Fill Out Your Employee Warning Notice Form

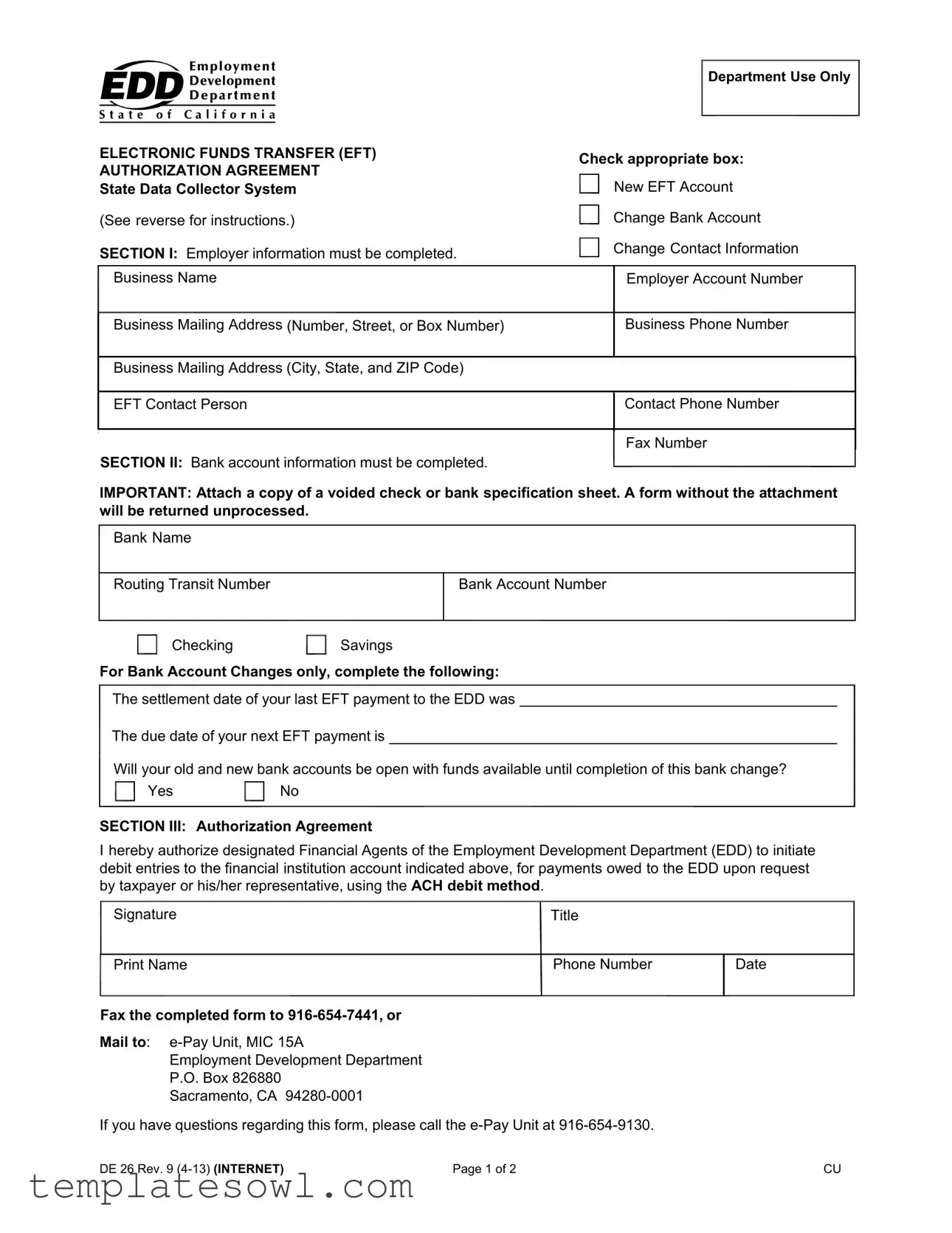

The Employee Warning Notice form plays a crucial role in the workplace, serving as a communication tool between employers and employees regarding behavioral or performance issues. This document outlines essential details, including employer information, bank account specifics, and authorization agreements that facilitate Electronic Funds Transfer (EFT) transactions. It comprises three main sections: the first requires the employer to provide their business name, mailing address, account number, and contact person’s information. In the second section, important banking details are gathered, such as the name of the financial institution, the routing number, and the type of account being used. Lastly, the third section includes an authorization agreement, which allows designated Financial Agents of the Employment Development Department (EDD) to process debit entries for payments owed. This form ensures that both parties are on the same page regarding payments and compliance, streamlining the process and minimizing misunderstandings. Notably, careful attention must be given to attaching a voided check or bank specification sheet, as the absence of this document can result in delays or rejection of the form. By understanding the significance and the particulars of this form, both employers and employees can navigate the complexities of payroll management more efficiently.

Employee Warning Notice Example

Department Use Only

|

ELECTRONIC FUNDS TRANSFER (EFT) |

Check appropriate box: |

||

|

AUTHORIZATION AGREEMENT |

|||

|

|

|

|

|

|

State Data Collector System |

|

New EFT Account |

|

|

(See reverse for instructions.) |

|

Change Bank Account |

|

|

SECTION I: Employer information must be completed. |

|

Change Contact Information |

|

|

|

|

|

|

|

Business Name |

|

Employer Account Number |

|

|

|

|

||

|

Business Mailing Address (Number, Street, or Box Number) |

|

Business Phone Number |

|

|

|

|

||

|

|

|

|

|

|

Business Mailing Address (City, State, and ZIP Code) |

|

|

|

|

|

|

|

|

|

EFT Contact Person |

|

Contact Phone Number |

|

|

|

|

|

|

|

|

|

Fax Number |

|

SECTION II: Bank account information must be completed.

IMPORTANT: Attach a copy of a voided check or bank specification sheet. A form without the attachment will be returned unprocessed.

Bank Name

Routing Transit Number

CheckingSavings

Bank Account Number

For Bank Account Changes only, complete the following:

The settlement date of your last EFT payment to the EDD was

The due date of your next EFT payment is

Will your old and new bank accounts be open with funds available until completion of this bank change?

YesNo

SECTION III: Authorization Agreement

I hereby authorize designated Financial Agents of the Employment Development Department (EDD) to initiate debit entries to the financial institution account indicated above, for payments owed to the EDD upon request by taxpayer or his/her representative, using the ACH debit method.

Signature |

Title |

Print Name |

Phone Number |

Fax the completed form to

Mail to:

Employment Development Department

P.O. Box 826880

Sacramento, CA

Date

If you have questions regarding this form, please call the

DE 26 Rev. 9 |

Page 1 of 2 |

CU |

Instructions for Completing the EFT Authorization Agreement Form for the State Data Collector System.

GENERAL

Please type or print clearly. Return the EFT Authorization Agreement form to the EDD.

Check the appropriate box for completing this form:

•Register for participation in the EFT program.

•Change the bank account information you use for EFT transactions.

•Change your contact information (Section II banking information must also be completed).

SECTION I

Complete all information in this section.

Business Name - Enter the business name.

Business Mailing Address - Enter the business mailing address.

Employer Account Number - The EDD account number is required. Enter the

Business Phone Number - Enter the business phone number.

EFT Contact Person - Enter the name of the person who can be contacted regarding this enrollment or tax payment inquiries.

Contact Phone Number - Enter the phone number for the contact person. Fax number - Enter the fax number for the contact person.

SECTION II

Complete all information in this section.

Bank Name - Enter the name of the selected bank.

Routing Transit Number - Enter the

Bank Account Number - Enter the bank account number.

Type of Account - Select the appropriate box for the type of bank account.

For Bank Account Change only - This information simplifies the bank account change process.

SECTION III

Complete all information in this section of the preparer or responsible individual.

Fax the completed form to

Mail to:

Employment Development Department

P.O. Box 826880

Sacramento, CA

If you have questions regarding this form, please call the

DE 26 Rev. 9 |

Page 2 of 2 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Employee Warning Notice form is used to authorize electronic funds transfers (EFT) for payments to the Employment Development Department (EDD). |

| Sections | The form includes three sections: Employer information, Bank account information, and Authorization Agreement. |

| Required Attachments | A voided check or a bank specification sheet must be attached; failing to do so will result in the form being unprocessed. |

| Employer Account Number | An eight-digit state employer account number is required, which is assigned by the EDD. |

| Submission Method | The completed form can be faxed or mailed to the specified addresses, including the e-Pay Unit at the EDD. |

| Contact Information | Provide contact information for a person who can assist with inquiries related to the form or tax payments. |

Guidelines on Utilizing Employee Warning Notice

Completing the Employee Warning Notice form is a straightforward process. To ensure everything is done correctly, it's best to proceed step-by-step. Gather all the necessary information before starting to fill it out, as this will help avoid any delays.

- Check the appropriate box: Decide whether you are registering for the EFT program, changing bank account information, or updating contact information.

- Complete Section I: Fill out the employer information. Include the business name, mailing address, employer account number, phone number, EFT contact person, contact phone number, and fax number.

- Complete Section II: Enter the bank account information. Provide the bank name, routing transit number, and bank account number. Choose whether the account is checking or savings. If changing accounts, fill out the additional questions regarding previous and new accounts.

- Complete Section III: Sign and date the form. Provide your title, printed name, phone number, and fax number.

- Attach voided check or bank specification sheet: Ensure to include a copy of a voided check or a bank specification sheet, as the form cannot be processed without this attachment.

- Submit the form: Fax the completed form to 916-654-7441 or mail it to the designated address: e-Pay Unit, MIC 15A, Employment Development Department, P.O. Box 826880, Sacramento, CA 94280-0001.

Once your form is submitted, keep an eye on your contact information for any follow-up communication from the Employment Development Department. Make sure you’ve provided accurate contact details to avoid any issues with processing your request.

What You Should Know About This Form

What is the purpose of the Employee Warning Notice form?

The Employee Warning Notice form is designed to document any performance issues or violations of company policy that an employee may have. This form serves as an official record to ensure that the employee is aware of their shortcomings and the actions required to improve. It also provides a structured way for employers to communicate concerns while offering a chance for the employee to rectify the situation.

How should I fill out the Employee Warning Notice form?

Begin by entering all relevant information in Section I, which includes your business name, contact details, and the employer account number assigned by the EDD. Make sure to fill in Section II with the accurate bank account information. Attach a voided check or a bank specification sheet, as forms lacking this attachment will be returned unprocessed. In Section III, sign and date the form, confirming your authorization to initiate debit entries as described. Finally, fax or mail the completed form to the appropriate EDD address listed in the instructions.

What should I do if I need to change the information on my Employee Warning Notice form?

If changes are necessary, you need to fill out the same sections of the form that contain the outdated information. Specify whether you are changing your bank account or contact information. For bank account changes, be sure to complete the additional required fields about your old and new accounts to ensure a smooth transition. Once updated, submit the revised form following the same submission methods as outlined in the instructions.

Who can I contact for help regarding the Employee Warning Notice form?

If you have any questions or need assistance filling out the Employee Warning Notice form, you can reach the e-Pay Unit at the Employment Development Department at 916-654-9130. They can provide you with the necessary information and support to complete the process effectively.

Common mistakes

When filling out the Employee Warning Notice form, one common mistake is leaving empty fields. It's vital to complete every section. Missing information can lead to delays and confusion in processing the form.

An inadequate understanding of the required contact details also leads to errors. Employers should ensure that the Employer Account Number is accurate. This eight-digit number is essential for identification. Without it, the form cannot be processed correctly.

Another frequent issue is the failure to attach the required documents, such as a voided check or a bank specification sheet. This attachment is crucial. Forms submitted without these documents will be returned unprocessed, causing frustration and potential payment delays.

In Section II, people often misstate their bank account type. Selecting the correct box for either a checking or savings account is critical. Using the wrong designation can complicate the payment process and prevent timely transactions.

Completing the bank account information without verifying the Routing Transit Number can cause setbacks. This nine-digit number is specific to the financial institution. Taking a moment to confirm its accuracy with the bank can save significant headaches later.

Furthermore, some individuals neglect to note whether both old and new accounts will have funds available during the transition period. This step is essential, and answering “Yes” or “No” ensures a smoother account change process.

People often overlook that every form must include a signature. Without it, the form remains invalid. A simple signature can make the difference between a completed process and an unprocessed submission.

Another mistake frequently made is failing to double-check the provided phone numbers. Errors in contact information can lead to missed communications, leaving people in the dark about important updates or requirements.

Lastly, not following the submission instructions can lead to processing delays. Whether faxing or mailing the completed form, it’s necessary to adhere to the outlined methods. Ensuring the form is sent to the correct address is equally important, as misrouting can prolong the resolution process.

Documents used along the form

The Employee Warning Notice form serves as a crucial tool for employers to document performance issues or misconduct. It provides a clear record that can facilitate discussions about improvement and potential consequences. Alongside this form, several other documents are commonly utilized to support the process of employee management and record-keeping. Below is a list of these important forms.

- Employee Performance Improvement Plan (PIP): This document outlines specific areas where an employee's performance requires improvement. It sets measurable goals and timelines for meeting those expectations. A PIP often follows an Employee Warning Notice when further formal action is deemed necessary.

- Disciplinary Action Form: This form details any disciplinary actions taken against an employee. Unlike the Warning Notice, which serves as a caution, the Disciplinary Action Form usually addresses more severe infractions that may result in suspension or termination.

- Attendance Record: This document tracks an employee's attendance, including any absences or tardiness. Employers often refer to this record during discussions about attendance-related warnings or disciplinary actions.

- Exit Interview Form: When an employee leaves a company, this form gathers feedback on their experience. It helps employers identify patterns in workplace culture or management practices that may have influenced departure decisions.

- Employee Handbook Acknowledgment: This document confirms that an employee has received, read, and understood the company’s policies and procedures. It is essential in reinforcing expectations and can support employer claims if disputes arise regarding policy violations.

Each of these documents plays a significant role in the overall management of employee performance and conduct. Utilizing them effectively can help ensure clarity, promote accountability, and support a fair work environment for all employees.

Similar forms

-

Disciplinary Action Notice: Similar to the Employee Warning Notice, this document formally addresses employee behavior or performance issues. It outlines concerns while documenting the steps taken to correct them.

-

Performance Improvement Plan (PIP): A PIP focuses on improving an employee's performance over a set period. Just like the warning notice, it sets clear expectations and consequences.

-

Termination Notice: This document communicates the end of employment. It parallels the warning notice by explaining reasons for termination and outlining previous warnings.

-

Write-Up Form: Often used interchangeably with warning notices, this form documents disciplinary issues. It serves to inform the employee of the specific concerns and expectations for improvement.

-

Attendance Notice: This document highlights attendance-related issues or violations. It resembles the warning notice by detailing specific instances and consequences of failing to meet attendance policies.

-

Incident Report: While typically focused on specific incidents affecting the workplace, it serves a similar purpose by documenting behavior or actions that warrant attention, akin to the Employee Warning Notice.

-

Grievance Form: This document allows employees to report issues or disputes. Like a warning notice, it helps facilitate communication and seeks resolution by documenting the situation.

-

Coaching Document: Used to guide employees in improving their performance, this document shares similarities with the warning notice by providing feedback and outlining steps for improvement.

-

Company Policy Acknowledgment Form: This form confirms that employees understand company policies. It relates to the warning notice in that it holds employees accountable for adhering to established guidelines.

-

Response to Employee Inquiry: In situations where an employee questions disciplinary actions, this document clarifies the reasons for actions taken. Its objective is similar to that of the warning notice, promoting transparency and understanding.

Dos and Don'ts

Things You Should Do:

- Type or print clearly to ensure readability.

- Complete all sections of the form fully, leaving no blanks.

- Provide a copy of a voided check or bank specification sheet, as required.

- Double-check your bank account number for accuracy.

Things You Shouldn't Do:

- Do not forget to check the appropriate box for your request.

- Never use your Federal Identification Number instead of your eight-digit state employer account number.

- Avoid submitting the form without the necessary attachments.

- Do not ignore the instructions regarding contact information.

Misconceptions

Understanding the Employee Warning Notice form is crucial for both employers and employees. Yet, several misconceptions surround this important document. Here are six common myths clarified:

- The form is only for serious violations. Many people believe that the Employee Warning Notice is reserved for major infractions. In reality, it can address minor issues too, serving as an early intervention tool.

- It's a final step before termination. Another misconception is that submitting this form signifies an impending termination. Instead, it often acts as a constructive feedback mechanism meant to guide employees toward improvement.

- Only supervisors can issue a warning. Some assume that only upper management can use the Employee Warning Notice. However, any supervisor with appropriate authority can issue a warning, fostering a culture of accountability across all levels.

- The notice automatically goes on an employee’s permanent record. Many fear that a warning will permanently stain their employment record. Typically, each company's policy determines how long warnings remain documented, and they might not always be permanent.

- Receiving a warning means my job is at risk. Employees often think that receiving a warning directly threatens their employment status. In truth, warnings aim to improve performance, not to intimidate or terminate.

- The form is only a legal requirement. While the document serves legal purposes, it also promotes communication about performance expectations. It encourages constructive dialogue, aiding in professional development.

By debunking these myths, individuals can engage with the Employee Warning Notice form more effectively. Understanding its true purpose can lead to better outcomes in the workplace.

Key takeaways

When filling out the Employee Warning Notice form, keep the following key points in mind:

- Complete All Sections: Ensure that all relevant sections are filled in completely and accurately. Missing information can lead to delays or rejections.

- Attach Required Documents: Always include a copy of a voided check or bank specification sheet. Forms submitted without these attachments will be returned unprocessed.

- Contact Information: Provide accurate contact details for the EFT contact person. This ensures timely communication regarding any inquiries or issues.

- Review Instructions: Carefully read the instructions for each section to avoid mistakes. Proper understanding of requirements will facilitate a smoother process.

Browse Other Templates

How to File Fafsa as Independent - Risks associated with money laundering increase with the number and type of services offered.

Gtbank Account Opening Form - The form requires your full name, including surname and other names.