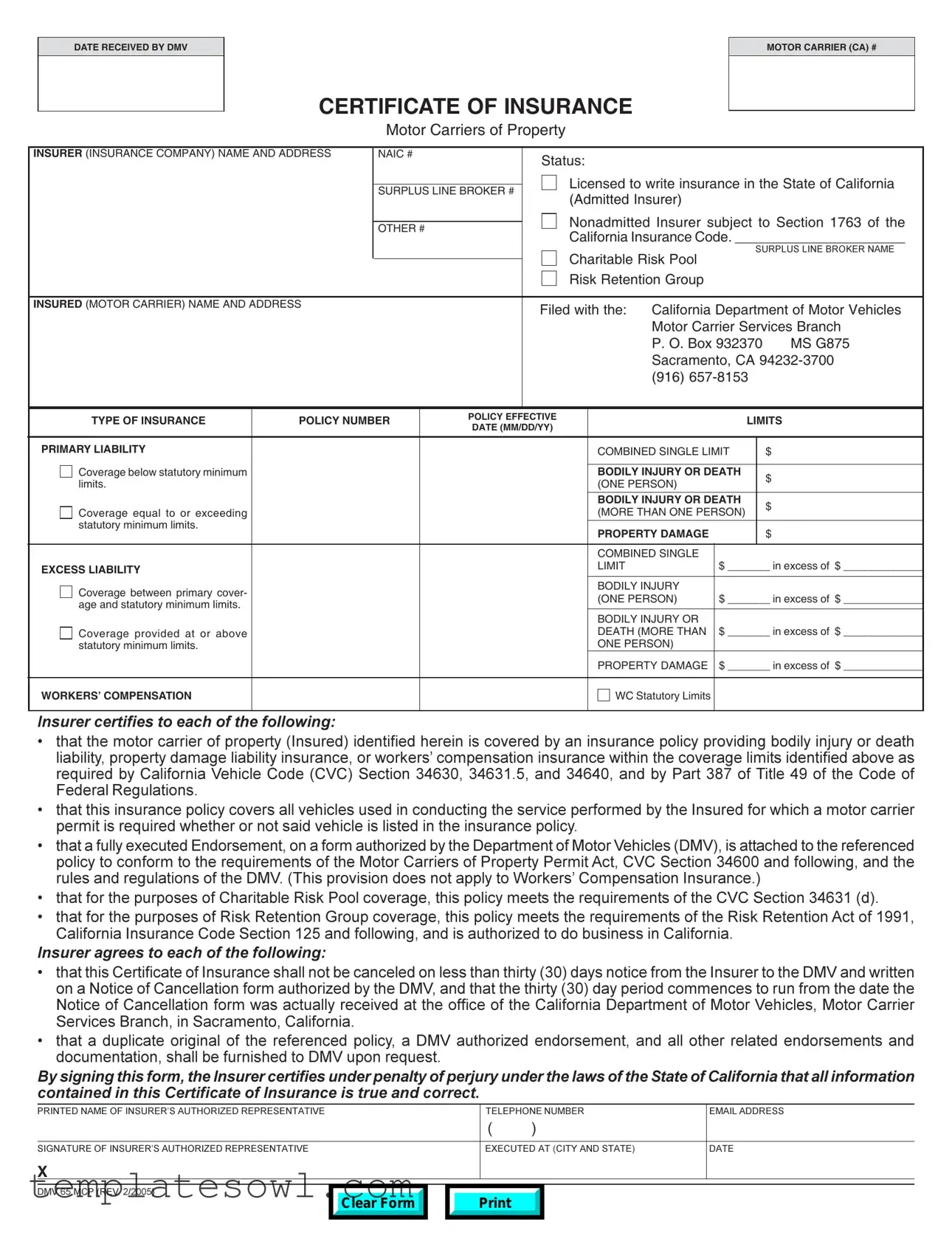

Fill Out Your Dmv 65 Mcp Form

The DMV 65 MCP form is a crucial document for motor carriers operating in California, serving to ensure compliance with state insurance requirements. This certificate of insurance verifies that a motor carrier has the necessary coverage for bodily injury, property damage, and workers' compensation as mandated by state law. Key sections of the form require details about the motor carrier, the insurance provider, and the specific types of coverage, including primary liability and excess liability limits. Insurers must confirm that their policy not only meets statutory minimums but also covers all vehicles involved in the carrier's operations, regardless of whether they are explicitly listed. Additionally, the form includes provisions that prevent cancellation of the insurance with less than thirty days' notice to the DMV. By signing this document, insurers certify the veracity of the information provided, reinforcing their accountability to both the carriers and regulatory bodies. This form ultimately plays a pivotal role in promoting safety and responsible practices within the motor carrier industry.

Dmv 65 Mcp Example

DATE RECEIVED BY DMV

CERTIFICATE OF INSURANCE

Motor Carriers of Property

MOTOR CARRIER (CA) #

INSURER (INSURANCE COMPANY) NAME AND ADDRESS |

NAIC # |

|

Status: |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

Licensed to write insurance in the State of California |

|||||

|

|

SURPLUS LINE BROKER # |

||||||||

|

|

(Admitted Insurer) |

|

|

|

|||||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

Nonadmitted Insurer subject to Section 1763 of the |

|||||

|

|

OTHER # |

|

|||||||

|

|

|

California Insurance Code. ______________________ |

|||||||

|

|

|

|

|

||||||

|

|

|

|

|

Charitable Risk Pool |

SURPLUS LINE BROKER NAME |

||||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

Risk Retention Group |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

INSURED (MOTOR CARRIER) NAME AND ADDRESS |

|

|

|

Filed with the: |

California Department of Motor Vehicles |

|||||

|

|

|

|

|

||||||

|

|

|

|

|

|

|

Motor Carrier Services Branch |

|||

|

|

|

|

|

|

|

P. O. Box 932370 |

MS G875 |

||

|

|

|

|

|

|

|

Sacramento, CA |

|||

|

|

|

|

|

|

|

(916) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TYPE OF INSURANCE |

POLICY NUMBER |

|

POLICY EFFECTIVE |

|

|

LIMITS |

||||

|

DATE (MM/DD/YY) |

|

|

|||||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

PRIMARY LIABILITY |

|

|

|

|

|

COMBINED SINGLE LIMIT |

|

$ |

||

|

|

|

|

|

|

|

|

|

|

|

Coverage below statutory minimum |

|

|

|

|

|

BODILY INJURY OR DEATH |

|

$ |

||

limits. |

|

|

|

|

|

(ONE PERSON) |

|

|

||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

BODILY INJURY OR DEATH |

|

$ |

||

Coverage equal to or exceeding |

|

|

|

|

|

(MORE THAN ONE PERSON) |

|

|||

|

|

|

|

|

|

|

||||

statutory minimum limits. |

|

|

|

|

|

PROPERTY DAMAGE |

|

|

$ |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMBINED SINGLE |

|

|

|

|

EXCESS LIABILITY |

|

|

|

|

|

LIMIT |

|

$ _______ in excess of $ _____________ |

||

|

|

|

|

|

|

|

|

|

|

|

Coverage between primary cover- |

|

|

|

|

|

BODILY INJURY |

|

|

|

|

|

|

|

|

|

(ONE PERSON) |

$ _______ in excess of $ _____________ |

||||

age and statutory minimum limits. |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BODILY INJURY OR |

|

|

|

|

Coverage provided at or above |

|

|

|

|

|

DEATH (MORE THAN |

$ _______ in excess of $ _____________ |

|||

statutory minimum limits. |

|

|

|

|

|

ONE PERSON) |

|

|

|

|

|

|

|

|

|

|

PROPERTY DAMAGE |

$ _______ in excess of $ _____________ |

|||

|

|

|

|

|

|

|

|

|

|

|

WORKERS’ COMPENSATION |

|

|

|

|

|

WC Statutory Limits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Insurer certifies to each of the following:

•that the motor carrier of property (Insured) identified herein is covered by an insurance policy providing bodily injury or death liability, property damage liability insurance, or workers’ compensation insurance within the coverage limits identified above as required by California Vehicle Code (CVC) Section 34630, 34631.5, and 34640, and by Part 387 of Title 49 of the Code of Federal Regulations.

•that this insurance policy covers all vehicles used in conducting the service performed by the Insured for which a motor carrier permit is required whether or not said vehicle is listed in the insurance policy.

•that a fully executed Endorsement, on a form authorized by the Department of Motor Vehicles (DMV), is attached to the referenced policy to conform to the requirements of the Motor Carriers of Property Permit Act, CVC Section 34600 and following, and the rules and regulations of the DMV. (This provision does not apply to Workers’ Compensation Insurance.)

•that for the purposes of Charitable Risk Pool coverage, this policy meets the requirements of the CVC Section 34631 (d).

•that for the purposes of Risk Retention Group coverage, this policy meets the requirements of the Risk Retention Act of 1991, California Insurance Code Section 125 and following, and is authorized to do business in California.

Insurer agrees to each of the following:

•that this Certificate of Insurance shall not be canceled on less than thirty (30) days notice from the Insurer to the DMV and written on a Notice of Cancellation form authorized by the DMV, and that the thirty (30) day period commences to run from the date the Notice of Cancellation form was actually received at the office of the California Department of Motor Vehicles, Motor Carrier Services Branch, in Sacramento, California.

•that a duplicate original of the referenced policy, a DMV authorized endorsement, and all other related endorsements and documentation, shall be furnished to DMV upon request.

By signing this form, the Insurer certifies under penalty of perjury under the laws of the State of California that all information contained in this Certificate of Insurance is true and correct.

PRINTED NAME OF INSURER’S AUTHORIZED REPRESENTATIVE |

|

|

|

TELEPHONE NUMBER |

EMAIL ADDRESS |

||

|

|

( |

) |

|

|

||

|

|

|

|

|

|

|

|

SIGNATURE OF INSURER’S AUTHORIZED REPRESENTATIVE |

|

|

|

EXECUTED AT (CITY AND STATE) |

DATE |

||

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DMV 65 MCP (REV. 2/2005) |

|

|

|

|

|

|

|

Clear Form

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Purpose of DMV 65 MCP | This form serves as a Certificate of Insurance needed for motor carriers of property in California. |

| Governing Law | The form is governed by the California Vehicle Code (CVC) Sections 34630, 34631.5, and 34640. |

| Required Insurance Types | Insured must have bodily injury, property damage liability insurance, or workers' compensation insurance. |

| Notice of Cancellation | The insurer must provide at least thirty (30) days notice to the DMV before canceling the policy. |

| Policy Coverage | Insurance must cover all vehicles used by the motor carrier, whether or not listed on the insurance policy. |

| Endorsement Requirement | A fully executed Endorsement, authorized by the DMV, is necessary to meet coverage requirements. |

| Charitable Risk Pool | This policy must conform to CVC Section 34631 (d) for coverage related to Charitable Risk Pools. |

| Risk Retention Group Compliance | The policy must comply with the Risk Retention Act of 1991, California Insurance Code Section 125 and following. |

| Certification Under Penalty | By signing, the insurer certifies that all information on the form is true under penalty of perjury. |

Guidelines on Utilizing Dmv 65 Mcp

Filling out the DMV 65 MCP form carefully is crucial to ensure compliance with California regulations regarding motor carrier insurance. Follow the steps below to complete the form accurately. Each section contains important details that must be filled out correctly.

- Obtain the Form: Download the DMV 65 MCP form from the official DMV website or visit your local DMV office to get a paper copy.

- Date Received: Write the date you complete the form as the "DATE RECEIVED BY DMV."

- Motor Carrier Information: Fill in the "MOTOR CARRIER (CA) #" with the unique identifier for your motor carrier.

- Insurer Information: Enter the "INSURER (INSURANCE COMPANY) NAME AND ADDRESS" and include the NAIC # if applicable.

- Status Selection: Indicate whether the insurer is a "Surplus Line Broker," "Nonadmitted Insurer," or "Charitable Risk Pool." Make sure to check the appropriate box.

- Insured Information: Fill in the "INSURED (MOTOR CARRIER) NAME AND ADDRESS" sections accurately.

- Type of Insurance: Specify the type of insurance policy you hold and enter the "POLICY NUMBER." Include the "POLICY EFFECTIVE DATE" in the designated format (MM/DD/YY).

- Limits of Coverage: Provide the coverage limits for "PRIMARY LIABILITY," "BODILY INJURY OR DEATH," and "PROPERTY DAMAGE." Make sure to indicate whether these coverages meet statutory minimums.

- Additional Coverage: If applicable, fill out the details for "COMBINED SINGLE EXCESS LIABILITY LIMIT," "WORKERS’ COMPENSATION," and other coverage types.

- Insurer's Certification: Ensure the insurer certifies compliance with the listed insurance requirements. This section should be signed by an authorized representative.

- Contact Information: Enter the printed name, telephone number, and email address of the insurer’s authorized representative.

- Signature: The authorized representative must sign and date the form at the bottom, stating the city and state where signed.

After completing these steps, review the form for accuracy before submission. All required documents, such as endorsements, should accompany the form when you send it to the DMV. Ensure that you keep a copy for your records. Your attention to detail will help facilitate a smooth processing of your insurance certificate.

What You Should Know About This Form

What is the DMV 65 MCP form?

The DMV 65 MCP form is a Certificate of Insurance specifically designed for motor carriers of property operating in California. This form verifies that a motor carrier has the required insurance coverage as mandated by California law, including liability and workers’ compensation insurance.

Who needs to file the DMV 65 MCP form?

Motor carriers of property, providing transportation services for goods within California, must file the DMV 65 MCP form. This includes any business or entity that operates commercial vehicles that require a motor carrier permit.

What information is required on the DMV 65 MCP form?

The form requires information such as the name and address of the motor carrier, the name and address of the insurer, policy numbers, coverage limits, and type of insurance. Additional details about the insurer’s licensing status in California and any surplus line broker information must also be included.

How does one complete the DMV 65 MCP form?

To complete the form, gather the necessary insurance details, including policy numbers and coverage amounts. Fill out the required fields accurately and ensure that the authorized representative from the insurer signs the form. Attach any additional endorsements as necessary.

What types of insurance are needed for the DMV 65 MCP form?

The form stipulates that motor carriers must have liability insurance for bodily injury, death, and property damage. Workers’ compensation insurance is also required to cover employees in the event of work-related injuries. The insurance policy must comply with specified limits set by California law.

How does the cancellation process work for the insurance certificate?

The insurer must provide written notice to the DMV at least 30 days before canceling the insurance coverage. The notice must be documented using a Notice of Cancellation form authorized by the DMV, and the 30-day period starts from the date the DMV receives this notice.

What happens if the DMV 65 MCP form is not filed?

If the DMV 65 MCP form is not filed, the motor carrier may face penalties, including fines or suspension of their operating permit. This non-compliance can also result in legal liability for any accidents or incidents that occur while the carrier operates without proper insurance coverage.

What is the purpose of attaching endorsements to the DMV 65 MCP form?

Endorsements are required to confirm that the insurance policy meets additional regulations outlined in the California Vehicle Code. These documents ensure that all vehicles being used for the motor carrier's operations are covered, whether or not they are listed in the insurance policy.

Can multiple policies be included in the DMV 65 MCP form?

While the form primarily requires information about one insurance policy, if multiple policies cover the motor carrier, it is essential to provide details for each policy. Discussing coverage with the insurer will clarify how to report these on the form accurately.

Who should be contacted for questions regarding the DMV 65 MCP form?

For specific inquiries related to the DMV 65 MCP form, individuals should contact the California Department of Motor Vehicles, Motor Carrier Services Branch, at the provided phone number: (916) 657-8153. They can offer guidance on filing requirements and any pertinent regulations.

Common mistakes

Filling out the DMV 65 MCP form can be straightforward, but several common mistakes can lead to delays or rejections. One frequent issue occurs when individuals fail to include the correct Motor Carrier (CA) Number. Omitting or misentering this number can cause confusion and may result in the form being returned.

Another mistake is leaving out the Insurer's Information. This section requires the insurance company's name, address, and NAIC number. If this information is incomplete or inaccurate, it can delay the approval process and create significant issues regarding coverage verifications.

People often confuse policy limits or do not enter them correctly. It's vital to provide accurate coverage limits for bodily injury, property damage, and combined single limits. If the limits fall below statutory minimums, the form will likely be deemed invalid, which could leave the motor carrier without the necessary insurance.

Inadequate understanding of attached endorsements is another common pitfall. The form requires that a fully executed endorsement be attached, which conforms to DMV requirements. Failing to attach this endorsement or submitting the wrong version can render the entire form unacceptable.

Some individuals neglect to sign the form altogether. The signature of the insurer's authorized representative is necessary under penalty of perjury. Without this signature, DMV cannot process the form.

Finally, not providing adequate contact information for the insurer’s representative can hinder communication efforts. The telephone number and email address must be clearly included to ensure that any questions or concerns can be addressed promptly. Careful attention to these details helps avoid unnecessary delays or complications in the insurance certification process.

Documents used along the form

The DMV 65 MCP form is essential for motor carriers in California, as it verifies compliance with insurance requirements. However, it often accompanies other important documents that further facilitate the motor carrier's operations and insurance validation. Below is a list of ten commonly used forms and documents alongside the DMV 65 MCP form.

- Form MC-100: This form serves as an application for a Motor Carrier Permit in California. It collects information about the motor carrier's business operations and vehicle information.

- Certificate of Insurance (COI): A document confirming that the motor carrier has the necessary insurance coverage. This is often provided by the insurance company and should match the details on the DMV 65 MCP form.

- Form E: A specific endorsement that must accompany the Certificate of Insurance, stipulating the insurance coverage for the vehicles used by the motor carrier. It ensures compliance with state regulations.

- Form FR-1: This form is a proof of insurance card that drivers must carry while operating commercial vehicles. It provides quick verification of insurance coverage.

- Form CHP 362: This is a California Highway Patrol (CHP) form required for a vehicle inspection. It certifies that the vehicle meets safety standards for commercial usage.

- Statement of Facts: A supplement that may be needed to explain any special circumstances regarding the motor carrier’s operations, vehicle usage, or insurance complexities.

- Workers’ Compensation Insurance Policy: If applicable, this document verifies that the motor carrier has coverage for work-related injuries. It is crucial for protecting employees and meeting legal requirements.

- Business License: A document issued by local government agencies, confirming that the motor carrier is authorized to operate within its jurisdiction.

- Transportation Agreement: This contract outlines the terms between the motor carrier and its clients, detailing responsibilities, rates, and services offered.

- Driver's License Verification: Documentation ensuring that all drivers operating commercial vehicles possess valid licenses. This may include background checks or DMV records.

Each of these documents plays a vital role in ensuring that motor carriers comply with state and federal regulations. Keeping them organized and readily available can streamline the process of establishing and maintaining the necessary permits and licenses.

Similar forms

-

DMV Form REG 50: This form is used for vehicle registration and shows proof of insurance similar to the DMV 65 MCP. Both documents confirm that the vehicle is insured within required limits.

-

DMV Form DL 123: This form is a proof of insurance declaration used for driver's license applications. Like the DMV 65 MCP, it certifies that the driver has the necessary insurance coverage.

-

Certifications of Insurance for Commercial Vehicles: These documents specify coverage for businesses. They provide similar insurance information required for motor carriers, as seen in the DMV 65 MCP.

-

DMV Form INS 22: This document provides notification of insurance changes. Similar to the DMV 65 MCP, it is crucial for maintaining current insurance records with the DMV.

-

DMV Form SR 1P: This form is submitted following an accident to show proof of insurance. Both documents are essential in demonstrating compliance with California insurance laws.

-

DMV Form 293: This form is a notice of cancellation of insurance. Like the DMV 65 MCP, it requires a specific notification period and ensures that the DMV is informed of any changes in coverage.

Dos and Don'ts

When filling out the DMV 65 MCP form, it is crucial to ensure the information is accurate and complete. Here are some important dos and don’ts to consider:

- Do carefully read the entire form before starting to fill it out.

- Do provide accurate information regarding the motor carrier, including the name and address.

- Do ensure that the insurance policy number is listed accurately.

- Do check that the effective date of the policy is correctly entered.

- Do confirm that the limits of coverage meet statutory requirements.

- Don't leave any sections blank unless instructed that they are optional.

- Don't provide false information, as it could lead to serious penalties.

- Don't forget to attach any required endorsements to the form.

- Don't ignore the need for a signature from an authorized representative of the insurer.

Misconceptions

Here are some common misconceptions about the DMV 65 MCP form that you should be aware of:

- This form is only needed for large companies. Many people think the DMV 65 MCP form is only for big businesses. However, any motor carrier, regardless of size, must submit this form if they operate commercial vehicles.

- Filling out the form is optional. Some believe that they can skip the DMV 65 MCP form without any consequences. This isn't true. Submitting the form is a requirement for compliance with California law.

- Using outdated information is acceptable. It's a common belief that prior versions of the form or outdated insurance details are fine to use. Always use the most current version and ensure your insurance information is up to date.

- Once submitted, there’s no need for annual updates. Many think that once they submit the DMV 65 MCP form, they won’t need to update it. In reality, this form may need to be updated regularly, especially if there are changes to your insurance policy.

- All types of insurance are covered under this form. Some assume that any insurance policy will suffice when filling out the DMV 65 MCP form. This is incorrect. The policy must meet specific criteria defined by California Vehicle Code and federal regulations.

- The DMV handles the insurance verification process automatically. There's a belief that once the form is submitted, the DMV automatically verifies the insurance. While they do check, it’s the responsibility of the motor carrier to ensure all information is accurate and current.

It's important to clear these misconceptions to avoid potential issues down the line.

Key takeaways

Understanding the DMV 65 MCP form is crucial for motor carriers of property in California. Here are key takeaways that simplify the process of filling out and using this form:

- Insurance Coverage Requirements: The insurer must ensure that the motor carrier has comprehensive coverage, including bodily injury, property damage, and workers' compensation, within the limits set by California law.

- Endorsement Necessity: A fully executed endorsement must accompany the insurance policy to meet DMV requirements. This endorsement confirms coverage for all vehicles used by the motor carrier.

- Cancellation Terms: The insurer is obligated to provide a thirty-day notice before canceling the insurance policy. The notification must be submitted in a specific format to the DMV.

- Accurate Information and Certification: The insurer's representative must sign the form, certifying that the information provided is accurate and complete. This certification is made under penalty of perjury.

Browse Other Templates

Dwc Forms California - Specific codes are used to classify the nature and cause of the injury.

Sample Letter to Close Current Bank Account and Transfer Funds - Filling out this form correctly leads to efficient processing.

Change Beneficiary - Payment of benefits to a Testamentary Trust depends upon the probate status of the will.