Fill Out Your Dtb Account Opening Form

The DTB Account Opening Form represents a key first step for individuals and organizations looking to establish a banking relationship with Diamond Trust Bank. It opts for a comprehensive approach, accommodating various account types, including current accounts, fixed deposits, and call deposit accounts. Each applicant must specify their legal status, whether they are a sole proprietor, limited company, partnership, or other types of entity, and provide fundamental details about their business. Essential information includes the company name, date of incorporation, and contact details. The form also requests information about directors, trustees, or proprietors, ensuring all necessary parties are identified for the banking relationship. Additionally, applicants are guided to select preferred account facilities, such as cheque books and account statement frequencies, enhancing the banking experience. Attachments required to validate the application ensure that the information provided is trustworthy, maintaining a high standard of compliance. Understanding these aspects can turn a daunting process into a streamlined experience, ultimately leading to an efficient account setup that meets the applicant's needs.

Dtb Account Opening Example

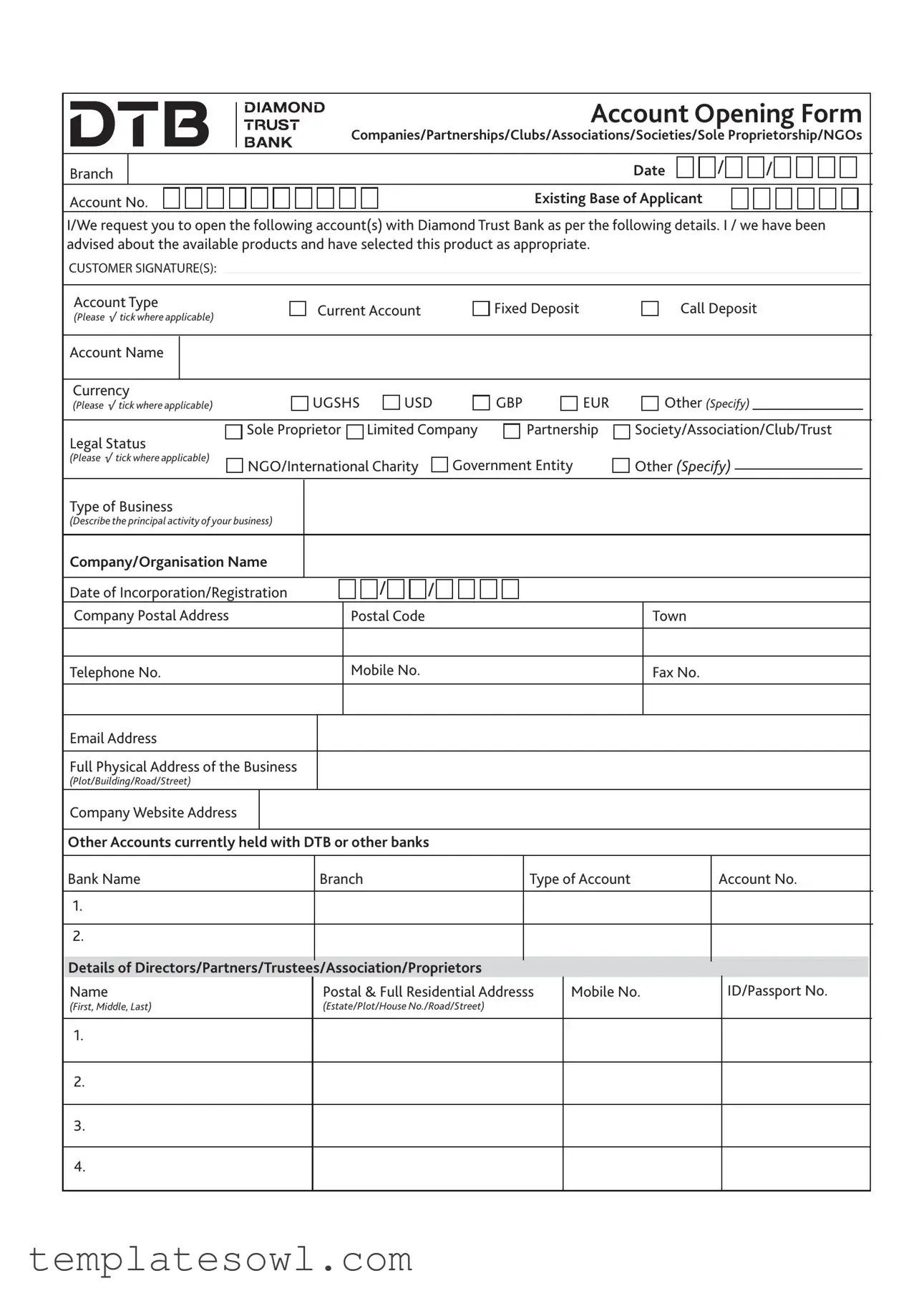

Account Opening Form

Companies/Partnerships/Clubs/Associations/Societies/Sole Proprietorship/NGOs

Branch

Account No.

Date

/

/

/

/

Existing Base of Applicant

I/We request you to open the following account(s) with Diamond Trust Bank as per the following details. I / we have been advised about the available products and have selected this product as appropriate.

CUSTOMER SIGNATURE(S):

Account Type

(Please √ tick where applicable)

Current Account

Fixed Deposit

Call Deposit

Account Name

Currency |

UGSHS |

USD |

GBP |

EUR |

Other (Specify) |

||

(Please √ tick where applicable) |

|||||||

|

|

|

|

|

|

|

|

Legal Status |

Sole Proprietor |

Limited Company |

|

Partnership |

Society/Association/Club/Trust |

||

|

|

|

|

|

|

|

|

(Please √ tick where applicable)

NGO/International Charity

Government Entity

Other (Specify)

Type of Business

(Describe the principal activity of your business)

Company/Organisation Name

Date of Incorporation/Registration |

/ |

/ |

Company Postal Address |

Postal Code |

Town |

Telephone No.

Mobile No.

Fax No.

Email Address

Full Physical Address of the Business

(Plot/Building/Road/Street)

Company Website Address

Other Accounts currently held with DTB or other banks

|

Bank Name |

Branch |

Type of Account |

Account No. |

|||

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Details of Directors/Partners/Trustees/Association/Proprietors |

|

|

|

|

|

|

|

Name |

Postal & Full Residential Addresss |

Mobile No. |

|

ID/Passport No. |

|

|

|

(First, Middle, Last) |

(Estate/Plot/House No./Road/Street) |

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

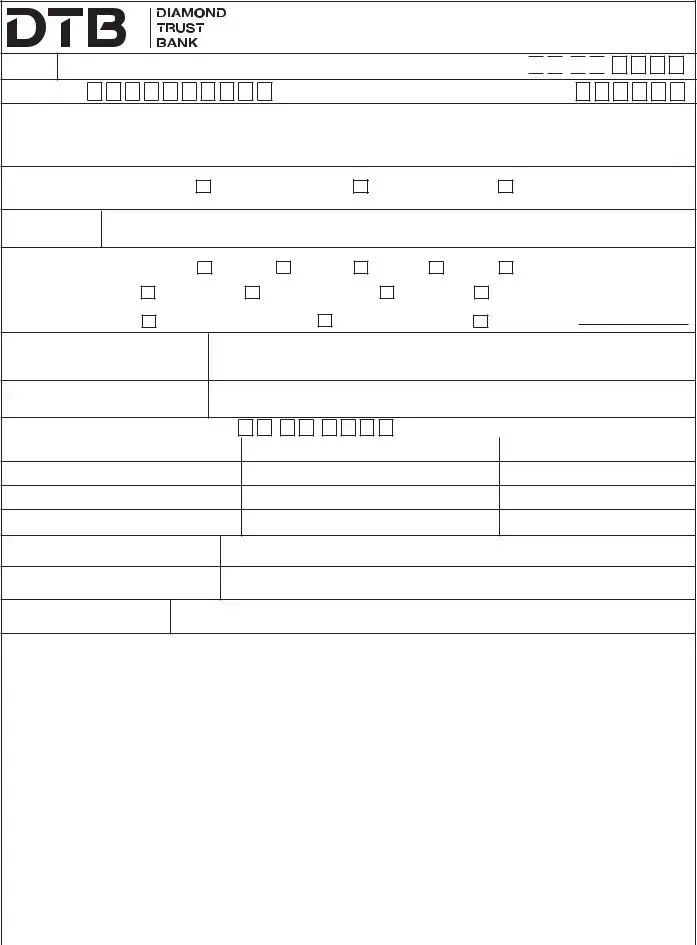

Account Facilities (Tick √ where applicable)

Check Book |

Third Party Operation (Please sign separate Authorised Agent Mandate Form) |

||

For my/our current account I authorize Diamond Trust Bank to issue me/us |

|

cheque book(s) and debit my/our |

|

|

|||

account with the relevant charges (Where applicable) |

|

|

|

25 Leaf Cheque Book |

50 leaf Cheque Book |

100 Leaf Cheque Book |

|

Cheque Book to be collected form

Correspondence sent to:

Postal Address

Hold Mail (for collection)

Statements

Frequency:

Monthly

Quarterly

Half Yearly

Other

By:

Postal Address

Hold Mail (for collection)

Introducer |

|

|

Name |

|

|

(First, Middle, Last) |

|

|

Full Physical Addres |

|

|

(Plot/Building/Road/Street) |

|

|

DTB Bank A/C No. |

|

|

Telephone |

Office |

Mobile |

Certificate By Introducer

I would like to introduce the above account applicant to open and maintain an account with you. I have known him/her

for years and the physical location and address indicated herein is correct. I also confirm that I consider the new account holder suitable to operate an account with you.

Date |

|

Signature |

|

Signature verified by |

|

|

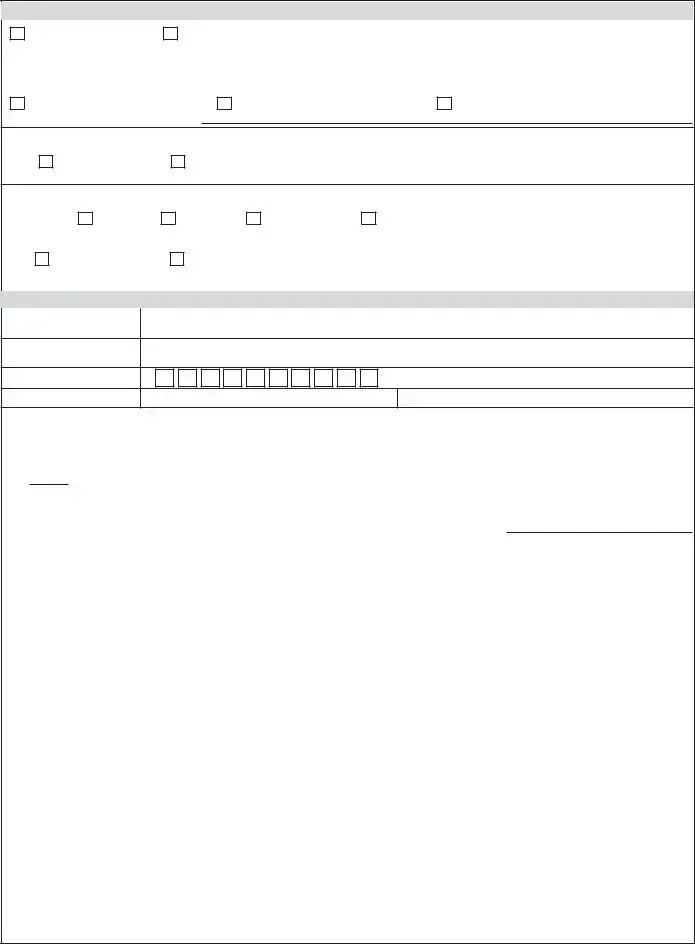

SIGNATURE & MANDATE FORM

Account Mandate: Signing Instructions (Please tick √ where applicable)

Signly |

|

Jointly |

|

Either or Survivor |

|

Other (specify below) |

Other Signing instructions:

I/we have read and understood the conditions necessary to open and run an Account with DTB and I/we oblige to comply. I/we agree that this account shall be opened solely as the discretion of DTB Uganda and hereby agree to indemnity DTB Uganda at my/our cost against claims arising out of the account being closed by DTB Uganda upon issuance of 30 days notice due to unsatisfactory performance.

Furthermore I/we accept that the operations of the account will be subject to the General Terms and Conditions as published from time to time signed by me/us and confirm that all given information on this form is true and correct.

1st Signatory |

|

2nd Signatory |

|

||||||||||

Name: |

|

|

|

Name: |

|

|

|

||||||

|

|

|

|

|

|

|

|

||||||

Designation/Title: |

|

|

Designation/Title: |

|

|

||||||||

|

|

|

|

||||||||||

ID/Passport No: |

|

|

|

ID/Passport No: |

|

|

|

||||||

|

|

|

|

|

|

||||||||

Telephone: |

|

|

|

|

Telephone: |

|

|

|

|

||||

|

|

Signature |

|

|

|||||||||

|

|

|

|

|

Signature |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

/

/

Date:

/

/

1 coloured passport photograph here |

1 coloured passport photograph here |

||||

|

|

|

|

|

|

|

|

|

|

|

|

3rd Signatory |

|

4th Signatory |

|

||||||||||

Name: |

|

|

|

Name: |

|

|

|

||||||

|

|

|

|

|

|

|

|

||||||

Designation/Title: |

|

|

Designation/Title: |

|

|

||||||||

|

|

|

|

||||||||||

ID/Passport No: |

|

|

|

ID/Passport No: |

|

|

|

||||||

|

|

|

|

|

|

||||||||

Telephone: |

|

|

|

|

Telephone: |

|

|

|

|

||||

|

|

Signature |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

|

|

/ |

|

|

|

/ |

|

|

|

|

|

|

|

|

Date: |

|

|

|

|

/ |

|

|

|

/ |

|

|

|

|

|

|

|

|

|

1 coloured passport photograph here |

1 coloured passport photograph here |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

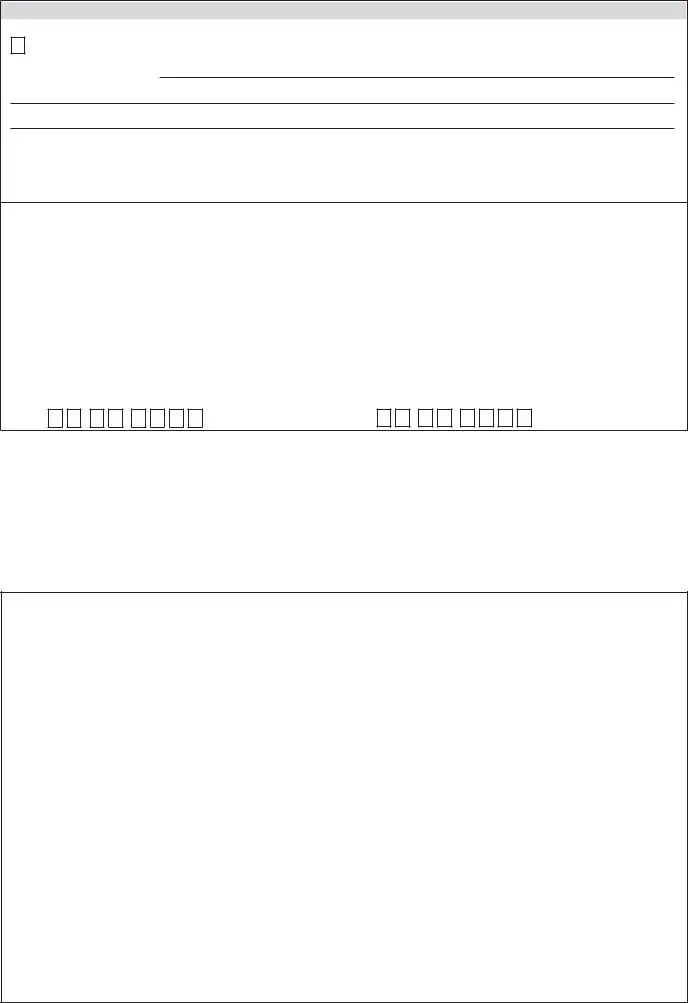

DOCUMENTS REQUIRED (Please provide copies of these documents certified by Registrar of Companies or Branch Official)

Introduction/Reference |

One Passport photograph of all authorised |

|

|

||

|

signatories |

|

|

|

|

ID/Passport copy of all authorized signatories |

Memorandum & Articles of Association of |

|

|

Letter from Auditor/Co. Secretary certifying names of existing |

Copy of Certificate of Incorporation/Business |

||

directors or certified copy of the latest returns |

Registration |

||

|

|

||

Copy of PIN card of Company or Organisation |

Board Resolution/Extracts of committee meeting |

||

|

|

|

signed by Chairman and Secretary |

|

|

|

|

Confirmation |

of Address of each Signatory & Directors/ |

Confirmation of address of the Business |

|

Partners / Trustees / Proprietors (Utility |

bill in name |

(Utility bill/Trading Licence/Tenancy Agreement) |

|

of individual |

or Comopany letter stating |

the residential |

|

addresses and telephone numbers of the individuals)

Latest Annual Return on Particulars or Directors and

Latest Annual Return on Particulars or Directors and

Secretary

FOR BANK USE ONLY

Customer Information Checklist |

|

|

Initials |

|

|

|

Initials |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Valid Identification Documents obtained and |

|

|

|

|

Signatures scanned |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

authenticated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

Photographs obtained |

|

|

|

|

Interviewed/Confirmed by |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

Reference verified & Black listed list checked |

|

|

|

|

Verified |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Mandated signatures obtained |

|

|

|

|

Manager’s Approval |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer contact information available |

|

|

|

|

Exeptions (Given reasons) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cheque Book Ordered |

|

|

|

|

Exeptions approved by |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Risk profile allocated |

|

|

Grade |

|

Approved by |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Account introduced by |

|

|

|

|

Authorised by |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

||

Account No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account Opened by |

|

Name |

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Approved by |

|

Name |

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial deposit received: |

|

|

Cash |

Cheque |

Transfer Amount |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional Comments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIMITED COMPANY ACCOUNT

Company Account Mandate: |

|

|

|

|

|

|

|

|

|

|

||

We wish to inform you that at a meeting of the Directors of |

|

|

|

|

|

Limited |

||||||

|

|

|

|

|

|

|

|

(Insert company name) |

|

|

|

|

held at |

|

|

|

on the |

|

|

day of |

|

20 |

|

|

|

|

|

|

|

|

|

|

||||||

It was resolved: “That a banking account(s) for |

|

|

|

|

|

|

Limited |

|||||

|

(Insert company name) |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|||

be opened at the |

|

|

Branch of DIAMOND TRUST BANK UGANDA LIMITED and that the said bank be |

|||||||||

and hereby authorised and requested to pay all Cheques, Bills of Exchange, Promissory Notes and other negotiable instruments purporting to be signed, made or accepted on behalf of the Company and to debit the same to the account(s) to be kept with them by the said company, whether such account(s) be in credit or otherwise, to hold the Company liable on all endorsements of Cheques, Bills of Exchange, Promissory Notes, and other negotiable instruments, and to bind the Company to all arrange- ments or indemnities in connection with the issue of Letters or Credit, Drafts, Telegraphic Transfers and the usual Banking transactions, provided that the said Cheques, Bills, Promissory Notes or other aforesaid documents are signed by

Note: Fill in here the Official designation of the party or parties signing, and not their names, (Insert any two of the Directors, and countersigned by the Secretary for the time being or otherwise as required).

for the time being of the said Company, that the list of the names and specimen signatures of the present authorised to sign under this resolution be furnished to the said Bank at the said Branch and that they be advised in writing all changes that may take place in the same from time to time, that a copy of this resolution be furnished to the said Bank at the said Bank at the said branch; and that it remain in force until the receipt by the said Bank at the said Branch of a copy of a rescinding the same”.

We hand you herewith:

a)An

b)The Company’s certificate of Incorporation

c)The Company’s Certificate to Commence Business (Public company only)

d)The full list of the present Directors and Secretary with their respective signature

Dated at |

|

|

this |

|

|

|

day of |

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Chairman |

|

|

|

Secretary |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

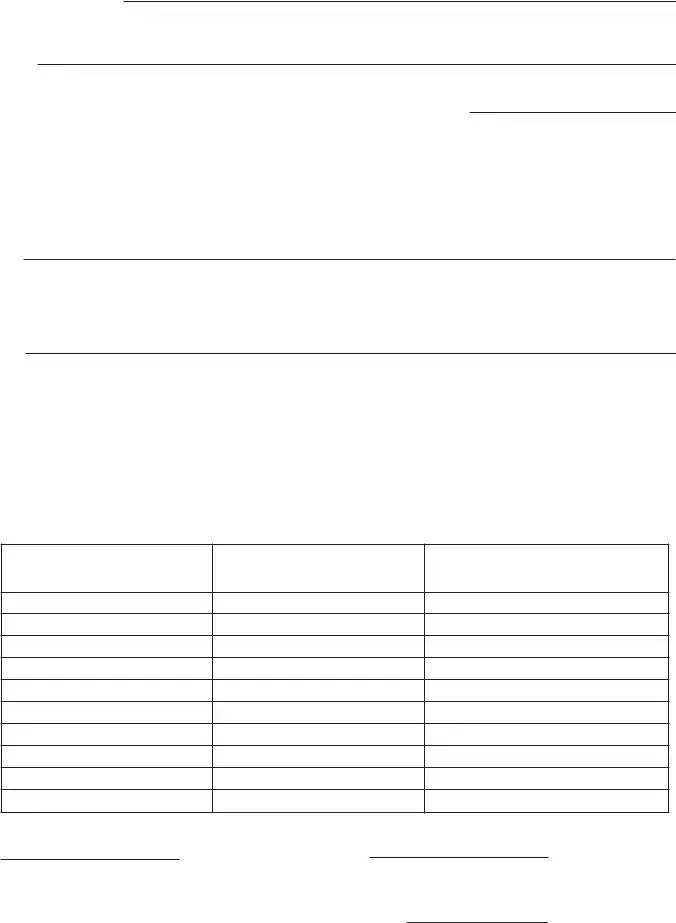

Name of Directors |

|

|

Address |

|

|

Signature |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CERTIFICATE THAT MEMORANDUM AND ARTICLES OF ASSOCIATION ARE AMENDED ANDUP TO DATE We hereby certify that the Memorandum and Articles of Association of

M/S

given by is to DIAMOND TRUST BANK UGANDA LIMITED have been amended up to date. We further undertake that any future amendments to the Memorandum and Articles of Association will be advised to DIAMOND TRUST BANK UGANDA LIMITED within fourteen days of such amendments.

We indemnify DIAMOND TRUST BANK UGANDA LIMITED against any loss, expenses and damages it may sustain through our failure to notify or delay in notifying DIAMOND TRUST BANK UGANDA LIMITED of any alterations or amendment to the Memorandum and Articles of Association

Chairman |

Secretary |

||

Date: |

|

Date: |

|

|

|

||

PARTNERSHIP ACCOUNT

We, the undersigned

Being individual partners trading under the style or firm or

(hereinafter called “the firm”) appoint you our bankers and hereby authorize and request to open an account in the firm’s name to be called the

Account and

1.To honour and comply with all cheques, drafts, bills of exchange, promissory notes, acceptances, negotiable instruments and orders expressed to be drawn accepted made or given by anyone of us in the name of the firm at any time or times whether our banking account is overdrawn or any overdraft is increased by any payment thereof or in relation thereto or is in credit or otherwise be without prejudice to your right to refuse to allow any overdraft or increase of overdraft and for any balance on the said account which may become due to you at any time we agree to be jointly severally liable.

2.To honour and comply with all instructions to deliver or dispose of any securities or documents held by you on our behalf; to hold us liable on all agreements and indemnities in connection with the issue of letters of credit, drafts, telegraphic transfers and with all banking instructions, provided any such cheques, drafts, bills of exchange, promissory notes, acceptances, negotiable instruments, orders, instructions, agreements and indemnities are signed by anyone of us in the name of the firm.

3.To treat all cheques, drafts, bills of exchange promissory notes, acceptances, negotiable instruments and orders as being endorsed on our behalf and to discount or otherwise deal with them provided such endorsement purport to be signed by anyone of us in the name of the firm.

All instructions in connection to this account and in particular, but without limiting the generality of the foregoing, all instructions relating to instruments and securities and the charging pledging disposal and withdrawal thereof are in order if given by anyone of, us in the name of the firm.

Notwithstanding any alteration in the constitution of the firm this authority shall remain in force and in the event of such alterations or of others besides the partners being authorized to sign, due notice in writing will be given to you and such notice will be binding on the partnership if given in the firm’s name by anyone of the signatories hereto.

This authority shall continue in force until anyone of us shall have expressly revoked it by notice in writing delivered to you at the above mentioned branch and it shall not be revoked by the death of any of us.

We produce herewith a certified extract dated |

|

|

from the Registrar of Business names and confirm that |

|||||

|

|

|||||||

no changes in the particulars registered with him have taken place since the date of issue of the extract. |

||||||||

We declare ourselves jointly and severally liable on all foregoing transactions. |

||||||||

(To be signed by all the partners in their personal capacity) |

|

|

|

|

||||

Dated this |

|

day of |

|

|

20 |

|

|

|

|

|

|

|

|||||

Please give the names and address (es) of your present bankers, or two persons from whom we may obtain a reference

Name

Account Number

Signature

CLUB SOCIETY OR ASSOCIATION ACCOUNT

At the meeting of the

(Insert ‘Committee of Management’ or as the case may be)

of the

(Insert name of Club, Society or Association)

Held on the |

|

day of |

It was resolved

1.That the Diamond Trust Bank Uganda Limited Branch be authorised to honour all cheques or other orders for payment drawn upon any account or accounts for the time being kept with the Bank in the name of the Club, Society or Association notwithstanding that any such payment may cause such account or accounts be overdrawn or increase any existing run- ning finance provided they are signed by:

(Insert ‘Chairman and Secretary for the time being or as the case may be)

2.That the Bank be authorised to accept all requests and receipts for the delivery of securities, papers or other property if signed by:

(Insert ‘Chairman and Secretary for the time being or as the case may be)

3.That the Bank be given a list of the names ofthe signing Officers and be advised in writing under the hand of the Secretary of any changes that may take place and the Bank be entitled to act upon the signature so given.

4.That these Resolutions be communicated to the Bank and remain in force until revoked by notice in writing to the Bank signed by the Chairman or the Secretary acting or purporting to act on behalf of the Club, Society or Association and the Bank shall be entitled to act upon such notice.

SPECIMEN SIGNATURES

Name in full (in BLOCK CAPITALS)

Description

e.g. Secretary, Treasurer, Chairman

Signature

Chairman |

Secretary |

Dated: |

|

Dated: |

FOREIGN CURRENCY ACCOUNT AGREEMENT

Date:

The undersigned hereby requests you to establish / open on / in your bank an account in (currency)

(hereinafter called the “Account”) and to credit thereto the amounts of such currency as may from time to time be received by you for Account. In order to establish / open the Account, and at your option, to main- tain it on / in your bank. It is hereby agreed that

1.Withdrawals from the Account shall be made only by your drafts, telegraphic transfers or cash in the currency of the Account at the request of the undersigned in writing or by authenticated cable. Such request may be in the form of a cheque drawn upon you. Any stamp, transmission, or other charges related to withdrawals from the account will be paid by the under- signed upon demand.

2.You shall have no responsible for a liability to the undersigned for any diminution due to taxes or imposts or depreciation in the value of funds credited to the Account (which funds may be deposited by you in your name and subject to your control with such depository(ies) as you may select) or for the unavailability of such funds due to restrictions on convertibility, req- uisitions, involuntary transfers, distraints of any character, exercise of military or usurped powers, or other similar causes beyond your control.

3.You may at any time in your discretion discharge your entire liability with respect to the Account by mailing to the under- signed, at the address set forth below, your draft in the currency of the Account without recourse to you as drawer, payable to the order of the undersigned in the amount of the then credit balance in the account, together with such other docu- ments, if any, as may be necessary, in your sole discretion, to transfer to the undersigned such claim as you may have no such funds

Signature:

Name of the company:

Address:

SOLE PROPRIETORSHIP ACCOUNT

I, the undersigned

Being the Sole Proprietor trading under the style or firm orhereinafter called “the firm”) appoint you our bankers and hereby authorise and request you to peon an account in the firm’s name to be called the

Account and

1.To honour and comply with all cheques, drafts, bills or exchange, promissory notes, acceptances, negotiable instruments and orders expressed to be drawn accepted made or given by me in the name of the firm at any time or times whether my bank account is overdrawn or any overdraft is increased by any payment thereof or in relation thereto or is in credit or otherwise be without prejudice to your right to refuse to allow any overdraft or increase or overdraft and for any balance on the said account which may become due to you at any time I agree to be liable.

2.To honour and comply with all instructions to deliver or dispose of any securities or documents held by you on my behalf, to hold me liable on all agreements and indemnities in connection with the issue of letters of credit, drafts, telegraphic transfers and with all banking instructions.

Provided any such cheques, drafts, bills or exchange, promissory notes, acceptances, negotiable instruments, orders, instructions, agreements and indemnities are signed by me in the name of the firm.

3.To treat all cheques, drafts, bills of exchange promissory notes, acceptances, negotiable instruments and orders as being endorsed on my behalf and to discount or otherwise deal with them provided such endorsement purport to be signed by me in the name of the firm.

All instructions in connection to this account and in particular, but without limiting the generality of the foregoing, all instructions relating to instruments and securities and the charging pledging disposal and withdrawal thereof are in order if given by me in the name of the firm.

Notwithstanding any alteration in the constitution of the firm this authority shall remain in force and in the event of such alterations or of others being authorised to sign, due notice in writing will be given to you and such notice will be binding on the firm if given in the firm’s name by anyone of the signatories hereto.

This authority shall continue in force until I expressly revoked it by notice in writing delivered to you at the above mentioned branch and it shall not be revoked by my death.

We produce herewith a certified extractdated from the Registrar of Business names and confirm that no changes in the particulars registered with him have taken place since the date of issue of the extract.

I declare my sole liability on all foregoing transactions of the firm.

(To be signed by the Sole Proprietor)

Dated this |

|

day of |

|

20 |

DTB GENERAL TERMS & CONDITIONS

The relationship between the Bank and the Customer is governed by the Law of Uganda and Bank of Uganda guidelines, except where the following general terms and conditions apply to any further agreement in writing. Specific terms apply to specific accounts and products and are available to the Customer upon request.

1.Definitions

(a) |

“Account” |

means any one or more accounts to be opened in |

|

accordance with the instructions on the Account Opening |

|

|

Form and |

any other Account opening by the Customer at |

|

any time. |

|

(b)“Agent” means any person(s) authorized by the Customer or by the Authorized Signatory to receive and collect cash on any Withdrawal Instrument (hereinafter defined) acceptable to the Bank from time to time and authorized to collect and/or deliver any other documents or notices relating to the Account.

(c)“Authorized Signatory” means the Customer or in relation to the Customer any person(s) authorized, as notified by the Customer in writing to the Bank, to operate the Account in accordance with the Mandate. Reference to Authorized Signatory shall include any duly appointed Attorney of the Customer.

(d)“Available Balance” means the amount (excluding any uncon- firmed credit and amount under hold/lien) in the Account, which can be withdrawn by the Customer.

(e)“Bank” means Diamond Trust Bank Uganda Limited, incorporated in Uganda as a limited liability company under the Companies Act (Cap. 110 of the Laws of Uganda) and includes such Branch or Subsidiaries of the Bank as may from time to time be specified by the Bank to the Customer. Reference to the “Bank” shall include without limitation reference to the Bank’s successors in title and assigns, and shall also include any director, officer, manager or any other person duly authorized to represent the Bank.

(f)“Banking Day” means a day on which the counters of the Branch and/or Bank Subsidiary (as applicable) are open for the transac- tion of ordinary business.

(g)“The Card” means any Diamond Trust Bank Uganda Limited card issued at the request of the Customer by the Bank or any other person on behalf of the Bank to the Customer or any other person at the Customer’s request for use in the manner referred to herein under Section 6.2 and in respect of any of th e Bank’s products and services from time to time.

(h)“Cardholder” means a person to whom the Bank’s card has been issued who shall be bound by these terms and conditions as var- ied from time to time by the Bank and includes a supplementary cardholder.

(i)“Cheque” means a negotiable instrument issued by the Bank to the Customer in a

(j)“Customer’s means the person(s) whose name(s) is specified as such in the Application Form and whose details are as recorded with the Bank with respect to the Bank Account. Reference to the expression “Customer” shall where the context so permits include any permitted personal representatives, successors in title, heirs and permitted assigns and in the case of a company, its holding company (if any) and their respective subsidiaries from time to time.

(k)“Electronic Banking Facility” means al l electronically enabled services capable of operation by the Bank and as may be notified to the Customer by the Bank from time to time.

(l)“Facility” means the aggregate of the financial accommodations funded or

(m)“Interest” means the amount payable on the Account at the rate specified by the Bank from time to time whereas “Default interest” means any additional interest payable on the Account at a rate e qually specified and which amounts are payable in accordance with these Terms and Conditions.

(n)“Letter of Offer” means any letter issued by the Bank to the Customer pursuant to which the Bank agrees to make available to the Customer facilities on the terms and subject to the conditions set out in the said letter as the same may be varied amended or substituted from time to time.

(o)“Mandate” means authority given by the Customer to the Authorized Signatory to operate the Account as provided for in the Application Form.

(p)“PIN Code” means the secret Personal Identification Number known only to the Customer or the Customer or the Customer’s Nominated (User(s) for access to the System via an ATM or any other point of sale (POS) terminal to give a transaction instruc- tion.

(q)“Principal Cardholder” means the person in whose name the bank account is maintained.

(r)“Property” means cash, all negotiable and

(s)“Security” means any movable or immovable property or asset of the Customer and/or of any other person, held under lien, charged, pledged, deposited or in any other way offered to the Bank to secure an Account, Facility or any other liability of the Customer.

(t)Specific Terms and Conditions: means the terms and conditions that may be published by the Bank from time to tome in relation to a specific product and/or service (or otherwise) provided by the Bank.

(u)“Statement” means the electronic or written record prepared by the Bank from time to time reflecting the amount, number and nature of transactions being made in and out of the Account in various currencies.

(v)“System” means the Computer hardware/ software for communications software or equipment enabling the Customer to communicate with the Bank for the purposes of the Electronic Banking Service. Where access through the Internet is necessary, the System and Service will for the purpose of this agreement be accessed through the Ban’s website.

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Applicable Entities | This form can be used by various entities including companies, partnerships, clubs, societies, sole proprietorships, and NGOs. |

| Account Types | Account types available include Current Accounts, Fixed Deposits, and Call Deposits. |

| Required Details | Applicants must provide identification, contact information, and business specifics like the principal activity. |

| Governor Law | The form adheres to the banking regulations set forth by the Central Bank of Uganda, including the Companies Act. |

| Signature Mandate | Signature instructions can be designated as singly, jointly, or as “Either or Survivor.” |

| Introduction Requirement | Each new account requires an introduction from an existing account holder within the bank. |

| Documents Needed | Certified copies of identification, a passport photo, and the company's Memorandum & Articles of Association are required. |

| Verification Process | The bank will authenticate identification documents and conduct reference checks before account approval. |

| Fee Structure | Applicants should be aware of any applicable fees for cheque books and account services as detailed in bank terms. |

| Account Terms | By signing the form, applicants agree to abide by the bank’s general terms and conditions for account operation. |

Guidelines on Utilizing Dtb Account Opening

After gathering the necessary documents, it's time to fill out the Dtb Account Opening form. This process involves providing important details about yourself and the organization for which you are opening the account.

- Begin by entering the Branch where you wish to open the account.

- In the Account No field, leave it blank if you don’t have an account number yet.

- Fill in the Date on which you are completing the form.

- Select the Account Type by placing a tick (√) next to your choice.

- Provide the Account Name.

- Choose the Currency you wish to use for the account.

- Indicate the Legal Status of your organization by ticking the appropriate box.

- Describe the Type of Business and its principal activities.

- Fill in the Company/Organisation Name and its Date of Incorporation/Registration.

- Complete the Postal Address, including the Postal Code and Town.

- Provide your contact numbers, including Telephone No, Mobile No, and Fax No if applicable.

- Fill in the Email Address and the Full Physical Address of the business.

- If applicable, complete the Company Website Address.

- List other accounts currently held with DTB or other banks by entering the Bank Name, Branch, and Type of Account.

- Provide Details of Directors/Partners/Trustees by filling in their names, addresses, mobile numbers, and ID/Passport numbers.

- Mark the preferred Account Facilities by ticking the applicable boxes.

- Input the Introducer Name and their contact information.

- Choose the Account Mandate by ticking the relevant signing instructions.

- Have all Signatories complete their sections, including names, titles, ID/Passport numbers, and signatures.

- Attach the required documents and any certifications or copies as specified.

Ensure all information is accurate. After completing the form, you may proceed to submit it along with the required documents to the bank. This will help to facilitate the opening of your account. It's advisable to keep a copy for your records.

What You Should Know About This Form

What is the purpose of the DTB Account Opening form?

The DTB Account Opening form is designed for individuals and organizations looking to open an account with Diamond Trust Bank. It collects essential information about the applicant, including the type of account being requested, the legal status of the business, and contact details. This form helps ensure that all necessary information is gathered to facilitate account opening efficiently.

What types of accounts can I open using this form?

You can use this form to open several types of accounts, including Current Accounts, Fixed Deposit Accounts, and Call Deposit Accounts. Simply indicate your preferred account type by ticking the appropriate box on the form.

What information do I need to provide about my business?

You'll need to provide details such as the company or organization name, date of incorporation or registration, business type, and principal activities. Additionally, you must include your company’s postal address, email, and telephone numbers. This information is crucial for establishing your account and future communications.

What documents are required to complete the application?

You must submit several documents along with your form, including a certified copy of your identification, a passport photograph, the company’s Memorandum and Articles of Association, and proof of address for all signatories. These documents are critical for verifying your identity and the legitimacy of your business.

Can I have multiple signatories on the account?

Yes, the form allows for multiple signatories. You can specify how the account will be operated, whether jointly, singly, or under different instructions. List all authorized signatories and their details on the form to ensure proper management of the account.

How does the introducer process work?

If you have an introducer, they will need to fill out their details, including their DTB account number and signature. The introducer acts as a referral, confirming your credibility and suitability to open and maintain an account with Diamond Trust Bank. This step adds another layer of assurance for the bank.

What happens if my application is approved?

If your application is approved, you will receive your account details along with instructions on how to manage your new account. You will also typically be issued a cheque book if requested. The bank will communicate with you about any additional steps needed to activate your account fully.

How long does the account opening process take?

The duration for opening an account can vary depending on several factors, including the completeness of your application and document submissions. Typically, it can take a few days to a couple of weeks. You will be informed of your application status throughout the process.

Can I change my account details later on?

Yes, if you need to update any information regarding your account after it has been opened, you can do so by contacting your bank branch. You may need to fill out additional forms and provide supporting documents to make these changes official.

Common mistakes

Filling out the DTB Account Opening form requires careful attention to detail. One common mistake people make is failing to provide complete information. For instance, if an individual skips sections such as the account type or legal status, it can lead to delays in processing the application. Everyone involved should ensure that each part of the form is filled out accurately.

Another frequent error is not including supporting documents. The form requires specific legal documents to validate the applicant's identity and business status. Without these, the bank cannot proceed with the account opening. It is essential to double-check that all necessary documents are gathered and submitted along with the form.

Many applicants also neglect to review the signatures. Improper or missing signatures can result in the application being rejected. Each required signatory must sign where indicated. A quick verification of signatures can save time and prevent unnecessary complications.

People sometimes overlook the importance of checking the introduction section. The introducer’s details should be accurate and comprehensive. An incomplete introducer section can raise questions and may require additional follow-up, which can hinder the speed of the application.

Another mistake made is failing to specify the type of business adequately. Applicants should clearly describe the principal activity of the business. Vague descriptions can lead to misunderstandings and may require the bank to seek clarifications, ultimately delaying the account opening process.

Lastly, not understanding the implications of account mandates and signing instructions can cause confusion. Selecting the wrong signing method may restrict how funds can be accessed, complicating management of the account. It is vital to read these sections carefully and choose the most appropriate option based on the organization's needs.

Documents used along the form

When opening a new account with Diamond Trust Bank, several important documents and forms are typically required alongside the Dtb Account Opening form. These documents help validate the identity and structure of the account holder, ensuring compliance with banking regulations. Below is a list of common forms and documents needed during this process.

- Identification Documents: Each authorized signatory must provide a valid ID or passport copy. These documents serve to verify the identity of individuals who will manage the new account.

- Passport Photographs: A recent passport-sized photograph of all authorized signatories is required. This photograph is used for account records and identification purposes.

- Memorandum & Articles of Association: For companies, a copy of the Memorandum and Articles of Association is necessary. This document outlines the company’s structure and regulations.

- Certificate of Incorporation: This certificate proves that a business is legally registered. It is critical for validating the status of companies opening accounts.

- Utility Bill for Address Verification: A utility bill or another document confirming the address of the business and its representatives is required. This helps in verifying the physical location of the business.

- Board Resolution: A resolution from the Board of Directors authorizing the account opening is often necessary. It indicates that the decision has been officially sanctioned by the organization's governing body.

- Latest Annual Return: Companies may need to provide their most recent annual return, which details the particulars of directors and company secretary. This documentation ensures that the bank has up-to-date information on the organization.

- Letter from Auditor or Company Secretary: This letter verifies the names of directors or any recent changes in the management structure. It adds an additional layer of legitimacy to your application.

Be sure to gather all necessary documents before proceeding with your application. Taking the time to prepare these items will help streamline the account opening process and reduce potential delays. Understanding these requirements is an essential step in ensuring your experience with Diamond Trust Bank is smooth and efficient.

Similar forms

-

Business License Application: Like the Dtb Account Opening form, a Business License Application collects essential information about the applicant's business, including the nature of the business and ownership details. Both documents require signatures and may include various legal requirements relevant to the business type.

-

Loan Application Form: A Loan Application Form is similar in that it also asks for personal and business information, financial details, and signatures. Both are vital in assessing the viability of the applicant and ensuring compliance with necessary standards.

-

Partnership Agreement: This document shares parallels with the Dtb Account Opening form, particularly in defining the parties involved and their roles. Just as the account opening form requires details about directors or partners, a partnership agreement outlines each partner's responsibilities and stake.

-

Customer Information Form: A Customer Information Form captures similar data for identifying account holders. It gathers personal details, contact information, and signatures, thus serving as a foundational document for banks and financial institutions.

-

Legal Entity Registration Form: This form aligns closely with the Dtb Account Opening form regarding legal status and registration requirements. Both documents require proof of existence and governing documents, confirming the legitimacy of the entity seeking to open an account.

Dos and Don'ts

When filling out the DTB Account Opening form, it's important to approach the task with care. Here are some things to keep in mind:

- Do: Read the instructions carefully before you begin.

- Do: Provide accurate information for each section.

- Do: Use clear and legible handwriting if completing the form by hand.

- Do: Double-check your contact information for correctness.

- Don't: Leave any required fields blank.

- Don't: Use abbreviations or shorthand that may cause confusion.

- Don't: Include unnecessary information that is not requested.

- Don't: Forget to sign and date the form as needed.

Misconceptions

There are several misconceptions regarding the Diamond Trust Bank (DTB) Account Opening form. Understanding these can lead to a smoother application process. Here is a list of common misunderstandings:

- The form is only for businesses. While the form is commonly used by companies, partnerships, and organizations, it can also be completed by NGOs or sole proprietorships. Individuals can open accounts too, provided they meet the requirements.

- All documents must be original. This is not true. The form requires copies of documents, which must be certified. You do not have to submit original documents unless specified.

- Any business type can apply without specific information. The form requires a clear description of the type of business and its principal activities. This information helps the bank understand your operations.

- The introducer's role is unimportant. The introducer is required to verify your identity and suitability for opening an account. This step ensures that the bank adheres to regulatory standards.

- Account opening approval is guaranteed. Filling out the form does not guarantee that an account will be opened. Final approval is at the discretion of Diamond Trust Bank based on their evaluation.

- There are no penalties for incomplete forms. Submitting an incomplete form can lead to delays in processing or outright denial. Ensuring all necessary sections are completed is crucial for a smooth application.

- Only one signatory is needed for joint accounts. For joint accounts, all parties must provide appropriate signatures as indicated. This requirement ensures accountability and agreement among signatories.

By recognizing and understanding these misconceptions, individuals and organizations can better prepare for opening their accounts with Diamond Trust Bank.

Key takeaways

Here are key takeaways for filling out and using the DTB Account Opening form:

- Identify the Correct Account Type: Ensure you select the right account type such as Current Account or Fixed Deposit by ticking the appropriate box.

- Provide Accurate Business Information: Clearly fill in details such as the business name, legal status, and physical address. Incorrect information could delay the opening process.

- List All Required Documents: Attach copies of all necessary documents, including identification for authorized signatories and proof of business registration.

- Signatures Matter: All signatories must provide their signatures as designated in the signing instructions section. Be sure to confirm the signing authority structure.

- Introduce the New Account Holder: Ensure an introducer completes their section of the form to validate your business and its operations.

- Understand Account Operations: Familiarize yourself with the account's operational terms and conditions, as well as understand the implications of account closure.

Browse Other Templates

How to Get Transcripts From College - Holding the transcript until grades are posted is an available option.

How Much Do You Have to Owe in Child Support to Go to Jail - Biological father information is important to establish before court-ordered support can be issued.

What Time Does Paychex Direct Deposit Hit - Monitor your account regularly after setting up direct deposit.