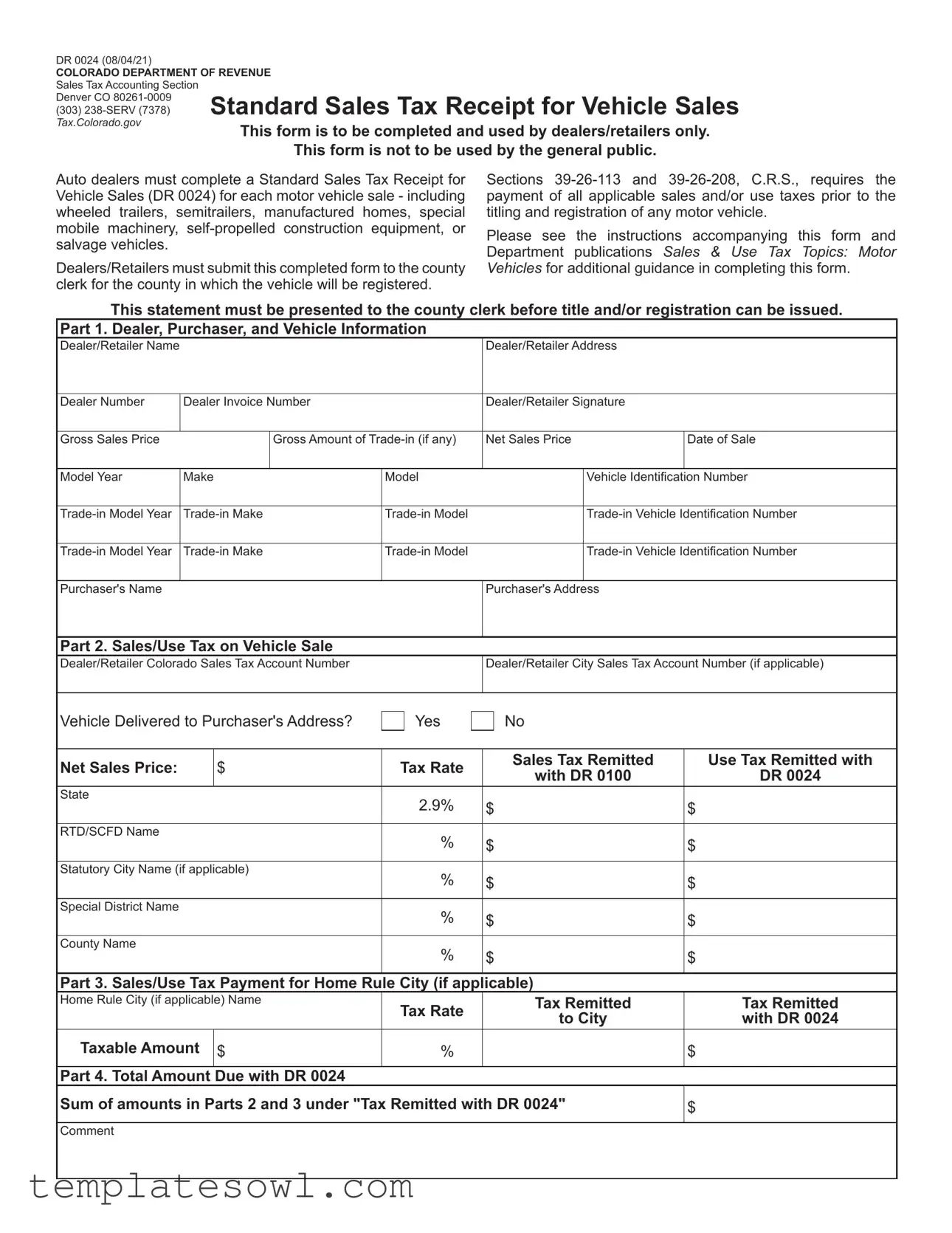

Fill Out Your Dr 0024 Form

The DR 0024 form, officially known as the Standard Sales Tax Receipt for Vehicle Sales, plays a critical role in the vehicle sales process within Colorado. Specifically designed for dealers and retailers, this form is essential for documenting the sale of various motor vehicles, which includes not just automobiles but also wheeled trailers, semitrailers, manufactured homes, and specific types of equipment. Each time a dealer completes a motor vehicle sale, the form must be filled out accurately, detailing essential information such as the dealer and purchaser's names, vehicle make and model, and the applicable sales and use tax. This documentation is a requirement before the vehicle can be titled and registered; per Colorado statutes, all relevant taxes must be settled prior to registration. Upon completion, the DR 0024 must be submitted to the county clerk in the jurisdiction where the vehicle's registration will occur. It includes vital sections that address the sales price, trade-in values, and tax remittance, ensuring compliance with local tax regulations. For detailed guidance on the form's completion, dealers can refer to accompanying instructions and the Colorado Department of Revenue's publications related to motor vehicle sales and use tax topics.

Dr 0024 Example

DR 0024 (08/04/21)

COLORADO DEPARTMENT OF REVENUE

Sales Tax Accounting Section |

Standard Sales Tax Receipt for Vehicle Sales |

(303) |

|

Denver CO |

|

Tax.Colorado.gov |

This form is to be completed and used by dealers/retailers only. |

|

|

|

This form is not to be used by the general public. |

Auto dealers must complete a Standard Sales Tax Receipt for Vehicle Sales (DR 0024) for each motor vehicle sale - including wheeled trailers, semitrailers, manufactured homes, special mobile machinery,

Dealers/Retailers must submit this completed form to the county clerk for the county in which the vehicle will be registered.

Sections

Please see the instructions accompanying this form and Department publications Sales & Use Tax Topics: Motor Vehicles for additional guidance in completing this form.

This statement must be presented to the county clerk before title and/or registration can be issued. Part 1. Dealer, Purchaser, and Vehicle Information

Dealer/Retailer Name |

|

|

|

|

|

|

Dealer/Retailer Address |

|

||

|

|

|

|

|

|

|

|

|

|

|

Dealer Number |

Dealer Invoice Number |

|

|

|

Dealer/Retailer Signature |

|

||||

|

|

|

|

|

|

|

|

|

|

|

Gross Sales Price |

|

|

Gross Amount of |

Net Sales Price |

Date of Sale |

|||||

|

|

|

|

|

|

|

|

|

|

|

Model Year |

Make |

|

Model |

|

|

Vehicle Identification |

Number |

|||

|

|

|

|

|

|

|

|

|

||

|

|

|||||||||

|

|

|

|

|

|

|

|

|

||

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

Purchaser's Name |

|

|

|

|

|

|

Purchaser's Address |

|

||

|

|

|

|

|

|

|

|

|||

Part 2. Sales/Use Tax on Vehicle Sale |

|

|

|

|

|

|

|

|||

Dealer/Retailer Colorado Sales Tax Account Number |

|

|

|

Dealer/Retailer City Sales Tax Account Number (if applicable) |

||||||

|

|

|

|

|

|

|

|

|||

Vehicle Delivered to Purchaser's Address? |

|

Yes |

|

|

No |

|

||||

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Net Sales Price: |

|

$ |

|

Tax Rate |

|

Sales Tax Remitted |

Use Tax Remitted with |

|||

|

|

|

with DR 0100 |

DR 0024 |

||||||

|

|

|

|

|

|

|

|

|||

State |

|

|

|

2.9% |

|

$ |

|

$ |

||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

RTD/SCFD Name |

|

|

|

% |

|

$ |

|

$ |

||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||

Statutory City Name (if applicable) |

% |

|

$ |

|

$ |

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Special District Name |

|

|

|

% |

|

$ |

|

$ |

||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

County Name |

|

|

|

% |

|

$ |

|

$ |

||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

||||

Part 3. Sales/Use Tax Payment for Home Rule City (if applicable) |

|

|||||||||

Home Rule City (if applicable) Name |

Tax Rate |

|

Tax Remitted |

Tax Remitted |

||||||

|

|

|

|

|

to City |

with DR 0024 |

||||

|

|

|

|

|

|

|

|

|||

Taxable Amount |

$ |

% |

|

|

|

|

$ |

|||

|

|

|

|

|

|

|

|

|

||

Part 4. Total Amount |

Due with DR 0024 |

|

|

|

|

|

|

|

||

Sum of amounts in Parts 2 and 3 under "Tax Remitted with DR 0024" |

$ |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

Comment |

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Title | Standard Sales Tax Receipt for Vehicle Sales |

| Governing Authority | Colorado Department of Revenue |

| Form Code | DR 0024 |

| Usage Requirement | To be completed by dealers/retailers only, not for public use. |

| Submission Requirement | Must be submitted to the county clerk for vehicle registration. |

| Applicable Laws | Sections 39-26-113 and 39-26-208, C.R.S. |

| Sales Tax Payment | Required before titling and registering any motor vehicle. |

| Form Updates | Last updated on August 4, 2021. |

| Contact Information | Phone: (303) 238-SERV (7378) |

| Additional Guidance | See Department publications for guidance on tax topics related to motor vehicles. |

Guidelines on Utilizing Dr 0024

When it comes to selling a vehicle in Colorado, completing the DR 0024 form is a necessary step for dealers. Once you have filled it out accurately, you’ll be ready to submit it to the county clerk, which is essential for the title and registration process. Below are the steps to help you navigate this form smoothly.

- Begin with Part 1 by entering the dealer/retailer name and address.

- Fill in the dealer number and dealer invoice number.

- Make sure to sign the form where indicated to authenticate it.

- Next, provide the gross sales price, any potential gross amount of trade-in, and calculate the net sales price.

- Record the date of sale along with the vehicle details, such as model year, make, model, and vehicle identification number.

- If there’s a trade-in, repeat vehicle details for all trade-ins, including their model years, makes, models, and identification numbers.

- Proceed to fill out the purchaser's details, including the purchaser's name and address.

- In Part 2, provide the dealer/retailer Colorado Sales Tax Account Number and City Sales Tax Account Number if applicable.

- Indicate if the vehicle was delivered to the purchaser's address with a simple yes or no.

- List the net sales price again and apply the relevant tax rate.

- Detail the sales tax remitted for state, RTD/SCFD, statutory city (if applicable), special district, and county.

- If applicable, complete Part 3 for the home rule city by stating its name, tax rate, and amounts.

- Finally, in Part 4, sum all amounts listed under "Tax Remitted with DR 0024" for a total amount due.

With all the sections filled out accurately, you'll be well-prepared to hand over the completed form to the county clerk for processing. This step is crucial to ensure the timely registration and titling of the vehicle.

What You Should Know About This Form

What is the DR 0024 form used for?

The DR 0024 form is a Standard Sales Tax Receipt for Vehicle Sales, used specifically by auto dealers and retailers in Colorado. It serves as documentation that facilitates the payment of applicable sales and use taxes for motor vehicle transactions. This includes various types of vehicles such as wheeled trailers, semitrailers, manufactured homes, and more.

Who is required to complete the DR 0024 form?

The responsibility to complete the DR 0024 form lies solely with licensed dealers and retailers. Individuals in the general public do not utilize this form. It is crucial for dealers to accurately fill out this form for each motor vehicle sale to ensure compliance with tax regulations.

Where do I submit the completed DR 0024 form?

After filling out the DR 0024 form, dealers must submit it to the county clerk of the county where the vehicle will be registered. This step is essential as the form verifies that all applicable sales and use taxes have been paid before any vehicle can be titled and registered.

What information is required on the DR 0024 form?

This form requires comprehensive information, including details about the dealer or retailer, the purchaser, and the specific vehicle being sold. Key fields include the dealer's name and address, sales price, tax rates, and vehicle identification numbers. Accurate information is critical to prevent any delays in the registration process.

What happens if the DR 0024 form is not submitted?

If the DR 0024 form is not submitted to the county clerk, the title and registration of the vehicle cannot occur. Consequently, this could leave the purchaser unable to legally operate the vehicle on public roads until the proper documentation is provided and processed.

How do tax rates get determined on the DR 0024 form?

Tax rates on the DR 0024 form are determined based on several factors, including state, county, and city tax regulations applicable to the location of the sale. The dealer must ensure they are applying the correct rates, as any mistake could lead to insufficient tax collection and potential legal consequences.

Is there any guidance available for completing the DR 0024 form?

Yes, the Colorado Department of Revenue provides accompanying instructions with the DR 0024 form. Additionally, the department publishes various resources, including Sales & Use Tax Topics specific to motor vehicles, which can further assist dealers in properly completing this documentation.

Can the DR 0024 be used for all types of vehicle sales?

The DR 0024 form is specifically designed for sales conducted by dealers and retailers. It applies to a range of vehicle types, including cars, trailers, and specialized machinery. However, it should not be used by individuals selling personal vehicles, as this form is intended solely for licensed dealers.

What are the penalties for incorrect information on the DR 0024 form?

Providing incorrect information on the DR 0024 form can lead to significant penalties, including fines and delayed processing of vehicle registration. More critically, an incomplete or inaccurate form might result in the improper collection of taxes, which could attract scrutiny from tax authorities.

Common mistakes

Completing the DR 0024 form accurately is essential for vehicle dealers and retailers who wish to comply with Colorado's sales tax regulations. However, several common mistakes can hinder the process. Awareness of these errors can streamline submissions and avoid unnecessary delays.

One frequent error involves omitting essential dealer information. Failure to include the Dealer/Retailer Name, Dealer Number, or the Dealer Invoice Number can lead to complications. Each section requires attention to detail to ensure smooth processing.

Incorrect vehicle information is another significant oversight. Dealers should double-check the Vehicle Identification Number (VIN), Model Year, and Make of the vehicle. Errors in these fields can result in increased scrutiny from the authorities, which may cause delays in registration.

Providing an inaccurate sales price or misunderstanding the Net Sales Price can be problematic. It is crucial for dealers to calculate the correct amount after considering trade-ins. Inaccuracies in this area can affect the tax calculation and lead to compliance issues.

Moreover, miscalculating tax amounts is a common mistake. Ensure that each tax rate is applied correctly based on the vehicle's location and that the total tax remitted aligns with state regulations. Mistakes here can disrupt the financial aspect of the transaction.

Incomplete information regarding trade-ins can also cause issues. When documenting trade-ins, all relevant details must be filled out accurately. Missing the Trade-in Vehicle Identification Number or other specifications can lead to complications during the registration process.

Another area of concern is the lack of clarity in the Purchaser's Information section. Dealers must provide complete and accurate purchaser details. This includes the Purchaser's Name and Purchaser's Address. Without these details, the sale may not be valid.

Failing to check the Vehicle Delivered to Purchaser's Address box accurately can lead to additional tax assessments. Always ensure this section correctly reflects where the vehicle will be registered.

Lastly, neglecting to review the accompanying instructions and guidelines can lead to mistakes. The instructions contain essential information regarding sales tax topics specific to motor vehicles. Taking the time to read these can facilitate the correct completion of the form.

In summary, being mindful of these potential mistakes is vital for dealers completing the DR 0024 form. Thorough checks and attention to detail can help avoid complications and ensure compliance with Colorado sales tax requirements.

Documents used along the form

The DR 0024 form plays a crucial role in the vehicle sales process in Colorado, particularly for auto dealers. Along with this form, there are several other documents that dealers and retailers typically need. Below is a list of common forms and their brief descriptions.

- DR 0100 - This form is used for the sales and use tax return in Colorado. When applicable, it should accompany the DR 0024 form to report the sales tax that has been collected from the purchaser.

- DR 2404 - This document serves as a title application for new motor vehicles. It provides proof of ownership and is necessary for registering a newly acquired vehicle.

- DR 2444 - This form is designed to assist dealers in applying for a certificate of title for used motor vehicles, ensuring that the title transfer process complies with state regulations.

- DR 2001 - This application is for a specialist dealer’s license. It is a prerequisite for those wanting to operate as a licensed motor vehicle dealer in the state.

- DR 2802 - Required for exempt vehicle transactions, this form outlines the exemption from sales tax under specific circumstances, such as certain governmental or nonprofit purchases.

- DR 2283 - This is the form utilized by buyers to apply for special plates, which may be necessary for certain vehicle types, providing them with unique identification.

- DR 2416 - This document is used for reporting title brand information, such as salvage or rebuilt titles, which affects how the vehicle can be sold and registered.

- DR 2271 - This form allows an individual to cancel a title application, facilitating the correction of any errors made in the title submission process.

- DR 2514 - This document functions as an affidavit for the sale of vehicles without a title, affirming the seller's declaration regarding ownership and intent to transfer.

Each of these forms contributes to ensuring compliance with state regulations and facilitates smooth transactions in vehicle sales. Understanding their requirements can prevent delays and complications during vehicle registration and titling processes.

Similar forms

The DR 0024 form is a specific document used in Colorado for vehicle sales tax transactions. It is particularly relevant for auto dealers and retailers. Here are six documents that are similar to the DR 0024 form, each serving a related purpose in the realm of sales tax and vehicle registration:

- DR 0100: This form is a Colorado Sales Tax Return. It consolidates sales tax information for various transactions, including vehicle sales, and allows businesses to report their sales tax collected during a specified period.

- DR 2489: This form is the Colorado Exempt Sale Certificate. It is utilized by buyers who qualify for sales tax exemptions, and it helps the seller verify the exemption at the time of the sale.

- DR 2471: This document is known as the Colorado Refund Application for Sales Tax. It allows businesses to request a refund of sales tax previously paid, which can be particularly useful if an error was made in the original transaction.

- TR-130: The Vehicle Registration Application, also a critical document, is submitted when registering a vehicle. It includes details about the vehicle and the owner and may work in conjunction with forms like the DR 0024 when registering a new vehicle sale.

- DR 0051: This form, the Colorado Sales and Use Tax Rate Schedule, provides all current tax rates applicable to various sales, including those for vehicles, helping dealers determine the right amount to collect based on local rates.

- DR 0595: This is the Colorado Affidavit of Vehicle Odometer Reading form. While it serves a different primary function, it’s often submitted alongside vehicle sales documentation to verify the odometer reading at the time of sale, thus influencing tax calculations and registration process.

Dos and Don'ts

When filling out the DR 0024 form, consider the following guidelines to ensure proper completion:

- Provide accurate dealer and purchaser information. Make sure to enter the correct details for both parties, as inaccuracies can lead to processing delays.

- Double-check the vehicle information. Verify the Vehicle Identification Number and model details to match the actual vehicle being sold.

- Calculate the sales tax correctly. Ensure that the tax amounts align with the applicable rates for the vehicle sale.

- Sign the form. The dealer/retailer must provide a signature to validate the completion of the form.

- Submit the form on time. Ensure that this form is provided to the county clerk before registering the vehicle.

Additionally, avoid the following common mistakes:

- Do not use this form if you are not a dealer or retailer. This form is specifically for authorized auto dealers.

- Avoid leaving any sections incomplete. All parts of the form must be filled to facilitate a smooth process.

- Do not neglect to pay applicable sales and/or use taxes before titling and registration.

- Refrain from altering any pre-printed information on the form. Changes can result in confusion during processing.

- Do not forget to attach any required documentation that may be necessary for the transaction.

Misconceptions

When it comes to the DR 0024 form, misunderstandings are common. Here are some prevalent misconceptions clarified:

- Only the General Public Can Use the DR 0024 Form. This form is specifically for dealers and retailers. The general public is not permitted to use it for vehicle sales.

- The DR 0024 Form is Optional for Vehicle Sales. On the contrary, this form is mandatory for auto dealers in Colorado to document each sale of motor vehicles, including trailers and salvage vehicles.

- Sales Tax Can Be Paid After Registration. The law requires that sales and/or use taxes must be paid before any vehicle can be titled and registered. This must be done upfront with the form.

- The DR 0024 Form is Only for New Vehicle Sales. The form applies to all types of vehicle sales, including used vehicles and trade-ins, ensuring clarity in the transaction.

- Dealers Can Submit the Form Anywhere. Dealers must submit the completed DR 0024 form to the county clerk in the county where the vehicle will be registered. Specificity matters in this process.

- Once Submitted, the DR 0024 Form is Irrelevant. The completed form serves as crucial documentation required when presenting for title and registration. Keeping a copy is essential for your records.

- Tax Rates are Standard Across All Transactions. In reality, the tax rates can vary depending on the jurisdiction. It’s vital to confirm the rates applicable to the specific city or county.

- The Form Doesn’t Require Dealer Signatures. A dealer's signature is necessary to validate the form. This ensures authenticity and proper accountability in the sales process.

Understanding these key points can help ensure compliance and avoid potential hassles during vehicle sales in Colorado.

Key takeaways

When working with the DR 0024 form, here are some key points to keep in mind:

- This form is strictly for dealers and retailers. It's not intended for use by private individuals or the general public.

- Completing a Standard Sales Tax Receipt is essential for all sales of motor vehicles and related items, including trailers and construction equipment.

- Dealers must submit the filled-out form to the county clerk where the vehicle registration takes place, ensuring compliance with Colorado sales tax laws.

- It's important to provide accurate details in each section of the form, including the dealer's information, vehicle specifics, and tax breakdown.

- Failure to present this form can result in delays or complications when seeking vehicle title and registration.

Browse Other Templates

Steer Clear Safe Driver Discount - This form promotes safe driving among young drivers.

Llc Charter Number - Only authorized individuals can submit Form 801 for reinstatement purposes.

Tufts Prior Authorization Form - It is utilized for Medicare Part B and Part D coverage determinations.