Fill Out Your Edd Ideninty Verification Form

The EDD Identity Verification form is an essential document for claimants seeking unemployment benefits, as it serves to confirm the accuracy of the information provided to ensure the protection of individuals from potential fraud. This form requires claimants to verify critical details such as their name, address, date of birth, and Social Security number. It explains the necessary steps to complete this verification efficiently. Claimants must respond within ten calendar days from the mail date of receiving this notice, or their benefits may be denied. The form offers two options for submitting verification documents: online through the UI Online portal or by mail. Additionally, it highlights common errors that could impede the verification process, such as discrepancies in names or dates of birth against official records. The form not only provides clear instructions and guidelines for documentation but also emphasizes the importance of accuracy in maintaining the integrity of the unemployment benefits system. Furthermore, it warns claimants about the potential penalties for providing false information, underscoring the seriousness of the responsibilities that accompany the receipt of public benefits. In light of these requirements, this article will delve deeper into the nuances of the EDD Identity Verification form, offering guidance and support to those navigating this important process.

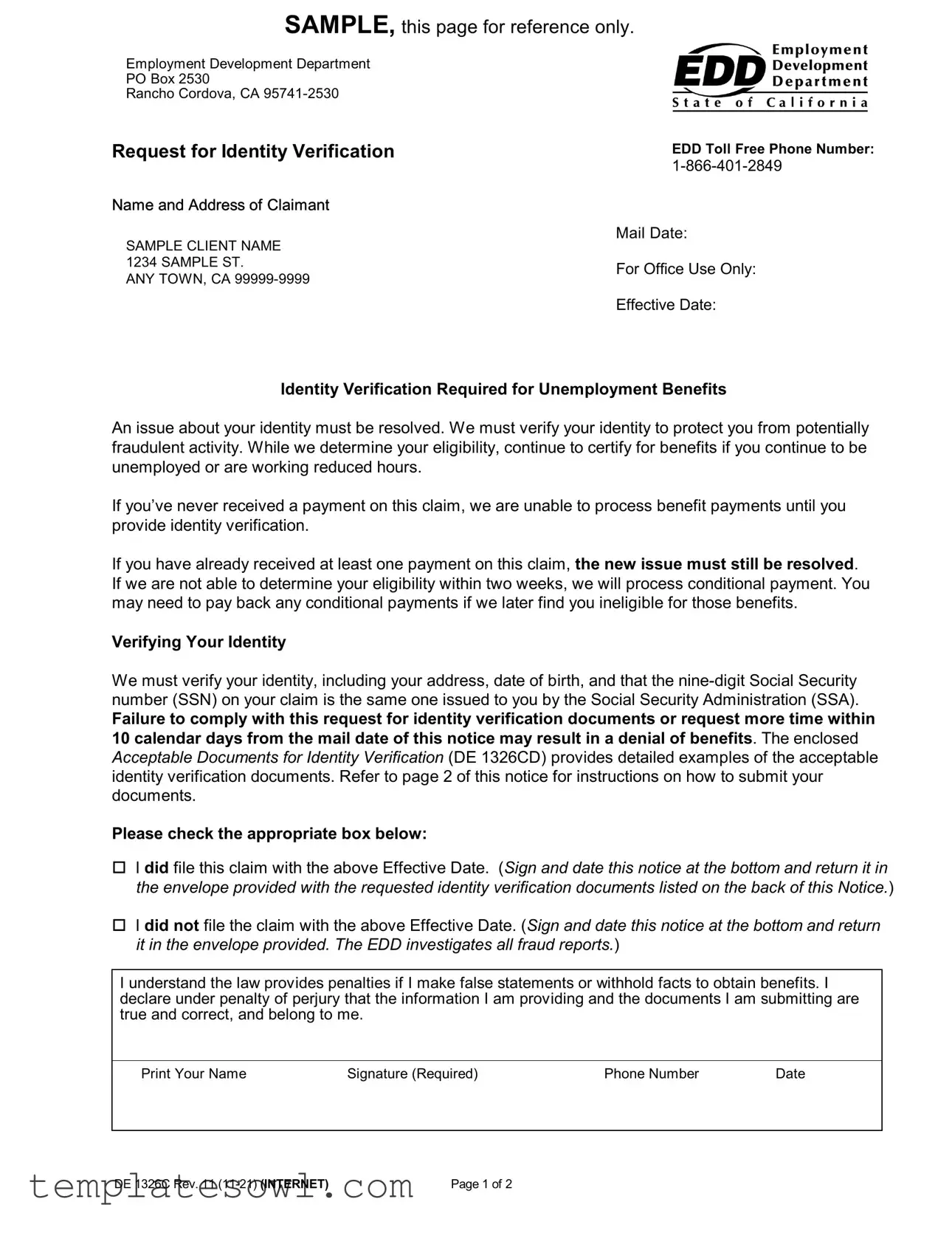

Edd Ideninty Verification Example

SAMPLE, this page for reference only.

Employment Development Department

PO Box 2530

Rancho Cordova, CA

Request for Identity Verification |

EDD Toll Free Phone Number: |

|

|

||

Name and Address of Claimant |

|

|

SAMPLE CLIENT NAME |

Mail Date: |

|

|

||

1234 SAMPLE ST. |

For Office Use Only: |

|

ANY TOWN, CA |

||

|

||

|

Effective Date: |

Identity Verification Required for Unemployment Benefits

An issue about your identity must be resolved. We must verify your identity to protect you from potentially fraudulent activity. While we determine your eligibility, continue to certify for benefits if you continue to be unemployed or are working reduced hours.

If you’ve never received a payment on this claim, we are unable to process benefit payments until you provide identity verification.

If you have already received at least one payment on this claim, the new issue must still be resolved. If we are not able to determine your eligibility within two weeks, we will process conditional payment. You may need to pay back any conditional payments if we later find you ineligible for those benefits.

Verifying Your Identity

We must verify your identity, including your address, date of birth, and that the

Failure to comply with this request for identity verification documents or request more time within 10 calendar days from the mail date of this notice may result in a denial of benefits. The enclosed Acceptable Documents for Identity Verification (DE 1326CD) provides detailed examples of the acceptable identity verification documents. Refer to page 2 of this notice for instructions on how to submit your documents.

Please check the appropriate box below:

I did file this claim with the above Effective Date. (Sign and date this notice at the bottom and return it in the envelope provided with the requested identity verification documents listed on the back of this Notice.)

I did not file the claim with the above Effective Date. (Sign and date this notice at the bottom and return it in the envelope provided. The EDD investigates all fraud reports.)

I understand the law provides penalties if I make false statements or withhold facts to obtain benefits. I declare under penalty of perjury that the information I am providing and the documents I am submitting are true and correct, and belong to me.

Print Your Name |

Signature (Required) |

Phone Number |

Date |

DE 1326C Rev. 11 |

Page 1 of 2 |

SAMPLE, this page for reference only.

Instructions to Submit Your Identity Verification Documents

Refer to the enclosed Acceptable Documents for Identity Verification (DE 1326CD) for detailed examples of the acceptable identity verification documents.

You have two options to submit your verification documents:

UI OnlineSM - Log in to your UI Online account and select Upload Documents on the homepage to provide your identity verification documents. This is the quickest and most secure method to provide documentation.

Mail - If you cannot upload your documents, mail us a copy of the required documents. Sign page 1 of this notice and include it with your identity verification documents in the return envelope provided. Do not return any other EDD forms in the envelope.

Important: Include your complete Social Security number on ALL documents mailed.

Request Additional Time

You have the right to request more time to gather documents or obtain the advice of a representative. If you need more time, you must contact us by phone or mail at the address/phone number on page 1 within 10 calendar days from the mail date of this notice. If we do not receive your required documents by the end of the

Common Errors Associated with Identity Verification

The date of birth you provided when you filed your claim is different than the one at the SSA and/or the Department of Motor Vehicles (DMV).

The name you provided when you filed your claim is different than the one at the SSA or the DMV. You may have changed your name and not notified the SSA and/or the DMV.

The SSN you provided when you filed your claim is incorrect. You may have forgotten the number, or transposed the number when you filed your unemployment claim or when you provided it to your employer.

We do not update SSA or DMV information. If your date of birth or name used at the SSA or the DMV is incorrect based on your review of your SSA statement, driver license or photo identification card, contact SSA or DMV directly to make change(s). Continue to submit any available documents to us to resolve the identity verification issue within 10 calendar days from the date of this notice. Provide copies of updated documents to us as soon as they are available.

Legal References

Section 1253(a) of the California Unemployment Insurance Code (CUIC) states all claims for benefits must be filed in accordance with the EDD regulations. Section 1257(a) of the CUIC states that if an individual gives false information to the EDD in order to obtain benefits, the individual may be subject to a penalty. Title 22, California Code of Regulations, section

DE 1326C Rev. 11 |

Page 2 of 2 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The EDD Identity Verification form is designed to confirm a claimant's identity for unemployment benefits, ensuring protection against fraud. |

| Submission Deadline | Claimants must submit their identity verification documents within 10 calendar days of receiving the notice to avoid potential denial of benefits. |

| Acceptable Documents | The form references the DE 1326CD, which outlines the types of documents acceptable for identity verification. These documents typically include proof of identity, address, and Social Security number. |

| Consequences of Non-compliance | If the required documents are not submitted in time, benefits may be denied. This highlights the importance of responding promptly. |

| Legal References | This process is governed by Section 1253(a) and Section 1257(a) of the California Unemployment Insurance Code, among others, which outline the need for accurate claims and penalties for providing false information. |

| Method of Submission | Claimants can submit their documents through UI Online for a faster process or by mailing the documentation. Both methods require accurate completion of the form and include the proper documents. |

Guidelines on Utilizing Edd Ideninty Verification

Once you have received the EDD Identity Verification form, it's important to complete it accurately and promptly. Providing the necessary documents will help resolve any identity issues that may be impacting your unemployment benefits. Please follow the steps below to fill out the form correctly.

- Carefully read the entire form to understand what is being requested.

- In the space provided, enter your full name as it appears on your Social Security card.

- Fill in your address, including street number, street name, city, state, and ZIP code.

- Provide your phone number to ensure the EDD can contact you if needed.

- Identify whether you filed the claim by checking the appropriate box:

- ☐ I did file this claim with the above Effective Date.

- ☐ I did not file the claim with the above Effective Date.

- Sign and date the form at the bottom to confirm your information is accurate.

- Gather the required identity verification documents as specified in the Acceptable Documents for Identity Verification (DE 1326CD).

- If you choose to mail your documents, place the completed form and copies of your documents in the envelope provided. Ensure to include your complete Social Security number on all documents.

- If you need more time to gather your documents, contact the EDD by phone or mail within 10 calendar days of the notice date to request an extension.

What You Should Know About This Form

What is the purpose of the EDD Identity Verification form?

The EDD Identity Verification form is required to confirm your identity before you can receive unemployment benefits. This procedure helps protect you from potential fraud. If there is a discrepancy concerning your identity, it must be resolved in order for the Employment Development Department (EDD) to process your claim and provide benefits.

What documents do I need to provide for identity verification?

You need to submit documents that establish your identity, address, date of birth, and Social Security number (SSN). The EDD provides a specific list of acceptable documents in the attached Acceptable Documents for Identity Verification (DE 1326CD). It is essential that the SSN you provide matches the one issued to you by the Social Security Administration (SSA).

How do I submit my identity verification documents?

You have two options for submitting your verification documents. The quickest and most secure way is to log into your UI Online account and select 'Upload Documents' from the homepage. Alternatively, if you prefer to mail your documents, include copies of the required verification documents along with a signed page of the notice in the return envelope provided. Please remember, only send documents related to your identity verification—do not include other EDD forms.

What happens if I don’t respond within 10 days?

If the EDD does not receive your requested identity verification documents within 10 calendar days from the mail date of the notice, you may face a denial of benefits. It’s crucial to respond promptly to avoid any interruptions in your benefits. If you need additional time, make sure to request it within that same timeframe.

Can I ask for more time to gather my documents?

Yes, you can request additional time to obtain the necessary documentation. If you find yourself needing more time, contact the EDD by phone or via mail, using the information provided in the notice. Ensure to do this within 10 calendar days of the mail date. Keep in mind that you must specifically request the extra time; otherwise, failure to submit documents in the required timeframe can result in denial.

What should I do if my name or date of birth does not match?

If the name or date of birth you provided on your unemployment claim doesn't match the records at the SSA or the DMV, you should contact those agencies directly to correct the discrepancies. It is essential to ensure that your records are accurate to avoid potential issues with your identity verification.

What are some common errors to avoid when completing the identity verification process?

Common errors include providing an incorrect Social Security number, submitting a date of birth that does not match the SSA or DMV records, or using a name that differs from what is listed with those agencies. To ensure a smooth verification process, double-check all information against your SSA statement or DMV documents before submission.

What should I do if I believe I did not file this claim?

If you did not file the claim mentioned in the notice, it is important to indicate this on the form and return it. EDD investigates all reports of fraudulent claims, so your timely response matters. Mark the appropriate box on the form, sign it, and send it back in the provided envelope.

Common mistakes

Completing the Employment Development Department (EDD) Identity Verification form can be a straightforward task, yet many individuals make simple mistakes that can lead to complications in receiving their unemployment benefits. One common error is providing an incorrect date of birth. If the date of birth listed on the form does not match what is recorded with the Social Security Administration (SSA) or the Department of Motor Vehicles (DMV), it can trigger delays. It is essential to cross-check this information and ensure accuracy before submitting.

Another frequent mistake involves discrepancies in the name provided. For example, if a person has changed their name but did not update their records with the SSA or DMV, this can create issues. The EDD requires that your name matches exactly with official records to confirm your identity properly. Individuals should always verify that all name changes have been officially documented with relevant agencies.

A third common pitfall is incorrectly entering the Social Security number (SSN). This might occur due to simple errors like transposing digits or using an outdated number. Individuals must ensure that the nine-digit SSN they provide is accurate and corresponds with their official SSA records. It is advisable to double-check the number against an official document to avoid submitting incorrect information.

Additionally, failing to submit documents within the required timeframe can significantly impact the claims process. The EDD stipulates that individuals must provide the necessary identity verification documents within ten calendar days of the notice's mail date. Missing this deadline can result in a denial of benefits. Therefore, it is crucial for claimants to gather and send their documents promptly.

Lastly, individuals often neglect to sign and date the form before submission. This may seem minor, but it is a critical requirement. The EDD must have a signed declaration from the claimant, affirming that the information provided is true and accurate. A missing signature can halt the processing of claims and prolong the waiting period for benefits.

Documents used along the form

The EDD Identity Verification form is crucial for confirming a claimant's identity for unemployment benefits. Along with this form, several other documents and forms may be required to ensure a smooth verification process. Below is a list of nine commonly used forms and documents that might accompany the identity verification process.

- Acceptable Documents for Identity Verification (DE 1326CD): This document lists specific types of identification that you can submit for verification. It details what is necessary, ensuring you provide the appropriate paperwork.

- Unemployment Insurance Claim Form (UI Claim Form): This initial application form is submitted when claiming unemployment benefits. It collects basic information about your employment history.

- Authorization for Release of Information (DE 1101A): This form allows the EDD to obtain necessary information from other agencies, such as the SSA or DMV, to confirm your identity and eligibility.

- Social Security Administration (SSA) Statement: This document provides proof of your Social Security number as issued by the SSA. It confirms your identity and ensures the correct SSN is on your claim.

- Driver License or State ID Copy: A copy of your current driver’s license or state-issued ID serves as an additional form of identification to verify your name and address.

- Birth Certificate: A copy of your birth certificate may be required to verify your date of birth. It serves as primary evidence of your identity.

- Proof of Address (Utility Bill, Lease Agreement): Providing proof of your current address ensures that the information on your unemployment claim matches your present location.

- Employment Records: Documentation from your previous employers, such as pay stubs or W-2 forms, may be necessary to substantiate your claims of employment and unemployment.

- Request for Additional Time (if applicable): If you need more time to gather your identity verification documents, submitting a request for additional time ensures your benefits are not denied due to delays.

Understanding these documents helps streamline the verification process and minimizes complications with your unemployment benefits application. Keeping them organized and readily available will facilitate timely submissions and improve your chances of approval.

Similar forms

- W-2 Form: Similar to the EDD Identity Verification form, the W-2 form confirms your identity through your name and Social Security number. It acts as an official record of your earnings and taxes withheld, ensuring that your financial information aligns with government records.

- Social Security Card: The Social Security card is a critical document for identity verification. Just like the EDD form, it displays your name and Social Security number, verifying your identity in various applications, including benefits.

- Driver's License: Your driver's license serves as a government-issued photo identification. It can verify both your identity and residence, similar to the requirements of the EDD form, which asks for proof of address alongside identity confirmation.

- Passport: A valid passport serves as another form of identification that confirms your identity. It includes your name, date of birth, and a photograph, fulfilling similar verification purposes as the EDD Identity Verification form.

- Utility Bill: Utility bills help verify residence and identity by showing your name and address. Like the EDD form, which requests documentation of your address, utility bills can be commonly accepted forms of proof.

- Bank Statement: A bank statement can confirm your identity and provide an address, much like the EDD form asks for. This document reflects your financial status and is often used to validate your identification for various applications.

- Birth Certificate: A birth certificate establishes personal identity by providing your name and date of birth. This document supports identity verification similar to the EDD requirements for confirming your date of birth and identity.

- Pay Stub: Like the W-2 form, a pay stub verifies your employment and identity. It includes your name, address, and the last four digits of your Social Security number, aligning with the information the EDD needs for verification.

- Government Assistance Letter: If you receive government assistance, letters or documents verifying this can also serve to confirm your identity. These letters typically contain your name and pertinent personal information, playing a role similar to that of the EDD Identity Verification form.

Dos and Don'ts

When filling out the EDD Identity Verification form, it’s essential to take certain steps to ensure your submission is complete and accurate. Here are seven important dos and don’ts to keep in mind:

- Do double-check your personal information.

- Don't provide information that does not match your Social Security records.

- Do include your complete Social Security number on all mailed documents.

- Don't forget to sign and date the notice before returning it.

- Do submit the required documents within 10 calendar days.

- Don't wait until the deadline to request additional time if you need it.

- Do refer to the Acceptable Documents for Identity Verification list for guidance.

Following these simple guidelines can help streamline your experience and prevent delays in processing your claim.

Misconceptions

There are several misconceptions regarding the EDD Identity Verification form that can lead to confusion. Here are four common ones:

- Misconception 1: Submitting documents is optional.

- Misconception 2: The EDD will automatically correct any discrepancies.

- Misconception 3: You will not receive any payments during the verification process.

- Misconception 4: There is no need to contact EDD if you need more time.

Some individuals believe that providing identity verification documents is optional. This is incorrect. Failure to submit the required documents within 10 calendar days can result in a denial of benefits.

Many people assume that the EDD will fix any discrepancies in their name, date of birth, or Social Security number. However, it is the claimant’s responsibility to ensure all information matches what is on file with the SSA or DMV.

Some claimants think they will not receive any payments until their identity is verified. In reality, if you have received at least one payment on your claim, you may get a conditional payment while your eligibility is being determined.

It is a common belief that you do not need to contact the EDD for extra time to gather documents. If you do need more time, you must reach out to the EDD within 10 calendar days to request this extension.

Key takeaways

1. Timely Submission is Crucial: It is essential to respond to the request for identity verification within 10 calendar days from the mail date of the notice. Failure to do so may result in a denial of benefits.

2. Acceptable Documents are Key: Refer to the enclosed Acceptable Documents for Identity Verification (DE 1326CD) for examples of valid documents. Submitting the correct documentation will help avoid delays.

3. Verify Your Information: Check that your name, date of birth, and Social Security number match what is on file with the Social Security Administration (SSA) and the Department of Motor Vehicles (DMV). Discrepancies can lead to complications.

4. Options for Document Submission: You can submit your verification documents either online through your UI Online account or by mailing them in the provided envelope. Choose the method that is most convenient for you.

Browse Other Templates

If You Are Injured on the Job the First Thing You Should Do Is - Email addresses enable digital communication regarding the claim.

Virginia Llc Application - One authorized person must sign the form, indicating they have the power to manage the company.

How to Hook Up Directv - The form should clearly reflect both parties' agreement on the installation.