Fill Out Your Dps Surcharge Indigent Form

The DPS Surcharge Indigent form is a vital resource for individuals seeking financial relief from surcharges imposed under the Texas Driver Responsibility Program. This application plays a crucial role in assessing eligibility for Indigency and Incentive Programs, each crafted to assist drivers who are struggling financially. Participants can apply for either waiver of surcharges or a substantial reduction, depending on their financial circumstances. The form requires applicants to provide complete and accurate information about their living situation, income, and dependents, ensuring that the Department of Public Safety can fairly evaluate the application. Supporting documentation, such as proof of income, bank statements, and details regarding any government assistance received, is mandatory to substantiate claims made in the application. Failure to provide complete information can result in delays or outright rejection of the application. The Indigency Program targets individuals below 125% of the federal poverty level, while the Incentive Program serves those earning between 125% and 300%, offering different levels of financial relief. Understanding the requirements and process associated with the DPS Surcharge Indigent form is essential for eligible applicants aiming to maintain their driving privileges while navigating financial hardship.

Dps Surcharge Indigent Example

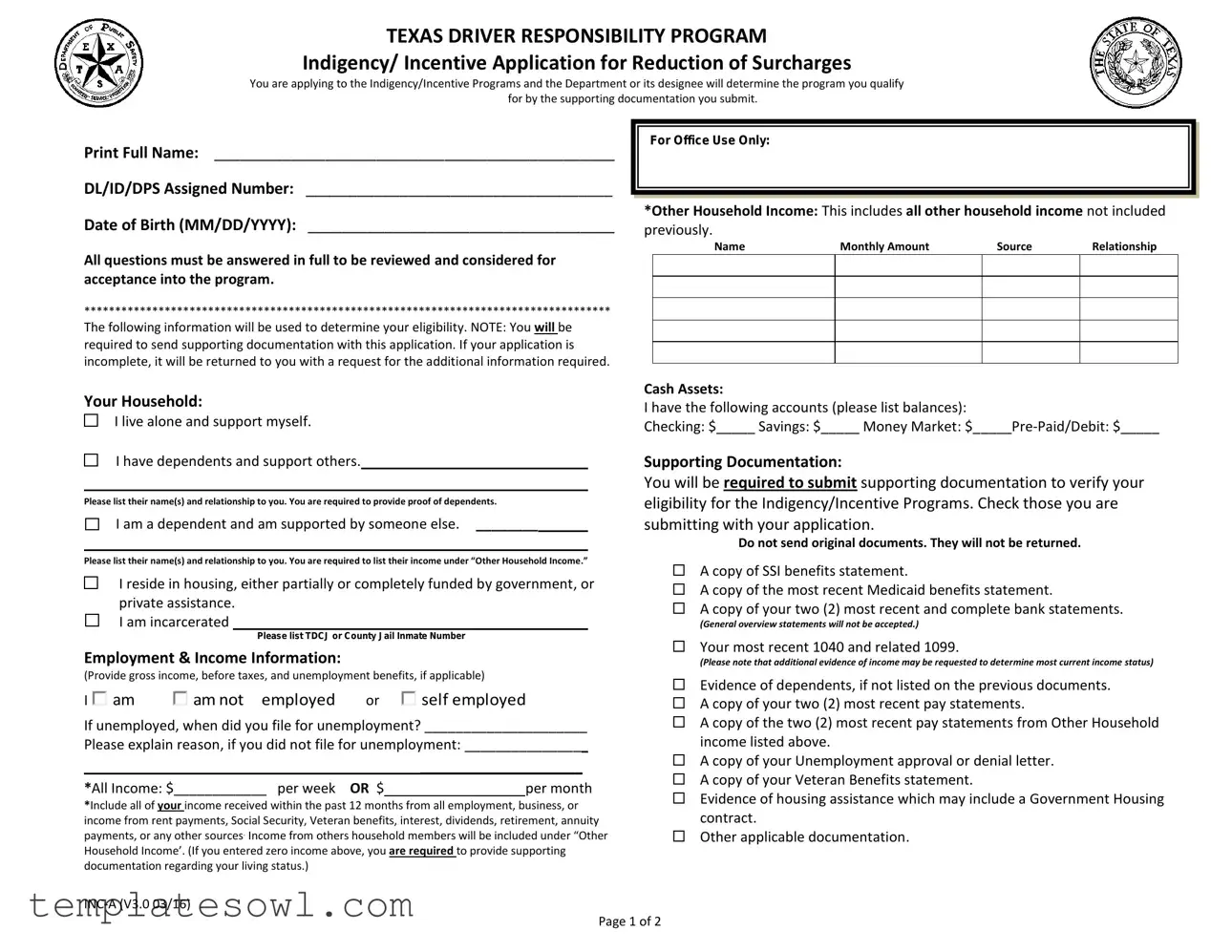

TEXAS DRIVER RESPONSIBILITY PROGRAM

Indigency/ Incentive Application for Reduction of Surcharges

You are applying to the Indigency/Incentive Programs and the Department or its designee will determine the program you qualify for by the supporting documentation you submit.

Print Full Name: _______________________________________________

DL/ID/DPS Assigned Number: ____________________________________

Date of Birth (MM/DD/YYYY): ____________________________________

All questions must be answered in full to be reviewed and considered for acceptance into the program.

*************************************************************************************

The following information will be used to determine your eligibility. NOTE: You will be required to send supporting documentation with this application. If your application is incomplete, it will be returned to you with a request for the additional information required.

Your Household:

I live alone and support myself.

I have dependents and support others.

Please list their name(s) and relationship to you. You are required to provide proof of dependents.

I am a dependent and am supported by someone else. ________

Please list their name(s) and relationship to you. You are required to list their income under “Other Household Income.”

I reside in housing, either partially or completely funded by government, or private assistance.

I am incarcerated

Please list TDCJ or County Jail Inmate Number

Employment & Income Information:

(Provide gross income, before taxes, and unemployment benefits, if applicable)

I  am

am  am not employed or

am not employed or  self employed

self employed

If unemployed, when did you file for unemployment? _____________________

Please explain reason, if you did not file for unemployment: _______________

|

_____________________ |

|

|

*All Income: $____________ per week OR $ |

|

per month |

|

*Include all of your income received within the past 12 months from all employment, business, or income from rent payments, Social Security, Veteran benefits, interest, dividends, retirement, annuity payments, or any other sources. Income from others household members will be included under “Other Household Income’. (If you entered zero income above, you are required to provide supporting documentation regarding your living status.)

For Office Use Only:

*Other Household Income: This includes all other household income not included previously.

Name |

Monthly Amount |

Source |

Relationship |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Assets:

I have the following accounts (please list balances):

Checking: $_____ Savings: $_____ Money Market:

Supporting Documentation:

You will be required to submit supporting documentation to verify your eligibility for the Indigency/Incentive Programs. Check those you are submitting with your application.

Do not send original documents. They will not be returned.

A copy of SSI benefits statement.

A copy of the most recent Medicaid benefits statement.

A copy of your two (2) most recent and complete bank statements.

(General overview statements will not be accepted.)

Your most recent 1040 and related 1099.

(Please note that additional evidence of income may be requested to determine most current income status)

Evidence of dependents, if not listed on the previous documents.

A copy of your two (2) most recent pay statements.

A copy of the two (2) most recent pay statements from Other Household income listed above.

A copy of your Unemployment approval or denial letter.

A copy of your Veteran Benefits statement.

Evidence of housing assistance which may include a Government Housing contract.

Other applicable documentation.

Page 1 of 2

TEXAS DRIVER RESPONSIBILITY PROGRAM

Indigency/ Incentive Application for Reduction of Surcharges

You are applying to the Indigency/Incentive programs and the department will determine which program you qualify for by the supporting documentation you submit.

NOTICE: Additional documentation may be requested. You will be notified in writing of the specific documentation required. Requested documentation must be received within 30 days of the date on the initial notice, to be considered as part of this application. If you are unable to respond within 30 days, you will be required to fill out and submit a new application with new supporting documentation.

ENTER ADDITIONAL INFORMATION IN THIS SPACE

____________________________________________________

____________________________________________________

Signature of Applicant

Date

____________________________________________________

____________________________________________________

____________________________________________________

____________________________________________________

___________________________________________________

____________________________________________________

____________________________________________________

____________________________________________________

Mail the completed form to:

INDIGENCY/INCENTIVE APPLICATION PROCESSING

PO BOX 16733 – AUSTIN, TX

TOLL FREE (800)

Mon – Thur 8AM– 9PM, Fri 8AM – 6PM

Saturday 8AM – 12PM

Page 2 of 2

TEXAS DRIVER RESPONSIBILITY PROGRAM

Indigency/ Incentive Application for Reduction of Surcharges

You are applying to the Indigency/Incentive programs and the department will determine which program you qualify for by the supporting documentation you submit.

Indigency/Incentive Programs

These programs provide drivers the ability to comply with surcharges owed under the Driver Responsibility Program and maintain driving privileges. Under the Indigency Program, the surcharges are waived. However, under the Incentive Program, the surcharges are not waived but are reduced. The objective is to ensure drivers can become licensed, obtain financial liability insurance, and continue to keep our roads safe. Any surcharge assessed on or after September 1, 2003 are eligible for the Indigency/Incentive Programs.

The Indigency Program applies to individuals who are living at or below 125% of the federal poverty level, defined annually by the United States Department of Health and Human Services. For approved applicants, surcharges will be waived with accounts totaling a zero balance.

The Incentive Program applies to individuals who are living above 125% but are below 300% federal poverty level, defined annually by the United States Department of Health and Human Services. For approved applicants, the surcharge fees will be reduced by 50% of the total amount assessed (service fees apply).

Once approved for a reduction under the Incentive program, the individual must pay the the reduced balance in full within six (6) months. All surcharge suspensions will be lifted during this period. If the individual does not pay the balance in full by the due date, their driving privileges will be suspended until the reduced balance is paid in full.

These programs will not remove other suspensions on the driving record. To check the status of your driving record, please visit www.texas.gov/driver, then select Driver License and Reinstatement Status.

To Apply – Complete the application in black or blue ink only. The application must be completed in full prior to submission. Use notes section on page 2 for additional information.

You may also apply online at www.txsurchargeonline.com.

PLEASE NOTE: Until your application review is

completed, you must continue to remit the minimum monthly payment by the due date to avoid suspension of your driving privileges.

Supporting Documents - Applicants must include supporting documentation based on answers provided on the application. If submitting an online application, you may upload all documents, including your application. All documents must be complete and accurate. Your application and any supporting documents you provide may be forwarded to the Texas Department of Public Safety for additional review. If your application is found to be fraudulent, it can result in criminal penalties.

Approved - A written notice will be sent to the applicant and will provide the due date and the reduced balance owed.

Denied - A written notice will be sent to the applicant with the reason for the denial.

Status - If you applied online, you can check the status of your application online. Online notices will be available 10

New Surcharges- If additional surcharges are assessed within 90 calendar days of reduction approval, those surcharges will be automatically reduced and a letter sent with the new balance due. The original due date remains the same. If new surcharges are assessed 91 days or more after the reduction approval, a new application will be required.

All notices will be sent to the address associated with the surcharge account(s).

Page 2 of 2

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Form | This form is used to apply for financial assistance in paying surcharges under the Texas Driver Responsibility Program. |

| Eligibility Criteria | Applicants may qualify for either the Indigency Program, which waives surcharges, or the Incentive Program, which reduces them. Income levels determined by the federal poverty guidelines govern eligibility. |

| Supporting Documentation | Applicants must provide various documents to verify their income, living situation, and dependents. Incomplete applications will be returned. |

| Application Guidelines | The application must be filled out completely and sent in using black or blue ink. It can also be submitted online. |

| Processing Time | Written notifications regarding the application's status will be sent out typically within 10-14 business days for online applications and up to 60 days for mailed submissions. |

| Payment Requirements | Approved applicants must remit payments for reduced surcharges by the due date to avoid suspension of their driving privileges. |

| State Law Reference | This process is governed by the Texas Transportation Code, specifically under provisions addressing the Texas Driver Responsibility Program. |

| Contact Information | For assistance, applicants may call the designated toll-free number, 1-800-688-6882, or visit the official website for more details. |

Guidelines on Utilizing Dps Surcharge Indigent

After obtaining the Dps Surcharge Indigent form, you will need to fill it out accurately to ensure that your application is reviewed effectively. The information provided in this form will help determine your eligibility for the Indigency or Incentive Programs. Be sure to have all necessary documentation ready for submission.

- Print your full name in the designated space.

- Provide your DL/ID/DPS assigned number.

- Enter your date of birth in the MM/DD/YYYY format.

- Indicate whether you live alone or support dependents. If supporting others, list their names and relationship to you.

- If you are a dependent, list the names and relationships of those who support you.

- State whether you are residing in government or privately funded housing, or if you are incarcerated by providing your TDCJ or County Jail Inmate Number.

- Provide your employment and income information. Specify if you are employed, self-employed, or unemployed. If unemployed, indicate when you filed for unemployment and the reason if you did not.

- List all income received over the past 12 months in the designated section.

- Record any other household income, including names, monthly amounts, sources, and relationships.

- Provide balances for any cash assets in your accounts, like checking and savings.

- Check off the boxes for any supporting documentation you are submitting.

- Use the additional information section for any extra details needed.

- Sign and date the application.

Once you have completed the form, gather all supporting documents and send everything to the provided address. Be sure to keep a copy for your records. After submission, you will receive notifications regarding your application status.

What You Should Know About This Form

What is the purpose of the DPS Surcharge Indigent form?

The DPS Surcharge Indigent form is used to apply for the Indigency/Incentive Programs under the Texas Driver Responsibility Program. These programs assist drivers in managing surcharges owed and aim to help maintain driving privileges. Depending on eligibility, the surcharges may be waived or reduced.

Who is eligible to apply for these programs?

Eligibility for the Indigency Program is available to individuals living at or below 125% of the federal poverty level, while the Incentive Program applies to those living between 125% and 300% of the poverty level. This determination is based on the documentation submitted with your application.

What supporting documentation is needed when submitting the form?

Applicants must provide various documents to verify their financial status. Required documentation may include pay statements, bank statements, benefit statements, or proof of dependents. A complete list of necessary documents is provided with the form. Be sure to submit copies, as original documents will not be returned.

What happens if my application is incomplete?

If your application is incomplete, it will be returned to you. You will receive a request for the additional information required. To proceed, you must complete the application and resubmit it with all necessary documents.

How will I be notified of the application status?

Notification of the application status takes different timelines based on the submission method. For online applicants, status updates are available within 10-14 business days. For mailed applications, written notices can take up to 60 days. You'll receive either an approval notice, detailing the reduced payment and due date, or a denial notice, providing the reasons for denial.

What if my application is denied?

If your application is denied, you will receive a written notice explaining the reason for the denial. If you believe your situation qualifies, you can address the denial issues and consider reapplying.

What payment methods are accepted for the reduced surcharges?

You can pay the reduced surcharge amount using various methods including ACE Cash Express, MoneyGram, Western Union, checks, money orders, or credit/debit cards. Ensure your payment reaches the designated department by the due date to avoid suspension of your driving privileges.

Common mistakes

Filling out the DPS Surcharge Indigent form can be challenging. Many people make mistakes that can delay their application or even lead to denial. Here are seven common errors to avoid.

First, leaving sections of the form blank is a frequent oversight. Each question must be answered fully for your application to be considered. If any part of the information is missing, your application might be returned. Make sure to double-check that all fields are completed before submission.

Second, some applicants forget to provide necessary supporting documentation. The instructions are clear: you must submit proof that aligns with the information you provide. This includes documents like bank statements or evidence of income. Not including these documents is a common reason applications are rejected.

Another common mistake involves misreporting income. When asked for your total household income, ensure you include all sources—like social security or unemployment benefits. Omitting any source, even accidentally, can misrepresent your financial situation and negatively impact your eligibility.

Fourth, applicants sometimes fail to clarify their dependent situation. If you have dependents, specified their names and your relationship to them. Ensure to provide proof of their status. This helps the department assess your household accurately and can make all the difference.

Additionally, many people submit original documents instead of copies. The instructions explicitly state not to send originals, as they will not be returned. This simple mistake can result in having to redo the application process if valuable documents are lost.

Another common pitfall pertains to the signature line. Make sure the applicant’s name matches the name provided in the application. Not providing a signature, or signing differently, can cause delays or deny your application outright.

Lastly, missing the 30-day deadline for submitting any additional requested documentation is crucial. If more information is needed, your response must arrive within the timeline specified. Failure to meet this timeline means you’ll need to start again with a new application.

Being meticulous and thorough when filling out this form vastly improves your chances of a smooth processing experience. Avoid these common mistakes and stay on track towards obtaining the assistance you need.

Documents used along the form

When applying for the DPS Surcharge Indigent form, several other documents can enhance your application. Each one provides essential information and supports your eligibility for the program. Here are some common forms that applicants may need to submit along with the Indigency/Incentive Application.

- SSI Benefits Statement: This document shows your eligibility for Supplemental Security Income, which may support your claim of financial need.

- Medicaid Benefits Statement: A recent Medicaid statement can verify that you receive healthcare assistance, further demonstrating low income.

- Bank Statements: Submitting two recent and complete bank statements will help confirm your financial situation. Avoid general overview statements.

- Tax Returns: Your most recent 1040 and related 1099 forms provide a comprehensive view of your income sources and financial status.

- Evidence of Dependents: Documentation proving you have dependents will strengthen your application. This may include birth certificates or court orders.

- Pay Statements: Submitting two recent pay statements from your employer allows the department to verify your income.

- Unemployment Letter: Include your unemployment approval or denial letter to demonstrate your employment status.

- Veteran Benefits Statement: If you receive veteran benefits, this statement will help illustrate your financial context and support your application.

Providing accurate and complete documentation will assist in a smoother review process for your application. Make sure to keep copies of everything you submit and follow up on your application to ensure it is being processed on time.

Similar forms

Financial Aid Application: Similar to the DPS Surcharge Indigent form, this document requires individuals to submit detailed information about their income, living situation, and dependents to determine eligibility for financial assistance programs.

Medicaid Application: This form collects information on applicants' household income and expenses to assess eligibility for Medicaid benefits, much like the assessment done in the DPS form.

Food Stamp Application: Like the DPS form, this application requests detailed income verification and information about household members to evaluate nutrition assistance eligibility.

Housing Assistance Application: This document requires proof of income and living arrangements, paralleling the requirements seen in the DPS Surcharge Indigent form.

Unemployment Benefits Application: Similar in nature, this application collects information on an individual’s employment history and income to determine eligibility for unemployment benefits.

Low-Income Home Energy Assistance Program (LIHEAP) Application: This form asks for household income and expenses, aligning it closely with the DPS Surcharge Indigent form’s focus on financial situations.

Veterans Benefits Application: This document requires proof of income and disability status, similar to the supporting documentation needed in the DPS form.

Child Care Assistance Application: Much like the DPS Surcharge Indigent form, this application requires information about income and household to determine eligibility for child care support.

Supplemental Security Income (SSI) Application: Applicants must provide information about income and living arrangements. This approach mirrors the detailed requirements outlined in the DPS Surcharge Indigent form.

Tax Credit Application: Similarities lie in the need to document income and household structure to qualify for tax credits, following a parallel process as seen in the DPS form.

Dos and Don'ts

- Do fill out all sections of the form completely. Incomplete applications may be returned for additional information.

- Do provide supporting documentation as specified. This can significantly affect your eligibility.

- Do ensure you write in blue or black ink for clarity.

- Do keep copies of everything you send in. This will help if any issues arise during processing.

- Do respond quickly to any additional documentation requests. You have 30 days to provide the necessary information.

- Don't submit original documents. They will not be returned, which could create issues if you need them later.

- Don't overlook including income from all sources. Be thorough to provide an accurate picture of your financial situation.

- Don't ignore the application deadlines. If you miss the due date for additional documentation, you must reapply.

- Don't forget to sign and date your application before submission. An unsigned application will be deemed incomplete.

Misconceptions

When it comes to the DPS Surcharge Indigent form, many individuals carry misconceptions that may hinder their application process. Understanding these myths is crucial for those seeking to benefit from the Indigency/Incentive Programs. Below are some common misconceptions:

- Misconception 1: The form is only for people who are completely unemployed.

- Misconception 2: Supporting documentation is optional.

- Misconception 3: Income from any source disqualifies applicants.

- Misconception 4: Only current drivers can apply.

- Misconception 5: The application process takes a long time.

- Misconception 6: Once accepted, all surcharges disappear.

Many believe that only individuals without any employment can apply. In reality, the form is designed for anyone whose financial situation might qualify them for assistance, even if they have a job.

Some applicants think they can submit the form without accompanying documents. However, proper supporting documentation is required to verify eligibility, and incomplete applications will be returned.

Individuals often assume that any income automatically disqualifies them from the program. The programs allow for certain income thresholds, and providing accurate numbers from various sources can still lead to potential acceptance.

Many think that only those actively holding a driver’s license are eligible. In fact, even individuals whose driving privileges have been suspended due to surcharges can apply for the programs.

Some individuals worry that submitting their application will lead to an indefinite wait. In truth, there are timelines for approvals and denials. Typically, if applied online, you might receive a response in as little as 10-14 business days.

There’s a belief that acceptance into the program completely erases surcharges. While the Indigency Program waives fees for qualifying individuals, the Incentive Program only reduces them. It's essential to understand the specifics of each program.

Clarifying these misconceptions can empower applicants. With the right knowledge and preparation, individuals can navigate the application process with confidence.

Key takeaways

Filling out the DPS Surcharge Indigent form is a significant step for many individuals seeking assistance with their driving privileges. Understanding the nuances of this process can make it more manageable. Here are some key takeaways:

- Eligibility Criteria: Your application will be evaluated based on supporting documentation, which substantiates your financial situation.

- Complete Every Section: It is crucial to answer all questions fully. Incomplete applications will be returned, prolonging the process.

- Household Information: Clearly indicate your living situation and include details about any dependents you support.

- Income Verification: You must report all sources of income, including social security, unemployment, and any support from household members.

- Supporting Documentation: Providing accurate documents, such as bank statements and benefit letters, is essential for verifying your claims.

- Application Submission: Send your completed form and supporting documents without original forms, as they will not be returned.

- Communication and Timeliness: After application, respond to any requests for additional documentation within 30 days to avoid resubmission.

- Approval Notification: If accepted, you will receive written confirmation detailing the reduced balance and payment due dates.

- Payment Responsibilities: Until your application is processed, continue making minimum monthly payments to maintain your driving privileges.

In navigating the complexities of the DPS Surcharge Indigent form, being proactive and attentive to detail can greatly enhance your chances of approval and ultimately aid in retaining your driving privileges.

Browse Other Templates

How to Change Informed Delivery Address - Different types of residency documents may overlap with primary requirements.

Esther Beth Moore - The Book of Esther uniquely does not mention God directly.