Fill Out Your Dmv Reg 256 Form

When it comes to vehicle ownership transfers in California, the DMV Reg 256 form is an essential document that addresses various aspects of vehicle registration. This form serves multiple purposes, requiring individuals to provide comprehensive information about the vehicle, along with specific circumstances surrounding the transfer. For instance, it includes sections for claiming exemptions from use tax—such as gifts, family transfers, or inheritances. It also allows for smog exemptions, which may apply depending on the vehicle’s recent smog certification or its power source. Additionally, if someone is simply looking to transfer ownership without registering the vehicle or wishes to get a title only, the form includes provisions for that as well. Other sections of the form cater to individuals needing a window decal for wheelchair lifts or changes in vehicle body configuration. By carefully completing the relevant sections, individuals can ensure a smoother transaction and compliance with California's motor vehicle laws.

Dmv Reg 256 Example

_STATE.,,OF.CALIFORNIA,,..,

~S6l!l!!I

Department of Motor Vehicles

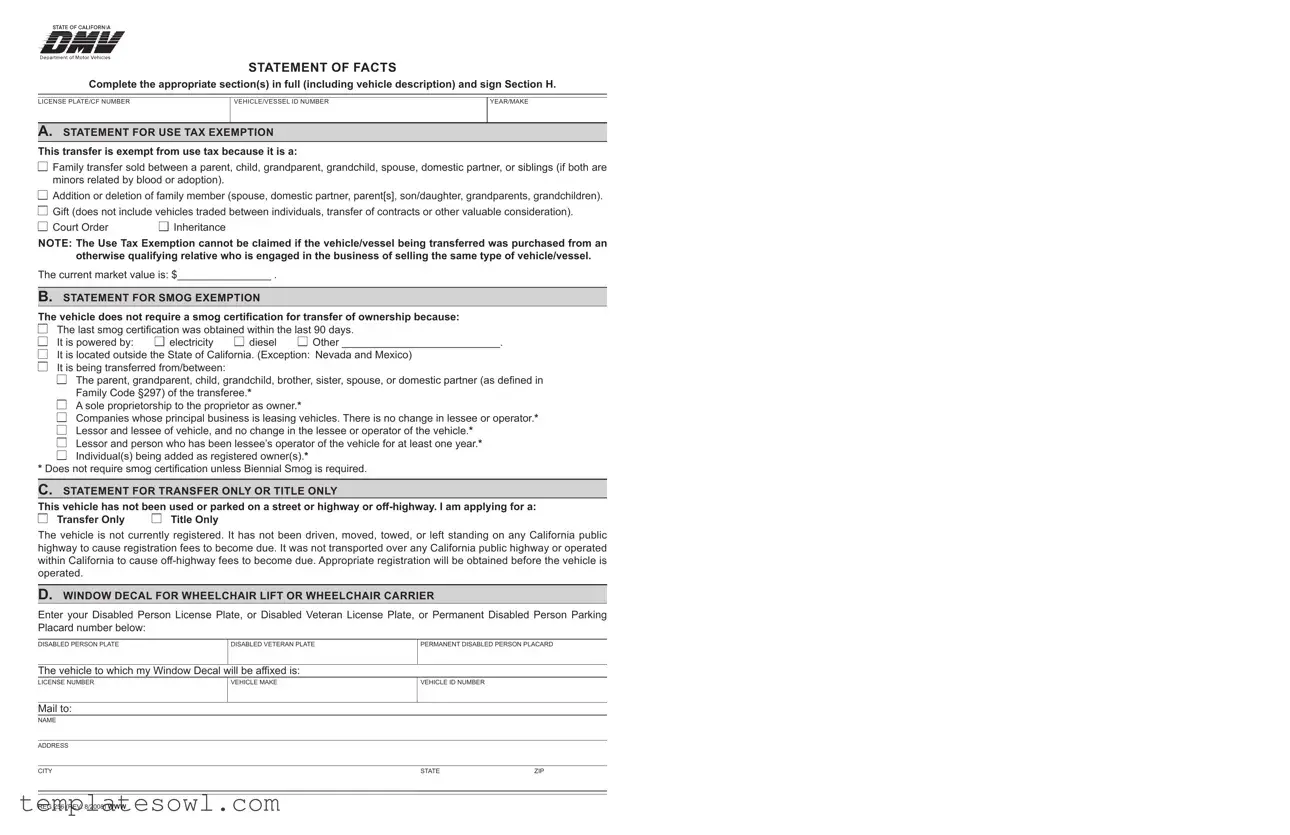

STATEMENT OF FACTS

Complete the appropriate section(s) in full (including vehicle description) and sign Section H.

LICENSE PLATE/CF NUMBER |

VEHICLE/VESSEL ID NUMBER |

YEAR/MAKE |

|

|

|

A. STATEMENT FOR USE TAX EXEMPTION |

|

|

This transfer is exempt from use tax because it is a: |

|

|

□

Family transfer sold between a parent, child, grandparent, grandchild, spouse, domestic partner, or siblings (if both are minors related by blood or adoption).

Family transfer sold between a parent, child, grandparent, grandchild, spouse, domestic partner, or siblings (if both are minors related by blood or adoption).

□

Addition or deletion of family member (spouse, domestic partner, parent[s], son/daughter, grandparents, grandchildren). □

Addition or deletion of family member (spouse, domestic partner, parent[s], son/daughter, grandparents, grandchildren). □

Gift (does not include vehicles traded between individuals, transfer of contracts or other valuable consideration).

Gift (does not include vehicles traded between individuals, transfer of contracts or other valuable consideration).

□ Court Order |

□ Inheritance |

NOTE: The Use Tax Exemption cannot be claimed if the vehicle/vessel being transferred was purchased from an otherwise qualifying relative who is engaged in the business of selling the same type of vehicle/vessel.

The current market value is: $________________ .

B. STATEMENT FOR SMOG EXEMPTION

The vehicle does not require a smog certification for transfer of ownership because:

□ |

The last smog certification was obtained within the last 90 days. |

||||

□ |

It is powered by: |

□ electricity |

□ diesel |

□ Other ___________________________. |

|

□ |

It is located outside the State of California. (Exception: Nevada and Mexico) |

||||

□ |

It is being transferred from/between: |

|

|

||

|

□ |

The parent, grandparent, child, grandchild, brother, sister, spouse, or domestic partner (as defined in |

|||

|

|

Family Code §297) of the transferee.* |

|

||

|

□ |

A sole proprietorship to the proprietor as owner.* |

|||

|

□ |

Companies whose principal business is leasing vehicles. There is no change in lessee or operator.* |

|||

|

□ |

Lessor and lessee of vehicle, and no change in the lessee or operator of the vehicle.* |

|||

|

□ |

Lessor and person who has been lessee’s operator of the vehicle for at least one year.* |

|||

□Individual(s) being added as registered owner(s).*

*Does not require smog certification unless Biennial Smog is required.

C. STATEMENT FOR TRANSFER ONLY OR TITLE ONLY

This vehicle has not been used or parked on a street or highway or

□ Transfer Only |

□ Title Only |

The vehicle is not currently registered. It has not been driven, moved, towed, or left standing on any California public highway to cause registration fees to become due. It was not transported over any California public highway or operated within California to cause

D. WINDOW DECAL FOR WHEELCHAIR LIFT OR WHEELCHAIR CARRIER

Enter your Disabled Person License Plate, or Disabled Veteran License Plate, or Permanent Disabled Person Parking Placard number below:

DISABLED PERSON PLATE |

DISABLED VETERAN PLATE |

PERMANENT DISABLED PERSON PLACARD |

The vehicle to which my Window Decal will be affixed is:

LICENSE NUMBER |

VEHICLE MAKE |

VEHICLE ID NUMBER |

Mail to:

NAME

ADDRESS

CITY |

STATE |

ZIP |

|

|

|

|

|

|

REG 256 (REV. 8/2008) WWW |

|

|

STATEMENT OF FACTS

Complete the appropriate section(s) in full (including vehicle description) and sign Section H.

LICENSE PLATE/CF NUMBER |

VEHICLE/VESSEL ID NUMBER |

YEAR/MAKE |

|

|

|

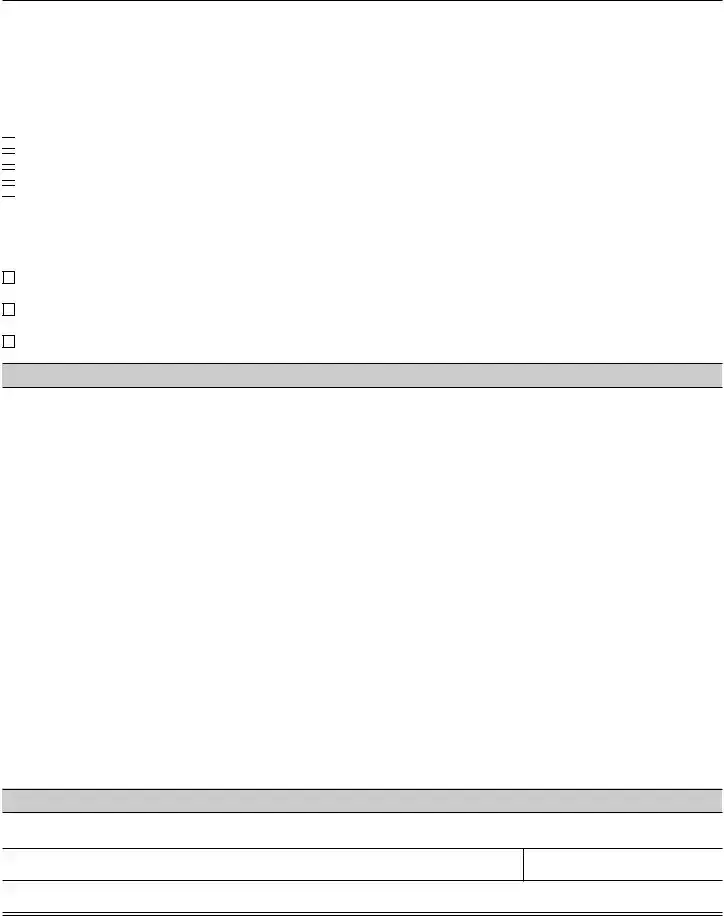

E. STATEMENT FOR VEHICLE BODY CHANGE (OWNERSHIP CERTIFICATE REQUIRED) |

||

The current market value of the vehicle or vessel is: $________________ . |

|

|

Changes were made at a cost of $________________ on this date ________________ . |

|

|

This is what I changed: Check all that apply: |

|

|

□

□

□

□

□

□

□

Unladen Weight changed because __________________ (Public Weighmaster Certificate is required. Exception: Trailers)

Motive Power changed from ________________ to ________________ .

Body Type changed from ________________ to ________________ .

Number of Axles changed from ________________ to________________ .

F. |

NAME STATEMENT (OWNERSHIP CERTIFICATE REQUIRED) |

Please print |

|

□ |

I, _______________________________ and _______________________________ are one and the same person. |

□ |

My name is misspelled. Please correct it to: _________________________________________________________ |

□ |

I am changing my name from _____________________________ to ___________________________________ |

G. STATEMENT OF FACTS

I, the undersigned, state:

H. APPLICANT’S SIGNATURE

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing is true and correct.

PRINTED LAST NAME |

FIRST NAME |

MIDDLE NAME |

DAYTIME PHONE NUMBER

( )

SIGNATURE |

DATE |

X

REG 256 (REV. 8/2008) WWW

Form Characteristics

| Fact Name | Description |

|---|---|

| Name of Form | The document is officially known as DMV Reg 256, a Statement of Facts used in California. |

| Purpose | This form is utilized to declare various statements concerning vehicle transfers, including use tax exemptions, smog exemptions, and changes in vehicle ownership. |

| Governing Law | The form aligns with California Vehicle Code provisions and regulations as specified in the California Family Code §297. |

| Use Tax Exemption | Certain family transfers and other specified scenarios can exempt the vehicle transfer from use tax. Examples include gifts and court-ordered transfers. |

| Smog Certification | Vehicles may not require a smog certification if specific criteria are met, such as recent certification or being powered by electricity or diesel. |

| ID and Signature Requirement | The form mandates a signature in Section H, certifying the accuracy of the statements provided, under penalty of perjury. |

| Multiple Sections | DMV Reg 256 contains various segments to address different scenarios, including vehicle body changes, name corrections, and statements for transferring ownership only. |

Guidelines on Utilizing Dmv Reg 256

After completing the DMV Reg 256 form, submit it to the appropriate DMV office or mail it to the address specified in the form instructions. Ensure that all necessary sections are filled out accurately to avoid delays in processing your submission.

- Download or obtain the DMV Reg 256 form.

- Fill out the License Plate/CF Number and Vehicle/Vessel ID Number at the top of the form.

- Provide the Year and Make of the vehicle.

- Determine which section applies to your situation (A through G) and fill it out as required:

- For section A, check the appropriate box and write the current market value.

- For section B, check the relevant exemption and note if applicable.

- In section C, indicate if this is a transfer only or title only situation.

- Complete section D if applying for a window decal related to wheelchair access.

- For section E, provide the vehicle's current market value and any changes made.

- In section F, clarify any name discrepancies as necessary.

- In section G, state any necessary facts regarding your application.

- Sign in section H, providing your printed name and contact information.

- Review the form for completeness and accuracy.

- Submit the form to the appropriate DMV office or mailing address.

What You Should Know About This Form

What is the DMV REG 256 form used for?

The DMV REG 256 form is a Statement of Facts used to explain specific circumstances concerning vehicle or vessel transactions in California. It can be utilized to claim exemptions from use tax, smog certification, or to document changes in ownership or vehicle specifications. The appropriate section of this form must be filled out based on the individual's situation.

Who can claim a use tax exemption on the REG 256 form?

A use tax exemption can be claimed for family transfers between certain relatives, such as parents, children, and spouses, as well as for gifts, court orders, or inheritances. However, this exemption cannot be applied if the vehicle was purchased from a relative who is in the business of selling vehicles.

What is required for a smog exemption?

A vehicle may be exempt from smog certification if it has a valid certification from the last 90 days, if it is powered by electricity or diesel, if it is located outside California (with some exceptions), or if it is transferred between specific family members or under certain business circumstances. Additional documentation may be necessary depending on the specifics of the transfer.

What does the 'Transfer Only' or 'Title Only' option mean?

This option applies when a vehicle has not been used or parked on California public highways and has not incurred registration fees. Completing this section signifies that the individual is applying solely for ownership transfer or obtaining a title, without the vehicle being operational in California.

How can a person request a window decal for wheelchair lifts or carriers?

To request a window decal, the individual must provide their Disabled Person License Plate number, Disabled Veteran Plate number, or Permanent Disabled Person Parking Placard number. Additionally, they must describe the vehicle associated with the window decal by including its license number and make.

What is required when changing ownership information on the REG 256 form?

When changing ownership details, the individual must provide identification that confirms they are the same person as indicated in the previous document. If the name is misspelled, they can request a correction on the form. If they are changing their name, this must be documented as well.

What should be done if the vehicle's specifications change?

If there are changes to the vehicle body or specifications, the individual must complete the relevant section of the form, detailing what changes were made, when they were done, and the cost associated with those changes. Important changes may include alterations to unladen weight, body type, or number of axles.

How can the current market value of the vehicle be determined?

The current market value should be determined by factors such as the vehicle’s age, condition, and market comparables. This value needs to be provided on the form when claiming exemptions or detailing changes.

Is there any penalty for providing false information on the REG 256 form?

Yes, individuals are required to certify the truthfulness of the information under penalty of perjury. This means that providing false or misleading information can lead to legal consequences.

Common mistakes

When filling out the DMV Reg 256 form, individuals often make errors that can lead to delays or complications in their vehicle registration process. One common mistake is failing to complete all relevant sections of the form. Each section must be filled out in full, including the vehicle description, to ensure that the DMV has all necessary information. Leaving sections blank or incomplete can result in the form being returned, prolonging the registration process.

Another frequent error is misunderstanding the requirements for claiming a use tax exemption. Many people mistakenly believe they qualify for an exemption without fully understanding the criteria. For example, the transfer must be a legitimate gift or a family transfer to qualify, and individuals sometimes overlook this requirement. This misunderstanding can lead to unexpected tax obligations.

In addition, failing to provide accurate vehicle information is a mistake that can complicate matters. It is essential to enter the vehicle’s identification number, make, and model correctly. Errors in these details could lead to issues with the title or registration, necessitating further corrections and resubmissions.

Many applicants neglect to sign the form properly, especially in Section H. This oversight is significant; without a signature, the DMV cannot process the application. Furthermore, not dating the signature can also create complications, as the DMV requires a clear indication of when the form was submitted.

Individuals occasionally forget to verify eligibility for smog exemption before submitting the form. It is important to confirm whether the vehicle requires a smog certification based on its age, type, and how it is being transferred. Misunderstandings in this area can cause delays as the DMV seeks required documents or certifications.

Lastly, many applicants do not keep copies of their submitted forms and documents. Retaining a copy provides a record of what was submitted, which can be vital in case of any disputes or questions about the application. It is always prudent to keep documentation ready for personal reference, which can save time and unnecessary stress during the registration process.

Documents used along the form

The DMV REG 256 form is often filed alongside several other documents that facilitate vehicle registration, transfer, and tax exemptions. Below is a list of commonly associated forms and a brief description of each.

- DMV REG 342: This form is used for a Notice of Transfer and Release of Liability. It informs the DMV that the ownership of a vehicle has changed hands and releases the previous owner from future liability associated with the vehicle.

- DMV REG 227: This application is for a Duplicate Title. If the original vehicle title is lost or damaged, this form allows the owner to request a replacement title from the DMV.

- DMV REG 262: This form is a Statement of Facts for Use Tax Exemption. It is often submitted to claim tax exemption for transfers due to gifts, family relationships, or inheritance.

- DMV REG 984: This is the Application for an Original or Duplicate Registration Card. It can be filed when the original registration card is lost or must be amended.

- DMV REG 508: This form is a Transfer of Title with the application for registration. It provides necessary information for both ownership transfer and vehicle registration simultaneously.

- DMV REG 4008: This is a request for a Smog Certification Waiver or Exemption. Use this form when a vehicle does not require a smog certification at the time of transfer.

- DMV REG 940: This Notice of Pending Sale form is filed when a vehicle is sold privately, offering protection for both the buyer and seller by documenting the transaction.

- DMV REG 204: This is a Vehicle/Vessel Transfer and Reassignment form. It includes sections for the seller and buyer to complete and sign if there are issues regarding odometer readings or if the title is not available.

Completing these documents accurately ensures a smooth process when dealing with vehicle transfers and registrations. Each form plays a vital role in protecting the rights and responsibilities of the involved parties. Act promptly to avoid any potential delays.

Similar forms

- DMV Form 2270 (Application for Title or Registration): This form is used to apply for a new title or register a vehicle in California. Like the DMV Reg 256, it requires detailed information about the vehicle and its ownership history.

- DMV Form REG 31 (Application for Duplicate Title): When a title has been lost or damaged, this form is used to request a duplicate. Similar to Reg 256, it verifies the ownership of the vehicle and requires personal information from the owner.

- DMV Form REG 139 (Statement of Facts for Vehicle Use Tax Exemption): This statement focuses specifically on use tax exemptions, much like section A of Reg 256. Both documents facilitate legal vehicle transfers without tax liability under certain conditions.

- DMV Form REG 343 (Statement of Vehicle Transfer): This form documents the transfer of ownership between parties and includes required signatures, similar to the ownership verification process outlined in Reg 256.

- DMV Form REG 205 (Application for Title or Registration for Non-Residents): Non-residents use this form when registering a vehicle in California. Like Reg 256, it involves specific facts about the vehicle and the parties involved in its transfer.

- DMV Form REG 262 (Vehicle Statement of Facts): This document allows for the declaration of certain facts about a vehicle, paralleling the multi-purpose nature of Reg 256 in capturing essential vehicle details and declarations from the owner.

Dos and Don'ts

When filling out the DMV Reg 256 form, attention to detail can make a significant difference. To help you navigate this process smoothly, here’s a list of things you should and shouldn’t do.

- Do read the instructions carefully to understand what is required.

- Do fill out all relevant sections completely, including vehicle details.

- Do ensure that any exemptions claimed are valid and applicable.

- Do sign Section H to certify the accuracy of your information.

- Do use clear and legible handwriting to avoid confusion.

- Don’t leave any sections blank unless it clearly states that it’s optional.

- Don’t forget to double-check for any spelling errors, especially names.

- Don’t submit the form without reviewing all provided information.

- Don’t assume the DMV will correct mistakes; it’s your responsibility.

Misconceptions

Misconceptions often surround the DMV REG 256 form, which can lead to confusion for individuals seeking to complete it. Below is a list of common misconceptions, along with explanations to clarify these misunderstandings.

- Only family transfers qualify for use tax exemptions. While family transfers are one reason, there are several other situations that can also qualify for a use tax exemption, such as gifts, court orders, and inheritances.

- The REG 256 form is only necessary for vehicle sales. This form serves multiple purposes beyond just sales. It is also used for title transfers, smog exemptions, and changes in ownership due to various circumstances.

- A smog certification is always required when transferring a vehicle. This is not necessarily true. Certain exemptions apply, such as when the last smog certification was obtained within the last 90 days or if the vehicle is powered by electricity.

- You cannot transfer a vehicle if it has never been registered. This form allows for specific situations where a title transfer can occur for vehicles that have not been previously registered, as long as the requirements are met.

- All name corrections on the REG 256 require additional documentation. Not all name changes need extensive documents. If the name is merely misspelled, a simple correction can be made directly on the form without needing additional proof.

- A vehicle must be operational to be transferred. This assumption can lead to complications. The REG 256 can be used for vehicles that have not been driven or parked on public highways, provided specific conditions are met.

Key takeaways

Filling out the DMV Reg 256 form can be straightforward if you keep a few key points in mind. This form is essential for various vehicle-related transactions in California, and understanding its components can save you time and effort. Here are four key takeaways:

- Complete Section H. Always remember to sign Section H of the form. Your signature is crucial as it certifies that the information you provided is true and correct, helping to avoid any potential delays in processing.

- Clarify Your Exemption. If you are claiming a use tax exemption, be prepared to specify the type of exemption you are applying for. This could range from family transfers to inheritances. Incorrectly claiming an exemption can result in additional fees, so clarity is key.

- Check Smog Requirements. Understand whether your vehicle requires a smog certification when transferring ownership. Certain transactions, such as those involving family members or vehicles that are not currently registered, may not need this certification, streamlining the process.

- Accurate Vehicle Description. Your vehicle description must be accurate, especially the Vehicle Identification Number (VIN) and make and year of the vehicle. Any discrepancies can complicate or delay the registration process.

Browse Other Templates

Dhsmv Forms - This form must be submitted to the Florida Department of Highway Safety and Motor Vehicles.

How to Fill Out a 1040 - Use this worksheet instead of IRS publications to find out if your benefits are taxable.