Fill Out Your Donation Form

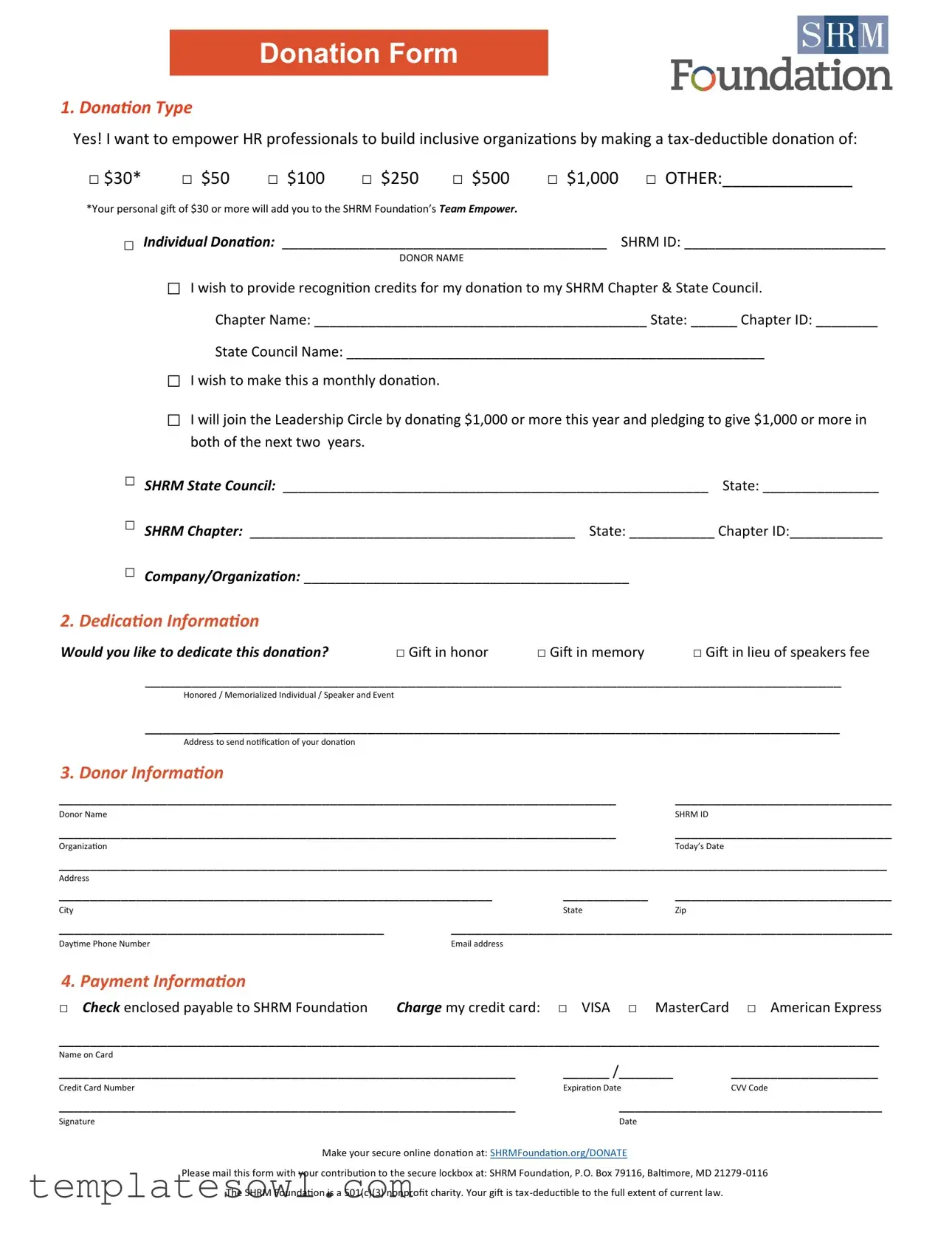

When considering a donation to support HR professionals striving for inclusivity, the Donation Form serves as a straightforward pathway to making an impactful contribution. This form offers a variety of donation types, allowing donors to choose amounts ranging from $30 to $1,000 or more, catering to different financial capabilities. Individuals can opt to designate their donations for specific recognition credits to their SHRM Chapter or State Council, enhancing community engagement. Each section of the form is laid out to gather pertinent information, including whether the donation is given in honor of someone, in memory of another, or as a speaker's fee. Providing donor information is essential, with sections dedicated to capturing your details, including address and contact information, ensuring that you receive acknowledgment for your generosity. The payment section provides options for checks or credit card payments, with security measures in place to protect sensitive information. Whether you prefer to make a one-time gift or become part of a monthly giving initiative, this form simplifies the process, making charitable giving accessible and impactful. Donors can easily submit the form either online or by mailing it to the designated SHRM Foundation address, reflecting the organization’s commitment to transparency and convenience.

Donation Example

Donation Form

1. Donation Type

Yes! I want to empower HR professionals to build inclusive organizations by making a

□ $30* |

□ $50 |

□ $100 |

□ $250 |

□ $500 |

□ $1,000 |

□ OTHER:______________ |

*Your personal gift of $30 or more will add you to the SHRM Foundation’s Team Empower. |

|

|

||||

□ Individual Donation: __________________________________________ |

SHRM ID: __________________________ |

|||||

|

|

|

DONOR NAME |

|

|

|

□

□

□

I wish to provide recognition credits for my donation to my SHRM Chapter & State Council.

Chapter Name: ___________________________________________ State: ______ Chapter ID: ________

State Council Name: ______________________________________________________

I wish to make this a monthly donation.

I will join the Leadership Circle by donating $1,000 or more this year and pledging to give $1,000 or more in both of the next two years.

□ |

SHRM State Council: _______________________________________________________ State: _______________ |

□ |

SHRM Chapter: __________________________________________ State: ___________ Chapter ID:____________ |

□Company/Organization: __________________________________________

2.Dedication Information

Would you like to dedicate this donation? |

□ Gift in honor |

□ Gift in memory |

□ Gift in lieu of speakers fee |

__________________________________________________________________________________________ |

|||

Honored / Memorialized Individual / Speaker and Event |

|

|

|

_________________________________________________________________________________________ |

|||

Address to send notification of your donation |

|

|

|

3. Donor Information |

|

|

|

________________________________________________________________________ |

____________________________ |

||

Donor Name |

|

|

SHRM ID |

________________________________________________________________________ |

____________________________ |

||

Organization |

|

|

Today’s Date |

___________________________________________________________________________________________________________

Address

________________________________________________________ |

___________ |

____________________________ |

|

City |

|

State |

Zip |

__________________________________________ |

_________________________________________________________ |

||

Daytime Phone Number |

Email address |

|

|

4. Payment Information

□ Check enclosed payable to SHRM Foundation Charge my credit card: □ VISA □ MasterCard □ American Express

__________________________________________________________________________________________________________

Name on Card

___________________________________________________________ |

______ /_______ |

___________________ |

Credit Card Number |

Expiration Date |

CVV Code |

___________________________________________________________ |

__________________________________ |

|

Signature |

Date |

|

Make your secure online donation at: SHRMFoundation.org/DONATE

Please mail this form with your contribution to the secure lockbox at: SHRM Foundation, P.O. Box 79116, Baltimore, MD

The SHRM Foundation is a 501(c)(3) nonprofit charity. Your gift is

Form Characteristics

| Fact Name | Description |

|---|---|

| Donation Types | The form offers multiple donation amounts, starting from $30 up to $1,000, with an option for custom amounts. |

| Monthly Donations | Donors can choose to make a monthly donation, creating ongoing support for the organization. |

| Recognition Credits | Donors can designate recognition credits for their donation to either a SHRM Chapter or State Council. |

| Gift Dedication Options | The form includes options to dedicate donations in honor or memory of individuals or in lieu of speaker fees. |

| Tax Deductibility | The SHRM Foundation is a 501(c)(3) nonprofit organization, making contributions tax-deductible under current tax laws. |

| Payment Methods | Donors may pay via check or charge their credit card with options including VISA, MasterCard, and American Express. |

| Secure Donations | Donors can also opt to make their donation through a secure online portal at SHRMFoundation.org/DONATE. |

| Mailing Information | Donations should be mailed to the SHRM Foundation's secure lockbox at P.O. Box 79116, Baltimore, MD, 21279-0116. |

| SHRM ID Requirement | Donors are prompted to provide their SHRM ID number to facilitate recognition and tracking of their contributions. |

Guidelines on Utilizing Donation

Filling out the Donation Form is a straightforward process that allows you to contribute meaningfully while specifying how you'd like your donation to be recognized. By following these instructions, you can ensure that your donation is processed smoothly and that all necessary details are captured accurately.

- Donation Type: Select the donation amount you wish to contribute. You can choose one of the predefined amounts or write in a different amount in the "OTHER" section.

- Complete the **Individual Donation** section by providing your SHRM ID and donor name.

- If applicable, indicate if you wish to provide recognition credits to your SHRM Chapter and State Council by filling in the Chapter Name, State, and Chapter ID.

- Indicate if you want to make your donation a monthly contribution.

- If you are pledging to join the Leadership Circle, indicate which organization (SHRM State Council or SHRM Chapter) you are representing along with the state and Chapter ID.

- Dedication Information: Choose whether you would like to dedicate the donation. If you select any of the dedication options (gift in honor, gift in memory, or gift in lieu of speaker's fee), fill in the respective details for the Honored/Memorialized Individual or Speaker and Event.

- Donor Information: Fill in your name, organization, today’s date, address, daytime phone number, and email address.

- Payment Information: Choose your payment method. If paying by check, ensure it is enclosed. If using a credit card, select your card type and fill in the requested details: name on card, card number, expiration date, CVV code, and signature.

- Make sure to sign and date the form at the bottom.

- Submit the form and payment. You can either make a secure online donation at the provided website or mail the completed form to the specified address.

What You Should Know About This Form

What types of donations can I make through the Donation Form?

You can choose from several donation types, including a one-time donation or a monthly donation. The form provides predefined amounts like $30, $50, $100, $250, $500, and $1,000. You also have the option to enter a custom amount if you’d like to donate a different sum. Additionally, if your donation is $30 or more, you will join the SHRM Foundation’s Team Empower, which recognizes your support for empowering HR professionals.

How can I dedicate my donation?

The Donation Form allows you to dedicate your contribution in a few meaningful ways. You can make a gift in honor or in memory of someone, or even as a substitute for speaker fees. Simply indicate your choice and provide the relevant information about the individual you wish to honor or memorialize. This personal touch can make your donation even more special for both you and the recipient.

Can I provide recognition credits for my donation?

Yes, if you’d like to give recognition credits to your SHRM Chapter or State Council, you can do so by filling in the chapter and state details on the form. You will need to include your chapter ID and the name of your state council. This allows your contribution to be recognized within the professional community you support, promoting engagement and inspiration among peers.

What if I want to make a larger commitment as part of the Leadership Circle?

If you want to join the Leadership Circle, you can pledge to donate $1,000 or more this year, and make a commitment to donate the same amount in the following two years. The form has a dedicated section for this, where you can indicate your status as a Leadership Circle member by checking the appropriate box and filling in the necessary details.

Is my donation tax-deductible?

Yes, the SHRM Foundation is a 501(c)(3) nonprofit organization, which means that your contributions are tax-deductible to the extent allowed by current law. That said, it’s always a good idea to consult with a tax advisor to understand the specific implications of your donation on your tax situation.

What payment methods are accepted for the donation?

The donation form accepts various payment methods. You can either send a check made out to the SHRM Foundation or charge your donation to a credit card. Accepted credit card options include VISA, MasterCard, and American Express. Be sure to provide the necessary details such as the name on the card, card number, expiration date, and CVV code to ensure a smooth transaction.

Common mistakes

When individuals complete a donation form, they often overlook important details that can lead to complications or delays. One common mistake is to skip filling in the SHRM ID section. This identification number allows the organization to track donations accurately. Without it, the donation may not be credited to the donor's account, resulting in disappointment later if they wish to claim recognition for their contribution.

Another frequent error involves failing to specify the amount of the donation. While the form provides several pre-set options, some donors mistakenly leave this section blank or write an amount in the “Other” field without adequately specifying it. Such oversights can delay processing and prevent timely acknowledgment of the gift.

Donors also sometimes neglect the dedication information. If an individual wishes to dedicate their donation in honor or memory of someone, omitting that detail means the organization cannot properly commemorate this intent. Providing this information ensures that the individual or event related to the donation receives the recognition they deserve.

A fourth mistake occurs when individuals attempt to make a monthly donation but fail to check the appropriate box. If the box indicating a monthly commitment is left unchecked, the donor may inadvertently set up a one-time donation instead. This mistake can lead to misunderstandings and unmet charitable intentions.

Completing the contact information section with missing or incorrect entries is also common. Donors may forget to fill in their daytime phone number or provide an email address. Incomplete contact details hinder the organization from reaching out for confirmation or additional information about the donation.

Another area where mistakes often arise is in the payment information. Donors can make errors by incorrectly filling in the credit card number, expiration date, or CVV code. Inaccuracies in these details can result in payment processing issues, which might require additional effort to resolve.

Many people rush through the signature section as well. Failure to sign the form or date it correctly can lead to delays in processing. The lack of a signature is a common reason forms are returned or set aside for further inquiry.

Leaving out details regarding recognition credits can also be a misstep. If someone wishes to direct credits to a specific SHRM Chapter or State Council, a failure to provide the necessary information means the donation may not be acknowledged properly in the donor's preferred venue. This can be frustrating for those who are actively involved in their local organizations.

Lastly, not following the submission instructions can create confusion. Some donors neglect to follow through by either mailing the form to the correct address or opting for the online donation option. Adhering to the submission guidelines ensures that the donation reaches the intended destination without unnecessary delays.

Documents used along the form

When making a donation, several related documents may come into play to ensure everything is processed correctly. Here are a few common forms you might encounter alongside the Donation Form.

- Payment Authorization Form: This document allows donors to authorize the organization to charge their credit or debit card for a specified amount. It includes details about the card holder as well as the terms of the transaction.

- Dedication Letter: If a donor wishes to dedicate their contribution, this letter outlines the specifics of that dedication. It may include information about who the gift honors or memorializes, and it serves as a formal acknowledgment for the recipient.

- Tax Receipt: After processing a donation, the organization generates a tax receipt for the donor. This document confirms the amount donated and includes the organization's tax identification number. Donors need this receipt for tax deduction purposes.

- Charitable Contribution Acknowledgment Form: This form is sometimes used to provide additional recognition for larger donations. It helps the organization track who should receive acknowledgments or credits for contributions made on behalf of individuals or groups.

By understanding these forms, donors can navigate the donation process more smoothly and ensure that their contributions are recognized appropriately.

Similar forms

- Fundraising Form: Similar to a donation form, a fundraising form is specifically designed to solicit funds for a cause. Both documents provide options for contribution amounts and often include sections for donor information and payment methods.

- Membership Application: A membership application seeks to enroll individuals in a particular organization. Like the donation form, it typically requires personal and contact information, along with options for different membership tiers.

- Pledge Form: A pledge form allows individuals to commit to making future payments. This is akin to the commitment made on the donation form, where individuals can indicate intentions for ongoing support or one-time donations.

- Volunteer Sign-Up Sheet: A volunteer sign-up sheet encourages individuals to contribute their time and skills. Both forms involve participant information and express a desire to support a cause, whether through financial donations or volunteer work.

- Grant Application: A grant application is used by organizations to request funding. It often requires detailed information about the project and budget, similar to how a donation form details the intended use of funds and organization affiliation.

- Sponsorship Proposal: A sponsorship proposal outlines a request for financial backing from a business or individual. It often mirrors donation forms by highlighting benefits to the sponsor and the impact of their financial support.

- Event Ticket Purchase Form: This form is completed to buy tickets for specific events. Similar to a donation form, it gathers attendee information and payment details, often providing options for different ticket types or levels of support.

- Certificate of Appreciation Request: This document is used to request an acknowledgment for donations or support. It requires donor information and reflects the desire for recognition, akin to the dedication information section in a donation form.

- In-Kind Donation Form: An in-kind donation form is used to document non-monetary contributions to an organization. It includes details about the goods or services being donated, similar to how the donation form captures specific giving choices.

- Corporate Match Donation Form: This form is submitted to request a matching gift from an employer. It parallels the donation form in that it requires both donor and organization information, revealing the donor's intent to amplify their charitable contribution.

Dos and Don'ts

Here are eight important tips for filling out the Donation form:

- Verify your donation amount before finalizing the form.

- Provide accurate contact information to ensure proper recognition.

- Specify if you are donating in honor or memory of someone.

- Double-check the payment method and details.

- Use a secure method to submit personal information.

- Don’t forget to sign the form if paying by credit card.

- Do not leave any required fields blank; incomplete forms may cause delays.

- Avoid outdated payment methods; check if your card is currently valid.

Misconceptions

Misconceptions often surround donation forms, leading to confusion. Here are seven common misconceptions about the Donation Form:

- You can only donate a specific amount listed on the form. Many assume that the amounts are fixed. In fact, you can choose "OTHER" and specify any amount you wish to donate.

- Donations are not tax-deductible. Some believe donations are not tax-deductible. However, the SHRM Foundation is a 501(c)(3) nonprofit, making your gift tax-deductible to the extent allowed by law.

- Only individuals can donate. It's a common misconception that only individuals can contribute. Organizations and companies can also make donations and fill out the organization section on the form.

- Donations are anonymous by default. While you can choose to remain anonymous, the form typically requires your information to issue receipts and recognition credits, if desired.

- Monthly donations aren't available. Many people think they cannot set up recurring donations. The form clearly allows for commitments to monthly giving, making it easier for donors.

- You cannot dedicate your donation. Some may think dedicating a donation is not an option. The form provides a section specifically to dedicate gifts in honor of someone or in memory.

- Payment options are limited to checks and credit cards. While checks and major credit cards are accepted, many are unaware that you can also make secure online donations through the specified website.

Key takeaways

Here’s a helpful guide to filling out and making the most of the Donation form. Understanding the process can make your contribution more impactful.

- Choose Your Donation Type: Start by selecting an amount that feels right for you. Options range from $30 to an amount of your choice, empowering HR professionals and supporting inclusive organizations.

- Recognition Credits: If you want your donation to benefit your SHRM Chapter and State Council, be sure to provide the relevant details. This allows your contribution to support local initiatives.

- Consider Monthly Donations: Opting for a monthly donation is a way to make a consistent impact. You can also join the Leadership Circle by committing to significant donations over three years.

- Dedication Options: Are you looking to honor or memorialize someone? Use the form to dedicate your donation in their name. This adds a personal touch to your contribution.

- Provide Accurate Contact Information: Include your complete donor information, such as your name, organization, and contact details. This ensures you can receive confirmation and updates.

- Secure Payment Information: Clearly fill out your payment method. Whether you choose a check or credit card, providing accurate details ensures your donation goes through smoothly.

- Understand Tax Deductibility: Your donation is tax-deductible, which means you can feel good about your gift while also benefiting during tax season.

- Check Submission Guidelines: If mailing your form, send it to the appropriate address at the SHRM Foundation. This ensures it gets processed without delays.

- Consider Online Donations: For convenience, you can also make a secure donation online at the SHRM Foundation’s website. This can be quicker and easier than mailing a form.

- Keep a Copy: It’s wise to keep a copy of your completed donation form for your records. This can be handy for tracking your contributions.

Remember, every contribution makes a difference. By filling out the Donation form thoughtfully, you’re playing a vital role in supporting HR initiatives and promoting inclusivity in organizations.

Browse Other Templates

Tobacco Use Declaration,Smoke-Free Commitment Form,Tobacco Status Verification,Nicotine Usage Affidavit,Cessation Participation Agreement,Tobacco-Free Compliance Form,Health Commitment Statement,Tobacco Usage Disclosure,Smoke-Free Affidavit,Nicotine- - Ensures transparency in claims of being tobacco-free.

Ba 208 - This application serves as a formal request to enhance the visibility of emergency responders.

Llc Charter Number - It is essential to provide accurate entity details to prevent processing delays.