Fill Out Your Dscb 15 134A Form

The DSCB 15 134A form, known as the Docketing Statement for New Entities, is an essential document for businesses looking to establish themselves in Pennsylvania. This form serves multiple purposes and facilitates the registration process for both domestic and foreign entities. When filling it out, you'll need to provide important details such as the entity name, and if applicable, an alternate name for foreign associations. Additionally, it requires the name and mailing address of the individual responsible for initial tax reports. You will also need to describe your business activity briefly. An Employer Identification Number (FEIN) is another crucial element, as it helps confirm proper account matching with state agencies. If you don’t already have an FEIN, you can obtain one quickly by applying online. Lastly, the form asks for the tax year end date, which can be either the last day of a calendar month or a specific date you choose for your fiscal year. Gathering this information beforehand can help streamline your application process and ensure you meet all state requirements efficiently.

Dscb 15 134A Example

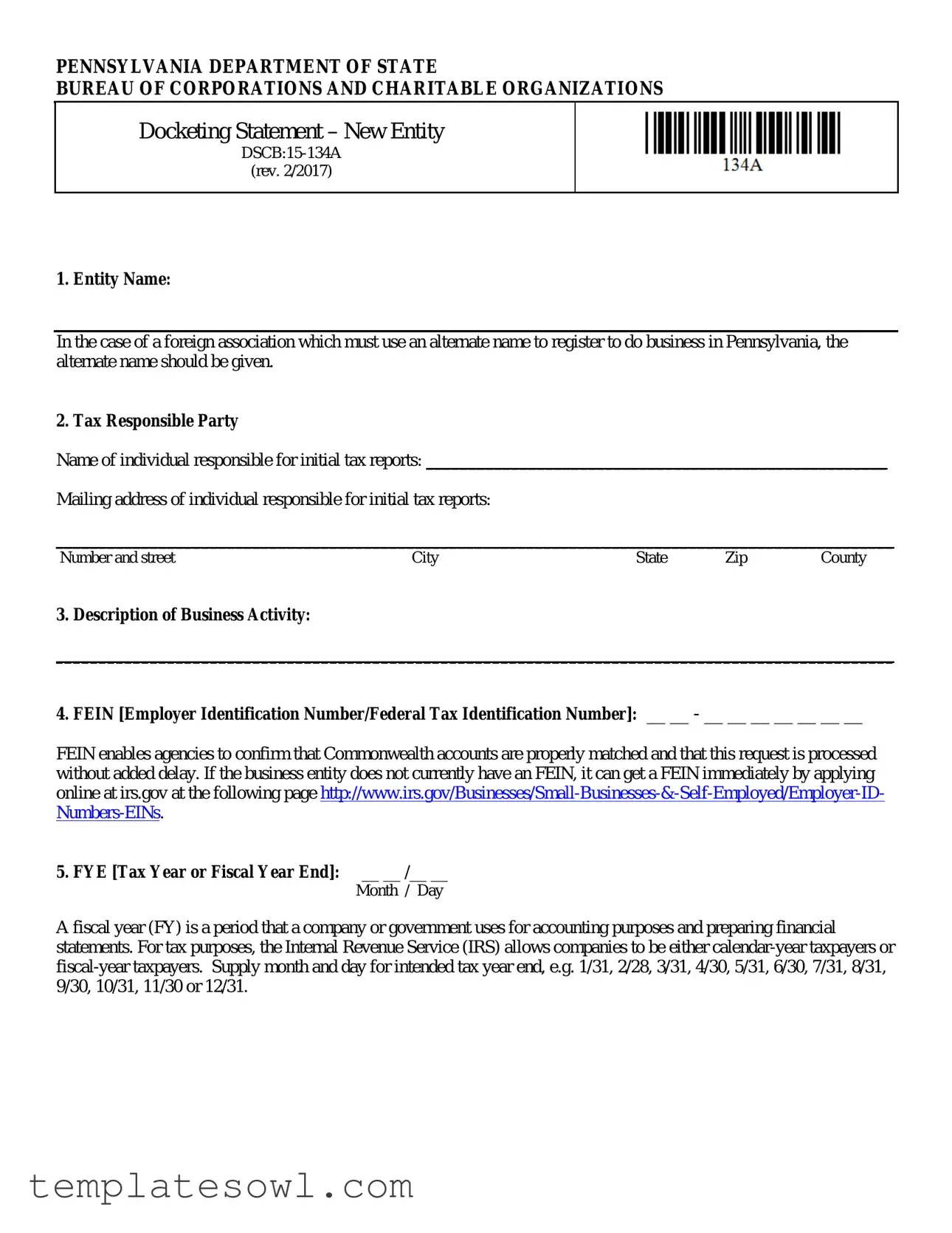

PENNSYLVANIA DEPARTMENT OF STATE

BUREAU OF CORPORATIONS AND CHARITABLE ORGANIZATIONS

Docketing Statement – New Entity

(rev. 2/2017)

1. Entity Name:

In the case of a foreign association which must use an alternate name to register to do business in Pennsylvania, the alternate name should be given.

2. Tax Responsible Party

Name of individual responsible for initial tax reports: ______________________________________________________

Mailing address of individual responsible for initial tax reports:

__________________________________________________________________________________________________

Number and street |

City |

State |

Zip |

County |

3.Description of Business Activity:

__________________________________________________________________________________________________

4.FEIN [Employer Identification Number/Federal Tax Identification Number]: __ __ - __ __ __ __ __ __ __

FEIN enables agencies to confirm that Commonwealth accounts are properly matched and that this request is processed without added delay. If the business entity does not currently have an FEIN, it can get a FEIN immediately by applying online at irs.gov at the following page

5.FYE [Tax Year or Fiscal Year End]: __ __ /__ __

Month / Day

A fiscal year (FY) is a period that a company or government uses for accounting purposes and preparing financial statements. For tax purposes, the Internal Revenue Service (IRS) allows companies to be either

Form Characteristics

| Fact Name | Description |

|---|---|

| Entity Name Requirement | Foreign associations must provide an alternate name when registering to do business in Pennsylvania. |

| Tax Responsible Party | The form requires the name and mailing address of the individual responsible for initial tax reports. |

| Business Activity Description | Applicants must outline the business activity on the form. |

| Employer Identification Number | The form requests the FEIN, which helps confirm identities and process requests efficiently. |

| How to Obtain FEIN | If entities do not have an FEIN, they can apply for one online at the IRS website. |

| Fiscal Year End | Entities must indicate their fiscal year end date, which can either be the last day of any month or December 31. |

| Governing Law | This form is governed by the Pennsylvania Business Corporation Law and other relevant statutes. |

| Version Information | The current version of the form, DSCB:15-134A, has been revised as of February 2017. |

| Importance of Accurate Information | Providing precise details is crucial to ensure that the business's request is processed without delays. |

Guidelines on Utilizing Dscb 15 134A

Filling out the DSCB 15-134A form requires careful attention to detail. Once you have completed the form, it will need to be submitted to the Pennsylvania Department of State as part of the registration process for your new business entity. Ensuring accuracy in this form is essential as it facilitates proper processing and compliance with state regulations.

- Entity Name: Enter the legal name of your business. If you're a foreign association, provide the alternate name used for registration in Pennsylvania.

- Tax Responsible Party: Fill in the name of the individual responsible for initial tax reports. This person should be knowledgeable about the tax obligations of your business.

- Address: Write the mailing address for the tax responsible party. Include the number and street, city, state, zip code, and county.

- Description of Business Activity: Provide a clear, concise description of what your business will do. This helps to categorize your entity within state records.

- FEIN: Enter your Employer Identification Number (EIN). If you don’t have one, you can apply for it online at the IRS website.

- FYE: Indicate your Tax Year or Fiscal Year End by entering the month and day. Choose from acceptable ending dates (e.g., 1/31, 2/28, etc.).

What You Should Know About This Form

What is the DSCB 15-134A form?

The DSCB 15-134A form, also known as the Docketing Statement for New Entities, is a document required by the Pennsylvania Department of State Bureau of Corporations and Charitable Organizations. This form is primarily for businesses or associations wishing to register to do business in Pennsylvania. It collects essential information such as the entity's name, mailing address, tax responsible party, a description of business activities, and other pertinent details needed for successful registration.

Who needs to fill out the DSCB 15-134A form?

This form must be completed by any new entity, whether domestic or foreign, looking to conduct business in Pennsylvania. Foreign entities, in particular, need to provide an alternate name they intend to use within the state if their original name is already in use. It is important for all business owners to ensure that they accurately complete this form to avoid delays in the registration process.

What information is required on the form?

The form requires several key pieces of information. You will need to provide the entity name, name and mailing address of the individual responsible for the entity’s initial tax reports, a brief description of the business activities, and the Employer Identification Number (FEIN), if available. Additionally, you must indicate your Tax Year or Fiscal Year End date. This information is critical for the state to process your request and ensure compliance with local laws.

How can I obtain an FEIN?

If your business does not already have an Employer Identification Number (FEIN), you can apply for one online through the IRS website. The application process is straightforward and typically provides you with your FEIN almost immediately. It is highly recommended to obtain this number prior to filling out the DSCB 15-134A form to ensure that all necessary information is available during the registration process.

What does FYE refer to on the form?

FYE stands for Fiscal Year End, which is the date that marks the end of a financial reporting period for a business. You can choose either a calendar year or a different fiscal year for tax purposes. It is critical to correctly indicate the month and day of your intended tax year end, as this will impact your tax filings and financial reporting throughout the year.

Where can I submit the completed DSCB 15-134A form?

You can submit the completed DSCB 15-134A form to the Pennsylvania Department of State Bureau of Corporations and Charitable Organizations. This can generally be done by mail or online, depending on the specific instructions provided on the form or the website. Ensure to keep a copy of your submission for your records and follow up if you do not receive confirmation of your registration within a reasonable timeframe.

Common mistakes

When completing the DSCB 15 134A form for a new entity in Pennsylvania, even small mistakes can lead to delays or complications. One common error is failing to provide the correct entity name. This is particularly crucial for foreign associations, which need to specify their alternate name for registration. Neglecting this step can result in rejection of the application or require additional steps to correct the information later.

Another frequent pitfall involves the Tax Responsible Party section. Applicants often omit vital information, such as the mailing address or name of the individual who will handle initial tax reports. Be thorough in providing all required details. Incomplete submissions can create unnecessary delays, as state officials may need to reach out for clarification.

The third mistake arises in the Description of Business Activity section. Many people write vague or overly general descriptions, making it difficult for the reviewing party to understand the business's purpose. A clear and concise explanation enhances the application’s credibility and can help expedite the review process.

Many applicants struggle with the FEIN field as well. Some may submit the form without an Employer Identification Number, which essential for tax processing and compliance. Ensure that you have this number handy, or remember that it can be applied for online through the IRS website. Missing this step will only delay your registration.

When it comes to specifying your FYE or Fiscal Year End, there’s a tendency to provide an incorrect date format. The IRS recognizes specific month and day formats, and straying from these can complicate your filing status. Precision in entering these details results in a smoother processing experience.

Some individuals also overlook the importance of checking for typos and other clerical errors before submitting the form. A simple misspelling or incorrect number can derail the submission process entirely. Always take a moment to review your entries before hitting "submit."

Another frequently made error is waiting too long to submit the completed form. Timeliness is key in registration, and delays can affect your business operations. Gather all necessary information and complete the application promptly to avoid unnecessary setbacks.

A lack of understanding regarding the requirements for foreign entities can lead to confusion. Some applicants mistake Pennsylvania's requirements for those of their home state. Familiarity with local regulations ensures you don't miss any crucial steps, fostering a seamless registration process.

Providing incorrect contact information in case officials need to reach you is another setback many face. Make certain that the contact details are accurate and easily accessible, so any questions can be addressed quickly, streamlining communication with state officials.

Lastly, failing to keep copies of the submitted form can leave you without documentation of your application. Retaining records can be invaluable if you need to refer back to your submission in the future, providing you a safety net for any potential issues that may arise.

Documents used along the form

When starting a new entity in Pennsylvania, various forms and documents work together to secure your business's legal standing and operational readiness. The DSCB 15-134A form is an essential piece in this puzzle, and it often accompanies several other important forms. Below is a list of documents frequently used alongside the DSCB 15-134A.

- DSCB: 15-134B - This is the Application for Certificate of Incorporation for profit corporations. It provides the necessary information regarding the formation of a for-profit entity, detailing the company's structure and purpose.

- DSCB: 15-134C - Nonprofit organizations need this form to apply for a Certificate of Incorporation. This document outlines the nonprofit's mission and operational guidelines, laying the groundwork for its eligibility for tax-exempt status.

- DSCB: 15-136 - Used for registering a fictitious name. If your business intends to operate under a name different from its registered entity name, this form must be filed to ensure legal protections for your branding.

- IRS Form SS-4 - This application is essential for obtaining an Employer Identification Number (EIN). The EIN is required for tax identification, and this form allows businesses to apply for it directly with the IRS.

- PA-100 - The Pennsylvania Enterprise Registration Form is key for new businesses. It registers the entity for state tax purposes, covering sales tax, employer withholding tax, and other applicable taxes.

- Annual Report - After registration, entities are typically required to file an annual report. This document provides updates on the entity’s financial status, management changes, and any other relevant information mandated by the state.

Understanding these accompanying documents will ensure you’re well-prepared to navigate the business formation process. Each piece plays a significant role in establishing a solid foundation for your new venture in Pennsylvania.

Similar forms

- DSCB:15-134B (Docketing Statement – Foreign Entity): Similar to DSCB 15 134A, this form is used for foreign businesses registering to operate in Pennsylvania. It includes information about the entity, responsible parties, and its business description.

- DSCB:15-134C (Docketing Statement – Domestic Entity): This document serves a similar purpose but is tailored for domestic entities. It collects analogous information, ensuring that all entities, regardless of origin, meet registration requirements.

- IRS Form SS-4 (Application for Employer Identification Number): Like the FEIN section of DSCB 15 134A, this form is necessary for obtaining an Employer Identification Number. Both documents are essential for tax purposes and business identification.

- PA Department of Revenue Form REV-183 (Sales Tax License Application): Similar in its requirement to provide business information, this form collects details about the entity and its business activities, relevant for state sales tax obligations.

- PA Corporation Bureau Form (Articles of Incorporation): This form is foundational for corporate establishment. It shares the same objective of registering a business entity with the state, needing similar identifying information.

- Form 1065 (U.S. Return of Partnership Income): This tax form allows partnerships to report income—a parallel to the DSCB 15 134A's requirement for the FEIN to facilitate taxation and reporting.

- Form 990 (Return of Organization Exempt from Income Tax): Charitable organizations use this form to report financial information. Both forms include descriptions of activities and responsible parties but cater to different entity types.

- State Business License Application: In various states, this form gathers the essential information to license a business. Similarly to DSCB 15 134A, it demands details about the business and its operations.

- Professional Licensing Applications: Licenses for professions like medicine or law require extensive information about the applicant and their business practice, similar to the general information requirements in DSCB 15 134A.

- DBA Registration (Doing Business As): When a business operates under a name other than its legal name, this registration is required. The comparison lies in gathering identifying information about the business and its operations.

Dos and Don'ts

When completing the DSCB:15-134A form for a new entity in Pennsylvania, consider the following important guidelines:

- Do ensure that the entity name is clearly stated, including any alternate name for foreign associations.

- Do provide accurate information for the individual responsible for initial tax reports, including their mailing address.

- Do offer a thorough description of the business activity to avoid confusion.

- Do input the correct FEIN, which is essential for processing your request smoothly.

- Don't forget to specify your tax year end date; leaving it blank can cause delays.

- Don't provide incorrect or incomplete details, as this may result in the rejection of your application.

Misconceptions

When it comes to the DSCB 15-134A form used in Pennsylvania, several misconceptions can lead to confusion and potential issues in the registration process for new entities. Understanding the truth behind these misunderstandings can ensure that businesses set the right foundation. Here are seven common misconceptions:

- The form is only for certain types of entities. Many people believe that this form is exclusively for corporations. In reality, any new business entity planning to operate in Pennsylvania, regardless of its structure, must use this form.

- You don't need an FEIN if you're a sole proprietor. Some individuals think that sole proprietors can skip the Federal Employer Identification Number (FEIN) requirements. However, obtaining an FEIN is vital, even for sole proprietors, especially for tax reporting purposes.

- The entity name must be the same as the owner's name. There’s a common belief that the business name should mirror the owner’s personal name. In fact, businesses can operate under a different name, provided they register it appropriately.

- You can use any address on the form. Some mistakenly believe that any address can be provided for the tax responsible party. However, it must be a valid mailing address to ensure the receipt of important documentation from the state.

- Fiscal year options are not flexible. Many think they must follow a calendar year for tax purposes. On the contrary, businesses can choose a fiscal year end that suits their accounting practices best.

- The form is too complicated. While it may seem complex, most of the information requested is straightforward. With the guidance provided by the form's instructions, completing it is manageable for most users.

- You can’t get assistance with the form. Some assume they must complete the form without help. Fortunately, resources are available, including online guides and local business assistance programs to answer questions and offer support.

Clearing up these misconceptions can pave the way for a smoother registration process. Each business starts with a commitment to understanding its obligations, and the right information leads to success.

Key takeaways

Here are some key takeaways about filling out and using the DSCB 15 134A form:

- The form is used for registering new entities in Pennsylvania.

- Provide the entity name, including any alternate name for foreign associations.

- List the name and mailing address of the individual responsible for initial tax reports.

- Clearly describe the business activity the entity intends to engage in.

- An Employer Identification Number (FEIN) is required for processing. If you don’t have one, apply online at the IRS website.

- Fill in the Fiscal Year End (FYE) date accurately. This indicates your accounting period.

- Choose either a calendar year or a fiscal year for tax purposes based on your business needs.

- Ensure you double-check all entries for accuracy to avoid processing delays.

- The form may be downloaded from the Pennsylvania Department of State website for convenience.

- Keep a copy of the completed form for your records after submission.

Browse Other Templates

Patient Health Record Release Authorization,Authorization Form for Health Information Disclosure,Consent to Release Dental Records,Release of Health Information Agreement,Patient Consent for Record Sharing,Health Records Disclosure Authorization,Pati - Patients' rights to their health information are reinforced through this authorization.

What Is a Disclosure Statement - Buyers are encouraged to request their own inspections in addition to reviewing this disclosure.

Motion for Entry of Default Judgment - The application form serves as the basis for legal enforcement of the judgment.