Fill Out Your Dispute Transunion Form

When inaccuracies arise in your credit report, addressing them promptly is crucial for maintaining your financial health. The Dispute Transunion form serves as a straightforward tool for consumers to communicate errors to the credit bureau. To begin, individuals need to complete the top section of the form, providing essential identification information, such as their name and address. Next, it is important to specify the creditor's name and the corresponding account number of the item in question. In the designated dispute section, the individual should clearly articulate the reason for their disagreement. If you have additional supporting information, there’s space allocated for comments, allowing you to bolster your case. Finally, ensuring the form is signed is critical, as this final step authorizes the bureau to investigate the claim. After completing the form, it should be mailed to the appropriate address, which differs among credit bureaus—Equifax, Experian, and TransUnion. Moreover, it would be beneficial to contact the creditor directly, informing them of the error and any corrective steps you have undertaken. Taking these actions can help rectify issues that negatively affect your credit standing.

Dispute Transunion Example

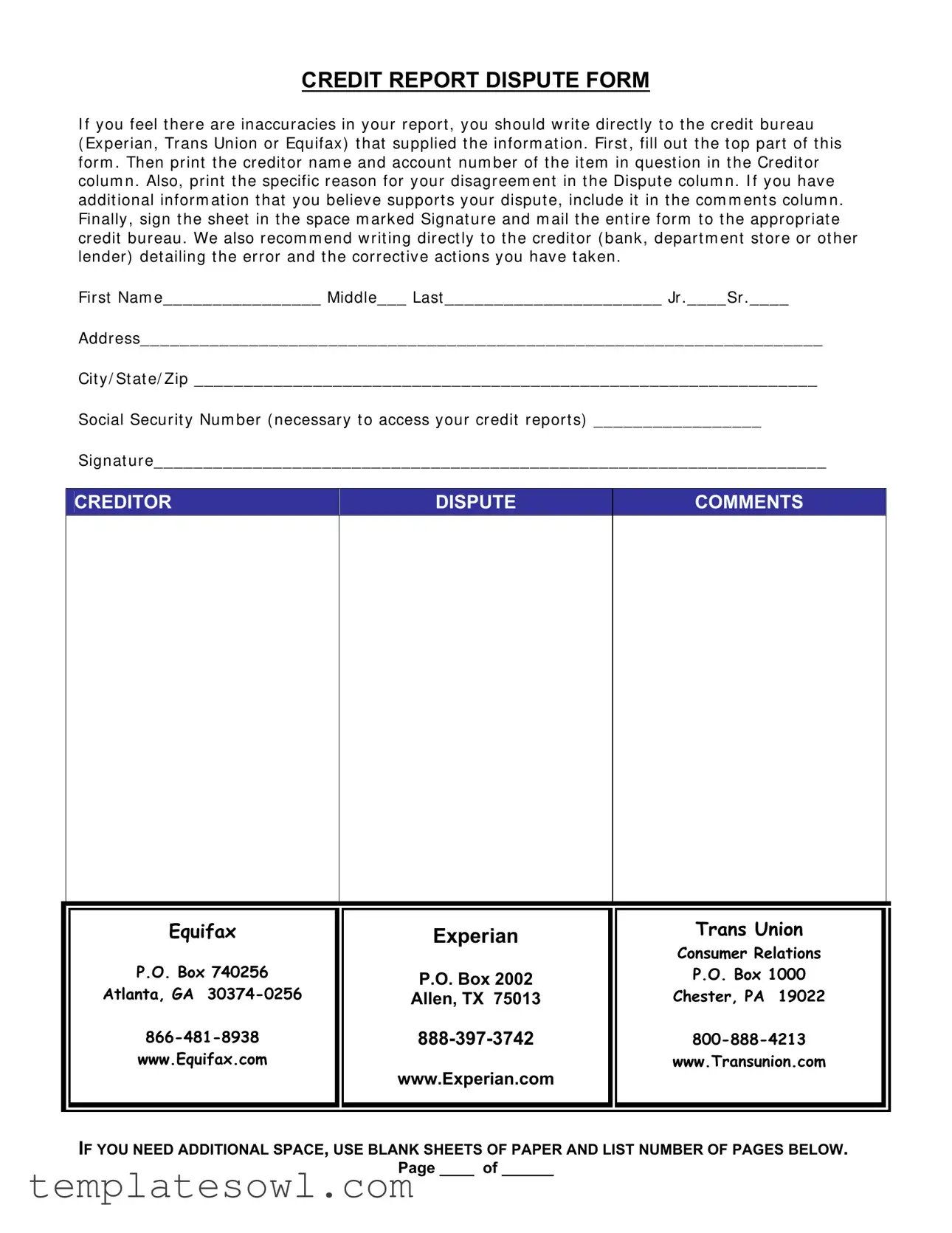

CREDIT REPORT DISPUTE FORM

I f y ou feel t her e ar e inaccur acies in y our r epor t , y ou should w r it e dir ect ly t o t he cr edit bur eau

( Ex per ian, Tr ans Union or Equifax ) t hat supplied t he infor m at ion . Fir st , fill out t he t op par t of t his for m . Then pr int t he cr edit or nam e and account num ber of t he it em in quest ion in t he Cr edit or colum n . Also, pr int t he specific r eason for y our disagr eem ent in t he Disput e colum n . I f y ou hav e addit ional infor m at ion t hat y ou believ e suppor t s y our disput e, include it in t he com m ent s colum n . Finally , sign t he sheet in t he space m ar k ed Signat ur e and m ail t he ent ir e for m t o t he appr opr iat e cr edit bur eau . We also r ecom m end w r it ing dir ect ly t o t he cr edit or ( bank , depar t m ent st or e or ot her lender ) det ailing t he er r or and t he cor r ect iv e act ions y ou hav e t ak en .

Fir st Nam e________________ Middle___ Last ______________________ Jr . ____ Sr . ____

Addr ess_____________________________________________________________________

Cit y / St at e/ Zip _______________________________________________________________

Social Secu r it y Num ber ( necessar y t o access y our cr edit r epor t s) _________________

Signat ur e____________________________________________________________________

CREDITOR

DISPUTE

COMMENTS

Equifax

P.O. Box 740256

Atlanta, GA

www.Equifax.com

Experian

P.O. Box 2002

Allen, TX 75013

www.Experian.com

Trans Union

Consumer Relations

P.O. Box 1000

Chester, PA 19022

www.Transunion.com

IF YOU NEED ADDITIONAL SPACE, USE BLANK SHEETS OF PAPER AND LIST NUMBER OF PAGES BELOW.

Page ____ of ______

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | This form is used to dispute inaccuracies in a credit report. |

| Submitting the Form | Individuals must mail the completed form to the credit bureau that provided the incorrect information. |

| Information Required | Fill out your first name, middle name, last name, address, city/state/zip, social security number, and signature. |

| Creditor Details | You need to enter the creditor's name and account number related to the dispute in the designated section. |

| Reason for Dispute | Clearly state the specific reason for your disagreement in the dispute column on the form. |

| Additional Information | Include any supporting information in the comments column, if applicable. |

| Governing Law | The Fair Credit Reporting Act (FCRA) governs the dispute resolution process in the U.S. |

Guidelines on Utilizing Dispute Transunion

Taking the time to accurately fill out the Dispute TransUnion form is essential when addressing any inaccuracies on your credit report. This process involves providing clear information that will help the credit bureau properly evaluate your dispute. Follow the steps below to ensure your form is completed correctly.

- Gather your personal information, including your first name, middle name, last name, and any suffix like Jr. or Sr.

- Write your address, including city, state, and zip code.

- Input your Social Security Number, which is necessary for the credit bureau to access your credit reports.

- Locate the section for the creditor's information. Write down the name of the creditor and their account number in the provided spaces.

- In the 'Dispute' column, state the specific reason for your disagreement with the report.

- If you have additional information supporting your dispute, include this in the comments column.

- Sign the sheet in the designated 'Signature' area.

- Make a copy of the completed form for your records, and then mail the entire form to the relevant credit bureau's address provided on the form.

After submitting your dispute, the credit bureau will review your information. They will reach out to the creditor to investigate your claims. You can expect to receive updates on the status of your dispute, which helps ensure that your credit report is accurate.

What You Should Know About This Form

What is the purpose of the Dispute Transunion form?

The Dispute Transunion form is designed for individuals who believe there are inaccuracies in their credit reports provided by TransUnion. By filling out this form, users can formally challenge incorrect or misleading information, ensuring that their credit report accurately reflects their financial history. This process is critical in maintaining a good credit score, which can impact future borrowing capabilities.

How do I fill out the Dispute Transunion form?

Filling out the form is straightforward. Start by entering your first name, middle name, last name, and suffix if applicable. Next, provide your complete address, including city, state, and zip code. It's essential to include your Social Security number as it is necessary for accessing your credit reports. After completing the personal information section, move on to the creditor information. Print the name and account number of the item you are disputing, and clearly explain your reason for the dispute. If you have any additional supportive information, include it in the comments section. Finally, remember to sign the form before mailing it to the appropriate credit bureau.

Where do I send the completed Dispute Transunion form?

Once you have completed the form, you will need to mail it to TransUnion's Consumer Relations address. The correct address is as follows: Trans Union Consumer Relations, P.O. Box 1000, Chester, PA 19022. It’s advantageous to send your dispute via certified mail, so you have proof of submission. Keeping a copy of the filled form for your records is also a wise move.

What happens after I submit the form?

Upon submitting your Dispute Transunion form, TransUnion is required to investigate your claim. They will typically investigate the disputable information within 30 days. During this time, they may reach out to the creditor who provided the disputed information to verify its accuracy. After the investigation is complete, you will receive a report detailing the findings, which will inform you whether the information was changed or confirmed.

Can I dispute more than one item on the same form?

While it is possible to dispute multiple items, it is often recommended to focus on one at a time for clarity. If you choose to dispute more than one item on the same form, be sure to list each creditor, their respective account numbers, and provide a clear reason for each dispute in the comments section. This way, TransUnion can specifically address each claim within your submission.

Should I contact the creditor as well?

Yes, contacting the creditor directly is highly advisable. After submitting your dispute to TransUnion, you should also inform the creditor of the error. Providing them with details about the inaccuracies and any corrective action you've taken can streamline the resolution process. This proactive step helps ensure that both your credit report and the creditor's records are aligned, preventing future issues.

Common mistakes

Filling out the Dispute Transunion form can be straightforward, but many make critical errors that can delay the process. One common mistake is failing to include all necessary personal information. Applicants often neglect to fill in their full name or address properly, leading to potential complications in verifying their identity.

Another frequent error is omitting the specific creditor name and account number related to the disputed entry. Without this information, the credit bureau might struggle to locate the relevant data, resulting in a prolonged investigation or incorrect assessments.

Many individuals also miss the opportunity to clearly articulate their reasons for disputing the information. The lack of detail in the Dispute column may lead to misunderstandings or insufficient insights into the issue at hand. Providing specific reasons strengthens the dispute and can expedite the process.

Including additional documentation can greatly aid a dispute. However, applicants sometimes forget to attach supporting materials that corroborate their claims. Failing to include these documents could weaken the case or leave the credit bureau needing further clarification, which can result in delays.

Many submitters do not double-check the information for accuracy before mailing the form. Errors in the Social Security number or other critical details may cause unnecessary delays. A simple review can help ensure all data is correct and complete.

Additionally, some individuals neglect to sign the form in the designated area. Without a signature, the submission may be deemed incomplete, leading to immediate rejection of the dispute.

It is also important to send the dispute to the correct address for the credit bureau. Some people mistakenly send their disputes to the wrong bureau, which can significantly hinder the processing time and lead to a lack of resolution.

Lastly, people often forget to include their contact information, such as phone number or email address. Including this information allows the credit bureau to reach out quickly if they require clarification or additional details regarding the dispute.

Documents used along the form

When disputing inaccuracies on your credit report, it is often helpful to have additional forms and documents prepared to support your case. The following list outlines some common documents that may accompany your Dispute Transunion form. These documents can enhance your claims and provide a stronger basis for resolution.

- Creditor Dispute Letter: This is a formal letter sent to your creditor explaining the error on your credit report. It details the inaccuracies and requests corrections, helping to clarify your position.

- Consumer Report Information: This document includes data from your credit report, indicating what specific information is in dispute. It provides context to your claims by pinpointing exact discrepancies.

- Proof of Payment: Including evidence of payment can strengthen your dispute, particularly if the issue involves a late payment or account status. Receipts, bank statements, or canceled checks can serve as proof.

- Identity Theft Report: If your dispute is related to identity theft, preparing an identity theft report can demonstrate the fraudulent activity. This should be filed with the Federal Trade Commission (FTC) and includes details about the unauthorized use of your information.

- Affidavit of Dispute: This sworn statement outlines the facts around your dispute, affirming your position. It can serve as a formal declaration of your claims and the measures you have taken to resolve them.

- Credit Monitoring Reports: Providing recent credit monitoring reports shows changes over time. It can reveal patterns of inaccuracies and highlight the need for corrections in your credit profile.

Ensuring all relevant documentation accompanies your Dispute Transunion form can significantly improve your chances of resolving the issue. Be thorough in gathering information and clearly presenting your case for the best possible outcome.

Similar forms

The Credit Report Dispute Form from TransUnion serves a similar purpose to several other documents that help individuals address inaccuracies in their credit reports. Each of these documents facilitates communication with credit bureaus or creditors to resolve discrepancies. Here’s a list of six other documents that share similarities with the Dispute TransUnion form:

- Experian Dispute Form: Like the TransUnion form, this document allows consumers to contest errors on their credit reports with Experian. It requires personal information, details of the disputed item, and the reasons for disputing the entry.

- Equifax Dispute Form: This form serves a similar role for customers dealing with Equifax. It gathers the same essential information regarding the consumer's identity, the disputed account, and the explanation for the dispute.

- Credit Report Request Form: While this document primarily requests a copy of the credit report, it includes sections where consumers can specify accounts they wish to dispute and provide justifications similar to those on the Dispute TransUnion form.

- Fair Credit Reporting Act (FCRA) Dispute Letter: This letter format outlines the consumer's rights under the FCRA. It empowers consumers to formally address inaccuracies directly and includes sections for detailed explanations of the disputes, much like the TransUnion form.

- Credit Repair Request Letter: This document is used when seeking the assistance of a credit repair company. It outlines disputed accounts and provides supporting details, reflecting the structure and intent of the Dispute TransUnion form.

- Consumer Financial Protection Bureau (CFPB) Complaint Form: Though broader in scope, this form allows consumers to report issues regarding credit report inaccuracies. It requests similar information to explain the complaint, echoing the layout of the credit dispute forms.

Each of these documents emphasizes the importance of clarity and thoroughness in addressing credit report inaccuracies, helping consumers take control of their financial records.

Dos and Don'ts

When filling out the Dispute Transunion form, it is important to keep a few guidelines in mind to ensure accuracy and clarity. Below are five things you should do and avoid:

- Do: Fill out the top part of the form completely. This includes your full name and current address.

- Do: Clearly print the creditor's name and account number in the designated section.

- Do: Specify your reason for disagreement in the "Dispute" column. Be as precise as possible.

- Do: Include any additional information that supports your dispute in the comments section.

- Do: Sign the form in the space marked "Signature" before mailing it to the correct credit bureau.

- Don't: Leave any sections blank. Incomplete forms may delay the processing of your dispute.

- Don't: Use vague language. Clearly state your issues and provide supporting details.

- Don't: Forget to include your Social Security number, as it is necessary for accessing credit reports.

- Don't: Mail the form without making a copy for your records. Documentation is important.

- Don't: Rely solely on the credit bureau to address your concerns. Consider contacting the creditor directly as well.

Misconceptions

- Misconception: You cannot dispute an account without supporting documentation. Many believe that without extensive documentation, a dispute cannot be filed. In fact, the form allows for the submission of a dispute based on personal knowledge and a statement of disagreement.

- Misconception: The dispute process is only for errors. While many use the form to correct inaccuracies, it can also be used to dispute the validity of the account, such as issues of identity theft.

- Misconception: You only need to contact one credit bureau. Disputes should be submitted to each credit bureau that reports the inaccuracy. Each bureau operates independently and may have different information.

- Misconception: Filling out the form is enough to resolve the issue. Simply submitting the form does not guarantee resolution. Follow-up may be necessary to ensure that the credit bureau investigates the claim.

- Misconception: You cannot dispute a closed account. Closed accounts can still be disputed if inaccuracies are present. Both open and closed accounts can impact credit scores.

- Misconception: You need a lawyer to file a dispute. Individuals can file disputes without legal representation. The form is designed for consumers to use independently.

- Misconception: Once you submit a dispute, it is permanently recorded. Disputes may be recorded temporarily during the investigation process, but they do not become a permanent part of a consumer's credit history if they are resolved favorably.

Key takeaways

When filling out the Dispute Transunion form, it is important to follow certain steps to ensure your concerns are addressed effectively. Here are some key takeaways to keep in mind:

- Clearly identify the inaccuracies in your credit report before proceeding with the form.

- Start by completing the top portion of the form with your personal information.

- In the Credit or Account Name column, print the name of the creditor and the corresponding account number.

- In the Dispute column, provide a specific reason for your disagreement; clarity is key.

- If you have supporting information, include it in the Comments section of the form.

- Remember to sign the form in the designated Signature space; your signature confirms your request.

- Mail the completed form to the appropriate credit bureau address; check that you have the right address to avoid delays.

- Consider contacting the creditor directly to detail the error and your corrective actions.

- Keep a copy of your dispute form for your records; maintaining documentation is essential for follow-up.

By following these steps, you can effectively communicate your concerns and seek the correction of inaccuracies on your credit report.

Browse Other Templates

Eyemed Submit Claim - If the patient is covered, select 'yes' and complete the following sections.

Service Participation Log,Volunteer Work Record,Community Contribution Tracker,Service Hours Verification Form,Court-Ordered Service Report,Community Work Time Register,Agency Service Completion Sheet,Assigned Service Hours Document,Public Service Wo - Volunteered at a cultural festival, helping with setup and guest services.

New Jersey Association of Realtors Standard Form of Residential Lease - Liability clauses clarify the extent of responsibility for both landlord and tenant regarding damages or injuries.