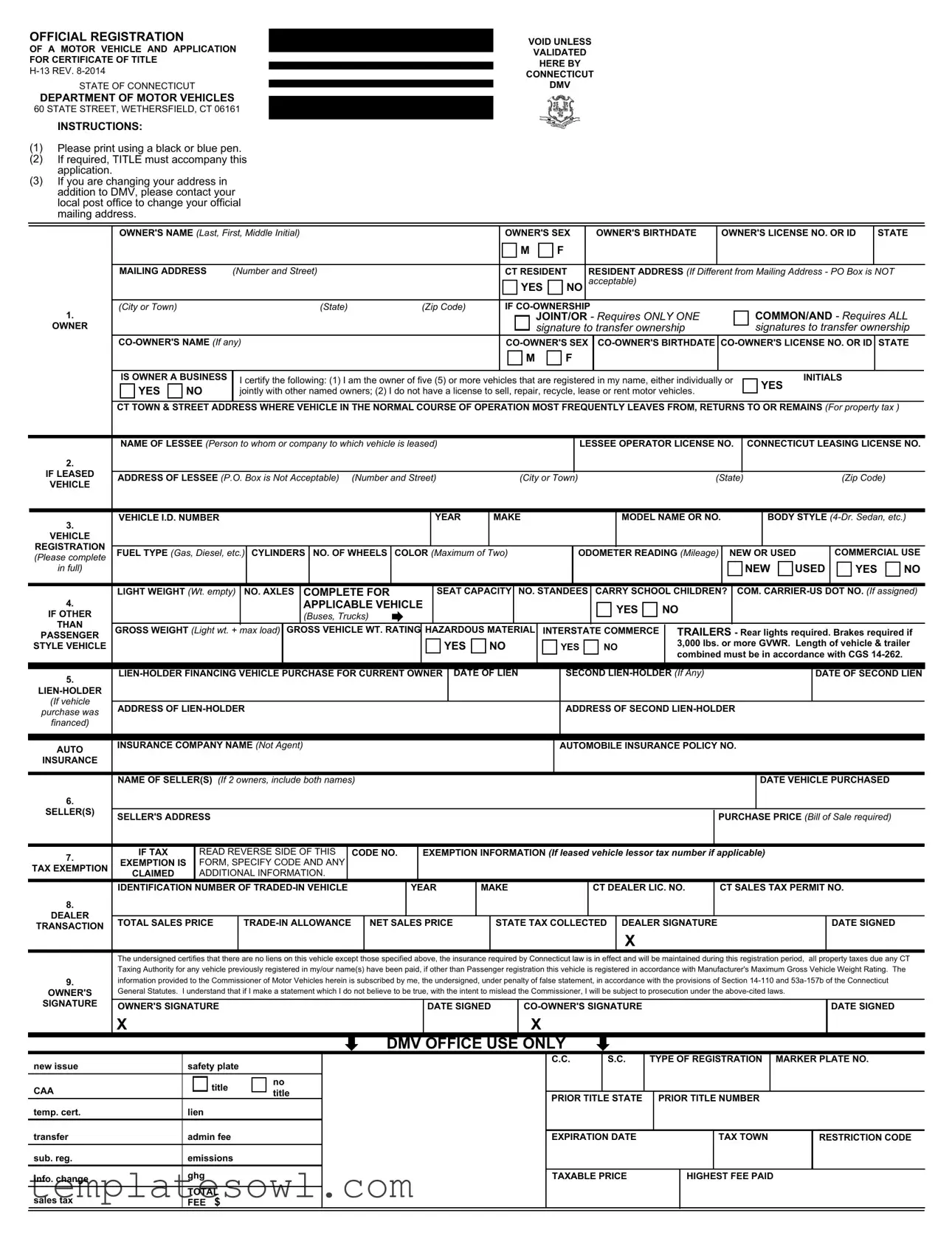

Fill Out Your Dmv H 13 Form

The DMV H 13 form plays a critical role in the process of registering motor vehicles and applying for a certificate of title in Connecticut. This official document requires detailed information about the vehicle, its owner, and any financial obligations tied to it. Individuals must provide personal data including their names, contact information, and identification numbers, which allows the Department of Motor Vehicles to verify ownership. The form also necessitates disclosure about any co-owners, lien-holders, and financing details, as well as the vehicle’s make, model, year, and unique identification number. Additionally, applicants must indicate whether the vehicle is new or used and provide relevant information about its registration status and any applicable taxes. Specific exemptions can be claimed on this form, enabling owners to navigate their tax obligations efficiently. As a detailed application, the H 13 form ensures that such crucial information is accurately documented, facilitating the legal transfer of ownership and the protection of financial interests throughout the registration process.

Dmv H 13 Example

OFFICIAL REGISTRATION

OF A MOTOR VEHICLE AND APPLICATION FOR CERTIFICATE OF TITLE

STATE OF CONNECTICUT

DEPARTMENT OF MOTOR VEHICLES

60 STATE STREET, WETHERSFIELD, CT 06161

INSTRUCTIONS:

VOID UNLESS

VALIDATED

HERE BY

CONNECTICUT

DMV

(1)Please print using a black or blue pen.

(2)If required, TITLE must accompany this application.

(3)If you are changing your address in addition to DMV, please contact your local post office to change your official mailing address.

|

OWNER'S NAME (Last, First, Middle Initial) |

|

OWNER'S SEX |

|

|

OWNER'S BIRTHDATE |

OWNER'S LICENSE NO. OR ID |

STATE |

|||||||

|

|

|

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

MAILING ADDRESS |

(Number and Street) |

|

CT RESIDENT |

|

RESIDENT ADDRESS (If Different from Mailing Address - PO Box is NOT |

|||||||||

|

|

|

|

|

|

|

|

YES |

NO |

acceptable) |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1. |

(City or Town) |

|

(State) |

(Zip Code) |

IF |

|

COMMON/AND - Requires ALL |

||||||||

|

|

|

|

|

|

|

JOINT/OR - Requires ONLY ONE |

|

|||||||

OWNER |

|

|

|

signature to transfer ownership |

|

signatures to transfer ownership |

|||||||||

|

|

|

STATE |

||||||||||||

|

|

|

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

IS OWNER A BUSINESS |

I certify the following: (1) I am the owner of five (5) or more vehicles that are registered in my name, either individually or |

INITIALS |

|

||||||||||

|

|

|

YES |

|

NO |

jointly with other named owners; (2) I do not have a license to sell, repair, recycle, lease or rent motor vehicles. |

|

YES |

|

||||||

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CT TOWN & STREET ADDRESS WHERE VEHICLE IN THE NORMAL COURSE OF OPERATION MOST FREQUENTLY LEAVES FROM, RETURNS TO OR REMAINS (For property tax )

|

NAME OF LESSEE (Person to whom or company to which vehicle is leased) |

|

|

|

|

|

|

|

LESSEE OPERATOR LICENSE NO. |

|

CONNECTICUT LEASING LICENSE NO. |

||||||||||||||||||||||||||||||||||

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IF LEASED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS OF LESSEE (P.O. Box is Not Acceptable) |

(Number and Street) |

|

|

|

(City or Town) |

|

|

|

|

(State) |

|

|

|

|

|

(Zip Code) |

|

||||||||||||||||||||||||||||

VEHICLE |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3. |

VEHICLE I.D. NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YEAR |

|

|

MAKE |

|

|

|

|

|

MODEL NAME OR NO. |

|

|

|

|

|

BODY STYLE |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VEHICLE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REGISTRATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Please complete |

FUEL TYPE (Gas, Diesel, etc.) |

CYLINDERS |

NO. OF WHEELS |

COLOR (Maximum of Two) |

|

|

|

ODOMETER READING (Mileage) |

|

NEW OR USED |

COMMERCIAL USE |

||||||||||||||||||||||||||||||||||

in full) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NEW |

USED |

YES |

NO |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

LIGHT WEIGHT (Wt. empty) |

NO. AXLES |

COMPLETE FOR |

|

|

|

|

SEAT CAPACITY |

NO. STANDEES |

CARRY SCHOOL CHILDREN? |

|

COM. |

|||||||||||||||||||||||||||||||||

4. |

|

|

|

|

|

APPLICABLE VEHICLE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

IF OTHER |

|

|

|

|

|

(Buses, Trucks) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

THAN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PASSENGER |

GROSS WEIGHT (Light wt. + max load) |

GROSS VEHICLE WT. RATING |

HAZARDOUS MATERIAL |

INTERSTATE COMMERCE |

|

TRAILERS - Rear lights required. Brakes required if |

|||||||||||||||||||||||||||||||||||||||

STYLE VEHICLE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

|

|

|

|

NO |

|

|

YES |

NO |

|

3,000 lbs. or more GVWR. Length of vehicle & trailer |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

combined must be in accordance with CGS |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

5. |

DATE OF LIEN |

|

|

SECOND |

|

|

|

|

|

|

|

|

|

DATE OF SECOND LIEN |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(If vehicle |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS OF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS OF SECOND |

|

|

|

|

|

|

|

||||||||||||||||||

purchase was |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

financed) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

AUTO |

INSURANCE COMPANY NAME (Not Agent) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AUTOMOBILE INSURANCE POLICY NO. |

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INSURANCE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

NAME OF SELLER(S) (If 2 owners, include both names) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE VEHICLE PURCHASED |

|

|||||||||||||||

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SELLER(S) |

SELLER'S ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PURCHASE PRICE (Bill of Sale required) |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

7. |

IF TAX |

READ REVERSE SIDE OF THIS |

|

CODE NO. |

|

|

EXEMPTION INFORMATION (If leased vehicle lessor tax number if applicable) |

|

|

|

|

||||||||||||||||||||||||||||||||||

EXEMPTION IS |

FORM, SPECIFY CODE AND ANY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

TAX EXEMPTION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

CLAIMED |

ADDITIONAL INFORMATION. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

IDENTIFICATION NUMBER OF |

|

|

|

|

YEAR |

MAKE |

|

|

|

|

CT DEALER LIC. NO. |

CT SALES TAX PERMIT NO. |

|

|||||||||||||||||||||||||||||||

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEALER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL SALES PRICE |

NET SALES PRICE |

|

|

STATE TAX COLLECTED DEALER SIGNATURE |

|

|

|

|

|

|

|

|

DATE SIGNED |

|

|||||||||||||||||||||||||||||||

TRANSACTION |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X

The undersigned certifies that there are no liens on this vehicle except those specified above, the insurance required by Connecticut law is in effect and will be maintained during this registration period, all property taxes due any CT Taxing Authority for any vehicle previously registered in my/our name(s) have been paid, if other than Passenger registration this vehicle is registered in accordance with Manufacturer's Maximum Gross Vehicle Weight Rating. The

9.information provided to the Commissioner of Motor Vehicles herein is subscribed by me, the undersigned, under penalty of false statement, in accordance with the provisions of Section

OWNER'S |

General Statutes. I understand that if I make a statement which I do not believe to be true, with the intent to mislead the Commissioner, I will be subject to prosecution under the |

|

|||

SIGNATURE |

OWNER'S SIGNATURE |

|

DATE SIGNED |

DATE SIGNED |

|

|

|

||||

|

X |

|

|

X |

|

|

|

DMV OFFICE USE ONLY |

|

||

new issue |

safety plate |

|

|

CAA |

title |

no |

|

title |

|||

|

|||

temp. cert. |

lien |

|

|

transfer |

admin fee |

|

|

sub. reg. |

emissions |

|

|

|

|

|

|

info. change |

ghg |

|

|

|

|

||

|

|

|

|

sales tax |

TOTAL |

|

|

FEE $ |

|

C.C. |

S.C. |

TYPE OF REGISTRATION |

MARKER PLATE NO. |

||||

|

|

|

|

|

|

|

|

PRIOR TITLE STATE |

|

PRIOR TITLE NUMBER |

|

|

|||

|

|

|

|

|

|

|

|

EXPIRATION DATE |

|

|

|

TAX TOWN |

|

RESTRICTION CODE |

|

|

|

|

|

|

|

|

|

TAXABLE PRICE |

|

|

HIGHEST FEE PAID |

|

|

||

|

|

|

|

|

|

|

|

SALES TAX INSTRUCTIONS

A)SALES OR USE TAX COMPUTATION - The sales or use tax is based on the invoiced purchase price for vehicles purchased from a licensed dealer. If the vehicle is purchased from a private individual, not from a licensed dealer, the sales or use tax is based on the current month's issue of the N.A.D.A. Official Used Car Guide, Eastern Edition or the Bill of Sale, whichever is greater.

B)SALES TAX PAID IN ANOTHER STATE - In order to obtain credit for sales/use tax paid to another jurisdiction, you must present proof of payment in the form of an official receipt or dealer's invoice.

C)BARTER, TRADE, SWAP - When two individuals trade vehicles, each must pay sales/use tax on the value of the vehicle received based on the current month's issue of the N.A.D.A. Official Used Car Guide, Eastern Edition.

D)CHECKS - Please make your check payable to "DMV". The total for all DMV fees also will include the sales tax.

E)REFUNDS - Claims for sales or use tax refunds must be submitted to the Department of Revenue Services. Use

SPECIAL INSTRUCTIONS FOR THOSE CLAIMING EXEMPTION FROM CONNECTICUT SALES OR USE TAX

Specify the applicable code (1, 2, 3, 4, or 5) as described below in the space on the front in SECTION 1 labeled IF TAX EXEMPTION IS CLAIMED. Include additional information as required below for the applicable code in the area labeled EXEMPTION INFORMATION.

Code 1:

Code 2:

Code 3:

Code 4:

Code 5:

Transfer between immediate family members (Only MOTHER, FATHER, SPOUSE (wife, husband, civil union), DAUGHTER, SON, SISTER or BROTHER qualify as "immediate family members"). Specify code "1" and in the area labeled EXEMPTION INFORMATION, write which of the

Sale to a Connecticut exempt organization or to a governmental agency. Specify code "2" and write the Connecticut Tax Exemption Number beginning with "E" in the area labeled EXEMPTION INFORMATION or attach a copy of the organization's Internal Revenue Code Section 501(c)(3) or 501(c)(13) exemption letter issued by the IRS.

Sales or Use Tax was paid to another jurisdiction. An official receipt or dealer's invoice must be presented identifying the amount of sales tax paid. Specify code "3" and, in the area labeled EXEMPTION INFORMATION, write the amount of tax paid and the jurisdiction to which this tax was paid.

Vehicles purchased while residing outside of Connecticut.

Other reasons. Specify code "5" and write the applicable letter from the list below in the area labeled EXEMPTION INFORMATION.

5A) GIFT - If vehicle was received as a gift, provide a copy of form

5B) VEHICLE PURCHASED BY A LESSOR EXCLUSIVELY FOR LEASE OR RENTAL - Provide the Connecticut Tax Registration Number of the lessor/purchaser.

5C) SALE BY A FEDERAL AGENCY, FEDERAL CREDIT UNION OR AMERICAN RED CROSS - Vehicle must have been obtained from a Federal Agency, a Federal Credit Union or the American Red Cross.

5D) CORPORATE ORGANIZATION, REORGANIZATION OR LIQUIDATION - Acquiring a vehicle in connection with the organization, reorganization or liquidation of an incorporated business provided (a) the last taxable sale, transfer or use of the motor vehicle was subjected to Connecticut sales or use tax, (b) the transferee is the incorporated business or a stockholder thereof.

5E) PARTNERSHIP OR LLC ORGANIZATION OR TERMINATION - Acquiring a vehicle in connection with the organization or termination of a partnership or LLC provided (a) the last taxable sale, transfer or use of the motor vehicle was subjected to Connecticut sales or use tax, and (b) the purchaser is the partnership or limited liability company, as the case may be, or a partner or member, thereof, as the case may be.

5F) HIGH MPG PASSENGER MOTOR VEHICLES - Section

5G) COMMERCIAL TRUCKS, TRUCK TRACTORS, TRACTORS AND SEMITRAILERS AND VEHICLES USED IN COMBINATION THEREWITH - Section

Section

For further information about sales and use taxes, see the DRS website (www.ct.gov/drs) or call DRS during business hours, Monday through Friday:

•

•

TTY, TDD, and Text Telephone users only may transmit inquiries anytime by calling

Form Characteristics

| Fact | Description |

|---|---|

| Purpose | The DMV H-13 form is used for the official registration of a motor vehicle and application for a certificate of title in Connecticut. |

| Owner Requirements | All vehicle owners must provide their name, address, birthdate, and other personal details on the form. This includes indicating co-ownership if applicable. |

| Tax Information | Sales or use tax applies based on the purchase price from licensed dealers or the N.A.D.A. Official Used Car Guide for private sales. |

| Governing Law | This form is governed by Sections 14-110 and 53a-157b of the Connecticut General Statutes. |

Guidelines on Utilizing Dmv H 13

Filling out the DMV H-13 form is the next step to ensure your vehicle is registered and titled correctly in Connecticut. Take your time to complete each section accurately, as this information is crucial for the registration process.

- Use a black or blue pen to print your information clearly.

- Fill in the owner's name (Last, First, Middle Initial) in the designated boxes.

- Select the owner’s sex by marking either M (Male) or F (Female).

- Enter the owner's birthdate in the format requested.

- Provide the owner's license number or ID and the corresponding state.

- Complete the mailing address section with your number and street, ensuring you include "CT."

- If the resident address differs from the mailing address, fill in that information. Note: PO Boxes are not acceptable.

- If applicable, include the co-owner's name and details following the same format as the owner.

- Specify if the owner is a business and initial if you meet the vehicle ownership conditions.

- Fill in the CT town and street address where the vehicle most frequently operates.

- Complete the vehicle information section, including the Vehicle I.D. number, year, make, model, body style, fuel type, color, and other required details.

- If the vehicle is leased, provide the lessee's information, including name, address, and license number.

- If applicable, fill out the lien-holder and second lien-holder information.

- Provide details regarding the seller(s), including their address and the sale price.

- Review the taxation section for any exemptions. Include specifics as needed.

- Ensure you understand the tax computation requirements specific to your situation.

- Sign and date the form appropriately. The owner and co-owner should both sign if applicable.

After completing these steps, review the form for accuracy and ensure all signatures are in place. Then, submit the form along with any required documents to the DMV for processing. Be sure to keep a copy of everything for your records.

What You Should Know About This Form

What is the DMV H 13 form used for?

The DMV H 13 form is primarily used for the registration of a motor vehicle in Connecticut and for applying for a certificate of title. This form is essential for both new and used vehicles and is required when a vehicle is bought, sold, or transferred. It collects important information regarding the vehicle, the owner, and any existing liens on the vehicle. Proper completion of this form ensures that the ownership and registration details are accurately reflected in the state's records.

What information do I need to complete the DMV H 13 form?

To complete the DMV H 13 form, you’ll need to provide a variety of details. This includes your name, mailing address, date of birth, and your Connecticut driver’s license or ID number. If applicable, you will also need to include information about any co-owners. For the vehicle itself, you must fill in details such as the vehicle identification number (VIN), make, model, year, color, odometer reading, and weight. Additionally, any liens or financing details should be reported, including the names and addresses of lien holders if applicable. If you are claiming any tax exemptions, make sure to gather supporting documentation that corresponds to the exemption codes described on the form.

How do I submit the DMV H 13 form?

The submission process for the DMV H 13 form can be done in person or by mail. If submitting in person, you can go to your local DMV office. Make sure to bring all necessary documentation, such as proof of identification and any other required documents like titles or bills of sale. If you opt to mail the form, ensure that it is filled out completely and that you include any applicable fees. The address for the DMV is specified on the form. Double-check that you have appropriate postage and that the envelope is clearly labeled to avoid any delays in processing.

What should I do if I need to make changes after submitting the DMV H 13 form?

If you discover that you need to make changes after you've submitted the DMV H 13 form, it is advisable to contact your local DMV office as soon as possible. Depending on the nature of the changes required, they may guide you through the steps needed to correct any errors. In some cases, you might be able to submit a corrected form or provide additional documentation to amend your original submission. Addressing changes promptly helps to ensure that your vehicle's registration and title accurately reflect the correct information.

What happens if I do not submit the DMV H 13 form?

Failure to submit the DMV H 13 form can lead to significant consequences. Most importantly, you would not legally own or be able to operate the vehicle on public roads. The vehicle could also accrue fines or penalties if it's not registered properly. Additionally, not registering a vehicle can cause complications regarding insurance coverage or claims. Without a proper title, the transfer of ownership can also be jeopardized, resulting in potential legal issues down the line. Therefore, it is crucial to ensure that the H 13 form is completed and submitted in a timely manner to avoid these complications.

Common mistakes

When filling out the DMV H 13 form for vehicle registration and title application in Connecticut, mistakes can lead to significant delays or complications. One common error is neglecting to use a black or blue pen, as required by the instructions. Instead, applicants sometimes use colored inks or pencils, which can invalidate the form. It's crucial to follow this basic guideline to avoid unnecessary setbacks.

Another frequent oversight involves not submitting the necessary title with the application. If you are applying for registration but you're coming from another state, the title must be included; otherwise, processing will be stalled until all documents are in order. This oversight can lead to frustration and increased wait times.

Inaccurate information is the third mistake that many individuals make. Filling in details such as the owner's name, address, or vehicle identification number incorrectly can cause the application to be flagged or rejected. Double-checking these details before submission can help ensure that everything is in line.

Not indicating whether you are residing at a different address than the mailing address is another common error. If your residential and mailing addresses differ, you need to explicitly state that. Failing to do so could lead to confusion or miscommunication from the DMV.

Many applicants also underestimate the importance of signatures. If the vehicle has co-owners, both signatures are required for transfer of ownership under the “AND” option, or just one for the “OR” option. Omitting a signature could delay or completely halt the registration process.

People often forget to check the box concerning the ownership of a business. If the owner is a business entity rather than an individual, this detail must be indicated clearly. Failing to do so may result in complications during verification.

Another issue arises with the financing information. Whether financing with a lien-holder or not, applicants must provide accurate details regarding liens. Inaccurate or incomplete lien-holder information can complicate ownership claims in the future.

Some individuals overlook the odometer reading section. This area requires meticulous attention, as incorrect or missing mileage readings can create issues related to ownership and vehicle history, and may raise questions about potential fraud.

Even tax exemption claims can become problematic if incorrectly filled out. If you are claiming an exemption, you must specify the correct code and provide supporting documentation. Missing details or incorrect codes can result in financial liabilities that frustrate the buyer.

Lastly, some applicants forget to include their contact information all together. While the form primarily focuses on vehicle registration, including a working phone number or email address allows the DMV to reach you easily if any questions or issues arise.

Avoiding these common mistakes can save time and frustration during the vehicle registration process. Careful attention to detail and thoroughness can help ensure a smooth transaction.

Documents used along the form

The DMV H-13 form is an important document used in Connecticut for registering a motor vehicle and applying for a certificate of title. When completing this form, you may also find the following forms and documents necessary to ensure a smooth process. Below is a brief description of each document commonly used alongside the DMV H-13 form.

- Title Transfer Form: This form is essential if you are transferring ownership of a vehicle from one person to another. It provides the necessary details about the transaction, including information about the buyer and seller, ensuring legal ownership is officially documented.

- Bill of Sale: This document records the sale of the vehicle between the buyer and the seller. It includes the purchase price, vehicle details, and signatures from both parties. A bill of sale acts as proof of the transaction and may be required for tax purposes.

- Certificate of Insurance: To register a vehicle, proof of insurance is required. This document confirms that the vehicle is insured, detailing the insurance provider and coverage information. It's important to have this prepared when submitting your DMV H-13 form.

- Trade-In Information Form: If you are trading in a vehicle as part of your purchase, this form details the trade-in vehicle’s information, including its make, model, and VIN (Vehicle Identification Number). This document can affect the sales tax calculation based on the trade-in value.

By gathering and understanding these forms, you can simplify the registration process for your vehicle in Connecticut. Always ensure you have all the required documents ready to facilitate timely processing and avoid any potential delays.

Similar forms

- DMV H-6 Form: This document is an application for a duplicate title. Like the H-13, the H-6 is essential for vehicle ownership transfers, and it requires the owner’s information and vehicle details.

- DMV H-7 Form: The H-7 serves as an application for a certificate of title for a vehicle purchased from a dealer. This form parallels the H-13 in requiring similar identification and registration details while facilitating title transfers.

- DMV H-8 Form: The H-8 is used for registering a vehicle acquired through a private sale. The necessity for providing personal and vehicle identification mirrors the H-13’s information requirements.

- DMV H-10 Form: The H-10 functions as a notice of lien. When applying for a vehicle title or registration, it parallels the H-13 in ensuring that lien details are disclosed, safeguarding both owner and lender.

- DMV H-14 Form: This form is for requesting a change in vehicle registration. It shares the focus on owner details and vehicle data inherent in the H-13, ensuring accurate title and registration records.

- DMV H-15 Form: The H-15 is an application for salvage vehicle title. It ensures that the vehicle's status is clear and requires similar data entry as the H-13, emphasizing accurate record-keeping for titles.

Dos and Don'ts

When filling out the DMV H-13 form, attention to detail is crucial. Mistakes can cause delays in the registration process, potentially impacting your ability to legally operate your vehicle. Here is a list of essential dos and don’ts to guide you through this process.

- Do use a black or blue pen when printing your information.

- Do ensure that your title accompanies the application if required.

- Do double-check that your mailing and residential addresses are accurate.

- Do include both owners’ signatures if applying for co-ownership.

- Do provide details about the lien-holder if applicable.

- Don't use a P.O. Box for your residential address, as it is not acceptable.

- Don't forget to include your odometer reading; it’s necessary for registration.

- Don't leave any sections blank; incomplete forms may lead to delays.

- Don't forget to include proof of sales tax payment if applicable.

- Don't overlook special exemptions; specify the correct codes if claiming an exemption.

Misconceptions

There are several misconceptions about the DMV H-13 form, which can lead to confusion for individuals looking to register a vehicle or apply for a title in Connecticut. Here are some commonly held beliefs along with clarifications.

- The H-13 form is only for new car registrations. This is not true. The H-13 form can also be used for transferring ownership of used vehicles, updating information, and more.

- All sections must be completed, even if not applicable. While it is important to provide accurate information, blank sections can be left when they do not apply to your situation.

- Using any color pen is acceptable. The form must be filled out using a black or blue pen only, as indicated in the instructions.

- You can apply without documentation. If you are applying for a title or registration, accompanying documents such as proof of ownership or prior registration may be required.

- The DMV H-13 form can be submitted electronically. Currently, the form must be submitted in person or via mail, as electronic submissions are not an option.

- Once submitted, there are no changes allowed. You can request modifications to your form after submission, but it may require additional steps and could delay processing.

- Only Connecticut residents can use the H-13 form. While it is primarily for residents, out-of-state individuals who have recently relocated can use the form for their Connecticut vehicle registrations.

Understanding these misconceptions can save time and help ensure that you complete the DMV H-13 form correctly. Accurate and complete submissions lead to smoother registration processes.

Key takeaways

Here are some important points to consider when filling out and using the DMV H-13 Form for vehicle registration and title application:

- Use a black or blue pen to print clearly on the form. This ensures that all the information is legible and reduces the chances of errors.

- If you are changing your address, be sure to update both the DMV and your local post office to avoid missing important correspondence.

- When co-owning a vehicle, all owners must provide their signatures if you are transferring ownership. Check the correct box for "AND" or "OR" to clarify how many signatures are needed.

- To claim any tax exemptions, be ready to specify the applicable code and provide the required documentation. This could include proof of relationship, tax exemption numbers, or vehicle registration details from another state.

Browse Other Templates

How to Fill Out Affidavit for Collection of Personal Property California - The SB 13100 form must accompany a list of assets for accurate processing.

Nypd Pension - Retirees can also specify if the address change is temporary or permanent.

Pennsylvania Llc Filing Requirements - An address for the individual responsible for tax reports is a requirement.