Fill Out Your Dmv Obl210 Form

The DMV Obl210 form is a critical document for individuals and businesses operating in the vehicle industry in Nevada. It serves as a Vehicle Industry Business License Bond, ensuring compliance with state regulations for various license types, including brokers, dealers, manufacturers, and distributors. At its core, the Obl210 form establishes a legal obligation among three parties: the principal— who is the licensee—, the surety— a corporation providing the bond—, and the state of Nevada as the obligee. The bond amount is specified, and it secures the payment against damages that may arise from fraudulent actions or violations of state laws concerning vehicle transactions. This bond acts as a safety net for consumers who may suffer losses due to the principal's misrepresentations. The Obl210 form is designed to be continuous in nature, meaning it remains effective until canceled by the surety, provided proper notice is given. Additionally, procedures for resolving disputes involve the Nevada Department of Motor Vehicles, ensuring that claims can be addressed in a structured manner. The form requires careful completion, as any errors or unauthorized signatures could render it void. Understanding the components and requirements of the Obl210 form is essential for anyone looking to engage in the vehicle business in Nevada.

Dmv Obl210 Example

r, u1111

555 Wright Way

Carson City, NV 89711

Reno/Sparks/Carson City (775)

Las Vegas area (702)

dmv.nv.gov

VEHICLE INDUSTRY BUSINESS LICENSE BOND

Bond Number

License Type:

□

Broker

Broker

□

Dealer/Rebuilder/Lessor

Dealer/Rebuilder/Lessor

□

Distributor

Distributor

□

Manufacturer

Manufacturer

□

KNOW ALL MEN BY THESE PRESENTS:

That |

|

|

|

|

, as principal, |

||||

|

|

|

|

(Individual or Corporate Name and Name Doing Business as) |

|

|

|

||

located in the County of |

|

|

|

|

|

, State of Nevada, obligee, and |

|||

|

|

|

|

|

, a corporation organized and existing under and by virtue of the |

||||

|

(Name of Surety) |

|

|

|

|

|

|

||

laws of the State of |

, and authorized to transact a surety business in the State of Nevada, as surety, |

||||||||

are held and firmly |

bound unto the State |

of Nevada in the penal sum of |

THOUSAND DOLLARS for the payment |

||||||

of which well and truly to be made we hereby bind ourselves, our respective heirs, administrators, executors, successors and assigns jointly and severally, firmly by these presents:

To be effective on the |

|

day of |

|

, 20 |

THE CONDITION OF THIS OBLIGATION IS SUCH THAT:

WHEREAS, the

WHEREAS, the

OBL210 (02/2022) |

Page 1 of 2 |

Bond Number

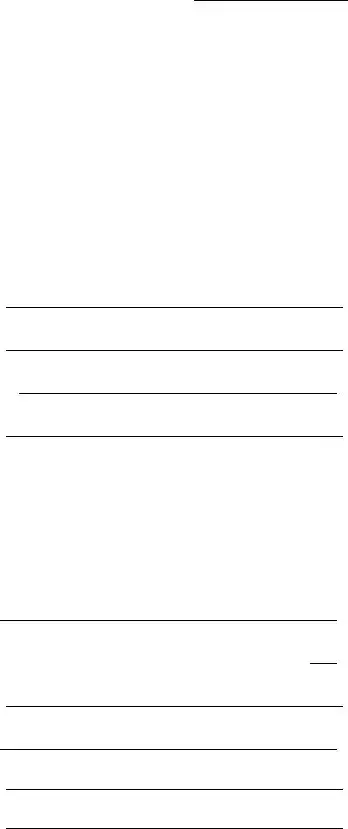

This bond may be canceled by the surety at any time by giving written notice by registered mail of its desire and intention so to do. Said cancellation shall be effective thirty (30) days after the receipt of said notice by the State of Nevada Department of Motor Vehicles, Occupational and Business Licensing Section.

Signed, sealed and dated this |

|

day of |

, 20 |

|

|

|

|

|

|

|

|||

|

|

|

X |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

(Principal’s Signature) |

|

|

|||||

|

|

|

________________________________________________________ |

||||||||||

|

|

|

|

|

|

(Principal’s Printed Name) |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Surety) |

|

|

|

|

||

|

|

|

Telephone Number of Surety: ( |

|

) |

|

- |

|

|||||

(Mailing Address of Surety Company, Street)

(City, State and Zip Code)

By

(Signature,

(Printed Name,

(The Corporate Seal of the Surety Company must be imprinted or affixed

to the bond form) (Surety Seal)

(A licensed agent of the issuing company must countersign this form)

Countersigned on behalf of:

(Surety)

this |

|

day of |

|

, 20 |

(Signature, Agent)

(Printed Name, Agent)

(Business Name, Agent)

(Business Address, Agent)

(All signatures must be original. Electronic signatures and/or photocopies will not be accepted. Any alterations will void this form.)

OBL210 (02/2022) |

Page 2 of 2 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of Form | The OBL210 form serves as a vehicle industry business license bond required for individuals and businesses operating in Nevada's vehicle industry. |

| Licensing Entities | It is utilized by various license types such as brokers, dealers, manufacturers, and distributors, as regulated by the Nevada Revised Statutes. |

| Surety Requirement | Individuals must obtain a surety bond from a corporation authorized to conduct surety business in Nevada to be eligible for licensing. |

| Consumer Protection | The bond protects consumers by allowing them to file claims against the surety for damages arising from fraudulent actions or violations of licensing laws. |

| Cancellation Policy | The surety can cancel the bond by providing written notice to the Nevada DMV, with cancellation taking effect 30 days after receipt of the notice. |

| Governing Law | This form is governed under Chapter 482 and Chapter 490 of the Nevada Revised Statutes, which outline the regulatory framework for vehicle industry licensing. |

Guidelines on Utilizing Dmv Obl210

Filling out the DMV Obl210 form requires careful attention to detail. Each section must be completed accurately to ensure compliance with Nevada state regulations. Here’s what you need to know before you begin the process of filling out the form. Follow the steps below for a seamless experience.

- Obtain the Form: Start by downloading the DMV Obl210 form from the Nevada DMV website or request a physical copy at the DMV office.

- Fill in the Principal Name: Enter the name of the individual or corporation acting as the principal. This includes any trade name or "doing business as" name.

- Insert the County and State: Indicate the county where the principal is located and the state (Nevada).

- Provide Surety Information: Write the name of the surety company and its location (state of incorporation).

- State the Bond Amount: Clearly specify the total amount of the bond in words and numbers (e.g., “THOUSAND DOLLARS”).

- Effective Date: Enter the day, month, and year when the bond becomes effective.

- Principal's Signature: The principal must sign and print their name on the designated line.

- Surety Telephone Number: Provide a contact phone number for the surety company.

- Surety Mailing Address: Fill in the complete mailing address for the surety, including city, state, and zip code.

- Attorney-In-Fact Signature: An authorized person from the surety company must sign and print their name.

- Corporate Seal: Ensure the corporate seal of the surety company is affixed to the bond form, if applicable.

- Agent Countersignature: A licensed agent from the issuing company must countersign the form, and their name and business information should be provided as well.

- Check for Original Signatures: All signatures should be original; remember that electronic signatures or photocopies will void the form.

Once you complete these steps, review the form for any errors before submission. Submit the form along with any required it to the DMV to fulfill your licensing obligations. Ensure you retain a copy for your records, as this can be an important document for your business operations.

What You Should Know About This Form

What is the DMV Obl210 form?

The DMV Obl210 form is a Vehicle Industry Business License Bond used in the state of Nevada. This bond serves as a financial guarantee for individuals or businesses engaged in activities such as brokering, dealing, or manufacturing vehicles. The bond ensures that these entities adhere to state regulations and provides protection for consumers against potential fraud or misrepresentation by the business or its employees.

Who needs to fill out the DMV Obl210 form?

The DMV Obl210 form must be completed by individuals or businesses seeking a Vehicle Industry Business License in Nevada. This includes various types of businesses such as dealers, brokers, distributors, manufacturers, and those involved in off-highway vehicle activities. It is essential for ensuring that these entities can operate legally within the state.

What is the purpose of the bond associated with the DMV Obl210 form?

The bond associated with the DMV Obl210 form acts as a safety net for consumers. It allows individuals who suffer damages due to fraudulent actions of the licensed business to file a claim against the surety company. The bond outlines that the principal and surety are responsible for fulfilling the obligations to the state, as well as for compensating any injured parties in cases of misconduct.

How does one cancel the bond once it has been established?

The surety company can cancel the bond at any time by providing written notice through registered mail to the State of Nevada Department of Motor Vehicles. The cancellation becomes effective thirty days after the state receives this notice. It is advisable for businesses to remain informed about their bond status to avoid any interruptions to their business operations.

What happens if there is a dispute regarding a claim on the bond?

If a dispute arises regarding a claim on the bond, either party can apply to the Director of the Department of Motor Vehicles. This application should detail good cause for the claim. After reviewing the circumstances through notice and hearing, the Director may authorize the payment of funds from the surety coverage if warranted.

Are electronic signatures accepted on the DMV Obl210 form?

No, electronic signatures and photocopies are not accepted on the DMV Obl210 form. All signatures must be original to validate the bond. This requirement helps ensure that there is a clear and trustworthy record of consent from all parties involved in the bond agreement.

Common mistakes

Filling out the DMV Obl210 form may seem straightforward, but many people make mistakes that could delay their applications or even lead to complications later on. One common mistake is failing to provide the correct principal name. The principal, whether an individual or corporation, must be accurately identified. Misnaming the entity or incorrectly completing the “doing business as” section can cause significant issues in processing the bond.

Another frequent error involves the bond amount section. The form requires that the total bond amount be clearly stated. Leaving this field blank or entering an incorrect amount not only creates confusion but may also slow down the approval process. It is crucial to ensure that the numbers are accurately reflected and match the required sum based on your specific licensing type.

Many applicants overlook the importance of signatures on the form. All required signatures must be original; electronic signatures or photocopies will not be acceptable. This applies not just to the principal but also to the attorney-in-fact for the surety company. Failing to sign in the appropriate places can render the entire form invalid, prompting unnecessary delays.

Finally, ensure that you include the surety company seal. This is a vital aspect of the form that many individuals neglect. The absence of the corporate seal can lead to rejection during the review process. It’s advisable to double-check that all sections of the form are completed, including this detail, before submission.

Documents used along the form

When navigating the process of acquiring a vehicle industry business license in Nevada, several forms and documents are often required alongside the DMV Obl210 form. Each document plays a critical role in ensuring compliance with state laws and regulations. Below is a list of these forms, detailing their significance.

- Application for Vehicle Industry Business License: This form initiates the licensing process. It requires basic information about the business, including its name, address, and the nature of operations. Ensuring accurate completion is vital, as discrepancies can delay approval.

- Surety Bond Verification Statement: This document acts as proof of the surety bond’s existence. It confirms that the business has secured the necessary bond to protect consumers in case of fraud or legal violations. It is typically submitted along with the Obl210 form.

- Business Entity Formation Documents: Depending on the structure of the business (e.g., LLC, corporation), various documents may be needed to validate its formation and legitimacy. This could include Articles of Incorporation or organization documents, which provide foundational details about the business.

- Certificate of Good Standing: This certificate verifies that the business is compliant with all state regulations and is in good standing. It reassures the DMV and consumers that the business is legally recognized and operational.

- Insurance Certificates: Proof of liability insurance coverage is essential for vehicle industry businesses. These certificates demonstrate that the business is financially protected against claims that may arise during operations.

Gathering these documents in advance can streamline the licensing process and help ensure compliance with Nevada's regulations for vehicle industry businesses. Being well-prepared will not only facilitate smoother interactions with the DMV but also provide peace of mind as you move forward in your business endeavors.

Similar forms

The DMV Obl210 form serves a specific purpose related to vehicle industry business licensing in Nevada. However, several other documents share similarities in purpose or function. Below is a list of seven such documents:

- Surety Bond Agreement: Similar to the Obl210 form, a Surety Bond Agreement outlines the commitment of a principal and a surety to protect the obligee against potential losses. It establishes the conditions under which claims may be made and the responsibilities of the parties involved.

- Business License Application: This document, like the Obl210 form, is essential for individuals or entities wishing to operate legally in a particular industry. It provides information about the business and ensures compliance with relevant regulations.

- Certificate of Incorporation: Both the Obl210 form and a Certificate of Incorporation represent formal documents required for business operations. They serve to verify the establishment of a business entity with legal standing in the state.

- Contract Agreement: A Contract Agreement, much like the Obl210 form, formalizes the understanding between parties entering a business venture. It outlines terms, conditions, and duties similar to how the Obl210 form establishes obligations related to vehicle sales and services.

- Franchise Disclosure Document (FDD): This document provides transparency about the obligations and rights within a franchise agreement. It parallels the Obl210 form in that it protects consumers and businesses alike by detailing terms and responsibilities inherent to the relationship.

- Employment Contract: An Employment Contract is akin to the Obl210 form in that it defines the relationship between employer and employee, outlining obligations, terms of employment, and provisions for compliance—important for legal clarity.

- Insurance Policy Document: Like the Obl210 form, an Insurance Policy provides a binding agreement that outlines coverage and responsibilities for parties involved. It safeguards consumers against potential losses that may arise in business operations.

Each document shares a common theme of establishing legal obligations and protections, ensuring that both individuals and businesses can operate in a structured and accountable environment.

Dos and Don'ts

When filling out the DMV Obl210 form, consider the following tips to ensure your submission is successful:

- Double-check information: Verify that all names, addresses, and dates are correct before submitting the form.

- Use clear handwriting: If filling out the form by hand, make sure your writing is legible.

- Sign in the right places: Ensure all required signatures are included and properly completed.

- Keep a copy: Make a copy of the completed form for your records before sending it in.

- Provide accurate bond information: Fill out the bond number and surety information carefully.

It’s also important to avoid common mistakes that could lead to delays:

- Don't leave blank spaces: Fill in all required fields on the form.

- Don’t use electronic signatures: All signatures must be original.

- Do not alter the form: Any changes can void the submission.

- Avoid submitting photocopies: Ensure you provide the original document.

- Don’t ignore deadlines: Submit the form in a timely manner to avoid issues.

Misconceptions

The DMV Obl210 form is an important document related to the vehicle industry business license bond in Nevada. Despite its significance, there are several common misconceptions about this form that can lead to confusion. Here are five widespread misunderstandings:

- Misconception 1: The Obl210 form is only for vehicle dealers. In reality, this form applies to a variety of vehicle industry participants, including brokers, manufacturers, distributors, and lessors. It is essential for anyone involved in buying, selling, or dealing with vehicles in Nevada.

- Misconception 2: Completing the Obl210 form is optional. Some people believe that this form is not necessary if they have obtained other licenses. However, it is a mandatory requirement for conducting business in the vehicle industry in Nevada, ensuring financial protection for consumers.

- Misconception 3: The bond amount is fixed and cannot change. While the Obl210 specifies a bond amount, it may vary depending on the specific license type or business activities. It’s important to verify the amount required based on your business classification.

- Misconception 4: Cancellation of the bond is as simple as just informing the DMV. Although the surety company can cancel the bond, they must give written notice to the DMV. This cancellation is not immediate; it takes effect 30 days after the DMV receives the notice. Understanding this timeline is crucial for continued compliance.

- Misconception 5: Electronic signatures are acceptable for the Obl210 form. Some may think that digital signatures can replace traditional signatures on this form. In fact, the form requires original signatures only. Using electronic signatures or photocopies can result in the form being voided.

Awareness of these misconceptions can help individuals and businesses navigate the requirements of the DMV Obl210 form more effectively, ensuring compliance and proper operation within the vehicle industry in Nevada.

Key takeaways

Filling out the DMV Obl210 form is crucial for individuals engaging in vehicle-related businesses in Nevada. Here are some key takeaways about the form:

- Identify License Type: The form requires users to specify the license type, which can include broker, dealer, distributor, and other classifications.

- Principal Information: The principal's name and business name must be clearly stated. Accurate reporting of the principal’s location is also mandatory.

- Surety Details: It is essential to include the name of the surety company providing the bond. This information must reflect a corporation legally authorized to operate in Nevada.

- Compliance with Statutes: The form outlines obligations under chapters of the Nevada Revised Statutes, reinforcing the importance of adherence to state regulations in vehicle transactions.

- Cancellation Process: The surety can cancel the bond with written notice, which becomes effective after 30 days from the receipt of such notice by the state.

- Signature Requirements: All necessary signatures on the form must be original. The inclusion of electronic signatures or photocopies will render the form void.

- Corporate Seal: It is critical to ensure that the corporate seal of the surety company is imprinted on the bond form to validate the document.

Browse Other Templates

Sentry Safe Reset Code With Key - A valid signature from the safe owner is required on the form.

Direct Deposit Wells Fargo - Properly completing this form can save time in communications regarding your loan.