Fill Out Your Ebb Ri 20 97 Form

The EBB RI 20 97 form plays a crucial role in the process of calculating estimated earnings earned during military service. Specifically designed for military personnel, this form must be submitted to the appropriate military finance center. It caters to individuals who have served in multiple branches, necessitating separate requests for earnings from each branch. The form requires essential personal details like the employee's name, Social Security Number, and military service number, ensuring that records can be accurately matched. Attachments, such as the DD 214 or equivalent documentation, are essential for verification, as the pay center cannot process the request without this information. It’s important to note that the form primarily estimates pay for non-appropriated fund employees with service dating after December 31, 1956, and excludes specific types of additional pay like combat or flight pay. The completed form must include signatures from authorized officials who prepare estimates, further solidifying the need for official verification in this process. Understanding the components of the EBB RI 20 97 form is vital for any service member seeking to secure retirement service credit efficiently.

Ebb Ri 20 97 Example

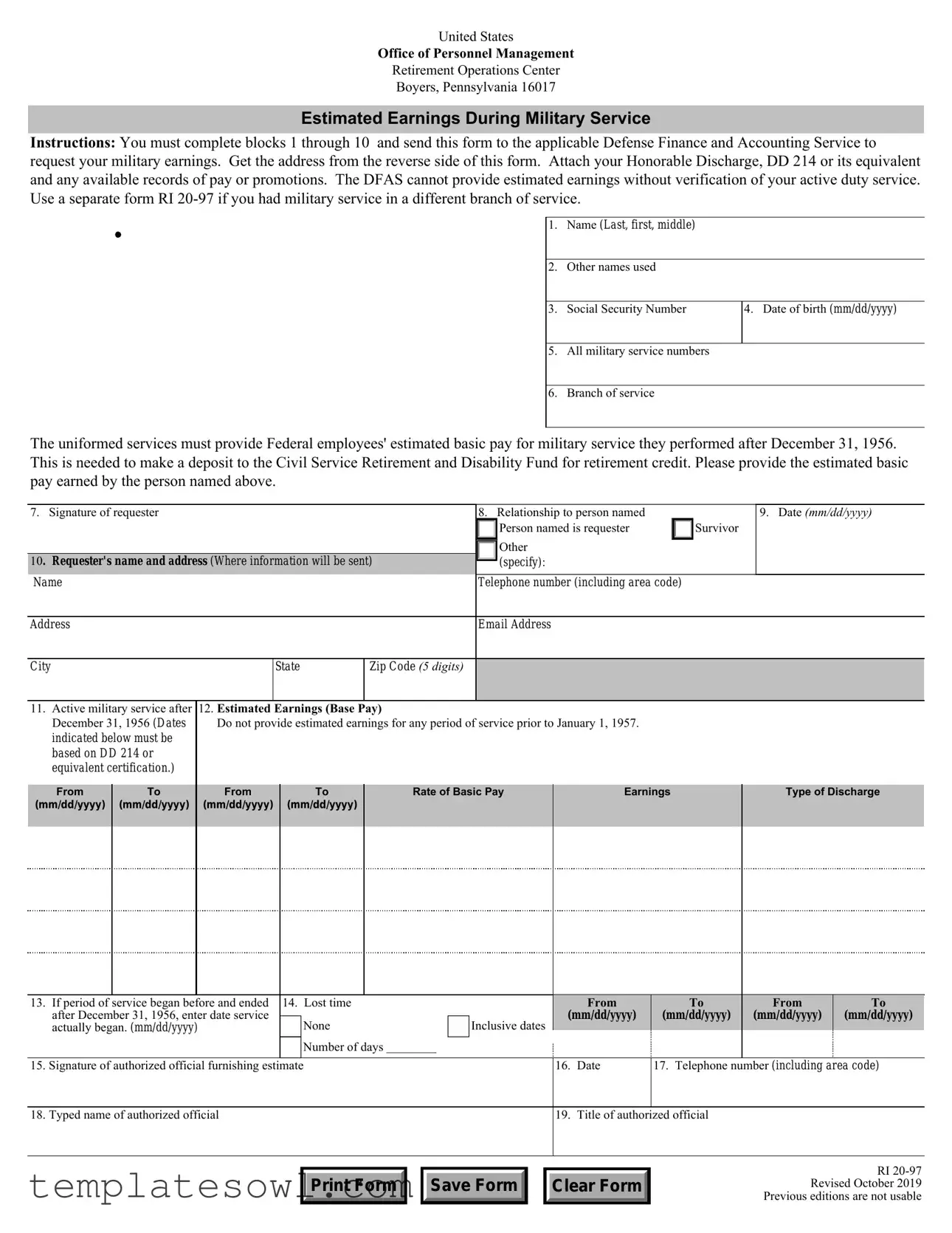

United States

Office of Personnel Management

Retirement Operations Center

Boyers, Pennsylvania 16017

Estimated Earnings During Military Service

Instructions: You must complete blocks 1 through 10 and send this form to the applicable Defense Finance and Accounting Service to request your military earnings. Get the address from the reverse side of this form. Attach your Honorable Discharge, DD 214 or its equivalent and any available records of pay or promotions. The DFAS cannot provide estimated earnings without verification of your active duty service. Use a separate form RI

1. |

Name (Last, first, middle) |

|

|

2. |

Other names used |

|

|

3. |

Social Security Number |

|

4. Date of birth (mm/dd/yyyy) |

|

|||

|

|

|

|

5. |

All military service numbers |

|

|

6. |

Branch of service |

|

|

|

|

|

|

The uniformed services must provide Federal employees' estimated basic pay for military service they performed after December 31, 1956. This is needed to make a deposit to the Civil Service Retirement and Disability Fund for retirement credit. Please provide the estimated basic pay earned by the person named above.

7. Signature of requester

10. Requester's name and address (Where information will be sent)

Name

8. Relationship to person named |

|

9. Date (mm/dd/yyyy) |

Person named is requester |

Survivor |

|

Other |

|

|

(specify): |

|

|

Telephone number (including area code) |

|

|

|

|

|

Address

Email Address

City

State

Zip Code (5 digits)

11.Active military service after 12. Estimated Earnings (Base Pay)

December 31, 1956 (Dates Do not provide estimated earnings for any period of service prior to January 1, 1957. indicated below must be

based on DD 214 or equivalent certification.)

From |

To |

From |

To |

Rate of Basic Pay |

Earnings |

(mm/dd/yyyy) |

(mm/dd/yyyy) |

(mm/dd/yyyy) |

(mm/dd/yyyy) |

|

|

|

|

|

|

|

|

Type of Discharge

13. If period of service began before and ended |

14. Lost time |

From |

after December 31, 1956, enter date service |

None |

(mm/dd/yyyy) |

actually began. (mm/dd/yyyy) |

Inclusive dates |

|

|

Number of days ________ |

|

15. Signature of authorized official furnishing estimate |

16. Date |

|

To |

From |

To |

(mm/dd/yyyy) |

(mm/dd/yyyy) |

(mm/dd/yyyy) |

|

|

|

17.Telephone number (including area code)

18. Typed name of authorized official

19. Title of authorized official

Print Form

Save Form

Clear Form

RI

Estimated Earnings Requests for Military Deposits

Military Finance Centers

www.dfas.mil/civilianemployees/militaryservice/militarydeposits.html

Note: For cover sheet, go to: https://corpweb1.dfas.mil/civpaywf/coversheet

Air Force

DFAS - Indianapolis Center

Attention: Verifications Center (Estimated Earnings)

8899 East 56th Street

Indianapolis, IN

Phone:

https://corpweb1.dfas.mil/civpaywf/coversheet Title: Estimated Earnings - Air Force

Fax:

*Utilizing cover sheet expedites processing time*

Army

DFAS - Indianapolis Center

Attention: Verifications Section (Estimated Earnings)

8899 East 56th Street

Indianapolis, IN

Phone:

https://corpweb1.dfas.mil/civpaywf/coversheet Title: Estimated Earnings - Army

Fax:

*Utilizing cover sheet expedites processing time*

Coast Guard

Commanding Officer (SES)

Coast Guard Pay and Personnel Center

444 Southeast Quincy Street

Topeka, KS

Phone:

Fax:

US Coast Guard Website:

http://www.uscg.mil/ppc/separations/

Email:

Marine Corps

DFAS - Indianapolis Center - JFVBB

Attention: Verifications Section (Estimated Earnings)

8899 East 56th Street

Indianapolis, IN

Fax Coversheet:

https://corpweb1.dfas.mil/civpaywf/coversheet Title: Estimated Earnings - Marine Corps

Fax:

*Utilizing coversheet expedites processing time*

National Oceanic and Atmospheric Administration (NOAA)

NOAA Commissioned Personnel Center

1315

Silver Spring, MD

Navy

DFAS - Indianapolis Center - JFVBB

Attention: Verifications Section (Estimated Earnings)

8899 East 56th Street

Indianapolis, IN

Fax Coversheet:

https://corpweb1.dfas.mil/civpaywf/coversheet Title: Estimated Earnings - Navy

Fax:

*Utilizing coversheet expedites processing time*

Public Health Service

U.S. Public Health Service

Division of Commissioned Personnel and Readiness

Commissioned Corps Compensation

1101 Wootton Parkway, Plaza Level, Suite 100

Rockville, MD 20852

Phone Number:

Fax:

To obtain a copy of your

Recently separated military veterans may be able to find their records through the Joint Department of Veterans Affairs

and Department of Defense eBenefits Portal.

(https://www.ebenefits.va.gov/ebenefits/homepage)

Or, you may write or send a military records request form, Standard Form 180 (http://www.archives.gov/research/order/

Department of Veterans Affairs and Department of Defense

National Personnel Records Center

Military and Civilian Personnel Records

1 Archives Drive

St. Louis, Missouri 63138

Reverse of RI

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | The EBB RI 20 97 form is used to estimate earnings during military service for employees. |

| Submission | This form must be submitted to the appropriate military finance center based on the branch of service. |

| Supporting Documents | To complete the form, attach a DD 214 or equivalent records of pay or promotions. |

| Verification Requirement | Verification of service must be attached; otherwise, the pay center cannot provide estimated earnings. |

| Applicable Dates | The estimated earnings are relevant only for military service after December 31, 1956. |

| Governing Law | This form is governed by federal laws pertaining to military service benefits and employee retirement plans. |

Guidelines on Utilizing Ebb Ri 20 97

Completing the EBB RI 20 97 form can be a straightforward process if you follow the steps correctly. Ensure that you have all necessary documentation ready for submission, as this will help you avoid delays in processing. This form should be submitted to the appropriate military finance center for your branch. Keep in mind that if you have service in more than one branch, you must submit a separate request for each.

- Obtain the form: Download or receive a copy of the EBB RI 20 97 form.

- Fill in personal information: Write your name (last, first, middle) and any other names used, your Social Security Number, date of birth, military service number, and branch of service in the appropriate fields.

- Attach documents: Include your DD 214 or an equivalent form along with any available records of pay or promotions. If you do not have a DD 214, request a SF 180 from your personnel office to verify your service.

- Provide estimated earnings: Indicate the estimated basic pay earned during military service after December 31, 1956, without including combat pay or other special payments. Include dates of service and type of discharge, along with the rate of basic earnings.

- Document lost time: If applicable, provide details about any lost time during service, including the number of days lost.

- Signature: Sign the form and indicate your relationship to the employee (if applicable). Ensure the date is accurate.

- Authorized official section: If necessary, have an authorized official complete their section at the end of the form, which includes their signature, date, telephone number, typed name, and title.

- Return completed form: Send the completed form to the designated address provided in the instructions, ensuring it reaches the appropriate military finance center.

What You Should Know About This Form

What is the Ebb Ri 20 97 form?

The Ebb Ri 20 97 form is used to report estimated earnings during military service. It's specifically designed for Non-Appropriated Fund (NAF) employees within the military who need to establish credit for retirement service. This form helps to document base pay earned after December 31, 1956, for retirement purposes.

Who should submit this form?

Any employee who has served in the military and wants to report their estimated earnings should complete this form. If you have served in more than one branch of the military, you must request estimated earnings separately for each period from the appropriate branch.

What documents do I need to attach?

You must attach your DD 214 or an equivalent document, which serves as proof of your military service. Additionally, if you don’t have a DD 214, obtain a SF 180 form from your personnel office to verify your service before forwarding the Ebb Ri 20 97 form.

Where do I submit the Ebb Ri 20 97 form?

This form should be submitted to the appropriate military finance center for your branch of service. Make sure to send it to the right location to avoid delays in processing.

What if I don’t have a DD 214?

If you do not have a DD 214, you will need to fill out a SF 180 form and have your military service verified prior to submitting the Ebb Ri 20 97. The pay center cannot provide estimated earnings without this verification.

Is there any information that should not be included in the estimated earnings?

Yes, when filling out the form, do not include any special pay types such as combat pay, flight pay, or other additional benefits. Only report base pay earned during your service.

What happens if there are discrepancies in my submission?

In case of discrepancies, the pay center may reach out for clarification or additional documentation. It's essential to ensure that all information you provide is accurate and matches your military records.

Who can sign the form and what is their role?

The form should be signed by an authorized official who is providing the estimated earnings. This official usually has a designated role within the military finance department. Their signature verifies that the estimated earnings are accurate and true to the best of their knowledge.

What should I do if I need assistance filling out the form?

If you need help completing the Ebb Ri 20 97 form, consider reaching out to your unit's administrative office or the personnel office. They can provide guidance on how to properly fill out the form and ensure you submit it correctly.

Common mistakes

Filling out the EBB RI 20 97 form can be a straightforward task, but mistakes can lead to delays or complications in processing. One common error people make is leaving out necessary documentation. The form explicitly requires a DD 214 or equivalent and any available records of pay or promotions. Without these documents, the pay center cannot provide the estimated earnings. Taking the time to gather the correct paperwork before submitting the form is essential to avoid setbacks.

Another frequent mistake involves incorrectly entering personal details. It’s vital to ensure that the employee's name, Social Security number, and military service number are accurately filled in. Even a minor typo can cause significant issues later in the process. Double-checking these details can prevent unnecessary confusion and ensure a smoother experience.

Some individuals also forget to properly specify the dates of military service. Completing the sections that detail when military service began and ended is critical. If these dates are missing or inaccurate, it can complicate the verification of earnings and lead to delays. Taking the time to accurately record all relevant dates helps maintain clarity in the submission.

Lastly, people often overlook the importance of signing the form. Both the requestor and the authorized official must provide their signatures for the form to be valid. Failing to include these signatures can result in the form being rejected. It’s a simple step, but ensuring all necessary signatures are present prior to submission can make a significant difference in the processing time.

Documents used along the form

The Ebb Ri 20 97 form is crucial for military personnel and their families in managing retirement benefits. You may need to accompany it with other forms and documents to ensure everything is in order. Here’s a concise overview of some commonly used forms related to the Ebb Ri 20 97 form.

- DD Form 214: This document serves as a certificate of release or discharge from active duty. It provides detailed information about a service member's time in the military, including dates of service, awards, and discharge status. It’s often required for VA benefits and proof of service.

- SF 180 (Request Pertaining to Military Records): This form is essential if you need to request a copy of your military records. It helps verify your service history, especially if you don't have a DD 214. You'll use it to reach out to the appropriate records office.

- VA Form 21-526EZ: This form is used to apply for disability compensation from the Department of Veterans Affairs. If you had an injury or illness related to your military service, you’d need this form to initiate your claim.

- SF 15 (Application for 10-Point Veteran Preference): Veterans seeking federal jobs can use this form to claim points that give them preference in hiring. It’s particularly useful when competing against non-veteran applicants.

Including these forms along with your Ebb Ri 20 97 can help streamline your process and ensure all required information is provided. Proper documentation is key in navigating the complexities of military service benefits.

Similar forms

The Ebb Ri 20 97 form is used to estimate earnings during military service for retirement purposes. Several documents serve similar functions in different contexts. Below are eight documents comparable to the Ebb Ri 20 97, along with an explanation of their similarities:

- DD Form 214: This document is a Certificate of Release or Discharge from Active Duty. It provides detailed information about a service member's military service, including the dates of service, which is essential for estimating earnings.

- SF 180: The Request Pertaining to Military Records enables individuals to obtain their military records. Similar to the Ebb Ri 20 97, it assists in verifying service times necessary for calculating retirement benefits.

- VA Form 21-526EZ: This application for disability compensation requires proof of service and can include estimated earnings, akin to the earnings estimation of the Ebb Ri 20 97.

- Form W-2: Employee's Wage and Tax Statement details income earned during the tax year. Both forms provide important financial information that influences retirement calculations.

- Form DD 1357: This form is used for reporting active duty and reserve service members’ pay information. Its similarity lies in the provision of estimated earnings during specified periods of service.

- IRS Form 1040: The U.S. Individual Income Tax Return summarizes earnings and taxes owed. Both this form and the Ebb Ri 20 97 rely on accurate earnings data, though for different purposes.

- DD Form 149: This form is known as the Application for Correction of Military Records. It requires service details that can impact estimates of service-related earnings, reinforcing a connection to retirement considerations.

- Universal Service Form: This document is used to apply for benefits under various military service programs. Like the Ebb Ri 20 97, it solicits service details and earnings estimates necessary for processing benefits.

Dos and Don'ts

When completing the Ebb Ri 20 97 form, it is essential to adhere to specific guidelines to ensure that the process goes smoothly. Below is a list of dos and don'ts to consider:

- Do ensure all required information is accurately filled out.

- Do attach the DD 214 or equivalent documentation.

- Do verify service records with the personnel office if the DD 214 is not available.

- Do provide your relationship to the employee when applicable.

- Don't leave any sections blank; incomplete forms may result in delays.

- Don't include non-basic pay items, such as combat or flight pay, in the estimated earnings.

- Don't forget to sign the form before submission.

- Don't submit the form without verifying that all necessary documentation is attached.

Misconceptions

Here are ten common misconceptions regarding the Ebb Ri 20 97 form, along with clarifications to help you understand its true purpose and requirements.

- Only veterans need to fill out this form. - This is incorrect. Active military personnel and survivors can also submit the form to request estimated earnings.

- You don't need to attach any documentation. - In fact, you must attach a DD 214 or equivalent documents for the estimation process to proceed.

- The form is only for one branch of the military. - If you've served in multiple branches, you must submit separate Ebb Ri 20 97 forms for each branch.

- The estimated earnings section is optional. - It is mandatory to provide accurate estimated earnings based on your military service.

- Submitting the form guarantees immediate payment. - Submission does not guarantee payment; verification is required first.

- Combat pay counts towards the estimated earnings. - This is a misconception. Combat pay and flight pay should not be included in the estimate.

- Anyone can fill out this form for you. - Only authorized officials can complete certain sections of the form.

- You can use old military records for estimates. - Only use the DD 214 or equivalent documentation that accurately reflects your service periods.

- There's no need to verify your service. - Verification is essential. The pay center cannot process estimates without it.

- Once submitted, you're done. - Follow-up may be necessary to ensure your request is processed correctly and timely.

Understanding these misconceptions will help you navigate the form more efficiently and ensure all requirements are met.

Key takeaways

Here are key takeaways regarding the Ebb Ri 20 97 form used for estimating earnings during military service:

- Submission Process: The form must be submitted to the appropriate military finance center corresponding to the service branch.

- Multiple Branches: If there is service in more than one branch of the military, separate requests must be made for each period of service.

- Documentation Required: Attach a DD 214 or equivalent documents, along with any available records of pay or promotions.

- Verification: If a DD 214 is unavailable, obtain a SF 180 from the personnel office to verify service before forwarding the form.

- Estimate Requirement: Estimated earnings cannot be provided without the appropriate verification attached to the form.

- Basic Pay Exclusion: Do not include combat pay, flight pay, or similar allowances when reporting estimated earnings.

- Authorized Official: The estimated earnings section must be completed by an authorized official, who must also provide their contact information.

- Return Instructions: The completed form should be sent to the specified address of the employee or their representative.

Browse Other Templates

Pay to Delete Collections Letter - Sending a well-structured letter can enhance your image as a responsible borrower.

Humana Employee Modification Form,Humana Benefits Update Form,Humana Employee Benefit Change Request,Humana Coverage Adjustment Form,Humana Plan Change Form,Humana Health Plan Modification Form,Humana Employee Benefit Adjustment Form,Humana Member Ch - The qualifying event section helps clarify the reason for your benefit adjustments.