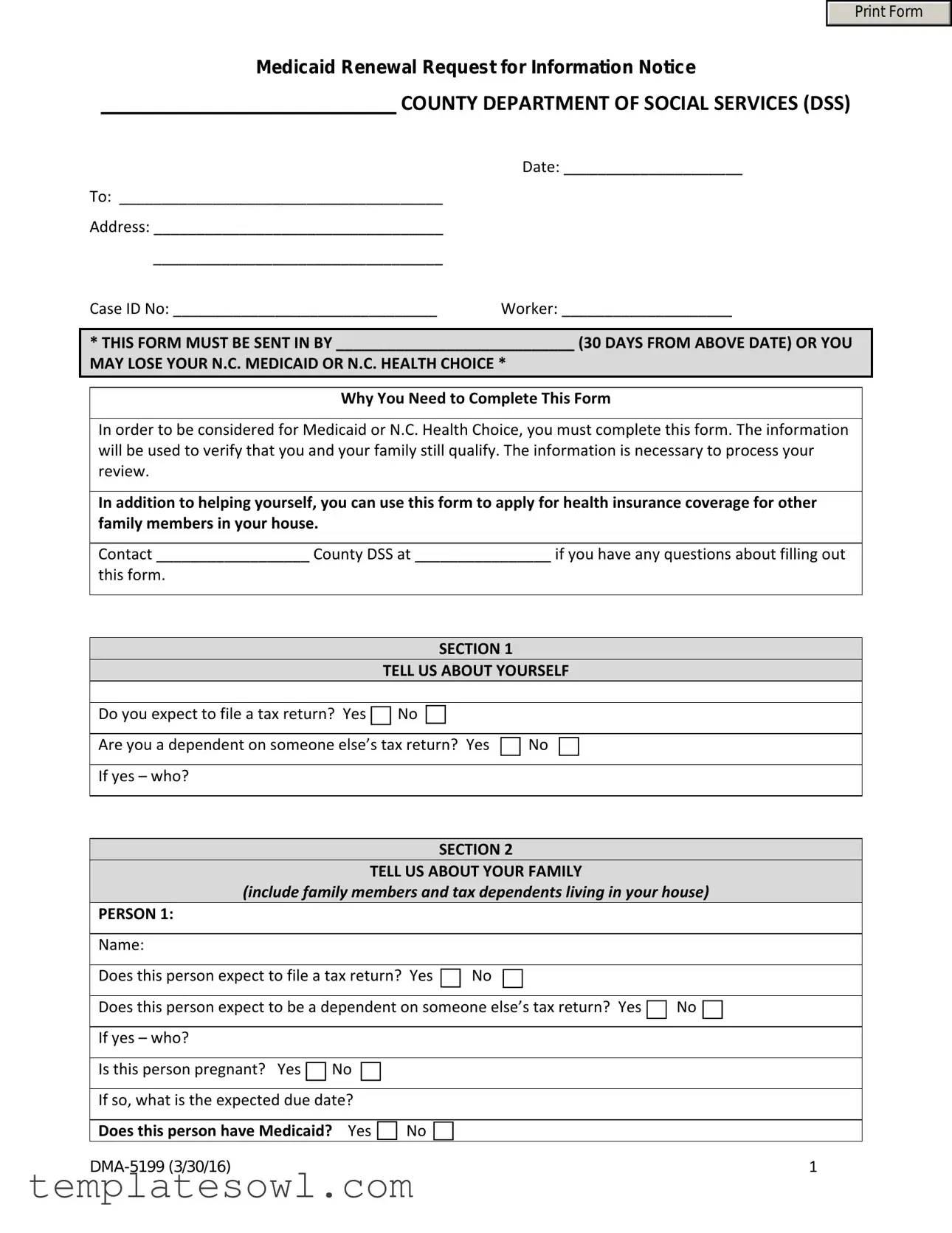

Fill Out Your Dma 5199 Form

The DMA 5199 form serves as a critical step for individuals seeking to renew their Medicaid or N.C. Health Choice benefits. Time is of the essence, as this form must be submitted within 30 days from the issuance date to avoid potential loss of coverage. Completing the DMA 5199 is essential for demonstrating your continued eligibility and helps the County Department of Social Services to assess both your situation and that of your family. This form not only gathers personal and tax-related information but also inquires about dependents and other household members who may need coverage. Furthermore, if someone listed on the form does not currently have Medicaid, you will have the opportunity to apply for them directly. Should you have any questions while completing the form, assistance is available from your local County DSS. It’s vital to approach this task promptly and accurately to ensure you maintain access to necessary health services.

Dma 5199 Example

Print Form

Medicaid Renewal Request for Information Notice

COUNTY DEPARTMENT OF SOCIAL SERVICES (DSS)

|

Date: _____________________ |

To: ______________________________________ |

|

Address: __________________________________ |

|

__________________________________ |

|

Case ID No: _______________________________ |

Worker: ____________________ |

*THIS FORM MUST BE SENT IN BY ____________________________ (30 DAYS FROM ABOVE DATE) OR YOU MAY LOSE YOUR N.C. MEDICAID OR N.C. HEALTH CHOICE *

Why You Need to Complete This Form

In order to be considered for Medicaid or N.C. Health Choice, you must complete this form. The information will be used to verify that you and your family still qualify. The information is necessary to process your review.

In addition to helping yourself, you can use this form to apply for health insurance coverage for other family members in your house.

Contact __________________ County DSS at ________________ if you have any questions about filling out

this form.

|

SECTION 1 |

|

|

TELL US ABOUT YOURSELF |

|

|

|

|

Do you expect to file a tax return? Yes |

No |

|

|

|

|

Are you a dependent on someone else’s tax return? Yes |

No |

|

|

|

|

If yes – who? |

|

|

|

|

|

SECTION 2

TELL US ABOUT YOUR FAMILY

(include family members and tax dependents living in your house)

PERSON 1:

Name:

Does this person expect to file a tax return? Yes  No

No

Does this person expect to be a dependent on someone else’s tax return? Yes  No

No

If yes – who?

Is this person pregnant? Yes  No

No

If so, what is the expected due date?

Does this person have Medicaid? Yes  No

No

1 |

If this person does not have Medicaid, complete Attachment A to apply for Medicaid.

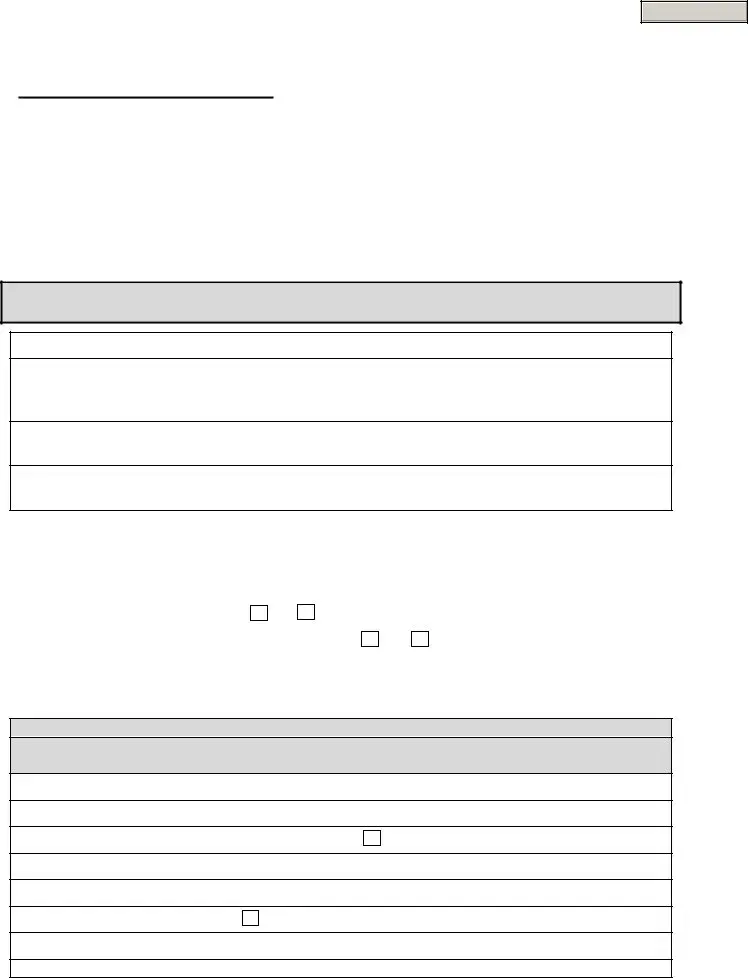

PERSON 2:

Name:

Does this person expect to file a tax return? Yes  No

No

Does this person expect to be a dependent on someone else’s tax return? Yes  No

No

If yes – who?

Is this person pregnant? Yes  No

No

If so, what is the expected due date?

Does this person have Medicaid? Yes  No

No

To apply for Medicaid for this person complete Attachment A.

PERSON 3:

Name:

Does this person expect to file a tax return? Yes  No

No

Does this person expect to be a dependent on someone else’s tax return? Yes  No

No

If yes – who?

Is this person pregnant? Yes  No

No

If so, what is the expected due date?

Does this person have Medicaid? Yes  No

No

To apply for Medicaid for this person complete Attachment A.

PERSON 4:

Name

Does this person expect to file a tax return? Yes  No

No

Does this person expect to be a dependent on someone else’s tax return? Yes  No

No

If yes – who?

Is this person pregnant? Yes  No

No

If so, what is the expected due date?

Does this person have Medicaid? Yes  No

No

To apply for Medicaid for this person complete Attachment A.

If more space is needed, please attach a separate sheet.

2 |

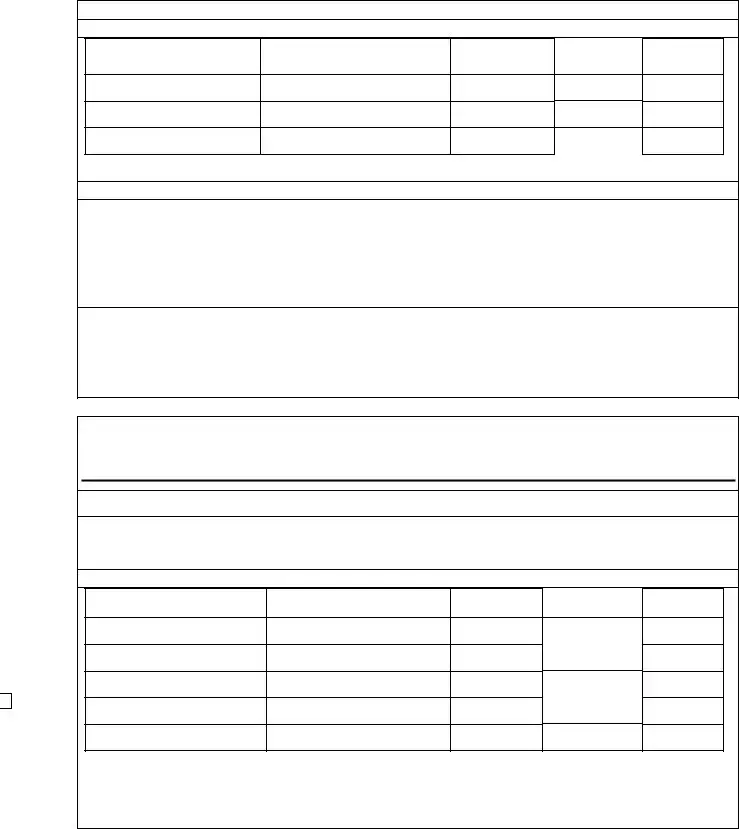

Medicaid Renewal Request for Information Notice

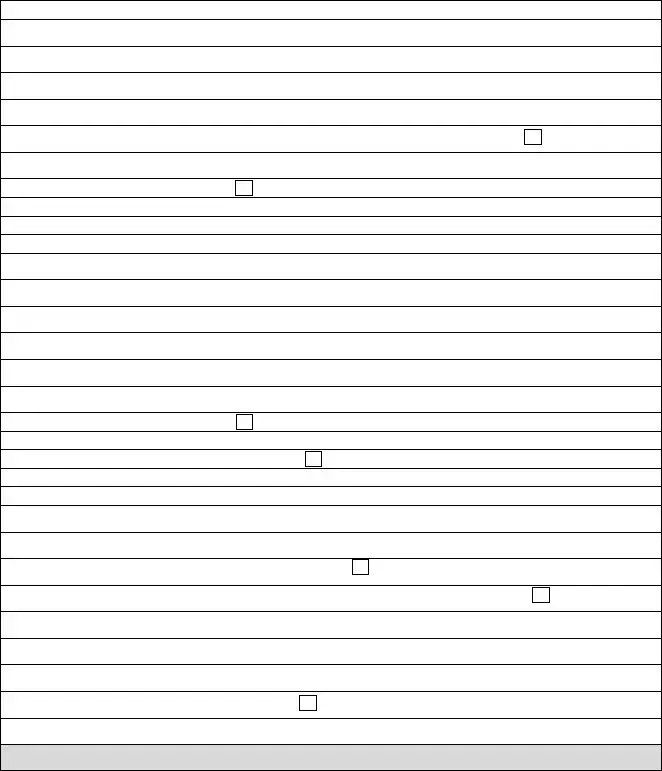

SECTION 3

TELL US MORE ABOUT THE PEOPLE LISTED ON THIS FORM

A.Income: Does anyone listed on this form have an income? Yes  No If yes, complete Attachment B.

No If yes, complete Attachment B.

B.Living Situation: Does anyone listed on this form live in a:

Long‐term care facility, group home, or nursing home

Private home, but gets at‐home medical, personal or health services

Private home, but gets medical, personal or health services in the community (such as adult day care)

If so, please list their names:

Name(s):

C.Foster Care: Is anyone listed on this form between the ages of 18 and 26 and was in foster care at

age 18? Yes  No

No

If so, please list their names:

Name(s):

SECTION 4

SIGNATURE

I am signing this renewal form under penalty of perjury which means I have provided true answers to all the questions to the best of my knowledge. I know that I may be subject to penalties under federal law if I provide untrue information.

Beneficiary/Authorized Representative*

Date

*The person who completed the form or their legal representative.

|

WHERE TO SEND THE INFORMATION |

|

|

You can complete the form: |

|

|

|

• In‐person at the |

County DSS Office (street address) |

•By phone at:

• By mail at: |

County DSS Office, (mailing address) |

3 |

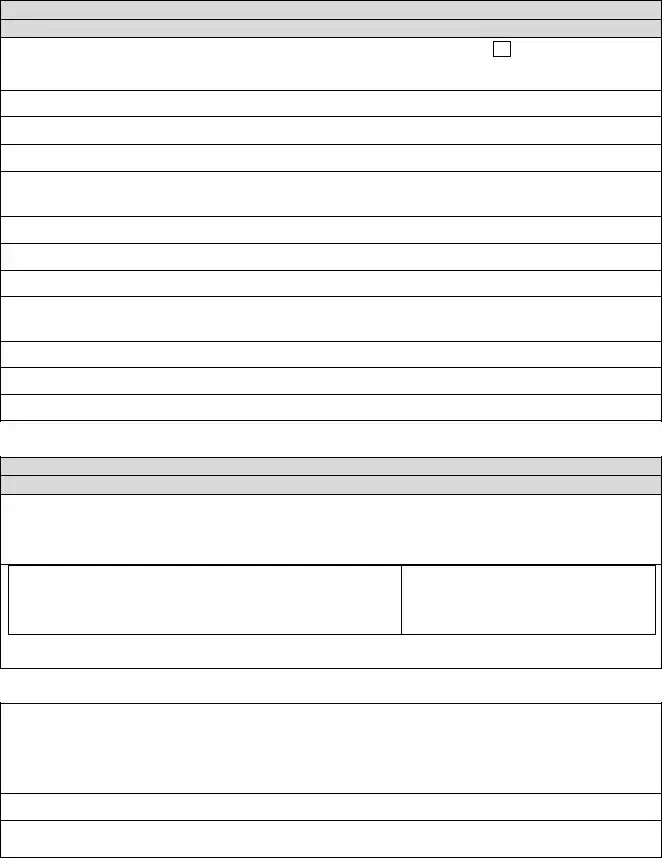

ATTACHMENT A

TO APPLY FOR MEDICAID FOR ANYONE LISTED IN SECTION 2.

Person 1:

A.Name:

B.Social Security Number:

C.Date of Birth:

D.How is this person related to you?

E.This person is : Male  Female

Female

F.This person is a U.S. citizen or U.S. national Yes  No

No

If yes, skip to “additional information” below.

If no, answer question “G”:

G.If this person has eligible immigration status: Document Type:

ID Number:

Check here, if this person has lived in the U.S. since 1996

Check here, if this person has lived in the U.S. since 1996

Check here, if this person, his or her spouse, or a parent is a veteran or an active duty member in the U.S. military

Check here, if this person, his or her spouse, or a parent is a veteran or an active duty member in the U.S. military

Additional Information

Check here, if this person lives with at least one child under the age of 19 and is the person taking care of this child.

Check here, if this person lives with at least one child under the age of 19 and is the person taking care of this child.

Check here, if this person is 18 years or younger and has a parent living outside of the house

Check here, if this person is 18 years or younger and has a parent living outside of the house

Check here, if this person wants help paying for medical bills from the last three months

Check here, if this person wants help paying for medical bills from the last three months

Person 2:

A.Name

B.Social Security Number

C.Date of Birth

D.How is this person related to you?

E.This person is : Male  Female

Female

F.This person a U.S. citizen or U.S. national Yes  No If yes, skip to “additional information” below.

No If yes, skip to “additional information” below.

4 |

Medicaid Renewal Request for Information Notice

If no, answer question “G”

G.If this person has eligible immigration status: Document Type:

ID Number:

Check here, if this person has lived in the U.S. since 1996

Check here, if this person, his or her spouse, or a parent is a veteran or an active duty member in the U.S. military

Check here, if this person, his or her spouse, or a parent is a veteran or an active duty member in the U.S. military

Additional Information

Check here, if this person lives with at least one child under the age of 19 and is the person taking care of this child.

Check here, if this person lives with at least one child under the age of 19 and is the person taking care of this child.

Check here, if this person is 18 years or younger and has a parent living outside of the house

Check here, if this person is 18 years or younger and has a parent living outside of the house

Check here, if this person wants help paying for medical bills from the last three months

Check here, if this person wants help paying for medical bills from the last three months

If more space is needed, please attach a separate sheet.

5 |

ATTACHMENT B

INCOME

Person Receiving Income

Income Type *

Amount

Before Taxes

How Often

Received

Start Date

If more space is needed to report changes, attach a separate sheet.

Include income from:

Jobs |

Foreign Income |

Self‐Employment |

Investment Income or Interest |

Alimony |

Farming or Fishing Income |

Unemployment |

Rental or Royal Income |

Social Security Benefits |

Capital Gains |

Retirement / Pension |

Scholarship |

Title |

Alien Sponsor |

Lump Sum Amount |

American Indian / Alaskan Native Income

Do not include:

Child Support

Workers Compensation

Supplemental Security Income (SSI)

Veterans Administration (VA) Benefits

C. Loss of Income: Was anyone listed on this form receiving income in the last 12 months but no longer is?

Yes  No

No

If yes, who, when and what type?

D. Expenses: Is there anyone in the family deducting expenses from their taxes? Yes  No

No  If yes, complete Expenses (Deductions) below.

If yes, complete Expenses (Deductions) below.

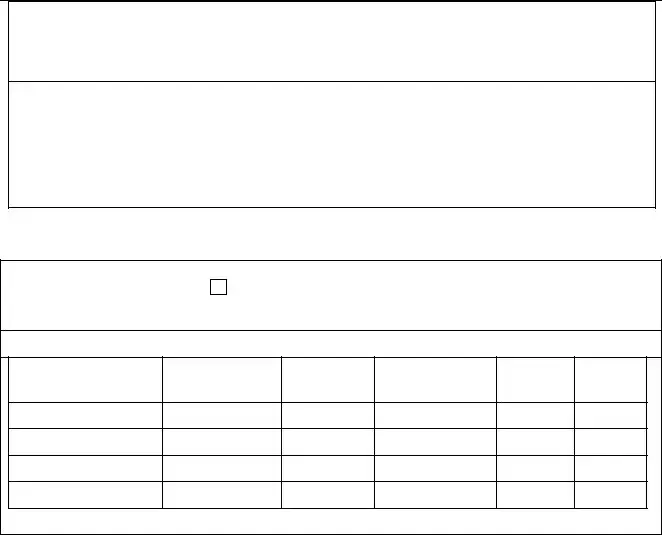

EXPENSES (DEDUCTIONS)

Person Paying Deduction

Deduction Type

Amount

How Often

Start Date

If more space is needed to report changes, please attach a separate sheet.

6 |

Medicaid Renewal Request for Information Notice

Allowable deductions include: |

|

|

Alimony Paid |

Health Savings Acct Contributions |

Educator Expenses |

IRA Contributions |

Tuition / Fees |

Moving Expenses |

Student Loan Interest |

Penalty on Early Withdrawals of savings |

|

For those who are self‐employed, allowable deductions also include:

Rent / Royalty Expenses

Certain Business Expenses of Reservists, Performing Artists and Fee Basis Government Officials Deductible Part of Self‐Employment Tax

Domestic Production Activities Deduction Health Insurance Deduction

SEP, SIMPLE and Qualified Plans

E. Health Insurance: Does anyone listed on this form have other health insurance besides Medicaid and

N.C. Health Choice? Yes  No

No

If so, complete Health Insurance below.

HEALTH INSURANCE

Person Covered

Policy Holder

Policy

Number

Insurance Company

Type of

Coverage

Start Date

If more space is needed to report changes, please attach a separate sheet.

Voter Registration:

If you are not registered to vote where you live now, would you like to apply to register to vote here today? __ yes __ no

If you want to register to vote, you can complete a voter registration form at http://www.ncsbe.gov/.

7 |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | The DMA-5199 form is used to collect necessary information for the renewal of Medicaid or N.C. Health Choice benefits. |

| Submission Deadline | This form must be submitted within 30 days of the date indicated at the top of the form to avoid loss of benefits. |

| Family Inclusion | Applicants should include details about all family members and tax dependents living in the household on the form. |

| Legal Basis | This form is regulated under North Carolina General Statutes § 108A-54, which governs Medicaid eligibility and administration. |

| Additional Applications | Attachment A can be used to apply for Medicaid for family members whose information is listed in Section 2 of the form. |

Guidelines on Utilizing Dma 5199

Filling out the DMA 5199 form is an important step in ensuring that you and your family remain qualified for Medicaid or N.C. Health Choice. After you complete the form, you must submit it to your local County Department of Social Services (DSS) within the specified timeframe to avoid losing your coverage.

- Start by obtaining the DMA 5199 form.

- At the top of the form, fill in the date, your name, and address.

- Write down your Case ID Number and the name of your worker.

- Note the deadline for submission, which is 30 days from the date at the top of the form.

Next, complete Section 1 about yourself:

- Indicate if you expect to file a tax return (Yes/No).

- State whether you are a dependent on someone else's tax return (Yes/No). If yes, provide their name.

Move on to Section 2, where you’ll provide information about each family member or tax dependent living in your household:

- For Person 1, fill in the name and answer all questions about tax returns, pregnancy status, and Medicaid eligibility. If this person does not have Medicaid, indicate that you will complete Attachment A to apply.

- Repeat the same process for Person 2, Person 3, and Person 4, ensuring all answers are accurate.

- If you require more space, attach a separate sheet as necessary.

Next, proceed to Section 3 for additional information:

- In subsection A, indicate if anyone listed has an income (Yes/No). If yes, complete Attachment B.

- Subsection B is about your living situation. Check the appropriate box regarding long-term care, a private home with services, or community services. List names if applicable.

- Subsection C identifies if anyone is between 18 and 26 and was in foster care at age 18 (Yes/No). List names if applicable.

In Section 4, provide your signature and date. Make sure to confirm that your answers are true and complete, understanding the importance of honesty.

Finally, send in your completed form. You can deliver it in person, call your local DSS for assistance, or mail it to the designated County DSS Office address.

What You Should Know About This Form

What is the purpose of the DMA 5199 form?

The DMA 5199 form is required for individuals applying to renew their North Carolina Medicaid or N.C. Health Choice benefits. The information provided on this form is essential to determine ongoing eligibility for these programs. It collects details about household income, family members, and other relevant factors. Completing this form accurately is crucial as it affects not only the individual applying but also any family members seeking health insurance coverage.

Who needs to fill out the DMA 5199 form?

Every household member who may be eligible for Medicaid or N.C. Health Choice should be represented on the DMA 5199 form. This includes not just the primary applicant but also any family members and tax dependents residing in the same household. Accurate information must be provided about each person’s tax filing status, income, and health insurance coverage to facilitate a thorough eligibility review.

What happens if I do not return the DMA 5199 form by the deadline?

If the DMA 5199 form is not returned by the specified deadline, which is typically 30 days from the date of issuance, the individual may risk losing their Medicaid or N.C. Health Choice benefits. Timely submission is essential to maintain coverage. If you require additional time or assistance, it is recommended to contact the local County Department of Social Services for guidance.

How do I send the DMA 5199 form once completed?

You have several options for submitting the DMA 5199 form. You can deliver it in person to the County Department of Social Services office, call them to discuss other submission options, or mail it to the designated DSS mailing address. Ensure you keep a copy of the completed form for your records.

What if I need help filling out the DMA 5199 form?

If you experience difficulties while completing the DMA 5199 form, it is advisable to reach out to the County DSS office for assistance. They can provide helpful guidance on the necessary information and any specific circumstances that may apply to your situation. Don't hesitate to ask for help to ensure your application is processed smoothly.

Common mistakes

Completing the DMA 5199 form can be straightforward, but there are common mistakes to avoid that may complicate the process. First, failing to meet the submission deadline is a frequent oversight. The form must be sent in within 30 days of the date provided at the top. Missing this deadline may result in losing your N.C. Medicaid or N.C. Health Choice coverage. Be sure to mark your calendar and send the completed form on time.

Another common mistake is not including all relevant family members and tax dependents living in the household. The form specifically requests information about these individuals in Section 2. Omitting anyone who qualifies can lead to incomplete evaluations and potential denials of coverage. It’s crucial to gather information from all applicable family members before beginning.

Inaccurate responses to questions about income can delay processing and result in complications. Many applicants underestimate their income or neglect to report certain sources. Double-check any income-related questions in Section 3 before submitting the form. Accuracy in reporting ensures that the review is based on real circumstances.

A lack of detail about changes in living situations can also be problematic. Section 3 inquires about whether anyone lives in particular types of facilities. If applicable, this information must be clearly stated. Furthermore, failing to mention changes in residency or dependence status can affect eligibility.

It is important to provide information about each listed person’s Medicaid status. Not indicating whether individuals have Medicaid or leaving the response blank can lead to confusion. Ensure that this section is filled out fully to avoid unnecessary follow-ups from the Department of Social Services.

Many people underestimate the importance of signing the form. Section 4 requires a signature from the beneficiary or an authorized representative. Not signing or failing to obtain the necessary signatures may result in the form being considered invalid, thereby jeopardizing the application.

Lastly, unclear or unreadable handwriting can frustrate those processing your application. Always write clearly and legibly to ensure all information is understood. If you have concerns about clarity or formatting, consider typing or printing the form when possible.

Documents used along the form

The DMA-5199 form is an essential document for Medicaid renewal in North Carolina. Along with this form, there are several other documents that individuals often use to ensure a comprehensive application process. Below are additional forms frequently submitted with the DMA-5199.

- Attachment A: This attachment is used to apply for Medicaid for individuals listed in Section 2 of the DMA-5199 form. It collects personal information, including Social Security numbers and immigration status for each person applying.

- Attachment B: This is intended for disclosing income information for anyone listed on the DMA-5199 form. Detailed income data is necessary to determine eligibility for Medicaid or N.C. Health Choice.

- Medicaid Eligibility Verification Form: This document verifies eligibility based on income and family size. It may need to be submitted if more detailed income information is required.

- Proof of Residency Documentation: Applicants may need to provide documentation that proves their residency in North Carolina. This can include utility bills, rental agreements, or government correspondence.

- Tax Return Forms: Recent tax returns may be requested to confirm income and household composition, which are important factors in determining eligibility for Medicaid assistance.

- Birth Certificates: For individuals applying under Medicaid, birth certificates may be necessary to establish the age and identity of family members listed in the application.

- Social Security Cards: These are often required to verify the Social Security numbers of persons applying for Medicaid and are essential to the SSI and Medicaid application processes.

Gather these documents ahead of time to streamline your Medicaid renewal process. Each form plays a crucial role in demonstrating eligibility and ensuring the application is complete and accurate.

Similar forms

- Medicaid Application Form: This document is used to apply for Medicaid benefits. It collects personal and family information to determine eligibility. Similar to the DMA 5199, it requires detailed information about income, household composition, and citizenship status.

- Medicaid Renewal Form: Like the DMA 5199, this form is necessary for individuals already enrolled in Medicaid to verify continued eligibility. It includes questions about household members, income, and medical needs, ensuring that recipients still meet the criteria.

- Application for Health Coverage: This form is used for people seeking health insurance under various programs, similar to the DMA 5199. It gathers information about the applicants and their family members, including residency and income details to assess qualification.

- Food Assistance Program Application: This application requires similar information regarding household income, family composition, and residency. It aims to determine eligibility for food assistance, much like the DMA 5199 evaluates eligibility for Medicaid benefits.

Dos and Don'ts

When filling out the DMA 5199 form, there are essential steps to ensure accuracy and compliance. Here is a list of things to remember:

- Do fill out the form completely, providing all required information for yourself and family members.

- Don't leave any sections blank. Incomplete forms may delay your application.

- Do double-check information regarding tax returns and dependents to avoid errors.

- Don't forget to include a valid contact number and mailing address for follow-up.

- Do sign and date the form to confirm the accuracy of the provided information.

- Don't submit the form close to the deadline; aim to submit it well in advance.

- Do attach any additional sheets if you need more space for listing family members or information.

- Don't neglect to check if any family members are eligible for Medicaid before applying.

- Do contact the County Department of Social Services if you have questions or need assistance.

Adhering to this guidance will help ensure that your Medicaid renewal process proceeds smoothly.

Misconceptions

- Misconception 1: The DMA 5199 form is only for those already on Medicaid.

- Misconception 2: Completing the form is optional.

- Misconception 3: You do not need to provide any personal income information.

- Misconception 4: It's not necessary to declare pregnancy on the form.

- Misconception 5: The DMA 5199 form can only be submitted in person.

- Misconception 6: The information provided is not subject to verification.

- Misconception 7: Only one household member needs to fill out the form.

- Misconception 8: Once submitted, there’s no need to follow up.

This form is used for Medicaid renewal, but it can also help individuals apply for Medicaid for family members who are not currently enrolled.

The form must be submitted within 30 days of receipt. Failing to do so can result in losing Medicaid eligibility.

Income details are crucial. The form asks if anyone listed has an income, and additional documentation may be required.

Pregnancy status must be disclosed. It impacts eligibility and services available.

You can submit the form via mail or phone as well, providing flexibility for applicants.

All information is subject to verification, and providing false information can lead to legal penalties.

All relevant household members must be listed to ensure a complete review of eligibility.

Key takeaways

Completing and using the DMA 5199 form is crucial for those seeking Medicaid or N.C. Health Choice. Here are some key takeaways to guide you through the process:

- Timeliness is Essential: Submit the form within 30 days of the date indicated on the notice. Failing to do so may result in losing your Medicaid coverage.

- Complete Family Information: Provide details for all family members living in your household. This includes income, tax dependency status, and whether any are pregnant.

- Assess Income and Living Situations: Indicate if anyone on the form has an income and their living arrangements, such as whether they reside in a long-term care facility or receive at-home medical services.

- Use Attachments Appropriately: If you are applying for Medicaid for individuals identified in Section 2, be sure to complete Attachment A and provide necessary documentation.

- Sign Under Penalty of Perjury: Your signature affirms that all information provided is accurate. Understand that false statements can lead to serious penalties.

- Contact Information: If you have questions while filling out the form, reach out to your local County Department of Social Services for assistance.

- Diverse Needs Considered: If anyone listed is a former foster care participant, aged 18 to 26, be sure to indicate this on the form for appropriate evaluation.

Following these guidelines can help ensure a smooth application process for Medicaid or N.C. Health Choice, providing you and your family with necessary health coverage.

Browse Other Templates

Rosebud Sioux Tribe - All required documents must have the correct state seals for authenticity.

Maryland Nonresident Tax Withholding Form,Nonresident Real Property Tax Form,Maryland Income Tax Withholding for Nonresidents,Form for Nonresident Real Estate Sales,Nonresident Seller Tax Calculation Form,Maryland Tax Form for Nonresident Sales,Nonre - Incorrect or incomplete forms can lead to delays in the sale process.