Fill Out Your Disclaimer Inheritance Form

Understanding the Disclaimer Inheritance form is essential for anyone navigating the complexities of inheritance laws, especially as they pertain to shares in a corporation like Tanadgusix Corporation. This document allows an heir to officially refuse their right to inherit a deceased individual's ownership in the company’s stock. The form captures critical information, including the decedent’s identity, date of death, and the number of shares owned. It requires the heir to assert their relationship to the decedent and their intent to disclaim any interest in the inherited assets. By signing this affidavit, the heir not only relinquishes their claim to the shares but also agrees to indemnify the corporation against any resulting claims or disputes that may arise based on this decision. Thus, the Disclaimer Inheritance form serves as both a legal declaration and a protective measure for the corporation, setting the stage for a smoother transition of ownership and mitigating potential legal complications.

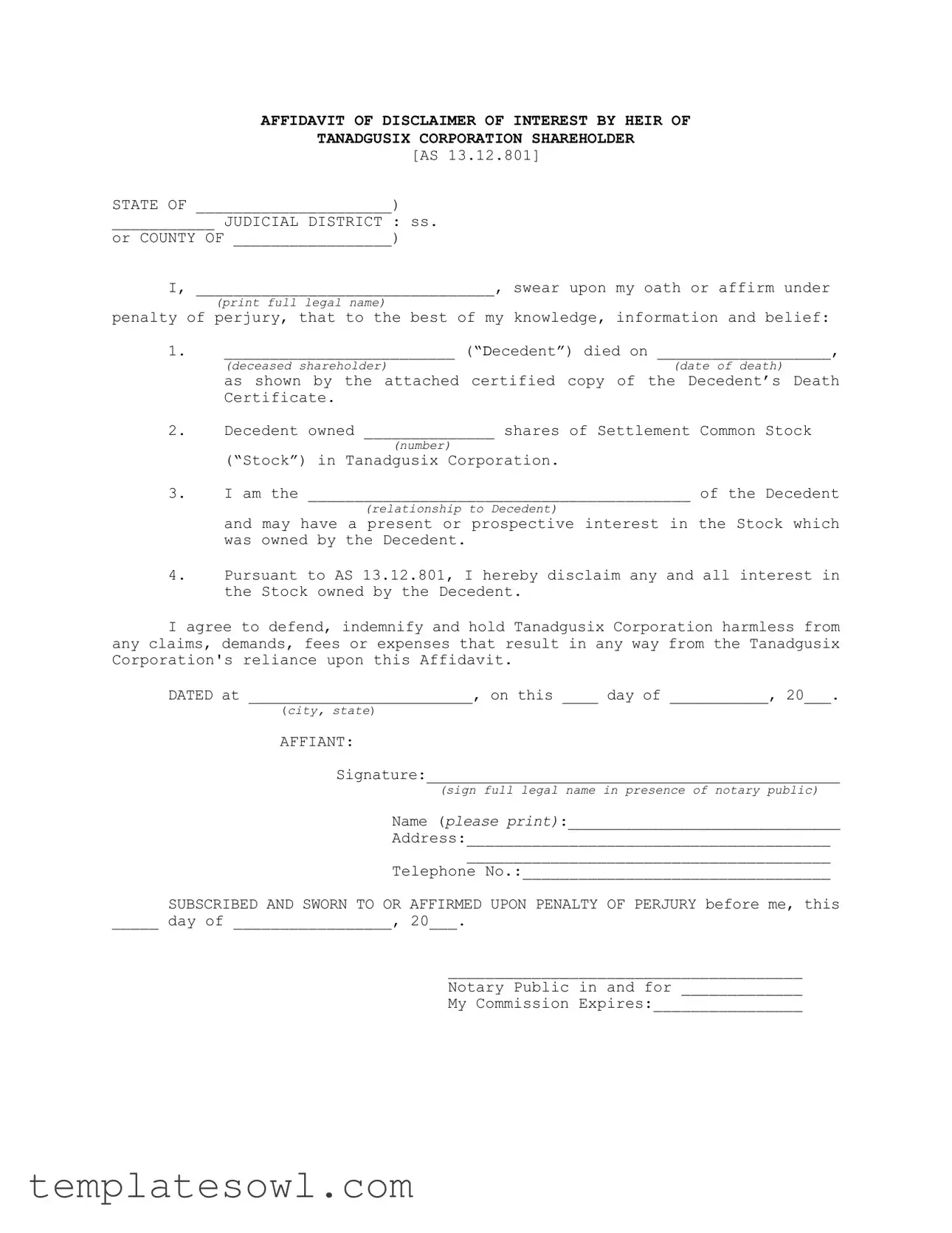

Disclaimer Inheritance Example

AFFIDAVIT OF DISCLAIMER OF INTEREST BY HEIR OF

TANADGUSIX CORPORATION SHAREHOLDER

[AS 13.12.801]

STATE OF _____________________)

___________ JUDICIAL DISTRICT : ss.

or COUNTY OF _________________)

I, ________________________________, swear upon my oath or affirm under

(print full legal name)

penalty of perjury, that to the best of my knowledge, information and belief:

1._________________________ (“Decedent”) died on ___________________,

(deceased shareholder) |

(date of death) |

as shown by the attached certified copy of the Decedent’s Death Certificate.

2.Decedent owned ______________ shares of Settlement Common Stock

(number)

(“Stock”) in Tanadgusix Corporation.

3.I am the _________________________________________ of the Decedent

(relationship to Decedent)

and may have a present or prospective interest in the Stock which was owned by the Decedent.

4.Pursuant to AS 13.12.801, I hereby disclaim any and all interest in the Stock owned by the Decedent.

I agree to defend, indemnify and hold Tanadgusix Corporation harmless from any claims, demands, fees or expenses that result in any way from the Tanadgusix Corporation's reliance upon this Affidavit.

DATED at _________________________, on this ____ day of ___________, 20___.

(city, state)

AFFIANT:

Signature:______________________________________________

(sign full legal name in presence of notary public)

Name (please print):_______________________________

Address:_______________________________________

_______________________________________

Telephone No.:_________________________________

SUBSCRIBED AND SWORN TO OR AFFIRMED UPON PENALTY OF PERJURY before me, this

_____ day of _________________, 20___.

______________________________________

Notary Public in and for _____________

My Commission Expires:________________

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | This form is governed by Alaska Statutes, specifically AS 13.12.801. |

| Purpose | The purpose of the Disclaimer Inheritance form is to formally renounce any interest in shares held by a deceased shareholder. |

| Affidavit Requirement | An individual must provide a sworn statement, affirming the disclaimer under penalty of perjury. |

| Decedent Information | The form requires the name and date of death of the deceased shareholder, showing the connection to their stock. |

| Stock Details | The number of shares owned by the decedent must be specified in the affidavit. |

| Affiant Relationship | The affiant must declare their relationship to the decedent, confirming their standing to disclaim interest. |

| Indemnification Clause | By signing the affidavit, the affiant agrees to indemnify Tanadgusix Corporation against any claims arising from the disclaimer. |

| Notarization | The affidavit must be notarized, validating the identity of the affiant and the legitimacy of the statements made. |

Guidelines on Utilizing Disclaimer Inheritance

Filling out the Disclaimer Inheritance form is a process that requires careful attention to detail. Once completed, this form must be signed in the presence of a notary public to ensure its validity. Below are the steps to guide you through filling out the form correctly.

- Begin by entering the state name where you are filing the form in the first blank space.

- Next, fill in the judicial district or county where you reside, in the space provided.

- Print your full legal name in the designated area under "I, ________________________________".

- Provide the name of the deceased shareholder (referred to as "Decedent") in the corresponding blank.

- Insert the date of death of the Decedent in the next blank space.

- In the following line, state the number of shares owned by the Decedent in Tanadgusix Corporation.

- Identify your relationship to the Decedent by completing the next blank with your description (such as spouse, child, etc.).

- In the next part, clearly indicate your intent to disclaim any interest in the shares by writing “I hereby disclaim any and all interest in the Stock owned by the Decedent.”

- Fill in the city and state where you are signing the affidavit.

- Write the date of signing in the designated area.

- Sign your full legal name in the "AFFIANT" section, ensuring this is done in the presence of a notary public.

- Print your name again under this signature as requested.

- Provide your current address in the designated blank spaces.

- Include your telephone number in the area provided.

- Lastly, the notary public will need to complete their section, which includes their signature and commission expiration date. Ensure you have the notary present to witness your signing before this is completed.

What You Should Know About This Form

What is the purpose of the Disclaimer Inheritance form?

The Disclaimer Inheritance form is a legal document that allows an heir to formally decline any interest in shares of stock that a deceased individual owned. By completing this form, the heir communicates their decision to Tanadgusix Corporation, which helps clarify the ownership of the shares and prevents future claims against the corporation regarding those shares.

Who should complete the Disclaimer Inheritance form?

The form should be completed by any heir of a deceased Tanadgusix Corporation shareholder who wishes to disclaim their interest in the stock of that shareholder. This may include individuals who are direct relatives or other heirs designated by law. It is important for the person completing the form to be aware of their relationship to the decedent and the implications of disclaiming any interest in the stock.

What information is required to complete the form?

The form requires specific information, including the name of the decedent, the date of death, the number of shares owned, the relationship of the affiant to the decedent, and a statement of the intent to disclaim interest in the stock. Additionally, it must be signed in the presence of a notary public to ensure authenticity and legality.

What are the consequences of signing the Disclaimer Inheritance form?

By signing the form, the heir waives any claim to the stock previously owned by the decedent. This means that the heir relinquishes their right to inherit any value from those shares. Furthermore, the signer agrees to defend and indemnify Tanadgusix Corporation against any claims or expenses that may arise from this decision to disclaim ownership.

How does one submit the Disclaimer Inheritance form?

The completed form, signed and notarized, should be submitted directly to Tanadgusix Corporation. It is advisable to keep a copy of the form for personal records after submission. Check with the corporation for any specific submission guidelines or additional documentation that may be required.

Common mistakes

Completing the Disclaimer Inheritance form requires careful attention to detail. One common mistake is omitting or incorrectly filling out the date of death. This date is crucial, as it establishes the context for the disclaimer and connects the affiant to the decedent.

Another frequent error involves the relationship to the decedent. If the form does not accurately reflect the affiant's relationship, it may cause confusion or even invalidate the disclaimer. Be clear and precise when indicating your connection to the decedent. This avoids any assumptions or misinterpretations.

People also often forget to attach the certified copy of the death certificate. This document is essential to substantiate the claim made in the affidavit. Without it, the form may not be accepted, leading to delays or complications.

Signature and notarization errors are another significant pitfall. The affiant must sign the form in the presence of a notary public. If this step is overlooked, the affidavit may not hold up in legal terms. Always ensure that the signature matches the printed name to prevent any issues.

Lastly, individuals sometimes neglect to fill in their complete address and contact information. This oversight can lead to communication problems. Including accurate information ensures that Tanadgusix Corporation can reach the affiant without difficulty, should there be any questions or further steps needed.

Documents used along the form

When dealing with inheritance matters, various forms and documents may be necessary to ensure the process runs smoothly. Below are several essential documents that are often used alongside the Disclaimer Inheritance form to address different aspects of estate management and beneficiary decisions.

- Last Will and Testament: This document outlines a person's wishes regarding the distribution of their assets after their death. It typically identifies beneficiaries and may appoint an executor to manage the estate.

- Trust Agreement: A trust agreement allows a person to place their assets in a trust, managed by a trustee for the benefit of designated beneficiaries. This can be effective in avoiding probate.

- Letter of Administration: Issued by a probate court, this document appoints an administrator to handle the estate of a deceased person who did not leave a valid will.

- Death Certificate: A vital record that serves as official proof of a person's death. It is often required to access bank accounts and other assets owned by the deceased.

- Beneficiary Designation Forms: These forms allow individuals to specify beneficiaries for specific assets, such as life insurance policies and retirement accounts. They usually take precedence over a will.

- Inventory of Assets: This document lists all assets within an estate. It is usually prepared for probate court and helps to ensure that all property is accounted for during the distribution process.

- Power of Attorney: This legal document grants someone the authority to act on behalf of another person in financial or legal matters. It is especially useful if the person becomes incapacitated.

Each of these documents plays a crucial role in managing an estate and the distribution of assets. Understanding their importance can help ensure that wishes are honored and responsibilities are clearly defined.

Similar forms

The Disclaimer Inheritance form is a crucial legal document for those wishing to decline a share of an inheritance. It shares similarities with several other documents in the realm of estate and inheritance law. Here are five similar documents:

- Last Will and Testament: This document outlines an individual's wishes regarding the distribution of their assets upon death. While the Disclaimer Inheritance form focuses on renouncing an interest, a will explicitly states what an individual wants to happen to their estate.

- Trust Agreement: A trust agreement sets up a legal arrangement where one party holds property for the benefit of another. Like the Disclaimer Inheritance form, it deals with asset distribution but does so proactively rather than reactively.

- Letter of Intent: Often used to communicate wishes about the distribution of assets or to explain decisions regarding estate planning, a letter of intent guides the executor or beneficiaries but does not hold the same legal weight as a disclaimer.

- Power of Attorney: This legal document allows someone to act on behalf of another person in financial matters. While it empowers a representative, the Disclaimer Inheritance form serves the opposite purpose by relinquishing personal claims to an inheritance.

- Renunciation of Interest Form: Similar in nature, this form is specifically designed to allow heirs to formally renounce rights to an inheritance. Both documents serve the purpose of ensuring that the disclaimed interest is clear and legally recognized.

Dos and Don'ts

- Do double-check the accuracy of the personal information provided, including names and relationships.

- Don't leave any sections blank; all relevant fields must be filled out.

- Do attach a certified copy of the Decedent's Death Certificate as required.

- Don't use unclear or ambiguous language when stating your relationship to the Decedent.

- Do sign the form in the presence of a notary public to ensure its validity.

- Don't rush the process; take your time to understand each requirement before submission.

Misconceptions

When it comes to the Disclaimer Inheritance form, there are several misconceptions that people often hold. Understanding these can help clarify its purpose and function in the legal process. Here are seven common misconceptions:

- This form is only for wealthy individuals. Many believe that the Disclaimer Inheritance form is reserved for those who are wealthy or have substantial assets. In reality, anyone who is an heir can use this form to disclaim any interest in an inherited asset, regardless of its value.

- Disclaiming an inheritance means losing all rights to the estate. Some people think that by disclaiming one asset, they forfeit their rights to the entire estate. This is not true. The form pertains only to the specific asset mentioned, allowing heirs to keep their rights to other assets in the estate.

- You can't change your mind after submitting the form. Many may assume that once the form is filed, it's final and irrevocable. However, if the disclaimer is done properly and within the required time frame, the individual may choose not to pursue the inheritance.

- This form has to be filed in person. It is often thought that the disclaimer must be submitted in person to a court. While this can be the case, in some jurisdictions, mailing the completed form or submitting it online is perfectly acceptable.

- You can only use this form if the decedent had a will. Some might assume that a will is necessary for the Disclaimer Inheritance form to apply. This is a misconception; the form can be used regardless of whether the decedent left a will.

- Disclaiming an inheritance has tax implications. Another common belief is that by disclaiming an inheritance, one will incur tax liabilities. Actually, a properly executed disclaimer often allows the disclaimed property to pass directly to the next heir without immediate tax consequences for the heir who declined it.

- Only immediate family members can file this form. People often think that only close relatives, like children or spouses, are eligible to use the Disclaimer Inheritance form. In reality, anyone who qualifies as an heir under the applicable laws can file the disclaimer, including distant relatives or even friends, depending on the estate's structure.

Understanding these misconceptions helps clarify the role and potential of the Disclaimer Inheritance form for individuals navigating the complexities of inheritances.

Key takeaways

- The Disclaimer Inheritance form must be filled out accurately, reflecting all required information about the decedent and the shares involved.

- Include a certified copy of the Decedent's Death Certificate as part of the submission.

- Clearly state your relationship to the decedent to establish your eligibility to file the disclaimer.

- Understand that by submitting this form, you are legally disclaiming any interest in the decedent's shares.

- Seek legal advice if you have questions, as you are responsible for any claims or expenses incurred due to the reliance on this affidavit by Tanadgusix Corporation.

Browse Other Templates

How Does Champva Work With Medicare - To avoid running out of medication, it is advisable to request a second 30-day supply from your provider.

Registered Retail Merchant Certificate - The legal name of the business must be included, whether it's a corporation, partnership, or sole proprietorship.

26-1820 - Certification by a lender demonstrates due diligence in the loan approval process.