Fill Out Your Dtf 911 Form

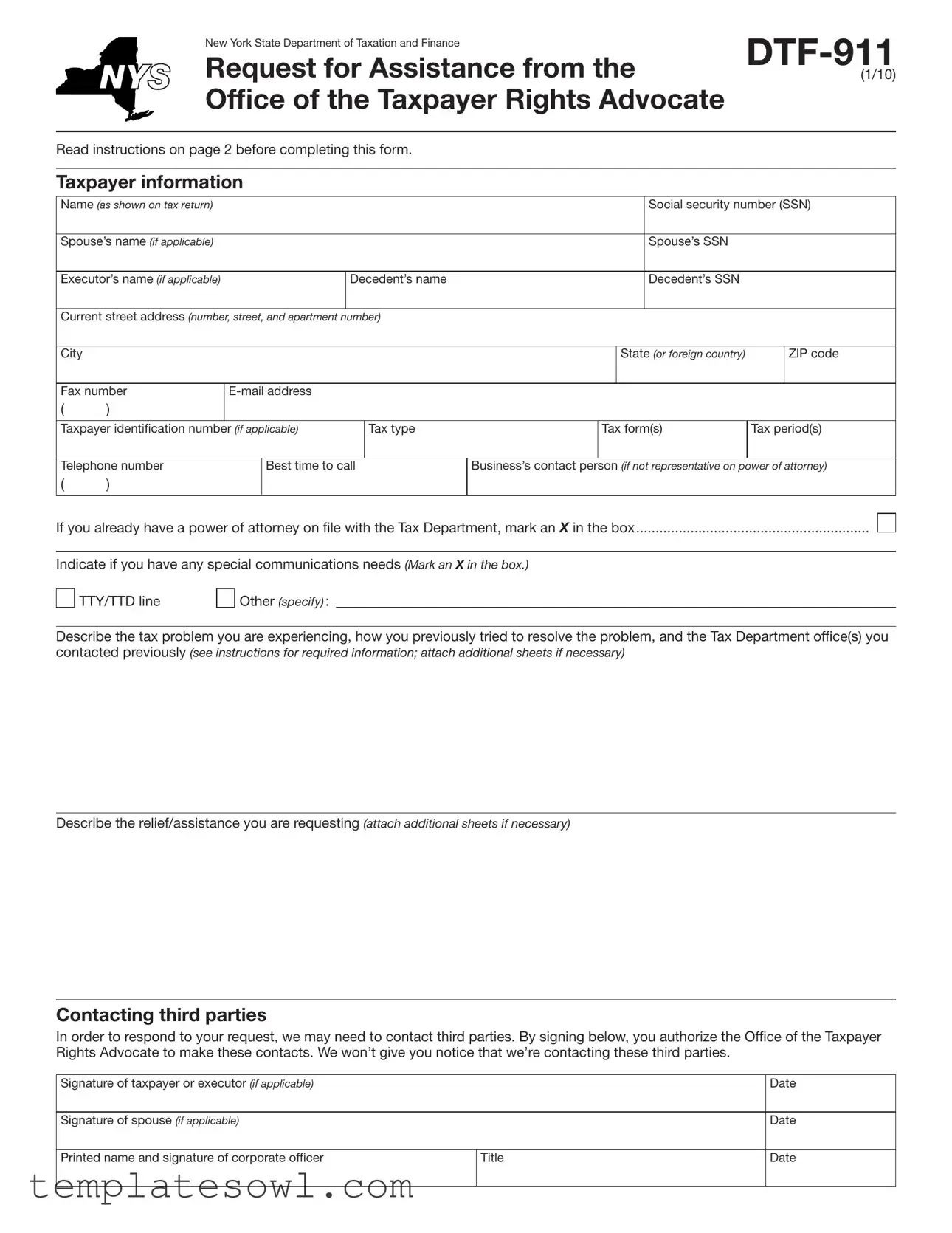

The DTF-911 form, officially known as the Request for Assistance from the Office of the Taxpayer Rights Advocate, serves as a vital resource for New York taxpayers facing challenges with the Tax Department. This form is designed for those who have encountered significant tax-related issues—such as potential asset seizures that they believe are unwarranted or situations causing undue economic harm. Taxpayers can request help if they feel there has been an unfair delay in resolving their inquiries or believe that the tax laws are not being administered fairly. Additionally, this form allows individuals to describe their tax problems in detail, specify the assistance they seek, and provide relevant taxpayer information. Those filling out the DTF-911 are also given the option to indicate any special communication needs they may have. Importantly, the Office of the Taxpayer Rights Advocate, which operates independently within the New York State Department of Taxation and Finance, aims to safeguard taxpayer rights and ensure fair treatment within the tax system. By utilizing this form, individuals can take a proactive step toward resolving their tax dilemmas effectively.

Dtf 911 Example

|

New York State Department of Taxation and Finance |

|

|

|

|

||||||

|

|

|

|

|

|

|

|||||

|

Request for Assistance from the |

(1/10) |

|||||||||

|

Office of the Taxpayer Rights Advocate |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Read instructions on page 2 before completing this form. |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer information |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

Name (as shown on tax return) |

|

|

|

|

|

|

|

Social security number (SSN) |

|||

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s name (if applicable) |

|

|

|

|

|

|

|

Spouse’s SSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Executor’s name (if applicable) |

|

|

Decedent’s name |

|

|

|

Decedent’s SSN |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Current street address (number, street, and apartment number) |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

State (or foreign country) |

|

ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

Fax number |

|

|

|

|

|

|

|

|

|||

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer identiication number (if applicable) |

|

Tax type |

|

Tax form(s) |

Tax period(s) |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Telephone number |

|

Best time to call |

Business’s contact person (if not representative on power of attorney) |

||||||||

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you already have a power of attorney on ile with the Tax Department, mark an X in the box............................................................

Indicate if you have any special communications needs (Mark an X in the box.)

TTY/TTD line

Other (specify) :

Describe the tax problem you are experiencing, how you previously tried to resolve the problem, and the Tax Department ofice(s) you contacted previously (see instructions for required information; attach additional sheets if necessary)

Describe the relief/assistance you are requesting (attach additional sheets if necessary)

Contacting third parties

In order to respond to your request, we may need to contact third parties. By signing below, you authorize the Ofice of the Taxpayer Rights Advocate to make these contacts. We won’t give you notice that we’re contacting these third parties.

Signature of taxpayer or executor (if applicable) |

|

Date |

|

|

|

Signature of spouse (if applicable) |

|

Date |

|

|

|

Printed name and signature of corporate oficer |

Title |

Date |

|

|

|

Page 2 of 2

Instructions

The Ofice of the Taxpayer Rights Advocate (OTRA) is an independent organization within the New York State Department of Taxation and Finance. OTRA was created to safeguard taxpayer rights and to assist taxpayers who are experiencing problems with the Tax Department.

When to use this form

Use this form if you are experiencing any of the following problems:

•You are facing a threat of immediate adverse action

(e.g., seizure of an asset) for a debt you believe is not owed or where the action is, in your view, unwarranted, unfair, or illegal.

•You are experiencing undue economic harm or are about to suffer undue economic harm because of your tax problem.

•You believe there has been an undue delay by the Tax

Department in providing a response or resolution to your problem or inquiry.

•You believe the tax laws, regulations, or policies are being administered unfairly or have impaired (or will impair) your rights.

•You believe a Tax Department system or procedure has failed to operate as intended, or has failed to resolve your problem or dispute.

•You believe that the unique facts of your case or compelling public policy reasons warrant assistance.

When not to use this form

•If you haven’t exhausted all reasonable efforts to obtain timely relief through normal Tax Department channels.

•To seek legal or tax return preparation advice.

•To seek review of an unfavorable administrative law judge, Tax Appeals Tribunal, or judicial determination.

Specific instructions

Taxpayer information

Taxpayer identification — Enter your taxpayer identiication number if this request involves a business or

Tax type — Enter the tax type (for example, personal income tax, corporation tax, sales tax, etc.) that relates to this request.

Tax form(s) — Enter the form number(s) that relates to this request. For example, an individual taxpayer with an income tax issue might enter FORM

Tax period(s) — Enter the quarterly, annual, or other tax period(s) that relates to this request. For example, if this request involves an income tax issue, enter the calendar or iscal year; if an employment tax issue, enter the calendar quarter.

Business contact person — If a business entity is iling this form, enter the name of the person to contact about the request. This may be the corporate oficer signing the request, or another person authorized to discuss the matter.

Power of attorney

If you choose to have a representative act on your behalf, you must complete a power of attorney form.

Businesses: use Form

Individuals: use Form

Estates: use Form

You can get these forms from our Web site at www.nystax.gov.

Include the power of attorney form when you submit this form.

Describe the tax problem you are experiencing

Enter any detailed information necessary to describe the tax problem you are experiencing. If you have been involved with a Bureau of Conciliation and Mediation Services conference, a small claims hearing, the Tax Appeals Tribunal, a courtesy conference, an administrative law judge, an Offer in Compromise, or an audit or other collection action, include the dates of such activity, as well as the following information (if applicable):

•BCMS number

•DTA number

•audit case number

•assessment or collection case number

•formal or informal protest number

Where to file

Send your completed Form

By mail — NYS TAX DEPT

OTRA

W A HARRIMAN CAMPUS

ALBANY NY 12227

By fax — (518)

Privacy notification — The Commissioner of Taxation and Finance may collect and maintain personal information pursuant to the New York State Tax Law, including but not limited to, sections

This information will be used to determine and administer tax liabilities and, when authorized by law, for certain tax offset and exchange of tax information programs as well as for any other lawful purpose.

Information concerning quarterly wages paid to employees is provided to certain state agencies for purposes of fraud prevention, support enforcement, evaluation of the effectiveness of certain employment and training programs and other purposes authorized by law.

Failure to provide the required information may subject you to civil or criminal penalties, or both, under the Tax Law.

This information is maintained by the Manager of Document Management, NYS Tax Department, W A Harriman Campus, Albany NY 12227; telephone (518)

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The DTF-911 form is designed for taxpayers in New York who need assistance with tax-related problems. |

| Governing Authority | This form is governed by the New York State Department of Taxation and Finance. |

| When to Use | Use this form if facing immediate adverse action or experiencing economic harm due to tax issues. |

| Power of Attorney | Taxpayers can authorize a representative to act on their behalf by completing a power of attorney form. |

| Submission Methods | The form can be submitted by mail or fax to the Office of the Taxpayer Rights Advocate. |

| Email Communication | Taxpayers must provide an email address for potential communication regarding their case. |

| Confidentiality | Personal information collected is protected and used strictly for tax administration purposes. |

| Attachments | Additional sheets can be attached to elaborate on the tax problems or the relief being requested. |

| Contact Information | Taxpayers are encouraged to provide a reliable phone number and the best time to contact them for assistance. |

Guidelines on Utilizing Dtf 911

Filling out the DTF-911 form correctly is essential for ensuring your request for assistance is processed efficiently. Follow these steps to complete the form accurately and increase your chances of receiving the help you need.

- Provide Taxpayer Information: Fill in your name as shown on your tax return, social security number (SSN), and current address. Include spouse's name and SSN if applicable.

- Include Contact Details: Enter your e-mail address, telephone number, and the best time to reach you.

- Identify Tax Information: Specify your taxpayer identification number (if applicable), tax type, applicable tax form(s), and the relevant tax period(s).

- Describe the Tax Problem: Clearly explain the tax issue you're facing. Include any attempts made to resolve it and the Tax Department offices previously contacted.

- Request Relief: State the specific assistance you are seeking. Attach additional sheets if necessary to elaborate.

- Authorize Third Party Contact: If you consent to the Office of the Taxpayer Rights Advocate contacting third parties, sign and date the form accordingly.

- Provide Additional Signatures: Include signatures of the taxpayer, spouse (if applicable), and any corporate officer if it's a business entity.

- Submit the Form: Send the completed DTF-911 form via mail or fax to the provided addresses. Ensure any attachments are included.

Following these steps will help clarify your tax issue to the Office of the Taxpayer Rights Advocate. Make sure all information is accurate to avoid delays in processing your request.

What You Should Know About This Form

What is the DTF-911 form?

The DTF-911 form is a request for assistance from the Office of the Taxpayer Rights Advocate (OTRA) within the New York State Department of Taxation and Finance. It is designed to help taxpayers who are facing significant tax-related issues and need support in addressing them effectively.

When should I use the DTF-911 form?

This form is appropriate for use in several situations. You should consider it if you are confronting an imminent adverse action regarding a debt you believe you do not owe, if you are facing undue economic harm, or if there has been a delay in the Tax Department's response to your inquiry. Other valid reasons include concerns over the fairness of tax regulations or processes, and unique circumstances that merit assistance.

When should I not use the DTF-911 form?

Avoid using this form if you have not first tried to resolve your issue through the standard channels of the Tax Department. Additionally, it is not intended for obtaining legal advice or assistance related to an unfavorable ruling by an administrative law judge.

What information do I need to provide on the form?

You will need to submit your personal information, including your name, Social Security number, and contact details. Moreover, you must detail the tax problem you are experiencing and the immediate relief you are seeking. It is helpful to include any previous attempts to resolve the issue and relevant identification numbers from any prior interactions with the Tax Department.

How do I submit the DTF-911 form?

You can submit the completed form by mailing it to the New York State Tax Department or by faxing it to the Office of the Taxpayer Rights Advocate. Ensure that you send it to the correct address or fax number to prevent delays.

What happens after I submit the DTF-911 form?

Once your form is submitted, the Office of the Taxpayer Rights Advocate will review your situation. They may contact you for additional information or clarification. In some cases, they may reach out to other parties as part of their investigation into your request.

Will my personal information be kept confidential?

Yes, your personal information is protected under New York State Tax Law. The Department may use it for lawful purposes associated with tax administration. However, this information will not be shared without appropriate authorization.

Can I have someone represent me on this form?

If you wish for someone to act on your behalf, you must include a power of attorney form with your submission. Make sure to complete the appropriate power of attorney form based on your situation, whether it involves a business or individual representation.

How long will it take to process my request?

The processing time for the DTF-911 form can vary. While the Office of the Taxpayer Rights Advocate strives to resolve issues promptly, it can take time as they may need to connect with other departments or third parties to gather necessary information.

What if I need further assistance after submitting the form?

If you do not receive a timely response or need additional help, consider following up directly with the Office of the Taxpayer Rights Advocate. Keeping communication lines open can help facilitate a resolution to your tax issues.

Common mistakes

Filling out the DTF-911 form can be a straightforward process if approached correctly. However, many people make significant mistakes that can hinder their request for assistance. Here are six common errors to avoid.

One major mistake is failing to provide complete taxpayer information. The form requires accurate names, Social Security numbers, and other personal details. Omissions can lead to delays in processing. Ensure that every section is filled out correctly and matches the information on your tax return.

Another error involves the description of the tax problem. Many individuals give vague or incomplete explanations of their issues. The more specific you are, the better. Include relevant details such as the type of tax problem and any previous attempts to resolve it. This information helps the Office of the Taxpayer Rights Advocate understand your situation.

People often neglect to include their taxpayer identification number when applicable. This is especially crucial for business entities. Without this identifier, the Tax Department may struggle to locate your records and assist you effectively. Be sure to check this entry before submitting the form.

Excessive lengths in the problem description can also be an issue. While detail is important, overwhelming the agency with lengthy narratives can be counterproductive. Stick to the facts and avoid unnecessary information that doesn’t directly pertain to your request.

Another common mistake is not submitting required attachments. If you've been involved in prior disputes or have other relevant documents, including them can strengthen your case. Many people miss this step, thinking the DTF-911 form is sufficient on its own.

Lastly, failing to sign the form can result in automatic rejection. Many individuals forget this critical step, thinking their submission is complete without it. Always ensure that all required signatures are present for both the taxpayer and the spouse if applicable.

Documents used along the form

The DTF-911 form is often accompanied by various other forms and documents to facilitate the resolution of tax issues. Below is a list of commonly used documents that may be relevant when submitting a DTF-911 request.

- Form POA-1: This is the Power of Attorney form for businesses. It allows a designated representative to act on behalf of the business in tax matters.

- Form POA-1-IND: This form grants Power of Attorney for individuals. It enables an authorized person to manage tax issues for the taxpayer.

- Form ET-14: The Estate Tax Power of Attorney form is used to designate someone to handle estate tax matters on behalf of the estate.

- Form IT-201: This is the New York State Resident Income Tax Return. Include this form if your DTF-911 request involves individual income tax issues.

- BCMS Number: The Bureau of Conciliation and Mediation Services number is required when you have had a conference or mediation related to your tax issue.

- DTA Number: This is the tax department number assigned to your case, useful for tracking and managing ongoing tax disputes.

- Audit Case Number: Include this number if your request relates to an audit, as it provides specific details for reference.

- Assessment or Collection Case Number: If your tax matters involve any assessments or collections, this number will help manage those cases effectively.

- Formal or Informal Protest Number: This number may be relevant if you have protested any tax assessments or decisions formally or informally.

Using these documents in conjunction with your DTF-911 request can help streamline communication with the New York State Department of Taxation and Finance. Proper documentation is crucial for a successful resolution of your tax concerns.

Similar forms

The DTF-911 form shares similarities with several other tax-related documents. Each of these documents serves specific functions for addressing taxpayer issues.

- Form POA-1 (Power of Attorney): This form allows taxpayers to authorize another individual to represent them before the New York State Department of Taxation and Finance. Like the DTF-911, it collects detailed taxpayer information and requires signatures from the involved parties.

- Form POA-1-IND (Power of Attorney for Individuals): Similar to Form POA-1, this form is specific to individual taxpayers seeking representation. It includes personal details and authorizes a representative, aligning with the DTF-911’s aim to facilitate communication with tax authorities regarding taxpayer problems.

- Form ET-14 (Estate Tax Power of Attorney): This document is focused on estate tax matters and allows executors to act on behalf of the decedent. Both the ET-14 and DTF-911 enable representatives to handle tax situations directly with the tax department, ensuring proper authority and communication.

- Form IT-201 (Resident Income Tax Return): This tax return form is used by individual taxpayers to report yearly income. Like the DTF-911, it demands accurate taxpayer identification details and contextual information regarding tax situations, ensuring all relevant data is submitted to the tax department.

- Form DTA (Tax Appeals Tribunal Case Form): Used for disputing tax matters, this form seeks administrative review similar to the requests made on DTF-911. Both forms allow taxpayers to present their cases with comprehensive details about the issues faced with the Tax Department.

Dos and Don'ts

- Do: Carefully read the instructions on page 2 before filling out the form.

- Do: Provide complete and accurate taxpayer information, including names and Social Security Numbers.

- Do: Clearly describe the tax problem you are facing and any previous attempts to resolve it.

- Do: Include any relevant details such as BCMS numbers or audit case numbers if applicable.

- Do: Make sure to sign the form where required to authorize any communication.

- Don't: Use this form if you haven't exhausted other options for relief with the Tax Department.

- Don't: Seek legal or tax return preparation advice through this form.

Misconceptions

Misconceptions about the DTF-911 form can lead to confusion and misuse. Here are eight common misconceptions along with explanations to clarify each one:

- The DTF-911 form is only for individuals with large tax debts. Many people believe that this form is reserved for serious tax issues. In reality, it can be used by anyone experiencing tax-related problems, including minor issues or delays.

- You must have an attorney to file the DTF-911 form. This is not true. Taxpayers can complete and submit the form without the assistance of an attorney. However, having legal representation may help in complex cases.

- The form guarantees a favorable outcome. Filing the DTF-911 does not guarantee that a taxpayer will receive the relief or assistance they are seeking. It serves as a request for evaluation and support from the Office of the Taxpayer Rights Advocate.

- Using the DTF-911 form means I am filing a formal tax appeal. The DTF-911 form is not a formal appeal process. It is meant for requesting assistance related to existing tax problems and is separate from any formal appeals process.

- Once I submit the form, I will be continuously updated on my case. Taxpayers should understand that the Office of the Taxpayer Rights Advocate may not provide continuous updates while assessing the request. Communication may be limited to significant developments.

- The DTF-911 form is only for issues with audits. This perception is misleading. The form can address a variety of problems, including undue economic harm, delays in resolution, and perceived unfairness in tax law application.

- All tax issues require this form. Not every tax problem warrants a DTF-911 filing. Taxpayers should first attempt to resolve their issues through regular Tax Department channels before considering this form.

- My personal information is not at risk when submitting the form. It is important to note that the DTF-911 form collects personal information, which is protected but must be disclosed to some extent according to state tax laws. Taxpayers should handle such information with care.

Key takeaways

Here are some important points to remember when filling out and using the DTF-911 form.

- Purpose of the Form: Use the DTF-911 form to request assistance from the Office of the Taxpayer Rights Advocate if you're experiencing tax-related problems.

- Eligibility: You're eligible to use this form if you face immediate adverse action, undue economic harm, or delays in receiving responses from the Tax Department.

- Exhausting Options: Before using this form, ensure you have exhausted all reasonable efforts to resolve your issues through regular Tax Department channels.

- Personal Information: Provide complete taxpayer information including names, social security numbers, and contact details.

- Describing Your Issue: Clearly describe the tax problem, previous attempts to resolve it, and any relevant information, such as case numbers.

- Power of Attorney: If someone will represent you, complete the appropriate Power of Attorney form and include it with your submission.

- Privacy Considerations: Remember that personal information will be collected and may be used for lawful purposes related to tax liabilities.

- Submission Methods: You can submit the completed form by mail or fax to the appropriate Tax Department office.

- Contacting Third Parties: By signing the form, you allow the Advocate's office to contact others to assist with your request.

- Your E-Mail Address: If you provide an email, they may use it to contact you about your request, but not to discuss specifics of your case.

By keeping these key takeaways in mind, you'll be better equipped to complete the DTF-911 form accurately and effectively seek assistance with your tax matters.

Browse Other Templates

Epa Prior Authorization - Completing this form accurately can lead to timely interventions in patient care.

Baptismal Record,Holy Baptism Certificate,Child Baptism Confirmation,Sacramental Baptism Document,Baptism Registration Form,Certificate of Holy Baptism,Baptism Acknowledgment Certificate,Baptism Verification Form,Catholic Baptism Certificate,Baptisma - A historical record outlining the rites of baptism.

Watoga State Park Riverside Campground - No more than two vehicles are allowed per campsite for your convenience and safety.