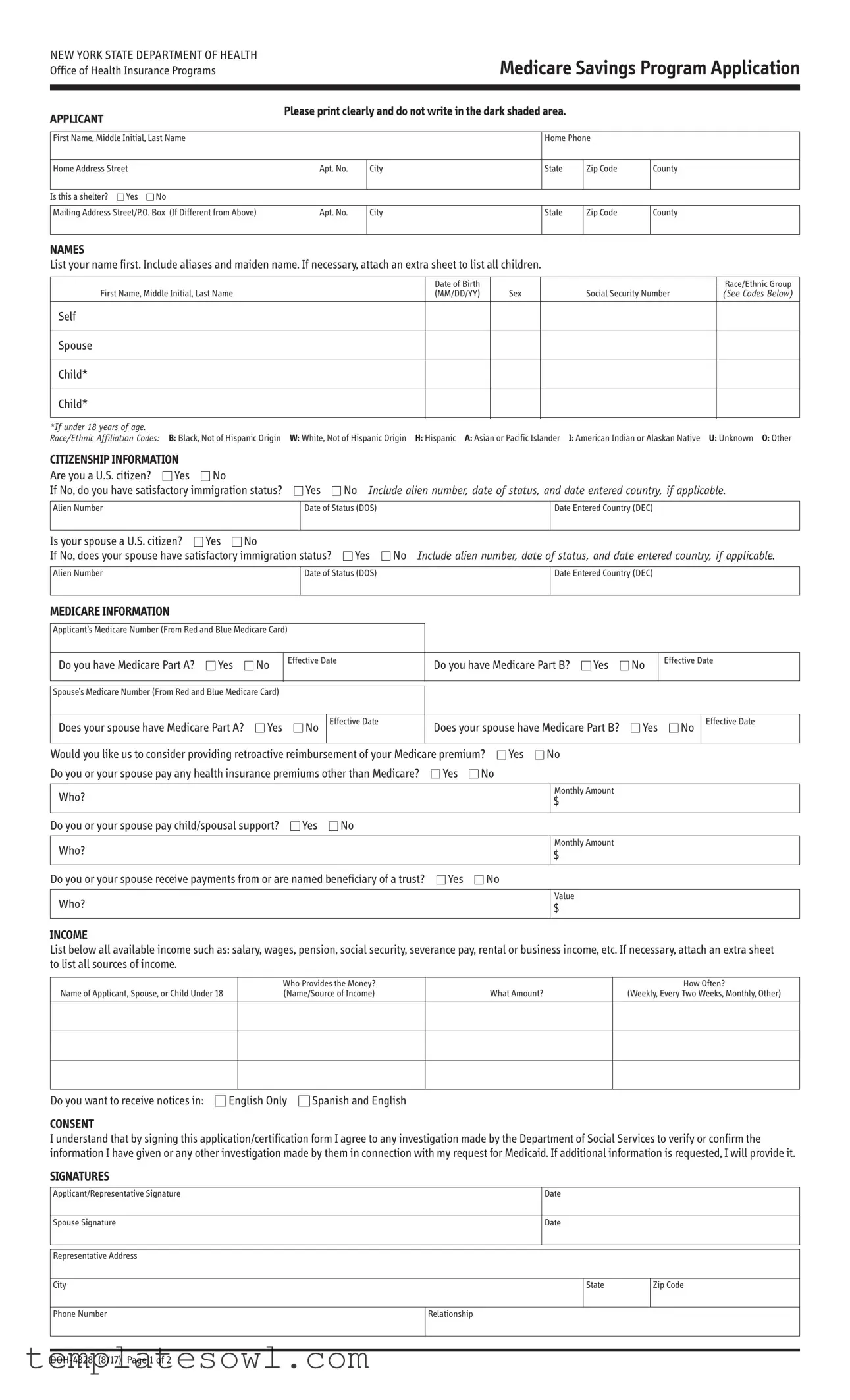

Fill Out Your Doh 4328 Msp Application Form

The DOH 4328 MSP Application form plays a vital role in facilitating access to the Medicare Savings Program (MSP) in New York State. This application is designed for individuals who may qualify for assistance with Medicare premiums through Medicaid. It collects essential personal information, including the applicant’s name, contact details, and household composition. Understanding the various sections of the application is crucial for a smooth submission process. Individuals must provide information about their income sources, Medicare status, and any additional health insurance they may have. The form also addresses citizenship status and includes a section for both applicant and spouse Medicare details. Proper completion and submission of required verification documents, such as income proofs and residency information, are imperative. The process is further underscored by the necessity of signing the form and agreeing to its terms, which emphasize truthfulness in disclosures. By comprehensively gathering this information, the DOH 4328 MSP Application form not only ensures that applicants receive the assistance they need but also upholds the integrity of the Medicaid program.

Doh 4328 Msp Application Example

NEW YORK STATE DEPARTMENT OF HEALTH Office of Health Insurance Programs

Medicare Savings Program Application

APPLICANT |

|

|

Please print clearly and do not write in the dark shaded area. |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

First Name, Middle Initial, Last Name |

|

|

Home Phone |

|

|||

|

|

|

|

|

|

|

|

Home Address Street |

|

Apt. No. |

City |

State |

Zip Code |

County |

|

|

|

|

|

|

|

|

|

Is this a shelter? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

||

Mailing Address Street/P.O. Box (If Different from Above) |

Apt. No. |

City |

State |

Zip Code |

County |

||

|

|

|

|

|

|

|

|

NAMES

List your name first. Include aliases and maiden name. If necessary, attach an extra sheet to list all children.

|

Date of Birth |

|

|

Race/Ethnic Group |

First Name, Middle Initial, Last Name |

(MM/DD/YY) |

Sex |

Social Security Number |

(See Codes Below) |

Self

Spouse

Child*

Child*

*If under 18 years of age.

Race/Ethnic Affiliation Codes: B: Black, Not of Hispanic Origin W: White, Not of Hispanic Origin H: Hispanic A: Asian or Pacific Islander I: American Indian or Alaskan Native U: Unknown O: Other

CITIZENSHIP INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Are you a U.S. citizen? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If No, do you have satisfactory immigration status? |

|

|

|

Yes |

No Include alien number, date of status, and date entered country, if applicable. |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Alien Number |

|

|

|

|

|

|

|

|

|

|

Date of Status (DOS) |

|

|

|

|

|

Date Entered Country (DEC) |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Is your spouse a U.S. citizen? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

If No, does your spouse have satisfactory immigration status? |

Yes |

No Include alien number, date of status, and date entered country, if applicable. |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Alien Number |

|

|

|

|

|

|

|

|

|

|

Date of Status (DOS) |

|

|

|

|

|

Date Entered Country (DEC) |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MEDICARE INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Applicant’s Medicare Number (From Red and Blue Medicare Card) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Do you have Medicare Part A? |

|

Yes |

|

|

No |

Effective Date |

|

|

Do you have Medicare Part B? |

|

Yes |

|

|

No |

Effective Date |

||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s Medicare Number (From Red and Blue Medicare Card) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Does your spouse have Medicare Part A? |

|

Yes |

|

|

|

No Effective Date |

|

Does your spouse have Medicare Part B? |

|

Yes |

|

|

No Effective Date |

||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Would you like us to consider providing retroactive reimbursement of your Medicare premium? |

Yes |

No |

|

|

|

|

|

|

|

|

|

||||||||||||||||

Do you or your spouse pay any health insurance premiums other than Medicare? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Who? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Monthly Amount |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Do you or your spouse pay child/spousal support? |

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Who?

Monthly Amount

$

Do you or your spouse receive payments from or are named beneficiary of a trust? |

Yes |

No |

Who?

Value

$

INCOME

List below all available income such as: salary, wages, pension, social security, severance pay, rental or business income, etc. If necessary, attach an extra sheet to list all sources of income.

Name of Applicant, Spouse, or Child Under 18

Who Provides the Money? (Name/Source of Income)

What Amount?

How Often?

(Weekly, Every Two Weeks, Monthly, Other)

Do you want to receive notices in:

English Only

Spanish and English

CONSENT

I understand that by signing this application/certification form I agree to any investigation made by the Department of Social Services to verify or confirm the information I have given or any other investigation made by them in connection with my request for Medicaid. If additional information is requested, I will provide it.

SIGNATURES

Applicant/Representative Signature |

|

Date |

|

|

|

|

|

|

|

Spouse Signature |

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

Representative Address |

|

|

|

|

|

|

|

|

|

City |

|

|

State |

Zip Code |

|

|

|

|

|

Phone Number |

Relationship |

|

||

|

|

|

|

|

|

|

|

|

|

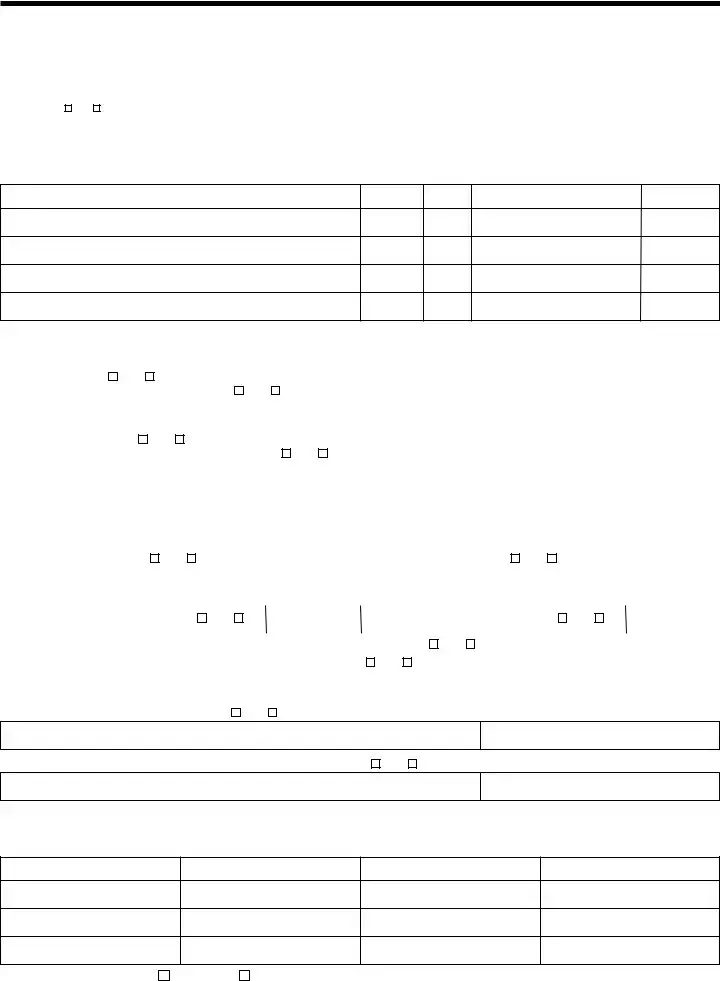

INSTRUCTIONS

COMPLETE THE APPLICATION

Be sure to answer all the questions. If you are married and living with your spouse, you must complete both the “Self” and “Spouse” questions on the application (even if the spouse is not applying for the MSP).

SIGN AND DATE THE APPLICATION

If both spouses are applying, both must sign the MSP application.

INCLUDE THE FOLLOWING VERIFICATION DOCUMENTS

Please review this list and submit the documents that you will need to provide in order for the Medicaid Program to determine if you are eligible for MSP. If you are requesting retroactive reimbursement of your Medicare premiums, you must send proof of income for the previous

•A photocopy of the front and back of your Medicare card.

•Proof of income: Paycheck stubs, letter from employer, income tax return, award letter for any unearned income benefit such as social security, unemployment, or veteran’s benefit, or letter from renter, boarder or tenant.

•Health insurance premiums that you pay other than Medicare: Letter from employer, premium statement, or pay stub.

•Proof of date of birth: State driver’s license, U.S. birth certificate, permanent resident card (“green card”), or NYS Benefit Identification Card.

•Proof of residence: Lease/letter/rent receipt with your home address from your landlord, driver’s license (if issued in the past 6 months), utility bill (gas, electric, phone, cable, fuel or water), government ID card with address, property tax records or mortgage statement, or postmarked envelope or postcard (cannot use if sent to a P.O. Box).

•If you are not a U.S. citizen, you must provide documents indicating your current immigration status.

Mail the application and required documentation to your local Department of Social Services (LDSS) or Human Resource Administration (HRA). To find the address in your county: http://www.health.ny.gov/health_care/medicaid/ldss.htm

TERMS, RIGHTS AND RESPONSIBILITIES

By completing and signing this form, I am applying for the Medicare Savings Program. PAYMENT OF YOUR MEDICARE PREMIUM IS A MEDICAID BENEFIT.

PENALTIES

I understand that my application may be investigated, and I agree to cooperate in such an investigation. Federal and State laws provide for penalties of fine, imprisonment or both if you do not tell the truth when you apply for Medicaid benefits or at any time when you are questioned about your eligibility, or cause someone else not to tell the truth regarding your application or your continuing eligibility.

CHANGES

I agree to immediately report any changes to the information on this application.

SOCIAL SECURITY NUMBER (SSN)

If you are applying for the Medicare Savings Program, you must report your SSN, unless you are a pregnant woman. The laws requiring this are: 18NYCRR Sections 351.2,

CERTIFICATION OF CITIZENSHIP & IMMIGRATION STATUS

I certify, under the penalty of perjury, by signing my name on this application, that I, and/or any person for whom I am signing is a U.S. citizen or national of the United States or has satisfactory immigration status. I understand that information about me will be submitted to the United States Citizenship and Immigration Services (USCIS) for verification of my immigration status, if applicable. I further understand that the use or disclosure of information about me is restricted to persons and organizations directly connected with the verification of immigration status and the administration and enforcement of the provisions of the Medicaid program.

This application will be considered without regard to race, color, sex, disability, religious creed, national origin, or political belief.

CERTIFICATION

In signing this application, I swear and affirm that the information I have given or will give to the Department of Social Services as a basis for Medicaid is correct. I also assign to the Department of Social Services any rights I have to pursue support from persons having legal responsibility for my support and to pursue other

If after reading and completing this form, you decide that you DO NOT want to apply for the Medicare Savings Program, please sign your name below:

I consent to withdraw my application:

Applicant Signature

Date

Signature of Person Who Obtained Eligibility Information |

|

|

Date |

Employed By |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

Date Eligibility Determined By Worker |

|

|

|

|

|

Date Eligibility Approved By |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Central/Office |

Application Date |

|

Unit ID |

|

Worker ID |

Case Type |

Case No. |

|

|

Reuse Ind. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Case Name |

|

|

District |

|

|

|

Registry No. |

|

Ver. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effective Date |

|

MA Disp. |

Denial |

Withdrawal |

Reason Code |

|

Proxy |

No |

|||

|

|

|

|

Yes |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Application Type | This form is specifically for applying to the Medicare Savings Program in New York State. |

| Required Details | Applicants must provide personal details such as name, address, and Social Security Number. |

| Income Disclosure | All sources of income must be reported, including wages, pensions, and any rental income. |

| Citizen Status | The application asks if the applicant is a U.S. citizen and requires information on immigration status if not. |

| Verification Documents | Applicants must submit various documents, including proof of income, state ID, and Medicare card photocopy. |

| Consent for Investigation | Applicants agree to allow the Department of Social Services to verify the provided information during an investigation. |

| Non-Discrimination Clause | The application ensures no discrimination based on race, color, sex, or other protected characteristics. |

| Governing Laws | This application complies with New York social services regulations as outlined in 18 NYCRR and federal law 42 USC. |

Guidelines on Utilizing Doh 4328 Msp Application

Filling out the DOH 4328 MSP Application form is a critical step in accessing important Medicare savings. By completing this form accurately, you pave the way for the necessary review process that will help determine your eligibility for assistance. Below are the structured steps to guide you through the application process.

- Gather necessary personal information, including your full name, phone number, home address, and county.

- Indicate whether the address is a shelter, and if different, provide your mailing address.

- List all names, including any aliases or maiden names, and provide your date of birth, race/ethnic group, sex, and social security number.

- Answer the citizenship questions, indicating whether you or your spouse is a U.S. citizen or has satisfactory immigration status, including any relevant information such as alien numbers and dates of status.

- Input your Medicare information, including Medicare numbers for yourself and your spouse, and specify whether you both have Medicare Part A and Part B, along with effective dates.

- State if you wish to consider retroactive reimbursement of your Medicare premium and provide details about any additional health insurance premiums you pay.

- List all sources of income, detailing who provides the money, the amount, and frequency of payment.

- Select your preferred language for notices: English only, or Spanish and English.

- Read and agree to the consent section regarding investigations and the correctness of information provided.

- Sign and date the application, ensuring both spouses sign if both are applying.

After completing the application, gather relevant verification documents to submit alongside your form. This includes copies of identification, income verification, and proof of residence. Make sure to mail everything to your local Department of Social Services or Human Resource Administration. For help finding the correct address, you can visit the New York State Department of Health’s website.

What You Should Know About This Form

What is the DOH 4328 MSP Application form?

The DOH 4328 Medicare Savings Program (MSP) Application form is used by individuals applying for financial assistance to help pay for Medicare premiums. This application is submitted to the New York State Department of Health to determine eligibility for the program based on income, citizenship, and financial needs.

Who can apply for the Medicare Savings Program?

Any individual who is enrolled in Medicare and meets specific income and resource limits can apply for the Medicare Savings Program. This includes individuals, their spouses, and sometimes dependent children. Eligibility is primarily based on income and assets.

What information is required to complete the application?

The application requires personal information such as your name, contact details, and Social Security number. You will also need to provide income details, Medicare information, and citizenship documentation. It's important to answer all questions truthfully, as any discrepancies may affect your application.

What documents must be submitted with the application?

Applicants must provide various verification documents, including copies of the Medicare card, proof of income, documentation of health insurance premiums, proof of date of birth, and proof of residence. If applicable, documentation indicating immigration status should also be included.

How do I submit the completed application?

After completing the DOH 4328 MSP Application and assembling the necessary documents, you can mail it to your local Department of Social Services or Human Resource Administration. The specific address for your county can be found on the New York Department of Health’s website.

Can I receive retroactive reimbursement for my Medicare premiums?

Yes, you can request retroactive reimbursement for your Medicare premiums. To do this, ensure that you indicate your desire for reimbursement on the application. Additionally, you will need to attach proof of income for the three months preceding your application submission.

What happens if I don't report changes in my situation?

It's crucial to report any changes to your financial or personal situation immediately. Failure to do so can lead to penalties, including the possibility of fines or legal action. Keeping your information updated ensures you remain eligible for the Medicare Savings Program.

Where can I find help with completing the application?

If you need assistance with the application, the local Department of Social Services can provide guidance. You may also contact local advocacy groups or organizations focused on health care for support in understanding and completing the form.

Common mistakes

Completing the DOH 4328 MSP Application form can be complicated. Many applicants make mistakes that can delay their application process, or worse, lead to their application being rejected. Here are some common errors to watch out for.

One common mistake is failing to provide accurate personal information. It’s crucial to ensure that your name, address, and Social Security Number are correct. Errors in this section can lead to significant delays. For example, a small typo can create confusion in your identity verification process.

Another frequent error involves not signing the application. Both the applicant and, if applicable, the spouse must sign the form. Not doing so will result in the application being incomplete. Double-check that all required signatures are in place before submission.

Some individuals overlook including all necessary documents. Applicants must submit proof of income, residence, and identity, among other things. Missing documentation can lead to a denial of benefits. Take time to review the required documents carefully.

Another mistake often seen is not answering all questions. Incomplete answers can hinder eligibility determinations. Be thorough when providing information. If a question doesn’t apply, make sure to mark it appropriately rather than leaving it blank.

Applicants sometimes forget to check their Medicare information. Providing inaccurate Medicare details, like the Medicare Number or effective dates, can also cause obstacles. Ensure that all Medicare-related queries are answered correctly and completely.

Some people use a P.O. Box for their mailing address, even when not allowed. It's important to provide a physical address when required. The application has specific instructions regarding acceptable addresses, and failing to follow them can create issues.

Not reporting all sources of income is another common mistake. Applicants should list all income, including wages, social security, and any other financial assistance. Leaving out even one source could result in incorrect income calculations.

Another issue arises when applicants fail to specify how they prefer to receive notices. Selecting a language or format is essential for effective communication. Ensure this preference is clearly indicated on the application.

Many individuals forget to keep a copy of their completed application for their records. Keeping a copy is a good practice, as it can serve as a reference if any issues arise. Be proactive and maintain a record of your submission.

Lastly, not reporting changes in circumstances promptly can lead to complications. If your situation changes after submitting the application, communicating those changes is critical. It’s a requirement to report changes that might affect your eligibility.

Documents used along the form

When applying for the Medicare Savings Program using the DOH 4328 MSP Application form, several other forms and documents are typically needed. Each of these items plays a crucial role in ensuring your application is complete and your eligibility can be evaluated effectively.

- Medicare Card Photocopy: A copy of both the front and back of your Medicare card is needed. It confirms your Medicare coverage and provides essential identification information.

- Proof of Income: This can include paycheck stubs, tax returns, or letters from employers. This document verifies your income and is critical for determining your eligibility for financial assistance.

- Health Insurance Premium Documentation: If you pay premiums for health insurance other than Medicare, include a letter or statement that details these payments. This helps assess your overall financial situation.

- Date of Birth Proof: A birth certificate, driver’s license, or permanent resident card must be provided to confirm your age and identity.

- Residence Verification: Submit a lease, utility bill, or official government document that includes your home address. This confirms your residency and is necessary for eligibility assessment.

- Immigration Status Documents: If you are not a U.S. citizen, documentation proving your current immigration status will be required. This can include visas or other pertinent documents.

- Spousal Documents: If a spouse is applying or contributing information, include details about their income and Medicare coverage, similar to your own documentation.

- Child Support Documentation: If applicable, records illustrating child or spousal support payments should be included to provide a complete view of your financial obligations.

- Additional Sheets: If there are more names or sources of income to report than space allows on the form, attach extra sheets as needed. This ensures all necessary information can be reviewed.

Providing all these forms and documents accurately and completely will help streamline the application process. Understanding and preparing these requirements can make a significant difference in gaining access to the support you may need.

Similar forms

The DOH 4328 MSP Application form serves a critical purpose in the Medicare Savings Program, but it's similar in nature to several other application forms typically used in health and social services. Below are six documents that share similar elements with the DOH 4328 form:

- Medicaid Application Form - Like the DOH 4328, this form collects personal and financial information to assess eligibility for Medicaid benefits. It requires details regarding income, household composition, and citizenship status.

- Food Stamp Application (SNAP) - This application, similar to the DOH 4328, seeks to determine eligibility for nutrition assistance. Both forms require information about household income, assets, and identification details.

- Temporary Assistance Application - The Temporary Assistance form, like the DOH 4328, is used to evaluate financial need for short-term assistance. It involves providing personal information, income verification, and residency details.

- Health Insurance Marketplace Application - This application is focused on determining eligibility for health insurance subsidies. It requires similar information on income and household demographics, akin to what is asked in the DOH 4328.

- Medicare Part D Extra Help Application - Like the DOH 4328, this application helps determine eligibility for subsidies related to prescription drug costs. It involves disclosing income, resources, and personal identification.

- Supplemental Security Income (SSI) Application - The SSI application seeks to establish eligibility for financial assistance due to disability or age. Both forms inquire about income, assets, and residency, reflecting the individual's financial situation.

Each of these forms shares a common goal: to assess eligibility for a program by gathering essential information about the applicant. They also reinforce the importance of accurate and honest reporting when seeking assistance.

Dos and Don'ts

When filling out the Doh 4328 MSP Application form, it is crucial to follow certain best practices to ensure a smooth application process. Here are some dos and don'ts to consider:

- Do print clearly and avoid writing in the dark shaded areas of the form.

- Do answer all questions thoroughly, especially for both yourself and your spouse if applicable.

- Do attach any necessary documentation, such as proof of income and identification, to support your application.

- Do sign and date the application, ensuring that all required signatures are included.

- Don't leave any sections blank; incomplete applications may delay processing.

- Don't forget to include your spouse's information if you are married and living together.

- Don't submit the form without double-checking for errors or missing information.

- Don't assume that all submitted documents will be retained; keep copies for your own records.

Misconceptions

Misconception 1: The DOH 4328 MSP Application is only for low-income individuals.

This form is designed for anyone seeking assistance with Medicare premiums, regardless of their current financial situation. While income does play a role in eligibility, the application is not limited solely to those who are deemed low-income.

Misconception 2: You need to apply every year for Medicare Savings Program (MSP) benefits.

Once you are approved for the MSP, your benefits typically continue without the need for reapplication each year. However, it is essential to report any changes to your income or household situation that might impact your eligibility.

Misconception 3: All documentation required for the application is to be submitted later.

The DOH 4328 form explicitly states that you should include necessary verification documents with your application at the time of submission. Waiting to send these later can lead to delays in processing your application.

Misconception 4: Signing the application guarantees approval for the Medicare Savings Program.

Completing and signing the DOH 4328 does not assure acceptance. The application will undergo a review process, and approval depends on meeting specific eligibility criteria set by the state Medicaid program.

Misconception 5: You cannot include your spouse's information if they are not applying for MSP.

The form requires information from both spouses, even if only one is applying for benefits. This requirement ensures accurate assessment of household income and other factors that may affect eligibility.

Misconception 6: If you make a mistake on the form, your application will be automatically denied.

It is best to correct any mistakes before submitting the application. However, if an error is discovered later, the applicant will usually be given an opportunity to clarify or rectify the information before any denial of benefits.

Misconception 7: Children under 18 do not need to provide any income information.

If a child under 18 has income or assets, that information must be included in the application. This transparency helps to assess the total financial picture, which may affect eligibility for Medicare Savings Programs.

Key takeaways

When filling out the DOH-4328 Medicare Savings Program Application form, there are several important points to keep in mind:

- Clear Information is Essential: It is crucial to provide clear and accurate information. Ensure that all sections are completed without leaving any blank spaces.

- Include All Required Details: If you have a spouse, make sure to fill out their details as well, even if they are not applying for the program themselves.

- Verification Documents Matter: Gather all necessary documentation such as proof of income and copies of your Medicare card. Missing documents can delay the application process.

- Be Truthful: Honest responses are vital. Misrepresentation could lead to penalties, including fines or even criminal charges.

- Report Changes Promptly: If there are any changes to your situation after submitting the application, report them immediately to ensure your eligibility remains valid.

Following these steps can help streamline the application process and increase the chances of approval.

Browse Other Templates

Medicare Cgm Form - Patient and supplier information must be clearly stated to facilitate processing.

Hit a Thon Fundraiser Template - Players must submit this form on the day of the event to qualify.