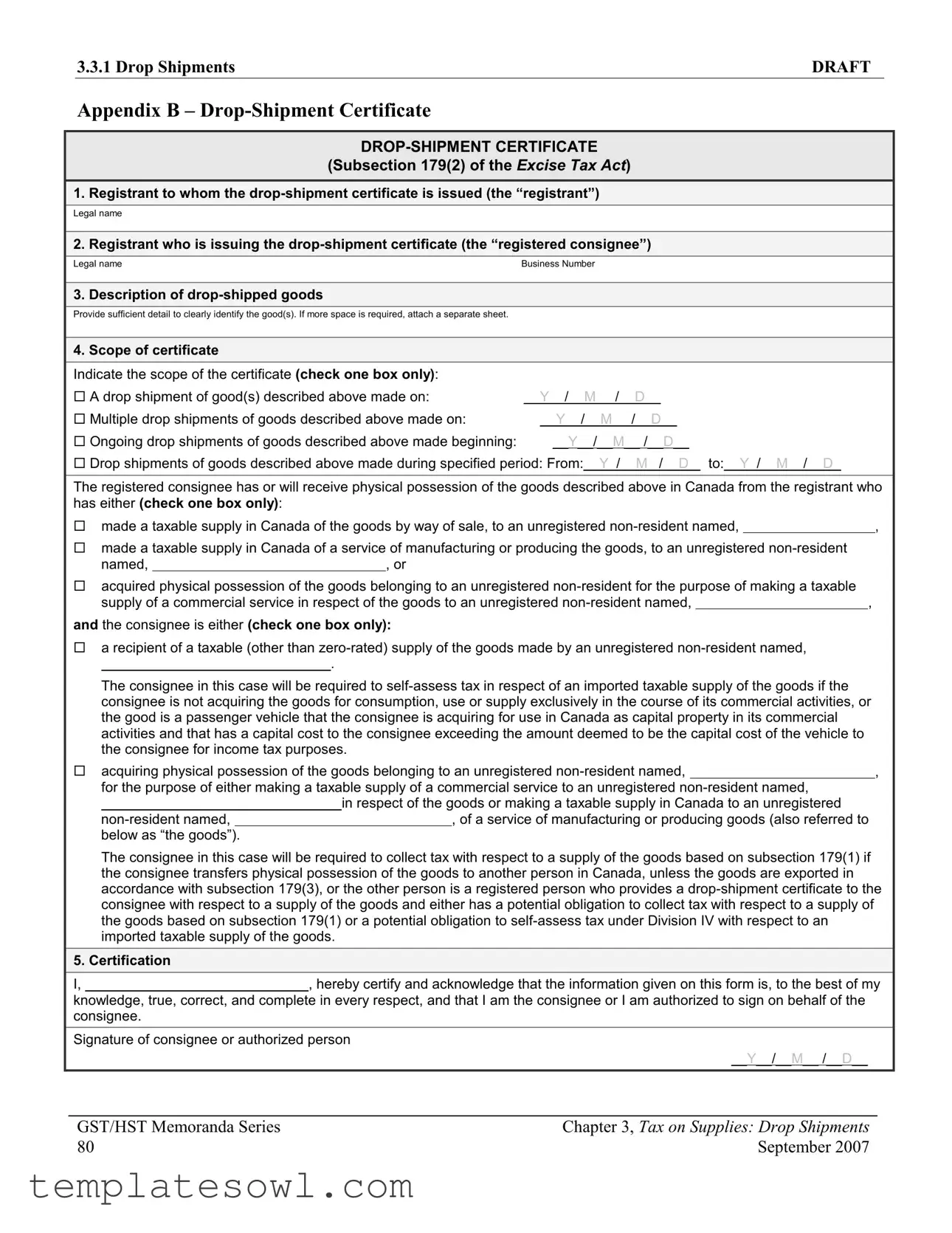

Fill Out Your Drop Shipment Certificate Form

The Drop Shipment Certificate is an essential document in the realm of goods distribution, particularly for businesses engaging in drop shipment practices. This form serves to facilitate the transfer of goods from a supplier directly to a customer, while ensuring proper tax compliance under Canada’s Excise Tax Act. Key components of the certificate include details about the registrant and registered consignee, alongside a clear description of the drop-shipped goods. It allows users to delineate the scope of the shipment—whether it’s a single drop, multiple transactions, or ongoing shipments—offering flexibility based on the nature of the business arrangement. Additionally, the certificate requires specific checks to confirm the registrant’s and consignee’s obligations concerning taxable supplies, as well as the necessary compliance actions for tax collection or self-assessment. Finally, the certification section necessitates a signature from the consignee or an authorized representative, reinforcing accountability and authenticity. Understanding this form is crucial for businesses to navigate their tax responsibilities effectively while maintaining efficient shipping processes.

Drop Shipment Certificate Example

3.3.1 Drop Shipments |

DRAFT |

|

|

Appendix B –

(Subsection 179(2) of the EXCISE TAX ACT)

1. Registrant to whom the

Legal name

2. Registrant who is issuing the

Legal nameBusiness Number

3. |

Description of |

|

|

|

|

|

Provide sufficient detail to clearly identify the good(s). If more space is required, attach a separate sheet. |

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Scope of certificate |

|

|

|

|

|

Indicate the scope of the certificate (check one box only): |

|

|

|

|

|

|

|

A drop shipment of good(s) described above made on: |

__Y__/__M__ /__D__ |

||||

|

Multiple drop shipments of goods described above made on: |

__Y__/__M__ /__D__ |

||||

|

|

|

|

|

|

|

|

Ongoing drop shipments of goods described above made beginning: |

|

|

__Y__/__M__ /__D__ |

|

|

Drop shipments of goods described above made during specified period: From:__Y_/__M_ /__D_ to:__Y_/__M__/__D_

The registered consignee has or will receive physical possession of the goods described above in Canada from the registrant who has either (check one box only):

made a taxable supply in Canada of the goods by way of sale, to an unregistered |

|

, |

||||

|

|

|

|

|

|

|

made a taxable supply in Canada of a service of manufacturing or producing the goods, to an unregistered |

|

|

||||

named, |

|

, or |

|

|

||

acquired physical possession of the goods belonging to an unregistered |

|

|

||||

supply of a commercial service in respect of the goods to an unregistered |

|

, |

|

|||

and the consignee is either (check one box only):

arecipient of a taxable (other than

.

The consignee in this case will be required to

acquiring physical possession of the goods belonging to an unregistered |

|

, |

|||

for the purpose of either making a taxable supply of a commercial service to an unregistered |

|

||||

|

|

in respect of the goods or making a taxable supply in Canada to an unregistered |

|

||

|

|

, of a service of manufacturing or producing goods (also referred to |

|

||

below as “the goods”). |

|

|

|

|

|

The consignee in this case will be required to collect tax with respect to a supply of the goods based on subsection 179(1) if the consignee transfers physical possession of the goods to another person in Canada, unless the goods are exported in accordance with subsection 179(3), or the other person is a registered person who provides a

5. Certification

I,, hereby certify and acknowledge that the information given on this form is, to the best of my

knowledge, true, correct, and complete in every respect, and that I am the consignee or I am authorized to sign on behalf of the consignee.

Signature of consignee or authorized person

|

|

__Y__/__M__ /__D__ |

|

|

|

|

|

|

|

|

|

|

GST/HST Memoranda Series |

Chapter 3, Tax on Supplies: Drop Shipments |

|

|

80 |

September 2007 |

|

Form Characteristics

| Fact Name | Detail |

|---|---|

| Definition | The Drop Shipment Certificate is used to document transactions involving the sale and movement of goods from a seller to a buyer via a third party. |

| Legal Reference | This certificate is governed by subsection 179(2) of the Excise Tax Act. |

| Parties Involved | The form requires information from two primary parties: the registrant who sells the goods and the consignee who receives them. |

| Goods Description | Users must provide a detailed description of the drop-shipped goods to ensure clear identification. |

| Scope of Certificate | The certificate allows the consignee to specify whether the transaction is for a single shipment, multiple shipments, or ongoing shipments. |

| Tax Implications | The consignee may need to self-assess tax for certain scenarios regarding the importation and use of goods. |

| Certification Requirement | The form must be completed and signed by the consignee or an authorized representative, certifying that the information is accurate. |

| Regulatory Guidance | Guidance can be found in the GST/HST Memoranda Series Chapter 3, Tax on Supplies: Drop Shipments, issued in September 2007. |

Guidelines on Utilizing Drop Shipment Certificate

Once you obtain the Drop Shipment Certificate form, follow these steps to complete it accurately. This form captures important details required for processing drop shipments under specific tax regulations.

- Registrant's Legal Name: Fill in the legal name of the registrant to whom the drop shipment certificate is issued.

- Registered Consignee's Legal Name: Enter the legal name of the registrant who is issuing the drop shipment certificate.

- Business Number: Input the business number of the registered consignee.

- Description of Goods: Provide a detailed description of the drop-shipped goods. If necessary, attach additional sheets to provide sufficient detail.

- Scope of Certificate: Check only one box to indicate the scope of the drop shipment. Choose from options like a single drop shipment, multiple drop shipments, ongoing shipments, or shipments during a specified period.

- Date(s): For the selected scope, fill in the relevant dates (year, month, day) as required.

- Physical Possession Information: Indicate how the registered consignee has or will receive possession of the goods. Check the appropriate box corresponding to the situation.

- Recipient Status: Specify whether the consignee is receiving a taxable supply or acquiring goods for a taxable service. Select the relevant option by checking the appropriate box.

- Certification: Sign and date the form. Make sure to print your name and state whether you are the consignee or authorized to sign on their behalf.

What You Should Know About This Form

What is a Drop Shipment Certificate?

A Drop Shipment Certificate is a form used to document the details of goods that are shipped directly from a supplier to a customer. This certificate helps facilitate tax compliance under the Excise Tax Act by clearly indicating the terms of the drop shipment arrangement.

Who should issue the Drop Shipment Certificate?

The registered consignee, who is receiving the goods, must issue the Drop Shipment Certificate. This party must have a legal name and business number registered in Canada to ensure proper reporting and compliance.

What information is required on the form?

The form must include the legal names of both the registrant and the registered consignee, a description of the drop-shipped goods, the scope of the certificate, and proper certification by the consignee. If more space is needed for the description, an additional sheet may be attached.

How do I specify the scope of the Drop Shipment Certificate?

To specify the scope, you must check one box that indicates whether the drop shipment is for a single event, multiple events, ongoing shipments, or a specified period. Accurate selection is crucial for proper tax treatment.

What is the significance of the drop shipment receiver’s certification?

By signing the certificate, the consignee certifies that all information is true and complete. This certification is critical as it establishes responsibility for tax compliance and confirms the legitimacy of the drop shipment transaction.

What are the tax implications for the consignee?

If the consignee receives goods for consumption in their commercial activities and is not a registered person, they may need to self-assess tax on the imported goods. Additionally, if the consignee transfers the goods to another person in Canada, tax collection obligations may arise unless certain exemptions apply.

When is the Drop Shipment Certificate required?

This certificate is required anytime goods are shipped directly from the supplier to the end customer, particularly when there are tax implications associated with the transaction. Timely submission of the certificate helps ensure compliance with relevant tax laws.

What should I do if I need more space on the form?

If the provided space on the Drop Shipment Certificate is insufficient for detailing the goods, you may attach a separate sheet with the additional information. Ensure that all attached documents follow the same format and are clearly labeled.

Common mistakes

Filling out the Drop Shipment Certificate form can seem straightforward, but many people make common mistakes that can lead to issues down the line. Understanding these pitfalls can save time and avoid complications. Here are ten mistakes to look out for when completing this important document.

First, forgetting to include the legal name of both the registrant and the registered consignee is a frequent oversight. Failing to provide this information can result in the certificate being invalid. Each party's legal name must be specified clearly, ensuring that all parties are accurately identified.

Another common error is a lack of detail when describing the drop-shipped goods. Providing too vague a description can cause confusion. It’s crucial to include enough specifics so that anyone reviewing the form can easily identify the items involved. If you need more space, attach a separate sheet rather than cram the information into the available area.

People often miss the section about the scope of the certificate. Selecting multiple boxes instead of just one leads to uncertainty about the nature of the drop shipment. Make sure to carefully check the appropriate option to avoid providing conflicting information.

Incorrectly completing the dates can also create problems. Some individuals overlook the importance of formatting the date correctly. Ensure that the year, month, and day are filled in accurately to avoid any potential misunderstandings regarding the timeline of the shipments.

Another misstep occurs in the section regarding the supply method. Some users fail to check the box that corresponds to how the goods are supplied. This omission can raise compliance questions later. It’s vital to ensure that the correct choice is marked clearly, reflecting the actual transaction details.

People sometimes forget the requirement to self-assess tax or provide clarity on tax obligations. If the consignee is acquiring goods that won’t be used exclusively for commercial activities, this makes proper tax identification crucial. Not addressing this requirement can lead to compliance issues with tax regulations.

Additionally, individuals may neglect to verify the signature of the consignee or the authorized person. An unsigned form is not valid and can jeopardize the entire transaction. Always make sure the form is signed before submission.

Omitting the date of certification is another common mistake. The date is an important part of the legal validity of the form. A missing date can render the certificate ineffective and could lead to disputes about when the information was provided.

Some individuals provide inaccurate contact information or fail to include any contact details at all. This makes it difficult for tax authorities or other involved parties to clarify any potential issues that arise later on. Providing clear and accurate contact information is essential for smooth communication.

Lastly, not retaining a copy of the completed form can lead to difficulties if any questions arise after submission. Keeping a copy for personal records is a simple but important practice that can save hassle in the future.

By being mindful of these common mistakes, individuals can ensure that their Drop Shipment Certificate forms are filled out correctly. This attention to detail not only helps in complying with regulatory requirements but also streamlines business operations.

Documents used along the form

When dealing with drop shipments, several documents complement the Drop Shipment Certificate form. Understanding these documents can help streamline the process and ensure compliance with applicable regulations. Below is a list of essential forms often used in conjunction with the Drop Shipment Certificate.

- Sales Invoice - This document outlines the transaction details between the seller and the buyer. It includes information such as item descriptions, quantities, prices, and payment terms. The sales invoice serves as proof of sale and helps both parties keep accurate records.

- Packing List - A packing list details the contents of a shipment. It includes item descriptions, quantities, and sometimes weights and dimensions. This document allows the receiver to verify if they received everything as expected.

- Purchase Order - The purchase order is issued by a buyer to the seller, indicating their intent to buy goods at specified prices and terms. It helps to formalize the order and serves as a reference for both parties throughout the transaction.

- Bill of Lading - A bill of lading is a legal document between the shipper and carrier, outlining the shipment's details. It serves as a receipt of goods delivered and can provide proof of contract terms regarding shipping and handling.

- Customs Declaration - This document is required for international shipments. It provides details about the goods being shipped, including their value and purpose. Customs declarations help ensure proper assessment of duties and taxes by customs officials.

- Tax Exemption Certificate - This certificate is used to claim an exemption from sales tax for qualifying transactions. It is important for businesses looking to avoid paying tax on purchases that are tax-exempt under specific conditions.

- Returns Authorization - This document permits a customer to return goods and often includes instructions for returning the items. A returns authorization helps maintain organized record-keeping for returns and refunds between sellers and customers.

These documents collectively support the drop shipment process, ensuring transparency and compliance. Make sure to prepare all relevant paperwork carefully, as having these documents can prevent issues and clarify responsibilities in transactions.

Similar forms

- Certificate of Origin: This document certifies the country where the goods were manufactured, similar to how the Drop Shipment Certificate verifies the details and flow of goods between parties.

- Bill of Lading: Like the Drop Shipment Certificate, a Bill of Lading acknowledges the receipt of goods and outlines the terms of transport, establishing the responsibility for the shipment.

- Commercial Invoice: This document itemizes the goods sold. It fulfills a role similar to the Drop Shipment Certificate by outlining details such as product descriptions, quantities, and prices, helping to clarify the transaction between parties.

- Purchase Order: A Purchase Order serves as an official request for goods, just like the Drop Shipment Certificate seeks to confirm details about the shipment of goods from the registrant to the consignee.

- Sales Tax Exemption Certificate: This certificate allows purchasers to claim exemption from sales tax. Similar to the Drop Shipment Certificate, it specifies tax responsibilities and obligations regarding the supply of goods.

- Import/Export Declaration: This document provides a detailed account of goods being imported or exported. It shares similarities with the Drop Shipment Certificate by ensuring compliance and tracking of the goods passing into or out of a country.

- Affidavit of Compliance: This affidavit confirms that goods comply with all relevant regulations and laws. Much like the Drop Shipment Certificate, it reinforces accountability for the shipment process and the accuracy of reported information.

Dos and Don'ts

When filling out the Drop Shipment Certificate form, attention to detail is crucial. Here are five guidelines to follow to ensure accuracy and compliance.

- Do use the correct legal names of the registrant and registered consignee.

- Do provide a thorough description of the drop-shipped goods to eliminate confusion.

- Do specify the correct scope of the certificate by checking only one box.

- Do ensure all required boxes are completed as missing information can result in delays.

- Do review the certification statement carefully before signing to guarantee authenticity.

- Don't leave any sections blank unless otherwise indicated; incomplete forms can be automatically rejected.

- Don't use ambiguous descriptions; clarity helps facilitate smoother processing of the document.

- Don't check more than one scope box; this can lead to misunderstandings regarding your intention.

- Don't forget to include the date of signature, as this is essential for validation.

- Don't hesitate to consult additional resources if uncertain about any part of the form.

Misconceptions

- Misconception 1: The Drop Shipment Certificate only applies to physical goods.

- Misconception 2: Issuing the Drop Shipment Certificate absolves tax responsibilities.

- Misconception 3: The Drop Shipment Certificate can be used without proper documentation.

- Misconception 4: All drop shipments require a new certificate.

Many believe that this certificate is only relevant for tangible products. However, it also relates to certain services that involve drop shipments. Manufacturers and service providers can utilize this form when dealing with non-residents, broadening its applicability.

Some think that completing this certificate means they do not have to worry about taxes. This isn't true. Tax obligations remain in place, and the consignee may need to self-assess tax for imported taxable supplies, depending on specific circumstances.

It's a common belief that the certificate can be filled out without supporting documentation. In reality, it requires detailed descriptions of the goods, and any necessary extra information must be attached. Proper documentation is essential for compliance.

Many assume that every drop shipment transaction needs a fresh certificate. However, ongoing drop shipments can use a single certificate for multiple transactions, as long as all details are clearly indicated and comply with the requirements outlined in the form.

Key takeaways

Filling out and using the Drop Shipment Certificate form can be crucial for ensuring compliance and proper tax handling. The following key takeaways highlight important aspects to keep in mind:

- The certificate must be completed accurately with the legal names of both the registrant and registered consignee to avoid issues.

- Detailed descriptions of the drop-shipped goods are essential. Providing clear information helps verify the type of goods being shipped.

- Only one box should be checked under the scope of the certificate section. Options include multiple shipments, ongoing deliveries, or a specific period for drop shipments.

- When indicating possession of the goods, ensure to select the correct status regarding the supply made by the registrant and the nature of the consignee's acquisition.

- If the consignee is a recipient of a taxable supply, they must be mindful of their obligation to self-assess tax if the goods are not for exclusive commercial use.

- For passenger vehicles being acquired for capital use, specific tax implications must be fulfilled, particularly if the vehicle's cost exceeds a certain threshold.

- In cases where the consignee handles goods that should be taxed, they may need to collect tax based on their role in transferring physical possession of the goods.

- The certification section of the form demands an accurate declaration of truthfulness, confirming that the signer has the authority to represent the consignee.

- Signatures must be dated properly to maintain accurate records and ensure validity.

Browse Other Templates

Kybella Consent Form - A series of Kybella® treatments may be needed for the best results.

Starrett City Application - The first month’s rent is also due when you sign the lease agreement.