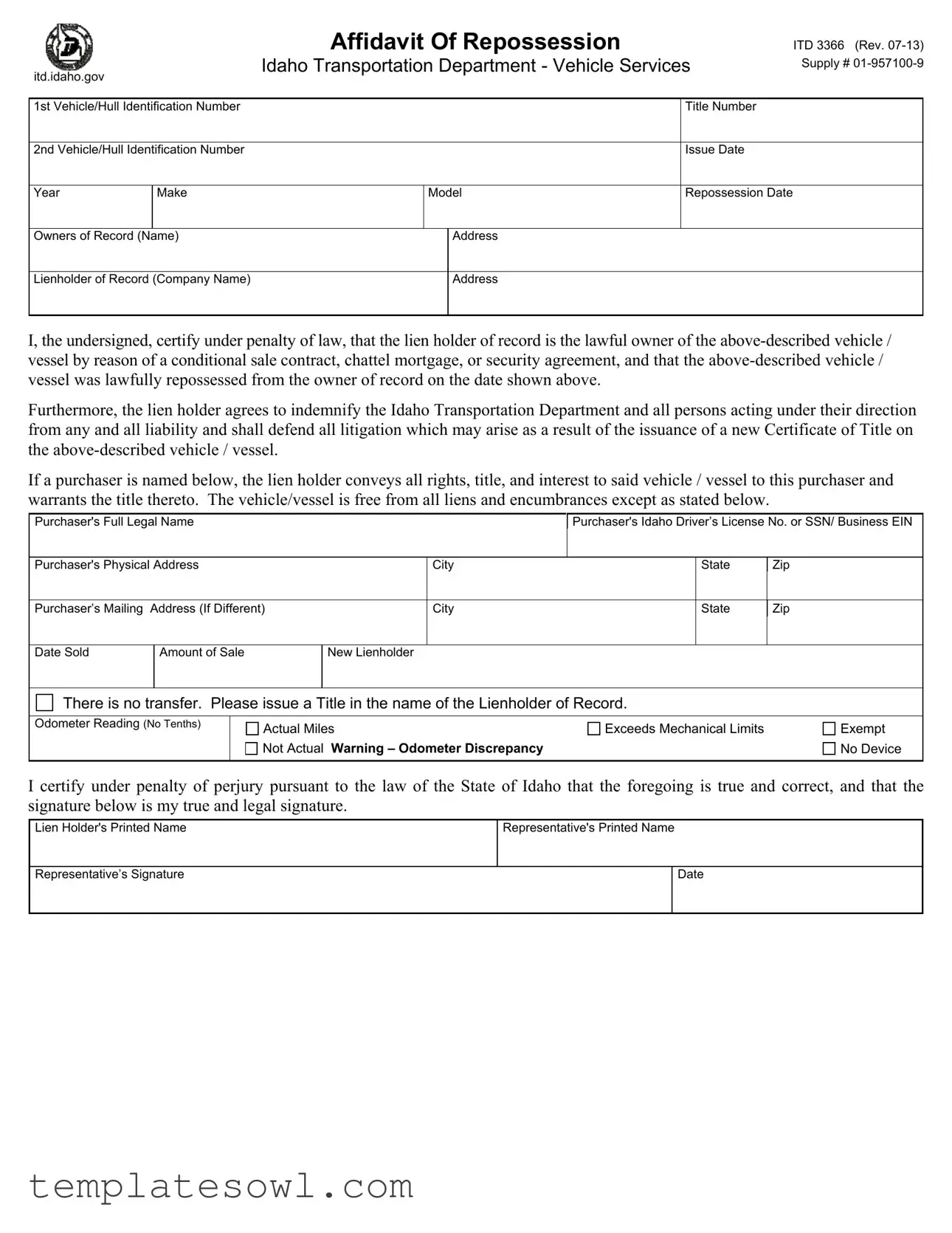

Fill Out Your Dmv Affidavit Of Repossession Form

When a vehicle or vessel is repossessed, it is crucial to formalize the process to ensure clarity and legal protection for all parties involved, particularly for the lienholder. The DMV Affidavit of Repossession form serves as a vital document in this context, detailing the circumstances surrounding the repossession, including key information such as the vehicle's identification numbers, the lienholder's details, and the owner's record. Within this form, the lienholder certifies their lawful ownership of the vehicle based on a conditional sale contract, chattel mortgage, or security agreement, while also outlining the specifics of the repossession, including the date it occurred. The form not only establishes the obligation of the lienholder to defend any related legal claims but also addresses the transfer of rights to any subsequent purchaser if they are identified. Additionally, it includes critical elements such as the purchaser's full legal name, identification, and any outstanding liens or encumbrances. Through this comprehensive framework, the DMV Affidavit of Repossession ensures that all necessary parties are protected and that the transition of ownership is executed smoothly and transparently.

Dmv Affidavit Of Repossession Example

|

|

|

|

Affidavit Of Repossession |

|

ITD 3366 (Rev. |

||

|

|

|

|

Idaho Transportation Department - Vehicle Services |

Supply # |

|||

itd.idaho.gov |

|

|

||||||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

1st Vehicle/Hull Identification Number |

|

|

|

Title Number |

|

|||

|

|

|

|

|

|

|

|

|

2nd Vehicle/Hull Identification Number |

|

|

|

Issue Date |

|

|||

|

|

|

|

|

|

|

|

|

Year |

Make |

|

Model |

Repossession Date |

|

|||

|

|

|

|

|

|

|

|

|

Owners of Record (Name) |

|

|

Address |

|

|

|||

|

|

|

|

|

|

|

|

|

Lienholder of Record (Company Name) |

|

|

Address |

|

|

|||

|

|

|

|

|

|

|

|

|

I, the undersigned, certify under penalty of law, that the lien holder of record is the lawful owner of the

Furthermore, the lien holder agrees to indemnify the Idaho Transportation Department and all persons acting under their direction from any and all liability and shall defend all litigation which may arise as a result of the issuance of a new Certificate of Title on the

If a purchaser is named below, the lien holder conveys all rights, title, and interest to said vehicle / vessel to this purchaser and warrants the title thereto. The vehicle/vessel is free from all liens and encumbrances except as stated below.

Purchaser's Full Legal Name |

|

|

Purchaser's Idaho Driver’s License No. or SSN/ Business EIN |

||||

|

|

|

|

|

|

|

|

Purchaser's Physical Address |

|

City |

|

State |

Zip |

||

|

|

|

|

|

|

|

|

Purchaser’s Mailing |

Address (If Different) |

|

City |

|

State |

Zip |

|

|

|

|

|

|

|

|

|

Date Sold |

|

Amount of Sale |

New Lienholder |

|

|

|

|

|

|

|

|

|

|

|

|

There is no transfer. Please issue a Title in the name of the Lienholder of Record.

Odometer Reading (No Tenths) |

Actual Miles |

Exceeds Mechanical Limits |

Exempt |

|

|||

|

Not Actual Warning – Odometer Discrepancy |

|

No Device |

|

|

|

|

I certify under penalty of perjury pursuant to the law of the State of Idaho that the foregoing is true and correct, and that the signature below is my true and legal signature.

Lien Holder's Printed Name

Representative's Printed Name

Representative’s Signature

Date

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The form is officially known as the Affidavit of Repossession ITD 3366. |

| Governing Authority | This form is governed by the Idaho Transportation Department. |

| Version Information | The form was last revised in July 2013. |

| Identification Numbers | Two vehicle or hull identification numbers must be provided. |

| Owners of Record | Names and addresses of the vehicle's owners of record are required. |

| Liability Indemnification | The lienholder agrees to indemnify the Idaho Transportation Department from liability related to the title issuance. |

| Odometer Disclosure | The form requires an odometer reading and provides options for disclosure. |

| Legal Certification | Filing the form certifies under penalty of perjury that the information is accurate. |

| Purchaser Information | If applicable, the form must include details about the purchaser, including their ID or SSN. |

| Transfer Statement | The lienholder can indicate whether there is a transfer of title to a new lienholder. |

Guidelines on Utilizing Dmv Affidavit Of Repossession

Once you have gathered the necessary information, filling out the DMV Affidavit of Repossession form is straightforward. This document is crucial for accurately recording the repossession of a vehicle or vessel. Follow the steps below to complete the form effectively.

- Obtain the form: Download or request a hard copy of the DMV Affidavit of Repossession form from the Idaho Transportation Department's website or your local DMV office.

- Enter Vehicle Information: Fill in the first vehicle or vessel's identification number as well as the title number. If applicable, include information about a second vehicle or vessel.

- Provide Details: Input the issue date, year, make, and model of the vehicle or vessel. Then enter the date of repossession.

- List Owners of Record: Write the full names and addresses of the owners of record as they appear on the title.

- Specify Lienholder of Record: Fill in the name and address of the lienholder of record.

- Certification Statement: Carefully read the certification statement. It asserts that the lienholder is the lawful owner based on the existing contract. Signing verifies that you understand and agree to its terms.

- Purchaser Information: If there’s a purchaser, include their full legal name, Idaho driver’s license number or social security number, and physical and mailing addresses. If the purchaser’s address differs from their physical address, ensure both are accurately filled out.

- Date Sold: Enter the date when the sale occurred, along with the sale amount.

- New Lienholder: If applicable, specify if there is a new lienholder or if no transfer occurs and a title should remain under the name of the lienholder of record.

- Odometer Reading: Report the odometer reading (no tenths) and check the appropriate box regarding the condition of the odometer: actual miles, exceeds mechanical limits, exempt, or not actual.

- Final Certification: Beneath the statement of certification, provide the printed names of both the lienholder and their representative. The representative must sign and date the form.

After completing the form, double-check for any errors before submission. Once everything is confirmed, you can submit the form to the Idaho Transportation Department or your local DMV office. Make sure to keep a copy for your own records as well.

What You Should Know About This Form

What is the DMV Affidavit of Repossession form?

The DMV Affidavit of Repossession form is a document used to confirm that a lienholder has legally repossessed a vehicle or vessel. This form certifies the ownership of the lienholder based on a prior agreement, such as a conditional sale contract or a security agreement.

Who needs to fill out this form?

This form is typically completed by a lienholder, such as a bank or financial institution, after repossessing a vehicle or vessel from the owner. It ensures that the transfer of ownership and titles reflects the current legal status of the property.

What information is required on the form?

You will need to provide various details, including the Vehicle or Hull Identification Number, title number, date of repossession, and the names and addresses of both the owner and the lienholder. Additionally, the form requires information about any purchaser if applicable, including their legal name, driver’s license number or taxpayer ID, and addresses.

What happens after I submit the form?

Once submitted, the Idaho Transportation Department processes the affidavit. If approved, a new Certificate of Title will be issued in the name of the lienholder or the purchaser, if one is designated. This must be done in accordance with Idaho law to ensure legal compliance.

Why is this form important?

This form protects both the lienholder and the state by providing legal proof of repossession. It helps prevent disputes regarding ownership and assures that the vehicle or vessel is free of any outstanding liens, barring those that are disclosed. This makes the transition smoother for future sales or registrations.

What penalties are associated with false information on this form?

Providing false information can lead to serious legal consequences. The form requires that you certify the truthfulness of the statements under penalty of law. This means that if you knowingly provide inaccurate or misleading information, you could face fines or other legal repercussions.

Can I use this form for any vehicle or vessel?

This form is specifically designed for vehicles and vessels within Idaho jurisdiction. It's important to verify that your circumstances meet the requirements for using the DMV Affidavit of Repossession. Always consult the relevant transportation department if you are unsure.

How do I obtain this form?

The DMV Affidavit of Repossession form can be obtained directly from the Idaho Transportation Department's website or their physical office. Ensure you're using the latest version to prevent any processing delays.

Common mistakes

Filling out the DMV Affidavit of Repossession form can be a straightforward task, yet many individuals encounter common pitfalls that can lead to delays and complications. Understanding these mistakes is essential to ensure that the process goes smoothly.

One notable error occurs with the Vehicle/Hull Identification Number. Failing to provide this critical identifier or entering it incorrectly can result in significant setbacks. Double-checking this number against the vehicle documentation is imperative. A small oversight here can create mismatches in the records.

Another frequent mistake involves the detail of the repossession date. The date should reflect when the vehicle was actually repossessed. Mixing this date with other significant dates, such as the sale date or the current date, can confuse the records and lead to potential legal disputes. It’s crucial to pay attention to the specific date and ensure its accuracy.

Individuals often overlook the full legal name of the purchaser. If this information is not complete or accurate, complications can arise when transferring the title. Verify that the name matches what appears on legal documents to alleviate any future issues with ownership claims.

Another common oversight is neglecting to indicate the correct odometer reading. This reading must accurately reflect the vehicle’s miles at the time of repossession. Providing an estimated figure or failing to disclose a discrepancy can trigger investigations, potentially leading to fines or additional legal trouble.

It is also important to clearly indicate if there are any liens or encumbrances on the vehicle. Omitting this information or stating that there are none when there actually are can lead to complications down the line. Transparency is essential in this process to avoid liability issues for the lienholder.

Many applicants forget to sign the affidavit, or they may fail to provide the printed names of both the lienholder and the representative. Without these necessary signatures and printed names, the document is incomplete and will not be processed by the DMV. Ensuring that all required signatures are present before submission is crucial to avoid delays.

Finally, neglecting to provide contact information can lead to complications should the DMV have questions about the form. Having accurate information readily available for any follow-up can expedite the process and help clarify any uncertainties that arise.

Documents used along the form

When dealing with vehicle repossession, the DMV Affidavit of Repossession form is often accompanied by other important documents. Each of these forms plays a crucial role in ensuring the repossession process is legally sound and the required information is appropriately documented. Below is a list of relevant documents.

- Conditional Sale Contract: This document outlines the terms under which a buyer is purchasing the vehicle, including payment details and responsibilities. It serves as proof of the buyer's obligation to pay for the vehicle.

- Security Agreement: This form establishes the lender's rights to the vehicle in the event of default. It details the obligations of the borrower and the rights of the lender regarding repossession.

- Chattel Mortgage: A chattel mortgage is similar to a traditional mortgage but is used specifically for personal property such as vehicles. It gives the lender the right to seize the vehicle if the borrower fails to meet payment terms.

- Notice of Default: Issued when a borrower fails to meet the terms of their financial agreement, this document alerts the borrower of their default status and outlines the consequences, including potential repossession.

These forms collectively provide a comprehensive foundation for handling the repossession of a vehicle, ensuring that all parties are aware of their rights and responsibilities. Understanding and preparing these documents can help facilitate a smoother repossession process and mitigate potential disputes.

Similar forms

The DMV Affidavit Of Repossession form has similarities to several other legal documents. Each serves a specific purpose related to vehicle ownership and liability in the context of repossession. Below is a list of six such documents:

- Bill of Sale: This document records the transaction between the buyer and seller of a vehicle. Like the affidavit, it confirms the transfer of ownership and can detail any liens on the vehicle.

- Power of Attorney for Vehicle Transactions: This allows an individual to authorize another person to act on their behalf in transactions involving their vehicle. Similar to the affidavit, it establishes legal authority and responsibility.

- Title Transfer Form: This form is used to officially transfer ownership of a vehicle from one person to another. It functions like the affidavit by documenting the change in ownership and ensuring all parties are aware of their rights and obligations.

- Notice of Sale: This serves as a public notification that a vehicle has been sold or transferred. Similar to the affidavit, it helps to clarify ownership and can protect the seller from future liabilities regarding that vehicle.

- Vehicle Lien Release Form: This document is used to release a lien on a vehicle once a debt has been satisfied. Like the affidavit, it signifies the intent to clear any claims against the vehicle, confirming that the lienholder has relinquished control.

- Vehicle Repossession Agreement: This outlines the terms under which a lienholder may repossess a vehicle due to non-payment. Similar to the affidavit, it provides legal grounds for the repossession and the rights of both parties involved in the process.

Dos and Don'ts

When completing the DMV Affidavit Of Repossession form, following the right steps can make the process smoother. Here’s a list of what you should and shouldn’t do.

- Do ensure all vehicle identification numbers are accurate and correctly noted.

- Do provide complete and up-to-date information for both the lienholder and the owner of record.

- Do verify that the repossession date is clearly indicated on the form.

- Do make sure to sign and date the form where required.

- Don't leave any fields blank; incomplete information can delay processing.

- Don't alter the form; any changes should be initialed to maintain clarity.

Remember, attention to detail is key. By following these guidelines, you can help ensure that your application is processed without unnecessary delays.

Misconceptions

Understanding the DMV Affidavit of Repossession form is essential for individuals and businesses involved in vehicle repossession. However, several misconceptions exist regarding this document. Below is a list of common misunderstandings, along with explanations to clarify each.

-

This form is only for car repossession.

This is incorrect. The Affidavit of Repossession can apply to various types of vehicles, including boats and trailers, not just automobiles.

-

You do not need a lien holder to complete this form.

This is a misconception. A lien holder is necessary for submitting this form, as it verifies their legal claim over the vehicle being repossessed.

-

Once the form is filed, the lien holder loses ownership of the vehicle.

This is false. Filing the affidavit does not transfer ownership; it serves to document the lien holder's right to repossess the vehicle, maintaining their ownership status.

-

The form can take any date for repossession.

This is misleading. The repossession date must be accurate and reflect when the vehicle was actually repossessed. Falsifying this date can lead to legal issues.

-

The affidavit guarantees that no further legal action will occur after repossession.

This is not true. Filing the affidavit does not prevent the previous owner from contesting the repossession or pursuing legal action against the lien holder.

Being aware of these misconceptions can help individuals navigate the repossession process with greater clarity and understanding.

Key takeaways

When dealing with the DMV Affidavit of Repossession form, it's important to keep a few key points in mind. Here’s a straightforward guide to help you navigate filling it out and using it effectively.

- Understand the Purpose: This form serves as a legal declaration that the lien holder has repossessed a vehicle or vessel. It provides proof of ownership and liability.

- Accurate Information: Ensure all details about the vehicle, including the Identification Number, title number, and the repossession date, are correct. Any discrepancies can cause delays or issues.

- Certification: By signing the form, the lien holder certifies under penalty of law that the vehicle was lawfully repossessed. Take this seriously, as it carries legal weight.

- Indemnification Clause: The lien holder agrees to protect the Idaho Transportation Department and others from any liability arising from issuing a new vehicle title. This is an important responsibility.

- Purchaser Information: If the vehicle is being transferred to a new purchaser, provide their complete name, Idaho driver’s license number or Social Security Number, and addresses clearly.

- Odometer Reading: Accurately report the odometer reading, including any notes about discrepancies or mechanical limits. This information is crucial for the vehicle's history.

- Legal Assurance: The lien holder must print their name, representative's name, and sign the form. This ensures that all parties are legally recognized in this process.

Filling out the DMV Affidavit of Repossession form accurately and carefully is key to a smooth transaction. Keep these takeaways in mind to aid in your completion and submission of the form.

Browse Other Templates

Chp 362 Form - Traffic citations, regardless of when they occurred, must also be reported on this form.

Owcp-1168 - Completed forms can be sent to specific addresses for each program covered.

Free Printable Child Care Receipt Template - This receipt can act as a reference in case of any tax audits or reviews.