Fill Out Your Discharging Indemnity Funding Bond Form

The Discharging Indemnity Funding Bond form serves as a crucial document in the realm of financial agreements and obligations. This form provides a means of indemnification and is issued in connection with significant financial transactions, specifically for the account holder identified as John Alex Doe. The bond includes critical details such as the bond number, issue date, maturity date, and the considerable face value amount of $100,000,000.00. The form outlines the roles of various parties involved, namely the principal, guarantors, and fiduciaries, ensuring that all parties are aware of their responsibilities. Notably, it affirms that this document is authorized under multiple federal laws and acts, emphasizing its legal grounding. Provisions within the bond allow for the satisfaction of debts through offsetting, which enables the account holder to discharge public debts and current obligations effectively. Furthermore, the responsibilities of fiduciaries are specified, including the required timeline for the potential dishonoring of the bond. Ultimately, the Discharging Indemnity Funding Bond serves to facilitate lawful transactions while protecting the interests of all parties involved.

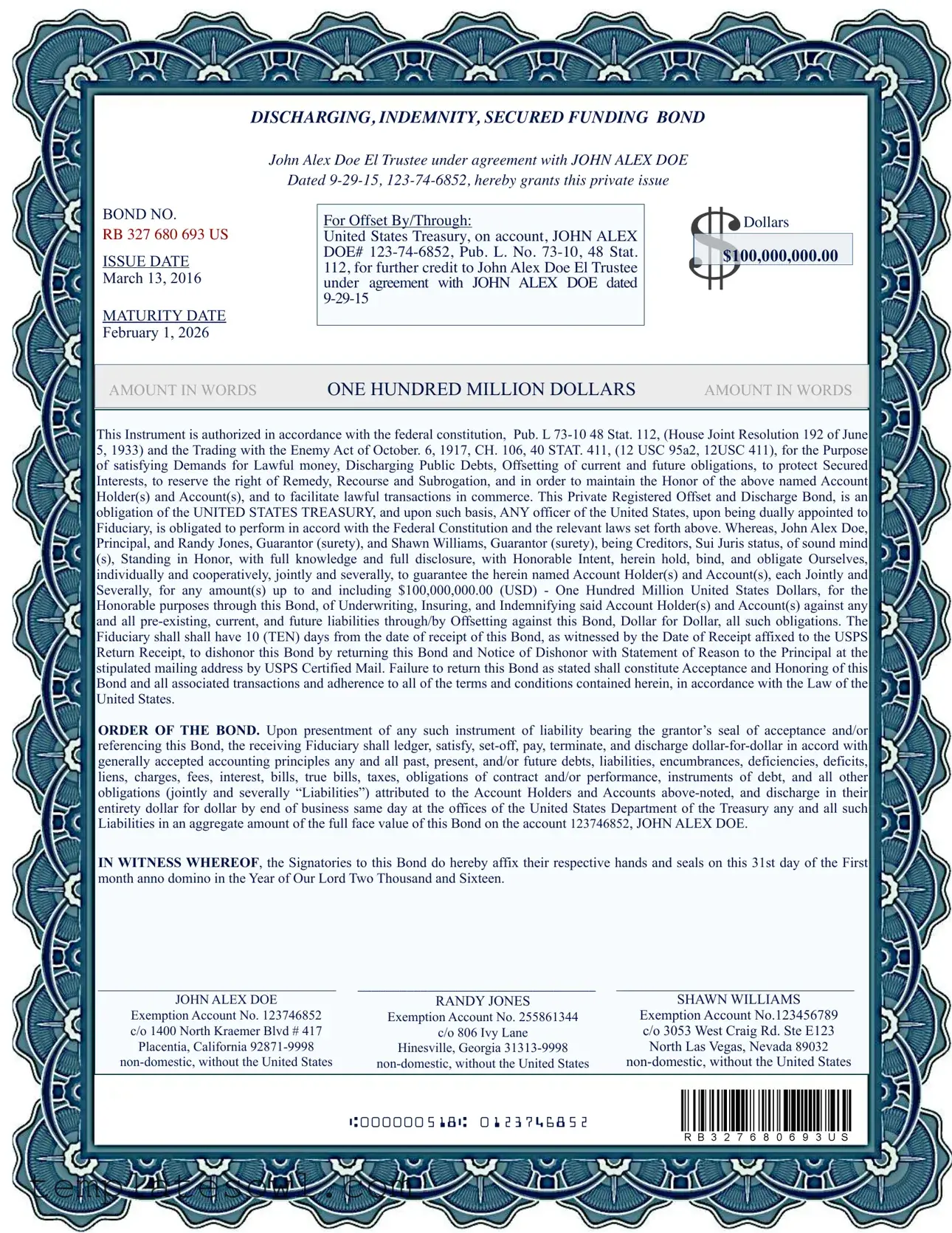

Discharging Indemnity Funding Bond Example

DISCHARGING, INDEMNITY, SECURED FUNDING BOND

BOND NO.

RB 327 680 693 US

ISSUE DATE

March 13, 2016

MATURITY DATE

February 1, 2026

John Alex Doe El Trustee under agreement with JOHN ALEX DOE

Dated

For Offset By/Through:

United States Treasury, on account, JOHN ALEX DOE#

Dollars

$100,000,000.00

AMOUNT IN WORDS |

ONE HUNDRED MILLION DOLLARS |

AMOUNT IN WORDS |

|

|

|

This Instrument is authorized in accordance with the federal constitution, Pub. L

ORDER OF THE BOND. Upon presentment of any such instrument of liability bearing the grantor’s seal of acceptance and/or referencing this Bond, the receiving Fiduciary shall ledger, satisfy,

IN WITNESS WHEREOF, the Signatories to this Bond do hereby affix their respective hands and seals on this 31st day of the First month anno domino in the Year of Our Lord Two Thousand and Sixteen.

__________________________________ |

__________________________________ |

__________________________________ |

JOHN ALEX DOE |

RANDY JONES |

SHAWN WILLIAMS |

Exemption Account No. 123746852 |

Exemption Account No. 255861344 |

Exemption Account No.123456789 |

c/o 1400 North Kraemer Blvd # 417 |

c/o 806 Ivy Lane |

c/o 3053 West Craig Rd. Ste E123 |

Placentia, California |

Hinesville, Georgia |

North Las Vegas, Nevada 89032 |

a000000518a 0123746852

INDEMNITY BOND

WE THE WITNESSES NAMED BELOW DO hereby attest to witnessing the signatories to this Bond affixing their respective hands hereto on this 31st Day of January, 2016.

Witness 1

Sign

Mailing Address

Witness 2

Sign

Mailing Address

NOTES BELOW THIS LINE

I would highly advise that you do NOT use this template and that you create your own unique bond, based on Pub L.

Form Characteristics

| Fact Name | Details |

|---|---|

| Bond Number | RB 327 680 693 |

| Issue Date | March 13, 2016 |

| Maturity Date | February 1, 2026 |

| Face Value | $100,000,000.00 (One Hundred Million Dollars) |

| Governing Laws | Federal Constitution, Pub. L. 73-10, 48 Stat. 112 |

| Fiduciary Obligations | Officers of the United States must honor the bond as per the relevant laws and regulations. |

Guidelines on Utilizing Discharging Indemnity Funding Bond

After completing the Discharging Indemnity Funding Bond form, it is important to ensure that all information is accurate and that it is submitted correctly. Follow the outlined steps to fill out the form appropriately.

- Begin by writing the Bond Number in the designated space. For this form, enter RB 327 680 693.

- Insert the issue date in the specified format. Use March 13, 2016.

- Fill in the maturity date as February 1, 2026.

- In the next section, clearly print the name John Alex Doe in the role of Trustee.

- Write the account number 123-74-6852 under the appropriate field.

- Indicate the amount of the bond. Enter $100,000,000.00 in the designated area.

- In the provided space, write out the amount in words: ONE HUNDRED MILLION DOLLARS.

- Review the language regarding the federal constitution and laws, ensuring it is left unchanged while signing and dating.

- Ensure the names of the Principal and Guarantors are listed as follows: John Alex Doe, Randy Jones, Shawn Williams.

- Confirm the account information, especially the exemption account numbers, for consistency: 123746852, 255861344, 123456789.

- Provide the respective mailing addresses for each individual involved underneath their names.

- Witness signatures and mailing addresses should also be added on the lines provided at the bottom.

What You Should Know About This Form

What is the Discharging Indemnity Funding Bond form?

The Discharging Indemnity Funding Bond form is a financial instrument that helps facilitate lawful transactions by providing a guarantee against existing and future liabilities. It is issued under specific federal laws and provides a mechanism for individuals to discharge debts owed to them through a bond backed by the United States Treasury.

Who is the Principal in this bond?

In this bond, the Principal is John Alex Doe. He is the individual who holds the main rights and responsibilities associated with the bond, allowing him to leverage its benefits for discharging debts or liabilities.

What are the roles of the Guarantors?

The Guarantors, Randy Jones and Shawn Williams, offer additional assurance for the bond. They agree, along with the Principal, to cover any liabilities up to the full amount of the bond, which is $100 million. Their participation strengthens the bond's credibility and support for the obligations outlined.

How does the bond work in practice?

When the bond is presented, the receiving Fiduciary is required to satisfy any liabilities by offsetting them against the bond’s face value. This means if there are debts attributed to the account holders, the Fiduciary will erase those debts dollar-for-dollar, up to the bond's limit, on the same day of receipt.

What happens if the Fiduciary dishonors the bond?

The Fiduciary has ten days to return the bond, along with a notice of dishonor and a statement of reasons, to the Principal. If they do not return it within that timeframe, the bond is considered accepted, and all terms become binding.

How is this bond authorized?

The bond is authorized under the U.S. Constitution, specifically referencing laws like Public Law 73-10 and the Trading with the Enemy Act. These legal frameworks provide the foundation for the bond’s validity and enforceability in U.S. law.

What is the maturity date of the bond?

The bond matures on February 1, 2026. This means that the provisions and obligations of the bond are expected to be settled or executed by this date.

What is the significance of the $100 million amount?

The amount of $100 million signifies the total liability the bond can cover. This ensures that if any debts or liabilities arise, they can be offset fully by this bond, providing substantial security and assurance for the Principal.

Can this bond be used for future obligations?

Yes, the bond can be used to offset both current and future obligations. This feature offers flexibility, allowing the account holders to manage their liabilities effectively over time.

Is it advisable to use this bond as a template?

The bond document itself includes a note advising against using it as a template. Instead, it suggests creating a unique bond tailored to specific needs based on legal statutes. This is important to ensure it meets individual circumstances and legal requirements.

Common mistakes

Filling out the Discharging Indemnity Funding Bond form can be tricky, and several common mistakes can lead to complications later on. First, one of the most frequent errors occurs when individuals provide incorrect or inconsistent personal information. This might include misspelled names, wrong Social Security numbers, or incorrect addresses. Accuracy is vital; even a small mistake can delay processing or create legal complications down the line.

Secondly, many people overlook the importance of properly indicating the amount in both numbers and words. For example, writing "100,000,000" but failing to clearly state it as "One Hundred Million Dollars" can lead to confusion. Consistency here helps avoid ambiguity and ensures that everyone is on the same page regarding the bound amount.

Another common pitfall is neglecting to include the witness signatures. The form explicitly requires witnesses to attest to the signatures of the bondholders. Skipping this step can render the document invalid, thereby eliminating the intended protective benefits of the bond. Without proper witnessing, the whole process could fall flat.

Fourth, many individuals fail to read the fine print. There are specific dates and requirements mentioned that are crucial for the bond's validity. Missing a deadline to return the bond or not adhering to stipulations regarding certifications can invalidate the bond. Understanding every aspect protects your interests effectively.

Fifth, misunderstanding fiduciary duties and obligations is another common mistake. Some individuals might not realize the responsibilities they take on as signatories or fiduciaries. This lack of clarity can lead to misunderstanding about who is accountable for what, potentially resulting in costly legal ramifications.

Sixth, a failure to create a unique bond tailored to individual circumstances can also be a mistake. People often think they can use standard templates without modifications. However, every financial situation is different; what works for one person may not work for another. Tailoring your bond ensures that it best reflects your specific agreement and needs.

Lastly, misunderstanding the regulatory language can be detrimental. The form includes references to laws and acts that may seem intimidating. Many individuals skip researching or clarifying these items. A little bit of knowledge can empower you to address concerns proactively, ensuring that you are fully compliant with regulations.

Documents used along the form

The Discharging Indemnity Funding Bond form is often used alongside other important documents that serve various functions in financial and legal transactions. Here is a list of commonly associated forms, each with a brief description to provide clarity.

- Indemnity Agreement: This document outlines the obligations of one party to compensate another for certain damages or losses. It establishes the terms under which one party agrees to protect another from potential claims.

- Personal Guarantee: In this form, an individual agrees to be personally responsible for the debts or obligations of a business entity. This is often used to secure loans or credit lines for small businesses.

- Trust Agreement: This document outlines the terms of a trust, detailing how assets are to be managed and distributed. It establishes the roles of the trustee and beneficiaries.

- Payment Bond: Typically used in construction contracts, this bond guarantees that a contractor will pay all subcontractors and suppliers involved in a project, providing assurance to all parties involved.

- Loan Agreement: A legally binding contract that outlines the terms of a loan including the amount borrowed, interest rate, repayment schedule, and consequences for default.

- Release of Liability: This form releases one party from liability for certain events or claims. It is often used in situations where one party is offering a service to another, acknowledging that risks are involved.

- Settlement Agreement: This document outlines the terms under which parties agree to resolve a dispute without going to trial. It usually includes compensation terms and any actions required by either party.

- Escrow Agreement: This agreement involves a third party holding funds or assets on behalf of two other parties until certain conditions are met, providing security in transactions.

- Certificate of Authority: This document is issued by a state government to recognize a business's right to exist and operate within that state. It may be required for legal transactions or financing.

Using the Discharging Indemnity Funding Bond in conjunction with these documents can provide a comprehensive approach to financial dealings, ensuring that the obligations and rights of all parties are clearly defined and protected. Understanding each document's role can streamline processes and enhance security in your transactions.

Similar forms

The Discharging Indemnity Funding Bond form shares similarities with several key financial or legal documents. Each of these documents serves distinct functions but operates under similar principles of obligation, liability, and assurance. Below is a summary of four such documents:

- Indemnity Agreement: Like the Discharging Indemnity Funding Bond, an indemnity agreement provides a promise to compensate for any loss or damage. Such agreements are often utilized in various transactions to assure parties that they will be protected from financial harm due to actions of another. This document establishes mutual responsibilities, akin to the bondsman and principals outlined in the funding bond.

- Surety Bond: A surety bond guarantees the obligations of one party to another. It assures that the obligation will be fulfilled, directly parallel to the protective measures featured in the Discharging Indemnity Funding Bond. Through the involvement of a surety, the bond confirms that any defaults will be covered financially, much like the protections afforded to the account holders in the bond form.

- Letter of Credit: A letter of credit is a financial instrument from a bank guaranteeing payment to a seller as long as the seller meets specific conditions. This is similar to the Discharging Indemnity Funding Bond in that it offers security and assurance of payment, protecting parties involved in a transaction from potential financial losses resulting from non-performance or default.

- Escrow Agreement: An escrow agreement involves a neutral third party who holds onto funds or assets until predetermined conditions are met. This concept echoes the obligation aspects of the Discharging Indemnity Funding Bond, where responsibilities and transactions are managed through structured terms, ensuring that all parties' interests are adequately protected until obligations are fulfilled.

Each of these documents plays a critical role in facilitating secure financial transactions, addressing various liabilities and obligations while ensuring that all parties involved are protected under agreed-upon terms.

Dos and Don'ts

When filling out the Discharging Indemnity Funding Bond form, it's essential to follow specific guidelines to ensure the process is smooth. Below are seven things you should and shouldn't do:

- Do: Carefully read all instructions before filling out the form. Understanding each section will minimize errors.

- Do: Use clear, legible handwriting or type the information directly. This ensures that all details are easy to read and understand.

- Do: Double-check all names, amounts, and dates for accuracy. A small mistake can lead to significant delays or issues.

- Do: Keep copies of the completed form and any documents for your records. Documentation may be necessary for future reference.

- Don't: Rush through the form. Take your time to ensure that all information is complete and accurate.

- Don't: Alter any pre-printed information on the form. This may void the bond or create confusion.

- Don't: Ignore any additional instructions provided. Specific details may be required for compliance with legal standards.

Misconceptions

Misconceptions about the Discharging Indemnity Funding Bond form can lead to confusion. Below are some common misconceptions and clarifications:

- This bond is a government guarantee. The bond is a private agreement, not a guarantee from the government. It’s important to understand it remains a private contractual obligation.

- The bond discharges all debts automatically. While the intention is to offset debts, it requires proper presentation and acceptance by relevant parties according to stated procedures.

- Any officer can arbitrarily execute the bond. The bond requires a duly appointed fiduciary. Not every officer has the authority to act on it without proper appointment.

- This form can be used without modification. It’s advised to customize the bond to fit specific situations. Using it as-is may not address unique legal needs.

- There are no deadlines associated with the bond. The bond specifies a ten-day period for dishonor response. Delaying beyond this period implies acceptance.

- The bond is unnecessary for public transactions. If one seeks to facilitate lawful commerce, this bond can serve as a useful tool despite public debt obligations.

- The bond guarantees payment within one business day. While it aims for prompt discharge, the actual processing may vary based on specific circumstances and compliance.

- This bond needs witnesses to be valid. Witnessing is not a strict requirement for validity but is often recommended for additional legitimacy in agreements.

Key takeaways

- Understand the Purpose: This form serves as a Discharging Indemnity Funding Bond, allowing you to offset debts and facilitate lawful transactions in commerce.

- Personal Responsibility: All signatories are personally liable for any obligations up to the bond's total value of $100 million.

- Review Signature Requirements: Ensure all parties involved sign the bond to make it valid; missing signatures can invalidate the agreement.

- Time is of the Essence: The Fiduciary must return any dishonor notice within ten days; neglecting this results in acceptance of the bond.

- Use Plain Language: Avoid over-complicating the bond with legal jargon. Clarity ensures all parties understand their obligations and rights.

- Document Everything: Keep copies of the completed form and any associated correspondence for your records. This can prove essential in future dealings.

- Be Cautious with Defaults: Understand the implications of dishonoring the bond; it may lead to financial disputes or complications.

- Seek Guidance if Needed: If unsure about any aspect, consult with a knowledgeable professional. Proper guidance can prevent costly mistakes.

Browse Other Templates

Restaurant Cleaning Checklist Pdf - Proper waste storage is vital in managing the restaurant's environmental impact.

Registrar Nu - A dedicated section for signature and date confirms student consent and authorizes Northcentral University to release transcripts.

Az New Hire - Indicate the employer's address for the Income Withholding Order to be sent to.