Fill Out Your Edd De 26 Form

The EDD DE 26 form serves as the request for enrollment in the Electronic Funds Transfer (EFT) State Data Collector Program, specifically for vendors or third-party payers. It is essential for employers who have not yet enrolled in this program to complete this form accurately to facilitate electronic payment options for payroll taxes. The form comprises two key sections: the first section collects important employer information, including the business name, address, phone number, and the Employer Account Number assigned by the Employment Development Department (EDD). This number is distinct from the Federal Employer Identification Number and is crucial for proper record-keeping and processing. The second section contains an authorization statement, requiring the signature of an individual responsible for the business. Without this signature, the form cannot be processed. Upon successful submission, employers will receive a confirmation letter that provides further instructions on establishing their online profile and linking a bank account for electronic transactions. This process not only simplifies tax payments but also empowers employers to manage their account information more efficiently. For any questions or assistance regarding the DE 26 form, employers can contact the EDD e-Pay Unit directly.

Edd De 26 Example

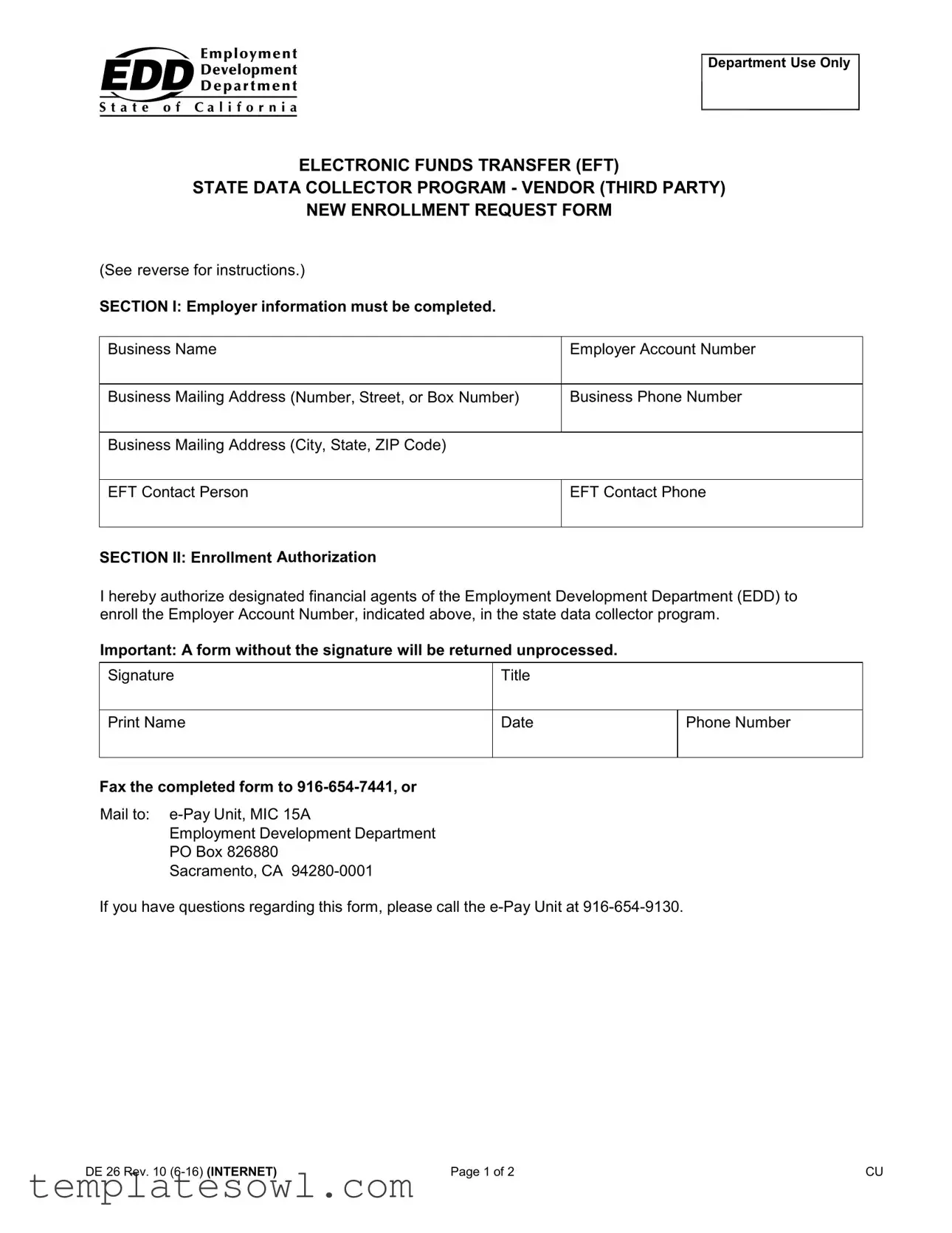

Department Use Only

ELECTRONIC FUNDS TRANSFER (EFT)

STATE DATA COLLECTOR PROGRAM - VENDOR (THIRD PARTY)

NEW ENROLLMENT REQUEST FORM

(See reverse for instructions.)

SECTION I: Employer information must be completed.

Business Name |

Employer Account Number |

|

|

Business Mailing Address (Number, Street, or Box Number) |

Business Phone Number |

|

|

Business Mailing Address (City, State, ZIP Code) |

|

EFT Contact Person

EFT Contact Phone

SECTION II: Enrollment Authorization

I hereby authorize designated financial agents of the Employment Development Department (EDD) to enroll the Employer Account Number, indicated above, in the state data collector program.

Important: A form without the signature will be returned unprocessed.

Signature

Print Name

Title

Date |

Phone Number |

|

|

Fax the completed form to

Mail to:

Employment Development Department

PO Box 826880

Sacramento, CA

If you have questions regarding this form, please call the

DE 26 Rev. 10 |

Page 1 of 2 |

CU |

Instructions for Completing the Electronic Funds Transfer (EFT) State Data Collector

Program - Vendor (Third Party) New Enrollment Request Form (www.govone.com/PAYCAL)

GENERAL

Please type or print clearly. Return the New Enrollment Request form to the EDD by mail or fax.

This authorization form is for employers who are not currently enrolled in the state data collector program - vendor (third party) website.

The employer accepts all responsibility for managing access to their profile on the state data collector system.

Once enrolled, you will receive a confirmation letter with instructions on how to create your profile and add a bank account to be used for debiting. You will also be able to update your bank account information directly from the state data collector website.

SECTION I

Complete all information in this section.

Business Name - Enter the business name.

Business Mailing Address - Enter the business mailing address.

Employer Account Number - The EDD employer payroll tax account number is required. Enter the

Business Phone Number - Enter the business phone number.

EFT Contact Person - Enter the name of the person who can be contacted regarding this enrollment or tax payment inquiries.

EFT Contact Phone Number - Enter the phone number for the contact person.

SECTION II

Preparer or responsible individual, complete all information in this section.

Fax the completed form to

Mail to:

Employment Development Department

PO Box 826880

Sacramento, CA

If you have questions regarding this form, please call the

DE 26 Rev. 10 |

Page 2 of 2 |

CU |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This form is used to enroll a business in the Electronic Funds Transfer (EFT) State Data Collector Program for submitting payments. |

| Governing Law | The EDD governs this form under California state regulations pertaining to payroll tax collection. |

| Signature Requirement | A signature is mandatory for processing this form; without it, the form will not be processed. |

| Submission Methods | Completed forms must be faxed to 916-654-7441 or mailed to the E-Pay Unit at the designated address in Sacramento. |

| Contact Information | If there are questions regarding this form, reach out to the E-Pay Unit at 916-654-9130 for assistance. |

Guidelines on Utilizing Edd De 26

The

What You Should Know About This Form

What is the purpose of the EDD DE 26 form?

The EDD DE 26 form is designed for employers to enroll in the Electronic Funds Transfer (EFT) State Data Collector Program. This program allows businesses to manage their payroll tax payments electronically, providing a secure and efficient way to handle financial transactions. By completing this form, employers authorize the Employment Development Department (EDD) to facilitate these electronic payments on their behalf.

Who should complete the EDD DE 26 form?

The EDD DE 26 form should be completed by employers who are not already enrolled in the State Data Collector Program. The form requires specific information about the business, such as the employer account number and contact details. It is crucial that the person responsible for payroll or tax payments fills out this form, as they often manage the access and communication related to the program.

What information is required on the EDD DE 26 form?

Section I of the form requires essential employer information, including the business name, mailing address, business phone number, employer account number, and details about the EFT contact person. Section II includes the signature of the responsible individual who authorizes the enrollment. Incomplete forms will be returned, so it’s important to provide all required information accurately.

How do I submit the EDD DE 26 form?

Once completed, the EDD DE 26 form can be submitted either by faxing it to 916-654-7441 or by mailing it to the E-Pay Unit of the Employment Development Department at the provided address. It is advisable to keep a copy of the submitted form for your records until you receive confirmation of enrollment.

What happens after submitting the EDD DE 26 form?

After submission, employers will receive a confirmation letter from the EDD, which contains instructions on how to create a profile on the state data collector website. This portal will allow employers to add a bank account for debiting payroll taxes and update their bank account information as necessary. The proper management of this profile is the responsibility of the employer.

Common mistakes

Filling out the EDD DE 26 form can be a straightforward process, but many make mistakes that complicate their enrollment. One common error is leaving out required information in SECTION I. This section is critical and includes the business name, mailing address, employer account number, and contact details. Missing even one piece of this information can lead to delays or outright rejection of the form.

Another mistake occurs when applicants provide inaccurate information. For instance, some use their Federal Employer Identification Number (FEIN) instead of the EDD employer payroll tax account number. This eight-digit number is essential for processing. When incorrect numbers are listed, it creates confusion and may require the applicant to resubmit the form, wasting time and effort.

People frequently overlook the need for a signature in SECTION II. Without a signature, the form will be returned and remain unprocessed. This might seem minor, but it is vital to confirm authorization for enrollment in the state data collector program. Make sure to print your name and title as well, providing clarity on who is submitting the form.

Lastly, many candidates forget to follow up after submitting their form. It's crucial to check that it has been received and processed by the EDD. After faxing or mailing the DE 26, keep an eye out for the confirmation letter. This letter will provide further instructions, and without it, you may not even know if your application was successful or if additional steps are required.

Documents used along the form

The EDD DE 26 form is crucial for employers seeking to enroll in the Electronic Funds Transfer (EFT) State Data Collector Program through the Employment Development Department (EDD). Several other forms and documents are often used alongside this form to ensure proper compliance and ease in managing employer accounts. Below is a list of these documents, offering a brief overview of each one.

- EDD DE 9: This is the Quarterly Contribution Return and Report of Wages. Employers use this form to report wages paid to employees, the number of employees, and contributions owed for unemployment insurance.

- EDD DE 34: This form is the Notice of Labor Dispute. It advises the EDD about any labor disputes affecting the payment of unemployment insurance benefits for employees.

- EDD DE 1870: This is the Employer's Request for Relief from Penalty. Employers submit this document when they believe they have a legitimate reason for failing to comply with specific EDD requirements.

- EDD DE 231: The Employee's Withholding Allowance Certificate. Employees use this form to establish their withholding allowances, which in turn affects the employer’s payroll taxes.

- IRS Form W-4: This form provides information on employee tax withholding. Employers must keep this on file to ensure the correct amount of federal taxes are withheld from employee wages.

- IRS Form 941: This is the Employer's Quarterly Federal Tax Return. Employers report income taxes withheld and FICA taxes owed on this form, which is essential for maintaining compliance with federal tax laws.

- EDD DE 542: The Employer's Declaration of Exempt Status. Employers use this form to declare their status for workers' compensation exemptions in the state of California.

Using these forms and documents in conjunction with the EDD DE 26 will assist employers in managing their responsibilities under the law effectively. Careful attention to detail and timely submission can help prevent potential issues with compliance and enhance the overall administration of employee-related requirements.

Similar forms

The EDD DE 26 form is an important document used to enroll employers in the state data collector program for electronic funds transfer. There are several other forms and documents that share similarities with the DE 26 in terms of purpose or structure. Here are five related documents:

- W-9 Form: Like the DE 26, the W-9 form collects important information about a business, including its name, address, and taxpayer identification number. It's also a common requirement when enrolling in new programs or establishing a business relationship with another entity.

- Direct Deposit Authorization Form: This document serves a similar function to the DE 26 by authorizing automatic bank transfers. It requires business or individual details and provides banking information for the deposits, making transactions more efficient.

- Vendor Registration Form: Much like the DE 26, this form is used to enroll businesses in payment systems. It typically requires contact information, business details, and various authorizations, ensuring that payments can be processed without delay.

- EFT Authorization Agreement: This agreement outlines the permission granted for electronic funds transfer, similar to the enrollment process detailed in the DE 26. It often includes information about the financial institution and the account to be used for transfers.

- Employer Tax Account Information Form: This form gathers essential details for employers regarding their tax accounts, much like how the DE 26 requires the Employer Account Number. This information is critical for accurate processing and record-keeping for tax-related purposes.

Understanding the similarities between these documents can help in navigating the enrollment process smoothly. Always ensure that the required information is complete and accurate to avoid any delays in processing.

Dos and Don'ts

When Filling Out the EDD DE 26 Form:

- Ensure all sections of the form are completed accurately.

- Provide the correct Employer Account Number – this is crucial and must be the eight-digit number assigned by EDD.

- Enter a valid business mailing address that matches EDD records.

- Clearly print or type all information to enhance legibility.

- Include a signature; forms without a signature will be returned unprocessed.

- Fax or mail the completed form promptly to avoid delays.

Things to Avoid:

- Do not use your Federal Employer Identification Number in place of the EDD account number.

- Avoid incomplete forms; leaving any section blank may lead to processing issues.

- Never provide inaccurate contact information, as it may lead to important communications being missed.

- Do not forget to check your entries for clarity to prevent misunderstandings.

- Do not delay submission; immediate action is encouraged to ensure timely enrollment.

- Refrain from attempting to submit the form through unauthorized channels.

Misconceptions

Understanding the Edd De 26 form is crucial for employers looking to enroll in the state data collector program. However, several misconceptions may lead to confusion. Here are six common myths debunked:

- Only large businesses need to fill out the Edd De 26 form. Many believe that only larger companies have to enroll. In reality, any employer that is required to pay payroll taxes can benefit from this program, regardless of size.

- The form can be submitted without a signature. Some think that a signature is unnecessary for submission. However, the form must be signed. Without a signature, it will be returned unprocessed.

- Enrollment guarantees immediate access to the system. There’s a misconception that once the form is submitted, access is instantaneous. In fact, after enrollment, you will receive a confirmation letter with further instructions, and you must complete additional steps to access your profile.

- The EDD will maintain all bank account information. It’s commonly assumed that the EDD will manage and update bank account information. However, once enrolled, employers are responsible for managing their own accounts directly through the state data collector website.

- Only payroll departments can fill out the form. It’s often thought that only HR or payroll professionals are eligible to complete this form. However, any designated representative from the business can fill it out as long as they complete all required information accurately.

- There’s no need to double-check the information on the form. Many believe that as long as the form is filled out, it will be accepted. This is misleading. Any errors can delay processing, so it's vital to double-check all entries for accuracy.

Clear understanding of these points will streamline the enrollment process and ensure that employers are better equipped to manage their obligations.

Key takeaways

- Employer Information is Essential: Complete all sections in the Employer Information section accurately to avoid processing delays.

- Have the Right Documents Ready: Make sure to have your eight-digit Employer Account Number at hand, as this is crucial for enrollment.

- Signature Requirement: Remember, the form will be returned unprocessed if it is not signed. A simple oversight can cause delays.

- Submit the Form Correctly: You can fax the completed form to 916-654-7441 or mail it to the designated address. Be sure to choose the method that works best for you.

- Confirmation Letter: Once your enrollment is processed, you will receive a confirmation letter with instructions about creating your online profile.

- Manage Your Profile: After enrollment, you will have the ability to update your bank account information directly through the state data collector website.

- Get Help if Needed: If you have any questions, don’t hesitate to reach out to the e-Pay Unit at 916-654-9130 for assistance.

Browse Other Templates

1095-b Vs 1095-a - This document breaks down the different health coverage options provided by your employer.

Hazmat Bill of Lading Pdf - A dedicated section is included for emergency response contact information.

What Is Board Resolution - This Board Resolution signifies the company's commitment to proper governance and authorized decision-making.