Fill Out Your Dr 1093 Form

The DR 1093 form, an essential document for employers in Colorado, carries the weight of ensuring compliance with state tax regulations. This Annual Transmittal of State W-2 Forms must be submitted each January for the withholding taxes reported from the previous calendar year. Its importance cannot be overstated. When submitting this form, employers must indicate whether they are filing an amended return, as separate forms are required for each year in which changes have occurred. This submission is not just a formality; it must be attached to the W-2s provided to each employee. Timeliness is key—active accounts have a January due date, while closed accounts must file within thirty days of closure. The form includes several lines for reporting total state withholdings, remitted payments, potential penalties, and interest calculations. For any discrepancies between what was withheld and what was paid, detailed instructions guide employers through correcting or accounting for overpayments. When properly filled out and submitted, the DR 1093 aids the state in accurately tracking tax payments and ensures employers can avoid unnecessary penalties—certainly a win-win situation for all parties involved.

Dr 1093 Example

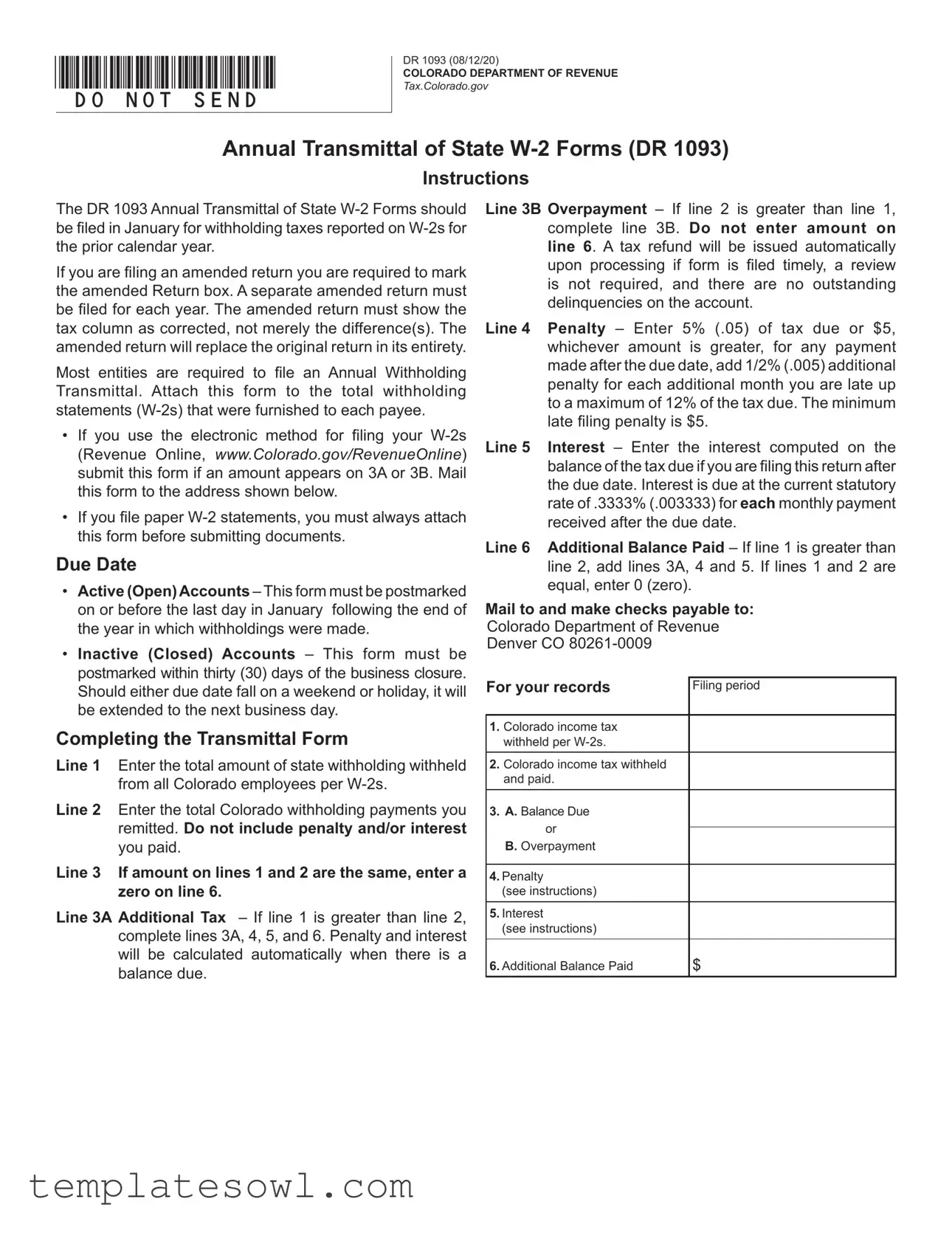

*DO=NOT=SEND*

DR 1093 (08/12/20)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

Annual Transmittal of State

Instructions

The DR 1093 Annual Transmittal of State

If you are filing an amended return you are required to mark the amended Return box. A separate amended return must be filed for each year. The amended return must show the tax column as corrected, not merely the difference(s). The amended return will replace the original return in its entirety.

Most entities are required to file an Annual Withholding Transmittal. Attach this form to the total withholding statements

•If you use the electronic method for filing your

•If you file paper

Due Date

•Active (Open)Accounts – This form must be postmarked on or before the last day in January following the end of the year in which withholdings were made.

•Inactive (Closed) Accounts – This form must be postmarked within thirty (30) days of the business closure. Should either due date fall on a weekend or holiday, it will be extended to the next business day.

Completing the Transmittal Form

Line 1 Enter the total amount of state withholding withheld from all Colorado employees per

Line 2 Enter the total Colorado withholding payments you remitted. Do not include penalty and/or interest you paid.

Line 3 If amount on lines 1 and 2 are the same, enter a zero on line 6.

Line 3A Additional Tax – If line 1 is greater than line 2, complete lines 3A, 4, 5, and 6. Penalty and interest will be calculated automatically when there is a balance due.

Line 3B Overpayment – If line 2 is greater than line 1, complete line 3B. Do not enter amount on line 6. A tax refund will be issued automatically upon processing if form is filed timely, a review is not required, and there are no outstanding delinquencies on the account.

Line 4 Penalty – Enter 5% (.05) of tax due or $5, whichever amount is greater, for any payment made after the due date, add 1/2% (.005) additional penalty for each additional month you are late up to a maximum of 12% of the tax due. The minimum late filing penalty is $5.

Line 5 Interest – Enter the interest computed on the balance of the tax due if you are filing this return after the due date. Interest is due at the current statutory rate of .3333% (.003333) for each monthly payment received after the due date.

Line 6 Additional Balance Paid – If line 1 is greater than line 2, add lines 3A, 4 and 5. If lines 1 and 2 are equal, enter 0 (zero).

Mail to and make checks payable to: Colorado Department of Revenue Denver CO

For your records |

Filing period |

|

|

|

|

1. |

Colorado income tax |

|

|

withheld per |

|

2. |

Colorado income tax withheld |

|

|

and paid. |

|

3. |

A. Balance Due |

|

|

or |

|

|

|

|

|

B. Overpayment |

|

|

|

|

4. Penalty |

|

|

|

(see instructions) |

|

5. Interest |

|

|

|

(see instructions) |

|

|

|

|

6. Additional Balance Paid |

$ |

|

*201093==19999*

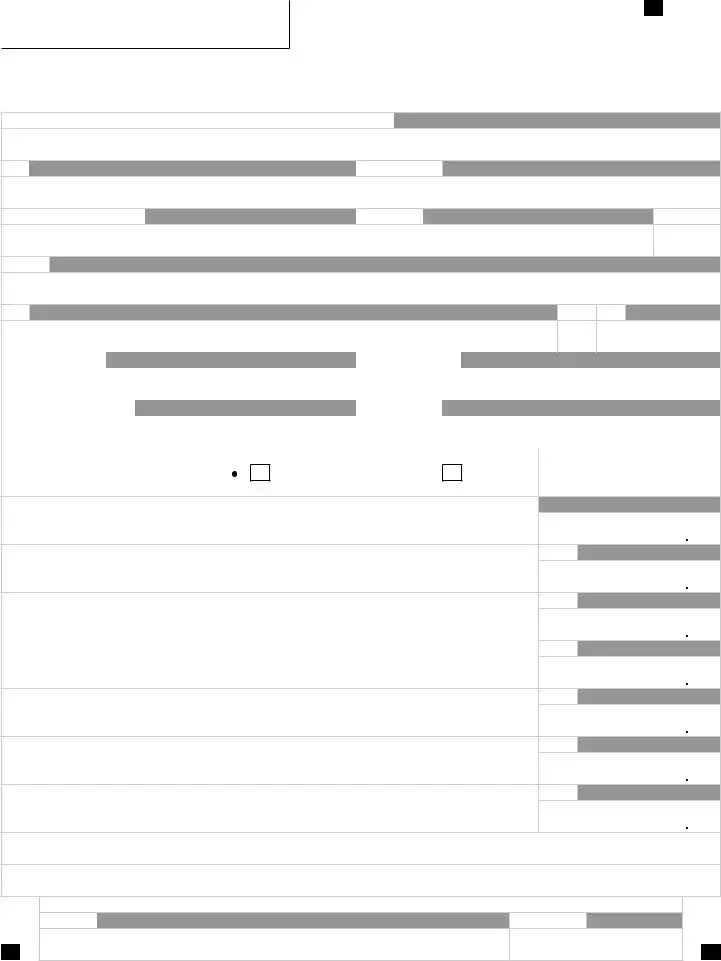

DR 1093 (08/12/20)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

Page 1 of 1

Colorado Department of Revenue

Annual Transmittal of State

SSN 1 |

|

|

SSN 2 |

|

|

|

|

|

|

|

|

|

|

|

|

Account Number |

||||

FEIN |

|

|

||||

|

|

|

||||

Last Name or Business Name |

|

First Name |

|

|||

|

|

|

|

|

|

|

Middle Initial

Address

City

State

ZIP

Period (MM/YY – MM/YY) |

|

|

Due Date (MM/DD/YY) |

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

Number of |

|

Phone Number |

|

|

|

|

|

|

|

|

|

Mark here if this is an Amended Return |

Paid by EFT |

1. Total Colorado income taxes withheld per

(890)

2. Total Colorado income taxes remitted for the period indicated above.

(100)

3. A. Balance Due If line 1 is more than line 2, enter difference and (see instructions)

(415)

B. Overpayment If line 2 is more than line 1, enter the difference and (see instructions)

(200)

4. Penalty (see instructions)

(300)

5. Interest (see instructions)

(355)

6. Additional Balance Paid Add lines 3A, 4 and 5

The State may convert your check to a

Mail reconciliation with

Colorado Department of Revenue, Denver, CO

Signed under penalty of perjury in the second degree.

Signature

Date (MM/DD/YY)

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The DR 1093 form is used for the Annual Transmittal of State W-2 Forms in Colorado, reporting withholding taxes for the previous calendar year. |

| Due Date | The form must be postmarked by the last day in January for active accounts. For closed accounts, it must be submitted within 30 days of the business closure. |

| Amended Returns | If you are filing an amended return, you must mark the appropriate box. Each year requires a separate amended return. |

| Filing Methods | You can file electronically via Revenue Online, which allows for quicker processing, or submit paper forms with attached W-2 statements. |

| Financial Information | The form requires details on total Colorado income taxes withheld and remitted, along with any penalties or interest incurred. |

| Governing Law | This form is governed by Colorado state tax laws, specifically relating to income tax withholding as outlined by the Colorado Department of Revenue. |

Guidelines on Utilizing Dr 1093

Completing the DR 1093 form accurately is essential for fulfilling your withholding tax obligations. Once you have filled out the form, it needs to be submitted alongside the W-2 statements that were issued to employees for the previous calendar year. Be sure to send it in promptly before the deadline to avoid late penalties.

- Gather all W-2 forms for Colorado employees to determine the total state withholding.

- At the top of the form, enter your Account Number and FEIN in the appropriate fields.

- Fill in your Last Name or Business Name, First Name, Middle Initial, Address, City, State, and ZIP Code.

- Specify the Filing Period in the MM/YY format and the Due Date in MM/DD/YY format.

- Indicate the Number of W-2s Attached by filling in the relevant box.

- If applicable, mark the box indicating this is an Amended Return.

- On Line 1, enter the total amount of Colorado income tax withheld from the W-2 forms attached.

- On Line 2, enter the total amount of Colorado withholding payments you have remitted.

- If the amounts on Line 1 and Line 2 are the same, enter zero on Line 6.

- If Line 1 is greater than Line 2, complete Lines 3A, 4, 5, and 6. Calculate Line 3A as the balance due.

- If Line 2 is greater than Line 1, complete Line 3B for the overpayment.

- On Line 4, calculate any applicable penalty, ensuring you use the greater of 5% or $5.

- On Line 5, calculate the interest due if filing after the deadline.

- On Line 6, if Line 1 is greater than Line 2, add Lines 3A, 4, and 5.

- Sign and date the form under penalty of perjury.

- Mail the completed DR 1093 form, along with the W-2 forms, to the Colorado Department of Revenue at the address specified on the form.

What You Should Know About This Form

What is the DR 1093 form?

The DR 1093 form, officially known as the Annual Transmittal of State W-2 Forms, is required by the Colorado Department of Revenue. This form helps report the state income tax that has been withheld from employee wages for the previous calendar year. It must be filed each January for the W-2s issued for the preceding year.

When is the DR 1093 form due?

The deadline for submitting the DR 1093 form depends on your business's status. For active accounts, it should be postmarked by the last day of January following the year for which the W-2s were issued. Conversely, if the business has closed, the form must be postmarked within 30 days of the closure. If the due date occurs on a weekend or holiday, the deadline extends to the next business day.

What should I do if I need to amend my DR 1093 filing?

If you discover that you need to amend your DR 1093, mark the "Amended Return" box on the form. It's important to submit a separate amended filing for each tax year that requires an adjustment. When making corrections, ensure that the amended return shows the corrected tax column and not just the differences.

How do I complete the DR 1093 form?

Completing the DR 1093 requires attention to several specific lines. Begin by entering the total amount of state withholding from W-2s on Line 1. Then, input the total payments made to Colorado for withholding taxes on Line 2. If the amounts are equal, you will enter zero on Line 6; otherwise, proceed to complete additional required lines based on whether you have a balance due or an overpayment.

What happens if I miss the filing deadline for the DR 1093?

If the DR 1093 is filed late, penalties and interest may apply. The penalty is 5% of the tax due or a minimum of $5, increasing with each additional month of lateness, up to a maximum of 12% of the due tax. Interest also accumulates at a statutory rate of 0.3333% per month on the overdue amount.

Where do I send the DR 1093 form once completed?

After filling out the DR 1093 form, it should be mailed to the Colorado Department of Revenue. The correct mailing address is Denver, CO 80261-0009. If you're making a payment, ensure that checks are made payable to the Colorado Department of Revenue.

Can I file the DR 1093 electronically?

Yes, electronic filing is an option. If you file your W-2s through Revenue Online, you should submit the DR 1093 electronically as well, particularly if you have any amounts on Lines 3A or 3B to report. Following the electronic submission guidelines will ensure that your filings are processed accurately.

Common mistakes

Filling out the DR 1093 form is a crucial task for anyone managing Colorado state withholding taxes. However, many people make common mistakes that can lead to delays or complications. Here are seven frequent errors to watch out for when completing this important form.

One common mistake is forgetting to check the "Amended Return" box if applicable. This box must be marked when you are filing an amended return. Failing to identify your submission as an amended return could result in the form being processed incorrectly, creating further issues down the line.

Another error often occurs when people neglect to enter the correct total state withholding amount on Line 1. This figure should come directly from the W-2s provided to employees. If this number is inaccurate, every subsequent calculation on the form could also be wrong, leading to discrepancies that may require rectification later.

Line 2 requires the total Colorado withholding payments that have been remitted. It is vital to exclude any penalties or interest that may have been incurred. A common mistake here is to mistakenly include these figures, which can distort the overall balance and complicate filing.

Additionally, people frequently confuse Lines 3A and 3B. Line 3A is for reporting additional taxes due, while Line 3B is for overpayments. Incorrectly placing amounts on these lines can misrepresent your financial situation, which could delay any refunds or require additional payments.

As it pertains to penalties and interest, some individuals miscalculate these figures on Lines 4 and 5. The penalties for late payments and the interest for overdue amounts are specific percentages that must be accurately computed. Even minor errors in calculations can lead to significant discrepancies in what is owed.

Lastly, many individuals overlook the importance of mailing the form on time. Understanding the deadlines for active and inactive accounts is crucial. Submitting the form late can result in additional penalties, further complicating the tax filing process.

Avoiding these common pitfalls can pave the way for a smoother filing experience. Double-checking the details, ensuring correct entries, and being mindful of due dates can save time and prevent future headaches with the Colorado Department of Revenue.

Documents used along the form

When filing your Colorado state taxes, the DR 1093 form is just one component of your reporting responsibilities. In conjunction with this transmittal form, several other forms and documents may be required to ensure compliance with tax regulations. Understanding these supporting documents can help you streamline the filing process, reducing the chances of errors or complications.

- W-2 Form: This is the key document issued to employees, detailing their annual earnings and the amount of taxes withheld. Each employee must receive a copy of their W-2 by January 31 for the previous tax year.

- DR 0100: Known as the Colorado Individual Income Tax Return, this form is used by residents and non-residents to report income earned within Colorado, including income tax owed or refunds due.

- DR 0278: The Colorado Withholding Tax Return is needed by employers to report income taxes withheld from employees' wages. It allows for periodic remittance of withheld amounts and is typically filed monthly or quarterly.

- DR 1345: This document serves as a declaration of estimated tax for corporations. It is used if a corporation expects to owe $1,000 or more in Colorado tax for the current year.

- DR 0200: This form is the Commercial Registered Agent registration form. Businesses often need to designate a registered agent and provide this information to ensure legal notifications are received promptly.

- DR 0981: This form, the Colorado Tax Credit and Rebate Application, is used by individuals or businesses claiming various tax credits or rebates available within the state, helping them reduce tax liability.

- DR 0102: The Application for Withholding Tax Certificate allows businesses to register and establish their withholding tax responsibilities with the Colorado Department of Revenue. This is particularly important for newly established companies.

Having these documents ready and understanding their purpose will make the tax filing process smoother and more efficient. Always ensure that you’re using the latest versions of each document to maintain compliance with state regulations. Proper preparation can lead to fewer headaches and a more straightforward tax season.

Similar forms

- W-2 Form: The W-2 form is the primary document used to report wages and withholding for employees. Like the DR 1093, it summarizes payroll information for the previous calendar year, detailing how much income was earned and how much tax was withheld from it.

- DR 1094: The DR 1094 is the Annual Transmittal of State 1099 Forms. Similar to the DR 1093, it serves as a summary for the various 1099 forms filed for non-employee compensation, detailing total amounts distributed and taxes withheld.

- 1040 Form: This is the U.S. Individual Income Tax Return. It is similar in that it is filed annually and summarizes the taxpayer's earnings and tax responsibilities, capturing withholdings but differs by focusing on personal income tax rather than employer withholding.

- DR 0609: The DR 0609 form is used for the Annual Withholding Tax Reconciliation. Like the DR 1093, it consolidates information on withholdings throughout the year, specifically helping in reconciling an employer's quarterly filings with the total year-end taxes withheld.

- Form 941: The Employer's Quarterly Federal Tax Return is submitted every quarter and reports the amount of federal taxes withheld from employee pay. It shares a similar purpose with the DR 1093, as both deal with the reconciliation of withholdings over a specified time frame, though one is federal and the other is state-specific.

Dos and Don'ts

When preparing to fill out the DR 1093 form, it’s essential to follow certain guidelines to ensure proper submission. Here is a helpful list of do's and don’ts:

- Do fill out the form promptly, making sure to submit it in January for the previous calendar year’s W-2s.

- Do mark the amended return box if you are submitting an amended form.

- Do attach the DR 1093 to your W-2 statements before mailing.

- Do ensure all amounts in related lines are accurate, particularly between lines 1 and 2.

- Don't miss the submission deadlines—January 31st for active accounts and within 30 days for inactive accounts.

- Don't include penalties or interests in the amount reported on line 2; this should reflect only remitted withholdings.

- Don't forget to enter a zero on line 6 if the amounts on lines 1 and 2 match.

- Don't ignore the potential penalties for late submissions, which can accumulate daily if not filed on time.

Careful adherence to these points can help streamline the process and minimize any potential issues with the submission of the DR 1093 form.

Misconceptions

The DR 1093 form is essential for businesses in Colorado to report state withholding taxes from W-2s. Yet, several misconceptions surround its use. Below are five common misunderstandings about the form, clarified for better comprehension.

- Misconception 1: The DR 1093 form is not required if no taxes were withheld.

- Misconception 2: You can file the DR 1093 form at any time during the year.

- Misconception 3: An amended DR 1093 form can be filed anytime.

- Misconception 4: You don't need to attach W-2 forms if filing electronically.

- Misconception 5: Penalties and interest are automatically waived if the form is filed after the due date.

This is incorrect. Even if no taxes were withheld, businesses must still file the DR 1093 form, indicating that there were no withholdings for the reporting period. Failing to submit could lead to compliance issues.

In reality, the form must be filed in January for withholdings reported on the previous year’s W-2s. Adhering to deadlines is crucial to avoid penalties and ensure accurate tax processing.

This is misleading. An amended return must be submitted within specific timelines and requires marking the amended box on the form. Additionally, a separate amended return is necessary for each fiscal year that needs correction.

This is false. Even if using electronic methods to file W-2s, the DR 1093 form must be submitted if there are amounts on lines 3A or 3B. Ensuring all required documents are included is vital for a complete submission.

This is not the case. Penalties will apply for late submissions, as detailed in the form instructions. Understanding the consequences of missing deadlines can help businesses avoid unnecessary financial strain.

Key takeaways

When filling out the DR 1093 form, there are several crucial aspects to keep in mind to ensure compliance and accuracy.

- The DR 1093 must be submitted in January for the previous year's W-2 withholding tax records.

- For any corrections, check the amended return box and provide a complete amended return for each year, not just the discrepancies.

- Accuracy on the form is vital; ensure that the amounts reported on lines 1 and 2 are correct and that penalties and interest are well-calculated if necessary.

- Be aware of the due dates: submit the form by the last day of January for active accounts, and within 30 days for closed accounts.

Browse Other Templates

When a Veteran Dies Who Gets the Flag - If unsure about requirements, contacting a VA office can provide clarity.

Dr Precipitation - Fill in the quantity requested for the prescription.