Fill Out Your Discount Disclosure Statement Form

The Discount Disclosure Statement serves as an essential document in the mortgage process, especially for borrowers utilizing VA guaranteed loans. This form is delivered to prospective borrowers before they sign the borrower's certification on the HUD/VA Addendum to the Uniform Residential Loan Application. Understanding its contents is crucial, as it outlines the important aspects of interest rates and discount points, which are negotiable between the borrower and the lender. Unlike conventional loan guidelines, the VA does not dictate the interest rates or set limits on discount points. This flexibility allows you to work directly with lenders in determining the most favorable terms. It is also possible for the seller to contribute towards the discount points, should both parties come to an agreement. Additionally, borrowers should be aware of the concept of a lock-in agreement, which stipulates the duration for which the lender will commit to the offered loan terms. The length of this arrangement can influence the overall timeline of the closing process. Moreover, any changes in terms, particularly if the interest rate increases more than 1 percent, may necessitate re-underwriting, which may require additional paperwork. Therefore, it's vital to remain informed about how all these factors work together throughout the home-buying journey.

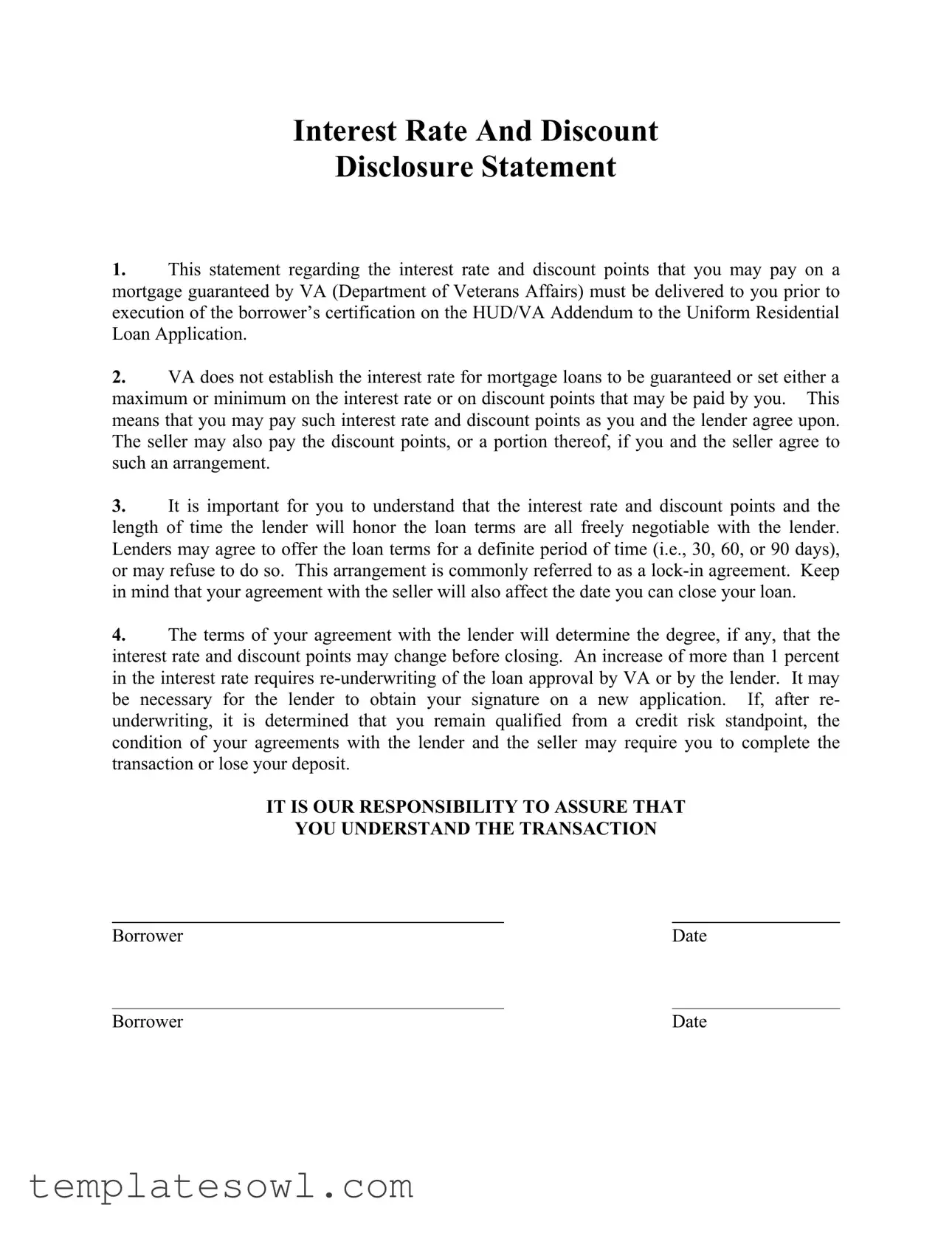

Discount Disclosure Statement Example

INTEREST RATE AND DISCOUNT

DISCLOSURE STATEMENT

1.This statement regarding the interest rate and discount points that you may pay on a mortgage guaranteed by VA (Department of Veterans Affairs) must be delivered to you prior to execution of the borrower’s certification on the HUD/VA Addendum to the Uniform Residential Loan Application.

2.VA does not establish the interest rate for mortgage loans to be guaranteed or set either a maximum or minimum on the interest rate or on discount points that may be paid by you. This means that you may pay such interest rate and discount points as you and the lender agree upon. The seller may also pay the discount points, or a portion thereof, if you and the seller agree to such an arrangement.

3.It is important for you to understand that the interest rate and discount points and the length of time the lender will honor the loan terms are all freely negotiable with the lender. Lenders may agree to offer the loan terms for a definite period of time (i.e., 30, 60, or 90 days), or may refuse to do so. This arrangement is commonly referred to as a

4.The terms of your agreement with the lender will determine the degree, if any, that the interest rate and discount points may change before closing. An increase of more than 1 percent in the interest rate requires

IT IS OUR RESPONSIBILITY TO ASSURE THAT

YOU UNDERSTAND THE TRANSACTION

Borrower |

Date |

Borrower |

Date |

Form Characteristics

| Fact Name | Description |

|---|---|

| Delivery Requirement | The Discount Disclosure Statement must be provided to the borrower before they sign the HUD/VA Addendum. This ensures that the borrower is informed about the terms prior to commitment. |

| Interest Rate Flexibility | VA does not regulate the interest rates for guaranteed loans. Borrowers can negotiate rates and discount points directly with their lenders. |

| Seller Contributions | In some situations, the seller might contribute to the discount points. This arrangement can be agreed upon between the borrower and the seller. |

| Negotiation Freedom | Borrowers have the flexibility to negotiate both the interest rate and discount points with the lender. These terms can vary based on the lender’s discretion. |

| Lock-In Agreements | Lenders may offer a lock-in agreement for the loan terms, which can last a specific period, such as 30 to 90 days. This protects the borrower from rate increases during that timeframe. |

| Rate Change Impact | If the interest rate increases by more than 1%, re-underwriting may be necessary. This could require the borrower to sign a new application. |

| Impact on Closing Date | The agreement with the seller can influence when the loan closing occurs. This is an important aspect to keep in mind when negotiating terms. |

| Withdrawal Consequences | If there are changes that affect the borrower’s qualification, they may have to either complete the transaction or lose their deposit. Understanding these implications is crucial. |

| Borrower Responsibility | It’s the borrower’s responsibility to understand the transaction and its terms fully. Awareness of all agreements and potential changes is necessary for making informed decisions. |

Guidelines on Utilizing Discount Disclosure Statement

Completing the Discount Disclosure Statement form is an essential part of your mortgage process. It's important to fill it out accurately to ensure clarity regarding the terms of your loan. Below are the steps to help you complete the form correctly.

- Obtain the Form: Ensure you have the latest version of the Discount Disclosure Statement form. This may be provided by your lender or downloaded from an official source.

- Enter Borrower's Name: Write your full name in the designated area for the borrower.

- Date: Fill in the current date next to your name. This helps to establish when the disclosure was made.

- Interest Rate: Clearly indicate the agreed-upon interest rate for the mortgage loan in the section provided.

- Discount Points: Enter the number of discount points that apply to the loan. Make sure this amount reflects your agreement with the lender.

- Lock-in Agreement: If applicable, specify the duration for which the lender will honor the agreed-upon loan terms.

- Seller Contributions: If applicable, note any arrangements regarding the seller paying discount points on your behalf.

- Review: Carefully review all the information you have entered. Ensure that it matches your agreements with the lender and any applicable parties.

- Sign the Form: Both you and any co-borrowers need to sign the form. This indicates your understanding and acceptance of the terms laid out in the document.

After completing these steps, ensure you keep a copy for your records. Once submitted, your lender will use this information as part of the loan process, helping to finalize the agreements made.

What You Should Know About This Form

What is the purpose of the Discount Disclosure Statement form?

The Discount Disclosure Statement serves as an important document that informs borrowers about the potential interest rate and discount points associated with their VA-guaranteed mortgage. It must be provided before you sign the borrower’s certification on the HUD/VA Addendum to the Uniform Residential Loan Application. This ensures that you have all necessary information regarding the financial terms of your mortgage, empowering you to make informed decisions.

Who sets the interest rates and discount points for VA loans?

There’s some flexibility when it comes to interest rates and discount points for VA loans. The VA does not set these rates or dictate a maximum or minimum amount. Instead, you and your lender will negotiate the terms that are agreeable to both parties. Additionally, if a seller agrees, they may cover some or all of the discount points, which can further affect your loan’s financial structure.

Can I negotiate the interest rate and discount points?

Absolutely! The terms including the interest rate and discount points are fully negotiable between you and the lender. This flexibility allows you to tailor the terms to suit your financial situation. Lenders might agree to keep the loan terms for a specified period, often called a lock-in agreement, but they are not required to do so. This negotiation can also impact your loan closing date based on your agreement with the seller.

What happens if my interest rate changes before closing?

If there is an increase of more than 1 percent in the agreed interest rate before closing, a re-underwriting process may be required by either the VA or the lender. This could mean that you will need to complete a new application, and your credit qualification will be reassessed. It’s important to understand that if you do not remain qualified based on this re-evaluation, you might face the risk of losing your deposit and may be required to complete the transaction per your agreements.

What does a lock-in agreement mean?

A lock-in agreement is a commitment from the lender to honor your loan terms for a certain period, such as 30, 60, or even 90 days. This means that the lender will not adjust your agreed-upon interest rate during this time frame, regardless of changes in the market. It's a helpful measure for borrowers, as it provides some certainty against potential rate increases while you finalize your loan process.

How can I ensure that I understand my transaction?

It is crucial to understand every aspect of your mortgage transaction. The Discount Disclosure Statement is part of your responsibility to ensure clarity. Don’t hesitate to ask questions and seek clarification on any areas that feel uncertain. Remember, the goal is to empower you to make the best financial decision. Always take the time to read through the documents carefully and consult with your lender if something isn’t clear.

Common mistakes

Filling out the Discount Disclosure Statement form can be challenging. One common mistake is failing to read the entire document thoroughly. Many individuals rush through the process, overlooking important information related to interest rates and discount points. Taking the time to comprehend all sections of the form is crucial for making informed decisions.

Another prevalent error occurs when individuals neglect to clarify the negotiable aspects of the loan terms. The form clearly states that interest rates and discount points are subject to negotiation. However, some borrowers may assume that these terms are non-negotiable, which can limit their ability to secure better conditions. Open communication with the lender is vital.

People often forget to consider the implications of a lock-in agreement. While the document mentions that lenders may offer loan terms for a specific period, some borrowers do not utilize this option adequately. Understanding the nuances of timeframes can impact when one can close the loan, so it is important to discuss this aspect with the lender.

Moreover, a mistake can stem from not being aware of how changes in the interest rate can affect the loan approval process. If the interest rate increases by more than 1 percent, re-underwriting is necessary. Some borrowers may not realize that this could involve further scrutiny of their credit risk and even require completing a new application.

Failing to understand the potential effects of the agreement with the seller is another misstep. The arrangement with the seller can directly influence the transaction’s terms, including the closing date and the necessity to complete the transaction. Being aware of how seller agreements work ensures that borrowers are prepared for any changes that may arise.

Lastly, some individuals may not properly document all signatures required on the form. The statement includes the borrower’s signatures to confirm understanding of the transaction. Omitting or incorrectly signing the document can lead to complications later in the process. Attention to detail in this area is essential to avoid future issues.

Documents used along the form

The Discount Disclosure Statement form is an important document used in conjunction with a mortgage guaranteed by the VA. Understanding additional related forms can help ensure a smooth transaction. Here are several documents that are often utilized alongside this statement:

- HUD/VA Addendum to the Uniform Residential Loan Application: This addendum accompanies the main loan application. It includes specific information related to VA guarantees and confirms the terms of the loan.

- Loan Estimate: This document provides a detailed overview of the mortgage costs, including interest rate, monthly payments, and other fees. It helps borrowers compare offers from different lenders.

- Closing Disclosure: Given to borrowers at least three days before closing, this form outlines the final terms of the loan and actual closing costs. It enables borrowers to see how the final figures compare to the Loan Estimate.

- Lock-In Agreement: This document specifies the terms of the interest rate lock between the borrower and lender. It ensures that the agreed interest rate will not change for a certain period, providing peace of mind during the loan process.

- Borrower’s Certification: This form serves as a written confirmation from the borrower stating they understand the loan agreement. It is typically signed at or before closing.

- VA Certificate of Eligibility: This document verifies a borrower’s eligibility for a VA loan. It demonstrates that the veteran or service member has met the service requirements needed for loan benefits.

- Purchase Agreement: This contract between the buyer and seller outlines the terms of the property sale, including price and contingencies. It plays a critical role in the loan process, as it specifies conditions that must be met before financing can be secured.

Each of these documents plays a vital role in the mortgage process. Familiarizing oneself with them can help ensure that all parties understand the terms and conditions associated with the loan. Proper documentation simplifies communication and supports a successful closing.

Similar forms

- Loan Estimate (LE): The Loan Estimate form provides details on the estimated interest rate, monthly payment, and total closing costs. Like the Discount Disclosure Statement, it is designed to ensure that borrowers understand the financial aspects of a mortgage before formally agreeing to the loan.

- Good Faith Estimate (GFE): Similar to the Discount Disclosure Statement, the Good Faith Estimate outlines expected costs related to the mortgage and provides transparency regarding the interest rate and discount points. It helps borrowers compare offers from different lenders.

- Closing Disclosure (CD): This document is provided shortly before the closing of a mortgage. Like the Discount Disclosure Statement, it contains detailed information about the loan terms, including the interest rate and any fees associated with the loan, ensuring borrowers are fully informed.

- HUD-1 Settlement Statement: The HUD-1 outlines all final financial details related to the mortgage transaction. Similar to the Discount Disclosure Statement, it includes information about the interest rate and any discount points, making it a key document for understanding total costs.

- Mortgage Note: The Mortgage Note is the legal document that outlines the terms of the mortgage, including the interest rate and repayment schedule. Like the Discount Disclosure Statement, it serves to clarify the borrower’s obligations and the specifics of the loan agreement.

Dos and Don'ts

Filling out the Discount Disclosure Statement form correctly is crucial for a smooth mortgage process. Here are eight tips

Misconceptions

Misconceptions can sometimes cloud understanding in financial matters. Here are some common misconceptions about the Discount Disclosure Statement form:

- The VA sets the interest rates. Many people believe that the Department of Veterans Affairs determines the interest rates for VA-backed loans. In reality, the VA does not establish or control the interest rates or discount points; these are set through negotiation between the borrower and lender.

- Discount points are always paid by the borrower. Some assume that all discount points are the responsibility of the borrower. However, they can also be negotiated with the seller, who might agree to pay all or part of the discount points.

- Loan terms cannot be negotiated. There is a common misconception that once loan terms are established, they cannot be changed. In fact, the interest rate, discount points, and durations of offers are all negotiable, allowing borrowers to have a say in their mortgage conditions.

- The interest rate cannot change before closing. It is often thought that once a borrower has agreed upon an interest rate, it will remain fixed. However, the terms between the borrower and lender can allow for changes, and any increase above 1 percent can lead to additional re-underwriting requirements.

- Signing new applications is unnecessary if terms change. Many borrowers believe that the original application suffices, even if loan terms change significantly. This is false; if the interest rate changes by more than 1 percent, a new application may need to be signed to proceed appropriately.

Understanding these misconceptions helps in making informed choices regarding your mortgage transaction.

Key takeaways

When filling out and using the Discount Disclosure Statement form, keep these key points in mind:

- Know your rights: This form must be provided before you sign the borrower’s certification. Understanding this document is critical.

- Interest rates are negotiable: You and your lender can agree on the interest rate and discount points. There are no limits set by the VA.

- Seller involvement is possible: The seller may cover some or all of the discount points if both parties agree on the terms.

- Lock-in agreements exist: The lender can offer loan terms for a specific period. This could range from 30 to 90 days, and it’s important to note how this might impact your closing date.

- Changes can cause delays: If the interest rate increases by more than 1 percent, it may trigger a re-evaluation of your loan application.

Understanding these key takeaways can help you navigate the process more smoothly. Clear communication with your lender and seller is essential.

Browse Other Templates

Types of Va Claims - Detailed instructions are included in the form to assist both veterans and sellers in the process.

Game Xchange - Employment with Game Xchange is "at will".

Prescription Fax Submission,Medication Order Fax Sheet,Cataramaran Rx Order Form,Cataramaran Medication Request Form,Prescription Transmission Form,Patient Prescription Fax Sheet,Cataramaran Rx Fax Application,Medication Requisition Fax,Cataramaran P - Do not stamp the prescription; a signature is required.