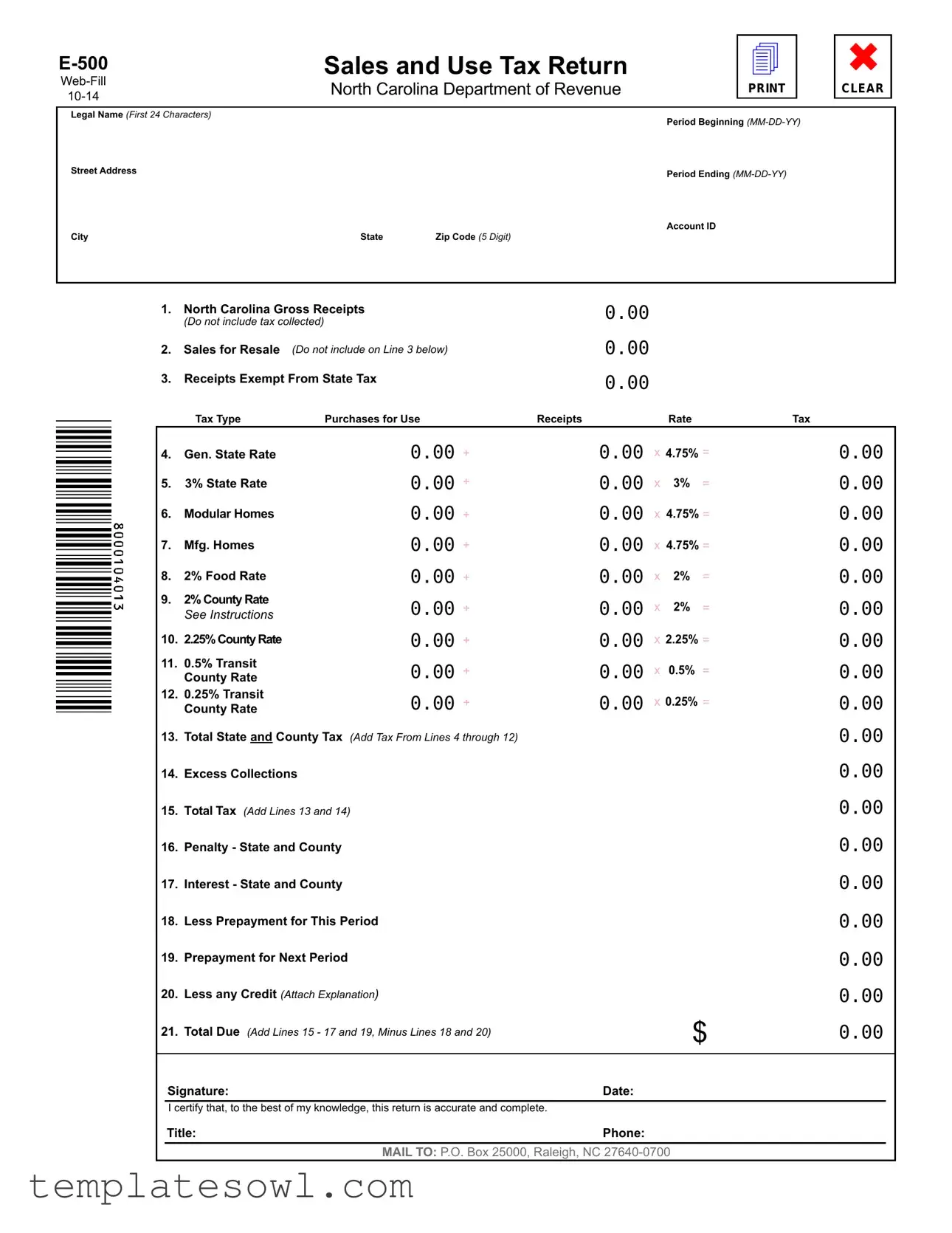

Fill Out Your E 500 Form

The E 500 form serves as a crucial tool for businesses in North Carolina, facilitating the reporting and payment of sales and use tax. Essential details include the legal name, address, account ID, and the specified tax period. The form requires businesses to report their gross receipts and sales that are exempt from state tax, providing a comprehensive view of taxable activities. Tax rates, including general state rates and specific rates for categories such as food and modular homes, need to be accurately calculated. Furthermore, the E 500 necessitates a breakdown of total tax collected, penalties, and any credits that may apply, ultimately leading to the calculation of the total amount due. Special attention is given to the possible prepayments for future periods and the requirement of a certification signature, asserting that reported information is accurate. To comply with state regulations, businesses must submit the completed form to the designated mailing address. This form not only manages tax liabilities but also plays a vital role in promoting transparency and accountability among taxpayers.

E 500 Example

Sales and Use Tax Return |

|

North Carolina Department of Revenue |

|

4

✖

CLEAR

Legal Name (First 24 Characters) |

|

Period Beginning |

|

|

|

Street Address |

|

Period Ending |

|

|

Account ID |

City |

State |

Zip Code (5 Digit) |

|

|

|

1.North Carolina Gross Receipts

(Do not include tax collected)

2.Sales for Resale (Do not include on Line 3 below)

3.Receipts Exempt From State Tax

0.00

0.00

0.00

Tax Type |

Purchases for Use |

Receipts |

Rate |

Tax |

4. |

Gen. State Rate |

0.00 + |

5. |

3% State Rate |

0.00 + |

6. |

Modular Homes |

0.00 + |

7. |

Mfg. Homes |

0.00 + |

8. |

2% Food Rate |

0.00 + |

9. |

2% County Rate |

0.00 + |

|

See Instructions |

|

10. |

2.25% County Rate |

0.00 + |

11. |

0.5% Transit |

0.00 + |

|

County Rate |

|

12. |

0.25% Transit |

0.00 + |

|

County Rate |

13.Total State and County Tax (Add Tax From Lines 4 through 12)

14.Excess Collections

15.Total Tax (Add Lines 13 and 14)

16.Penalty - State and County

17.Interest - State and County

18.Less Prepayment for This Period

19.Prepayment for Next Period

20.Less any Credit (Attach Explanation)

21.Total Due (Add Lines 15 - 17 and 19, Minus Lines 18 and 20)

0.00 |

x 4.75% = |

0.00 |

||

0.00 |

x |

3% |

= |

0.00 |

0.00 |

x 4.75% = |

0.00 |

||

0.00 |

x 4.75% = |

0.00 |

||

0.00 |

x |

2% |

= |

0.00 |

0.00 |

x |

2% |

= |

0.00 |

0.00 |

x 2.25% = |

0.00 |

||

0.00 |

x |

0.5% |

= |

0.00 |

0.00 |

x 0.25% = |

0.00 |

||

|

|

|

|

0.00 |

|

|

|

|

0.00 |

|

|

|

|

0.00 |

|

|

|

|

0.00 |

|

|

|

|

0.00 |

|

|

|

|

0.00 |

|

|

|

|

0.00 |

|

|

|

|

0.00 |

|

|

$ |

0.00 |

|

Signature: |

Date: |

I certify that, to the best of my knowledge, this return is accurate and complete.

Title: |

Phone: |

|

MAIL TO: P.O. Box 25000, Raleigh, NC |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of E-500 | The E-500 form is used for reporting and paying sales and use tax in the state of North Carolina. |

| Who Should File | Businesses that collect sales tax or use tax on taxable transactions in North Carolina must file the E-500. |

| Filing Frequency | The E-500 form is typically filed quarterly, aligning with the North Carolina Department of Revenue's prescribed periods. |

| E-500 Governing Law | The requirements for the E-500 form are governed by North Carolina General Statutes Chapter 105, specifically Section 105-164. |

Guidelines on Utilizing E 500

Filling out the E 500 form is a necessary step for reporting sales and use tax in North Carolina. Below are clear, straightforward steps to guide you through the process so you can complete the form accurately and efficiently.

- Begin by entering your Legal Name (first 24 characters) in the designated box.

- Input the Period Beginning date in the format MM-DD-YY.

- Enter the Street Address where your business operates.

- Input the Period Ending date in the format MM-DD-YY.

- Fill in your Account ID number.

- Enter the City where your business is located.

- Choose State from the dropdown menu (typically North Carolina).

- Provide your Zip Code (5-digit format).

- Report your North Carolina Gross Receipts (do not include tax collected).

- List Sales for Resale (do not include these on Line 3).

- Enter Receipts Exempt From State Tax as applicable.

- Complete each section for various Tax Rates (General State Rate, 3% State Rate, etc.) by following the instructions on the form.

- Add the figures from Lines 4 through 12 to calculate the Total State and County Tax.

- Record any Excess Collections you may have.

- Add Lines 13 and 14 for the Total Tax.

- Include any applicable penalties and interest (Lines 16 and 17).

- Deduct the Prepayment for This Period as well as any credits from Line 20.

- Calculate your Total Due by adding Lines 15 - 17 and 19, then subtracting Lines 18 and 20.

- Sign and date the form, certifying its accuracy and completeness.

- Provide your Title and Phone number.

- Mail your completed form to P.O. Box 25000, Raleigh, NC 27640-0700.

Following these steps will ensure that your E 500 form is properly filled out and submitted. This will help you stay compliant with tax regulations while keeping the process straightforward.

What You Should Know About This Form

What is the E 500 form?

The E 500 form is the Sales and Use Tax Return used by businesses in North Carolina to report their sales and use tax obligations. It helps the North Carolina Department of Revenue track how much tax a business has collected and needs to remit for a specific reporting period.

Who needs to file the E 500 form?

Any business that sells goods or services in North Carolina and is registered to collect sales tax must file the E 500 form. This includes retailers, wholesalers, and service providers that are required to charge customers sales tax on their transactions.

How often do I need to file the E 500 form?

The frequency of filing the E 500 depends on your business’s sales volume and tax liability. Generally, businesses may need to file monthly, quarterly, or annually. You should check your specific filing frequency as designated by the North Carolina Department of Revenue for your account.

What information do I need to complete the E 500 form?

To complete the E 500 form, you'll need your legal business name, account ID, period of the report, gross receipts, and details on any exempt sales or sales for resale. You also need to calculate the applicable sales and use tax rates, including state and county tax rates, which are outlined on the form.

What happens if I fail to file the E 500 form on time?

If you fail to file the E 500 form on time, your business may incur penalties and interest charges. These can accumulate quickly, impacting your financial standing. It’s essential to file by the deadline to avoid these additional costs.

Can I amend my E 500 form after I have submitted it?

Yes, if you discover an error after submission, you can amend your E 500 form. You'll need to follow the specific process set by the North Carolina Department of Revenue for amendments, which typically involves submitting an amended return with the correct information.

Where should I send my completed E 500 form?

Once you have completed the E 500 form, you’ll need to mail it to the North Carolina Department of Revenue at P.O. Box 25000, Raleigh, NC 27640-0700. Ensure that you allow plenty of time for the form to arrive by the filing deadline.

Common mistakes

Filing the E-500 form can be a straightforward process, yet many people make mistakes that can lead to issues down the road. One common error occurs when individuals forget to include their Legal Name accurately within the first 24 characters. This detail is crucial; an incorrect name can cause confusion and delays in processing.

Another frequent mistake is failing to specify the correct Period Beginning and Ending dates. These dates should reflect the period for which the sales tax is being reported. If you mix them up or leave them blank, it can lead to complications in your tax calculations.

Many also overlook the necessity of entering the correct Account ID. This number uniquely identifies your account with the North Carolina Department of Revenue. If this is incorrect, the department may not link your return to your account, causing additional headaches.

When completing the sales sections, it’s not unusual for individuals to inaccurately report sales for resale. These sales should not be included on Line 3, yet many people mistakenly cross these figures over. Keeping track of what should be reported where is essential to accurate tax filing.

Another area where mistakes commonly occur is in calculating the tax amounts. It's crucial to take a moment to review how tax rates are applied to different items. Failing to do so can result in either overestimating or underestimating your total tax liability.

Line 13 requires the total state and county tax to be summed up correctly. Sometimes, individuals either forget to add all applicable taxes or make simple arithmetic errors, leading to an inaccurate total on their return.

Some filers also neglect to account for any excess collections. This can complicate the Total Due calculation and result in needing to amend the return later. It’s wise to double-check this line, as it directly impacts the final amount owed.

Painfully, missing signatures and dates on the E-500 form continues to be a recurring issue. This oversight renders the entire form invalid, which could delay processing times significantly and potentially lead to penalties.

Finally, attaching any required explanations for credits can be forgotten. If you’re claiming a credit, make sure to provide sufficient documentation. Without this, the Department of Revenue may reject your claim, complicating your overall tax situation.

Documents used along the form

The E-500 Sales and Use Tax Return is an essential document for businesses in North Carolina, helping to report sales and use taxes accurately. Along with the E-500, several other forms and documents are often necessary to ensure compliance with state tax regulations. Below are six commonly used forms that complement the E-500.

- E-500CR - This form is a Credit for Sales and Use Tax Paid. It allows businesses to claim a refund for sales tax previously remitted. Proper documentation is required to support the request for credits.

- NC-BR - The Business Registration Application (NC-BR) is used by new businesses to register for state tax accounts. Completing this form is a prerequisite to collecting sales tax and filing the E-500.

- NC-3 - The Employer's Quarterly Tax and Wage Report (NC-3) is filed by businesses to report wages paid and taxes withheld from employees. While not directly related to the E-500, it is essential for overall tax compliance.

- Form NC-4 - This is the Employee's Withholding Allowance Certificate. Employees fill out this form to determine the amount of state tax to be withheld from their paychecks. Knowing this information can help businesses manage their sales tax obligations more accurately.

- Sales Tax Exemption Certificate - This document is used by purchasers to claim an exemption from sales tax when buying items that will not be subject to taxation. Sellers must retain these certificates to validate non-taxable sales on their E-500 forms.

- Form D-400 - The North Carolina Individual Income Tax Return (Form D-400) is for individuals to report their income and taxes due. While primarily for personal tax, it may relate to business owners who withdraw funds for personal use.

Using these forms together with the E-500 will help ensure that your business remains compliant with state tax laws. Staying organized and informed about all necessary documents can ease the tax reporting process and minimize the risk of penalties.

Similar forms

Form 1099-MISC: This form reports various types of income, including rental payments and royalties. Like the E-500, it requires accurate reporting of amounts but focuses on individual payees.

Form W-2: Employers use this form to report wages paid to employees and the taxes withheld. Similar to the E-500, it summarizes amounts owed and collected but is geared towards employment income.

Sales Tax Return Forms (various states): Most states have similar tax return forms for reporting sales and use taxes. They show gross sales, less exemptions, and the total amount of tax owed, much like the E-500.

Form 941: This is used by employers to report income taxes, Social Security tax, and Medicare tax withheld. Similar to the E-500 in its purpose of tax collection, it focuses on payroll rather than sales.

Form 990: Nonprofits use this form to report their financial information, including revenue and expenses. Like the E-500, it provides a summary of financial activities but is directed at charitable organizations.

Quarterly Business Tax Returns: Many businesses submit quarterly tax returns, similar in structure to the E-500. These forms summarize sales over a specific period and calculate tax liabilities.

Form 1040 Schedule C: Sole proprietors use this form to report income and expenses from their business. It shares similarities with the E-500 in summarizing revenue but is tailored for individual business owners.

Property Tax Return Forms: Used in various jurisdictions to report property values for tax assessments. Similar to the E-500, these forms calculate amounts owed based on assessed values and applicable rates.

Dos and Don'ts

When filling out the E-500 form, it is important to adhere to specific guidelines to ensure accuracy and compliance. Below are some key dos and don'ts:

- Do: Ensure you provide accurate legal name and address information.

- Do: Review the instructions carefully before starting your form.

- Do: Double-check all calculations for gross receipts and tax totals.

- Don’t: Include tax collected in your gross receipts.

- Don’t: Forget to sign and date the form before submission.

- Don’t: Leave any required fields blank, as this may delay processing.

By following these guidelines, you can help ensure a smooth filing experience for your sales and use tax return.

Misconceptions

There are many misunderstandings surrounding the E 500 form used for sales and use tax in North Carolina. Addressing these misconceptions can help individuals and businesses navigate their tax responsibilities more effectively. Below are seven common misconceptions:

- 1. The E 500 form is only for large businesses. In reality, this form is required for all businesses that have sales and use tax obligations in North Carolina, regardless of size.

- 2. Only physical goods are reported on the E 500 form. This is not true. Businesses must report all taxable services as well, not just physical products.

- 3. The E 500 form needs to be submitted annually. Many people think this is the case. However, the form is typically submitted quarterly, depending on the business's tax liability.

- 4. Any sales tax collected from customers can be kept by the business. It is a misconception that tax collected is revenue for the business. In reality, it must be remitted to the state.

- 5. Online businesses do not need to file the E 500 form. This is incorrect. Online retailers with a presence or economic activity in North Carolina must file.

- 6. The form can be completed and submitted without prior preparation. Many assume the form is straightforward, but it requires careful attention to detail to ensure accuracy and compliance.

- 7. There are no penalties for late submission of the E 500 form. Some believe that late filings are overlooked. However, late submissions can incur penalties and interest, affecting the total tax due.

Understanding these misconceptions can lead to better compliance and reduce the risk of penalties. Proper knowledge of the E 500 form is essential for all businesses operating in North Carolina.

Key takeaways

The E 500 form is used to report sales and use tax in North Carolina. Ensure all information is complete and accurate to avoid penalties.

Enter your legal name, address, and account ID at the top of the form. This information is crucial for proper identification.

Carefully itemize your collections and exemptions. Lines 1 through 3 require details about gross receipts, sales for resale, and exempt receipts.

Calculate the total state and county tax correctly by adding up all applicable rates on lines 4 through 12. Accurate calculations prevent future audits.

Submit the completed form by mailing it to the address provided: P.O. Box 25000, Raleigh, NC 27640-0700. Timely submissions help maintain compliance.

Browse Other Templates

Wells Fargo Bank Verification Letter - Streamlining the request procedure can improve turnaround times for credit inquiries.

Air National Guard Retirement - The military provides specific addresses where the completed form should be sent.