Fill Out Your Dr 0100 Form

The Colorado Retail Sales Tax Return, known as the DR 0100 form, serves as a crucial instrument for retailers operating within the state to comply with sales tax regulations. This comprehensive form ensures that all retailers, regardless of whether they made sales during a specific filing period, accurately report their sales tax obligations on a timely basis. Designed to accommodate various business locations, each retailer must submit separate returns for different sites, thereby allowing the Colorado Department of Revenue to track sales tax collections effectively. The form incorporates provisions for electronic filing, giving retailers the option to file their returns online, which streamlines the process and enhances efficiency. With specific sections allocated for reporting state and local sales taxes, including city and county taxes, the DR 0100 emphasizes the importance of recognizing the distinct tax rates that apply to different jurisdictions. Additionally, the form requires retailers to maintain meticulous records for potential audits, highlighting the necessity for proper documentation in determining accurate tax liabilities. Specific deadlines for filing and electronic payment options further reinforce the emphasis on compliance to avoid penalties and interest charges. In an era where digital solutions are becoming increasingly important, the DR 0100 guides retailers in navigating the complex landscape of sales tax reporting while also providing essential resources and support through the Colorado Department of Revenue’s website.

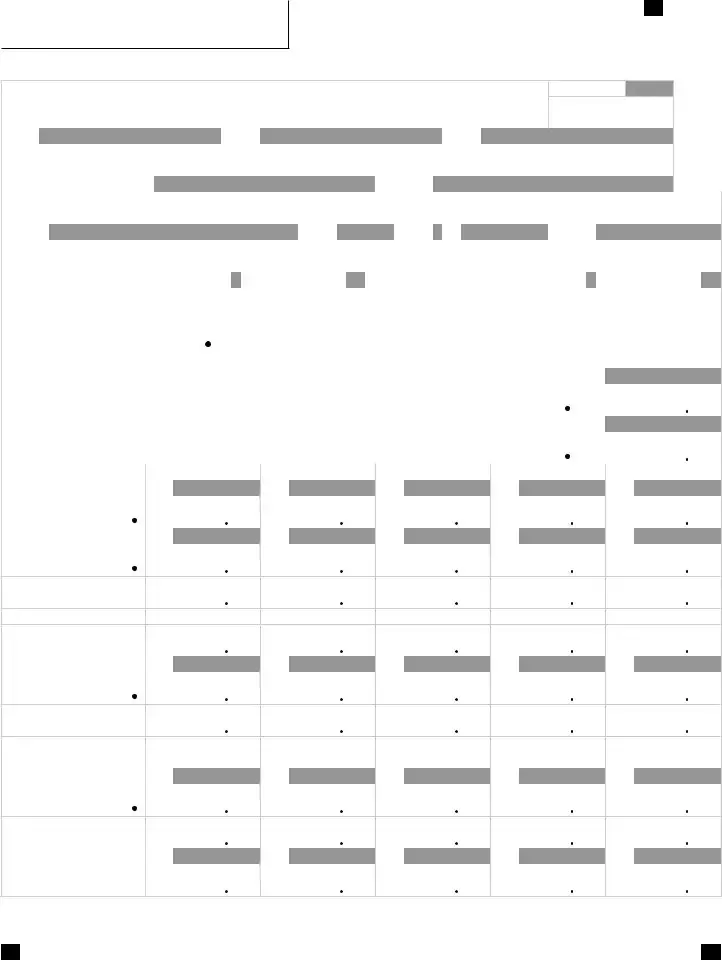

Dr 0100 Example

*DO*NOT*SEND*

DR 0100 (09/27/21)

COLORADO DEPARTMENT OF REVENUE

Denver CO

Tax.Colorado.gov

Colorado Retail Sales Tax Return

General Information

Retailers must file a sales tax return for every filing period, even if the retailer made no sales during the period and no tax is due. Typically, returns must be filed on a monthly basis. See Part 7: Filing and Remittance in the Colorado Sales Tax Guide for additional information regarding filing frequency.

A separate return must be filed for each business site or location at which a retailer makes sales. If a retailer fails to file a return for any filing period, the Department will estimate the tax due and issue to the retailer a written notice of the estimated tax due. The Department may deactivate the sales tax account of a retailer who fails to file returns for successive filing periods.

Electronic Filing Information

The Department offers multiple electronic filing options that retailers may use as an alternative to filing paper returns.

•Revenue Online – Retailers must first create a Revenue Online account to file returns through Revenue Online. Retailers who file returns through Revenue Online must file separate returns for each of the retailer’s business sites or locations. Revenue Online can be accessed at

Colorado.gov/RevenueOnline.

•XML Filing – Retailers may file returns electronically in an XML (Extensible Markup Language) format using any of the approved software options listed online at

Retailers do not need to obtain any special approval from the Department to file using an approved software option.

•Spreadsheet Filing – Retailers may file electronically using an approved Microsoft Excel spreadsheet. Each retailer must obtain approval from the

Department before filing returns with an Excel spreadsheet. Information can be found online at

Payment Information

The Department offers retailers several payment options for remitting sales taxes.

Electronic Payments

Regardless of whether they file electronically or with a paper return, retailers can remit payment electronically using one of two payment methods. Retailers who remit electronic payments should check the appropriate box on line 18 of the return to indicate their electronic payment.

•EFT Payment – Retailers can remit payment by electronic funds transfer (EFT) via either ACH debit or ACH credit. There is no processing fee for EFT payments. Retailers must register prior to making payments via EFT and will not be able to make payments via EFT until

•Credit Card and

Paper Check

Regardless of whether they file electronically or with a paper return, retailers can remit payment with a paper check. Retailers should write “Sales Tax,” the account number, and the filing period on any paper check remitted to pay sales tax

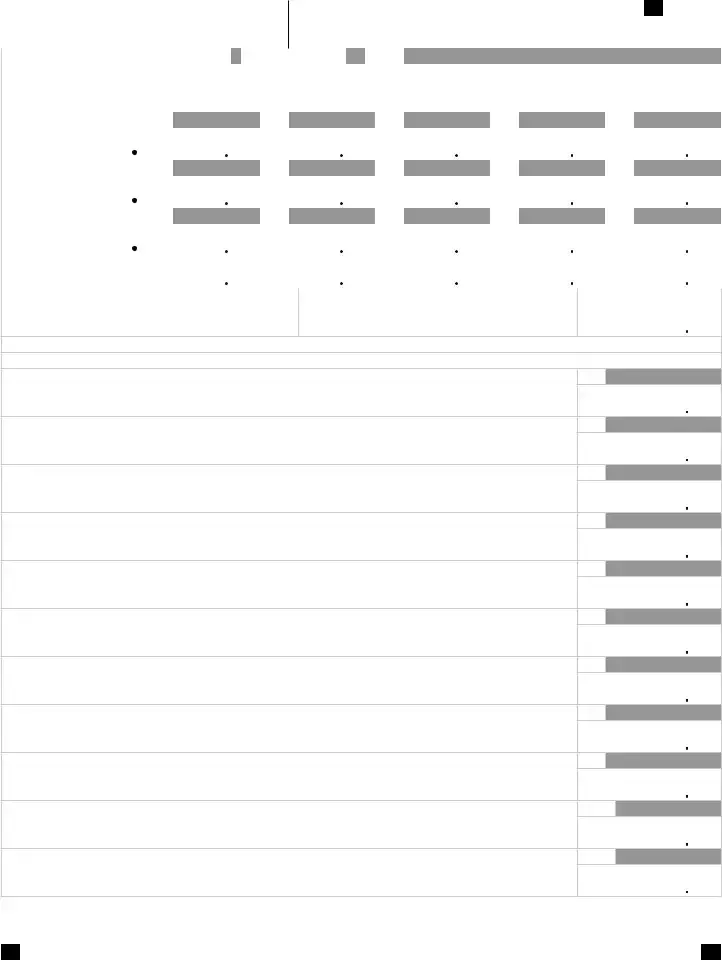

*DO*NOT*SEND*

DR 0100 (09/27/21)

COLORADO DEPARTMENT OF REVENUE

Denver CO

Tax.Colorado.gov

to ensure proper crediting of their account.

•Paper Return – Retailers who file a paper return can mail a paper check with the return to pay the tax reported on the return.

•Electronic Filing Through Revenue Online – A retailer who files electronically through Revenue Online can remit payment by paper check. Once the electronic return has been submitted, the retailer can select “Payment Coupon” for the payment option to print a payment processing document to send along with their paper check.

Physical And

A retailer is required to obtain a sales tax license and file separate sales tax returns for each separate place of business at which the retailer makes sales (a “physical site”). Additionally, if a retailer delivers taxable goods or services to a purchaser at any location other than the retailer’s place of business, the retailer must register with the Department a

Filing A Paper Return

Retailers electing to file a paper return must sign, date, and mail the return, along with their payment, if applicable, to:

Colorado Department of Revenue

Denver CO

Retailers are required to keep and preserve for a period of three years all books, accounts, and records necessary to determine the correct amount of tax.

Items Removed From Inventory

Any tangible personal property a retailer purchased for resale, but subsequently removed from inventory for the retailer’s own use, is subject to consumer use tax. A Consumer Use Tax Return (DR 0252) is required to report and remit any consumer use tax a retailer owes.

Additional Resources

Additional sales tax guidance and filing information can be found online at Tax.Colorado.gov. These resources include:

•Colorado Sales Tax Guide

•Sales tax classes and videos available online at

Tax.Colorado.gov/education.

•The Customer Contact Center, which can be contacted at (303)

Form Instructions

In preparing a sales tax return, a retailer must include its identifying information (such as name and account number), the filing period and due date, and information about sales and exemptions in order to calculate the tax due. Specific instructions for preparing sales tax returns appear below and on the following pages.

SSN and FEIN

Retailers must provide a valid identification number, issued by the federal government, when filing a sales tax return. If the retailer is a corporation, partnership, or other legal entity, this will generally be a Federal Employer Identification Number (FEIN). If the retailer is a sole proprietorship, a Social Security number (SSN) will generally be used instead.

Colorado Account Number

Retailers must enter their Colorado account number on each return, including both their

If you have applied for your license, but do not have your account number, please contact the Customer Contact Center at (303)

Period

Retailers must indicate the filing period for each return. The filing period is defined by the first and last months in the filing period and entered in a

•For a monthly return for January 2020, the filing period would be

•For a quarterly return for the first quarter (Jan. through March) of 2020, the filing period would be

•For an annual return filed for 2020, the filing period would be

Location Juris Code

Retailers must enter the

Due Date

Retailers must enter the due date for the return. Returns are due the 20th day of the month following the close of the filing period. If the 20th is a Saturday, Sunday, or legal holiday, the return is due the next business day.

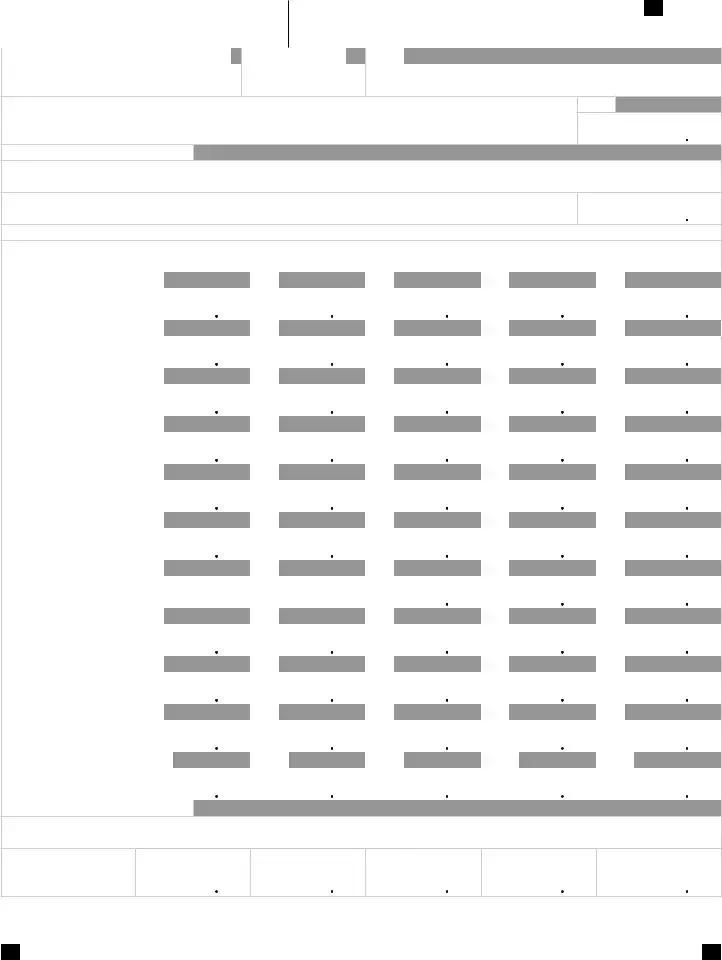

*DO*NOT*SEND*

DR 0100 (09/27/21)

COLORADO DEPARTMENT OF REVENUE

Denver CO

Tax.Colorado.gov

Monthly Returns: due the 20th day of the month following the reporting month.

Quarterly Returns:

1st quarter (January – March): due April 20

2nd quarter (April – June): due July 20

3rd quarter (July – September): due October 20

4th quarter (October – December): due January 20 Annual Returns: (January – December): due January 20

Amended Returns

If a retailer is filing a return to amend a previously filed return, the retailer must mark the applicable box to indicate that the return is an amended return. A separate amended return must be filed for each filing period and for each site/location. The amended return replaces the original return in its entirety and must report the full corrected amounts, rather than merely the changes in the amount of sales or tax due. If the amended return reduces the amount of tax reported on the original return, the retailer must file a Claim for Refund (DR 0137) along with the amended return to request a refund of the overpayment. If the amended return is filed after the due date and reports an increase in the amount of tax due, penalties and interest will apply.

State and

The Colorado Retail Sales Tax Return (DR 0100) is used to report not only Colorado sales tax, but also sales taxes administered by the Colorado Department of Revenue for various cities, counties, and special districts in the state. The sales taxes for different local jurisdictions are calculated and reported in separate columns of the DR 0100. Local sales taxes reported on the DR 0100 include:

•RTD/CD – Sales taxes for the Regional Transportation District (RTD) and the Scientific and Cultural Facilities District (CD) are reported in the RTD/CD column of the DR 0100.

•Special District – Special district sales taxes reported in the Special District column include sales taxes for any Regional Transportation Authority (RTA), Multi- Jurisdictional Housing Authority (MHA), Public Safety Improvements (PSI), Metropolitan District Tax (MDT), or Health Services District (HSD). Sales taxes for Mass Transportation Systems (MTS) and Local Improvement Districts (LID) are not reported in the Special District column, but are instead reported in the County/MTS and City/LID columns, respectively.

•County/MTS – County and Mass Transportation Systems (MTS) sales taxes administered by the Department are reported in the County/MTS column.

•City/LID – City and Local Improvement Districts (LID) sales taxes administered by the Department are reported in the City/LID column.

Many

cannot be reported and remitted with the DR 0100. Retailers must report such taxes directly to the applicable city.

See Department publication Colorado Sales/Use Tax Rates (DR 1002) for tax rates, service fee rates, and exemption information for state and

Avoiding Common Filing Errors

You can avoid several common errors by reviewing your return before filing it to verify that:

•You completed all applicable lines of the return.

•You completed all three pages of the return, including Schedule A and Schedule B. You must complete and submit all three pages when filing your return, even if you have no deductions or exemptions to report on Schedule A or Schedule B.

•You used the correct version of the form, depending on the filing period. There are different versions of the sales tax return for each year 2016 through 2020.

•You entered your account number and site number correctly on your return.

•You used the correct tax rate for each jurisdiction reported on your return. See

Additional information about common filing errors can be found online at

Specific Line Instructions

Retailers must complete all applicable lines, including lines 1, 2, 3, 4, 14, and 18, entering 0 (zero), if applicable. Retailers must also include Schedules A and B for each site/location.

Line 1. Gross sales of goods and services for this site/ location only

Enter the gross sales of goods and services made during the filing period. Include only sales sourced pursuant to state law to the site/location indicated on the return. See Part 7: Retail Sales in the Colorado Sales Tax Guide for additional information regarding sourcing.

For small retailers subject to origin sourcing rules, include all sales made from the retailer’s physical site/location, regardless of whether the property or service is delivered to the purchaser at another location.

For all other retailers who are subject to destination sourcing rules, do not include on a return for any physical site any sales delivered to the purchaser and sourced for sales tax purposes to another location. For

Include all sales of goods and services, whether taxable or not, and the collection during the filing period of any bad debts deducted on a return filed for a previous filing period.

*DO*NOT*SEND*

DR 0100 (09/27/21)

COLORADO DEPARTMENT OF REVENUE

Denver CO

Tax.Colorado.gov

Line 6. Tax rate

Enter the applicable state, city, county, and/or special district tax rate in each column of the return. The Colorado state sales tax rate is 2.9%. The sales tax rates for each city, county, and special district can be found in Department publication Colorado Sales/Use Tax Rates (DR 1002) or online at Colorado.gov/RevenueOnline.

Line 8. Excess tax collected

Enter any tax collected in excess of the tax due as computed on line 7. For example, if the retailer collected $50 of county sales tax during the filing period, but only $45 of tax is calculated in the County/MTS column of the return, the excess $5 of tax collected must be reported on this line.

Line 10. Service fee rate

Enter the applicable service fee rate in each column of the return. The Colorado state service fee rate is 4%. Service fee rates for each city, county, and special district can be found in Department publication Colorado Sales/Use Tax Rates (DR 1002).

Line 11. Service fee

The service fee is calculated by multiplying the amount on line 9 by the rate on line 10. The full amount calculated should be entered on line 11, unless the return is filed after the due date or possibly if the return is an amended return. Both of these situations are addressed in the following instructions.

If the amount in the state column, line 5 (net taxable sales) is $1,000,000 or greater, enter $0.

Retailers with multiple sites must add the amounts in the state column, line 5 for all sites. If the sum is greater than $1,000,000, enter $0.

Timely payment of tax

If the tax calculated on the return is paid by the return due date, enter on line 11 the service fee calculated by multiplying the amount on line 9 by the service fee rate on line 10, regardless of whether the return is an original or amended return. If the return is an original return and the tax is not paid by the due date for the return, and therefore no service fee is allowed, enter $0 on line 11.

Amended returns

If the return is an amended return and the tax reported on the original return was not paid by the due date for the return, the allowable service fee on the amended return is $0.

If the tax reported on the original return was paid by the due date and the amended return reports an increase of the tax due, the allowable service fee on the amended return is equal to the service fee allowed on the original return. Enter on line 11 of the amended return the service fee allowed on the original return. No additional service fee is allowed for the additional tax reported on the amended return.

If the tax reported on the original return was paid by the due date and the amended returns reports a decrease of the tax due, enter on line 11 the amount calculated by multiplying the amount on line 9 of the amended return by the service fee rate on line 10.

Limit on state service fee

The total combined Colorado state service fee allowed to a retailer for any given filing period is limited to $1,000. The retailer should enter on line 11 the full amount calculated by multiplying the amount on line 9 times the rate on line 10, but if the combined Colorado state service fee calculated on the retailer’s sales tax returns for all sites/locations for the filing period exceeds $1,000, the retailer must complete the State Service Fee Worksheet (DR 0103). The worksheet is used to determine what amount, if any, the retailer must pay in addition to the total balance due calculated on line 18 of the retailer’s returns. The amount of additional tax calculated on the State Service Fee Worksheet (DR 0103) should not be entered anywhere on the retailer’s Colorado Retail Sales Tax Return (DR 0100).

Beginning January 1, 2022, a retailer with total state net taxable sales (Column 1, line 5 or the sum of Column 1, line 5 across all sites), greater than $1,000,000 is not eligible to retain the state vendor's fee.

Line 13. Credit for tax previously paid

If a retailer overpaid tax on any previously filed return for a different filing period, and a refund claim for such overpayment is not barred by the statute of limitations, the retailer may claim a credit against tax calculated on the current return for such prior overpayment. Credit may be claimed only for tax overpayments for the same site/location and the same state or local jurisdiction. No credit may be claimed for an overpayment reflected in Department records either because the retailer filed an amended return or the Department adjusted the tax for the prior filing period.

Line 15. Penalty

If any retailer does not, by the applicable due date, file a return, pay the tax due, or correctly account for tax due, the retailer will owe a penalty. The penalty is 10% of the tax plus 0.5% of the tax for each month the tax remains unpaid, not to exceed a total of 18%. The minimum penalty amount is $15.

Line 16. Interest

If the tax is not paid by the applicable due date, the retailer will owe interest calculated from the due date until the date the tax is paid. See FYI General 11 for interest rates and information about interest calculation.

Schedule A and Schedule B

Schedule A and Schedule B are used to report various deductions and exemptions. Any amounts entered on lines 2 or 4 of the return may be disallowed if Schedules A and B for each site/location are not completed and included with the return. In general, Schedule A includes deductions and exemptions that are not optional for state- administered local jurisdictions and Schedule B includes exemptions that are optional for local jurisdictions. See the Supplemental Instructions available online at

*190100==19999*

DR 0100 (09/27/21)

COLORADO DEPARTMENT OF REVENUE

Denver CO

Tax.Colorado.gov

Colorado Retail Sales Tax Return

Signature (Signed under penalty of perjury in the second degree).

Date (MM/DD/YY)

SSN 1 |

|

|

|

|

|

|

SSN 2 |

|

|

|

|

|

|

|

|

|

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Last Name or Business Name |

|

|

|

|

|

|

|

|

|

|

|

|

First Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

|

ZIP |

|

|

|

Phone |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Colorado Account Number |

|

Period |

|

Location Juris Code (Refer to form DR 0800) |

|

Due Date (MM/DD/YY) |

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Mark here if this is an Amended Return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

1. Gross sales of goods and services for this site/location only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

2. Total from line 13 of Schedule A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

State |

|

|

RTD/CD |

|

Special District |

County/MTS |

|

|

|

City/LID |

|||||||||||||||

3. Subtract line 2 from line 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

and enter the result in each |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

applicable column |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

4.Total from line 12 of

Schedule B

5.Net taxable sales:

Subtract line 4 from line 3

6.Tax rate

7.Tax on net taxable sales:

Multiply line 5 by line 6

|

|

8. Excess tax collected

9.Add lines 7 and 8

10.Service fee rate

|

|

11. Service fee: Multiply line 9 by line 10

12.Net tax due: Subtract line 11 from line 9

|

|

13.Credit for tax previously paid

Attention: Continue to pages 2 and 3 to complete your return.

Page 1

*190100==29999*

DR 0100 (09/27/21)

COLORADO DEPARTMENT OF REVENUE

Denver CO

Tax.Colorado.gov

Colorado Account Number |

|

|

Period |

|

Name |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

RTD/CD |

|

|

Special District |

County/MTS |

|

|

City/LID |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

14. |

Subtract line 13 from |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

line 12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

15. |

Penalty |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

16. |

Interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. |

Add lines 14, 15, and 16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The State may convert your check to a |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Your bank account may be debited as early as the same day received by the |

18. Balance due: Add |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

||||||||||||||

State. If converted, your check will not be returned. If your check is rejected due |

amounts from line 17 |

|

Paid by EFT |

|

|

|

||||||||||||||

to insufficient or uncollected funds, the Department of Revenue may collect the |

|

$ |

|

|

||||||||||||||||

|

|

|

||||||||||||||||||

payment amount directly from your bank account electronically. |

|

|

|

in each column |

|

|

(355) |

|

|

|||||||||||

Schedule A (see instructions)

This schedule is required if any amount is entered on line 2 of Form DR 0100.

1.Wholesale sales, including wholesale sales of ingredients and component parts

2.Sales made to nonresidents or sourced to locations outside of Colorado

3.Sales of nontaxable services

4.Sales to exempt entities and organizations

5.Sales of gasoline, dyed diesel, and other exempt fuels

6.Sales of exempt drugs and medical devices

7.Fair market value of property received in exchange and held for resale

8.Bad debts

9.Cost of exempt utilities upon which tax was previously paid (restaurants must complete and attach Form DR 1465)

10.Exempt agricultural sales, not including farm and dairy equipment

11.Sales of computer software that is not taxable

Page 2

*190100==39999*

DR 0100 (09/27/21)

COLORADO DEPARTMENT OF REVENUE

Denver CO

Tax.Colorado.gov

Colorado Account Number |

Period |

Name |

|

–

12.Other exempt sales (see instructions and identify type(s) of exemption(s) claimed below)

Type(s) of other exemption(s) claimed:

13.Add lines 1 through 12. Enter the total on line 2 of Form DR 0100.

Schedule B (see instructions)

This schedule is required if any amount is entered on line 4 of Form DR 0100.

1. |

Sales of food for domestic |

|

|

State |

|

|

RTD/CD |

|

Special District |

|

County/MTS |

|

|

|

City/LID |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

home consumption and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

food sold through vending |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

machines |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

2. |

Sales of machinery and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

machine tools |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

3. |

Sales of electricity and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

fuel for residential use |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

4. |

Sales of farm and dairy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Sales of medium and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

heavy duty |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

vehicles and associated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

parts and power sources |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Exempt sales made |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

by schools, school |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

organizations, or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

charitable organizations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

7. |

Sales of cigarettes |

|

|

N/A |

|

|

|

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

8. |

Sales of renewable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

energy components |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

9. |

Sales of property for use |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

in space flight |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. Sales of retail |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

marijuana and retail |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

marijuana products |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. Other exempt sales (see |

|

|

|

|

|

|

|

|

|

|||||||||||

|

instructions and identify |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

type(s) of exemption(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

claimed below) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type(s) of other exemption(s) claimed:

12.Add lines 1 through 11 of each column. Enter the total on line 4 of Form

DR 0100.

Page 3

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Purpose | The DR 0100 is used by retailers in Colorado to file the Retail Sales Tax Return. |

| Filing Frequency | Retailers must file their sales tax return for each filing period, even if no sales occurred. |

| Electronic Filing Options | Retailers have options for electronic filing, including Revenue Online and XML formats. |

| Separate Returns for Locations | A separate return is required for each business location where sales are made. |

| Due Date | Returns are due by the 20th of the month following the filing period. |

| Estimate Tax for Non-Filers | If a retailer fails to file, the Department will estimate the tax and notify the retailer. |

| Consumer Use Tax | Items removed from inventory for personal use are subject to consumer use tax, which requires a Consumer Use Tax Return (DR 0252). |

| Records Retention | Retailers must keep sales tax records for at least three years to support their filings. |

| Credits for Overpayments | Retailers can claim a credit for previously overpaid taxes on future returns, under certain conditions. |

| Governing Laws | This form is governed by Colorado sales tax law, specifically under the Colorado Department of Revenue’s regulations. |

Guidelines on Utilizing Dr 0100

The completion of the Dr 0100 form is an important process for retailers in Colorado, facilitating the accurate reporting of sales tax and associated financial obligations. Each form must be filled out thoroughly to avoid penalties or additional scrutiny from the Colorado Department of Revenue. Retailers are encouraged to meticulously follow the instructions to ensure timely and accurate submissions. The next steps will guide you through the process of completing the Dr 0100 form effectively.

- Obtain the form: Make sure you have the official DR 0100 form. You can find it on the Colorado Department of Revenue's website or through tax software.

- Fill in identifying information: Write down your name, business name, and address in the designated fields. Your Colorado account number should also be clearly indicated.

- Enter the tax period: Specify the filing period in the MM/YY-MM/YY format, indicating the beginning and the end of the month you are reporting on.

- Include location jurisdiction code: Identify the six-digit location jurisdiction code associated with your business. This code can be found on your Sales Tax License.

- Mark the due date: Write the due date, which is typically the 20th day of the month following the filing period. If this day falls on a weekend or holiday, use the next business day.

- Amended return mark: If this submission is an amended return, check the box indicating so.

- Report gross sales: On line 1, input the total gross sales of goods and services for the filing period.

- Complete deductions: Fill in the totals from Schedules A and B to account for any deductions or exemptions on lines 2 and 4 respectively.

- Calculate net taxable sales: Subtract line 2 from line 1 and enter the result on line 3. Use the result from line 3 to calculate other taxes.

- Input tax rates: Enter the applicable tax rates for each column in line 6, utilizing current tax rate information for state, city, county, and special districts.

- Calculate tax due: Multiply net taxable sales by the tax rate to find the tax amount due on line 7.

- Report any excess tax collected: Fill out line 8 with any tax you collected that exceeds the amount calculated in line 7.

- Add taxes together: Sum lines 7 and 8 for the total on line 9.

- Include service fee rate: Enter the applicable service fee rate on line 10 based on your sales volume.

- Calculate service fee: Multiply the amount on line 9 by the service fee rate and place the result on line 11.

- Determine net tax due: Subtract the service fee on line 11 from the total on line 9 to find the net tax due, reported on line 12.

- Credit for prior overpayments: If applicable, enter any credits for tax previously paid on line 13.

- Penalties and interest: Be aware that penalties may apply for any late submissions or payments. Consult line 15 and line 16 for guidance on these potential issues.

- Sign and date: Don’t forget to sign and date the return at the bottom, as this indicates that you are submitting the information under penalty of perjury.

- Mail the form: Send the completed form along with any payment to the Colorado Department of Revenue at the address provided on the form.

What You Should Know About This Form

What is the DR 0100 form?

The DR 0100 form is the Colorado Retail Sales Tax Return. Retailers in Colorado must use this form to report and pay sales tax for each filing period, even if they did not have any sales. This ensures compliance with state tax regulations.

Who needs to file the DR 0100 form?

Any retailer conducting sales in Colorado is required to file the DR 0100 form. This includes businesses that made sales during the filing period as well as those that had no sales, as all retailers must report their activity to the Colorado Department of Revenue.

How often do I need to file the DR 0100 form?

Retailers must generally file the DR 0100 form on a monthly basis. However, some businesses may qualify for quarterly or annual filing, depending on their total sales volume. Review the Colorado Sales Tax Guide for specifics about different filing frequencies.

What if I fail to file the form on time?

If a retailer fails to file the DR 0100 form by the due date, the Colorado Department of Revenue may estimate the tax due and send a written notice. Repeated failures to file can result in deactivation of the retailer’s sales tax account.

How can I file the DR 0100 form?

Retailers can file the DR 0100 form electronically using Revenue Online or through XML or spreadsheet formats. Each method requires a separate filing for each business site. For those who prefer paper filing, they can download the form, complete it, and mail it to the Colorado Department of Revenue.

What payment options are available for the sales tax reported on the DR 0100 form?

Retailers have several payment options, including electronic payments via credit card or e-check, electronic funds transfer (EFT), or payment by paper check. When filing electronically, retailers should verify their payment method on the form to ensure correct processing.

What should I include when filling out the DR 0100 form?

When completing the form, you should include your identifying information, gross sales figures, applicable tax rates, and any deductions or exemptions. Be sure to check your calculations thoroughly to avoid common mistakes.

Where can I find more information about filing the DR 0100 form?

Additional guidance on the DR 0100 form and sales tax filing can be found on the Colorado Department of Revenue’s website. Resources include the Colorado Sales Tax Guide and informative videos about sales tax education.

Common mistakes

Completing the DR 0100 form can be straightforward, but many people still make common mistakes that can lead to complications. One frequent error is failing to complete all applicable lines on the return. It's crucial to fill in every necessary field, including those that may seem optional. For instance, even if a retailer has no deductions or exemptions to report on Schedules A and B, they must still include these schedules along with their return. Neglecting this requirement can cause the return to be considered incomplete.

Another common mistake is entering incorrect identification information. Retailers must accurately provide their Colorado account number, which includes both the eight-digit number and the unique four-digit site/location number. If a retailer has multiple locations, they must file a separate return for each one. An incorrect account number can lead to payment issues, penalties, or even account deactivation by the Department of Revenue.

Many people also mishandle the filing period. It is essential to specify the correct filing period in the required MM/YY-MM/YY format. If this information is not entered correctly, confusion can arise when the return is processed. Additionally, using the right version of the form is vital. Each year has a specific version, and using an outdated form can cause delays and complications, especially if tax rates or regulations have changed.

Finally, forgetting to check the electronic payment option can result in missed payments or incorrect processing. If a retailer is filing electronically but intends to pay via credit card or electronic check, they must indicate this on line 18 of the return. If not properly marked, it can lead to confusion about payment status and result in unwanted penalties or interest. Double-checking every detail before submission can make a significant difference in avoiding these common pitfalls.

Documents used along the form

When filing the Colorado Retail Sales Tax Return (DR 0100), several other forms and documents may be used to ensure compliance and proper reporting. Each one serves a specific purpose and complements the information provided on the DR 0100. Below is a list of these forms and documents.

- Consumer Use Tax Return (DR 0252): This form is used to report and pay any consumer use tax owed on tangible personal property purchased for resale that has been removed from inventory for personal use.

- Electronic Funds Transfer (EFT) Program for Tax Payments (DR 5782): This document provides information about remitting payments electronically through the Electronic Funds Transfer program.

- Electronic Funds Transfer Account Setup for Tax Payments (DR 5785): This form assists retailers in registering for their EFT account to enable electronic tax payments.

- Location/Jurisdiction Codes for Sales Tax Filing (DR 0800): This resource offers the jurisdiction codes needed for reporting sales tax by physical and non-physical sites.

- Claim for Refund (DR 0137): Retailers use this form to request a refund for an overpayment of sales tax when filing an amended return.

- State Service Fee Worksheet (DR 0103): This worksheet helps retailers calculate the service fee allowed for state net taxable sales over $1 million during a given filing period.

- Supplemental Instructions for Sales Tax Filing: Available online, these instructions provide further details about deductions and exemptions that may apply during sales tax filing.

- Sales Tax Classes and Educational Resources: These resources, accessible online, offer guidance and training for retailers on filing and managing sales tax returns effectively.

- Colorado Sales/Use Tax Rates (DR 1002): This document contains the current sales and use tax rates for the state and local jurisdictions, crucial for accurate tax calculations.

Utilizing these forms and documents alongside the DR 0100 can enhance accuracy in reporting and help retailers maintain compliance with Colorado sales tax regulations. Each tool plays a vital role in the overall process of filing taxes effectively and efficiently.

Similar forms

The DR 0100 form, which is a Colorado Retail Sales Tax Return, shares similarities with several other important documents used in tax compliance and reporting. Below are four documents that are comparable to the DR 0100 form, detailing their similarities:

- Consumer Use Tax Return (DR 0252): Just like the DR 0100, this form is used to report tax obligations. While the DR 0100 focuses on sales tax collected from customers, the DR 0252 is for retailers reporting use tax on goods taken from inventory for personal use. Both forms require accurate sales information to determine the correct tax liability.

- Claim for Refund (DR 0137): Similar to the DR 0100, this form is used to request the refund of overpaid taxes. Retailers must fill out specific details regarding the original payment. Both documents emphasize proper filing to ensure the retailer receives appropriate credit or refund amounts.

- Sales Tax License (DR 0586): This document is crucial for retailers intending to collect sales tax. Like the DR 0100, it serves as a registration tool to comply with sales tax regulations. Both forms require accurate business details, ensuring that the retailer is recognized by the Colorado Department of Revenue.

- State Service Fee Worksheet (DR 0103): Retailers utilize this form to calculate additional service fees if their sales tax filings exceed a specified limit. While the DR 0100 reports tax due, the DR 0103 focuses on fees, complementing the information required on the main return. Thus, both documents are integral for correct tax compliance.

Dos and Don'ts

When filling out the DR 0100 form, there are important steps to ensure accuracy and compliance. Here’s a helpful list of what you should and shouldn’t do:

- Do provide your complete and accurate identifying information, including your name and Colorado account number.

- Do indicate the correct filing period and due date, using the proper MM/YY-MM/YY format.

- Do file a separate return for each physical and non-physical site where your sales occur.

- Do review your return carefully for errors, including all relevant lines and affixing your signature.

- Don't leave any applicable lines blank; enter a 0 if there's no applicable amount.

- Don't forget to file additional Schedules A and B if you have deductions or exemptions.

- Don't use an outdated version of the form; ensure you have the correct one for the filing period.

- Don't fail to pay your tax by the due date to avoid penalties and interest charges.

Misconceptions

- Misconception 1: Retailers don't need to file if no sales were made.

- Misconception 2: Only big retailers need to worry about the DR 0100 form.

- Misconception 3: A single DR 0100 is enough for multiple business locations.

- Misconception 4: Payments can only be made via paper check.

- Misconception 5: You can file the DR 0100 at any time.

- Misconception 6: The sales tax licenses and jurisdiction codes are optional.

Many believe that if they haven't made any sales during a reporting period, they can skip filing. However, all retailers are required to file a return for every period, even if no tax is due.

This form is relevant for retailers of all sizes. Even small businesses or sole proprietors need to complete it, as it's essential for compliance with sales tax laws.

Each business site or location must submit a separate sales tax return. Owners with multiple locations often overlook this requirement and may face penalties due to incorrect filings.

Some retailers think paper checks are their only option for remitting tax payments. In reality, the state provides various electronic payment methods, such as credit cards and electronic funds transfers (EFT), which can simplify the process.

Many people fail to realize that the form has strict due dates. Returns are due on the 20th of the month following the close of the filing period, and late submissions attract penalties and interest.

Retailers sometimes underestimate the importance of obtaining the necessary sales tax licenses and entering the correct jurisdiction codes. These details are essential for accurately reporting sales and avoiding compliance issues.

Key takeaways

Every retailer must file a sales tax return using the DR 0100 form for every filing period, regardless of whether they made any sales during that time.

Returns are typically filed monthly, and separate returns are required for each business location.

Electronic filing options are available, including Revenue Online, XML filing, and approved Excel spreadsheets.

Make sure to include all required identifying information, such as your Colorado account number and the correct filing period.

Payment can be made via electronic funds transfer (EFT), credit card, or paper check, but be aware of processing fees for electronic payments.

If filing an amended return, it must include corrected amounts for the entire period and a Claim for Refund form if reducing tax due.

Browse Other Templates

Masshealth Non Custodial Parent Form - Contact details are crucial for follow-up communications regarding your application.

Cs-909 - Filing this form with the appropriate agency results in the same legal effect as a court order.

Unemployment Arkansas - Employers must fill in their DWS ID number and Federal ID number on the form.