Fill Out Your E Trade Api Form

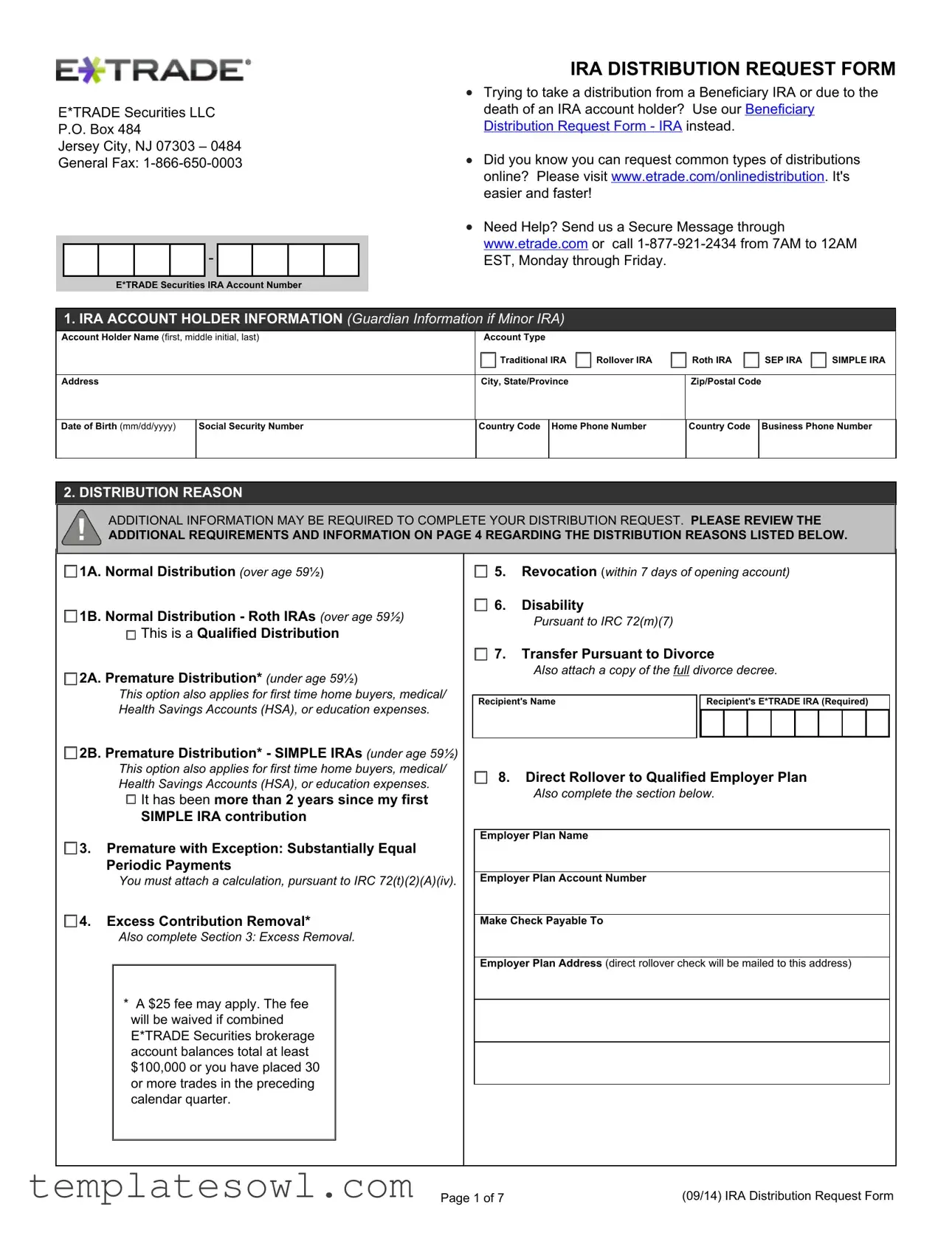

The E*TRADE IRA Distribution Request Form is a crucial document for individuals looking to manage and withdraw funds from their Individual Retirement Accounts (IRAs). It streamlines the process, allowing account holders to request distributions for various reasons, including normal distributions, premature distributions, and excess contribution removals. Account holders will find sections dedicated to specific distribution reasons, such as whether the withdrawal is related to a disability or divorce, ensuring that all necessary information is captured to comply with IRS regulations. The form also provides comprehensive instructions for distribution methods, whether opting for a one-time payment, installment payments, or direct rollovers to employer plans. Additionally, important sections cover tax withholding elections, detailing options for federal and state tax withholdings to avoid unexpected tax liabilities. For those who may feel overwhelmed, E*TRADE offers assistance through secure messages or phone support during business hours. Understanding these components of the form can ultimately lead to more informed financial decisions, helping individuals navigate their retirement plans with confidence.

E Trade Api Example

E*TRADE Securities LLC

P.O. Box 484

Jersey City, NJ 07303 – 0484

General Fax:

-

-

E*TRADE Securities IRA Account Number

IRA DISTRIBUTION REQUEST FORM

•Trying to take a distribution from a Beneficiary IRA or due to the death of an IRA account holder? Use our Beneficiary Distribution Request Form - IRA instead.

•Did you know you can request common types of distributions online? Please visit www.etrade.com/onlinedistribution. It's easier and faster!

•Need Help? Send us a Secure Message through www.etrade.com or call

1.IRA ACCOUNT HOLDER INFORMATION (Guardian Information if Minor IRA)

Account Holder Name (first, middle initial, last) |

|

Account Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

Traditional IRA |

|

Rollover IRA |

|

Roth IRA |

|

|

SEP IRA |

|

SIMPLE IRA |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

City, State/Province |

|

|

|

Zip/Postal Code |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth (mm/dd/yyyy)

Social Security Number

Country Code Home Phone Number

Country Code Business Phone Number

2. DISTRIBUTION REASON

ADDITIONAL INFORMATION MAY BE REQUIRED TO COMPLETE YOUR DISTRIBUTION REQUEST. PLEASE REVIEW THE

ADDITIONAL REQUIREMENTS AND INFORMATION ON PAGE 4 REGARDING THE DISTRIBUTION REASONS LISTED BELOW.

1A. Normal Distribution (over age 59½)

1A. Normal Distribution (over age 59½)

1B. Normal Distribution - Roth IRAs (over age 59½)

1B. Normal Distribution - Roth IRAs (over age 59½)  This is a Qualified Distribution

This is a Qualified Distribution

2A. Premature Distribution* (under age 59½)

2A. Premature Distribution* (under age 59½)

This option also applies for first time home buyers, medical/ Health Savings Accounts (HSA), or education expenses.

2B. Premature Distribution* - SIMPLE IRAs (under age 59½) This option also applies for first time home buyers, medical/ Health Savings Accounts (HSA), or education expenses.

2B. Premature Distribution* - SIMPLE IRAs (under age 59½) This option also applies for first time home buyers, medical/ Health Savings Accounts (HSA), or education expenses.

It has been more than 2 years since my first

It has been more than 2 years since my first

SIMPLE IRA contribution

3. Premature with Exception: Substantially Equal Periodic Payments

3. Premature with Exception: Substantially Equal Periodic Payments

You must attach a calculation, pursuant to IRC 72(t)(2)(A)(iv).

4. Excess Contribution Removal*

4. Excess Contribution Removal*

Also complete Section 3: Excess Removal.

*A $25 fee may apply. The fee will be waived if combined E*TRADE Securities brokerage account balances total at least $100,000 or you have placed 30 or more trades in the preceding calendar quarter.

5. Revocation (within 7 days of opening account)

5. Revocation (within 7 days of opening account)

6. Disability

6. Disability

Pursuant to IRC 72(m)(7)

7. Transfer Pursuant to Divorce

7. Transfer Pursuant to Divorce

Also attach a copy of the full divorce decree.

Recipient's Name |

|

Recipient's E*TRADE IRA (Required) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. Direct Rollover to Qualified Employer Plan

Also complete the section below.

Employer Plan Name

Employer Plan Account Number

Make Check Payable To

Employer Plan Address (direct rollover check will be mailed to this address)

Page 1 of 7 |

(09/14) IRA Distribution Request Form |

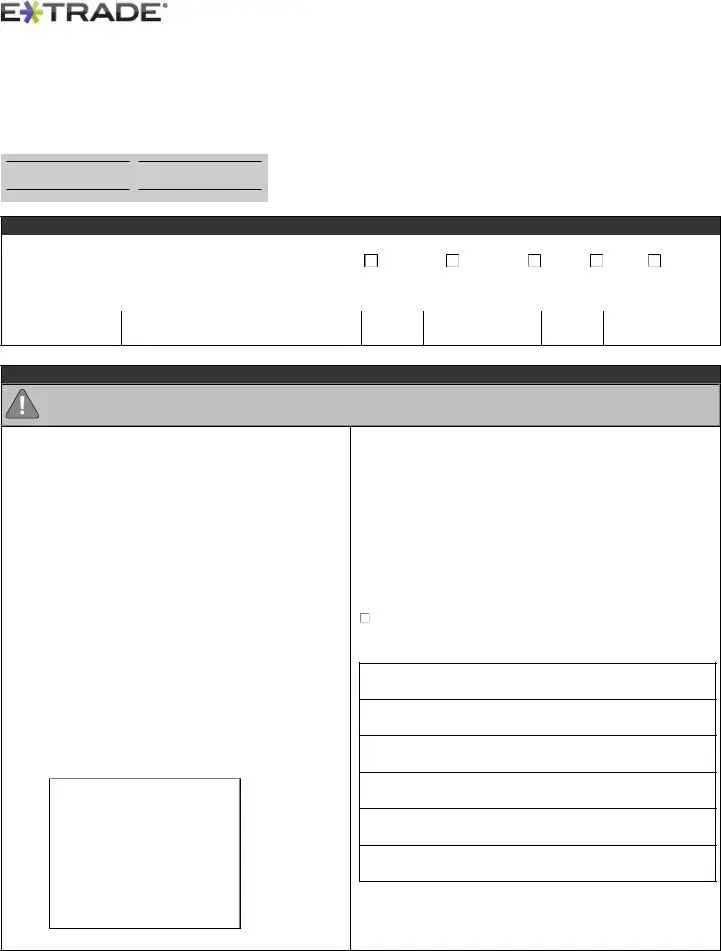

3.EXCESS REMOVAL (complete if option 4 was selected in Section 2)

1. To what tax year does the Excess Contribution currently apply?

2. This Excess Contribution correction is being requested:

A. Before the tax filing deadline |

B. After the tax filing deadline, plus extensions |

Refund excess including earnings amount, which may be negative. E*TRADE will calculate the net earnings attributed to the excess amount.

Refund excess only. E*TRADE will not calculate any earnings attributed to the excess amount.

3. Did you make the excess contribution to an IRA with E*TRADE or another institution?

A. To my E*TRADE Securities IRA (referenced on page 1) |

B. To an IRA at another institution |

You must attach the |

|

|

contribution(s) and date(s). |

4. What would you like to do with the excess contribution amount? (Requested funds must be available in the account for withdrawal)

A. Apply as a current year contribution to my E*TRADE

Securities IRA (referenced on page 1)

B. Refund my excess contribution

5.What would you like to do with any positive earnings that may exist? (Do not complete if you marked 2B in this section) A. Apply as a current year contribution to my E*TRADE

Securities IRA (referenced on page 1)

If the application of earnings to the current tax year will create an |

B. Refund my earnings attributed to the excess contribution |

excess contribution, the earnings will be disbursed to you by check |

|

to the address of record, instead. |

|

4.METHOD OF DISTRIBUTION (also see additional information beginning on page 5)

Until I give E*TRADE Securities written instructions to the contrary, I direct E*TRADE Securities or its affiliates to distribute the amount requested as follows:

One Time Payment of $

One Time Payment of $

Requested funds must be available in the account for withdrawal.

Balance of Account (lump sum)

Balance of Account (lump sum)

Also mark an option below.

Close Account |

|

Leave Account open for future deposits |

Required Minimum Distribution Over age 70½ Check this box to have your Required Minimum Distribution calculated for you without having to specify an exact amount.

Required Minimum Distribution Over age 70½ Check this box to have your Required Minimum Distribution calculated for you without having to specify an exact amount.

If you are over age 70 ½, your spouse beneficiary is the sole primary beneficiary, and he/she is more than 10 years younger than you, please indicate his/her date of birth:

Transfer Securities

Transfer Securities

You are not required to sell securities before taking distributions. In Section 5 indicate the E*TRADE brokerage account to which you would like to have the securities transferred.

All securities positions

All securities positions

Only the securities & quantities listed below

Only the securities & quantities listed below

(MM/DD/YYYY)

Installment Payments of (choose one):

Installment Payments of (choose one):

Requested funds must be in the account and available for

withdrawal at the time each installment payment is processed.

|

$ |

|

|

|

Dividends and Interest |

|

|

|

|

|

|

Security Symbol/Description* |

|

Quantity* |

Frequency (choose one): |

|

|

||||||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Monthly |

|

|

Quarterly |

||

|

|

|

|

|

|

|

|

Annually |

|||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

||||

|

|

|

|

Starting Date (MM/DD/YYYY): |

|

|

|||||

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

||||

|

|

|

|

Installment Payments: |

|

|

|||||

|

|

|

|

If you choose Direct Deposit in Section 5, be aware that you |

|||||||

|

|

|

|

must complete the following steps before submitting this |

|||||||

|

|

|

|

request. |

|

|

|||||

|

|

|

|

|

|

||||||

|

|

|

|

1) Add an external account |

|

|

|||||

|

|

|

|

2) Verify the external account |

|

|

|||||

|

|

|

|

3) Activate your external account for outgoing transfers |

|||||||

* Attach a signed letter of instruction to list additional |

|||||||||||

|

|

|

|

|

|

|

|||||

positions and quantities. |

|

|

Find instructions on how to complete the |

||||||||

|

|

|

|

www.etrade.com/quicktransfer_setup |

|

|

|||||

Page 2 of 7 |

(09/14) IRA Distribution Request Form |

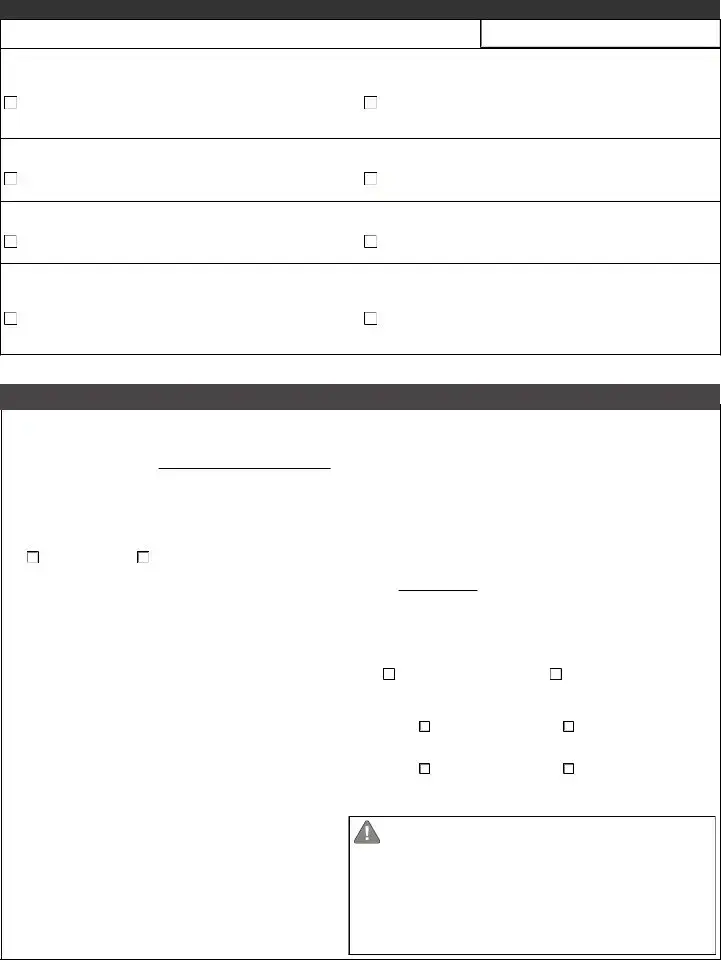

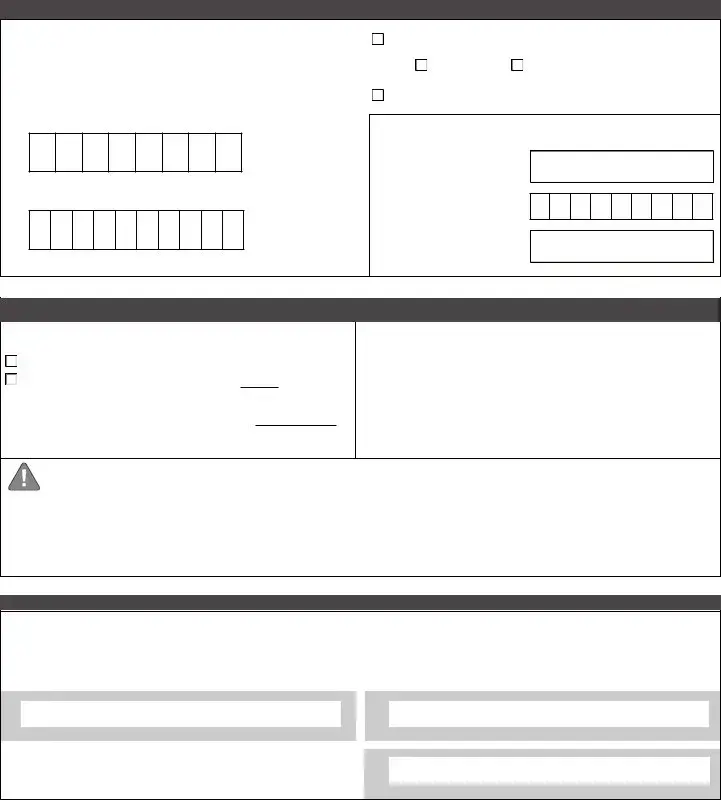

5. PAYMENT INSTRUCTIONS

Check

Check

Check by Express Mail (additional $20.00 fee)

Check by Express Mail (additional $20.00 fee)

Deposit to existing E*TRADE Securities brokerage account number:

Deposit to existing E*TRADE Securities brokerage account number:

Deposit to existing E*TRADE Bank account number:

Deposit to existing E*TRADE Bank account number:

Direct Deposit* to my:

|

Checking |

|

Savings |

Wire* (additional $25.00 fee)

*Complete the following information if you chose Direct Deposit or Wire

Bank Name

Bank Routing Number (ABA)

Bank Account Number

6.WITHHOLDING ELECTION (FORM

Federal Withholding* |

|

Do not withhold Federal income tax. |

|

Withhold Federal income tax at a rate of |

% |

(not less than 10 percent) from the amount withdrawn. Withhold additional Federal income tax of $

(in addition to above percentage elected).

State Withholding**

Do not withhold State income tax.

Do not withhold State income tax.

Withhold State income tax from my requested amount in accordance with State requirements.

Withhold State income tax from my requested amount in accordance with State requirements.

See pages 6 and 7 of this form for the Withholding Notice Information. Federal and State withholding elections should be provided for all distributions.

* If this section is not completed, 10 percent Federal withholding will apply to any distributions (Roth distributions are excluded), along with any applicable State withholding.

**State withholding will only be processed for the following states: AR, CA, DC, DE, GA, IA, KS, MA, ME, MI***, NC, NE, OK, OR, VA, and

VT

***Michigan residents: See information on page 6, regarding mandatory state tax withholding.

7. SIGNATURES

I certify that I am the proper party to receive payment(s) from this IRA and that all information provided by me is true and accurate. I have read and understand the Rules and Conditions Applicable to Withdrawal on page 4 of this form and agree to abide by those rules and conditions. I further certify that no tax advice has been given to me by E*TRADE Securities. All decisions regarding this withdrawal are my own. I expressly assume the responsibility for any adverse consequences that may arise from this withdrawal and agree that E*TRADE Securities shall in no way be held responsible.

✗

Signature of IRA Holder |

Printed Name |

All fields in this section are required.

Date

System response and account access times may vary due to a variety of factors, including trading volumes, market conditions, and system performance.

The E*TRADE Financial family of companies provides financial services including trading, investing and related banking products and services to retail investors. E*TRADE Securities LLC accounts are carried by E*TRADE Clearing LLC, Member FINRA/SIPC. Securities products and services are offered by E*TRADE Securities LLC, Member FINRA/SIPC. E*TRADE Securities and E*TRADE Clearing are separate but affiliated companies.

©2014 E*TRADE Financial Corporation. All rights reserved. E*TRADE Financial is a registered trademark and the E*TRADE Financial logo is a trademark of E*TRADE Financial Corporation.

Page 3 of 7 |

(09/14) IRA Distribution Request Form |

Rules and Conditions Applicable to Withdrawals

GENERAL INFORMATION

E*TRADE Financial Corporation and its affiliates do not provide tax advice and you always should consult your own tax adviser regarding your personal circumstances before taking any action that may have tax consequences.

You must supply all requested information so that E*TRADE Clearing can do the proper tax reporting. The term "IRA" will be used below to refer to Traditional IRAs, Rollover IRAs, Roth IRAs,

SECTION 2

DISTRIBUTION REASON

You are required to give the reason for taking the withdrawal from the IRA. If more than one reason applies, you must complete a separate IRA Distribution Request Form for each distribution reason. Only one reason may be applied per distribution amount.

1A. Normal Distribution

If you are over age 59½, you may take IRA distributions anytime you wish, without incurring an IRS early distribution penalty. In a Traditional IRA, you are responsible for taking the annual Required Minimum Distribution (RMD) upon your attainment of age 70½. You will have to pay the IRS a 50 percent penalty tax if you fail to take the RMD on time. Roth IRA accounts are not subject to RMD requirements.

1B. Normal Distribution for Roth IRAs

For Roth IRA distributions, if you are over age 59½ and otherwise qualify, the distributions are not included in your gross income. Qualified Roth IRA distributions are reported on the IRS form 1099R using Code Q. Distributions to Roth IRA holders over age 59½ are reported on the IRS Form 1099R using Code T, unless they are qualified distributions. If five years have passed since your initial Roth IRA contribution or conversion year, and: (1) you are over age 59½, (2) your distribution is on account of death, or (3) you are disabled, then your distribution is a Qualified Distribution.

"This is a Qualified Distribution" check box should be marked if you have satisfied the 5 year holding period AND at least one of the criteria listed in the paragraph above.

If your Roth IRA was transferred to E*TRADE within the 5 year holding period, attach an account statement from your previous financial institution showing when your first Roth IRA contribution was made. Alternatively, you may attach IRS Form 5498 indicating when your first Roth IRA contribution was made. This will ensure proper coding of your Roth IRA distribution.

2A. Premature Distribution

If you are under age 59 ½ and take a distribution from your IRA, it will generally constitute an early distribution. Unless an exception to the penalty applies, you must pay the appropriate penalty tax to the IRS. IRA holders who rollover an early distribution into another IRA (or in some cases a Roth IRA) will not be subject to the early distribution penalty. Payments made to pay medical expenses that exceed 10 percent of your adjusted gross income and distributions to pay for health insurance if you have separated from employment and have received unemployment compensation under a federal or state program for at least 12 weeks are exempt from the 10 percent tax; payments to cover certain qualifying education expenses and qualified

2B. Premature Distribution from SIMPLE IRAs

You may take a distribution from a SIMPLE IRA at any time. However, if you are under age 59 ½, distributions taken during the first two years following the date your first SIMPLE IRA contribution was deposited into your SIMPLE IRA plan are generally subject to a 25 percent early distribution penalty, unless an exception applies. Payments made to pay medical expenses that exceed 10 percent of your adjusted gross income and distributions to pay for health insurance if you have separated from employment and have received unemployment compensation under a federal or state program for at least 12 weeks are exempt from the 25 percent tax; payments to cover certain qualifying education expenses and qualified first

"It has been more than 2 years since my first SIMPLE IRA contribution" check box should be marked if it has been more than 2 years since the first deposit into your SIMPLE IRA, no matter where the account was held.

If your SIMPLE IRA was transferred to E*TRADE within the last 2 years, attach an account statement from your previous financial institution showing when your first SIMPLE IRA contribution was made. Alternatively, you may attach IRS Form 5498 indicating when your first SIMPLE IRA contribution was made. This will ensure proper coding of your SIMPLE IRA distribution.

Page 4 of 7 |

(09/14) IRA Distribution Request Form |

SECTION 3

EXCESS REMOVAL

3.Premature with Exception: Substantially Equal Periodic Payments - Provide calculation, pursuant to IRC 72(t)(2)(A)(iv)

If you are under 59 ½ and take “substantially equal periodic payments” (as defined in Internal Revenue Code (IRC) Section 72(t)(2)(A)(iv)) from your IRA, you may qualify for an exception to the early distribution penalty. Once this payment series begins, generally, the payment schedule may not be altered for a period of five years (60 months) or attainment of age 59 ½, whichever is longer. Funds may not be added or subtracted from the account in any way, including contributions, transfers in or out, and distributions from the account other than the calculated payment once the payment period is complete. The account you are requesting this payment schedule for must have sufficient cash funds for the distribution. A missed payment not corrected by year’s end constitutes an alteration of the schedule and will terminate the exception. Please consult with a financial or tax professional before submitting this request.made.

4.Excess Contribution Removal

If you have made an excess contribution to your IRA, you must take the appropriate steps to remove or redesignate the distribution. Depending on when you take the necessary corrective action and the amount of the excess contribution, you may have to pay the IRS either an excess contribution or early distribution penalty tax, or both. Code 1, 7, 8, or P (or a combination of these codes) will be applicable on IRS Form 1099R depending on the timing of the removal.

If you marked Excess Contribution Removal as your distribution reason, you must complete Section 3:

EXCESS REMOVAL.

5.Revocation

If you receive a disclosure statement at the time you establish your IRA or Roth IRA, you have the right to revoke your account within seven (7) calendar days of its establishment. If revoked, you are entitled to a full return of the contribution made.

6.Disability

You may take a distribution due to disability only if the disability renders you unable to engage in any substantial gainful activity and it is medically determined that the condition will last continuously for at least 12 months or lead to your death.

7.Transfer Pursuant to Divorce

A transfer may be made by an IRA holder and a recipient under a transfer due to divorce. The following documents are required to process a divorce transfer: Official Divorce Decree signed by a judge referencing the settlement, IRA Application from receiving party (if the party does not already have an IRA with the same registration) and the IRA Distribution Request Form from the releasing party.

8.Direct Rollover to Qualified Employer Plan

If you qualify, you may rollover taxable IRA assets to your employer’s qualified plan,

For Direct Rollovers to a Qualified Employer Plan, E*TRADE Clearing will send assets directly to that plan. Checks are typically be made out to the plan, for the benefit of the IRA holder. If you are unsure to whom the check should be made payable, check with your plan administrator. Checks are mailed to the Employer Plan Address supplied by you, in this section.

If you indicated the reason for your distribution is an excess contribution removal, you must complete this section.

Question 5: If you marked response "A", please note that if the application of earnings to the current tax year will create an excess contribution, the earnings will be disbursed to you by check to the address of record, instead.

SECTION 4 |

Complete this section to give details about your distribution amount, and timing. You may select multiple |

|

METHOD OF |

options. Additional instructions regarding some situations are provided below. |

|

DISTRIBUTION |

|

|

|

General |

If you are establishing periodic distributions from your IRA, you must: |

Distribution |

1. Take at least the minimum amount required by the Internal Revenue Code if you are age 70½ or older. |

|

Information |

2. Continue receiving distributions in the instructed manner until: (a) you furnish E*TRADE Clearing with new |

|

|

|

written instructions, (b) your death, or (c) your account is depleted, whichever occurs first. |

Age 70½ Life |

You are required to take a minimum distribution from your IRA by April 1 of the year following the year you attain age |

|

Expectancy |

70½ (required beginning date) and the end of that year and of each year thereafter. The minimum distribution for any |

|

|

Elections |

taxable year is equal to the amount obtained by dividing the account balance at the end of the preceding year by the |

appropriate life expectancy factor. Waiting until April 1 of the following year will require you to take a second payment that year so you may want to indicate for which tax year the required minimum distribution is for, so you do not miss a payment.

Page 5 of 7 |

(09/14) IRA Distribution Request Form |

Additional Instructions

If you would like to distribute the full balance of your account, including the

1.You may select both the option for "Balance of Account (lump sum)" and "Transfer Securities

2.In Section 5. Payment Instructions, you must then select the option "Deposit to existing E*TRADE Securities brokerage account number." Selection of a different option in Section 5 is not permitted for distribution of securities

If you would like to distribute a portion of your account balance, including the

1.You may select both the option for "One Time Payment of $___" and "Transfer Securities

2.In Section 5. Payment Instructions, you must then select the option "Deposit to existing E*TRADE Securities brokerage account number." Selection of a different option in Section 5 is not permitted for distribution of securities

If you would like an

1.Select the option for "Transfer Securities

2.In Section 5. Payment Instructions, you must then select the option "Deposit to existing E*TRADE Securities brokerage account number." Selection of a different option in Section 5 is not permitted for distribution of securities

If you would like recurring distributions to occur at regular intervals from your account.

1.Select the option for "Installment Payments of (choose one)"

2.Specify if you would like a fixed dollar amount to be distributed, or the sum of all dividends & interest that posted to your account during the cycle. Make only one selection per distribution form.

3.Indicate the frequency and starting date of the installment payments.

4.Please remember requested funds much be available for withdrawal from the account at the time each installment payment is processed. E*TRADE will not liquidate positions in order to free up cash for the purpose of distribution.

SECTION 5

PAYMENT INSTRUCTIONS

SECTION 6

WITHHOLDING ELECTION

Complete this section to indicate where your distribution cash and/or

Complete this section to indicate if you would like Federal and/or State income tax withholding from the value of your distribution.

Withholding |

Basic Information About Withholding from Pensions and Annuities |

Notice |

|

Information |

Generally, federal |

|

annuity, and certain deferred compensation plans, IRAs, and commercial annuities. |

Form

Purpose of Form

Unless you elect otherwise, federal income tax will be withheld from payments from Individual Retirement Accounts (IRAs). You can use Form

Nonperiodic Payments

Payments from IRAs that are payable upon demand are treated as nonperiodic payments for federal

State Withholding

Unless you elect otherwise, State income tax will be withheld as follows:

AR |

5% of gross payment |

ME |

5% of gross payment |

CA |

10% of Federal tax withheld |

MI |

4.25% of gross payment (see additional information below) |

DC |

8.95% of gross payment |

NC |

4% of gross payment |

DE |

5% of gross payment |

NE |

5% of gross payment |

GA |

6% of gross payment |

OK |

5.25% of gross payment |

IA |

5% of gross payment |

OR |

8% of gross payment |

KS |

5% of gross payment |

VA |

4% of gross payment |

MA |

5.20% of gross payment |

VT |

24% of Federal tax withheld |

Page 6 of 7 |

(09/14) IRA Distribution Request Form |

SECTION 7

SIGNATURES

Michigan residents born on, or after 01/01/1946, are subject to a mandatory MI state tax withholding, regardless of their federal tax withholding election. The mandatory state tax withholding does not apply to Roth IRA account types. If you are a resident of Michigan, born on or after 01/01/1946, and select the option "Do not withhold State income tax" in section 6, you must also provide a completed form MI

The election to not have income tax withheld does not apply to any payments that are delivered outside the U.S. or its possessions to a U.S. citizen or resident alien. Other recipients who have these payments delivered outside the U.S. or its possessions may choose not to have income tax withheld only if an individual completes Form

Caution: Remember that there are penalties for not paying enough tax during the year, through either withholding or estimated tax payments. New retirees should see Publication 505. It explains the estimated tax requirements and penalties in detail. You may be able to avoid quarterly estimated tax payments by having enough tax withheld from your IRA using Form

Revoking the Exemption from Withholding

If you want to revoke your previously filed exemption from withholding, file another Form

Statement of Income Tax Withheld from Your IRA

By January 31 of next year, you will receive a statement from E*TRADE Clearing showing the total amount of your IRA payments and the total federal income tax withheld during the year. Copies of Form

Your signature is required to certify that the information you have provided is true and correct and that you are aware of all the circumstances affecting this IRA withdrawal. Your printed name and the date are also required.

Page 7 of 7 |

(09/14) IRA Distribution Request Form |

Form Characteristics

| Fact Name | Details |

|---|---|

| Company Information | E*TRADE Securities LLC is located at P.O. Box 484, Jersey City, NJ 07303 – 0484. For assistance, they provide a general fax number and customer support at 1-877-921-2434. |

| Types of IRA | The form caters to various types of IRAs, including Traditional IRAs, Roth IRAs, Rollover IRAs, SEP IRAs, and SIMPLE IRAs. Choose the account type appropriately when submitting. |

| Distribution Requests | Requests for distributions can be made for reasons such as normal retirement withdrawals, premature distributions, and excess contribution removals. Each reason may have specific requirements outlined in the form. |

| State Withholding Information | Federal and state withholding elections apply, with specific states having differing regulations, such as Arkansas, California, and Virginia, among others. It's essential to review state requirements on pages 6 and 7 of the form. |

| Signature Requirement | All submitted forms must be signed by the IRA holder, affirming that the information provided is accurate and acknowledging the terms and conditions of the withdrawal process. |

Guidelines on Utilizing E Trade Api

Carefully completing the E Trade API form is essential for successfully processing your distribution request. It is important to follow each step to ensure all necessary information is provided accurately. The process will require you to gather personal details, specify your distribution reason, and choose your preferred payment method. Here’s how to proceed:

- Begin with section titled IRA ACCOUNT HOLDER INFORMATION. Fill in the account holder's full name. Include additional details such as account type, address, and Social Security number.

- Move to DISTRIBUTION REASON. Select your reason for taking a distribution. Read through the options carefully and note any requirements for additional information.

- If your reason includes Excess Contribution Removal, complete SECTION 3 and provide necessary details, such as the tax year applicable to the excess contribution.

- For the METHOD OF DISTRIBUTION section, indicate how you want to receive your funds. Choose options such as a one-time payment or transfer securities in-kind.

- In the PAYMENT INSTRUCTIONS section, specify how you would like the payment delivered. Indicate any preference for checks, direct deposits, or wire transfers, and provide any required banking details.

- Complete the WITHHOLDING ELECTION section. Decide if you want federal and state taxes withheld. Ensure that you are aware of the potential implications of your decisions.

- Review the SIGNATURES section. Sign and date the form to confirm accuracy and your understanding of the terms.

After completing all sections of the form, review your information for any discrepancies or omissions before submitting. This helps avoid potential delays in processing your request.

What You Should Know About This Form

What is the purpose of the E*TRADE API form?

The E*TRADE API form is used for requesting distributions from various types of Individual Retirement Accounts (IRAs). This includes Traditional IRAs, Roth IRAs, Rollover IRAs, and others. It is essential when individuals want to withdraw funds or make changes to their IRA accounts due to retirement, disability, or other reasons outlined in the form.

How do I complete the distribution request?

To complete the distribution request, fill in the required information, including your account details and the reason for the distribution. This involves providing personal information, including your name, address, social security number, and account type. Make sure to indicate how you would like to receive your distribution and whether any withholding elections need to be applied.

Are there any fees associated with the distribution?

Yes, there may be a $25 fee for processing certain types of distributions. However, this fee can be waived if your combined E*TRADE brokerage account balances total at least $100,000, or if you have placed 30 or more trades in the preceding calendar quarter. Review the section on fees carefully to understand any charges that may apply.

What if I need to remove an excess contribution?

If you have made an excess contribution to your IRA, you will need to complete the Excess Removal section of the form. This includes providing details about the tax year the excess applies to and whether the request is being made before or after the tax filing deadline. E*TRADE will calculate any potential earnings related to the excess amount during this process.

Can I request a distribution online instead of using the form?

Yes, E*TRADE allows certain types of distributions to be requested online, which can save time and simplify the process. You can visit www.etrade.com/onlinedistribution for more information on this option and to see the types of distributions available for online requests.

How does federal withholding work for IRA distributions?

For IRA distributions, federal tax withholding is typically set at a minimum of 10 percent. You can request a different withholding rate or set an additional amount to be withheld by completing the withholding election section of the form. If this section is not completed, the default 10 percent withholding will apply to your distribution.

What should I do if I have further questions about the distribution process?

If you have additional questions, you can send a secure message through the E*TRADE website or contact customer support at 1-877-921-2434. Customer service is available from 7 AM to 12 AM EST, Monday through Friday, to assist with any inquiries related to the distribution request form or your IRA account.

Common mistakes

Filling out the E*TRADE API form may seem straightforward, but there are common pitfalls individuals encounter. One frequent mistake is neglecting to indicate the correct distribution reason. Each reason has specific requirements and may necessitate additional documentation. If more than one reason applies, individuals must use a separate form for each reason. Failing to specify the appropriate reason can delay the processing of the request or result in a rejection altogether.

Another common error involves inaccuracies in personal information. It is essential to provide the correct account holder name, address, and Social Security number. Even a small typo can cause significant complications during processing. Ensuring that these details are accurate helps prevent delays and misunderstandings related to the distribution.

Individuals might also overlook the importance of completing the Excess Removal section when applicable. If the distribution reason selected involves an excess contribution, this section must be filled out thoroughly. Failing to do so can lead to complications with excess contribution penalties, resulting in additional fees or tax liability.

People sometimes make the mistake of forgetting to provide payment instructions. Clear and explicit instructions regarding how funds should be distributed are required. Omitting this information may lead to automatic processing under default conditions that might not align with the individual's preferences.

Another area of concern is withholding elections. If this section is left blank, federal regulations dictate a 10% withholding rate will be applied. Taxpayers should be aware of their options and the implications of their choices. Understanding the withholding rules can help individuals avoid unwanted surprises during tax season.

Confusion often arises when dealing with the checkboxes related to specific circumstances, such as normal distributions versus premature distributions. Many mistakenly choose the wrong option, which can result in unexpected penalties. It's crucial to carefully read the guidelines for each type of distribution and ensure the appropriate box is marked.

Completing the signature section correctly is also vital. Individuals must remember to sign and date the form, certifying that all information is accurate to the best of their knowledge. Neglecting this step can lead to delays as incomplete forms often require further clarification.

In their haste, applicants frequently fail to include necessary supporting documents that the form may require. Certain distribution reasons, such as transfers pursuant to divorce, necessitate specific documentation, such as divorce decrees. Without these attachments, the form will be deemed incomplete.

Another mistake to avoid is failing to review additional instructions on the form. E*TRADE provides specific guidance on managing certain situations, such as direct rollovers and disability distributions. Ignoring these instructions can lead to missteps that complicate the distribution process.

Lastly, it is a common oversight to consult a tax advisor before submitting the request. Individuals often underestimate the tax implications associated with IRA distributions. A discussion with a professional can provide clarity on potential penalties and tax consequences, ensuring that individuals make informed decisions with their distributions.

Documents used along the form

The E*TRADE API form is a crucial document for clients looking to manage their IRA distributions. However, it is often accompanied by additional forms and documents that help ensure compliance with various requirements and facilitate the distribution process. Below is a list of related forms you may encounter when submitting the E*TRADE API form.

- Beneficiary Distribution Request Form - IRA: This form is specifically designed for beneficiaries to request distributions from an inherited IRA after the account holder's death. It provides the necessary information for the transfer of assets to the beneficiary.

- Excess Contribution Withdrawal Form: If you've contributed more to your IRA than allowed, this form allows you to request the removal of excess contributions to avoid penalties. It details how to correct the overage and any associated fees.

- Revocation Form: This document must be completed if you wish to revoke your IRA account within seven days of its establishment. The form ensures you can receive a full return of your contributions made during this period.

- Direct Rollover Request Form: For those looking to move funds from their IRA to a qualified employer's plan, this form allows for seamless and tax-efficient transfers without incurring penalties, provided eligibility conditions are met.

- Divorce Settlement Documents: In instances of transferring IRA assets due to divorce, relevant documentation must accompany the E*TRADE form. This includes the official divorce decree and individual IRA applications signed by both parties involved.

- Income Tax Withholding Election (Form W-4P): This form allows you to specify how much federal and, if applicable, state income tax should be withheld from your IRA distribution. Making an informed choice can help avoid unexpected tax liabilities at the end of the year.

Understanding and completing these forms alongside the E*TRADE API form can help streamline the distribution process and ensure compliance with tax regulations. It's advisable to consult a financial advisor if you have questions related to these documents.

Similar forms

-

Beneficiary Distribution Request Form - IRA: This document is similar to the E*TRADE API form in that it facilitates withdrawals, particularly in cases of the death of the IRA account holder. Both forms require specific account holder information and justify the reason for the distribution.

-

Form 5329: This IRS document is used for reporting additional taxes on IRAs, including early distributions. Like the E*TRADE API form, it requires details about the account holder's age and the reason for the distribution, guiding users on penalties and tax implications.

-

Withdrawal Request Form: Commonly used by financial institutions, this form allows account holders to request distributions from their accounts. Similar to the E*TRADE API form, it captures personal details, the amount requested, and the reason for the withdrawal.

-

Direct Rollover Form: This document is essential for transferring funds from an IRA to an employer's retirement plan. Much like the E*TRADE API form, it necessitates detailed recipient information, the amount being rolled over, and the reason for the transfer.

-

Account Closure Form: A form used when an account holder wishes to close their account and withdraw remaining funds. This document shares similarities with the E*TRADE API form in outlining personal information and necessitating a specified method of distribution.

Dos and Don'ts

When filling out the E*TRADE API form, keep these essential tips in mind:

- Double-check your information: Ensure that all personal details, including your account number and Social Security Number, are accurate.

- Read the guidelines: Familiarize yourself with distribution reasons and any specific requirements that apply to your situation.

- Provide additional documentation: If required, attach forms or statements to support your distribution request.

- Keep a copy of your submission: Save a copy of the completed form for your records, as you may need it for future reference.

Avoid these common mistakes:

- Leaving fields blank: Incomplete forms can delay processing, so fill out every required field.

- Ignoring deadlines: Timely submission is crucial, especially for excess contribution removals and distributions due to specified reasons.

- Forgetting signatures: Make sure to sign and date the form. An unsigned document may result in automatic rejection.

- Using outdated forms: Always use the most current version of the E*TRADE API forms to avoid any compatibility issues.

Misconceptions

- Misconception 1: All IRA distributions trigger immediate taxation.

- Misconception 2: I can take a distribution from any type of IRA without any consequences.

- Misconception 3: I can take a distribution anytime without worrying about penalties.

- Misconception 4: The E*TRADE IRA Distribution Request Form is the only way to request a distribution.

- Misconception 5: There’s no fee for excess contributions.

- Misconception 6: If my application for distribution is rejected, I can simply submit a new request without checking the details.

- Misconception 7: I can bypass tax withholding just by not choosing it on the form.

- Misconception 8: The reason for my distribution doesn’t matter.

Not true! While most distributions are taxable, certain qualified distributions, such as those from Roth IRAs after age 59½, may not be included in taxable income.

This is a common misunderstanding. Different IRAs, like Traditional and SIMPLE IRAs, have specific rules regarding withdrawals, especially if you are under age 59½.

Actually, taking an early distribution (before age 59½) usually incurs a penalty, unless it meets certain exceptions like medical expenses or education costs.

That's not completely accurate. E*TRADE allows for common distribution requests to be submitted online, streamlining the process.

In reality, a fee may apply to excessive contributions, unless certain account balances or trading activity thresholds are met.

It's wise to be cautious. Ensure all required information is complete and accurate before resubmitting to avoid repeated rejections.

Actually, if you leave the withholding section blank, the IRS mandates a 10% withholding for federal taxes on distributions, unless stated otherwise.

On the contrary, you must specify a reason for the withdrawal. Each reason may have different tax implications and might require additional documentation.

Key takeaways

Filling out and using the E*TRADE API form can seem like a complex task, but understanding its key components will definitely help streamline the process. Here are some key takeaways.

- Complete Information: Always provide accurate and complete information for the account holder, including important personal details like social security numbers and contact numbers.

- Distribution Reasons: Clearly indicate the reason for the distribution. This section is crucial as it determines the type of penalties, if any, that may apply to your withdrawal.

- Excess Contribution Removal: If applicable, make sure to fill out the additional section for excess contribution removal to avoid potential penalties.

- Distribution Method: Choose your preferred distribution method. Options include one-time payments, direct rollovers, and installment payments.

- Tax Withholding Elections: Be aware of the withholding options available for federal and state taxes. You must specify if you want any withholding to take place.

- Required Signatures: Don’t forget that your signature is required at the end of the form, confirming that the information you provided is accurate and true.

- Contact for Assistance: If you encounter any challenges while filling out the form, remember that you can contact E*TRADE for help either through a secure message or by phone.

Having clarity on these elements will ease the form completion process. Make sure to double-check your entries, as the accuracy of the information will directly impact your ability to process your request smoothly.

Browse Other Templates

How Long Does a Chiropractor Appointment Take - Please include the member ID number for insurance verification.

Dhsh - Eligibility may depend on various factors, including household composition and income levels.