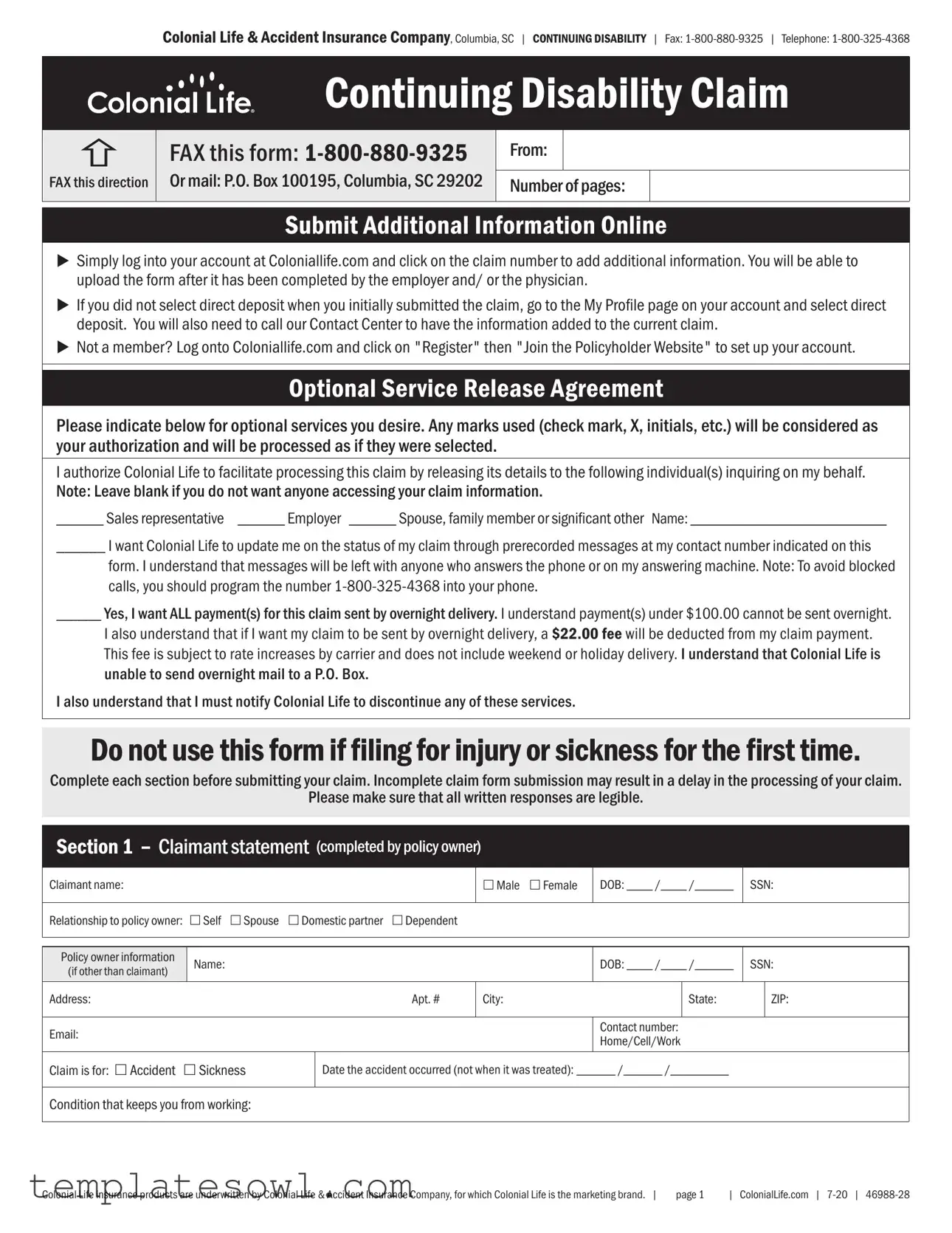

Fill Out Your Disability Claim Form

Filing a Disability Claim can seem daunting, but understanding the process, particularly the Disability Claim form, can make it much easier. This form, provided by Colonial Life & Accident Insurance Company, is structured into several sections that require specific information from both the claimant and the employer, as well as healthcare providers. The first section gathers details from the claimant, including personal information, the dates of inability to work, and an outline of daily activities they can no longer perform. Next, the employer needs to provide statements confirming the employee's work status and any accommodations available. Lastly, the physician must complete their section, detailing the medical condition that inhibits the claimant's ability to work and any treatments they have received. Be mindful that incomplete submissions can lead to delays, so it's crucial to ensure every section is filled out accurately and legibly. Additionally, there are optional services available for updates and express payments, giving you more control over how and when you receive assistance. This form plays a vital role in ensuring that individuals receive the benefits they deserve during challenging times, so handling it properly is paramount for a smooth claims process.

Disability Claim Example

Colonial Life & Accident Insurance Company, Columbia, SC | CONTINUING DISABILITY | Fax:

Continuing Disability Claim

FAX this direction

FAX this form:

Or mail: P.O. Box 100195, Columbia, SC 29202

From:

Number of pages:

Submit Additional Information Online

uSimply log into your account at Coloniallife.com and click on the claim number to add additional information. You will be able to upload the form after it has been completed by the employer and/ or the physician.

uIf you did not select direct deposit when you initially submitted the claim, go to the My Profile page on your account and select direct deposit. You will also need to call our Contact Center to have the information added to the current claim.

uNot a member? Log onto Coloniallife.com and click on "Register" then "Join the Policyholder Website" to set up your account.

Optional Service Release Agreement

Please indicate below for optional services you desire. Any marks used (check mark, X, initials, etc.) will be considered as your authorization and will be processed as if they were selected.

I authorize Colonial Life to facilitate processing this claim by releasing its details to the following individual(s) inquiring on my behalf. Note: Leave blank if you do not want anyone accessing your claim information.

______ Sales representative ______ Employer ______ Spouse, family member or significant other Name: _________________________

______ I want Colonial Life to update me on the status of my claim through prerecorded messages at my contact number indicated on this

form. I understand that messages will be left with anyone who answers the phone or on my answering machine. Note: To avoid blocked calls, you should program the number

______ Yes, I want ALL payment(s) for this claim sent by overnight delivery. I understand payment(s) under $100.00 cannot be sent overnight.

I also understand that if I want my claim to be sent by overnight delivery, a $22.00 fee will be deducted from my claim payment. This fee is subject to rate increases by carrier and does not include weekend or holiday delivery. I understand that Colonial Life is unable to send overnight mail to a P.O. Box.

I also understand that I must notify Colonial Life to discontinue any of these services.

Do not use this form if filing for injury or sickness for the first time.

Complete each section before submitting your claim. Incomplete claim form submission may result in a delay in the processing of your claim.

Please make sure that all written responses are legible.

Section 1 – Claimant statement (completed by policy owner)

Claimant name:

£Male £Female

DOB: ____ /____ /______

SSN:

Relationship to policy owner: £Self £Spouse |

£Domestic partner £Dependent |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Policy owner information |

Name: |

|

|

|

DOB: ____ /____ /______ |

SSN: |

||

(if other than claimant) |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

Address: |

|

|

Apt. # |

City: |

|

State: |

|

ZIP: |

|

|

|

|

|

|

|

|

|

Email: |

|

|

|

|

Contact number: |

|

|

|

|

|

|

|

Home/Cell/Work |

|

|

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Claim is for: £Accident £Sickness |

|

Date the accident occurred (not when it was treated): ______ /______ /_________ |

|

|

||||

|

|

|

|

|

|

|

|

|

Condition that keeps you from working:

Colonial Life insurance products are underwritten by Colonial Life & Accident Insurance Company, for which Colonial Life is the marketing brand. | |

page 1 |

| ColonialLife.com | |

Colonial Life & Accident Insurance Company, Columbia, SC | CONTINUING DISABILITY | Fax:

Claim Fraud Statements

For your protection, the laws of several states, including Alaska, Arkansas, Delaware, Idaho, Indiana, Louisiana, Minnesota, New Hampshire, Ohio, Oklahoma, and others, require the following statement to appear on this claim form. Fraud Warning: Any person who knowingly, and with intent to injure, defraud, or deceive an insurance company, files a statement of claim containing any false, incomplete, or misleading information is guilty of insurance fraud, which is a felony.

Alabama: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or who knowingly present false information in an application for insurance is guilty of a crime and may be subject to restitution fines or confinement in prison, or any combination thereof.

Arizona: For your protection Arizona law requires the following

statement to appear on this form: Any person who knowingly presents a false or fraudulent claim for payment of a loss is subject to criminal and civil penalties.

California, Rhode Island, Texas and West Virginia: For your protection, California, Rhode Island, Texas and West Virginia law requires the following to appear on this form: Any person who knowingly presents false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

Colorado: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Division of Insurance within the Department of Regulatory Agencies.

District of Columbia: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits if false information materially related to a claim was provided by the applicant.

Florida: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony of the third degree.

Kentucky: For your protection, Kentucky law requires the following to

appear on this form: Any person who knowingly and with intent to defraud any insurance company or other person files a statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime.

Maine, Tennessee, Virginia and Washington: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines or a denial of insurance benefits.

Maryland: Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

New Jersey and New Mexico: Any person who knowingly files a statement of claim containing any false or misleading information is subject to criminal and civil penalties.

New York: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed five thousand dollars and the stated value of the claim for each such violation.

Pennsylvania: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties

Puerto Rico: Any person who knowingly and with the intention of defrauding presents false information in an insurance application, or presents, helps, or causes the presentation of a fraudulent claim for the payment of a loss or any other benefit, or presents more than one claim for the same damage or loss, shall incur a felony and, upon conviction, shall be sanctioned for each violation with the penalty of a fine of not less than five thousand (5,000) dollars and not more than ten thousand (10,000) dollars, or a fixed term of imprisonment for three (3) years, or both penalties. If aggravating circumstances are present, the penalty thus established may be increased to a maximum of five (5) years; if extenuating circumstances are present; it may be reduced to a minimum of two (2) years.

Colonial Life insurance products are underwritten by Colonial Life & Accident Insurance Company, for which Colonial Life is the marketing brand. | |

page 2 |

| ColonialLife.com | |

Colonial Life & Accident Insurance Company, Columbia, SC | CONTINUING DISABILITY | Fax:

Claimant name:

Claimant SSN:

Section 1 – Claimant statement ~ continued (completed by policy owner)

Have you been unable to work?: £ Yes £ No If yes, list the dates unable to work: From: _______ / _______ / ________ To: _______ / _______ / ________

Date returned to work:

If not employed

List dates of house confinement: From: ______ / _______ / _________ To: ______ / _______ / _________

House confinement means you are kept at home (in house or yard) by the condition. However, you may follow physician's orders, even if it means leaving home.

Have you been unable to perform activities of daily living? £Yes £No |

If yes, list dates: From: ______ / _______ / _________ To: ______ / _______ / _________ |

Check activities of daily living that you are unable to perform: £Dressing |

£Eating £Meal preparation £Bathing £Transferring £Toileting £Continence |

Certification

Policy owner’s name: _________________________________________________________________________ SSN: _________________________

I have checked the answers on this claim form, and they are correct. I certify under penalty of perjury that my correct Social Security number is shown on this form. I acknowledge that I received the Claim Fraud Statements on page two of this form and that I read the statement required by the State Department of Insurance for my state, if my state was listed on the form. Fraud Warning: Any person who knowingly and with intent to defraud any insurance company or other person files a statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime.

____________________________________________________ |

____________________________________________________ |

______________________________ |

Print claimant’s name |

Claimant’s signature |

Date |

____________________________________________________ |

____________________________________________________ |

______________________________ |

Print policy owner’s name |

Policy owner’s signature |

Date |

Section 2 – Employer statement (completed by employer)

Employee name: |

|

|

|

|

|

|

Employee title: |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

Average number of scheduled hours per week: |

|

Date last worked: _____ / _____ / ________ |

Date employment terminated: _____ / _____ / ________ |

||||||||

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||

Was the employee at work when accident or sickness occurred? £Yes £No |

|

|

Was a workers’ compensation claim filed? £Yes £No |

||||||||

|

|

|

|

|

|

|

|

|

|||

Workers’ compensation carrier: |

|

|

|

|

|

Telephone: |

|

||||

|

|

|

|

||||||||

Employee unable to work |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

||

Do you permit light duty for employee? £Yes £No |

|

Do you permit partial duty for employee? £Yes £No |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Actual return to work |

|

|

|

Actual return to work |

|

||

Expected return to work: _______ / ______ / ________ |

|||||||||||

|

|

|

|

|

|

|

|

|

|||

Employee’s |

|

£ Sitting _____ per hr. £ Walking _____ per hr. £ Climbing stairs/ladders _____ per hr. £ Standing _____ per hr. £ Driving _____ hrs. per day |

|||||||||

duties |

|

|

|

|

|

|

|

|

|

|

|

include: |

|

Lifting: £ Less than 15 lbs. £ 15 to 44 lbs. £ More than 45 lbs. |

Stooping/bending: £ none £ seldom £ frequent |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

Contact for updates on return to work status: |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Telephone: |

|

|

|

Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Fraud warning: Any person who knowingly files a statement of claim containing false or misleading information is subject to |

|||||||||||

|

|

criminal and civil penalties. This includes employer’s portions of the claim form. |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

______________________________________________________________________________________________________ |

|

______________________________ |

|||||||||

|

|

||||||||||

|

|

|

Signature of authorized person |

|

|

|

|

|

Date (MM/DD/YYYY) |

||

|

|

|

|

|

|

|

|

|

|||

Title of authorized person signing: |

|

|

|

|

Employer/company name: |

|

|||||

|

|

|

|

|

|

|

|

|

|

||

Telephone: |

|

Fax: |

|

|

Email: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

Colonial Life insurance products are underwritten by Colonial Life & Accident Insurance Company, for which Colonial Life is the marketing brand. | |

page 3 |

| ColonialLife.com | |

Colonial Life & Accident Insurance Company, Columbia, SC | CONTINUING DISABILITY | |

Fax: |

| Telephone: |

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Claimant name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Claimant SSN: |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Section 3 – Physician statement (completed by physician) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Patient name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DOB: _____ / _____ / _______ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Is condition due to an accidental injury? £Yes £No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

What diagnosis prevents the patient from working? (If pregnancy, list complications.) |

|

|

|

|

|

|

|

|

|

|

|

|

Date first treated for this diagnosis: |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

______ / ______ / ________ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Are there any secondary diagnoses preventing the patient from working? £Yes £No |

Secondary diagnoses: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

When did symptoms first appear? |

|

Date of new patient consultation: |

|

Symptoms: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

______ / ______ / _________ |

|

______ / ______ / _________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current treatment plan: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

List any test performed (submit copy of test results): |

|

|

|

|

|

|

|

List any surgeries performed (submit copy of operative report): |

|

|

|||||||||||||||||||

Date: _________ / _________ / ___________ |

CPT code: ________________ |

|

|

|

Date: _________ / _________ / ___________ |

CPT code: ________________ |

|

||||||||||||||||||||||

Date: _________ / _________ / ___________ |

CPT code: ________________ |

|

|

|

Date: _________ / _________ / ___________ |

CPT code: ________________ |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

Date of patient’s last visit: |

|

|

|

|

Date of next scheduled visit: |

|

|

|

How soon do you expect significant improvement in the patient’s medical condition? |

|

|||||||||||||||||||

______ / ______ / _________ |

|

|

|

|

______ / ______ / _________ |

|

|

|

|

£1 - 2 months |

£3 - 4 months |

£5 - 6 months |

£more than 6 months |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

Does patient have permanent restrictions and/or limitations? £Yes £No |

|

|

|

|

Limitations (patient CANNOT DO): |

|

Restrictions (patient SHOULD NOT DO): |

|

|||||||||||||||||||||

If yes, which ones are permanent: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Dates unable to work |

From: _____ / ______ / ________ |

To: _____ / ______ / ________ |

|

Expected return to work: _____ / ______ / ________ |

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dates able to work |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From: _____ / ______ / ________ To: _____ / ______ / ________ |

Number of hours: ___________ |

|

Actual return to work (full time): _____ / ______ / ________ |

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Did this condition require house confinement?: £Yes £No |

If yes, From: ______ / ______ / _________ To: ______ / ______ / _________ |

|

|

|

|

||||||||||||||||||||||||

House confinement means the patient is kept at home (in house or yard) by the condition. However, the patient may follow your orders, even if it means leaving home. |

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Check activities of daily living that the patient is unable to perform: £Dressing |

£Eating £Meal preparation |

£Bathing |

£Transferring £Toileting £Continence |

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Dates unable to perform activities of daily living: From: _____ / _____ / ________ |

To: _____ / _____ / ________ |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Date(s) of hospitalization (last 3 months): |

|

|

|

|

|

|

|

|

|

Date(s) of office visit (last 3 months): |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Have you referred patient to a specialist? £Yes £No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hospital: |

|

|

|

|

|

|

|

|

|

|

|

Specialist: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address: |

|

|

|

|

|

State: |

|

ZIP: |

|

|

|

Address: |

|

|

|

|

|

|

|

State: |

ZIP: |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone: |

|

|

Fax: |

|

|

|

|

|

|

|

Telephone: |

|

|

|

Fax: |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

PREGNANCY |

|

|

Date of delivery: _______ / _______ / __________ |

|

|

|

Type of delivery: £Vaginal |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Fraud warning: Any person who knowingly files a statement of claim containing false or misleading information is subject to |

|

||||||||||||||||||||||||||||

criminal and civil penalties. This includes Attending Physician portions of the claim form. |

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

_________________________________________________________________________________________ |

|

|

|

___________________________________ |

|

||||||||||||||||||||||||

|

|

|

|

|

|

Physician signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date (MM/DD/YYYY) |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Physician/group name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Patient account number: |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Physician’s specialty: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone: |

|

|

|

|

Fax: |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

|

|

|

State: |

|

ZIP: |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Tax ID or SSN: |

|

|

|

|

|

|

|

|

|

|

|

Do you accept medical record requests by fax? |

£Yes £No |

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Do you require a special authorization for release of information? £Yes £No |

|

Patient Portal £Yes £No |

|

Will you accept the standard HIPAA release? |

£Yes £No |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Was patient referred to you by another physician? £Yes £No |

|

|

|

Authorization on file to release information to Colonial Life: £Yes |

£No |

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Referring physician: |

|

|

|

|

|

|

|

|

|

|

|

Telephone: |

|

|

|

Fax: |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

|

|

|

State: |

|

ZIP: |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Colonial Life insurance products are underwritten by Colonial Life & Accident Insurance Company, for which Colonial Life is the marketing brand. | |

page 4 |

| ColonialLife.com | |

Form Characteristics

| Fact Name | Description |

|---|---|

| Company Information | The form is issued by Colonial Life & Accident Insurance Company, based in Columbia, SC. |

| Fax Submission | Claims can be sent via fax to 1-800-880-9325. |

| Online Information | Additional information can be submitted online at Coloniallife.com using the claim number. |

| Direct Deposit | If direct deposit was not selected initially, claimants must update their preferences via their online profile. |

| Eligibility Requirement | This form should not be used for filing a claim for the first time due to injury or sickness. |

| Fraud Warning | Multiple states require a fraud warning statement, emphasizing the consequences of providing false information. |

| Activities of Daily Living | Claimants must specify if they are unable to perform essential daily activities like dressing or bathing. |

| Claimant Certification | The claimant must certify that the information provided is accurate under penalty of perjury. |

| Section Requirement | The form consists of three sections: claimant statement, employer statement, and physician statement. |

Guidelines on Utilizing Disability Claim

Completing the Disability Claim form is crucial for ensuring that your claim is processed in a timely manner. By following the steps outlined below, you can help facilitate the submission of your claim. Each section must be completed accurately to avoid delays.

- Gather Necessary Information: Before starting the form, collect relevant documents such as your identification, social security number, and any medical records related to your condition.

- Fill Out Section 1 – Claimant Statement: Include your personal information, including your name, date of birth, social security number, and contact details. Indicate your relationship to the policy owner and the nature of your claim (accident or sickness).

- Document Your Employment Status: State whether you have been unable to work, the dates of your inability to work, and your return-to-work dates if applicable. Provide details about whether your condition has impacted your daily living activities as well.

- Complete Optional Service Release Agreement: If desired, authorize individuals to obtain information about your claim, and indicate your preference for receiving updates and payment delivery options.

- Section 2 – Employer Statement: Give this section to your employer for completion. They will need to provide your work status, including last worked date and any work-related conditions.

- Section 3 – Physician Statement: Ensure that your physician completes this section. They will provide medical details about your condition, treatment history, and any limitations you may have.

- Review the Form: Carefully review all sections to ensure that all information is accurate and fully filled out. Legibility is essential.

- Submit the Form: Choose to fax the completed claim to 1-800-880-9325 or mail it to P.O. Box 100195, Columbia, SC 29202.

- Follow Up: After submission, check your account online or contact customer service to ensure your claim is being processed.

What You Should Know About This Form

What should I do if I forgot to select direct deposit when I submitted my claim?

If you did not select direct deposit, you can go to the My Profile page on your Colonial Life account and choose direct deposit. Additionally, you’ll need to call the Contact Center to have this information added to your current claim.

How can I submit my Continuing Disability Claim form?

You can submit your claim form by faxing it to 1-800-880-9325 or mailing it to P.O. Box 100195, Columbia, SC 29202. Make sure to double-check that your claim form is complete to avoid processing delays.

Can I provide additional information after submitting my claim form?

Yes, simply log into your account at Coloniallife.com and click on your claim number. From there, you can add additional information and upload the completed form signed by your employer or physician.

What if my payment is less than $100?

If your claim payment is under $100, it cannot be sent via overnight delivery, regardless of your request. Standard delivery will apply, and you will be notified when your payment is processed.

Is there an option to have my claim payments sent by overnight delivery?

Yes, you may choose to have your payment sent by overnight delivery for a fee of $22. Please note that this fee is subject to changes by the carrier and does not cover delivery on weekends or holidays.

What happens if I do not complete all sections of the claim form?

Leaving sections of the claim form incomplete may lead to delays in processing your claim. It's crucial to ensure that all responses are legible and each section is thoroughly completed.

Can I authorize someone to check on my claim status?

Yes, you can authorize individuals such as a sales representative, family member, or employer to check on your claim. You must indicate this on the form, and your authorization will be processed as if it were selected by you.

What information must my physician provide when completing the claim form?

Your physician must provide details such as the diagnosis preventing you from working, treatment plans, any surgeries or tests performed, and how long you are expected to be unable to work. This information helps in evaluating your claim.

What should I do if I experience fraud while filing my claim?

Be aware that reporting false or misleading information is considered insurance fraud. If you suspect any fraud related to your claim, you should report it immediately following your state’s procedures. Each state has different laws regarding penalties for fraud.

When should I expect to receive an update on my claim status?

You will receive updates on your claim status based on the processing timeline. If you opted for updates via prerecorded messages, you will be informed through the contact number provided on your claim form. Make sure to check your messages regularly but also feel free to reach out to the Contact Center for real-time updates.

Common mistakes

Filling out a Disability Claim form can be a daunting task. Many people inadvertently make mistakes that delay the approval process. One common error is failing to provide complete information. Each section of the form is critical. If any section is left blank, it can lead to complications and delays. Always ensure that you complete every part before submitting your claim.

Another mistake involves illegible handwriting. In many cases, reviewers rely on what is written on the form to make decisions. If the writing is unclear, it may be misinterpreted, leading to potential denial of the claim. To avoid this, write neatly or consider typing your responses if possible.

Some individuals forget to include the dates of their disability. This can be a crucial detail. It's important to specify when you were last able to work and when your symptoms began. Omitting these dates can raise questions and lead to further investigation into your claim.

Not having your physician complete their section of the form accurately can also cause issues. It's essential to ensure that the doctor provides all necessary information regarding your medical condition and treatment. If this section is incomplete, it may result in a delay or denial of benefits.

Additionally, many claimants do not read the instructions accompanying the form carefully. Instructions are provided to help you gather the necessary information appropriately. Missing a step or misunderstanding a requirement can lead to setbacks. Taking the time to read and understand these directions can save you frustration later.

Finally, always remember to double-check your contact information. Sometimes, claims are denied simply because the insurance company cannot reach you for more information. Ensure that your phone number and address are current and accurate, so you can receive updates regarding your claim promptly.

Documents used along the form

When submitting a Disability Claim form, several additional documents and forms may be required to support your claim. Each document has a specific purpose and can help ensure that your claim is processed efficiently and accurately. Here is a list of commonly associated documents and their descriptions:

- Employer Statement: This form is completed by the employer to verify the employee's work status, including dates of employment and reasons for absence. It provides essential information about the claimant’s job and the circumstances surrounding the leave.

- Physician Statement: Completed by the treating physician, this document includes medical information such as diagnosis, treatment plans, and any restrictions on work. It is crucial for substantiating the medical basis of the disability claim.

- Authorization for Release of Information: This consent form allows the insurance company to obtain medical records and other necessary documentation from healthcare providers. This is essential for validating the claim.

- Social Security Administration Records: Documentation from the SSA can assist in proving disability status or any benefits received from government programs, adding weight to the claim.

- Income Verification Form: This form confirms the claimant's income before the onset of the disability, which helps in calculating the appropriate benefit amount.

- Additional Information Form: Sometimes, a form may be required to provide further details or updates about the claimant's condition or situation. This supports the accuracy of the claim.

- Service Release Agreement: This optional agreement enables the insurer to share claim information with designated individuals, such as family members or representatives, streamlining communication during the claims process.

Collecting and submitting these documents ensures that your Disability Claim is comprehensive and well-supported. It minimizes delays and improves the likelihood of a successful claim outcome.

Similar forms

The Disability Claim form bears similarities to several other important documents often utilized in insurance and benefit applications. Here are four such documents:

- Workers' Compensation Claim Form: Like the Disability Claim form, the Workers' Compensation Claim Form captures information about an individual's medical condition and the inability to work due to injury or illness. Both forms require detailed reports from the claimant and employer to assess eligibility for benefits.

- Short-Term Disability Application: This document is intended for individuals applying for short-term disability benefits. It similarly includes personal information, a statement of the medical condition, and verification from both the claimant and a healthcare provider, akin to the Disability Claim form.

- Long-Term Disability Claim Form: In addition to personal and medical information, this form requires evidence of how an individual's condition interferes with their ability to perform work duties, paralleling the requirement in the Disability Claim form to describe the limitations affecting the claimant.

- Health Insurance Claim Form: This form is used to obtain reimbursement for medical expenses. Like the Disability Claim form, it necessitates clear details about medical treatment and the reasons for seeking insurance benefits, ensuring that the claim is processed correctly.

Dos and Don'ts

When filling out a Disability Claim form, there are important considerations to keep in mind. Below is a list of things to do and things to avoid to ensure a smooth submission process.

- Ensure all sections of the claim form are completed thoroughly.

- Double-check that all written responses are legible.

- Provide accurate dates of injury or sickness and their severity.

- Sign and date the form in the appropriate sections.

- Include any required documentation from employers or physicians.

- Do not submit an incomplete claim form, as it may delay processing.

- Avoid using abbreviations or unclear descriptions.

- Do not include any false or misleading information.

- Refrain from writing additional notes outside of the designated areas.

- Do not forget to keep a copy of the completed claim form for your records.

Misconceptions

Misconceptions about the Disability Claim form can lead to confusion or delays in processing claims. Below is a list of common misconceptions and explanations for each.

- It is unnecessary to provide complete information. Some individuals believe that filling out only part of the form suffices. However, incomplete submissions can delay processing times.

- Direct deposit is automatically set up. Many assume that their initial claim submission includes direct deposit. If this option was not selected, one must update their profile separately.

- The form can be submitted without a physician's statement. This is incorrect. A physician's statement is often required to validate the claim and provide necessary medical details.

- Making changes to the form post-submission is allowed. Once submitted, changes cannot be made to the form. New information must be submitted separately with proper documentation.

- Claims are processed immediately. While there are processes in place to expedite claims, several factors can influence the speed, including the completeness of the submission and the need for additional information.

- All claims are approved without review. Not every claim is guaranteed approval. All claims undergo reviews to ensure they meet the necessary criteria based on policy terms.

- Once approved, payments are always expedited. Although some payments can be delivered overnight, fees apply, and certain conditions may preclude overnight service.

- The form can be faxed or mailed without adhering to specific protocols. Individuals must follow outlined submission protocols, including ensuring all required documents are included.

- Claimants can freely provide their claim detail to anyone. Sharing claim information is limited, and authorization may be required for third-party inquiries.

- Fraud warnings on the form are merely legal formalities. The fraud warnings are serious. Filing misleading information may lead to criminal charges and denial of benefits.

Key takeaways

Understanding the process of filling out and utilizing the Disability Claim form from Colonial Life & Accident Insurance Company can greatly enhance your experience. Here are eight key takeaways:

- Complete the form in full: Incomplete submissions can delay the processing of your claim.

- Be legible: Ensure all written responses are clear and easy to read to prevent misunderstanding.

- Provide accurate claimant information: Include correct personal details, such as name, date of birth, and Social Security number.

- Submit additional information online: Log into your account at Coloniallife.com to upload additional details after the form is completed by the employer or physician.

- Check for optional service agreements: If you wish for someone to access your claim information, indicate this choice clearly on the form.

- Direct deposit options: If you didn’t choose direct deposit initially, update this preference in your account and contact the help center.

- Understand the fraud warning: Know the implications of submitting false information, which are serious and can lead to legal consequences.

- Communicate special requests regarding payment delivery: If you prefer overnight mail for payments, remember there is a fee and payment under $100 can’t be sent via this method.

Browse Other Templates

Home Health Documentation Checklist Tool - Reviews emergency preparedness plans provided to patients.

Wellpoint Prior Authorization Form - Only one form is needed for multiple related claims along with a comprehensive listing.

How to Get Power of Attorney Over a Parent in Michigan - Your agent must not be the sole recipient of account statements to ensure transparency in transactions.