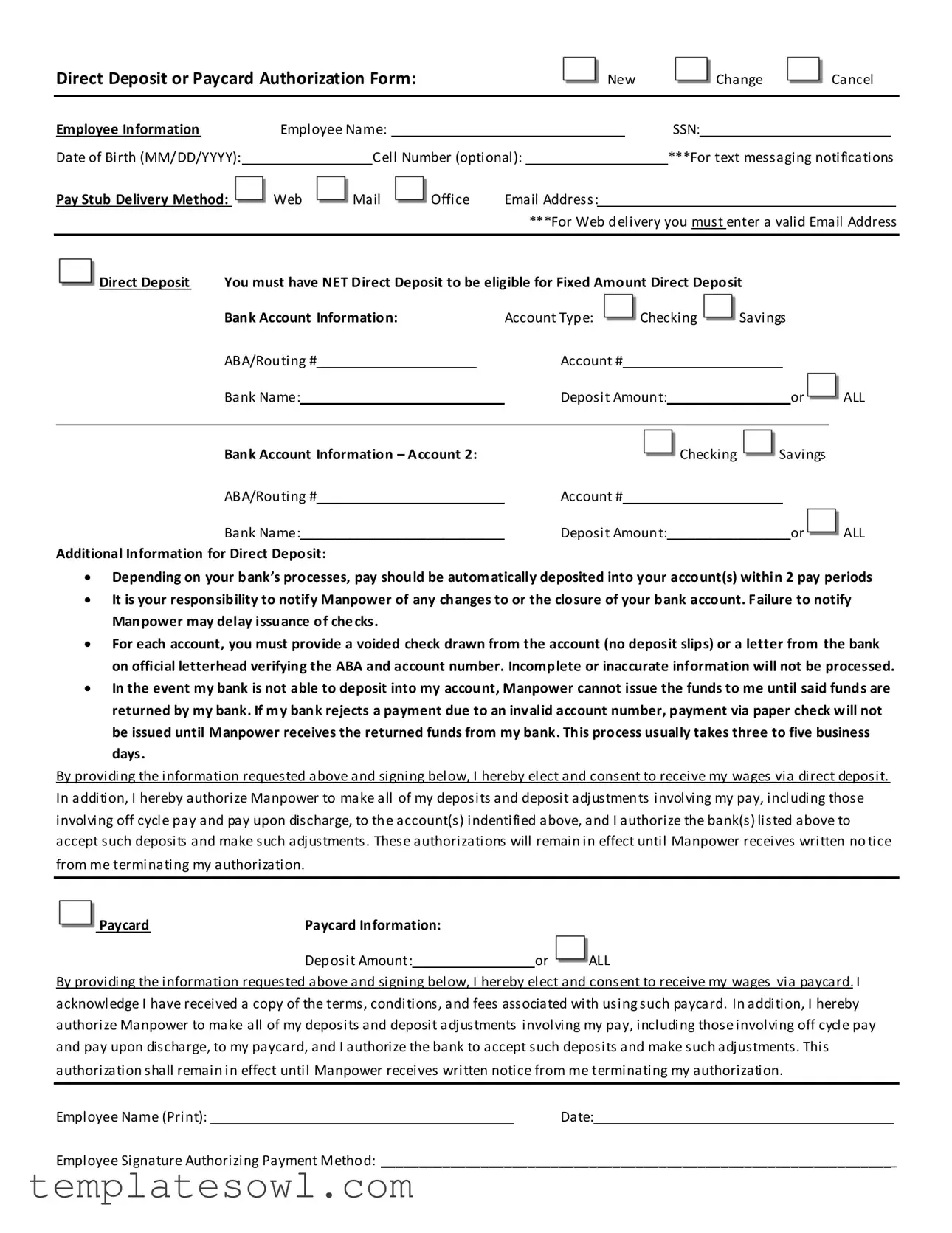

Direct Deposit or Paycard Authorization Form: |

New |

Change |

Cancel |

|

|

|

|

||

Employee Information |

Employee Name: ______________________________ |

SSN: ________________________ |

||

Date of Birth (MM/DD/YYYY): ________________ Cell Number (optional): __ _______________***For text messaging notifications

|

Pay Stub Delivery Method: |

Web |

Office |

|

Email Address: ______________________________________ |

|||||||

|

|

|

|

|

|

|

|

|

***For Web delivery you must enter a valid Email Address |

|||

|

|

|

|

|

|

|

||||||

|

Direct Deposit |

You must have NET Direct Deposit to be eligible for Fixed Amount Direct Deposit |

|

|||||||||

|

|

Bank Account Information: |

|

|

Account Type: |

Checking |

Savings |

|

||||

|

|

ABA/Routing # ____________________ |

|

Account # ____________________ |

|

|||||||

|

|

Bank Name: _______________________ |

|

Deposit Amount: _______________ or |

ALL |

|||||||

|

|

|

|

|

|

|

||||||

|

|

______________________________________________________________________________ |

|

|||||||||

|

|

Bank Account Information – Account 2: |

|

|

Checking |

Savings |

|

|||||

|

|

ABA/Routing # ____________________ |

|

Account # ____________________ |

|

|||||||

|

|

|

|

|

|

|

||||||

|

|

Bank Name: _______________________ |

|

Deposit Amount: _______________ or |

ALL |

|||||||

|

|

|

|

|

|

|

|

|

|

|||

|

Additional Information for Direct Deposit: |

|

|

|

|

|

|

|

||||

|

Depe di g o |

your |

a k’s pro esses, pay should |

e auto |

ati ally deposited i |

to your a ou t s |

withi 2 pay periods |

|||||

It is your responsibility to notify Manpower of any changes to or the closure of your bank account. Failure to notify Manpower may delay issuance of checks.

For each account, you must provide a voided check drawn from the account (no deposit slips) or a letter from the bank on official letterhead verifying the ABA and account number. Incomplete or inaccurate information will not be processed.

In the event my bank is not able to deposit into my account, Manpower cannot issue the funds to me until said funds are returned by my bank. If my bank rejects a payment due to an invalid account number, payment via paper check will not

be issued until Manpower receives the returned funds from my bank. This process usually takes three to five business days.

By providing the information requested above and signing below, I hereby elect and consent to receive my wages via direct deposit. In addition, I hereby authorize Manpower to make all of my deposits and deposit adjustments involving my pay, including those involving off cycle pay and pay upon discharge, to the account(s) indentified above, and I authorize the bank(s) listed above to accept such deposits and make such adjustments. These authorizations will remain in effect until Manpower receives written no tice from me terminating my authorization.

Paycard |

Paycard Information: |

|

|

Deposit Amount: _______________ or |

ALL |

By providing the information requested above and signing below, I hereby elect and consent to receive my wages via paycard. I acknowledge I have received a copy of the terms, conditions, and fees associated with using such paycard. In addition, I hereby authorize Manpower to make all of my deposits and deposit adjustments involving my pay, including those involving off cycle pay and pay upon discharge, to my paycard, and I authorize the bank to accept such deposits and make such adjustments. This authorization shall remain in effect until Manpower receives written notice from me terminating my authorization.

Employee Name (Print): _______________________________________ |

Date: ______________________________________ |

Employee Signature Authorizing Payment Method: __________________________________________________________________

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The form authorizes the use of direct deposit or paycard for employee wages. |

| Employee Information | Employees must provide their name, social security number, and date of birth. |

| Delivery Method | Pay stub delivery can be via web, mail, or office email. |

| Account Requirements | A voided check or a bank letter is required for each account listed. |

| Processing Time | Pay will typically be deposited into accounts within two pay periods. |

| Change Notification | Employees must inform Manpower of any bank account changes or closures. |

| Paycard Acknowledgment | Employees must acknowledge receiving the paycard's terms and fees. |

| Authorization Duration | The authorization remains in effect until written notice of termination is received. |

| Governing Law | The form is subject to applicable federal and state laws, including the Electronic Fund Transfer Act. |

Guidelines on Utilizing Direct Deposit Paycard Authorization

After completing the Direct Deposit Paycard Authorization form, submit it to the appropriate department. This will allow your wages to be deposited directly into your chosen account or onto a paycard.

- Begin by filling out your Employee Information: Write your name, Social Security Number (SSN), date of birth, and optional cell number. If you prefer text notifications, include the cell number.

- Choose a Pay Stub Delivery Method: Indicate whether you want your pay stub delivered by web, mail, or office.

- For Direct Deposit, select your account type (checking or savings). Fill in the following details:

- ABA/Routing #

- Account #

- Bank Name

- Deposit Amount, or select 'ALL' for full amounts.

- If applicable, complete the information for a second account by repeating step three.

- Include any additional information required, such as the need for a voided check or a bank letter for each account.

- For Paycard details, specify the deposit amount or select 'ALL'.

- Finally, print your name, write the date, and sign the form to authorize the deposit method.

What You Should Know About This Form

What is the Direct Deposit Paycard Authorization form?

The Direct Deposit Paycard Authorization form is a document that allows employees to choose how they receive their wages, either through traditional direct deposit to a bank account or via a paycard. By completing this form, employees can select their preferred method, provide necessary banking details, and authorize the employer to deposit their pay accordingly. This streamlined process aims to enhance convenience and ensure timely access to earnings.

What information do I need to provide on the form?

You will need to provide specific personal and banking information on the form. This includes your name, Social Security Number, date of birth, and contact information. If you opt for direct deposit, you must include details such as your ABA/routing number, account number, bank name, and the amount you would like deposited. If using a paycard, you'll need to indicate the deposit amount or choose to deposit all of your wages. It's essential to provide accurate information to avoid delays in processing.

How long does it take for my direct deposit to start?

Your direct deposit should be processed and reflect in your bank account within two pay periods, depending on your bank's processing methods. It’s important to keep in mind that this timeframe can vary if your bank requires additional processing. To ensure a smooth transition, always submit a voided check or bank verification for each account listed on your authorization form.

What happens if my bank account information changes?

If your bank account information changes or if the account is closed, it is your responsibility to inform your employer, in this case, Manpower, as soon as possible. Failure to do so may lead to delays in your wage payments. If funds cannot be deposited due to an account issue, you will need to wait until the bank returns the funds before receiving a paper check or any additional payment methods.

What are the advantages of using a paycard?

Using a paycard offers several advantages. It provides a safe and efficient way to access your wages without needing a traditional bank account. Paycards can be used for purchases, bill payments, and cash withdrawals at ATMs. Additionally, many paycards offer convenient features such as online account management and the potential for faster access to your funds compared to check deposits. Always review the terms and conditions associated with paycard usage to understand any applicable fees.

Common mistakes

Filling out the Direct Deposit Paycard Authorization form can seem straightforward, but many individuals make common mistakes that can delay their payment process. Understanding these pitfalls can help ensure that your information is submitted correctly, enabling timely access to your earnings.

One frequent error is not providing a valid email address. If you opt for web delivery of your pay stub, it is imperative to enter a functioning email. An incorrect or non-existent email address means you won’t be able to receive necessary notifications, such as pay stubs or updates regarding your direct deposit.

Another mistake involves the selection between checking and savings accounts. Often, individuals either forget to circle their preferred account type or mistakenly choose both. This can confuse the payroll department, resulting in potential delays in your deposits. It is essential to clearly specify your choice to avoid any issues.

Inaccurate banking information can cause significant complications. Many people inadvertently miswrite numbers in the ABA/routing number or account number fields. A wrong digit can lead to funds being deposited into a non-existent or incorrect account. Always double-check these critical numbers against your voided check or bank statement before submission.

Moreover, failing to attach the required documentation is a common oversight. The form mandates a voided check or a bank letter for each account listed. Skipping this step renders the application incomplete, meaning that payroll will not process your request until this information is received.

People sometimes overlook the significance of notifying the payroll department regarding any changes to their bank account. If you close an account or switch banks without informing Manpower, your pay could be delayed. Keeping communication open and timely reporting any changes is essential.

Lastly, misunderstanding the terms and conditions related to the paycard option can lead to unexpected surprises later on. By not thoroughly reading through the terms, you may miss crucial details about associated fees and conditions of use. It is advisable to review this information carefully to ensure you are comfortable with the pay methods available.

Awareness of these common mistakes is vital for a smooth payroll experience. Take a moment to review your application carefully before submission, and you can help prevent unnecessary delays in receiving your hard-earned wages.

Documents used along the form

In the employment context, ensuring that financial transactions, such as direct deposits, are processed smoothly is crucial for both employees and employers. Various forms and documents accompany the Direct Deposit Paycard Authorization form, each serving a specific purpose in the payroll process. Understanding these additional documents can help streamline the onboarding and payment processes.

- W-4 Form: This form is used by employees to indicate their tax situation to their employer. It specifies withholding allowances and determines how much federal income tax should be withheld from their paycheck.

- Direct Deposit Enrollment Form: Similar to the paycard authorization, this form allows employees to enroll in direct deposit for their paychecks, specifying bank account details for fund transfers.

- Employee Information Form: This document collects essential information from the employee, such as contact details, employment history, and relevant identification numbers, which are important for payroll and benefits administration.

- Voided Check: A document issued by the employee’s bank that confirms the account details for direct deposit. This check ensures accuracy in routing and account numbers.

- Paycard Agreement: This document outlines the terms and conditions related to the use of a paycard for receiving wages. It details any fees, usage restrictions, and employee responsibilities.

- State Tax Withholding Form: Depending on the state, employees may need to fill out a form to determine state income tax withholding, similar to the federal W-4 form.

- Employment Application: Although primarily used during the hiring process, this form contains vital information that may be referenced for payroll and benefits, such as the employee's name, social security number, and contact details.

- Benefits Enrollment Form: This form enables employees to elect benefits such as health insurance and retirement plans, which can affect their overall compensation package.

By ensuring all necessary forms are completed accurately, employees can facilitate timely and proper payment processing. It is important to keep open lines of communication with employers regarding any changes to personal or banking information to avoid delays.

Similar forms

- W-4 Form: This document outlines an employee's tax withholding preferences. Like the Direct Deposit Paycard Authorization form, it requires personal information, including the employee's name and Social Security Number.

- Direct Deposit Authorization Form: Similar to the Paycard Authorization form, this document provides instructions for automatic date deposits into a bank account. It captures bank account information and requires the employee's consent.

- Expense Reimbursement Form: Used for claiming refunds on business-related expenses. It demands details about the employee and the amounts being requested, reflecting the requirement for clear financial transactions.

- Payroll Deduction Authorization Form: Employees complete this form to authorize deductions from their paychecks for various purposes, like benefits or loans. It requires specific approvals and includes personal identification details, mirroring the structure of the Direct Deposit form.

- Bank Account Verification Form: This form confirms an employee’s bank details for various transactions, ensuring accuracy in information. It holds a similar importance in confirming compliance for payments as the Paycard Authorization form does.

- Tax Direct Deposit Form: Often provided by government tax agencies, this document allows taxpayers to direct their refunds into specific accounts. It involves similar personal and banking details and requires authorization.

- Insurance Benefit Enrollment Form: This document allows employees to enroll in benefits and requires personal information. Like the Paycard Authorization form, it necessitates informed consent to activate the benefits.

- Employee Information Form: This form collects personal and employment information for HR records. Its purpose is similar, as it ensures the accuracy of data needed for processing payments and communications.

Dos and Don'ts

When filling out the Direct Deposit Paycard Authorization form, attention to detail is crucial to ensure a smooth process. Here are some key do's and don'ts to guide you:

- Do provide accurate personal information, including your full name, Social Security Number, and date of birth.

- Do ensure that the bank account details, such as ABA Routing Number and account number, are correctly entered.

- Do submit a voided check or an official bank letter for each account listed to avoid processing delays.

- Do inform Manpower promptly of any changes to your bank account or its closure to prevent payment issues.

- Don't include deposit slips with your application; they will not be accepted.

- Don't forget to sign and date the form at the bottom before submitting it.

These guidelines will help you navigate the process effectively and minimize any potential complications.

Misconceptions

- Direct deposit is only for employees with a bank account. Many believe that they need a traditional bank account to use direct deposit. However, employees can also receive their wages through a paycard, which functions similarly to a debit card.

- It’s complicated to switch between direct deposit and paycard. Switching from one payment method to another is usually a straightforward process. Simply fill out the appropriate sections on the authorization form to make the change.

- I must provide a deposit slip for my bank account. Some assume that they can use deposit slips to verify their account information. The authorization form specifically requires a voided check or a bank letter on official letterhead, not a deposit slip.

- Direct deposit guarantees immediate access to my funds. It’s important to note that, depending on the bank’s processing time, employees may not see their funds immediately. Funds are typically available within two pay periods, depending on the bank's processes.

- Once I sign the authorization, I can’t change anything. Employees often think that signing the form means they are locked into one payment method. This is not true; you can update or change your payment method at any time by notifying the employer.

- The bank will notify me if there’s an issue with my account. Many mistakenly believe that the bank will reach out if there's a problem. In reality, it’s the employee’s responsibility to notify their employer of any changes to their bank account, as failing to do so could delay pay.

- Using a paycard incurs no fees. Employees sometimes expect that there are no fees associated with paycards. It’s crucial to review the terms and conditions, as there may be fees attached for certain transactions, such as ATM withdrawals.

- If my funds are rejected, I will receive a paper check immediately. Some employees think that they can quickly get a paper check if their direct deposit fails. However, if a payment is rejected, the company cannot issue a check until the funds are returned from the bank, which often takes several days.

- I need to provide my Social Security Number (SSN) for direct deposit. While the form asks for an SSN, some believe it is mandatory for direct deposit eligibility. The SSN is primarily for identification purposes and not a requirement for directing funds to a paycard.

- My employer can change my payment method without my consent. Many employees fear that their company can alter their payment method. In fact, employers require written notice from the employee to change any details in their direct deposit or paycard authorizations.

Key takeaways

When filling out the Direct Deposit Paycard Authorization form, consider the following key takeaways:

- Personal Information is Essential: Complete all required fields, including your name, Social Security Number, and correct bank account details.

- Account Verification: Submit a voided check or an official bank letter for each listed account to validate your information.

- Notification of Changes: Inform Manpower immediately of any changes or closures to your bank account to avoid delays in pay.

- Processing Time: Expect that pay will be automatically deposited into your account within two pay periods, depending on your bank’s processing time.

- Authorization Remains Effective: Your authorization to deposit your wages will continue until written notice is provided to Manpower for termination.

- Paycard Option: If you choose the paycard option, ensure you read and understand the associated terms, conditions, and fees before signing.

Browse Other Templates

Academy of Art University Transcript - Accessing transcripts is important for job applications and further education.

Texas Vehicle Information Request,Motor Vehicle Records Access Form,TxDMV Record Inquiry Form,Vehicle Title and Registration Request,Personal Vehicle Information Application,Motor Vehicle Data Request Form,Texas Driver Privacy Record Request,Vehicle - Any misuse of the information obtained can lead to legal ramifications for the requester.