Fill Out Your Dtf 5 Form

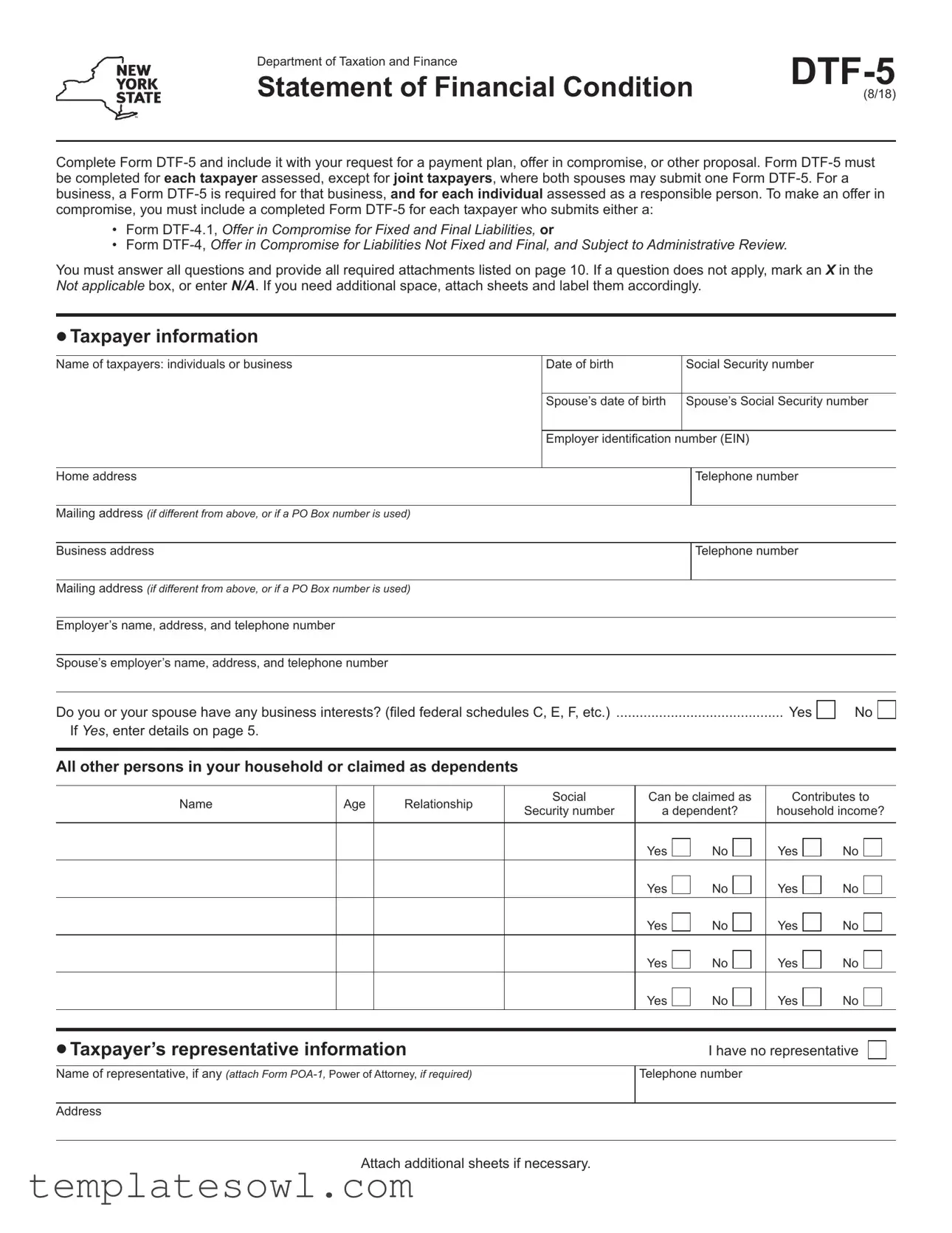

The DTF-5 form, officially known as the Statement of Financial Condition, is a critical document issued by the Department of Taxation and Finance in New York. This form serves several important functions within the tax resolution process. Taxpayers seeking a payment plan, offer in compromise, or other proposals must complete the DTF-5 and submit it alongside their request. Each taxpayer assessed is required to provide a separate DTF-5, although joint taxpayers can use a single form. Businesses must file a DTF-5 for themselves and any individual assessed as a responsible person. The form requires detailed taxpayer information, including identification details, home and business addresses, and specifics about household members. It also provides a comprehensive outline of the taxpayer's financial situation, necessitating information about assets such as bank accounts, properties, and vehicles, as well as liabilities. Inaccuracies or incomplete responses can complicate the process, so a thorough understanding of the questions and required supplemental information is essential. This form is not only a tool for financial assessment, but also a vital step towards addressing tax obligations and achieving financial clarity.

Dtf 5 Example

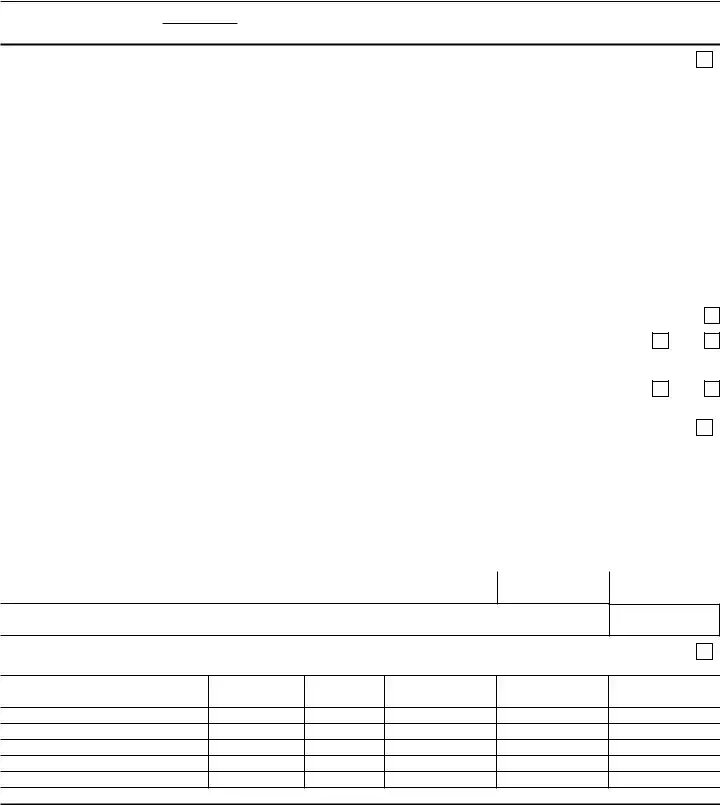

Department of Taxation and Finance |

|

|

|

Statement of Financial Condition |

(8/18) |

Complete Form

•Form

•Form

You must answer all questions and provide all required attachments listed on page 10. If a question does not apply, mark an X in the Not applicable box, or enter N/A. If you need additional space, attach sheets and label them accordingly.

•Taxpayer information

Name of taxpayers: individuals or business |

Date of birth |

Social Security number |

||

|

|

|

|

|

|

|

Spouse’s date of birth |

Spouse’s Social Security number |

|

|

|

|

|

|

|

|

Employer identification number (EIN) |

||

|

|

|

|

|

|

Home address |

|

|

Telephone number |

|

|

|

|

|

Mailing address (if different from above, or if a PO Box number is used) |

|

|

|

|

|

|

|

|

|

|

Business address |

|

|

Telephone number |

|

|

|

|

|

|

Mailing address (if different from above, or if a PO Box number is used) |

|

|

|

|

|

|

|

|

|

Employer’s name, address, and telephone number |

|

|

|

|

|

|

|

|

|

Spouse’s employer’s name, address, and telephone number |

|

|

|

Do you or your spouse have any business interests? (filed federal schedules C, E, F, etc.) |

Yes |

If Yes, enter details on page 5. |

|

No

All other persons in your household or claimed as dependents

Name |

Age |

Relationship |

Social |

Can be claimed as |

Contributes to |

|||

Security number |

a dependent? |

household income? |

||||||

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

Yes |

No |

|

|

|

|

|

Yes |

No |

Yes |

No |

|

|

|

|

|

Yes |

No |

Yes |

No |

|

|

|

|

|

Yes |

No |

Yes |

No |

|

|

|

|

|

Yes |

No |

Yes |

No |

|

•Taxpayer’s representative information

I have no representative

Name of representative, if any (attach Form |

Telephone number |

Address

Attach additional sheets if necessary.

Page 2 of 10

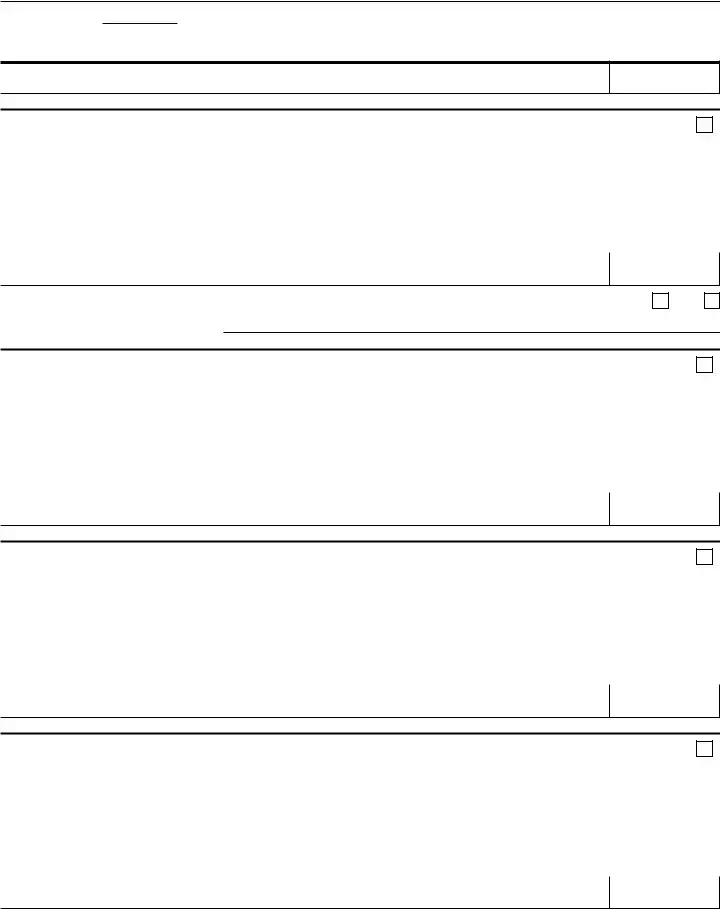

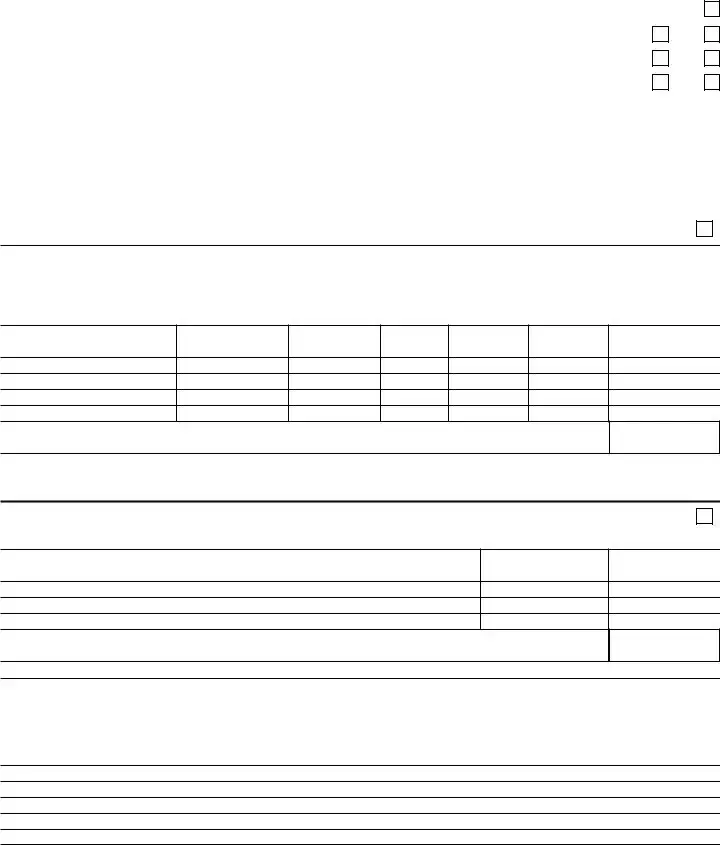

•Assets As of

Date

Enter the balance for each of the following, using the most current value. If any of the following amounts are negative, enter 0.

Cash on hand |

Box (A) – Total cash on hand (also enter on page 7, line 1) |

(A)

$

Bank accounts (domestic and foreign) |

|

|

Not applicable |

|

|

|

|

Name of financial institution |

Type* |

Account number |

Balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Type may include: checking, savings, |

Box (B) – Total balance (also enter on page 7, line 2) |

money market, stored value cards, etc. |

(B)

$

Do you rent a safe deposit box in your name, or in any other name? |

Yes |

If Yes, give name and address of bank: |

|

No

Brokerage accounts |

|

|

|

|

Not applicable |

|

|

|

|

|

|

Institution or brokerage name |

Type* |

Account number |

Market value |

Less: |

Net value |

Loans, if any |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Type may include: stocks, bonds, other |

Box (C) – Total net value (also enter on page 7, line 3) |

investments, etc. |

(C)

$

Retirement accounts |

|

|

|

|

Not applicable |

|

|

|

|

|

|

Institution or custodian name |

Type* |

Account number |

Market value |

Less: |

Net value |

Loans, if any |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Type may include: 401K, IRA, pension, |

Box (D) – Total net value (also enter on page 7, line 4) |

profit sharing, etc. |

(D)

$

Cash value of life insurance policies |

|

|

|

|

Not applicable |

|

|

|

|

|

|

|

|

Institution company name |

|

Type* |

Policy number |

Cash value |

Less: |

Net value |

|

Loans, if any |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Type may include: term, whole life, etc.

Box (E) – Total net cash value (also enter on page 7, line 5)

(E)

$

Attach additional sheets if necessary.

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

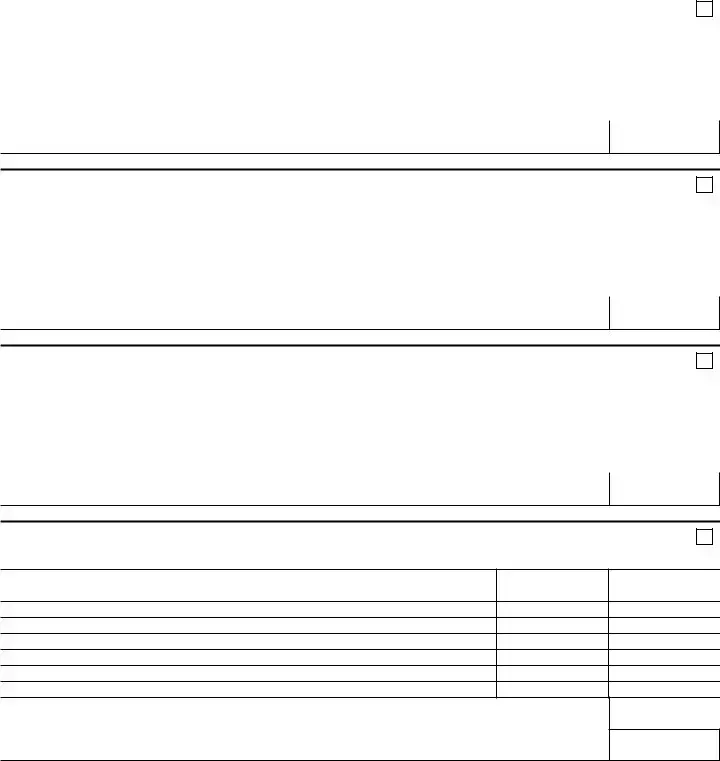

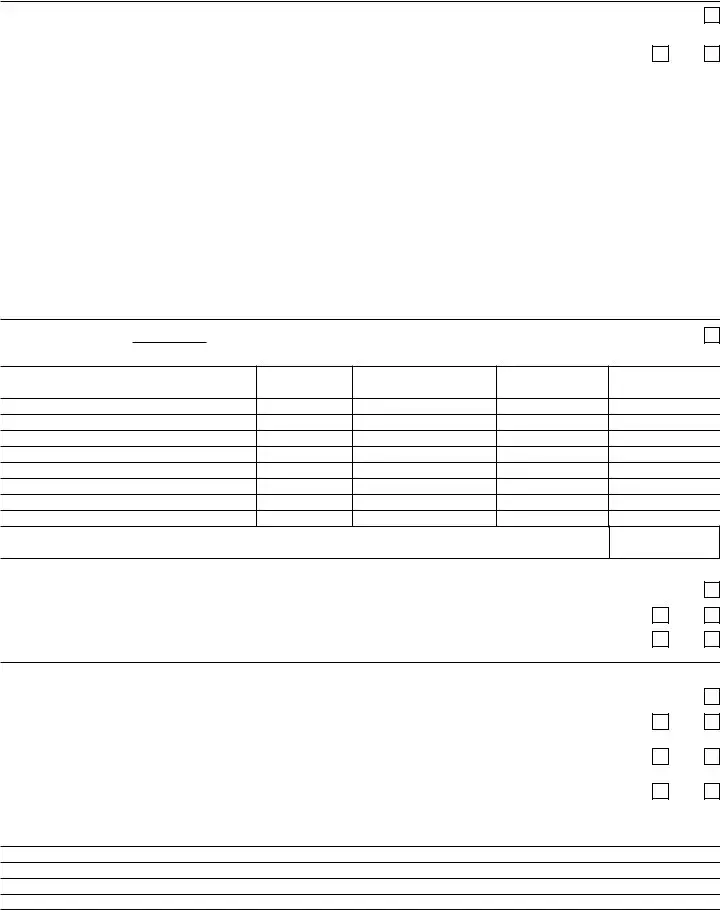

Assets (continued) As of |

|

|

|

|

|

|

|

Date |

|

|

|

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

|

|

|

|

Not applicable |

|

|

|

|

|

|

|

|

Name and address |

|

Date recorded |

Book value |

Less: |

Date pledged, |

Net value |

|

|

Loans, if any |

if applicable |

|||||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Box (F) – Total net value (also enter on page 7, line 6)

(F)

$

Inventory |

|

|

|

|

Not applicable |

|

|

|

|

|

|

|

|

Detailed description |

Date recorded |

Book value |

Less: |

Date pledged, |

Net value |

|

Loans, if any |

if applicable |

|||||

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Box (G) – Total net value (also enter on page 7, line 7)

(G)

$

Notes receivable |

|

|

|

|

Not applicable |

|

|

|

|

|

|

|

|

Name and address |

Date recorded |

Book value |

Less: |

Date pledged, |

Net value |

|

Loans, if any |

if applicable |

|||||

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Box (H) – Total net value (also enter on page 7, line 8)

(H)

$

Valuable items, machinery, and equipment |

Not applicable |

(List any artwork, collections, jewelry, items in safe deposit boxes, tools, furniture, fixtures, etc. that you own fully or partially)

Description

Fair market value

Loan balance, if any

Box (I) – Total fair market value (enter Asset on page 7, line 9) |

(I) |

$ |

Box (J) – Total loan balance, if any (enter Liability on page 7, line 18)

(J)

$

Attach additional sheets if necessary.

Page 4 of 10

Assets (continued) As of

Date

Real estate |

Not applicable |

(List any house, condo,

Complete address |

|

Description* |

Owners |

Current fair |

Mortgage balance, |

Unpaid property |

||

|

market value |

if any |

|

taxes |

||||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Box (K) – Total fair market value (enter Asset on page 7, line 10) |

(K) |

|

|

|

||||

$ |

|

|

|

|||||

Box (L) – Total mortgage balance (enter Liability on page 7, line 19) |

(L) |

|

|

|||||

$ |

|

|

||||||

* Description may include: primary residence, |

|

|

|

|

(M) |

|||

vacation home, rental property, etc. |

|

Box (M) – Total unpaid property taxes (enter Liability on page 7, line 20) |

$ |

|

||||

Foreclosure proceedings: |

|

|

|

|

|

|

Not applicable |

|

Are foreclosure proceedings pending on any real estate which you own or have an interest in? |

.................................... |

Yes |

No |

|||||

If Yes, please give locations of the real estate: |

|

|

|

|

|

|

||

Was the New York State Tax Department made a party to the suit? |

|

|

Yes |

No |

||||

|

|

|

|

|

||||

Vehicles (List any cars, boats, motorcycles, trucks, aircraft, etc. that you own) |

|

Not applicable |

||||||

|

|

|

|

|

|

|

|

|

Year, make, and model |

|

Plate number or |

Mileage |

Owners |

Fair market value |

Loan balance |

||

|

Reg. number |

|||||||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Box (N) – Total fair market value (enter Asset on page 7, line 11) |

(N) |

$ |

Box (O) – Total loan balance (enter Liability on page 7, line 21)

(O)

$

Leased vehicles (List any cars, boats, motorcycles, trucks, aircraft, etc. that you lease) |

Not applicable |

Year, make, and model

Plate number or

Reg. number

Mileage

Lessee name(s)

Date of lease

Term of lease

Attach additional sheets if necessary.

|

|

|

|

Page 5 of 10 |

|||

|

|

|

|

|

|

|

|

Assets (continued) As of |

|

|

|

|

|

|

|

Date |

|

|

|

|

|||

|

|

|

|

|

|||

|

|

|

|

||||

Interest in trust or estate |

|

|

Not applicable |

||||

Are you the grantor, donor, or trustee for any trust? |

|

|

Yes |

No |

|||

Are you the beneficiary of any trust or estate? |

|

|

Yes |

No |

|||

Do you have any life interest or remainder interest, either vested or contingent, in any trust or estate? |

Yes |

No |

|||||

If Yes to any of the above, furnish a copy of the instrument creating the trust or estate. Also, complete the table below. |

|

||||||

|

|

|

|

|

|

||

Name of trust or estate |

Annual income you received |

Present value of trust or |

Value of your |

||||

from this source |

estate |

interest |

|||||

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Box (P) – Total value of your interest (enter Assets on page 7, line 12) |

$ |

(P) |

|||

|

|

|

|||||

Business interests (from page 1, if you marked Yes) |

|

|

Not applicable |

||||

If you or your spouse have ownership in any business, complete the table below. You must complete this section if you:

•filed federal schedules C, E, F, and other federal business forms filed by an individual in the preceding 3 years.

•received federal schedules

•are a shareholder of a business that filed federal Form 1120, U.S. Corporation Income Tax Return, in the preceding 3 years.

Business name

Employer

identification number

Type of

business*

Ownership percentage

Annual cash contributed**

Annual cash

received**

Value of your investment***

Box (Q) – Total value of your investments (enter Assets on page 7, line 13)

(Q)

$

*List all types of businesses, including sole proprietorships, partnerships, S corporations, C corporations, etc.

**Annual cash contributed or received may include: Shareholder or partner contributions or distributions, etc.

***Value of your investment may include: Your share of net worth or your partner capital account, etc.

Contingent claims or legal actions |

Not applicable |

(Potentially receivable or collectable, such as pending insurance claims, settlements, etc.)

Name of payer(s)

Date you expect to

receive funds

Dollar amount

Box (R) – Total dollar amount (enter Assets on page 7, line 14)

(R)

$

•Increase in value

What is the prospect of an increase in value of any of your assets and your present income? Provide a detailed explanation.

Attach additional sheets if necessary.

Page 6 of 10

•Disposal of assets

Not applicable

Did you transfer any assets with a fair market value of $500.00 or more during the period beginning with the |

|

|

start of your proposal’s tax period and the present? |

Yes |

No |

If Yes, attach a copy of the applicable transfer document (i.e. sales agreement, closing statement,

•transfer or sale of real estate

•transfer or sale of business interests

•assets that were transferred for less than fair market value

•disposal of any of the above

Asset type and description |

Relationship of transferee |

Date of transfer |

Fair market value |

Dollar amount you |

|

when transferred |

received |

||||

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

•Judgments As ofNot applicable Date

Name of creditor(s)

Date recorded

Where recorded

Dollar amount of

judgment filed

Current balance due on judgment

Box (S) – Total balance due on judgments (enter Liability on page 7, line 22)

(S)

$

Bankruptcy |

Not applicable |

Are bankruptcy or receivership proceedings pending? |

Yes |

If a corporation or other business, is it in the process of liquidation? |

Yes |

No No

Unlawful activities |

Not applicable |

Is the liability you are trying to compromise related to a crime for which you pleaded or were found guilty? |

Yes |

|

Have you (or any one of you) been convicted of any crime involving unlawful possession or acquisition of property |

|

|

|

or income obtained by fraud, theft, or other illegal means within the last 5 years? |

Yes |

Are you the subject of, or defendant in, any pending criminal or grand jury action or proceeding which may involve |

|

|

|

or affect in any way, your right, title, or interest to any real or personal property whether or not listed herein? |

Yes |

If Yes to any of the above, provide details:

No

No

No

Attach additional sheets if necessary.

|

|

|

|

|

|

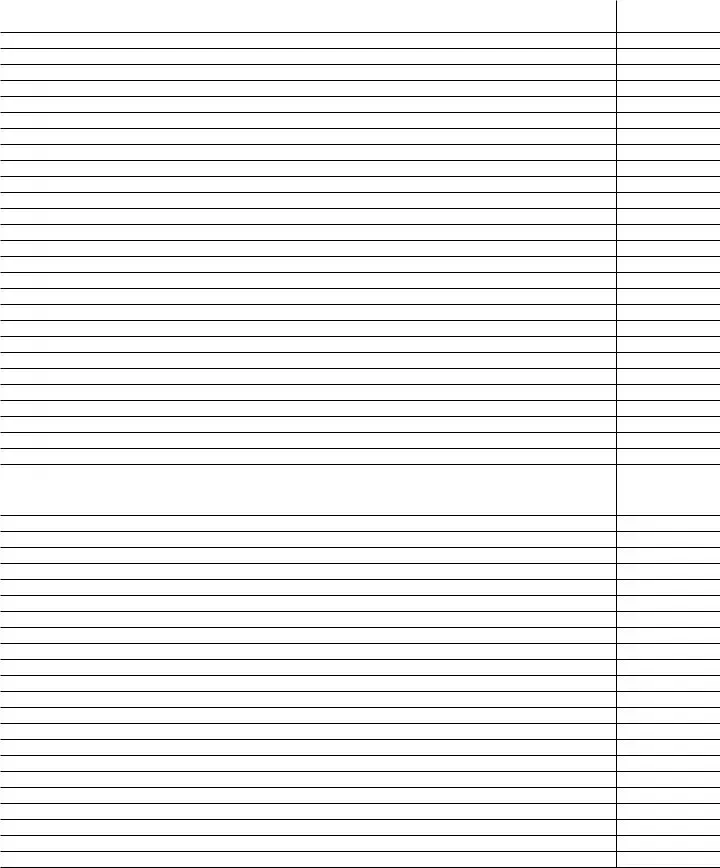

•Statement of assets and liabilities As of |

Date |

pages 2 through 6) |

|

|

Values (from |

|

|

|

Assets |

|

Amount |

1.Cash on hand (from page 2, Box (A))

2.Bank accounts (from page 2, Box (B))

3.Brokerage accounts (from page 2, Box (C))

4.Retirement accounts (from page 2, Box (D))

5.Cash value of life insurance (from page 2, Box (E))

6.Accounts receivable (from page 3, Box (F))

7.Inventory (from page 3, Box (G))

8.Notes receivable (from page 3, Box (H))

9.Valuable items (from page 3, Box (I))

10.Real estate (from page 4, Box (K))

11.Vehicles (from page 4, Box (N))

12.Interest in trust or estate (from page 5, Box (P))

13.Business interests (from page 5, Box (Q))

14.Contingent claims or legal actions, receivable (from page 5, Box (R))

15.Other assets (list)

Total assets |

$ |

Liabilities |

Amount |

16.New York State tax liabilities (not already included in Judgments on page 6)

17.Federal tax liabilities (not already included in Judgments on page 6)

18.Loans against valuable items (from page 3, Box (J))

19.Mortgage balances (from page 4, Box (L))

20.Unpaid property taxes (from page 4, Box (M))

21.Loans against vehicles (from page 4, Box (O))

22.Balance due on judgments (from page 6, Box (S))

23.Accounts payable

24.Credit card balances payable

25.Notes payable

26.Contingent claims and legal actions payable

27.Other liabilities (list)

Total liabilities

$

Attach additional sheets if necessary.

Page 8 of 10

•Household income and expenses – individual

Enter your household’s gross monthly income, including income from you, your spouse, significant other, children, and others who contribute to the household.

Monthly gross receipts or income |

Name of source |

|

Amount |

|

|

|

|

Salaries, wages, commissions of applicant(s) |

|

|

|

Salaries, wages, commissions of household members |

|

|

|

Dividends |

|

|

|

Interest |

|

|

|

Net business income from all sole proprietorships and |

|

|

|

federal schedule Cs) |

|

|

|

|

|

|

|

Distributions from partnerships and S corporations (from your attached federal schedules |

|

|

|

the partner or shareholder cash distributions you received on an average monthly basis)* |

|

|

|

|

|

|

|

Net proceeds from sales of securities and other investments ((stocks, bonds, mutual funds, |

|

|

|

real properties, etc.) on an average monthly basis)* |

|

|

|

Income from annuities and pensions |

|

|

|

Income from rents and royalties |

|

|

|

Income from trusts and estates |

|

|

|

Social Security |

|

|

|

Welfare |

|

|

|

Unemployment |

|

|

|

Gifts |

|

|

|

Money from relatives |

|

|

|

Other income (list) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total monthly household income: |

$ |

|

|

Monthly expenses |

To whom paid |

|

Amount |

(and relationship) |

|

||

|

|

|

|

Food, clothing, and miscellaneous (such as housekeeping supplies, personal care products)* |

|

|

|

Housing (rent or mortgage payment, plus property taxes, home insurance, maintenance, dues, or fees) |

|

|

|

Utilities (electricity, gas, other fuels, trash collection, water, cable, phone) |

|

|

|

Vehicle loan and lease payments |

|

|

|

Vehicle operating costs (maintenance, repairs, insurance, fuel, registrations, licenses, inspections, |

|

|

|

parking, tolls, etc.)* |

|

|

|

Public transportation costs (fares for mass transit such as bus, train, ferry, taxi, etc.)* |

|

|

|

Health insurance premiums |

|

|

|

|

|

|

|

eyeglasses, hearing aids, etc.)* |

|

|

|

|

|

|

|

Child or dependent care (daycare, home health care, etc.) |

|

|

|

Life insurance premiums |

|

|

|

Taxes (monthly cost of federal, state, and local tax, etc.) |

|

|

|

Debt service payments (monthly payment for loans where you pledged an asset as collateral; do not |

|

|

|

include payments on unsecured debt such as credit cards.) |

|

|

|

Other expenses (list) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total monthly household expenses: |

$ |

|

|

* You may provide reasonable estimates for certain income and expenses on an average monthly basis. |

|

||

Attach additional sheets if necessary.

•Income and expenses – business

If this proposal is from a business, enter the information below for the last two calendar (fiscal) years and most recent interim period

|

|

|

|

|

|

|

Most recent interim period |

||||

Gross receipts or income |

Year before last |

Last year |

|

||||||||

20 |

|

|

20 |

|

|

|

|

, 20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross sales or receipts (net of returns and allowances) |

|

|

|

|

|

|

|

|

|

|

|

Less: Cost of goods sold |

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

|

|

|

|

|

|

|

|

|

Dividend income |

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

|

|

|

|

|

|

|

|

|

Gross rents |

|

|

|

|

|

|

|

|

|

|

|

Gross royalties |

|

|

|

|

|

|

|

|

|

|

|

Ordinary income (loss) from partnerships, estates and trusts, if applicable |

|

|

|

|

|

|

|

|

|

|

|

Net farm profit (loss) (federal schedule F (Form 1040)) |

|

|

|

|

|

|

|

|

|

|

|

Gains from sales of assets (federal Form 4797)) |

|

|

|

|

|

|

|

|

|

|

|

Capital gain net income (federal schedule D (Form 1120)) |

|

|

|

|

|

|

|

|

|

|

|

Other income (list) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total income |

$ |

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

Most recent interim period |

||||

Deductions |

Year before last |

Last year |

|

||||||||

20 |

|

|

20 |

|

|

|

|

, 20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation of officers |

|

|

|

|

|

|

|

|

|

|

|

Guaranteed payments to partners |

|

|

|

|

|

|

|

|

|

|

|

Salaries and wages (not deducted elsewhere) |

|

|

|

|

|

|

|

|

|

|

|

Pension, |

|

|

|

|

|

|

|

|

|

|

|

Employee benefit programs |

|

|

|

|

|

|

|

|

|

|

|

Rents |

|

|

|

|

|

|

|

|

|

|

|

Repairs and maintenance |

|

|

|

|

|

|

|

|

|

|

|

Taxes and licenses |

|

|

|

|

|

|

|

|

|

|

|

Depreciation, amortization, depletion |

|

|

|

|

|

|

|

|

|

|

|

Bad debts |

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

|

|

|

|

|

|

|

|

|

Contract labor, commissions, and fees paid |

|

|

|

|

|

|

|

|

|

|

|

Legal and professional services |

|

|

|

|

|

|

|

|

|

|

|

Car and truck expenses |

|

|

|

|

|

|

|

|

|

|

|

Travel, meals, and entertainment |

|

|

|

|

|

|

|

|

|

|

|

Contributions, charitable giving |

|

|

|

|

|

|

|

|

|

|

|

Other operating expenses (list) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total deductions |

$ |

|

|

$ |

|

|

$ |

|

|

|

|

Total capital contributed by shareholders, partners, or owners |

|

|

|

|

|

|

|

|

|

|

|

of the business |

$ |

|

|

$ |

|

|

$ |

|

|

|

|

Total distributions or dividends paid to shareholders, partners, or |

|

|

|

|

|

|

|

|

|

|

|

owners of the business |

$ |

|

|

$ |

|

|

$ |

|

|

|

|

Annual benefit paid to principal officers and owners – Enter the total annual benefit paid to each of the principal officers and owners of the business. Annual benefit may include, but not be limited to, the following sources: wages, guaranteed payments to partners, shareholder/partner distributions, management fees, commissions, and shareholder/partner loans received from the business.

Name and title |

|

20 |

|

|

20 |

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, President |

|

|

|

|

|

|

|

|

|

|

, Vice President |

|

|

|

|

|

|

|

|

|

|

, Treasurer |

|

|

|

|

|

|

|

|

|

|

, Secretary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attach additional sheets if necessary.

Page 10 of 10

•Attachments

Items 1, 2, and 3 must be attached; items 4 through 12, if applicable, must also be attached.

Failure to provide these returns, statements, and documents will cause immediate rejection of your compromise request, request for payment plan, or other proposal.

You must attach:

1. Federal returns for the preceding three years, with all schedules and statements attached. If you were not required to file, include an explanation. In addition:

•for all sole proprietorships or

•include all federal schedules

2. Complete credit reports issued by a credit bureau dated within 30 days of this submission.

3. All bank account statements, brokerage account statements, and retirement account statements for the preceding 12 months.

•If you receive certain statements on a quarterly basis, provide the four most recent quarterly statements for the applicable account(s).

•If you receive certain statements on an annual basis, provide the most recent annual statement for the applicable account(s).

You must attach, if applicable:

4. Federal application to compromise, with the results.

5. Recent mortgage or home equity loan statements(s) dated within 30 days of submission. The statement(s) must show monthly payment amounts and current balance outstanding. We may request a real estate appraisal.

6. All mortgage indentures and conveyances, as grantor or grantee, for the preceding 10 years.

7. Lease agreements, both as landlord and tenant.

8. Loan agreements, both for note(s) receivable and note(s) payable. Include the security/collateral agreements for all secured loans.

9. Contracts of sale of any assets having a fair market value of over $500.00 within the last five years. For example, sales agreement, closing statement,

10. Copies of legal instruments related to pending claims (insurance or otherwise), rights to sue, subrogations, assignments, and other assets.

11. Bankruptcy discharge papers, if applicable.

12. For any business (corporation, partnership, s corp,

•Declaration

I declare that I have examined the information given in this statement and, to the best of my knowledge and belief, it is true, correct, and complete, and I further declare that I have no assets, owned either directly or indirectly, or income of any nature other than as shown in this statement. I make this statement with the knowledge that a willfully false representation is a misdemeanor punishable under New York State Penal Law section 210.45.

I authorize the New York State Department of Taxation and Finance (DTF) to contact certain third parties, including but not limited to financial institutions and consumer credit reporting agencies, and to obtain my consumer credit report for the purpose of verifying the information I provided to DTF for determining my eligibility for an installment payment agreement or other payment terms. In addition, I authorize DTF to use my Social Security number when requesting my credit history from consumer reporting agencies or when verifying the information provided. I understand that DTF will not notify me about which third parties, if any, are contacted by DTF as part of this review process.

Taxpayer’s signature(s)

Date

Attach additional sheets if necessary.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The DTF-5 form is an important document required for individuals or businesses requesting a payment plan, offer in compromise, or similar proposals. It serves to outline the financial condition of the taxpayer. |

| Submission Requirements | Each taxpayer assessed must complete a DTF-5 form, except for joint taxpayers, who can submit one form together. Each business must also submit a separate form for every responsible person assessed. |

| Governing Laws | This form falls under the regulations set by New York State tax laws, particularly for those seeking an offer in compromise or similar tax relief options. |

| Inclusions | When filling out the form, all relevant financial details must be provided. This includes cash on hand, bank accounts, real estate, and any other assets, to accurately reflect the taxpayer's financial condition. |

Guidelines on Utilizing Dtf 5

To successfully fill out the DTF-5 form, it is vital to provide accurate information about your financial condition. This form is necessary for various proposals, including requests for payment plans or offers in compromise. Follow the outlined steps carefully to ensure the form is completed properly.

- Gather all necessary personal information. This includes names, social security numbers, employer information, and addresses for both individuals and businesses involved.

- Provide details about financial interests. Indicate if either spouse has any business interests and include any necessary details on page 5.

- Record information about household members, including dependents’ names, ages, relationships, and whether they contribute to household income.

- Complete the Taxpayer's Representative section, if applicable. Indicate if you have a representative or include their information and attach Form POA-1 if required.

- List your assets as of a certain date. This includes cash, bank accounts, brokerage accounts, retirement accounts, cash value of life insurance, accounts receivable, inventory, valuable items, real estate, vehicles, and leased vehicles.

- For each asset category, enter the balance for cash and provide market values. If certain categories do not apply, mark them as such.

- Respond to questions regarding any interests in trusts or estates, including your status and details, if applicable.

- Complete the Business Interests section if relevant, providing the business name, type, employer identification number, ownership percentages, and other required details.

- Document any contingent claims or legal actions with relevant details including names, dates, and expected funds.

- Assess the potential increase in asset value and present income, providing a detailed explanation as necessary.

- Review the entire form for accuracy, ensuring all questions are answered, and required attachments are included.

Once the form is filled out, you may submit it alongside your payment plan, offer in compromise, or any other proposal to the relevant tax authority. Ensure that you keep copies of everything for your records.

What You Should Know About This Form

What is the purpose of Form DTF-5?

Form DTF-5, also known as the Statement of Financial Condition, is used to provide detailed financial information for individuals or businesses seeking a payment plan, offer in compromise, or other proposals to the Department of Taxation and Finance. It must be included with all relevant requests and is essential for assessing the financial status of the taxpayer.

Who is required to complete Form DTF-5?

Every taxpayer who is assessed must complete a Form DTF-5. Joint taxpayers can submit a single form together. For businesses, a Form DTF-5 must be filed for the business itself, as well as for each individual assessed as a responsible person regarding the tax liability.

What information needs to be provided on Form DTF-5?

The form requires comprehensive information about taxpayer assets, income sources, and financial obligations. This includes personal identification details, household income contributions from dependents, financial account balances, real estate holdings, and any other assets or liabilities. If certain questions do not apply, individuals should mark those as “not applicable.” Additional sheets can be attached for more detailed explanations, as necessary.

What should be done if I make a mistake on the form?

If an error is found on the Form DTF-5, it is advisable to correct it promptly. Depending on the stage of processing, you may need to resubmit the form with the correct details. Clearly indicate any corrections made and ensure that all required questions are answered accurately. Providing complete and accurate information is crucial for your request to be evaluated appropriately.

Common mistakes

When filling out the DTF-5 form, many individuals make common mistakes that can lead to complications. One significant mistake is failing to answer all the required questions. The DTF-5 requires detailed information about each taxpayer, and leaving sections blank can cause delays. Additionally, if a question does not apply, it is crucial to mark the "Not applicable" box or write "N/A." Ignoring this step can create confusion for the reviewers.

Another frequent error involves providing incorrect or outdated personal information. Taxpayers must ensure that they include their current address, Social Security numbers, and other contact details. Mistakes here can lead to misunderstandings or missed communications from the tax authorities. It is essential to double-check all entries for accuracy before submission.

Submitting incomplete supporting documentation is a problem that many encounter as well. The DTF-5 form lists several required attachments. Failing to provide these can result in the rejection of the application. It's advisable to review the checklist on the form carefully and gather all necessary documents before starting the submission process.

Some taxpayers overlook the importance of detailing business interests. If either the taxpayer or their spouse has business interests, they must include this information. Avoiding this section or providing minimal details may harm the application. Clarity and completeness regarding business contributions and income are crucial for properly assessing financial conditions.

Another mistake is neglecting to complete sections pertaining to assets and liabilities accurately. Taxpayers often forget to include all forms of assets, such as cash values of life insurance or market values of real estate. Furthermore, if assets are undervalued, it can misrepresent a taxpayer’s true financial position. It is important to use the most current valuations for accurate reporting.

Some individuals also fail to report contingent claims or legal actions. These can impact overall financial standing, and missing this information could lead to an incomplete picture of a taxpayer's condition. Including any current legal claims or potential receivables is essential.

Many applicants do not provide clear details for every required section. For example, when listing household members, it’s crucial to indicate their ages and relationships to the taxpayer. Missing this information can create further inquiries from the tax department, prolonging the process. Clear and concise answers will help streamline the submission.

Finally, neglecting to sign and date the form is a common oversight. Submission is incomplete without a proper signature. This simple step should not be forgotten, as it validates the information provided. Thorough attention to these small details can make a significant difference in the outcome of a DTF-5 submission.

Documents used along the form

The DTF-5 form, also known as the Statement of Financial Condition, serves as an essential component in various tax-related scenarios such as arranging a payment plan, making an offer in compromise, or presenting other financial proposals to the New York State Department of Taxation and Finance. Along with the DTF-5, several other forms may be necessary depending on the specifics of the taxpayer's situation. Below is a list of commonly used forms that complement the DTF-5 form.

- Form DTF-4: This form is used for submitting an Offer in Compromise for liabilities that are not fixed and final. It allows individuals or businesses to propose a settlement amount that is less than the total assessed liabilities.

- Form DTF-4.1: This is specifically for an Offer in Compromise for Fixed and Final Liabilities. Taxpayers must fill out this form to resolve liabilities that cannot be altered or disputed once finalized.

- Form POA-1: This document serves as a Power of Attorney. If taxpayers wish to allow someone else to represent them in discussions or negotiations with the tax authorities, this form must be attached.

- Form IT-201: This is the New York State Personal Income Tax Return. Taxpayers must file this form annually to report income, claim tax credits, and determine any taxes owed or refunds due.

- Form CT-3: Used by partnerships and corporations, this form is the New York State Corporation Tax Return. It provides information on business income and expenses, which may correlate with the financial details needed on the DTF-5.

- Form DTF-288: This form helps taxpayers claim a refund for any overpaid taxes. It can be included with the DTF-5 in scenarios where tax liabilities are being contested.

- Form IT-203: This is the New York State Non-Resident and Part-Year Resident Income Tax Return. It may be necessary for individuals who live outside of New York but have income sourced from the state.

- Form ST-120: This form is the Exempt Use Certificate, which may be relevant for taxpayers claiming exemptions on purchases or sales tax that are linked to financial proposals.

- Form NYS-1: This form is an Employer's Quarterly Tax Return. Businesses will need to submit this for reporting payroll taxes, which may affect their financial standing presented in the DTF-5.

- Form IT-245: The New York State Claim for Credit for Tax Paid to Another Jurisdiction form is useful to those who have paid state or local taxes elsewhere and wish to claim that amount as a credit against New York taxes.

Completing the DTF-5 and these accompanying forms accurately is crucial. Each form serves a distinct purpose and helps paint a clearer financial picture to the tax authorities. Proper documentation can significantly influence the outcome of any requests made to the Department of Taxation and Finance.

Similar forms

The DTF-5 form, officially known as the Statement of Financial Condition, serves important functions for taxpayers dealing with the New York State Tax Department. Here are five documents that bear similarities to the DTF-5 form, highlighting how they relate in purpose and structure:

- Form DTF-4. This form is used for making an offer in compromise for liabilities that are not fixed and final. Similar to the DTF-5, it requires detailed financial information from the taxpayer to assess their financial condition before negotiating tax liabilities.

- Form DTF-4.1. This document is specifically for making an offer in compromise for fixed and final liabilities. Like the DTF-5, it focuses on the taxpayer's financial details, enabling the Tax Department to evaluate the feasibility of a compromise offer based on the taxpayer's financial situation.

- Form POA-1. This is the Power of Attorney form, necessary when a taxpayer wishes to designate a representative. The DTF-5 requires this form if a representative is involved, emphasizing the need for transparency regarding the taxpayer's financial conditions and authority.

- Schedule C (Profit or Loss from Business). This form is used by sole proprietors to report income and expenses related to their business. Both the DTF-5 and Schedule C require detailed financial data to give a clear picture of the taxpayer’s assets and income, revealing their capability to pay tax debts.

- Income Tax Return (Form 1040). This federal form is used for annual income reporting. The DTF-5 is similar in that it also collects personal information and financial details about income and assets, essential in assessing the financial condition of a taxpayer.

Each of these forms aids in forming a comprehensive view of a taxpayer’s financial state, ensuring that the tax authorities are well informed during negotiations or assessments. Understanding these related documents can help taxpayers navigate their tax responsibilities more effectively.

Dos and Don'ts

When filling out the DTF-5 form, consider the following actions:

- Ensure all information is accurate and complete. Double-check the details before submission.

- Attach any necessary supporting documents as specified in the instructions.

- Use clear and legible handwriting or type the form to avoid any misinterpretations.

- Mark the "Not applicable" box with an X or enter N/A for questions that do not apply to your situation.

- Include additional sheets if you need more space for answers. Clearly label these sheets for easy reference.

Be cautious of these common mistakes:

- Do not leave any required fields blank; all questions must be answered.

- Avoid submitting the form without reviewing it for errors, which can lead to delays.

- Do not forget to sign and date the form before submission, as an unsigned form may be rejected.

- Refrain from providing outdated information; use the most current details available.

- Do not assume that the process will be straightforward; prepare for potential follow-up questions or requests for more information.

Misconceptions

-

Form DTF-5 is only for individuals. This form is also applicable to businesses. Each taxpayer assessed must complete a separate DTF-5, relating to business interests when applicable.

-

All taxpayers must submit a different DTF-5. Joint taxpayers can submit a single DTF-5. This simplifies the process for spouses assessed together.

-

Form DTF-5 is optional when submitting an offer in compromise. It is a required attachment when submitting either Form DTF-4 or DTF-4.1 as part of the tax resolution proposal.

-

Providing 'not applicable' answers is sufficient. Taxpayers must mark 'Not applicable' or write 'N/A' for questions that do not apply and cannot leave them blank.

-

Only current assets need to be reported. Individuals and businesses must report details of all assets as of the specified date, including anticipated future increases in asset value.

-

There is no need for additional documentation. Taxpayers must attach additional sheets if they need more space to provide details as required by the form.

-

It is acceptable to omit dependent information. Information about dependents in the household, including their ages and income sources, is essential and must be accurately reported.

-

All households must provide the same information. Each household is unique, and taxpayers should provide accurate and specific information regarding their own financial situation.

-

Information must be accurate but isn’t subject to verification. All information provided on Form DTF-5 can be subject to verification by the tax authority.

-

Completing the DTF-5 does not impact future assessments. Providing complete and accurate information through this form can influence the decision regarding payment plans or offers in compromise.

Key takeaways

When dealing with the DTF-5 form, it’s crucial to understand its purpose and how to fill it out correctly. Here are some key takeaways:

- Completing for Each Taxpayer: Each taxpayer assessed must complete their own DTF-5, except for joint taxpayers who can submit one form together. For businesses, each business entity and responsible individuals must also fill out a separate form.

- Including Required Information: Provide comprehensive taxpayer information such as names, Social Security numbers, and home addresses. Additionally, if there are any business interests, these should be documented on the form.

- Detail Your Assets: Accurately enter the value of your assets, including cash, bank accounts, and real estate. Negative values should be reported as zero. If the space provided is insufficient, you can attach additional sheets with the necessary details.

- Answer All Questions: It is important to respond to every question on the form. If something does not apply to your situation, simply mark it as not applicable (N/A). This ensures that your application is processed smoothly and avoids unnecessary delays.

Browse Other Templates

Informed Refusal Form - The form acknowledges that you have been informed about the injury by your employer.

How to Submit Medical Redetermination Form - Make sure to complete and return the form to your county promptly.