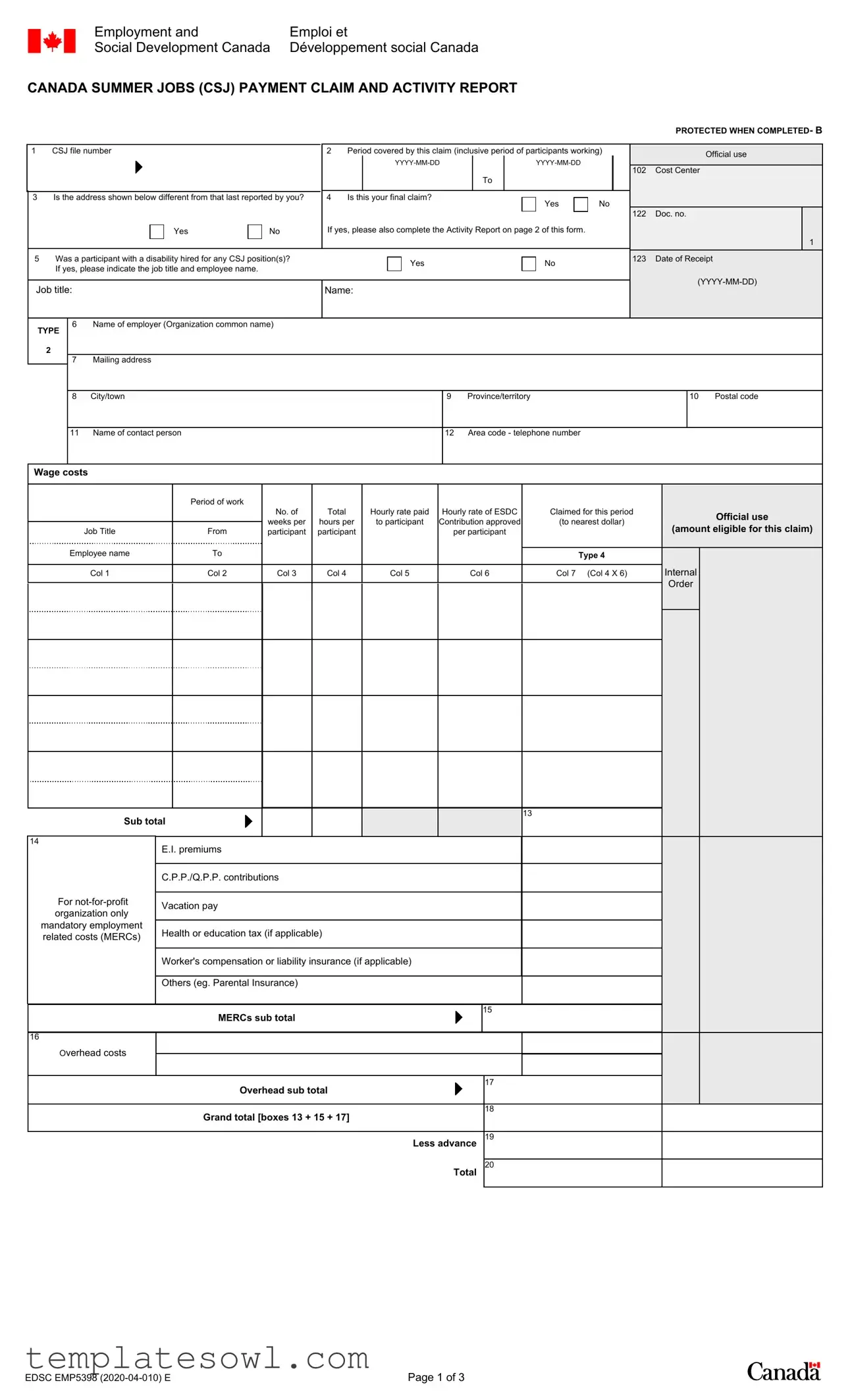

Fill Out Your Emp5398 Form

The EMP5398 form is a central document utilized by employers participating in the Canada Summer Jobs (CSJ) program, which aims to provide funding for organizations hiring youth. This form serves multiple purposes, primarily focused on the payment claim and accompanying activity report for the period in which participants were employed. Information required includes the employer's details, payment claims for wages, and associated costs such as Employment Insurance (EI) premiums and provincial contributions. Additionally, employers must declare whether they hired participants with disabilities and provide specific details regarding job titles and participant names. The EMP5398 form also incorporates an activity report section, which requires employers to outline the duties performed by employees and confirm that health and safety standards were communicated. An essential part of the submission process includes certifying the accuracy of the information and completing a mandatory employer questionnaire. Understanding the intricacies of this form is crucial for organizations to ensure compliance with funding criteria and facilitate smooth fund disbursement.

Emp5398 Example

Employment and |

Emploi et |

Social Development Canada |

Développement social Canada |

CANADA SUMMER JOBS (CSJ) PAYMENT CLAIM AND ACTIVITY REPORT

PROTECTED WHEN COMPLETED- B

1 |

CSJ file number |

|

2 |

Period covered by this claim (inclusive period of participants working) |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

To |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Is the address shown below different from that last reported by you? |

4 |

Is this your final claim? |

|

|

|

Yes |

|

No |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

If yes, please also complete the Activity Report on page 2 of this form. |

|

|

|||||||||

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

Was a participant with a disability hired for any CSJ position(s)? |

|

|

|

|

Yes |

|

|

|

No |

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||||||

|

If yes, please indicate the job title and employee name. |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Job title: |

|

Name: |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Official use

102Cost Center

122Doc. no.

123 Date of Receipt

1

6Name of employer (Organization common name)

TYPE

2

7Mailing address

8City/town

9Province/territory

10 Postal code

11 Name of contact person

12 Area code - telephone number

Wage costs

|

Period of work |

|

|

|

|

|

|

|

|

No. of |

Total |

Hourly rate paid |

Hourly rate of ESDC |

Claimed for this period |

|

|

|

weeks per |

hours per |

to participant |

Contribution approved |

(to nearest dollar) |

|

Job Title |

From |

||||||

participant |

participant |

|

per participant |

|

|||

Employee name |

To |

|

|

|

|

|

|

|

|

|

|

Type 4 |

|||

|

|

|

|

|

|

|

|

Col 1 |

Col 2 |

Col 3 |

Col 4 |

Col 5 |

Col 6 |

Col 7 (Col 4 X 6) |

|

|

|

|

|

|

|

|

13

Sub total

14 |

|

E.I. premiums |

|

|

|

|

|

||

|

|

|

|

|

|

|

C.P.P./Q.P.P. contributions |

|

|

For |

|

|

|

|

Vacation pay |

|

|||

organization only |

|

|||

|

|

|

||

mandatory employment |

Health or education tax (if applicable) |

|

||

related costs (MERCs) |

|

|||

|

|

|

||

|

|

|

|

|

|

|

Worker's compensation or liability insurance (if applicable) |

|

|

|

|

|

|

|

|

|

Others (eg. Parental Insurance) |

||

|

|

|

|

|

|

|

MERCs sub total |

15 |

|

|

|

|

||

|

|

|

|

|

16 |

|

|

|

|

Official use

(amount eligible for this claim)

Internal

Order

Overhead costs

Overhead sub total

Grand total [boxes 13 + 15 + 17]

Less advance

17

18

19

20

Total

EDSC EMP5398 |

Page 1 of 3 |

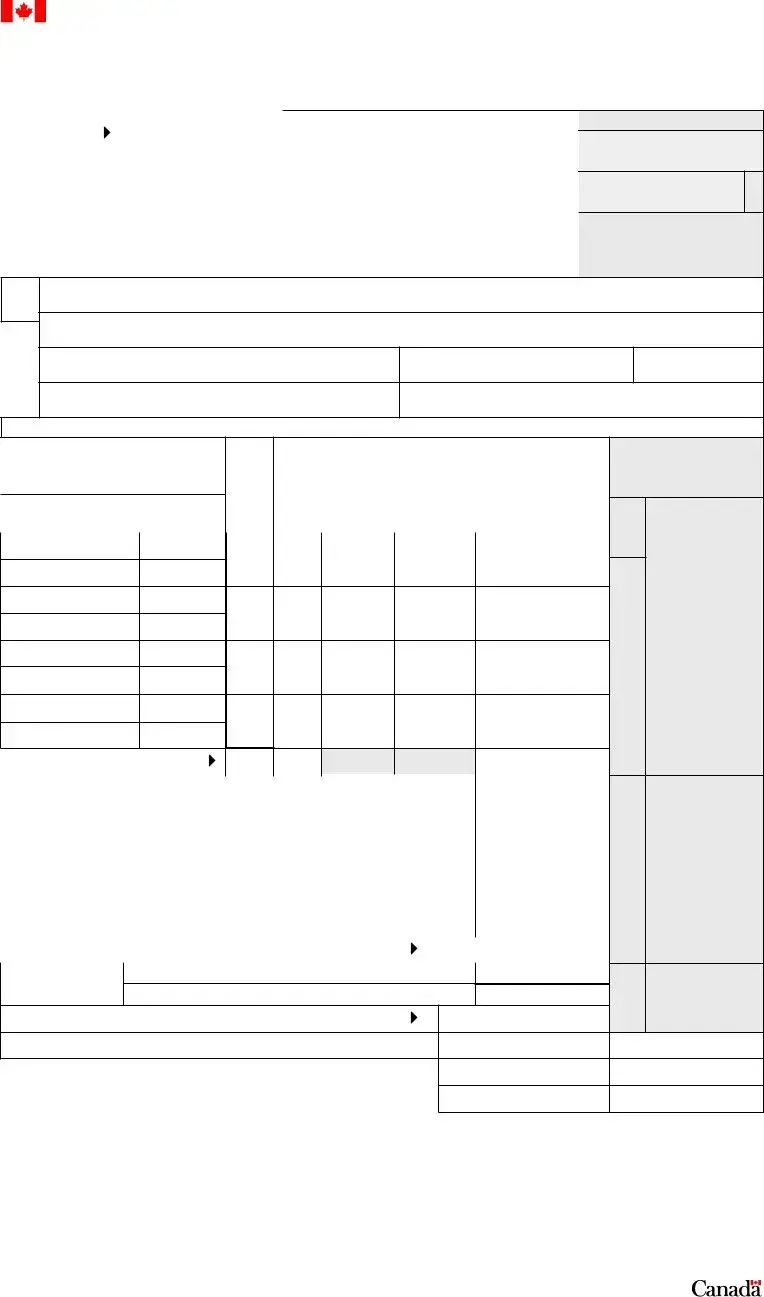

CANADA SUMMER JOBS (CSJ) ACTIVITY REPORT

21Have all CSJ employee(s) received all information concerning health and safety standards and regulations regarding their work environment and if necessary, safety equipment required for their job?

Yes

No

Please explain

22Briefly describe the duties performed by the participant(s) during their CSJ work experience. (If 4 or more youth were employed at your organization, include the additional participants on a separate form).

Job title:

Participant's nameSupervisor's name:

Duties performed

Job title:

Participant's nameSupervisor's name:

Duties performed

Job title:

Participant's nameSupervisor's name:

Duties performed

Job title:

Participant's nameSupervisor's name:

Duties performed

23.How many of your

24Employer Questionnaire

It is mandatory to have completed the employer questionnaire prior to submitting your final claim. Please provide the tracking number you received after completing your CSJ Employer Questionnaire.

25Recipient (employer) Certification

I certify that the information is true and correct to the best of my knowledge and claimed in accordance with the agreement and I am authorized to sign on behalf of the employer.

I certify that I have asked participants to complete the participant questionnaire to report on their experience with the Canada Summer Jobs program. NOTE: The information provided in this application will be administered in accordance with the Privacy Act and the Access to Information Act.

Signature |

|

Date |

|

Area Code/Telephone No. (for enquiries) |

Print Name and Position

Additional signature when required:

Signature |

|

Date |

|

Area Code/Telephone No. (for enquiries) |

Print Name and Position

EDSC EMP5398 |

Page 2 of 3 |

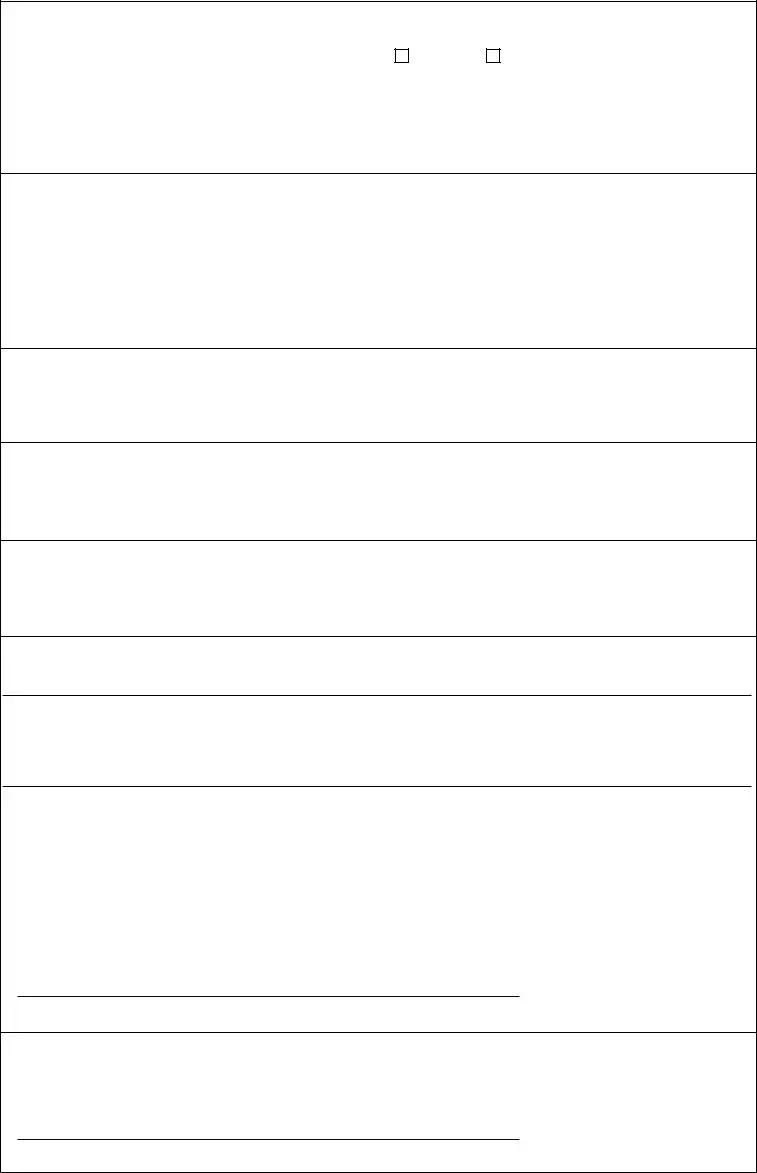

145

Official use

Type

3

Cheque stub information

|

Expenditure |

|

|

Certified pursuant to Section 34 of the FAA. |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature |

|

|

|

Authorized officer (Signature) |

|

Date |

Print Name and Title |

||||||||

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The |

|

|

|

|

System Approval |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

(Signature) |

|

(Signature) |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Manager,Corporate Services/ Chief, Administrative Services |

|

Date |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

(Signature) |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EDSC EMP5398 |

Page 3 of 3 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The EMP5398 form is used to submit a payment claim and activity report for the Canada Summer Jobs (CSJ) program. |

| Governing Law | The CSJ program operates under the regulations and guidelines set by Employment and Social Development Canada. |

| Eligibility Confirmation | Employers must confirm whether any participants with disabilities were hired for CSJ positions in the claim. |

| Final Claim Indicator | The form requires employers to indicate if this is their final claim for the CSJ funding. |

| Reporting Obligations | Employers must provide details on the duties performed by participants as part of the activity report. |

| Employee Retention | The form asks how many CSJ-funded employees were retained after the completion of the program. |

| Certification Requirement | Employers must certify that all provided information is accurate and authorized by a designated signatory. |

| Privacy Compliance | Information submitted in the application is governed by the Privacy Act and the Access to Information Act. |

Guidelines on Utilizing Emp5398

Next, you will need to prepare the Emp5398 form carefully to ensure all information is accurate and complete. Follow these steps to fill it out correctly.

- Start with your CSJ file number at the top of the form.

- Fill in the inclusive period covered by the claim by entering the start date and end date in YYYY-MM-DD format.

- Answer the question regarding whether the address is different from the last reported address.

- Indicate if this is your final claim by marking "Yes" or "No." If it is a final claim, remember to complete the Activity Report on page two.

- State whether a participant with a disability was hired for any position. If yes, provide the job title and the employee's name.

- Complete the employer's section with the name of the organization, mailing address, city or town, province or territory, and postal code.

- List the name of a contact person and their area code and telephone number.

- In the wage costs section, detail the following: the job title, employee name, period of work, total hours per participant, hourly wage paid, and ESDC contribution.

- Calculate and fill in the subtotal and any applicable costs such as E.I. premiums, C.P.P./Q.P.P. contributions, vacation pay, health tax, worker's compensation, and other costs.

- Sum up the overhead costs and calculate the grand total.

- If there is an advance amount, subtract it from the grand total to get the final amount due.

- For the Activity Report, confirm that all employees received information regarding health and safety and explain if necessary.

- Describe the duties performed by each participant briefly, including job titles and names.

- Indicate how many employees were retained after the agreement. Ensure you have completed the employer questionnaire and provide the tracking number.

- Certify the information by signing the certification section, providing a date, and printing your name and position. If another signature is required, repeat the process as needed.

What You Should Know About This Form

What is the purpose of the Emp5398 form?

The Emp5398 form is used to claim payment for participants working under the Canada Summer Jobs (CSJ) program. This program provides funding to employers to help create summer job opportunities for young people. The form documents hours worked, wages paid, and any associated costs, ensuring employers receive the appropriate reimbursement for their financial contributions.

Who is eligible to submit the Emp5398 form?

To submit the Emp5398 form, an organization must have participated in the Canada Summer Jobs program. This includes businesses, not-for-profit organizations, and public sector employers that have hired summer job participants. The form must be completed by an authorized representative of the organization who can verify the accuracy of the claims being made.

What information is required on the Emp5398 form?

The Emp5398 form requires various pieces of information. Employers need to provide their organization’s details, including the Common name, mailing address, and contact information. Additionally, details on employees hired under the program, including their job titles and wages paid, must be included. The form also asks for confirmations about health and safety information provided to participants and details regarding the employer questionnaire.

Is there a deadline for submitting the Emp5398 form?

The submission deadline for the Emp5398 form coincides with the completion of the funding period as defined by the Canada Summer Jobs program. Employers should check the specific guidelines provided for their funding year, as timely submission is critical to ensure that claims are processed without delay.

What happens after submitting the Emp5398 form?

Once submitted, the Information on the Emp5398 form is reviewed by Employment and Social Development Canada (ESDC). If everything is in order, the organization will receive reimbursement according to the details reported. In some cases, additional information may be requested to complete the review. Employers should retain all records related to the submitted claims for future reference.

Are there any penalties for incorrect information on the Emp5398 form?

Providing inaccurate information on the Emp5398 form can lead to several repercussions, including delays in payment or even disqualification from receiving future funding. It is important for employers to ensure that all information reported is accurate and complete. Deliberate misrepresentation may result in severe consequences, such as financial penalties or legal action.

Common mistakes

Completing the EMP5398 form for the Canada Summer Jobs (CSJ) program can be complex, and errors can lead to delays or denials of payment. One common mistake is failing to provide accurate dates. In section 2, applicants must indicate the claim period accurately. If dates are recorded incorrectly, financial assessments may be affected, leading to complications down the road.

Another frequent error is not adequately answering the questions regarding participant employment. In section 5, where employers need to specify if a participant with a disability was hired, some may overlook this requirement. Missing this detail can result in incomplete applications, which can hinder the support intended for participants with disabilities.

Additionally, many individuals forget to complete the mandatory employer questionnaire before submitting their claim. Section 24 makes it clear that this step is critical. Without the accompanying tracking number received after the questionnaire is submitted, processing of the claim may be stalled.

Lastly, applicants often neglect to double-check the information in the certification section. In this section, the individual certifies the accuracy of the information provided. Errors in contact details or signatures can lead to rejection of the entire claim. Thorough review and attention to detail in this area are crucial for ensuring successful processing of the EMP5398 form.

Documents used along the form

When filing the Emp5398 form for the Canada Summer Jobs program, several other documents may be necessary to support your claim. Each of these documents assists in verifying the employment activities and ensuring compliance with program requirements.

- Activity Report: This document outlines the specific duties performed by each participant during their employment period. It is essential for assessing the contributions of the participants and includes a summary of their work experience.

- Employer Questionnaire: Completing this questionnaire is mandatory prior to submitting the final claim. It gathers critical information about the employer's experience with the Canada Summer Jobs program and is used for program evaluation.

- Cheque Stub Information: This stub tracks the financial details related to the payment made to the employer. It ensures that all expenditures comply with the funding agreement and provides transparent financial reporting.

- Wage Subsidy Agreement: This agreement outlines the terms under which the wage subsidy is provided. It details the funding that will cover part of the wages paid to participants during their employment.

- Employment Verification Letters: These letters confirm the employment status, job title, and duration of employment for each participant. They serve as proof of participation in the Canada Summer Jobs program.

- Insurance Documentation: For employers, providing insurance documentation ensures compliance with workplace safety regulations. It also protects workers and employers alike from potential liabilities.

- Retention Report: This document details how many participants were retained by the employer after the end of their CSJ agreement. Retention rates are an essential measure of the program’s success.

- Final Claim Summary: This summary compiles all the financial details of the claim, including wages paid, employer contributions, and any outstanding amounts owed. It provides a clear overview for both the employer and the funding agency.

- Participant Questionnaires: These feedback forms are filled out by participants regarding their experience with the program. Their responses provide valuable insights for future program improvements.

Including these documents alongside the Emp5398 form will streamline the review process and enhance the credibility of your claim. Ensure that all necessary paperwork is complete and accurate before submission.

Similar forms

The Emp5398 form is a crucial document for employers participating in the Canada Summer Jobs program. Several other documents share similarities in structure and purpose. Here’s a brief overview of four related forms:

- CSJ Employer Questionnaire: This document requires employers to provide detailed information about their organization and the positions being offered to participants. Like the Emp5398, it collects information on the participants and their qualifications to ensure compliance with program requirements.

- Employment Insurance (EI) Claim Form: This form is used to apply for employment insurance benefits. Similar to the Emp5398, it includes sections for employer details and claim periods, allowing the employer to report wages paid during specific intervals. Both forms facilitate the tracking of government funds allocated to employees.

- Service Canada Record of Employment (ROE): The ROE is issued by employers to report an employee's work history. Both documents include participant details and are used to ensure proper record-keeping for employment periods, making it easier to manage participant claims and contributions.

- Canada Summer Jobs Program Activity Report: This report focuses on the duties performed by participants during their employment. Like the Emp5398, it emphasizes the importance of accurate reporting and compliance, providing a framework for employers to detail participants' experiences and contributions to the organization.

Dos and Don'ts

When filling out the Emp5398 form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here is a list of recommended actions as well as pitfalls to avoid.

- Do carefully read all instructions on the form before starting. Understanding the requirements will help in providing accurate information.

- Do include all necessary documentation to support your claims. Lack of supporting documents can delay processing.

- Do double-check all entries for typos or errors. Simple mistakes can lead to complications or rejections.

- Do sign and date the form where indicated to validate your submission. Missing signatures can result in an incomplete claim.

- Do provide a clear description of the duties performed by participants. This information is crucial for understanding the scope of their work.

- Don’t leave any required fields blank. Ensure all sections are completed, even if the answer is “no” or “not applicable.”

- Don’t use vague or unclear language in describing job titles or duties. Precision is critical in this document.

- Don’t submit the form without verifying that the employer questionnaire has been completed. This step is mandatory.

- Don’t overlook the privacy declaration. Ensure that participants are aware of how their information will be handled.

Misconceptions

There are several misconceptions about the EMP5398 form, which is essential for employers participating in the Canada Summer Jobs (CSJ) program. Clearing these misunderstandings can aid in ensuring a smooth claim process.

- Misconception 1: The EMP5398 form is only for final claims.

- Misconception 2: Only non-profit organizations can use this form.

- Misconception 3: Health and safety training is optional for participants.

- Misconception 4: There is no need to keep records of employee duties.

- Misconception 5: The certification statement is just a formality.

- Misconception 6: Overhead costs can be claimed without documentation.

- Misconception 7: Submitting the employer questionnaire is not necessary.

This form can be used for both interim and final claims. It is crucial to clarify the specific sections applicable to each type of claim.

While the EMP5398 is commonly associated with non-profits, any eligible employer, including for-profit companies, can submit the form if they have CSJ-funded employees.

Employers are mandated to provide health and safety information to all participants. Ensuring safety is paramount, and documentation of this training should be kept.

The form explicitly requires a brief description of the duties performed by each participant. Keeping accurate records helps substantiate claims and supports transparency.

The certification is a legal affirmation that the information is truthful and aligns with the agreement. Misrepresentation can lead to serious consequences.

Employers must provide adequate documentation to support overhead costs. These details ensure that claims are validated during the review process.

Completing the employer questionnaire is mandatory before submitting the EMP5398 form. Not having this completed can delay or deny the claim.

Key takeaways

- Verify your information: Ensure that all the employer details, including the mailing address and contact person, are accurate before submitting the form.

- Complete the Activity Report: If this is your final claim, remember to fill out the separate Activity Report detailing the duties and safety information for your employees.

- Monitor participant status: Indicate if any participant with a disability was hired and include relevant details, as this could impact claim eligibility.

- Certification is crucial: Sign and date the certification section to confirm that all information provided is true, complying with the CSJ guidelines.

Browse Other Templates

Direct Deposit Sign Up Form - If changing bank accounts, it is recommended to allow time for new setup.

Free Pest Control Forms Templates - Detailing pests to be controlled ensures focused and targeted treatment plans.