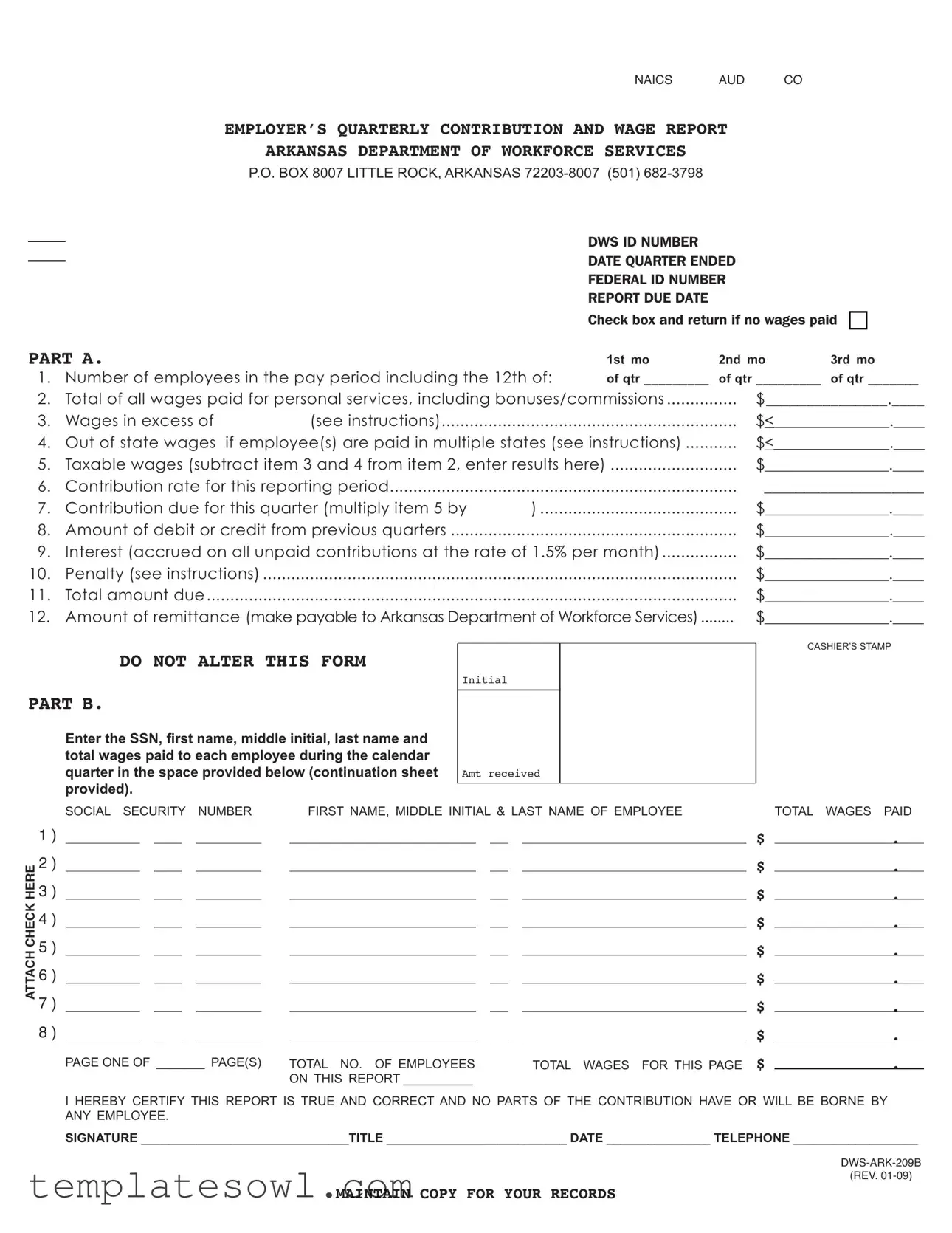

Fill Out Your Dws Ark 209B Form

The DWS Ark 209B form is an essential tool for employers in Arkansas, enabling them to report their quarterly contributions and wages accurately. This form is submitted to the Arkansas Department of Workforce Services and plays a critical role in ensuring compliance with state tax regulations. It encompasses several key elements that assist in tracking employee wages and contributions for unemployment insurance. For example, employers must provide their DWS ID and Federal ID numbers, along with the number of employees and total wages paid during the reporting period. The form also includes sections for reporting taxable wages, contributions owed, and any previous credits or debits. If applicable, employers must disclose out-of-state wages. It is vital that employers complete this form diligently, as it involves calculating exact contributions due, penalties for late payments, and interest on unpaid amounts. Additionally, income details for each employee must be itemized, strengthening transparency and accountability. Failure to adhere to these guidelines may result in penalties, emphasizing the importance of the DWS Ark 209B form in sustaining both employer integrity and compliance with state employment laws.

Dws Ark 209B Example

NAICS AUD CO

EMPLOYER’S QUARTERLY CONTRIBUTION AND WAGE REPORT

ARKANSAS DEPARTMENT OF WORKFORCE SERVICES

P.O. BOX 8007 LITTLE ROCK, ARKANSAS

DWS ID NUMBER

DATE QUARTER ENDED

FEDERAL ID NUMBER

REPORT DUE DATE

Check box and return if no wages paid

c

PART A.

1st mo |

2nd mo |

3rd mo |

1. |

Number of employees in the pay period including the 12th of: |

of qtr _________ of qtr _________ of qtr _______ |

|||

2. |

Total of all wages paid for personal services, including bonuses/commissions |

$_______________.____ |

|||

3. |

Wages in excess of |

(see instructions) |

|

$<_______________.____ |

|

4. |

Out of state wages |

if employee(s) are paid in multiple states (see instructions) |

$<_______________.____ |

||

5. |

Taxable wages (subtract item 3 and 4 from item 2, enter results here) |

........................... |

$________________.____ |

||

6. |

Contribution rate for this reporting period |

|

____________________ |

||

7. |

Contribution due for this quarter (multiply item 5 by |

) |

$________________.____ |

||

8. |

Amount of debit or credit from previous quarters |

|

$________________.____ |

||

9. |

Interest (accrued on all unpaid contributions at the rate of 1.5% per month) |

$________________.____ |

|||

10. |

Penalty (see instructions) |

|

$________________.____ |

||

11. |

Total amount due |

|

|

$________________.____ |

|

12. |

Amount of remittance (make payable to Arkansas Department of Workforce Services) |

$________________.____ |

|||

DO NOT ALTER THIS FORM

PART B.

Enter the SSN, irst name, middle initial, last name and total wages paid to each employee during the calendar quarter in the space provided below (continuation sheet provided).

INITIAL

AMT RECEIVED

CASHIER’S STAMP

SOCIAL SECURITY NUMBER |

FIRST NAME, MIDDLE INITIAL & LAST NAME OF EMPLOYEE |

TOTAL WAGES PAID

ATTACH CHECK HERE

1)

2 )

3 )

4 )

5 )

6 )

7 )

8 )

|

|

|

|

|

|

|

|

|

|

|

$ |

. |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

$ |

. |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

$ |

. |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

$ |

. |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

$ |

. |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

$ |

. |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

$ |

. |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

$ |

. |

|

|

|

|

|

|

|

|

|

|

|

||

PAGE ONE OF _______ PAGE(S) |

TOTAL NO. OF EMPLOYEES |

TOTAL WAGES FOR THIS PAGE $ |

. |

|||||||||

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

ON THIS REPORT __________ |

|

|

|

|||

I HEREBY CERTIFY THIS REPORT IS TRUE AND CORRECT AND NO PARTS OF THE CONTRIBUTION HAVE OR WILL BE BORNE BY ANY EMPLOYEE.

SIGNATURE ______________________________TITLE __________________________ DATE _______________ TELEPHONE __________________

(REV.

MAINTAIN COPY FOR YOUR RECORDS

CONTINUATION SHEET FOR FORM 209B

DWS ID Number ___________________________________ |

Quarter End Date _____________________ |

|

Employer ____________________________________________________________ |

||

Town |

_________________________________________ |

Page ________ of ________ |

1 )

2 )

3 )

4 )

5 )

6 )

7 )

8 )

9 )

10)

11)

12)

13)

14)

15)

16)

17)

18)

19)

20)

21)

22 )

23 )

24 )

25)

26)

SOCIAL SECURITY NUMBER |

FIRST NAME, MIDDLE INITIAL & LAST NAME OF EMPLOYEE |

TOTAL WAGES PAID |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

$ |

. |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

. |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

. |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

. |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

. |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

. |

|

|

|

|

|

|

|

|

|

|

|

$ |

. |

|

|

|

|

|

|

|

|

|

. |

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

. |

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

. |

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

. |

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

. |

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

. |

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

. |

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

. |

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

. |

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

. |

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

. |

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

. |

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

. |

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

. |

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

. |

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

. |

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

. |

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

. |

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

. |

|||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|||

TOTAL WAGES FOR THIS PAGE $ |

. |

|

(REV.

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The DWS Ark 209B form is used for reporting an employer's quarterly contribution and wages for the state of Arkansas. |

| Governing Agency | This form is administered by the Arkansas Department of Workforce Services. |

| Report Frequency | Employers must submit this form quarterly to provide accurate wage and contribution information. |

| Required Information | Employers need to report the number of employees, total wages paid, and taxable wages, among other details. |

| Due Date | The form is due on a specific date each quarter, which is listed on the form itself. |

| Submission Method | Employers should submit the completed form along with remittance to the Arkansas Department of Workforce Services. |

| Certification Requirement | By signing the form, the employer certifies that the report is true and correct, ensuring compliance with Arkansas laws. |

Guidelines on Utilizing Dws Ark 209B

Completing the DWS Ark 209B form requires careful attention to the details regarding employee wages and contributions. This important document must be accurately filled out to ensure compliance with Arkansas Department of Workforce Services regulations. The following steps will guide you through the process of completing this form seamlessly.

- Gather Information: Collect all necessary data related to your employees, including wages and any previous contributions.

- Fill Out Employer Details: Enter your DWS ID Number, Federal ID Number, and the date the quarter ended.

- Check the No Wages Box: If no wages were paid during the quarter, check the appropriate box and return the form.

- Complete Part A:

- Record the number of employees during each month of the quarter.

- Input the total wages paid, including bonuses and commissions.

- Indicate any wages exceeding the specified limit.

- Report out-of-state wages for employees paid in multiple states.

- Calculate taxable wages by subtracting excess wages and out-of-state wages from total wages.

- Provide the contribution rate for the reporting period.

- Calculate the contribution due for the quarter by multiplying taxable wages by the contribution rate.

- Add the amount of debit or credit from previous quarters and interest accrued on unpaid contributions.

- Include any penalties incurred.

- Sum up to find the total amount due and the specific amount of remittance.

- Complete Part B: List the Social Security Number, first name, middle initial, last name, and total wages paid for each employee during the quarter. Attach any continuation sheet if necessary.

- Certify the Report: Sign and date the form, indicating your affirmation that the report is accurate and that no contributions have been borne by employees.

- Submit the Form: Make a copy for your records before submitting the completed form along with your remittance to the Arkansas Department of Workforce Services.

Following these steps will help ensure all information is accurately provided on the DWS Ark 209B form, maintaining compliance with reporting requirements. If uncertainties arise, consulting with a qualified professional may provide additional guidance.

What You Should Know About This Form

What is the purpose of the DWS Ark 209B form?

The DWS Ark 209B form is used by employers in Arkansas to report their quarterly contributions and wages paid to employees. This report must be submitted to the Arkansas Department of Workforce Services. The data collected includes information on the number of employees, total wages, taxable wages, and the amount due for contributions. It is essential for ensuring compliance with state tax regulations and for funding unemployment benefits.

Who is required to submit the DWS Ark 209B form?

All employers who have employees in Arkansas and are subject to the state's unemployment insurance laws must complete and submit the DWS Ark 209B form. This obligation applies regardless of the size of the business or the number of employees. It is crucial for employers to stay compliant with reporting requirements to avoid penalties and ensure that they are contributing appropriately to the unemployment fund.

What information is needed to complete the DWS Ark 209B form?

To complete the DWS Ark 209B form, employers need to provide several pieces of information. They must list the number of employees during the pay period, total wages paid for personal services, and any wages that exceed the specified threshold. Additionally, if there are wages paid to employees in multiple states, those figures must be reported. Employers will also need to calculate the taxable wages, contribution rates, and total contributions due based on the figures provided in the form.

What happens if an employer fails to submit the DWS Ark 209B form on time?

If an employer fails to submit the DWS Ark 209B form by the due date, they may incur penalties and interest on the amount due. The Arkansas Department of Workforce Services could impose a penalty for late submission, and interest accrues at a rate of 1.5% per month on unpaid contributions. It is essential for employers to be aware of these consequences and to submit their reports timely to avoid additional costs.

How should employers submit the DWS Ark 209B form?

Employers should submit the DWS Ark 209B form to the Arkansas Department of Workforce Services by mailing it to the address specified on the form. Along with the completed form, employers should attach their payment, making the check payable to the Arkansas Department of Workforce Services. It is advisable for employers to retain a copy of the submitted form for their records. Proper documentation will be beneficial in case of any inquiries or audits regarding the submission.

Common mistakes

Completing the DWS Ark 209B form can be a straightforward process, but mistakes are common and can lead to fines or processing delays. One pervasive error occurs when individuals fail to accurately report the number of employees. The form specifically asks for the total number of employees during the pay period for the quarter. Not including each employee can result in an inaccurate contribution calculation, impacting the business's financial responsibilities. Always double-check the employee count during the relevant months, as this figure directly affects several subsequent calculations.

Another frequent mistake is related to the total wages reported. Some individuals miscalculate or forget to include bonuses and commissions. The form requires that all forms of compensation be summed up completely. Ignoring certain wages can lead to underreporting, which may eventually trigger audits or penalties. It’s essential to review payroll records thoroughly to ensure every bit of compensation is reflected correctly on the form.

Many filers also overlook the importance of the contribution rate. The contribution rate changes periodically and varies depending on the employer's experience rating. Failing to update this figure can skew the total amount owed, as the final tax liability hinges on this rate. Always refer to the most current guidelines and regulations when determining the contribution rate to avoid overpayment or underpayment.

Some employers make the mistake of not including out-of-state wages when applicable. If employees were paid for work done in multiple states, those wages must also be reported according to instructions on the form. This can be a complicated area, especially for companies with a mobile workforce. Missing these wages may result in owing taxes to additional states, leading to compliance issues.

Lastly, it’s crucial not to forget the certification section at the end of the form. This part requires a signature, indicating that the information provided is accurate and truthful. Omitting this signature can postpone processing and result in the form being returned. Always remember to sign and date the form before submission, ensuring that it is complete and valid.

Documents used along the form

When managing workforce contributions in Arkansas, various documents work together with the Dws Ark 209B form to ensure compliance with state regulations. Here are four important forms you may also encounter:

- DWS Ark 209C: This is a continuation form for additional employees when reporting wages. It allows you to list more employees than the primary Dws Ark 209B can accommodate without losing critical information.

- Employee Wage Reporting Form: This form outlines the wages paid to individual employees during a specific period. Employers use it to track and verify payment records and employee contributions.

- Unemployment Insurance Application: Employers need this form to apply for unemployment insurance for their employees. It contains essential information about the company's workforce and compliance requirements.

- Employer Status Update Form: This document is used by employers to report any changes in their business status or structure. Keeping this updated is crucial for maintaining accurate records with the Arkansas Department of Workforce Services.

Utilizing these forms in conjunction with the Dws Ark 209B ensures accurate reporting and adherence to employment laws in Arkansas. It's always a good practice to stay organized and informed about your reporting obligations.

Similar forms

Form 941 - Employer's QUARTERLY Federal Tax Return: Similar to the DWS Ark 209B, this form is also used by employers to report wages paid to employees and the taxes withheld. Employers must file it quarterly and detail earnings, tax withheld, and the payroll relating to Social Security, Medicare, and federal income tax.

Form 940 - Employer’s Annual Federal Unemployment (FUTA) Tax Return: The 940 form is related to the unemployment insurance system, just as the DWS Ark 209B deals with state employee contributions. Both forms collect information on employment and contributions made, though the 940 is filed annually instead of quarterly.

State Employer Payroll Tax Returns: Many states have their own forms similar to the DWS Ark 209B that allow employers to report state unemployment taxes and wages paid. These forms may vary in specifics but follow similar guidelines regarding reporting employee wages and calculating contributions.

W-2 Forms - Wage and Tax Statement: While the DWS Ark 209B collects quarterly data, W-2 forms summarize an employee's total wages and the taxes withheld during a calendar year. Both documents are necessary for reporting taxable income, but their frequency and purpose differ.

Form 1099-MISC - Miscellaneous Income: This form is used to report payments made to non-employees, such as independent contractors. Like the DWS Ark 209B, it is important for tracking income reported to tax authorities, although it is used differently in terms of employee versus contractor reporting.

Dos and Don'ts

When filling out the DWS Ark 209B form, it’s important to be careful and precise. Here’s a list of things you should and shouldn’t do:

- Do ensure that all fields are filled out completely before submitting.

- Do verify your DWS ID number and Federal ID number for accuracy.

- Do calculate the total wages carefully, including bonuses and commissions.

- Do remember to report wages for any employees who worked in multiple states.

- Do sign and date the form to certify its accuracy.

- Don’t leave any sections blank; if a section doesn't apply, indicate it clearly.

- Don’t forget to attach your payment check if there's an amount due.

- Don’t alter the form; use it as is to ensure it will be accepted.

- Don’t wait until the last minute to submit; allow time for any errors to be corrected.

- Don’t ignore the instructions provided, as they contain vital information.

Following these tips will help ensure your filing process goes smoothly. If you have questions while completing the form, don’t hesitate to reach out for assistance.

Misconceptions

The DWS Ark 209B form is an important document for employers in Arkansas regarding their quarterly contribution and wage reporting. Despite its significance, several misconceptions exist surrounding this form. Here are some of the most common misunderstandings:

- 1. The DWS Ark 209B is only for large employers. Many believe that only large businesses need to file this form. However, all employers who pay wages to employees in Arkansas must complete it, regardless of the number of employees.

- 2. The form is optional for employers with no wages paid. Some employers mistakenly think they do not need to submit the form if they haven’t paid any wages. In reality, they are required to check the box indicating no wages paid and submit it to remain compliant.

- 3. Wages reported on the form do not affect unemployment contributions. Employers often believe that the total wages they report are unrelated to their unemployment contributions. In truth, the contribution amount is directly tied to the taxable wages reported, which can influence future rates.

- 4. Only the finance department needs to understand the form. This form is primarily thought to be the concern of the accounting team. However, all managers and personnel involved in payroll should understand its implications to ensure compliance.

- 5. The form is only needed once a year. Employers sometimes think they can submit this form on an annual basis. In reality, the DWS Ark 209B must be submitted quarterly within specific deadlines established by the Arkansas Department of Workforce Services.

- 6. Errors on the form have no consequences. Many believe that minor mistakes will be overlooked. On the contrary, submitting inaccurate information can lead to penalties, interest charges, and increased scrutiny from state agencies.

- 7. Submission of the form guarantees benefits for employees. Employers may think that filing this form automatically ensures their employees qualify for benefits. While it is a necessary part of maintaining compliance, individual eligibility for benefits is determined by various factors.

- 8. The form can be submitted online only. It is a common misconception that electronic submission is the only option. Employers can still submit a paper form by mail, but online submission is often more efficient.

- 9. Retaining copies of the form is unnecessary. Employers might think that keeping records of this form isn’t important. However, maintaining copies is essential for future reference and in case of any audits or discrepancies.

Clear understanding of the DWS Ark 209B form can help employers navigate their responsibilities more effectively and avoid potential pitfalls.

Key takeaways

The DWS Ark 209B form is essential for employers in Arkansas when reporting quarterly contributions and wages. Here are nine key takeaways to keep in mind when filling out and using this form:

- Understand the Purpose: This form collects information regarding wages paid to employees and the employer's contributions for unemployment insurance.

- Accurate Reporting: Ensure that all employee wages are accurately reported to avoid penalties and issues with the Arkansas Department of Workforce Services.

- Filling Out Employee Information: Provide each employee's Social Security Number, full name, and total wages paid during the quarter in the designated areas.

- Calculate Taxable Wages: Remember to subtract wages in excess and out-of-state wages from total wages to arrive at the taxable wages.

- Check Contribution Rates: Contribution rates may change, so make sure to verify and apply the correct percentage for calculations.

- Penalties for Late Submission: Submitting the form after the due date can result in penalties, including interest on unpaid contributions.

- Certification Requirement: A certification statement at the bottom must be signed. This confirms the accuracy of the report and indicates that no part of the contribution has or will be passed on to employees.

- Maintain Copies: Keep a copy of the completed form for your records. This is useful for reference and in case of any inquiries from the Department of Workforce Services.

- Use the Continuation Sheet: If you have more employees than the space allows, utilize the continuation sheet provided to list additional employees and wages.

Filling out the DWS Ark 209B form accurately and on time is vital for compliance and the smooth operation of your business. Understanding these key points can help streamline the process and minimize potential issues.

Browse Other Templates

Clearances for Pa Teachers - Employers rely on the honesty of employees to maintain a safe educational setting.

Notice to Vacate Illinois - The form outlines the responsibilities of the tenant to return the property in good condition.