Fill Out Your E 585 Form

The E 585 form is a crucial document for nonprofit and governmental entities in North Carolina seeking to reclaim sales and use taxes paid for qualifying purchases. This form, formally titled the Nonprofit and Governmental Entity Claim for Refund, is specifically designed to streamline the process of obtaining refunds for taxes that organizations have already disbursed on tangible personal property and services. It's essential to adhere to the detailed instructions while filling out the form. For instance, users must ensure all information is completed accurately, utilizing blue or black ink and avoiding dollar signs or commas. The timeframe for submitting claims is also pivotal. Nonprofits must file their requests by October 15 for the first half of the year and by April 15 for the second half, while governmental entities have a six-month window post-fiscal year for claims. Additionally, organizations must maintain thorough records distinguishing between direct and indirect tax payments. Understanding the limitations on refund amounts is vital; for example, there is an annual cap on refunds for nonprofits. All these nuances highlight the importance of navigating the E 585 form carefully to expedite the refund process efficiently.

E 585 Example

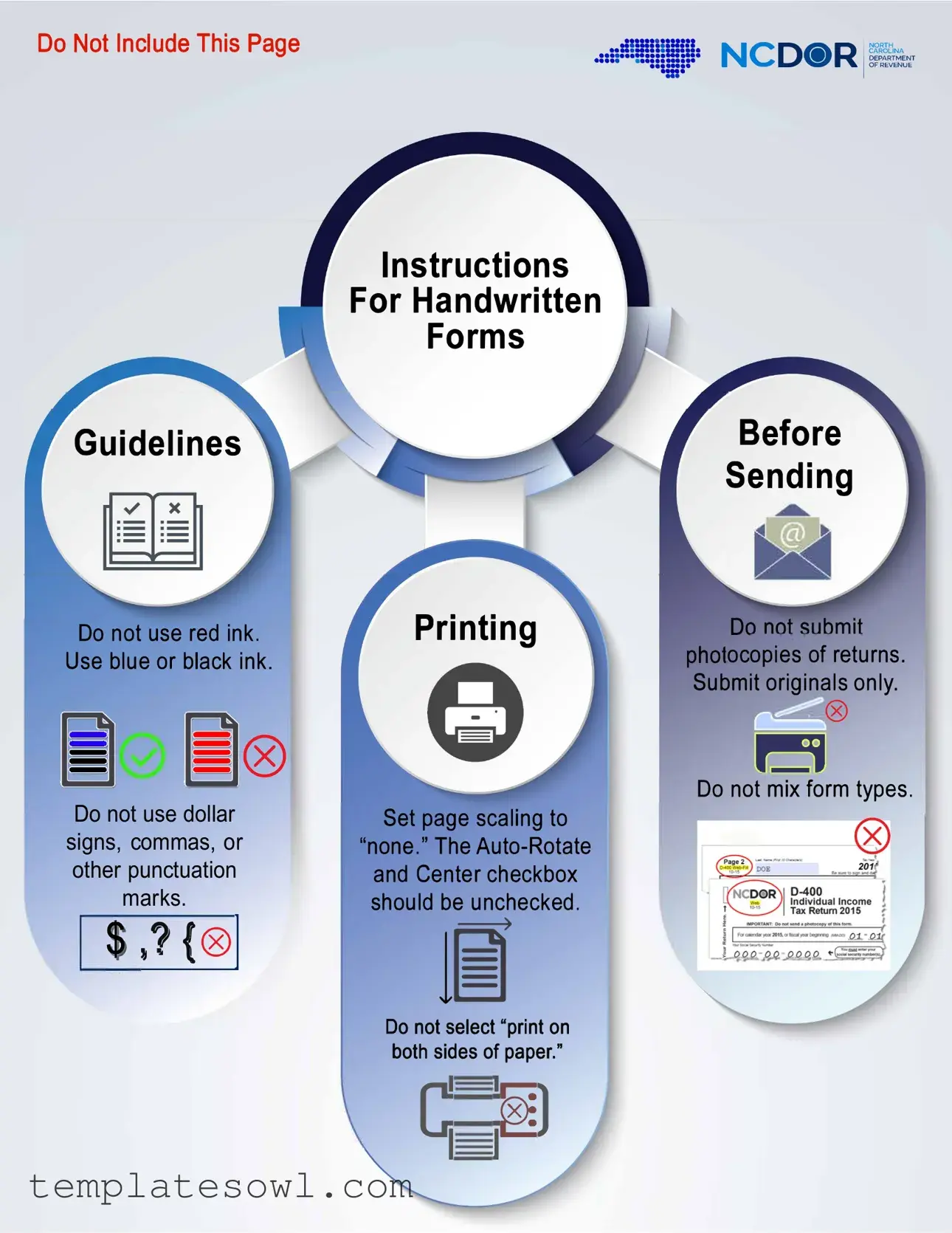

Do Not Include This Page

Guidelines

::::==·

. •• ··=!!!:::!:•

Instructions

For Handwritten

Forms

NCD(i)• R

Before Sending

I NORTH CAROLINA DEPARTMENT OF REVENUE

Do not use red ink. Use blue or black ink.

®

®

Do not use dollar signs, commas, or other punctuation

marks.

, 1 t®I

, 1 t®I

Printing

Set page scaling to

"none." The

1�

ocopies of returns. Submit originals only.

,,___(8)

Do not mix form types.

Do not select "print on bothc;sides of paper."

;�1

Nonprofit and Governmental Entity Claim for Refund |

|

State, County, and Transit Sales and Use Taxes |

|

Complete all of the information in this section. |

|

|

|

|

Legal Name (First 32 Characters) (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS) |

Account ID |

|

Mailing Address

Federal Employer ID Number

City |

State |

Zip Code |

County |

Period Beginning

Name of Person We Should Contact if We Have Questions About This Claim |

Contact Telephone |

Period Ending

Fill in the circle that describes your organization.

Nonprofit or other qualified entity as defined in N.C. Gen. Stat. §

National Taxonomy of Exempt Entities Number

(Nonprofit Entity Only)

1.Name of Taxing County

(If more than one county, see instructions on page 2 and attach Form

2. Total Qualifying Purchases of Tangible Personal |

|

|

State |

||

Property and Services for Use on Which North Carolina |

||

State or Food, County & Transit Sales or Use Tax Has |

|

|

Been Paid Directly to Retailers (Do not include tax paid, |

|

|

purchases for resale, or items described in box below.) |

|

Food, County & Transit

Tax paid on any of the following items are nonrefundable:

Electricity, piped natural gas, telecommunications and ancillary services, video programming, prepaid meal plans; the purchase, lease, rental, or subscription of motor vehicles; local occupancy or local prepared food and beverage taxes; scrap tire disposal or white goods disposal taxes; reimbursements for travel expenses; alcoholic beverages; digital property

3.Amount of Sales and Use Tax Paid Directly to Retailers on Qualifying Purchases

4.Amount of Sales and Use Tax Paid Indirectly on Qualifying Purchases

5.Amount of Use Tax Paid Directly to the Department on Qualifying Purchases (Do not include tax collected

and remitted on sales made by the entity.)

6. |

Total Tax (Add Lines 3, 4, and 5. Food, County & Transit |

|

|

tax must be identified by rate on Line 8.) (For nonprofit |

|

|

entity only; annual cap applies, see General Instructions.) |

|

7. |

Total Refund Requested |

$ |

|

(Add State and Food, County & Transit tax on Line 6.) |

8.Allocation of Food, County & Transit Tax on Line 6 (Enter the Food, County & Transit tax paid at each applicable rate. If you paid more than one county’s tax, see the instructions on page 2 and attach Form

Food 2.00% Tax |

County 2.00% Tax |

County 2.25% Tax |

Transit 0.50% Tax

Durham, Mecklenburg, Orange, Wake

Signature: |

|

Date: |

I certify that, to the best of my knowledge, this claim is accurate and complete.

Title: |

|

Telephone: |

Food Tax

,

,

,

,

Refund Approved:

For Departmental Use Only

. |

, |

County 2.00% Tax |

, |

County 2.25% Tax |

||

, |

. |

, |

. |

|||

|

|

|

|

, |

State Tax |

. |

As Filed |

|

As Corrected |

, |

|||

|

|

|

|

|||

Transit Tax

,

,

,

,

.

.

Total Tax

,

,

,

,

.

.

By: |

|

Date: |

|

|

|

|

|

||

|

MAIL TO: NC Department of Revenue, P.O. Box 25000, Raleigh, NC |

|

||

Page 2, |

General Instructions |

Use blue or black ink to complete this form. An Account ID is required to process the claim.

This form is to be filed by the following entities as specified:

-Nonprofit or other qualified entities as permitted in N.C. Gen. Stat. §

For a nonprofit entity, the total State sales and use tax refund amount for both six month periods may not exceed $31,700,000 for the State’s fiscal year and the total Food, County & Transit tax refund amount for both six month periods may not exceed $13,300,000 for the State’s fiscal year.

A hospital not listed in N.C. Gen. Stat. §

-Governmental entities as permitted in N.C. Gen. Stat. §

Records must be maintained, and distinguish the following information on a county by county basis: qualifying purchases of tangible personal property and services; State, county & transit tax paid directly to retailers on qualifying purchases for use as shown on sales receipts and invoices; State, county & transit tax paid indirectly on qualifying purchases of building materials, supplies, fixtures, and equipment as shown on certified statements; and State, county & transit tax paid directly to the Department of Revenue.

Records must be maintained for qualifying direct purchases and qualifying indirect purchases as follows:

-Qualifying direct purchases - Adequate documentation for tax paid directly to the vendor is an invoice or copy of an invoice that identifies the item purchased, the date of the purchase, the cost of the item, and the amount of sales or use tax paid. Reimbursements for travel expenses to an authorized person of the entity are not considered to be a direct purchase; therefore, the sales or use tax paid on such are not refundable.

-Qualifying indirect purchases - Adequate documentation for sales or use tax paid on qualifying indirect purchases is a certified statement from the real property contractor or other person that purchased the items. The statement must indicate the date the property was purchased; the type of property purchased; the name of the person from whom the purchase was made and the invoice number of the purchase; the purchase price of property purchased and the amount of sales and use tax paid thereon; the project for which the property was used; if the property was purchased in this State, a copy of the sales receipt and the statement must include the county in which it was delivered; and if the property was not purchased in this State, the county in North Carolina in which the property was used must be included. Only sales and use taxes paid on building materials, supplies, fixtures, and equipment that become part of or annexed to a building or structure that is owned or leased by or is being erected, altered, or repaired for use by the nonprofit entity for carrying on its nonprofit activities or by the governmental entity are sales and use tax paid on qualifying indirect purchases eligible for refund.

For a claim for refund filed within the statute of limitations, the Department must take one of the following actions within six months after the date the claim for refund is filed: (1) send the taxpayer a refund of the amount shown due on the claim for refund; (2) adjust the amount of the refund shown due and send the taxpayer a refund of the adjusted amount; (3) deny the refund and send the taxpayer a notice of proposed denial; or (4) request additional information from the taxpayer. If the Department does not take one of the actions within six months, the inaction is considered a proposed denial of the requested refund. A taxpayer who objects to a proposed denial of a refund may request a Departmental review of the proposed action by filing a Form

For a full explanation of the Departmental review process, refer to the North Carolina Taxpayers’ Bill of Rights found at www.ncdor.gov or the provisions of N.C. Gen. Stat. §

If you have questions about how to complete this form, more detailed instructions can be found on our website at www.ncdor.gov or call the Department at

Line 1 - If all taxes were paid in only one county, enter the name of that county. If you made purchases and paid county & transit tax in more than one county, do not list a county on Line 1.

For Lines 2 through 6, local school administrative units and associated joint agencies should only complete the Food, County & Transit column.

Line 2 - Enter in the State column the total amount of qualifying purchases of tangible personal property and services for use on which State sales or use tax was paid to retailers. The taxable purchase price of a modular home, manufactured home, boat, or aircraft is included in the State column only. Enter in the Food, County & Transit column the total amount of qualifying purchases of tangible personal property and services for use on which food, county & transit sales or use tax was paid to retailers.

For Lines 3 through 6, State tax must be entered in the State column and food, county & transit tax must be entered in the Food, County & Transit column.

Line 3 - Enter the amount of sales and use tax paid directly to retailers on qualifying purchases for use, as shown on sales receipts or invoices. Do not include tax paid on nonrefundable purchases as described in the box on the front of claim form.

Line 4 - Enter the total amount of sales and use tax paid indirectly on qualifying purchases of building materials, supplies, fixtures, and equipment as shown on certified statements from real property contractors or other persons.

Line 5 - Enter the total amount of use tax paid to the Department by the entity on its sales and use tax returns for qualifying purchases. Do not include tax collected and paid on taxable sales made by your entity.

Line 6 - Add the amounts of tax by column on Lines 3, 4, and 5 and enter the sum.

Line 7 - Add the State and Food, County & Transit taxes on Line 6 and enter the sum. This is the total amount of refund requested for the period.

Line 8 - Allocate the amount of county and transit taxes included on Line 6 in the Food, County & Transit Tax column to the applicable rate. If county or transit tax was paid for more than one county, complete Form

For nonprofit entity only: If the total entries of food, county, & transit tax on Form

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The E-585 form is used by nonprofit and governmental entities in North Carolina to claim refunds for state, county, and transit sales and use taxes they have paid. |

| Eligibility | Nonprofits as defined under N.C. Gen. Stat. § 105-164.14(b) and governmental entities as outlined in § 105-164.14(c) can file this form. These entities must meet specific criteria to qualify for tax refunds. |

| Filing Deadlines | Nonprofits should submit claims for taxes paid in the first half of the year by October 15 and for the second half by April 15 of the following year. Governmental entities must file within six months of the end of their fiscal year. |

| Limitations | For nonprofits, the total refund for sales and use tax cannot exceed $31,700,000 in a fiscal year. Likewise, for Food, County, and Transit tax, the cap is $13,300,000 per fiscal year. |

| Submission Guidelines | Claims must be completed using blue or black ink. Do not mix form types or include dollar signs and commas. Only send the original form, not copies. |

Guidelines on Utilizing E 585

Completing the E-585 form is an important process that requires careful attention to detail. After you fill it out, you will be submitting your claim for a refund on certain sales and use taxes. Ensure all sections are accurately completed to avoid delays in processing. Here are the steps to follow when filling out this form:

- Use blue or black ink and avoid red ink.

- Set page scaling to "none" and ensure "Auto-Rotate and Center" is unchecked.

- Fill in your Legal Name (first 32 characters in capital letters).

- Provide your Account ID and Federal Employer ID Number.

- Enter your Mailing Address, City, State, and Zip Code.

- List your County.

- Fill in the Period Beginning and Period Ending dates in MM-DD-YY format.

- Choose the circle that describes your organization: either as a Nonprofit entity or a Governmental entity.

- If applicable, enter your National Taxonomy of Exempt Entities Number.

- Write the Name of Taxing County if applicable and complete subsequent lines with qualifying purchase details:

- Line 2: Total qualifying purchases on which sales or use tax has been paid.

- Line 3: Enter the amount of sales and use tax paid directly to retailers on qualifying purchases.

- Line 4: Amount of sales and use tax paid indirectly on qualifying purchases.

- Line 5: Total amount of use tax paid directly to the Department.

- Line 6: Calculate total tax by adding Lines 3, 4, and 5.

- Line 7: Add the state and Food, County & Transit taxes from Line 6 for the total refund.

- Line 8: Allocate Food, County & Transit taxes by rates as applicable.

- Sign and date the form where indicated.

- Mail the completed form to the NC Department of Revenue, P.O. Box 25000, Raleigh, NC 27640-0001.

What You Should Know About This Form

What is the E 585 form used for?

The E 585 form is designed for nonprofit or governmental entities to claim a refund for state, county, and transit sales and use taxes that have been paid on qualifying purchases. This form allows eligible organizations to recover taxes paid directly to retailers, as well as taxes paid indirectly, subject to certain qualifications and limits.

Who is eligible to file the E 585 form?

The E 585 form can be filed by nonprofit entities as defined under North Carolina General Statutes, as well as governmental entities. Nonprofit organizations must meet specific criteria outlined in N.C. Gen. Stat. § 105-164.14(b), while governmental entities follow the provisions in N.C. Gen. Stat. § 105-164.14(c). Eligibility is determined based on the nature of the entity and the taxes paid during the applicable periods.

When are the submission deadlines for the E 585 form?

Submission deadlines vary based on the type of entity. Nonprofits must file their claims for taxes paid during the first half of the year by October 15 and for the second half by April 15 of the following year. Governmental entities must submit their claims within six months of the end of their fiscal year. Adhering to these deadlines is crucial for the successful processing of claims.

What information is required to complete the E 585 form?

To complete the E 585 form, organizations need to provide their legal name, mailing address, federal employer identification number, account ID, and the name and contact information of a representative for any inquiries. Additionally, they must include details about qualifying purchases, the amounts of sales and use tax paid, and the allocation of taxes by applicable rates, ensuring accurate documentation accompanies each submission.

What limitations exist for refunds claimed using the E 585 form?

There are specific limits on refund amounts. For nonprofit entities, the total refund for state sales and use tax cannot exceed $31,700,000 for the fiscal year, while the total for food, county, and transit tax cannot exceed $13,300,000. It is also important to note that not all taxes are refundable, such as those paid on non-qualifying purchases like alcoholic beverages or travel reimbursements.

What happens after submitting the E 585 form?

After submission, the North Carolina Department of Revenue has six months to take action on the claim. This can include issuing a refund for the amount claimed, adjusting the claim, denying the refund, or requesting additional information. If no action is taken within that timeframe, it is considered a proposed denial, allowing the claimant the option to request a departmental review of the decision.

Common mistakes

When completing the E-585 form, many individuals make simple yet impactful mistakes. One common error is using inappropriate ink color. It's essential to use blue or black ink as specified, since red ink may lead to the rejection of the form. Such a small detail could derail the entire refund process, causing delays and unnecessary complications.

Another frequent mistake involves the way monetary amounts are recorded. Some people mistakenly include dollar signs, commas, or other punctuation marks when entering amounts. This form explicitly instructs users to enter numbers without such symbols. Omitting these can seem trivial, but failing to follow this guideline can lead to confusion or processing errors by the reviewing authorities.

Additionally, filling out the required sections is crucial for a successful claim. Individuals often leave necessary fields blank, such as the Account ID or contact information for questions. These omissions can cause holds on the processing of the form, resulting in delays. It’s crucial to double-check that all sections are complete to prevent setbacks.

Lastly, some applicants neglect to attach supporting documentation when required. For example, if more than one county's taxes are involved, additional forms such as Form E-536R need to be submitted alongside the E-585. Missing attachments can lead to an incomplete submission, which might prevent refunds from being processed altogether. Ensuring all necessary documentation is gathered and attached is vital for a smooth refund process.

Documents used along the form

When submitting the E-585 form, several additional forms and documents may be needed to support your claim for refund. Each document plays a vital role in ensuring your submission is comprehensive and meets the requirements outlined by the North Carolina Department of Revenue. Below is a brief description of these important forms and documents.

- Form E-536R: This schedule is used to itemize county and transit tax rates paid in different counties. If taxes were paid in multiple counties during the claim period, this form must be attached to break down the tax amounts accordingly.

- Form NC-242: If you disagree with a proposed denial of your refund claim, this form allows you to formally request a Departmental review. It initiates the review process concerning any adjustment or denial decision made by the Department of Revenue.

- Sales Invoices: Original invoices or copies from retailers showing the amounts of taxable items purchased. These documents serve as proof that you paid sales tax on qualifying items, ensuring that your claim is valid.

- Certification Statements: Required for indirect purchases, these statements from contractors detail tax paid on building materials or supplies. They should include specific purchase details, project information, and the relevant tax amounts.

- Purchase Records: Maintain records for qualifying direct and indirect purchases. These include receipts and invoices providing clear documentation of all qualifying purchases for tax purposes.

- Tax Payment Records: Documentation reflecting the total amount of sales and use tax paid directly to retailers. This is important to support the tax refund claim you are making.

- Departmental Requests for Additional Information: If the Department requests further details about your claim during processing, it’s essential to provide timely and accurate responses to avoid delays or denials.

- Claim Instructions: Detailed instructions or guidelines provided by the Department can be crucial for correctly completing the E-585 form and understanding submission requirements.

- Contact Information: Providing accurate contact details on the E-585 form ensures that the Department can reach you if there are any questions or concerns regarding your claim.

Having these documents ready and organized will help facilitate a smoother application process and increase the likelihood of a successful refund claim. Always double-check that you have all the necessary information before submission to avoid any complications.

Similar forms

The E 585 form is a specific document used for claiming refunds of state, county, and transit sales and use taxes. Several other forms serve similar purposes. Here are four documents that are alike in function and aim:

- Form E-500: This form is primarily designed for businesses to report sales and use tax in North Carolina. Like the E 585, it requires detailed information about the taxpayer entity, including names, identification numbers, and the types of purchases that qualify for refunds. Businesses submit this form to comply with tax regulations while claiming tax credits or deductions related to sales tax overpayments.

- Form E-536R: Intended for more complex refund claims, this form is used to allocate county and transit taxes if the tax was paid in multiple jurisdictions. The E 536R closely relates to the E 585 as it offers detailed tracking of taxes applicable per county, which is important when figuring out the refunds for various regions.

- Form NC-BRCT-2: This document is utilized by some nonprofit entities for claiming refunds on sales tax specifically related to certain purchases. It is similar to the E 585 in that it specifically caters to qualified organizations and provides a way to claim back taxes that may have been paid in excess. Nonprofits frequently use this to recover funds linked to eligible purchases made in the course of their operations.

- Form NC-242: While technically more focused on appealing tax decisions, this form is relevant to the E 585 as it allows taxpayers to contest proposed denials of refunds from the Department of Revenue. If a refund request is not granted, this form can be used to initiate a departmental review, similar to how entities can seek refunds through the E 585.

Each of these forms relates to the E 585 in terms of claiming refunds, tracking tax obligations, or providing necessary information for nonprofit or governmental entities. Understanding their interconnections can help ensure compliance and successful navigation through tax-related processes.

Dos and Don'ts

When filling out the E 585 form, there are certain actions to take and avoid to ensure a smooth process. Here is a list of what to do and what not to do:

- Do use blue or black ink.

- Do complete all information required in the specified sections.

- Do ensure that the mailing address is accurate, including the correct zip code.

- Do check that all amounts are correctly added up before submitting the form.

- Do keep a copy of your completed form for your records.

- Don’t use red ink on the form.

- Don’t include dollar signs or commas in the amounts.

- Don’t submit copies of forms; only originals are accepted.

- Don’t mix different types of forms in a single submission.

Misconceptions

When navigating the E 585 form for refunds on state, county, and transit sales and use taxes, it's important to recognize some common misconceptions. Here are nine misunderstandings that can complicate the process:

- It's Only for Nonprofits: Many people believe that the E 585 form is exclusively for nonprofit organizations. However, governmental entities can also use this form to claim refunds.

- Any Purchases Qualify: A common myth is that all purchases made by qualifying entities are eligible for refunds. In reality, certain items such as alcoholic beverages and utilities do not qualify for refunds.

- Only the Form Submission Matters: Some think that simply filing the E 585 form guarantees a refund. Yet, comprehensive documentation of qualifying purchases is essential for successful claims.

- Red Ink is Acceptable: A frequent misconception is that using any ink color is fine. However, it’s clearly stated that only blue or black ink should be used when filling out the form.

- Mixing Form Types is Allowed: People often believe they can mix different forms when filing. This is incorrect; the E 585 form should be submitted as a standalone document.

- Refund Claims Have No Deadlines: Many assume they can file their claims whenever they like. The truth is there are firm deadlines, such as April 15 for the last six months of the year for nonprofits.

- Punctuation is Acceptable: Some individuals mistakenly think they can use dollar signs or commas on the form. In fact, these symbols should be avoided entirely.

- All Tax Types Are the Same: Another misconception is that state and local taxes are treated identically. However, each type of tax—state, county, and transit—has different allocation requirements that must be adhered to.

- Calls to the Department Are Not Needed: Many believe all information needed is in the form instructions. Yet, when in doubt, contacting the North Carolina Department of Revenue can provide clarity and ensure proper compliance.

Understanding these misconceptions is crucial for successfully navigating the E 585 form process. This knowledge will enable organizations to maximize their refund opportunities while minimizing the risks of errors.

Key takeaways

Understanding the E-585 form is crucial for nonprofits and governmental entities seeking a refund on state and local sales taxes. Here are some important points to consider:

- Use the Right Ink: Always complete the E-585 form using blue or black ink. Red ink is not acceptable.

- Submission Formats: Send only the original copies of the form. Do not mix different form types, and avoid printing on both sides of the paper.

- Know Your Filing Deadlines: Nonprofits should file refund claims for the first half of the year by October 15, and for the second half by April 15 of the following year.

- Documentation is Key: Keep detailed records of qualifying purchases, including invoices and receipts. These documents should clearly outline the items purchased and taxes paid.

- Limitations on Refunds: Be aware that nonprofits have a cap on the total amount of refunds they can claim annually, which is $31,700,000 for state tax and $13,300,000 for food, county, and transit tax.

- Allocation of Taxes: When completing Line 8, correctly allocate the food, county, and transit taxes to their respective rates. If multiple counties are involved, additional forms may be needed to detail the allocations.

These takeaways highlight the essential steps and considerations for successfully navigating the E-585 form. Proper adherence to these guidelines can significantly ease the refund process.

Browse Other Templates

Rut 50 Tax Information - Be mindful of tax-tiers outlined in Table B for vehicles valued over $15,000.

Trimet Lift - The assessment may involve simulated mobility tasks to measure your balance and coordination.

Ga It-511 Tax Booklet - The structure of the application helps ensure that no critical information is overlooked.