Fill Out Your Dmv Reg 343 Form

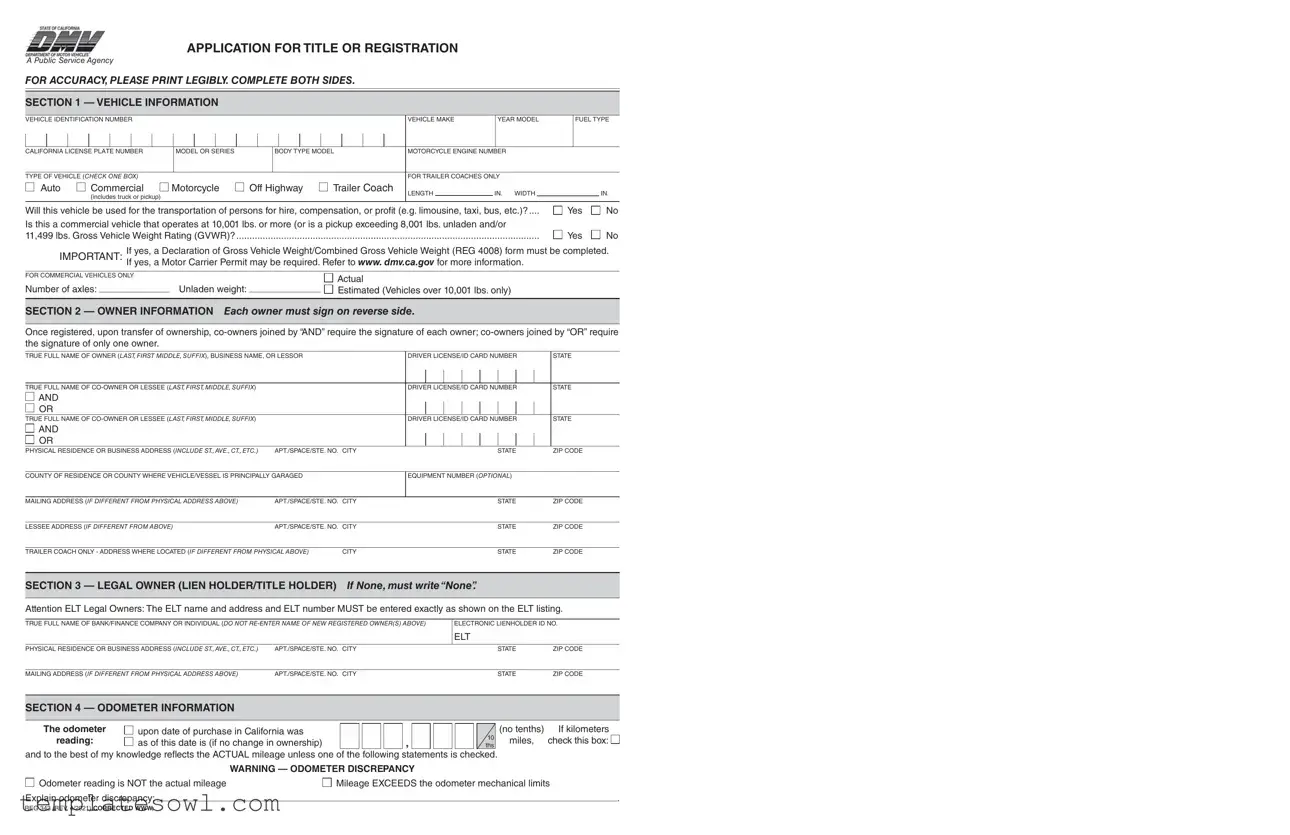

The DMV Reg 343 form serves as a critical document for vehicle owners in California who need to apply for title or registration. This form gathers essential information, including details about the vehicle such as its identification number, make, model, fuel type, and if applicable, its license plate number. It also differentiates between types of vehicles, categorizing them as auto, commercial, motorcycle, off-highway, or trailer coach. Owners must complete multiple sections, starting with vehicle specifics in Section 1, and then providing their own details in Section 2. Correct and clear completion is important, as inaccurate information can lead to processing delays. Additionally, certain vehicles require the inclusion of a Declaration of Gross Vehicle Weight if they meet specified weight criteria. Section 3 requires identification of the legal owner or lienholder, which is vital if the vehicle is financed. In Section 4, the odometer information must be reported meticulously to ensure transparency regarding mileage. The form also accounts for vehicle acquisition details, costs, and affiliations to military service in its subsequent sections. Overall, the Reg 343 form is structured to efficiently compile necessary information that supports the registration process for various vehicle types in California.

Dmv Reg 343 Example

APPLICATION FOR TITLE OR REGISTRATION

A Public Service Agency

For accuracy, please print legibly. complete both sides.

SECTION 1 — VEHICLE INFORMATION

VEHICLE IDENTIFICATION NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

VEHICLE MAKE |

|

YEAR MODEL |

FUEL TYPE |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CALIFORNIA LICENSE PLATE NUMBER |

|

MODEL OR SERIES |

|

|

BODY TYPE MODEL |

MOTORCYCLE ENGINE NUMBER |

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TYPE OF VEHICLE (CHECK ONE BOX) |

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR TRAILER COACHES ONLY |

|

|

||||||||||

Auto |

|

Commercial |

Motorcycle |

Off Highway |

Trailer Coach |

LENGTH |

|

IN. WIDTH |

|

|

IN. |

|||||||||||||||

|

|

|

(includes truck or pickup) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Will this vehicle be used for the transportation of persons for hire, compensation, or profit (e.g. limousine, taxi, bus, etc.)?.... |

Yes |

Is this a commercial vehicle that operates at 10,001 lbs. or more (or is a pickup exceeding 8,001 lbs. unladen and/or |

|

11,499 lbs. Gross Vehicle Weight Rating (GVWR)? |

Yes |

No

No

IMPORTANT: If yes, a Declaration of Gross Vehicle Weight/Combined Gross Vehicle Weight (REG 4008) form must be completed. If yes, a Motor Carrier Permit may be required. Refer to www. dmv.ca.gov for more information.

FOR COMMERCIAL VEHICLES ONLY |

Actual |

|

Number of axles: |

|

Unladen weight: |

|

Estimated (Vehicles over 10,001 lbs. only) |

|

|

|||

|

|

|

|

|

SECTION 2 — OWNER INFORMATION each owner must sign on reverse side.

Once registered, upon transfer of ownership,

TRUE FULL NAME OF OWNER (LAST, FIRST MIDDLE, SUFFIX), BUSINESS NAME, OR LESSOR |

|

DRIVER LICENSE/ID CARD NUMBER |

STATE |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TRUE FULL NAME OF |

|

|

DRIVER LICENSE/ID CARD NUMBER |

STATE |

|||||||

AND |

|

|

|

|

|

|

|

|

|

|

|

OR |

|

|

|

|

|

|

|

|

|

|

|

TRUE FULL NAME OF |

|

|

DRIVER LICENSE/ID CARD NUMBER |

STATE |

|||||||

AND |

|

|

|

|

|

|

|

|

|

|

|

OR |

|

|

|

|

|

|

|

|

|

|

|

PHYSICAL RESIDENCE OR BUSINESS ADDRESS (INCLUDE ST.,AVE., CT., ETC.) |

APT./SPACE/STE. NO. CITY |

|

|

|

|

STATE |

ZIP CODE |

||||

|

|

|

|

|

|

|

|

|

|

|

|

COUNTY OF RESIDENCE OR COUNTY WHERE VEHICLE/VESSEL IS PRINCIPALLY GARAGED |

|

EQUIPMENT NUMBER (OPTIONAL) |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

MAILING ADDRESS (IF DIFFERENT FROM PHYSICAL ADDRESS ABOVE) |

APT./SPACE/STE. NO. CITY |

|

|

|

|

STATE |

ZIP CODE |

||||

|

|

|

|

|

|

|

|

|

|

|

|

LESSEE ADDRESS (IF DIFFERENT FROM ABOVE) |

APT./SPACE/STE. NO. CITY |

|

|

|

|

STATE |

ZIP CODE |

||||

|

|

|

|

|

|

|

|

|

|

|

|

TRAILER COACH ONLY - ADDRESS WHERE LOCATED (IF DIFFERENT FROM PHYSICAL ABOVE) |

CITY |

|

|

|

|

STATE |

ZIP CODE |

||||

|

|

|

|

|

|

|

|

|

|

||

SECTION 3 — LEGAL OWNER (LIEN HOLDER/TITLE HOLDER) |

if none, must write “none”. |

|

|||||||||

Attention ELT Legal Owners: The ELT name and address and ELT number MUST be entered exactly as shown on the ELT listing.

TRUE FULL NAME OF BANK/FINANCE COMPANY OR INDIVIDUAL (DO NOT

ELECTRONIC LIENHOLDER ID NO.

ELT

PHYSICAL RESIDENCE OR BUSINESS ADDRESS (INCLUDE ST.,AVE., CT., ETC.) |

APT./SPACE/STE. NO. |

CITY |

STATE |

ZIP CODE |

|

|

|

|

|

MAILING ADDRESS (IF DIFFERENT FROM PHYSICAL ADDRESS ABOVE) |

APT./SPACE/STE. NO. |

CITY |

STATE |

ZIP CODE |

SECTION 4 — ODOMETER INFORMATION

The odometer |

upon date of purchase in California was |

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

reading: |

as of this date is (if no change in ownership) |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ths |

|

|||

and to the best of my knowledge reflects the ACTUAL mileage unless one of the following statements is checked. |

|||||||||||||||

|

WARNING — ODOMETER DISCREPANCY |

|

|

|

|

|

|

|

|||||||

(no tenths) |

If kilometers |

miles, |

check this box: |

Odometer reading is NOT the actual mileage |

Mileage EXCEEDS the odometer mechanical limits |

||

Explain odometer discrepancy: |

|

|

. |

|

|

||

REG 343 (REV. 4/2021) CORRECTED WWW |

|

|

|

MUST COMPLETE VEHICLE INFORMATION BELOW:

VEHICLE IDENTIFICATION NUMBER

VEHICLE MAKE

YEAR MODEL

SECTION 5 — DATE INFORMATION

DATE VEHICLE ENTERED OR WILL ENTER CALIFORNIA (CA): |

|

If vehicle was previously registered in CA, then registered or located |

||||

Month |

|

Day |

|

Year |

|

|

|

|

|

entered CA. If you did not own vehicle at time of entry, check this box: |

|||

|

|

|

||||

DATE VEHICLE FIRST OPERATED IN CALIFORNIA: |

|

|

Or enter date vehicle will be operated, if it has not been operated |

|||

Month |

|

Day |

|

Year |

|

yet. |

DATE YOU WENT TO WORK IN CALIFORNIA, OBTAINED A CA DRIVER LICENSE, OR BECAME A RESIDENT: Enter the date whichever occurred first. If you have been a resident

since birth, enter date of birth. If you are not a CA resident, check

Month |

|

Day |

|

Year |

|

this box: |

|

|

|

|

|

|

|

|

|

|

|||

DATE VEHICLE WAS PURCHASED OR ACQUIRED: |

|

|

AND WAS (CHECK BOX): |

AND WAS PURCHASED (CHECK BOX): |

|||||

Month |

|

Day |

|

Year |

|

New |

Used |

Inside CA |

Outside CA |

|

|

|

|

|

|

|

|

|

|

SECTION 6 — COST INFORMATION

NOTE: The total cost or value of the vehicle must include the cost of the basic vehicle, value of any

MUST CHECK ONE BOX ONLY, AND ENTER REQUIRED INFORMATION FOR THAT ONE BOX: |

|

|

|

|

VEHICLE WAS PURCHASED OR ACQUIRED FROM: |

|||||||

PURCHASE – I purchased the vehicle for the price of $ |

|

|

|

. |

|

|

|

|

Dealer |

Private Party |

Dismantler |

|

|

|

|

|

|

|

|||||||

GIFT – I acquired the vehicle as a gift. Its current market value is $ |

|

. |

|

|

Immediate Family Member – State |

|||||||

A Statement of Facts (REG 256) form must be completed. |

|

|

|

|

|

|

|

Relationship: |

|

|

||

TRADE – I acquired the vehicle as a trade. Its value when I acquired it was $ |

|

|

|

|

. |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR ALL VEHICLES: |

|

|

|

|

|

|

|

|

|

|||

Since purchasing or acquiring this vehicle, were any body type modifications, additions and/or alterations (e.g., changing from pickup to utility,

etc.) made to this vehicle? If yes, a Statement of Construction (REG 5036) form must be completed |

Yes |

No |

FOR REVIVED JUNK OR REVIVED SALVAGE VEHICLES: |

|

|

The cost of the vehicle must include the labor cost, whether or not the labor was provided or done by you. The total cost of the vehicle including

labor is $ |

|

. |

|

|

|

|

|

|

|

|

|

|

|

SECTION 7 — FOR |

|

|

|

|||

|

|

|

|

|

||

For vehicles which enter the state within 1 year of purchase, was Sales Tax paid to another state? |

N/A |

Yes |

No |

|||

If yes, enter amount of tax paid $ |

(this amount will be credited toward any Use Tax in CA). If your vehicle was last |

|||||

registered in another state, you may be eligible for a Use Tax exemption. For more information, contact the CA Department of Tax and Fee Administration (www.cdtfa.ca.gov).

For commercial vehicles (including pickups), this vehicle was last registered as a: |

Commercial Vehicle |

|

the last state of registration. |

|

|

DISPOSITION OF

The plates will not be affixed to any vehicle at any time, unless the vehicle is “Dual Registered” in both states. The plates are:

Expired, or will be or were:

Expired, or will be or were:

Surrendered to CA DMV

Surrendered to CA DMV  Destroyed

Destroyed  Retained

Retained

Returned to the motor vehicle department of the state of issuance.

Returned to the motor vehicle department of the state of issuance.

SECTION 8 — MILITARY SERVICE INFORMATION

Are you or your spouse on active duty as a member of the U.S. Uniformed Services?...............................................................

If yes, you may qualify for an exemption. Refer to Nonresident Military (NRM) Vehicle License Fee Exemption (REG 5045) form.

When this vehicle was last licensed, were you or your spouse on active duty as a member of the U.S. Uniformed Services? .. If yes, in what state or country were you or your spouse stationed?

Yes  No

No

Yes  No

No

SECTION 9 — CERTIFICATIONS Signatures required.

The signature for a company or business MUST include the printed name of the company/business and an authorized representative’s countersignature on the signature line (e.g., ABC CO. by JOHN SMITH or JOHN SMITH for ABC CO.).

The registered owner mailing address is valid, existing, and an accurate mailing address. I consent to receive service of process at this mailing address pursuant to CVC §1808.21.

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing is true and correct.

PRINTED NAME |

OWNER’S SIGNATURE |

DATE |

DAYTIME TELEPHONE NUMBER |

|

|

X |

|

( |

) |

PRINTED NAME |

DATE |

DAYTIME TELEPHONE NUMBER |

||

|

X |

|

( |

) |

PRINTED NAME |

DATE |

DAYTIME TELEPHONE NUMBER |

||

|

X |

|

( |

) |

|

|

|

|

|

Go to Page 1

Clear Form

REG 343 (REV. 4/2021) CORRECTED WWW

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The DMV REG 343 form is used for applying for the title or registration of a vehicle in California. |

| Owner Information | It requires the true full names of the owners or lessees, along with their driver's license or ID card numbers. |

| Odometer Disclosure | Section 4 of the form requires providing the odometer reading at the time of purchase, which is crucial for verifying vehicle mileage. |

| Vehicle Type | The form allows users to specify the type of vehicle, including options like auto, commercial, motorcycle, and off-highway. |

| Commercial Vehicle Requirements | If the vehicle operates over 10,001 lbs., additional forms, such as the REG 4008, may be required. |

| Signature Requirement | Each owner must provide a signature, confirming the information is accurate and truthful under penalty of perjury. |

| Sales Tax Considerations | For out-of-state vehicles, any sales tax paid may be credited toward California's use tax, provided proper documentation is included. |

| Military Service Information | Active duty military members may qualify for exemption from certain fees, which can be claimed via a separate form. |

| Regulation Reference | This form is governed by California Vehicle Code, specifically CVC §1808.21 regarding compliance and accuracy of mailing addresses. |

| Rev. Date | The most recent revision of the REG 343 form occurred in April 2021 (REV. 4/2021). |

Guidelines on Utilizing Dmv Reg 343

After you have gathered all the necessary information, you can proceed with filling out the DMV Reg 343 form. Ensure that all details are accurate and legible. After completing the form, you will need to sign where indicated and submit it to the DMV for processing.

- SECTION 1 - VEHICLE INFORMATION: Enter the Vehicle Identification Number (VIN), make, year, model, fuel type, California license plate number, body type, motorcycle engine number, and the type of vehicle. Check the appropriate box for trailers, commercial vehicles, or motorcycles.

- Fill in the dimensions (length and width) of the vehicle and answer questions on usage and weight capacity. If applicable, indicate if a Declaration of Gross Vehicle Weight form is needed.

- SECTION 2 - OWNER INFORMATION: Provide the full name of each owner or co-owner, including any business names. List the driver’s license or ID number and the state of issuance for each individual. Include the physical address and, if different, the mailing address.

- If relevant, list the lessee's address and the location of the trailer coach if it differs from the physical address.

- SECTION 3 - LEGAL OWNER: If there is a lien holder, include their full name, electronic lienholder ID number, and addresses. If there is no lien holder, write “none.”

- SECTION 4 - ODOMETER INFORMATION: Record the odometer reading at the time of purchase and check all applicable statements regarding the accuracy of the reading.

- SECTION 5 - DATE INFORMATION: Enter relevant dates regarding the vehicle's entry into California and any other important ownership dates.

- SECTION 6 - COST INFORMATION: Clearly check the appropriate box for how the vehicle was acquired. Fill in the purchase price, value, or any trade-in details if applicable.

- Respond to questions about modifications made to the vehicle since acquisition.

- SECTION 7 - OUT-OF-STATE VEHICLES: Answer whether sales tax was paid to another state and fill in the details if required.

- SECTION 8 - MILITARY SERVICE INFORMATION: Indicate if you or your spouse is on active duty, and answer questions regarding your last state of registration.

- SECTION 9 - CERTIFICATIONS: The registered owner must sign the form, providing their printed name, date, and daytime telephone number. Each co-owner must also provide similar information and sign the form.

What You Should Know About This Form

What is DMV Reg 343 form used for?

The DMV Reg 343 form is an application for title or registration of a vehicle in California. This form is essential for anyone who is registering a vehicle, including purchasing it or transferring ownership. It collects necessary information about the vehicle and its owners to ensure proper registration with the Department of Motor Vehicles (DMV).

Who needs to fill out this form?

Anyone who is registering a vehicle in California must complete this form. This includes individuals who have purchased a new or used vehicle, received a vehicle as a gift, or are looking to transfer ownership. If there are co-owners, all must be included on the form.

What information do I need to provide on this form?

You will need to provide basic information about the vehicle, including the Vehicle Identification Number (VIN), make, model, year, and fuel type. Additionally, owner information, odometer readings, and any lienholder details are required. All entries must be printed legibly to ensure accuracy.

What should I do if the vehicle has an odometer discrepancy?

If you believe there is an odometer discrepancy, you must check the appropriate box on the form. You also need to provide an explanation of the inconsistency. This transparency is necessary for maintaining accurate vehicle records.

Can I submit this form electronically?

Currently, the DMV does not accept the DMV Reg 343 form electronically. You must print the completed form and submit it by mail or in person to your local DMV office. Always check the latest guidelines on the DMV website for any updates regarding electronic submissions.

Is there a fee associated with submitting this form?

Yes, there may be fees associated with registering a vehicle using the DMV Reg 343 form. The fees depend on various factors, such as the type of vehicle, its weight, and any applicable taxes. Be sure to review the fee schedule on the DMV’s website or inquire directly with your local DMV office.

How long does it typically take to process this form?

The processing time for the DMV Reg 343 form can vary. Generally, it takes several weeks, depending on the DMV's current workload and the completeness of your application. To avoid delays, ensure that all sections are filled out accurately and that you have included any necessary documentation.

What happens if I made a mistake on the form?

If you realize that you’ve made a mistake after submitting the form, it is best to contact the DMV as soon as possible. Depending on the situation, you may be able to submit a corrected form or provide additional information. Prompt communication can help mitigate any negative impacts on your vehicle registration.

Common mistakes

When filling out the DMV REG 343 form, many individuals make mistakes that can lead to delays or complications in the registration process. Here are seven common errors to avoid:

First, incorrect vehicle information is a frequent pitfall. Ensure that the Vehicle Identification Number (VIN) and other details like make, model, and year are accurate. A simple typo in these fields can result in significant issues, including the rejection of your application.

Second, many overlook the importance of the odometer section. Not providing an odometer reading or incorrectly stating the mileage can raise red flags. Ensure to indicate whether the mileage reflects the actual reading and check any applicable boxes regarding discrepancies.

Third, neglecting to complete both sides of the form is another common mistake. Failing to sign or providing incomplete ownership information can delay the processing of your application. Every owner or lessee must provide their full legal name, ID number, and a signature.

Fourth, misrepresenting the purpose of the vehicle often leads to problems. If the vehicle is a commercial one, you must answer questions regarding its usage, weight, and axles correctly. Inaccurate declarations in this section might require additional documentation.

Fifth, people frequently misread the requirements for exemptions. If you qualify for military service exemptions or other similar conditions, mark these accurately. Failure to do so can lead to unnecessary fees or disqualification from benefits.

Additionally, many applicants forget to double-check their contact information. If you provide an incorrect mailing address, important communications from the DMV may not reach you. Always ensure that this information is up-to-date and precise.

Lastly, individuals may overlook the need for accompanying documentation. Certain scenarios, like transferring ownership through a gift or trade, require additional forms. Refer to the instructions and ensure all necessary documents are submitted with your application.

Documents used along the form

The DMV REG 343 form is an essential document used to apply for a vehicle title or registration. While this form facilitates the initial process, several other documents may also be required depending on the circumstances surrounding the vehicle's ownership, registration, or specific use. Here is a brief overview of some of these important documents:

- REG 4008 - Declaration of Gross Vehicle Weight/Combined Gross Vehicle Weight: This form must be filled out if the vehicle is a commercial vehicle that operates at a certain weight threshold, either over 10,001 lbs or with a pickup exceeding specific weight limits. It provides the DMV with details about the vehicle's weight class.

- REG 256 - Statement of Facts: Sometimes needed to clarify certain circumstances about a vehicle's acquisition, this form helps outline the relationship and nature of the transaction when a vehicle is gifted or traded among family members.

- REG 5036 - Statement of Construction: If any modifications have been made to the vehicle, such as a change in its function or appearance, this document must be submitted. It officially logs these changes with the DMV.

- REG 5045 - Nonresident Military Vehicle License Fee Exemption: Active duty military members may qualify for certain exemptions. This form provides information to the DMV about the service member’s status and the vehicle's registration fees.

- Title or Bill of Sale: A title or bill of sale is often needed to prove ownership and detail the transaction. It's especially important when purchasing a vehicle from a private seller.

- Odometer Disclosure Statement: This form is utilized to document the vehicle's mileage at the time of sale. It helps ensure transparency concerning the vehicle's history and condition.

- Proof of Insurance: Before registering a vehicle, proof of insurance must be provided, demonstrating that the vehicle meets the state’s minimum insurance requirements.

- Application for Title or Registration (form REG 343 in other contexts): Different registrations may require new applications, so a similar form may be necessary when perfecting title upon a change in ownership or status.

Each of these documents plays a vital role in ensuring that the registration process is smooth and legally sound. Gathering and submitting them alongside the DMV REG 343 form can simplify interactions with the DMV and contribute to a successful registration or title application.

Similar forms

- DMV REG 4008 - Declaration of Gross Vehicle Weight: This form is also used in vehicle registration processes, specifically to declare the gross weight of commercial vehicles, much like how the REG 343 captures vehicle information.

- DMV REG 256 - Statement of Facts: Like the REG 343, this document is used when specific details or circumstances regarding a vehicle's registration need clarification, such as modifications.

- DMV REG 5036 - Statement of Construction: This form addresses body type modifications and serves a purpose similar to the vehicle cost section of REG 343, which allows for documentation of changes.

- DMV REG 5045 - Nonresident Military Vehicle License Fee Exemption: Similar to REG 343, this form applies to those with specific residency situations, like military personnel, and collects vital information for fee exemptions.

- DMV Title Application: Both documents are essential for transferring ownership and require identification details in a similar format for verification purposes.

- DMV Registration Renewal Application: This form also collects owner and vehicle information like the REG 343 and is necessary for maintaining legal vehicle operation on California roads.

- VIN Verification Certificate (REG 31): This document verifies a vehicle’s VIN for registration purposes, paralleling REG 343’s requirement for precise vehicle identification details.

- California Vehicle Use Tax Clearance Certificate: Similar in its function to the REG 343, this certificate confirms tax obligations related to vehicle purchases, ensuring compliance during registration.

- Manufacturer's Certificate of Origin (MCO): Like REG 343, the MCO serves as a foundational document that provides critical information for the initial registration of a vehicle.

- DMV Notice of Transfer and Release of Liability (REG 138): This form, required during ownership transfer, shares similarities with the REG 343 in that it ensures relevant ownership data is correctly documented.

Dos and Don'ts

When filling out the DMV Reg 343 form, keep the following tips in mind:

- Do: Print clearly and legibly to avoid miscommunication.

- Do: Complete both sides of the form to ensure all necessary information is provided.

- Do: Sign the form where required; all owners must provide their signatures.

- Do: Check the appropriate boxes, especially regarding vehicle ownership details and purpose.

- Do: Double-check all information for accuracy before submitting.

- Don't: Leave sections blank; fill in all applicable fields.

- Don't: Use any abbreviations; provide full addresses and names as requested.

- Don't: Forget to include the appropriate odometer reading and any discrepancies.

- Don't: Submit without ensuring the document is fully completed and signed.

- Don't: Neglect to verify any specific requirements based on your vehicle type, such as commercial regulations.

Misconceptions

- Myth: The DMV REG 343 form is only for new vehicle registrations. This form is used for various purposes, including transferring ownership, registering out-of-state vehicles, and obtaining titles. Whether you’re buying a brand-new car or used one, this form is relevant.

- Myth: I don’t need to fill out the second side of the form. Both sides provide essential information related to vehicle ownership. Make sure to complete every section as required to avoid delays in processing.

- Myth: Only the primary owner needs to sign the form. If there is a co-owner or lessee, that person must also provide their signature. This ensures that ownership records are accurate and legally binding.

- Myth: The odometer information is optional. It's critical to report the odometer readings accurately. This part of the form helps to prevent fraud and provides a clear record of a vehicle’s mileage.

- Myth: I can leave the vehicle history section blank if I didn’t own it before. You still need to provide the date the vehicle entered California and any other relevant information. Transparency is key for processing your application smoothly.

- Myth: I can use any address for the vehicle registration. The address must be the physical residence or business where the vehicle is primarily garaged. Using an incorrect address could lead to complications down the line.

Key takeaways

When dealing with the DMV REG 343 form, several important points to keep in mind ensure a smooth experience.

- Accuracy is key: Fill out the form legibly and ensure that all required sections are complete. Missing or incorrect information can lead to delays in processing.

- Understand ownership requirements: All owners must sign the form appropriately. Co-owners listed as “AND” require all signatures, while those listed as “OR” need just one.

- Odometer disclosure: You must report the vehicle's odometer reading at the time of purchase and provide any discrepancies that may exist. Failing to do this could have legal implications.

- Know your eligibility for exemptions: If you are an active member of the U.S. Uniformed Services, specific exemptions might apply. Explore these options to possibly reduce fees.

Browse Other Templates

Workers Compensation Endorsements - This endorsement helps streamline claims processing by setting clear boundaries.

Social Security Earnings Request Form,Earnings Information Request F4,Form for Earning Details,SSA Earnings Statement Application,Request for Earnings Record,Social Security Earnings Inquiry Form,SSA Earnings Certification Application,Earnings Inform - Free yearly earnings totals can be accessed online through the Social Security website.

LLC Amendments Form,Oklahoma LLC Update Document,Articles of Organization Amendment,Public Benefit LLC Amendment,LLC Name Change Application,Oklahoma Business Structure Revision,Form for Amending LLC Articles,Oklahoma Limited Liability Company Amendm - Changes filed via the SOS 0079 can affect the LLC’s legal standing.